ZRXUSDT.PS trade ideas

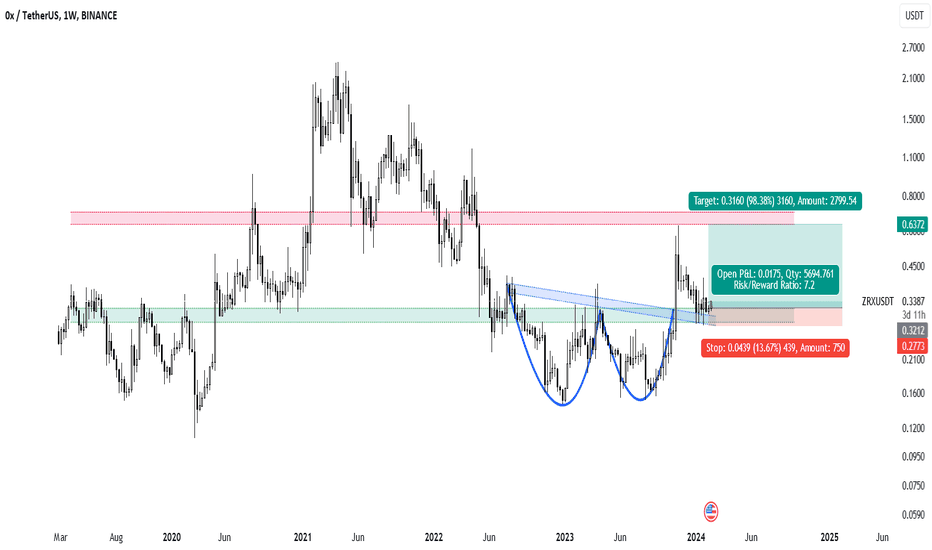

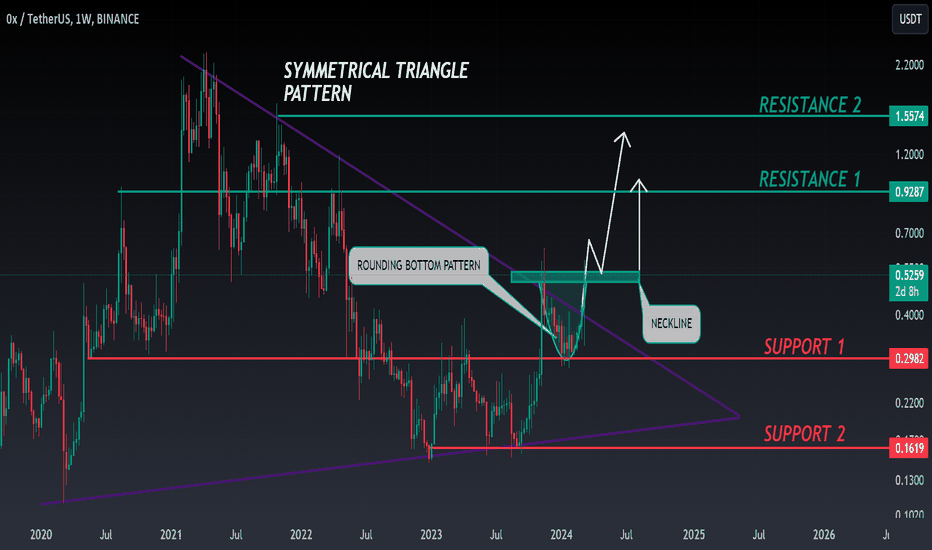

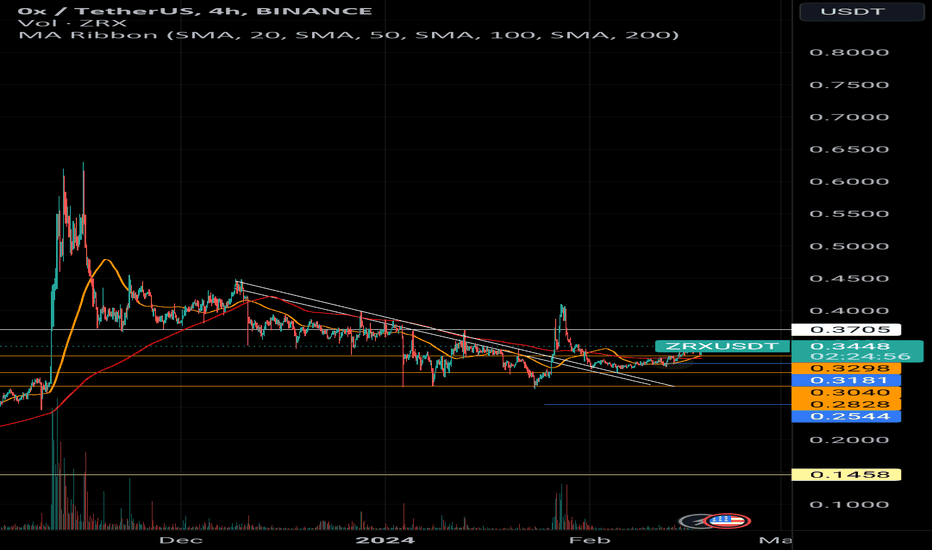

SOLID ZRX for spot buyers! ZRX tested multiple times on weekly candle at extreme demand zone, unable to break that level and break the neckline with bullish engulfing candle and retested the neckline back to back for two weeks.

Next station of resistance is at $0.93.

it may take 2-3 months to reach there but currently is at it best price!

