VERGE - Overview on Daily Timeframe - Downside ComingFollowing our previous analyses on the daily and smaller timeframes (), we are currently monitoring this cryptocurrency for a nice, coming short opportunity. As it stands now, BITTREX:XVGUSD is nicely gaining momentum for more downside. Slowly crawling up on the daily and smaller timeframes, it is, in fact, moving as a correction following a small impulse to the downside, and we are expecting this cryptocurrency to retest the low of the "B" wave of the daily ABC correction, potentially dropping down further towards the 0.014 area in the coming months.

Updates on smaller timeframes will follow.

If you feel that our analyses and views may be a useful complement to your trading strategies and in order to be notified in real time with our updates on the lower timeframes, please remember to click on the Follow button.

Remember that you can double check the bigger structures that are at play are on the weekly and daily time frames also by scrolling around the charts in the lower 4hr and 60min timeframes (right and left, up and down).

Trade with care and only with a backtested strategy that has proven to work in relation to your invested capital, risk appetite and potential small losses you might incur in before profiting from a good trade.

Thank you for viewing.

XVGUSD trade ideas

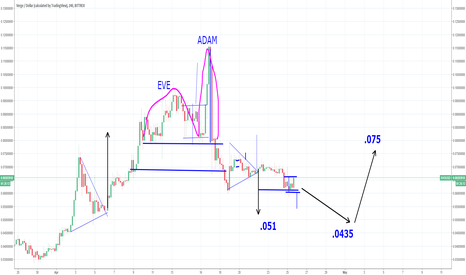

Verge XVG - Trade Active 500% TargetVERGE XVG Is Leaving the Ideal Buy Zone - Trade Active

Looking at the Verge one day USDT chart on Bittrex. Verge is now trading with a candle closed above the buy zone I had set on April 18th. Hopefully you bought while in this ideal zone. If not it's still not too late to jump onto the train. Verge is going higher, and if you are not a swing trader just buy and HODL you will not be sorry.

Best Recent Entry on April 25th at just below $0.06

Trade Targets:

Short term

$0.10

$0.12

Mid Term

$0.20 (Nearing 300% Profit on the Trade)

$0.30 (ATH_ 500% Return)

Progress of this trade can be interrupted by a sudden dip in BTC prices. If so don't panic and stay in the trade, otherwise you lock in a loss for yourself. Be patient, it will recover and you will profit.

Please, Don't forget to Like Agree, Comment and Follow Me, It's additional encouragement for me to share my work.

All statements and expressions I offer are my opinions, and not meant as investment advice or solicitation. Information provided is not personal investment advice. Seek guidance from a professional investment advisor before trading or investing. Trading cryptocurrencies can be a potentially profitable opportunity for investors. You should carefully consider your investment objectives, level of experience, and risk appetite. Most importantly, do not invest money you cannot afford to lose. I am not a registered investment advisor.

Wishing you success,

Isaac

Verge UpdateVerge has a lot of potential this year. The maximum price will be hit somewhere on the top of the parallel channel in the end. We won't assume how high it will go, instead follow it will elliot waves, to trade it effectively. Notice we are on the daily, smaller time frames and you will lose sight of what is really happening. Right now we have a 5 Impulse wave forming, which should take us back to the all time high, (calculated using fib levels and wave projection) by the end of may, which is also the target for the giant inverted head and shoulders that has formed. From there a likely ABC correction would follow. We wont project farther than that because we would need more information and price action. We'll cross that bridge when we get there. I will update.

XVG Forming Right shoulder Count Down to next impulse The right side of the inverse head and shoulder is forming nicely. We should be seeing the next run up back to .09-.10 very soon. Put your seat belt on.

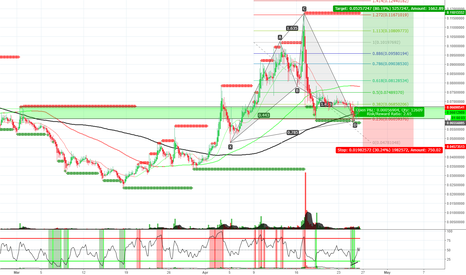

On the VERGE of bull run !Verge has got a good bullish entry confirmed with fxgreenhawk strategy . expecting a major bull run from this point !

