4xForecaster

PremiumBTCGBP - TG-1 = 179.89 - 13 DEC 2013 4xQuad predictive analysis points to a forecast back to TG-1 = 170.89, as a high-probability primary target ("TG-1") David Alcindor - 4xQuad.com

Friends, This page will be left open for the purpose of introducing traders to a variety of financial market geometries. While most of the geometric patterns are well know, such as H. M. Gartley's Gartley pattern, Scott Carney's Bat, Crab, Shark, ... as well as Robert Prechter 3-Drives, Bill Wolfe's Wolfe Waves, the emphasis will be to look at specific...

Friends, Following is a trade recapitulation and added analysis of Twitter: TRADE RECAP: On February 5th, my predictive analysis and forecasting system raised the question: "Which Way To The Bear Party?" - Within a few candles, price move towards the target, as I answered: " ... This Way, Replied The Bears." - On the following week, the system further...

DOW - Real Estate - 07 NOV 2013 | 4xQuad Forecasting

SYNOPSIS : 1 - Overall price action suggests an incomplete 5-wave impulse with Elliott Wave alternation rules giving way to a complex Wave-IV consolidation with support expected at 4104.70, compared to a simpler Wave-II which occurred between 04-2010 and 10 2011; A resultant Wave-V completion remains pending 2 - Predictive/Forecasting Model eyes ONE pending...

Friends, A rare coverage of the ag-commodity, but here it is - Corn (P) expected to remain under bearish strain, with a confluence of background technical tools pointing down towards the 244'4 to 202'6 range, against a foreground Predictive/Forecasting Model eyeing bearish targets as low as 202'6. TECHNICAL TOOLS: Fibonacci, Shark and 5-0 Patterns An overlay...

Friends, Following is a composite technical analytic view of $CAC40, in which all aspects of technical tools are displayed as shown in the following chart - We will dissect each of there thereafter: Looking in detail at each of the following components, let's consider the following items: 1 - PREDICTIVE/FORECASTING MODEL: As a foreground, stand-alone...

Friends, Predictive/Forecasting Model hit an unannounced target at the current price vicinity of 3.06557. I have constructed this DAILY chart to comprise three degrees of Elliott Waves: Cycle, Primary and Intermediate. In these relative terms, the recent top would likely represent cycle III of a Period of an Intermediate (5). The relevance of this detailed...

SYNOPSIS : 1 - Limited downside risk per Predictive/Forecasting Model 2 - Predictive/Forecasting Model eyes 7296.19 3 - large developing geometry complies with internal construction of Geo 4 - Internal ab = cd nears "Model" target 5 - Internal inverted H&S in near alignment with reciprocal ab = cd symmetry 6 - Reversal probable at WL target 7 - Invalidation...

Friends, A confluence of technical hurdles is likely limiting any immediate upside potential in the Italian MIB Index, based on the following set of observations: 1 - ELLIOTT WAVE + GEO: In the most recent past (12-19 OCT 20009), price rallied to complete Elliott Wave's 4th wave, completing its corrective swing at 24558.00. This became a spring board from...

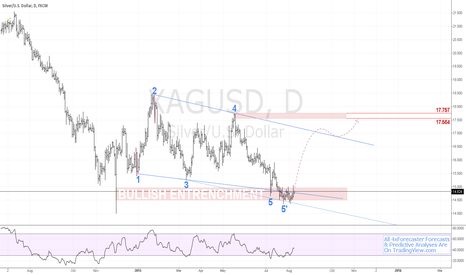

Friends, Watch for potential rally into the 17.564/17.757 range per Geo's Off-Set Rule, as price defined a higher-low structure into the bullish entrenchment - See following chart: Look for commodity-sensitive currencies, such as $AUD, $NZD, $CNH and correlated leaders such as $XAU, $XPT charts (posted earlier this week) for supportive hints in terms of...

SYNOPSIS : 1 - Fundamentals turn against $GBP; BOJ can't control strengthening $JPY: Net Bearish for $GBPJPY, expecting the strengthening #yen to carry a longer shaping effect in the overall geometry, as opposed to a weaker #pound 2 - Predictive/Forecasting Model is net bearish with TG-Lo = 87.772, TG-Lox = 66.900, WL = 38.992 in decreasing probability 3 -...

SYNOPSIS : 1 - Per Predictive/Forecasting Model, underlying force continue to favor bulls 2 - Support near the 77.61 handle offers a probable rebound level 3 - Forecasting Model eyes 01 AUG 2016 vicinity as probable timing in rally 4 - Invalidation: Break of 68.99 Best, David Alcindor, CMT Affiliate #227974 - Alias: 4xForecaster (Twitter)

Friends, Model presents a potential bearish turn in the Russell-2000 ... See following analysis: PREDICTIVE ANALYSIS/FORECASTING MODEL: Predictive/Forecasting Model offers a high-probability reversal in the vicinity of 119.97, as well as a abysmal bearish target defined today (11 JUN 2016) as TG-Lo = 67.51: Per above chart, note that a Fibonacci scale...

SYNOPSIS : 1 - Major bearish strength coming into play 2 - Immediate major support resides at the 15.54 handle 3 - Limited reactive rally expected at 15.54 4 - Ultimate bearish target at 7.83 Best, David Alcindor, CMT Affiliate #227974 - Alias: 4xForecaster (Twitter)

Re: TSLA Following is a quick analysis offered in a personal inquiry; I was asked that it be shared in TradingView.com. I thank my friend for his trust and recommendation. =========================================== Here is the 60-min. chart, which is revealing important technical developments: 1 - A positive divergence in RSI has built a solid floor,...

Friends, I would like to consider the possibility that the SP500 Index might carve out a higher high, based on a set of technical conditions I will define below. PREDICTIVE/FORECASTING MODEL: First and foremost, the Predictive/Forecasting Model I use in the foreground of my analysis has defined a probable bullish target, namely: - TG-Hix = 1063.34 -...

Friends, Predictive/forecasting model suggests a limited upside with a potential retracement target and cap as follows: 1 - TG-Hi = 56.79 - 04 FEB 2015, representing a low-probability, high-reversibility target and 2 - 60.75 -- 04 FEB 2015, representing a "terminal velocity" capping value. The taut value in RSI at 4.8489 corresponded to the recent nadir in...