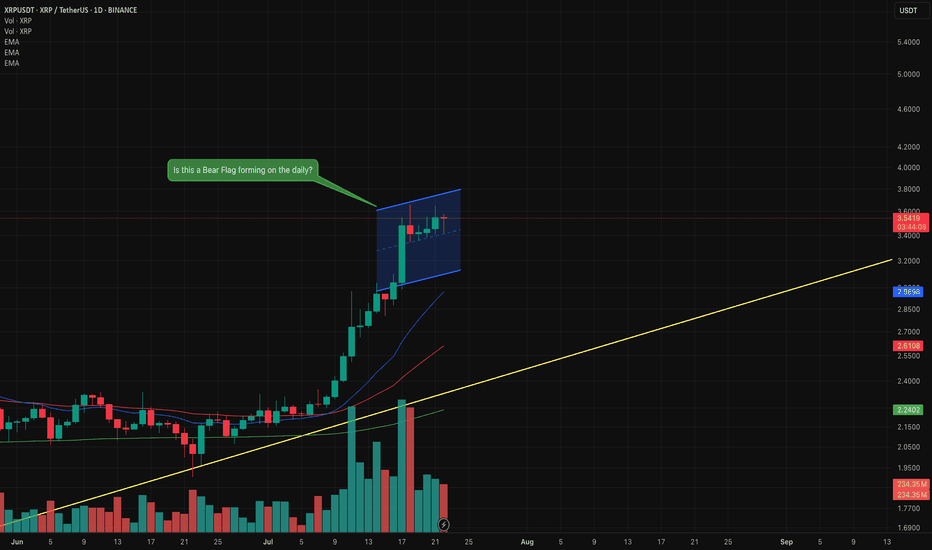

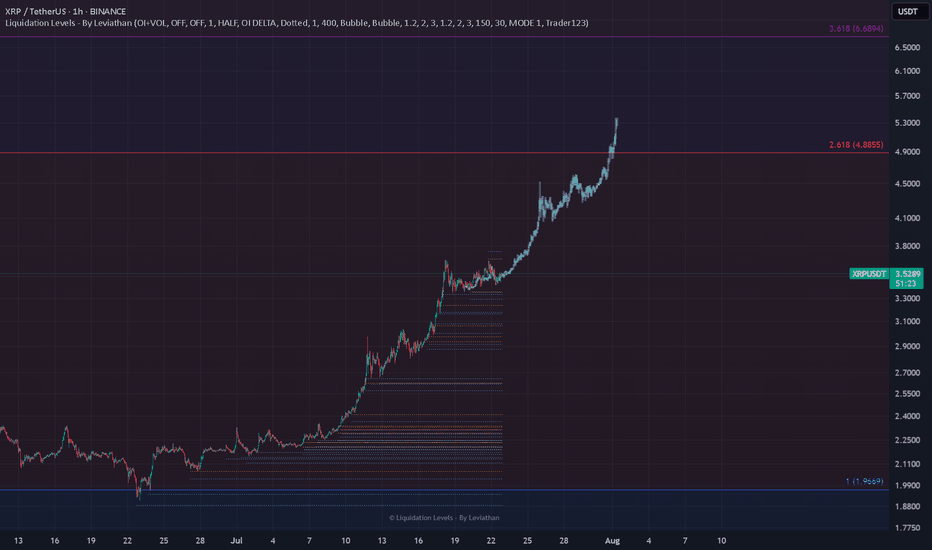

Is this a Bull Flag forming on the XRP daily timeframe?Although sentiment for XRP is strong and recent trend has been sharply upwards. I'm wondering if this is a bear flag forming on the daily?

Given the sharp rise it could be and may not be a negative signal as it could give the opportunity for a healthy pull back before rising again to new all time highs.

Let's watch how it progresses over the next few days. I will not be jumping into a trade until it confirms.