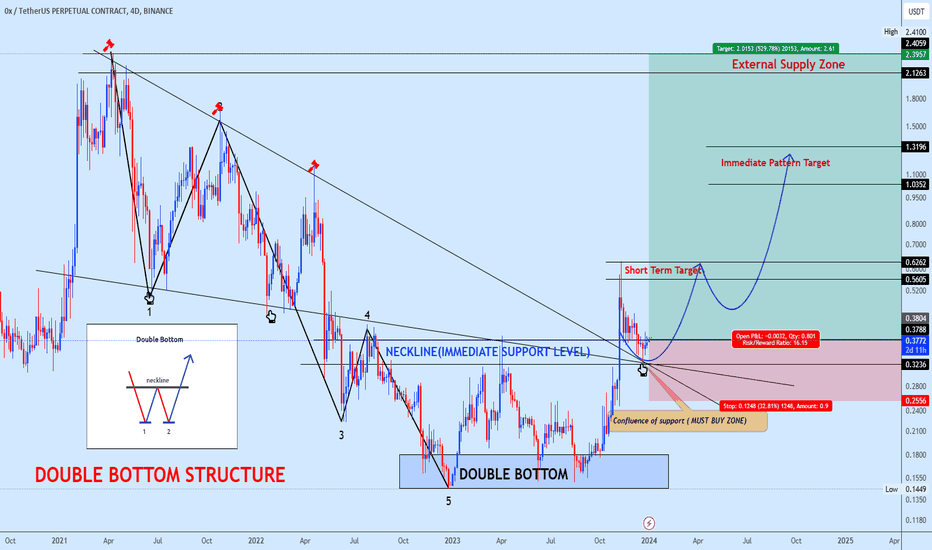

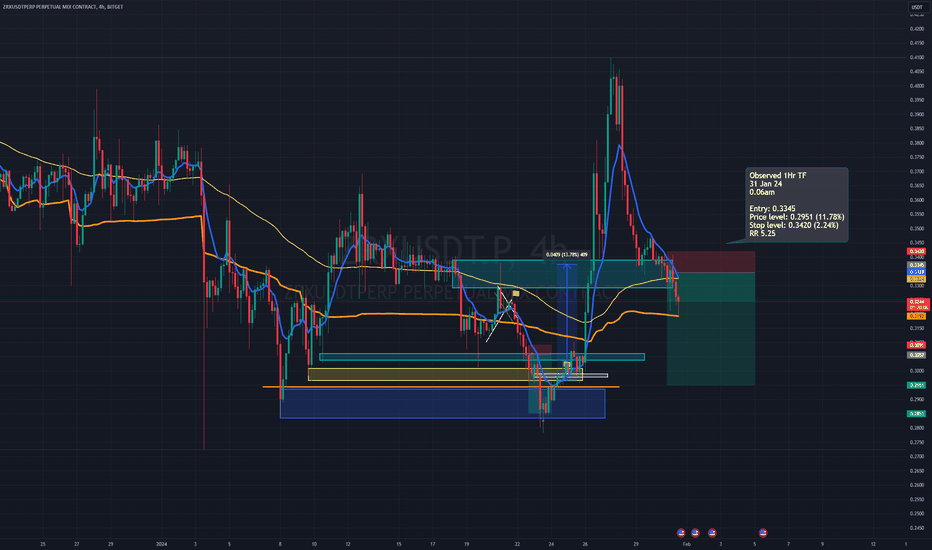

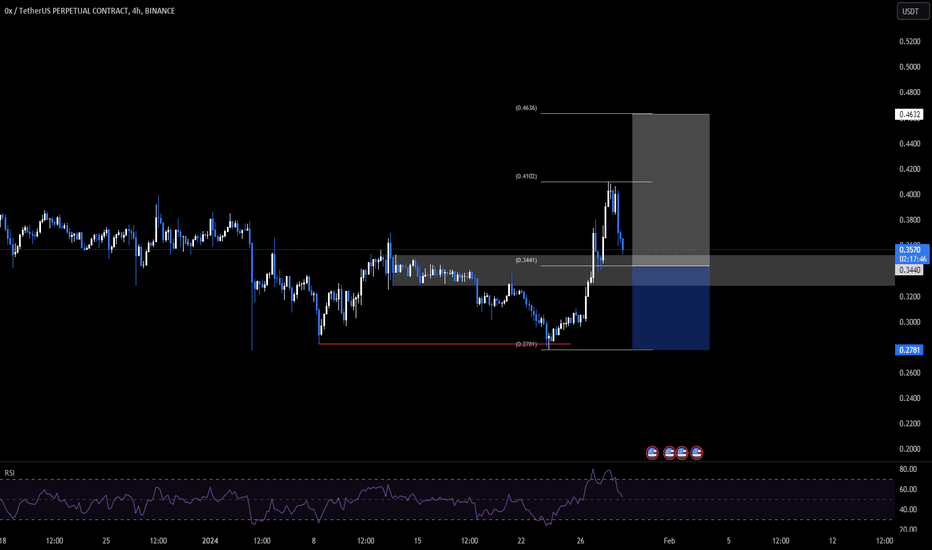

Zrxusdt Buy opportunityZRXUSDT is exhibiting a robust rebound pattern subsequent to the formation of a pronounced double bottom. The breach of the neckline reinforces our bullish stance.

The strategy entails initiating long positions or accumulating within the vicinity of the neckline, adhering to the delineated stop-loss parameters, and aiming for the substantial target projected on the chart.

The targets specified for the short to medium term represent favorable zones for realizing profits.

We welcome and value your interaction through comments and likes. Thank you.