Verge Is a Solid InvestmentNew partnerships, Mindgeek, possible Spotify, token pay deal is done for new Verge debit card, providing liquidity and more use case for this cryptocurrency. Based on Elliot waves we are on wave 5. Verge is a solid investment.

VERGE, the one you love or you hate!!!Maybe Verge can make a come back, in my opinion the step Verge maked is ok, most of us will have privacy :)) and Verge is in my opinion a good privacy coin!

The information isnt a recommendation to buy or sell!!!! "

Verge Elliot Wave: UpdateWe are most likely on wave 5, target is $0.48 USD. From there we start a new cycle of ABC and 12345 Impulse patterns.

VERGE(XVG) Elliot WavesVerge has had quite a run up over the past year, it has successfully completed waves 1-4 of a 12345 Impulse wave. We have just started wave 5. Wave 5 can be predicted by drawing a trend line from the end of wave 2 to the end of wave 4 and projecting a parallel line of the trendline off of waves 1 and 3. Wave 5 WILL end on of those lines before an ABC correction ensues. Generally, if wave 3 went past its Fibonacci targets, and was extended and run away type of wave, wave 5 will be shorter and end on the parallel trend off of wave 1. So wave 5 should end at $0.48 USD, by May 14. Also there is a beautiful Inverse Head and Shoulders forming as well.

XVG VERGE CYPHERCypher pattern opportunity for almost 100%. RSI oversold 200MA support. Level of supply

XVG Verge forming Inverse Head & Shoulders Verge is forming an Inverse head and shoulders which indicative of a reversal of a downtrend. The 20 day moving average is also now sitting above the 200 day moving average which could be a historical sign of an imminent impulse. Like Follow Comment

XVGUSD LONGAm pretty new at this but i just wanted to give my humble opinion on the XVG coin. the current setup in the market now is ripe for entry. i feel it should go up btween 0.14 and 0.18 then it would draw back before another big long. watch this space.

VERGE - 4hr Timeframe - Update on Buy and Sell OpportunitiesFollowing our previous daily timeframe overview (), we can clearly understand that Verge has completed a major running flat type correction and is heading to the downside, on the daily timeframe. In the 4hr chart, it seems that BITTREX:XVGUSD is now in the process of making a smaller degree flat type correction.

The "c" leg movement to the upside, which has already commenced, can be a nice buy opportunity, but for us it seems too short lived and not with such a great R/R ratio. The movement to the downside which will follow once the abc is completed, seems instead like a great short opportunity not to miss, with a target in the area of the previous lows and lower. Updates on this and smaller timeframes will follow.

If you feel that our analyses and views may be a useful complement to your trading strategies and in order to be notified in real time with our updates on the lower timeframes, please remember to click on the Follow button.

Remember that you can double check the bigger structures that are at play are on the weekly and daily time frames also by scrolling around the charts in the lower 4hr and 60min timeframes (right and left, up and down).

Trade with care and only with a backtested strategy that has proven to work in relation to your invested capital, risk appetite and potential small losses you might incur in before profiting from a good trade.

Thank you for viewing.

VERGE - Daily Timeframe OverviewVerge BITTREX:XVGUSD has just completed what now looks in a pretty defined manner like a running flat for more downside. If our vision is correct, the cryptocurrency is heading down all the way to retest previous lows in the 0.24 area, then we will see if there will be further buy opportunities. The extremely interesting thing about VERGE is that it is leading the way, time wise, for the movements of many other cryptocurrencies, which share very similar charts. If what we are currently seeing is correct in this matter, we can be pretty certain that once other cryptocurrencies will finish their identical corrections to the upside, they will come for one more down movement to the downside to retest previous lows.

Updates on smaller timeframes coming soon.

In relation to cryptocurrencies, let us remind all traders that any attempt of forecasting based on wave and structural analysis has to be taken in a very conservative manner, as these financial instruments could not have been traded in the markets for a long enough time to consolidate their structure and make a valid projection possible.

If you feel that our analyses and views may be a useful complement to your trading strategies and in order to be notified in real time with our updates on the lower timeframes, please remember to click on the Follow button.

Remember that you can double check the bigger structures that are at play are on the weekly and daily time frames also by scrolling around the charts in the lower 4hr and 60min timeframes (right and left, up and down).

Trade with care and only with a backtested strategy that has proven to work in relation to your invested capital, risk appetite and potential small losses you might incur in before profiting from a good trade.

Thank you for viewing.