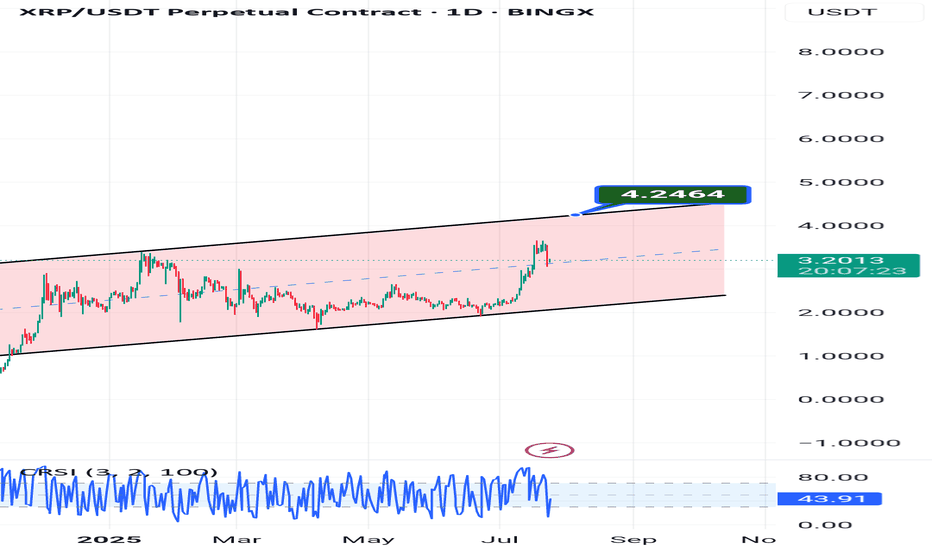

XRPUSDT.P trade ideas

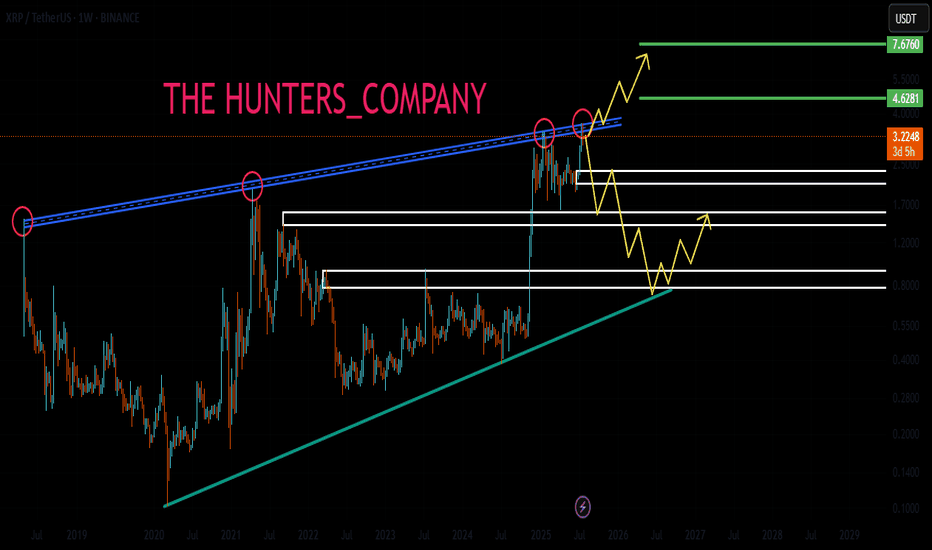

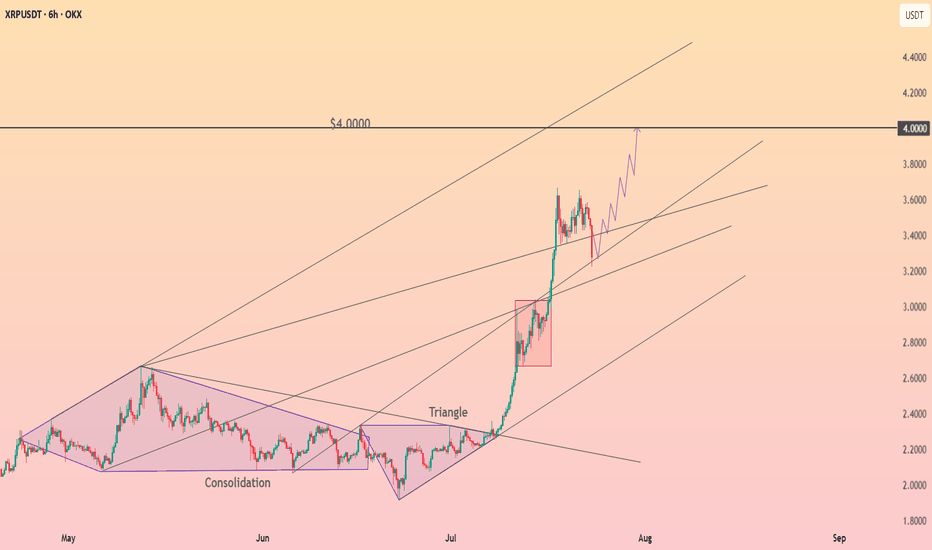

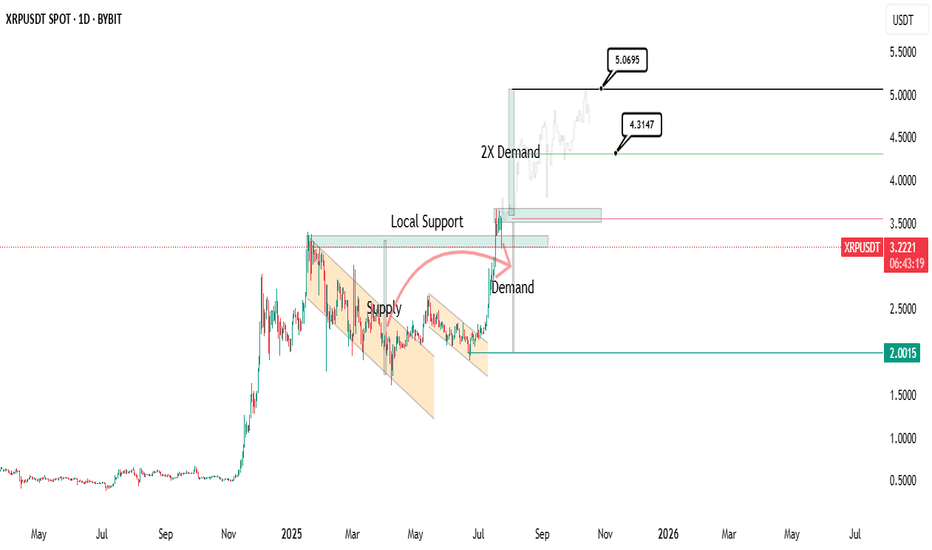

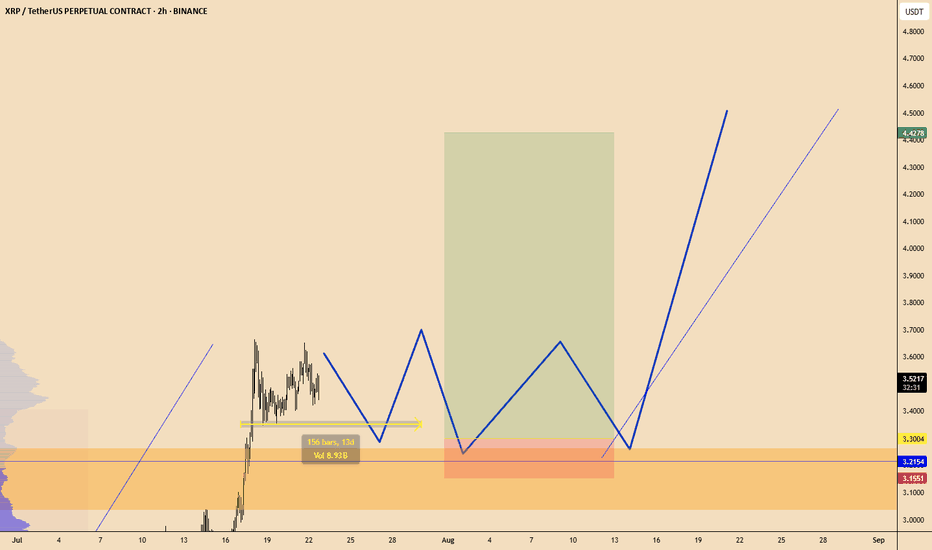

XRP : Long term analysisHello friends🙌

🔊Considering the great growth that the price has had and has set a new ceiling, be careful because we are at the ceiling and when we are at the price ceiling, we should always expect a price correction...

⚠Now, given the strong upward trend we have, you can buy with risk and capital management, but our suggestion is lower prices for the possibility of a correction and the possibility of a reversal pattern.

So we have identified important support levels for you and we have also identified price targets.