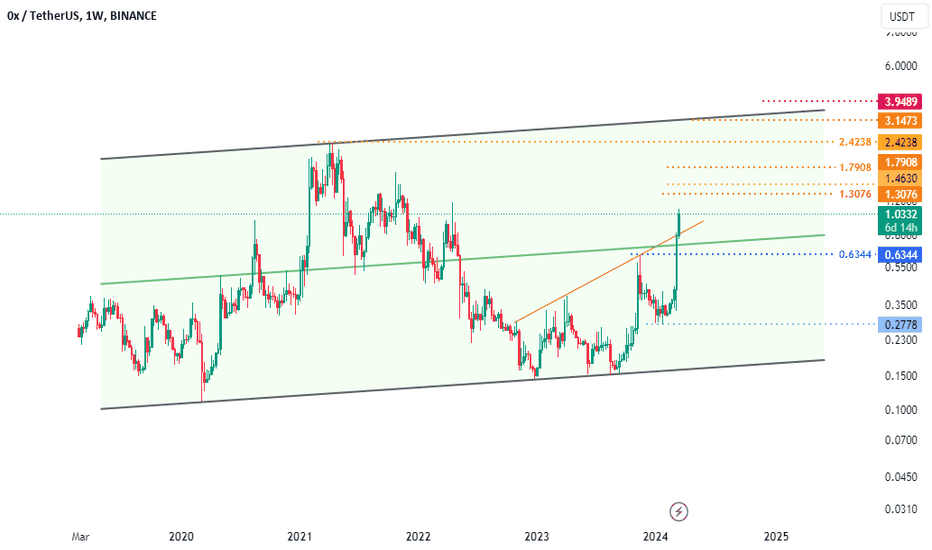

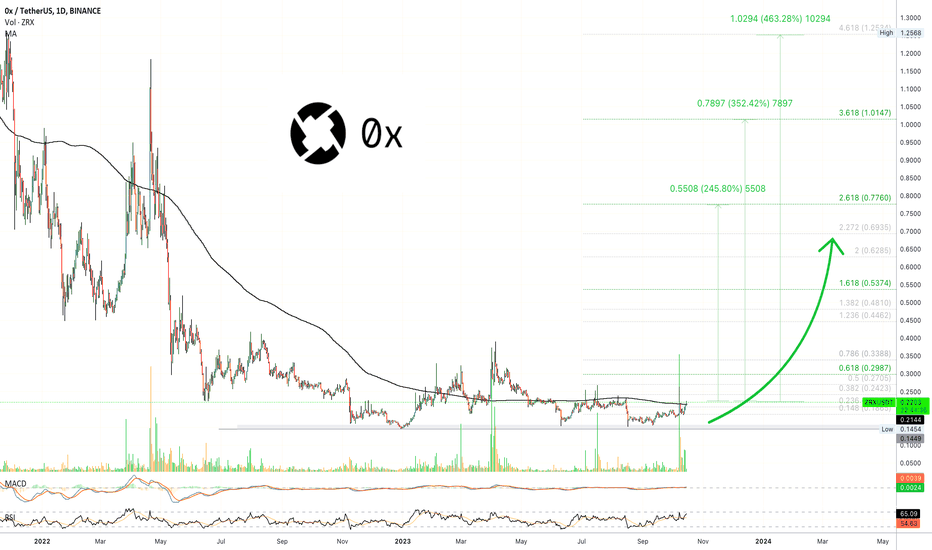

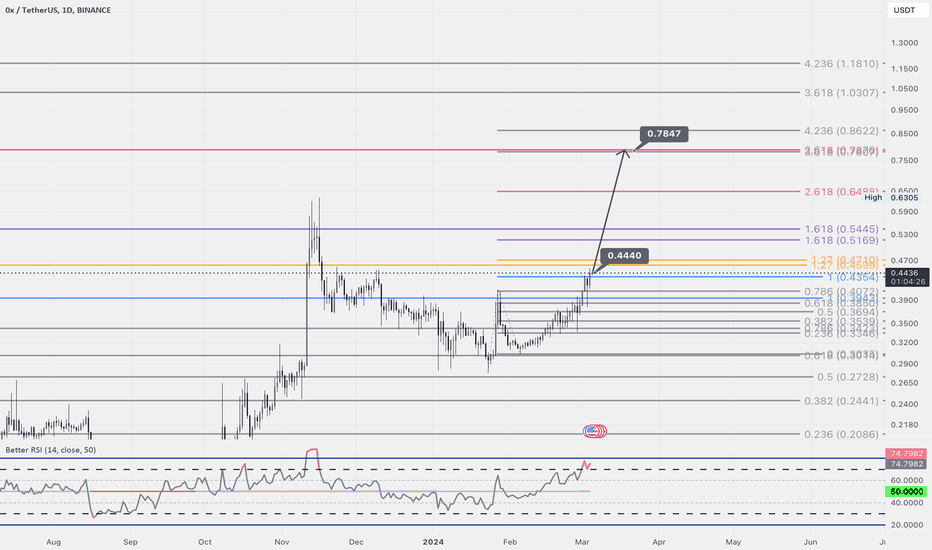

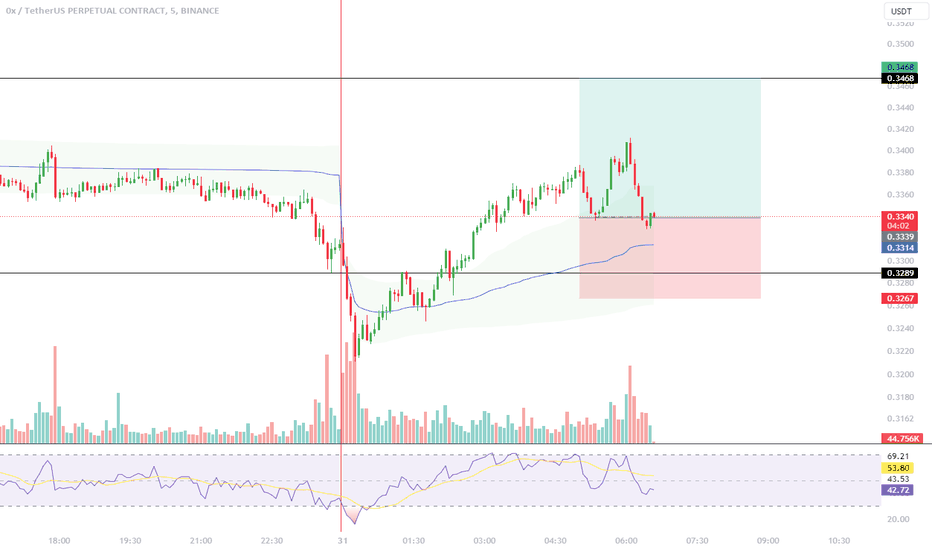

✴️ 0x Turns Long-Term Bullish (444% Potential Profits Or More)Here is another Altcoin trading pair that is looking great currently, this is a high probability setup.

0x (ZRXUSDT) is moving above MA200 to the upside for the first time since February 2021.

This is matched by the highest volume daily since February 2021.

The highest buy volume came in 8-October.

We have two really strong signals supporting each other:

➖ Break above MA200;

➖ Ultra-high buy volume at low prices.

The classic signals are also in place:

➖ Long-term higher low (Aug. '23 vs Dec. '22)

➖ RSI above 60.

➖ Bullish MACD.

Keeping it simple, this Altcoin is preparing for a major bull-run.

It will take time to develop, slow and sustained growth.

There will be retraces and corrections along the way, but the year when it all happens is 2024.

Namaste.