🔥Follow us for more signals🔥

*Trade safely with us*

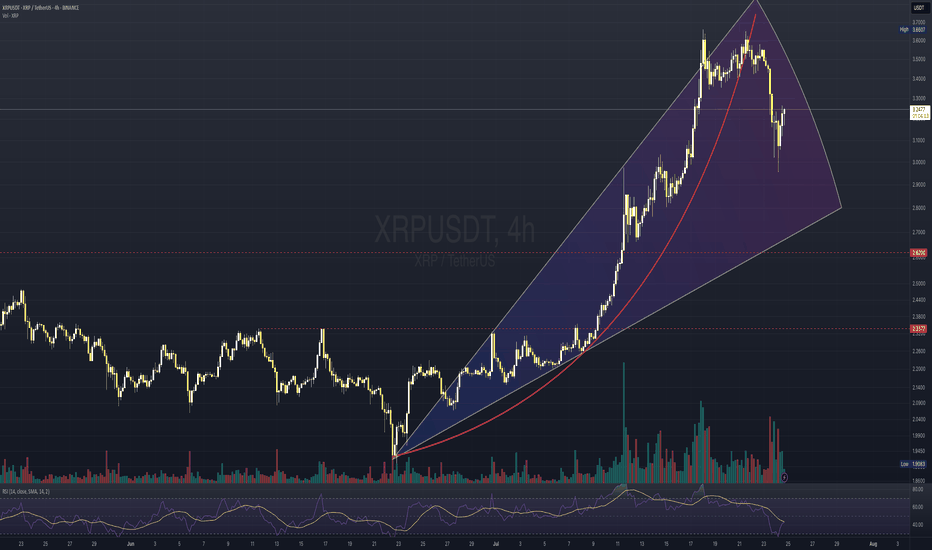

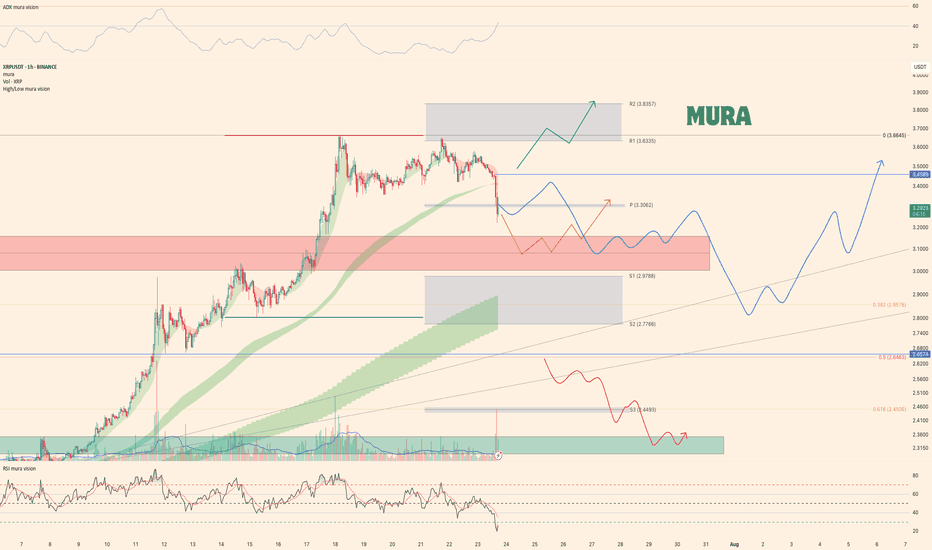

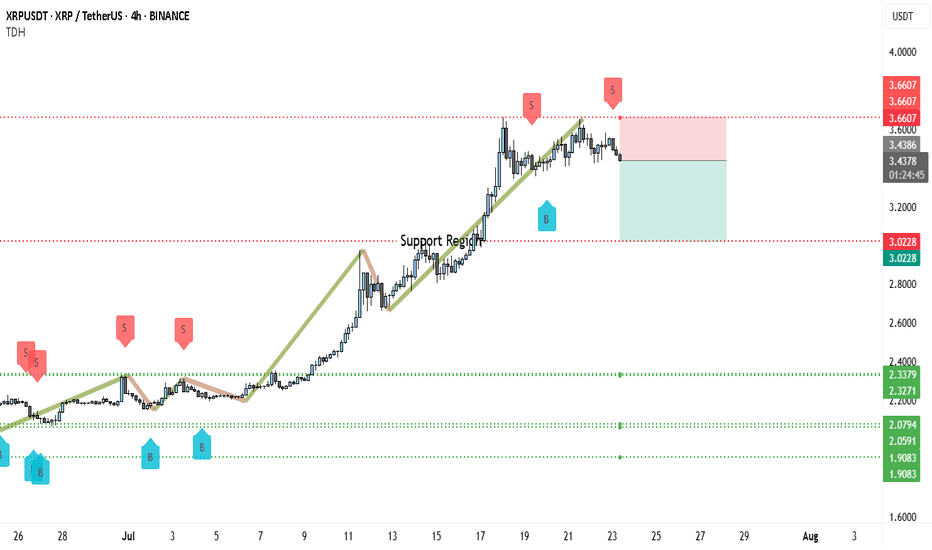

XRP - in the future is room for pastThe chart of XRP/USDT on the 4-hour timeframe reveals a classic example of a parabolic rise within a well-defined ascending channel, which has recently been broken to the downside. The price rallied strongly, forming higher highs and higher lows, supported consistently by the curved trajectory of a long-term trendline and multiple short-term moving averages. However, the steepness of the ascent, culminating in a local high around 3.66, appears to have exhausted momentum.

Following the peak, a sharp correction has taken place, breaching both the dynamic support and the lower boundary of the rising wedge structure. This breakdown signals a potential shift in market sentiment. The recent rebound seems more like a temporary relief or dead-cat bounce rather than a decisive reversal.

From a broader perspective, this move appears to be part of a larger cyclical retracement—where price may revisit and test previous high levels (now flipped into potential support) around the 2.62 and 2.33 zones. These levels are historically significant and could serve as key areas for demand reaccumulation in a longer-term bullish continuation, assuming macro conditions remain favorable.

In essence, while the immediate trend shows weakness, the larger structure still supports a healthy market correction. A return to prior resistance-turned-support would not only be expected but potentially constructive for sustainable future growth.

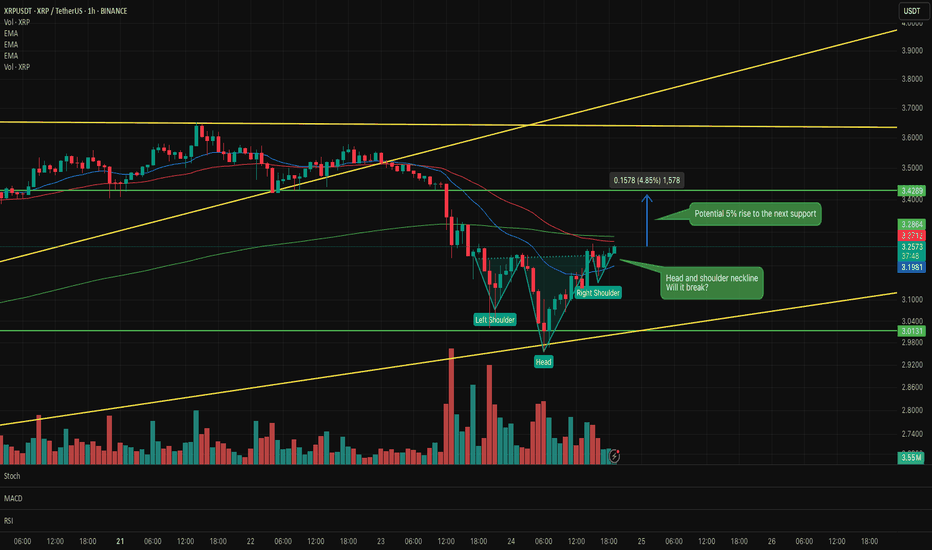

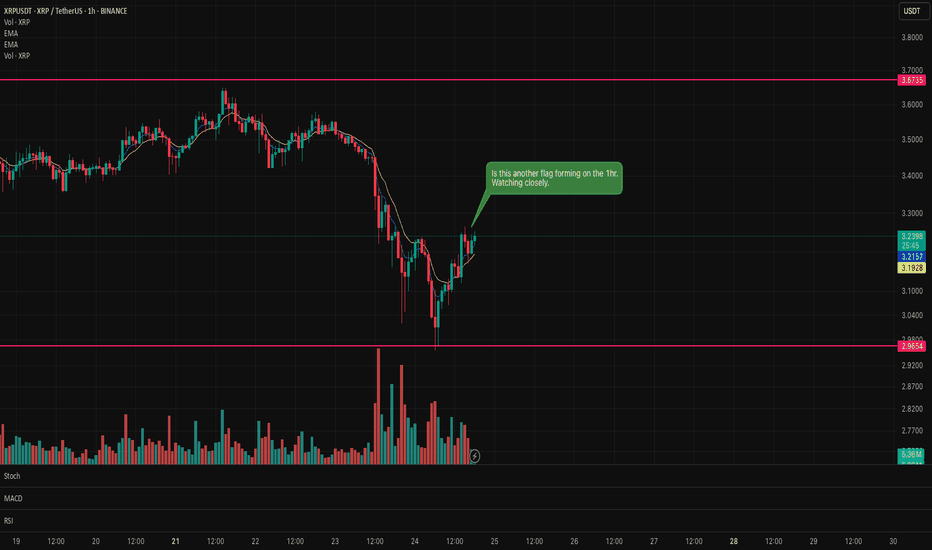

Is there another XRP flag forming on the hourly chart?Could be another flag forming on XRP. Waiting for the formation to prove confirmation as to whether it will be a bull or bear flag.

News of large amounts of XRP entering the exchanges from the CEO could mean a bear flag?

It's only appearing on the hourly so it could be a false flag.

Let's what and see what forms on the hourly candle.

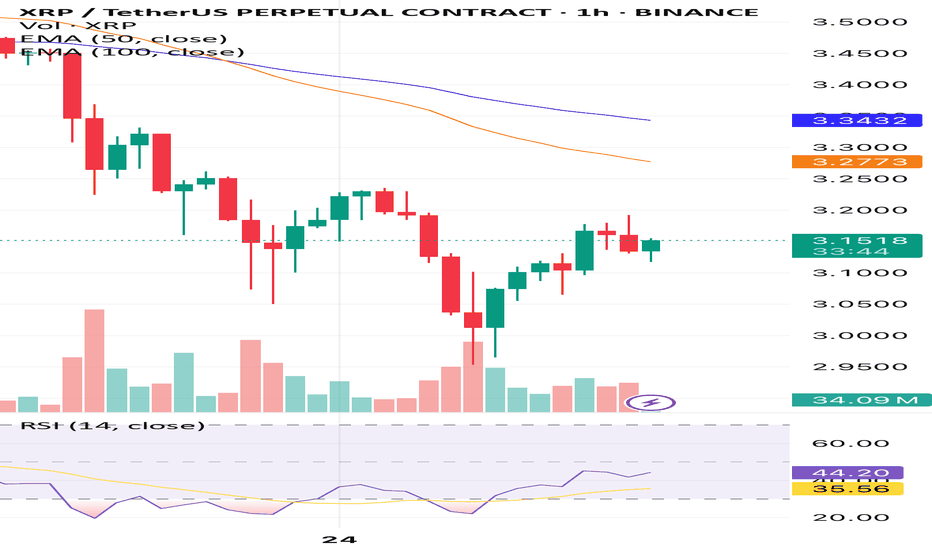

Xrp BOS at 3.17 with bullish engulfing and volume. A break of structure is first sign of strength which would be a bullish candle breaking 3.17. I am looking for a 3.17 push through, with high volume in compared to last candles on the 1hr time frame. Once a break of 3.17 occurs, I need a retest of the 3.17 area with another bullish candle to confirm my entry long. I will be looking to take minor profits as price moves through key supports of 3.2,3.23,3.3. Once they have been pushed through I will hold and take profit as I see fit. My tight sl will be 3.13. I will not be looking at wicks. I will strictly be looking at candle bodies.

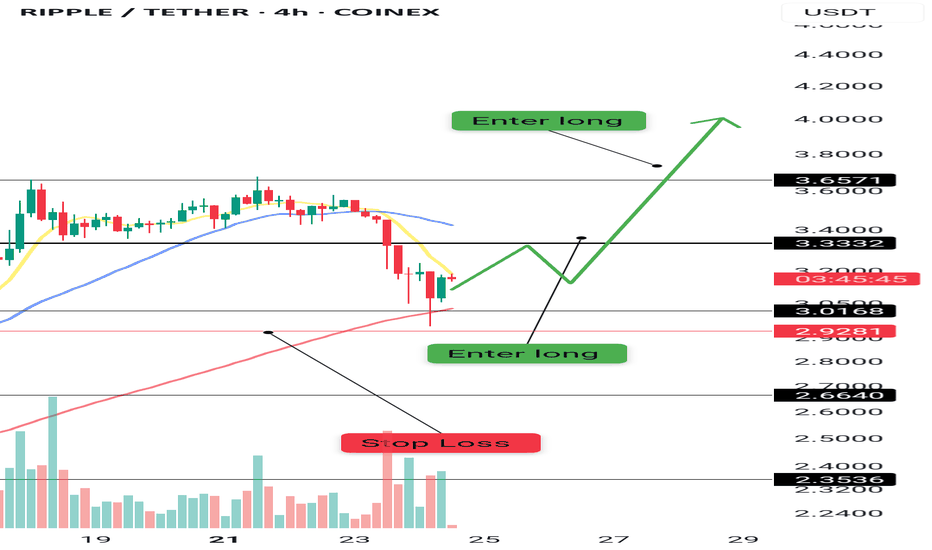

Ripple (XRP/USDT) Analysis – 4H🚀 Ripple (XRP/USDT) Analysis – 4H

Hello everyone,

Today I want to analyze Ripple (XRP). I hope you find this analysis useful and share your thoughts in the comments.

The following analysis is based on MWC (4H).

📢 Quick Overview of Key Ripple News:

• $759M transfer by XRP whales, indicating heavy behind-the-scenes activity that could signal a major price move.

• This large transfer could be a sign of Accumulation or preparation for high volatility.