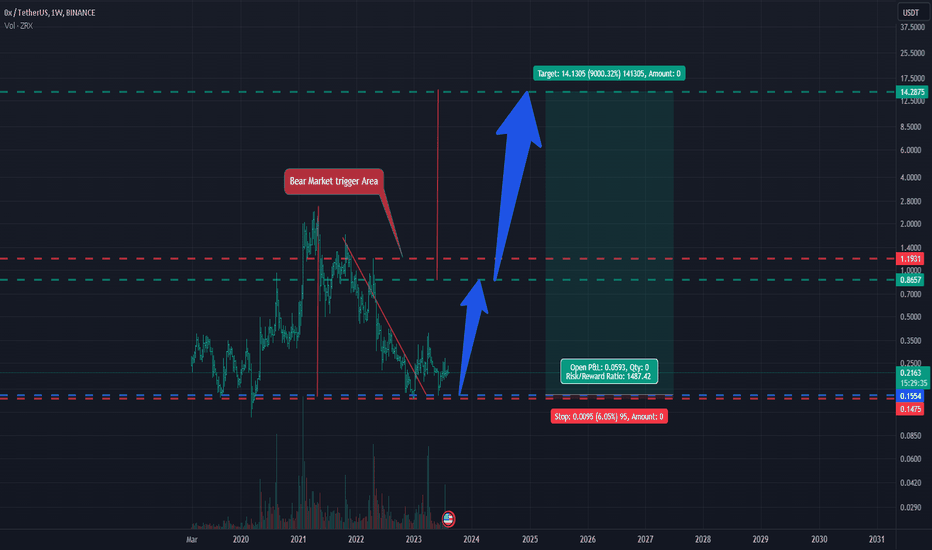

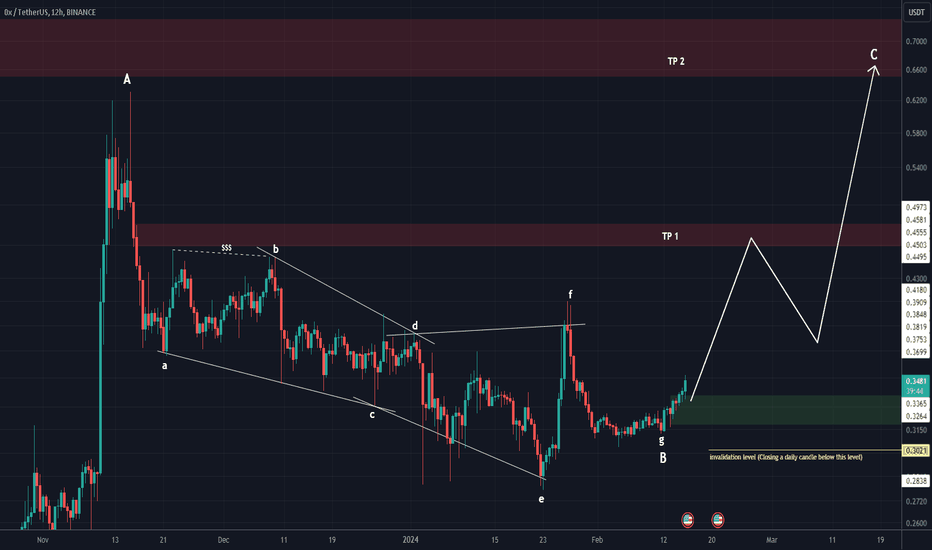

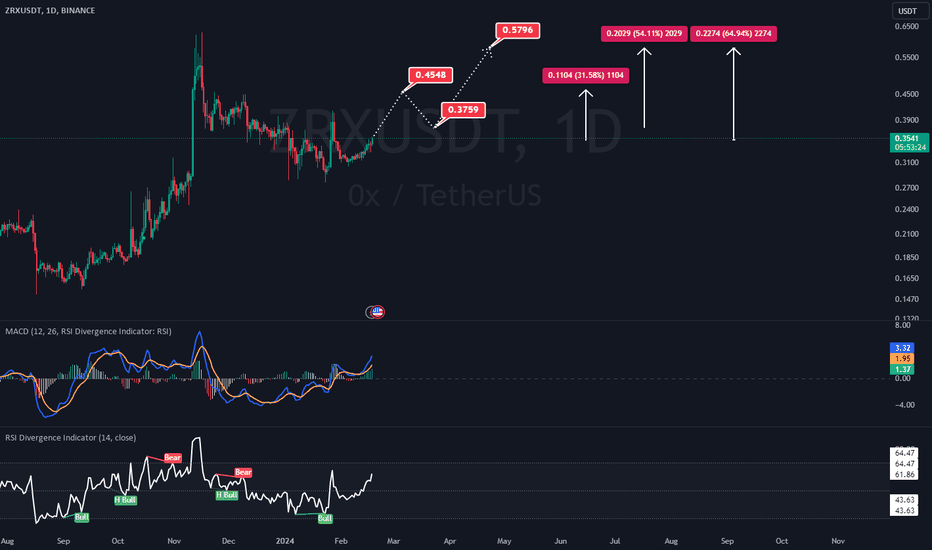

ZRX LOOKS BULLISHIt seems that we have 3 ABC waves, and wave B is a diametric one and it is over.

We should now be in a bullish wave C.

By maintaining the green range, it can move towards the TPs.

Closing a daily candle below the invalidation level will violate the analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