Our main focus to maintain the bullish scenario should be on btc.d and usdt.d charts.

♦️ Btc.d ♦️

After the heavy drop in the past week, Bitcoin dominance started correcting yesterday.

The levels I expect reactions from are:

61.31 (already broken),

Next levels 61.74 and 62.17 (currently testing).

A breakout and stabilization above these levels will put altcoins under strong selling pressure.

However, a rejection at these levels will bring attention to altcoins close to breaking their zones.

♦️ Usdt.d ♦️

This chart also shows signs of forming a bullish structure.

We need to watch for a reaction to the next important zone 4.44 – 4.36.

But for altcoins to continue their uptrend, 4.14 must break downward.

♦️ Others.d / Total / Total2 / Total3 ♦️

These charts are naturally bearish.

Before their support levels matter, we should focus on the potential reversal of btc.d and usdt.d.

These give earlier signals of correction continuation or completion.

We can use Total, Total2, Total3, and Others.d for confirmation.

Important levels:

Total: 3.91

Total2: 1.55

Total3: 1.08

Others.d: 8.05 (for now), but if the correction ends and a bullish move starts, we may see a lower high forming.

♦️ XRP ♦️

Currently, a breakout above 3.65 is the entry trigger.

The more likely bullish scenario: create a new high → minor correction → breakout = entry signal.

This will happen if Bitcoin dominance drops.

According to our strategy, both the market and XRP are in a bullish structure.

I will not consider short positions, even if XRP falls to 2.66.

Considering the strong seller activity at 3.65, I expect the breakout to be sharp and whale-driven.

Thus, there are two ways to enter:

1. After forming a new high and low, enter upon candle close and confirmation around 3.33.

2. If we miss the move, enter with a STOP BUY at 3.6.

In both cases, if the scenario is activated, Stop-Loss = 2.92.

🔥 If you found this analysis useful, hit the 🚀 and follow me for more updates!

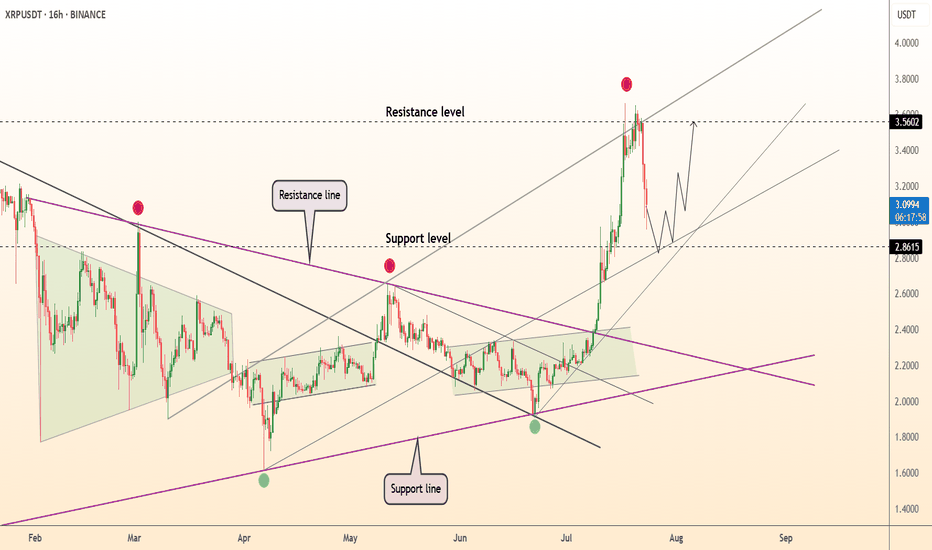

DeGRAM | XRPUSD rolls back to support📊 Technical Analysis

● After spiking to 3.56 (red dot) price slipped into a shallow bull-flag that is holding on the grey inner trend-line and the broken purple 2-year cap, converting 2.86-3.00 into firm support.

● Volatility compression inside the flag sits midway of the rising channel; a 16 h close back above 3.22 activates a 1:1 continuation toward the median-line cluster at 3.80, with the outer rail still pointing to 4.00.

💡 Fundamental Analysis

● CME’s launch of micro-XRP futures and fresh US exchange relistings lifted open-interest 18 % w/w, while Coinglass shows $12 M shorts liquidated since Monday—evidence of renewed upside pressure.

✨ Summary

Buy 3.05-3.22; breakout over 3.22 aims 3.80 → 4.00. Invalidate on a 16 h close below 2.86.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

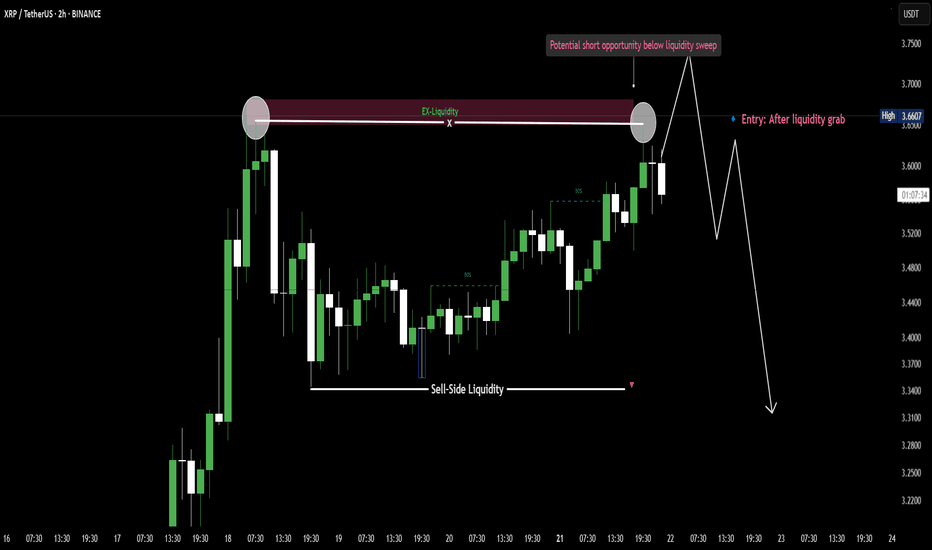

Comprehensive Analysis: SHORT Signal on XRPUSDT1. News Analysis (Market Sentiment)

The news actually reflects a strongly positive sentiment for XRP’s long-term fundamentals:

"Brazil's VERT Debuts Tokenized Credit Platform on XRP Ledger With $130M Issuance" : This is a very bullish piece of news. It highlights real-world adoption of the XRP Ledger (XRPL) for high-value transactions.

"VERT Launches Blockchain Platform on XRPL for $130M Deal" : This is the same news reported by a different source, confirming the significance of this adoption.

Bridging the Analysis:

Here lies the crucial difference between investors and traders. As long-term investors, this kind of news would motivate us to buy and hold XRP. But as day traders, we understand the common market behavior of “Buy the Rumor, Sell the News.”

The massive price rally before this announcement might indicate the market already anticipated this news. Now that the news is official, early buyers may begin taking profits, triggering selling pressure.

Sentiment Conclusion:

While the news is fundamentally positive, it could strengthen the case for a SHORT position in the short term. This “sell on good news” reaction is a common phenomenon in trading.

2. Technical Analysis (Chart Structure)

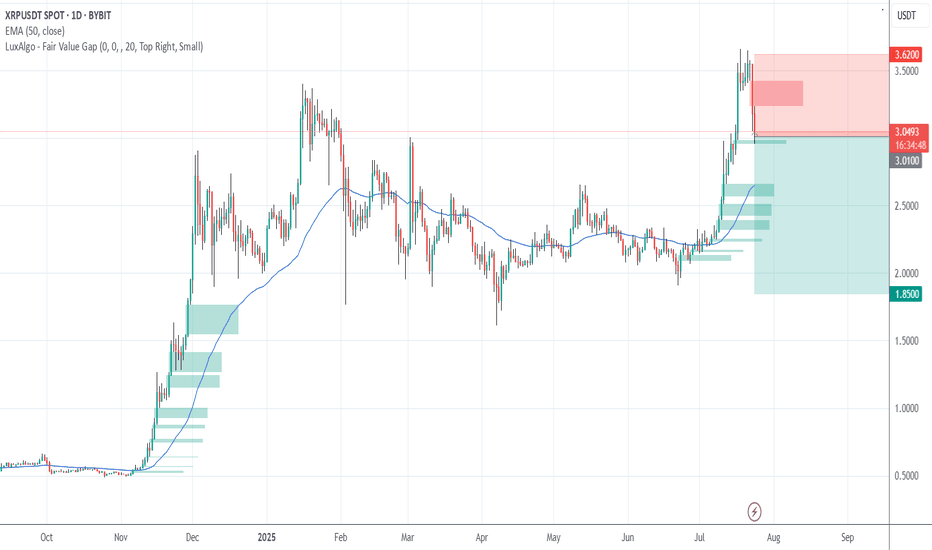

The daily chart of XRPUSDT supports a SHORT position even more convincingly:

Climactic Top Rejection : A sharp price rally ends with a long upper wick candle around the $3.60 area. This is a classic sign of buyer exhaustion and aggressive seller entry.

Short-Term Bearish Structure : A large red candle formed after the top, signaling that sellers have taken control. The current price is trading well below that top, confirming the rejection was valid.

Room for Correction : Below the current price, there’s a clear “gap” or market inefficiency. The first logical target for a correction is around $2.80 - $2.90, where the 50 EMA meets the upper edge of the Fair Value Gap (green box). This gives us a clean profit target.

Combined Conclusion:

Yes, based on a combination of “Sell the News” sentiment and clear bearish technical structure, the argument for a SHORT position on XRPUSDT is very valid. We are going against the positive headlines, but following price action signals.

Trading Plan: SHORT Operation on XRPUSDT

Position: SHORT

Asset: XRPUSDT (Perpetual Contract)

Current Status: ENTRY

Entry Reason:

We’re entering based on short-term bearish momentum after a strong rejection from the supply zone, expecting the price to fill the inefficiency below.

Entry Type: Market Order

Why: The bearish move is in progress. We want to catch it now before the price drops further and skips our limit order. We'll execute at the current market price (~$3.01).

Stop Loss (SL): $3.62

Why: Placed slightly above the previous swing high. If price breaks this level, our SHORT thesis is invalid, and we exit to prevent further losses.

Take Profit (TP) Targets & Risk/Reward:

We'll scale out profits in phases to lock in gains.

TP1: $2.85

Why: Confluence of 50 EMA and top of Fair Value Gap

Risk/Reward: ~1:2.8 (Risking $0.61 to gain $1.75 — very healthy ratio)

TP2: $2.55

Why: Mid-point of the Fair Value Gap — a common magnet for price

TP3: $2.25

Why: Full gap fill + retest of prior support/resistance area

TP4: $1.85

Why: Ambitious target — filling the second, deeper Fair Value Gap. Possible in a panic-driven selloff.

Position Management:

Once TP1 is hit:

Move SL to Entry ($3.01) to secure a risk-free trade on the remaining position.

We’ll continue to monitor the price and adjust the trailing stop loss as each TP level is reached.

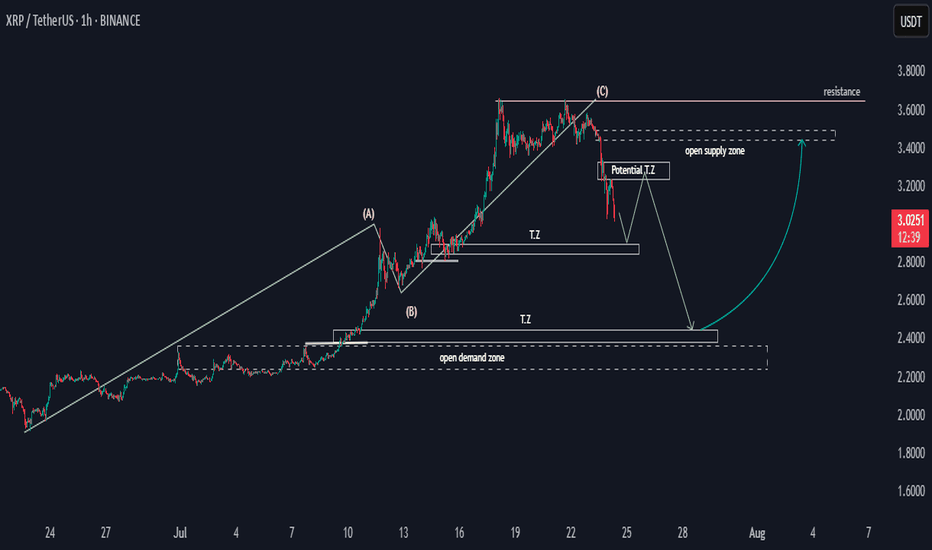

XRP Potential SND Flow MapHello,

This is a general overview of the XRPUSDT flow map, outlining potential price movements.

The price may experience a decline, followed by a pulse upwards before a final drop. Target zones have been identified, and following this, there is a possibility for the price to rally toward the 3.4 supply zone. This would establish the 2.4 to 2.2 range as a key potential bullish zone.

Happy Trading,

Khiwe.