#ZRXUSDT#ZRX

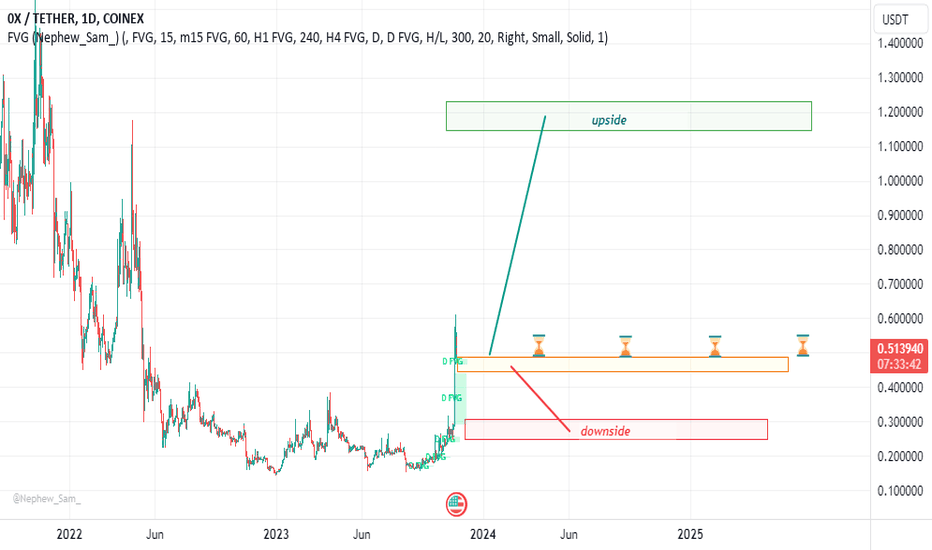

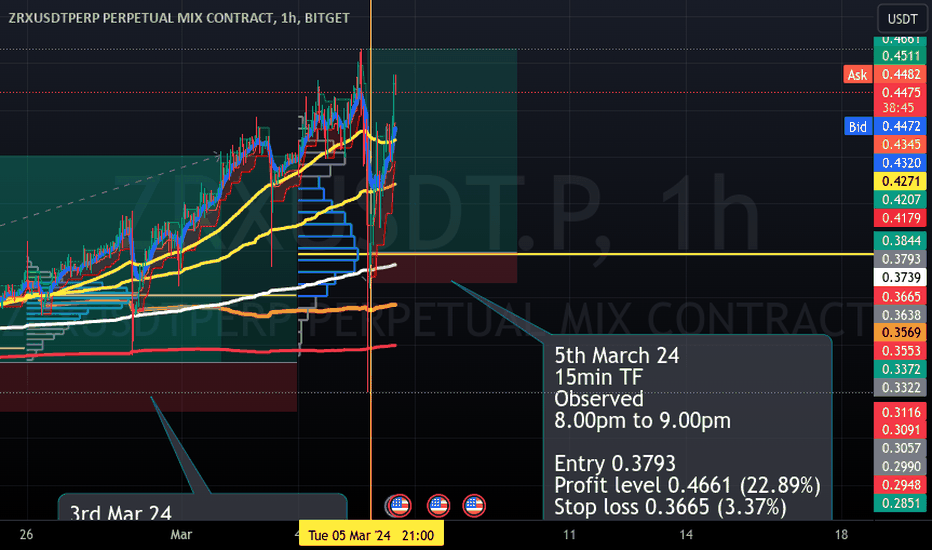

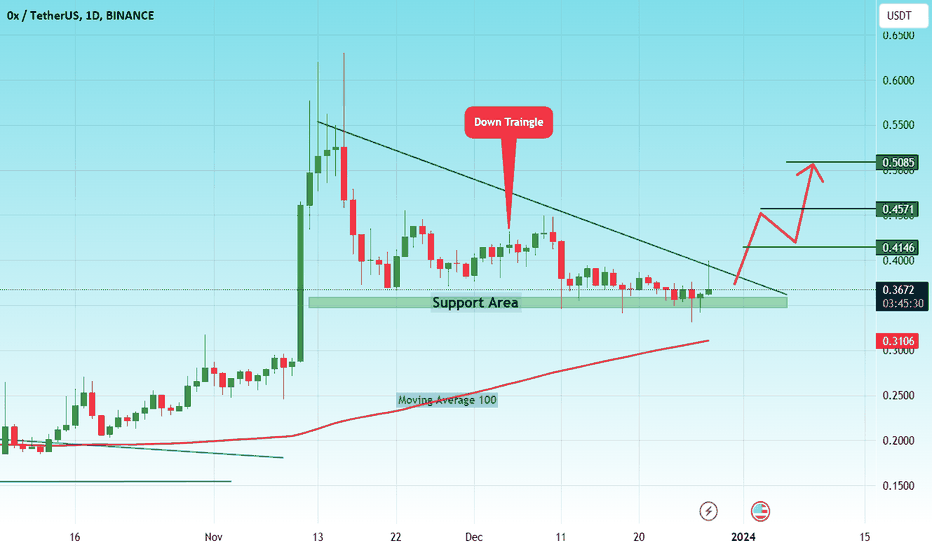

We are in a descending triangle since the last ascent, and it is about to break upward now

We have upward momentum and support from a good area

The price is expected to trade in an upward wave with price corrections

Current price 0.4146.

The first target is 0.4571.

The second goal 0.5085.

ZRX ANALYSIS🔮 #ZRX Analysis

🌟There was a breakout of Symmetrical Triangle Pattern in #ZRX with great volume. Currently #ZRX is trading in a small rounding bottom pattern and if it breakout the neckline then we will get a good bullish move of more than 50%🔥

🔖 Current Price: $0.5251

⏳️ Target Price: $0.9287

⁉️ What to do?