Not trading advice

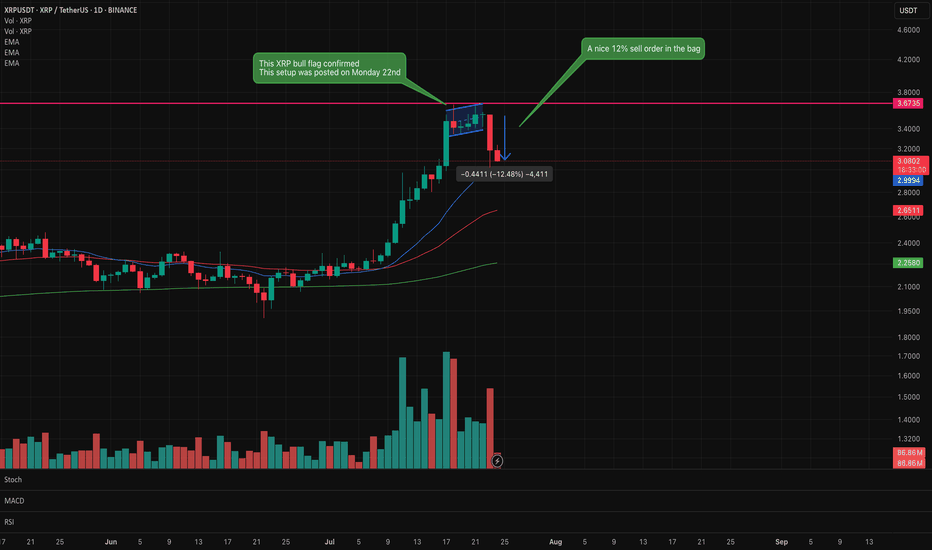

XRP Bear flag confirmed. Looking for support in the decline.XRP bear flag identified on Monday 22nd has now confirmed with a nice 12% short sell.

This signals do not always confirm but when they do it is satisfying that the analysis and patience has paid off.

Trading is all about controlling emotions and being patient. Wait for the confirmation before executing.

Weekly trading plan for XRP BINANCE:XRPUSDT Last week played out perfectly - price followed our green scenario, broke through resistance, and hit all targets. Now we're clearly in a correction phase. Here's what I'm watching:

$3.16 level - Waiting for this to break before expecting consolidation in that former resistance zone

$3.30 pivot - This week's key reversal level

$3.45 resistance - If we break $3.30 but can't push past $3.45, we'll likely see the correction extend down to $3

Not making predictions here - just setting the levels that'll tell us what's next.

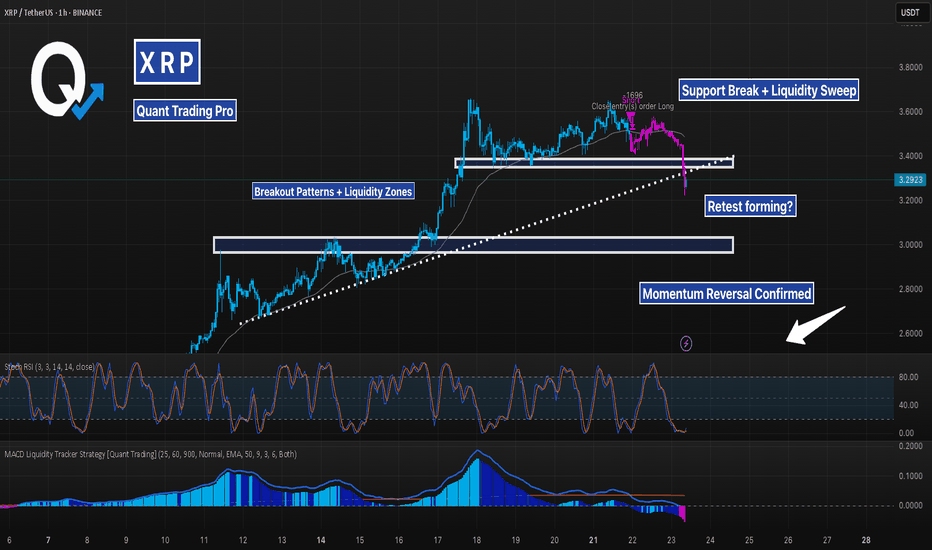

XRP Breakdown – Trend Break & Liquidity Zone Retest In ProgressXRP just gave us a clean breakdown below a well-formed ascending structure, violating both its dynamic trendline and horizontal support.

Let’s break down the setup:

🔹 Trend Context: Price was holding cleanly above the MA and respecting a dotted trendline, bouncing off prior breakout zones multiple times. This uptrend was sustained for days, with momentum supported by both MACD histogram expansion and Stoch RSI resets.

🔹 Structure Shift: After a minor consolidation, price rejected from the upper range and aggressively broke below support. The last long was closed during this transition — confirming the momentum was fading.

🔹 Liquidity Zones: The prior resistance-turned-support zone failed, with price wicking below and potentially sweeping stop orders before stabilizing.

🔹 Momentum Flip: MACD histogram has flipped red, and Stoch RSI is deeply oversold. This signals possible short-term exhaustion, but trend structure is clearly damaged.

Traders now face two scenarios:

1️⃣ Bearish case → Breakdown holds, and price trends lower into deeper liquidity (~3.00 or even 2.71).

2️⃣ Bullish case → Price reclaims structure with strength, invalidating the breakdown and trapping early shorts.

Key levels are in play. Wait for confirmation — especially on the retest.

#XRP #Breakdown #CryptoAnalysis #MACDStrategy #SupportResistance #LiquidityZones #TrendBreak #TechnicalAnalysis #AlgoTrading #QuantStrategy

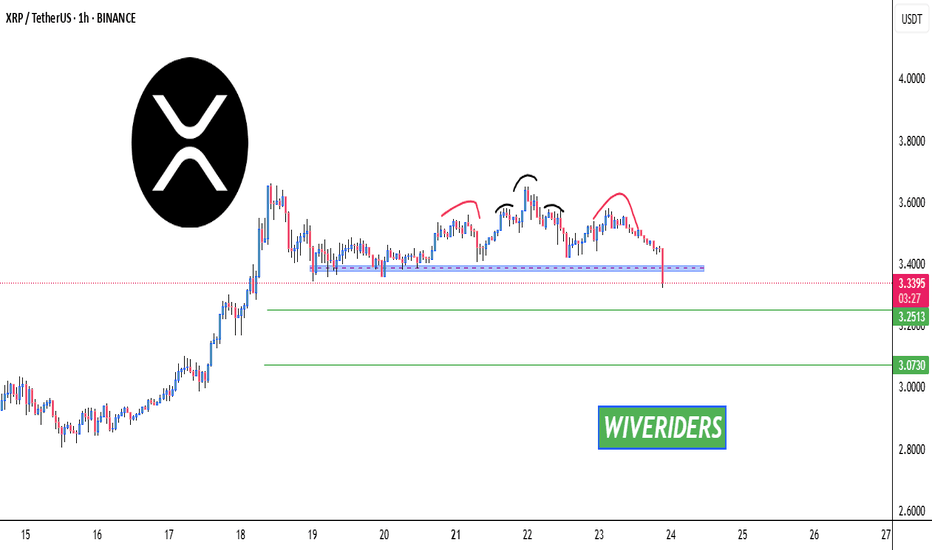

Bearish Patterns & Support Test🚨 CRYPTOCAP:XRP Price Update – Bearish Patterns & Support Test 📉

CRYPTOCAP:XRP has now formed two bearish Head & Shoulders patterns –

• One small H&S pattern

• One larger H&S pattern

Currently, XRP is testing the blue support zone.

📌 If this blue support breaks, the price could drop further toward the green line levels,

which are strong zones where buyers previously stepped in.

✅ Watch for potential bounce at the green zone – this could present a solid long opportunity if confirmation is seen.

Is XRP About to Crash to $2.40? Charts Don’t LieXRP has been in a steady bullish run throughout July, but cracks are beginning to show. The price recently failed to hold above the key $3.66 resistance, and what once looked like a strong continuation setup now hints at exhaustion. Price action shows clear hesitation near the $3.60–$3.66 region, where multiple “Sell” (S) markers have emerged.

More importantly, the ascending trendline has been broken, and XRP is consolidating beneath it — often a sign of a shift in structure. A lower high has now formed, which could be the early warning of a short-term top.

If buyers can't reclaim the $3.43–$3.60 zone soon, XRP could enter a deeper pullback phase. The former support band between $3.02 and $3.05 is now being tested from below, and if this flips to resistance, further downside looks likely.

There’s a visible liquidity void below $3.00, and with XRP having rallied significantly, a retracement to retest deeper support zones wouldn’t be surprising. Areas like $2.80, $2.40, and even $2.00 are still untouched and could attract buying interest if panic kicks in.

📊 Trading Setup

• Entry (Sell): Around $3.43 (confirmed rejection)

• Stop Loss: Just above $3.66 (key resistance and invalidation zone)

• Target 1: $3.02 (minor support zone)

• Target 2: $2.40–$2.33 (stronger cluster with past reaction)

• Risk-to-Reward: Approx. 1:1.8 — favorable for swing short

The structure is now showing early signs of bearish reversal. The failure to break above $3.66, break of the trendline, and formation of a lower high all signal weakness. If XRP drops below $3.02 and holds there, it may trigger a more aggressive selloff toward mid-$2s. This short setup is valid as long as the price stays below $3.66 — beyond that, bulls might regain control.

Let me know if you want a continuation scenario or need this adapted for tweet threads or YouTube script.

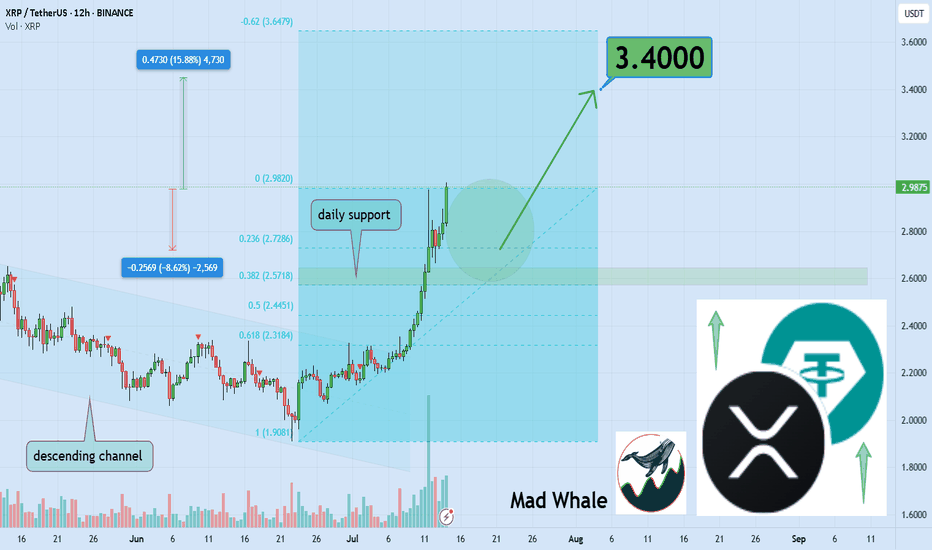

Can Ripple hit $3.40 with 15% upside soon?Hello✌

let’s dive into a full analysis of the upcoming price potential for Ripple📈.

BINANCE:XRPUSDT is poised to challenge the $3.40 level soon, supported by a notable increase in market volume 📊. This price zone also coincides with a key support area aligned with sharp Fibonacci levels, offering a strong base for potential upward movement 🔥.

✨ Need a little love!

We pour love into every post your support keeps us inspired! 💛 Don’t be shy, we’d love to hear from you on comments. Big thanks , Mad Whale 🐋

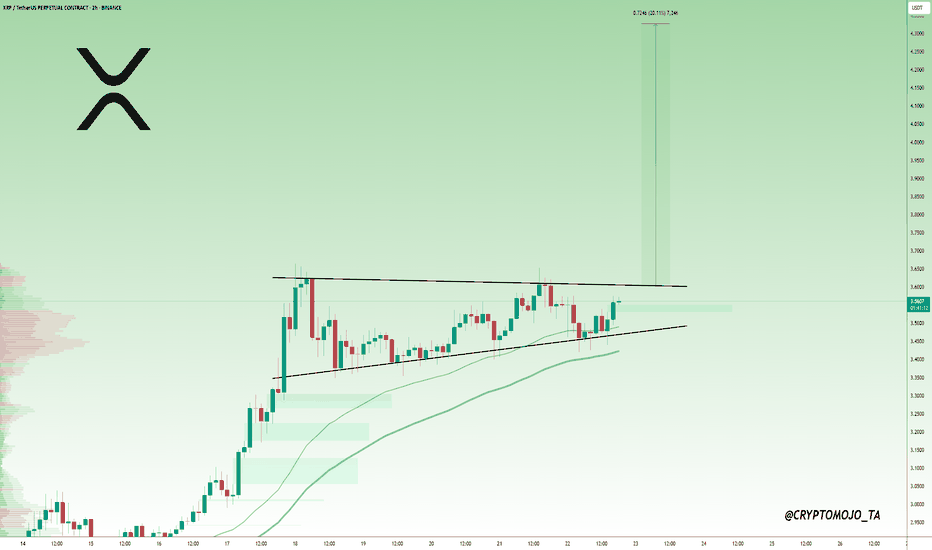

$XRP Breakout Loading, Watch That Triangle! XRP is forming a bullish ascending triangle

The price is holding higher lows while facing resistance around $3.60. This is a typical sign of buyers stepping in. If XRP breaks above this resistance with strong volume, a sharp move toward $4.30–$4.40 could follow. Until then, it’s building pressure inside the triangle. Breakout confirmation is key for the next leg up.