- We have marked crucial levels in the chart . We can trade according to the chart and make some profits. 🚀💸

#ZRX #Cryptocurrency #Breakout #DYOR

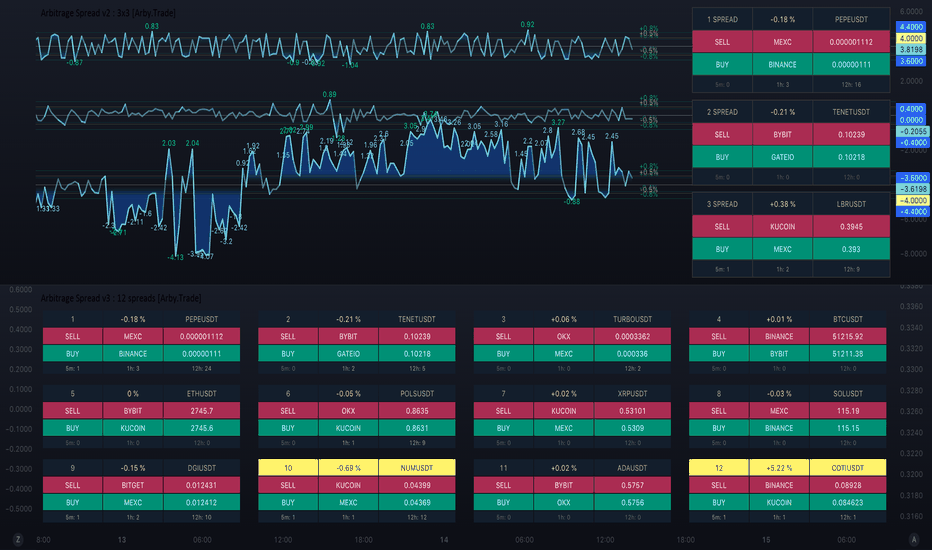

Arbitrage of cryptocurrencies using indicators

Many have heard about P2P cryptocurrency arbitrage using bank cards and exchangers. With this, there are a number of problems and risks associated with blocking accounts, freezing money indefinitely or blocking accounts on the exchanges, since in order to effectively engage in this type of arbitration a trader must have not only his personal cards, but also drop cards (relatives, friends, etc.), and in the case of If there are any problems it becomes extremely difficult to solve them, as well as to explain to banks the origin of so many transfers from different persons.

The interexchange arbitration of cryptocurrencies is devoid of all these disadvantages, when transactions are made only on exchanges, and coins are sent only between exchanges and no third-party services, exchangers, P2P platforms and banks participate in the process of such arbitration.

How do I find and track such arbitration situations?

– situations when the exchange rate for a certain asset on one exchange is lower than on another. This will be helped by a set of indicators that track exchange rate differences for the selected asset on different exchanges. Using these indicators a trader can track how the size of the spread (exchange rate difference) has changed over time, what were the extreme values of this spread and how often it occurs at all.

Currently, there are three versions of this indicator.

1️⃣

The first version – the lightest in terms of the load on the hardware – allows you to track arbitrage situations for one selected trading pair. It provides a chart of the spread itself, the definition of extreme spread values, as well as a counter for the number of arbitrage situations in three time intervals.

2️⃣

The second version of the indicator has the same functionality on board, but for three trading pairs. That is, using one indicator you can track the spread on three assets at the same time.

3️⃣

The third version is essentially an arbitrage dashboard showing and tracking 12 trading pairs at the same time.

As the authors of these indicators and arbitrage screeners, we use a combination of the 2nd and 3rd versions of the indicator in our work. If this is too heavy for your system you can use the 1st and 3rd, or some one. In the large dashboard version (3rd), we track 12 of the most interesting assets at a time, and in the version with the spread chart (1st or 2nd), we are already looking at a more detailed picture of those of them that are of the greatest interest for further work.

What else?

In all the presented indicators, you can configure:

✅ threshold values at which additional tinting of the spread chart will occur for a better visual representation of the nature of the movement.

✅ threshold values at which the spread value in its extreme values will be displayed on the chart. Since the charts are located in TradingView price zones other than the actual spread values, this option allows you to quickly understand the real historical spread values that were in the past.

✅ threshold values at which alerts from the indicator will be received through the built-in TradingView alerts function. All you need to do is set the threshold value in the indicator, and then add an alert from the indicator in the TradingView alert settings. It is important to understand that the threshold value for all trading pairs selected in the indicator is the same, so alerts will be sent as soon as the spread value exceeds the threshold value for any of them.

✅ time intervals of the counter for the number of arbitration situations. There are three of them. That is, when analyzing a particular trading pair you can see how many times the spread value exceeded the threshold. For example, in the last 5 minutes, an hour and a day. This will give an understanding of the prospects of tracking the selected trading pair in the future.

All that remains to be done is to buy the coin at the price indicated in the Buy row on the corresponding exchange and sell it at the price from the Sell row on the second exchange.