AlienOvichO

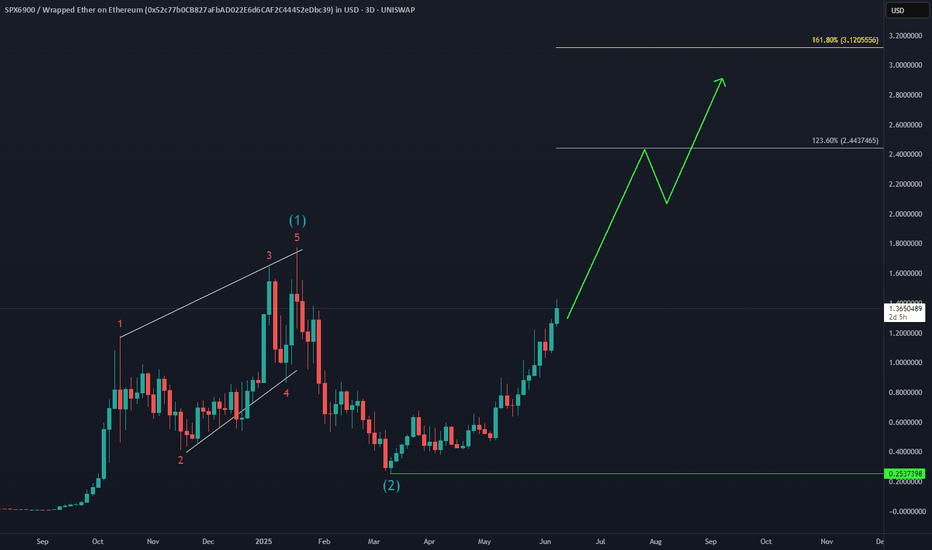

Essential🔥 CRYPTO:SPX6USD With a new ATH on the horizon, wave (3) is eyeing $2.4 - $3.1 as the next target. But this is just the start, momentum is building and summer volatility could push prices even higher!

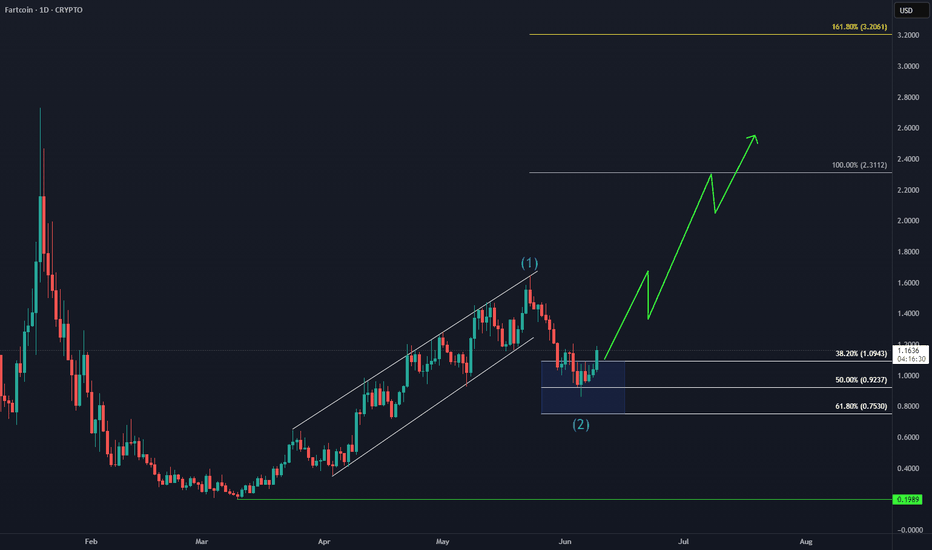

🚀 CRYPTO:FARTCOINUSD April rally cooled off, buyers stepped in at the $1 - $0.75 extreme zone, and now wave (3) is gearing up for liftoff. 🎯Targeting $2.3 - $3.2—momentum is building fast! Are you strapped in for the ride, or still watching from the sidelines?

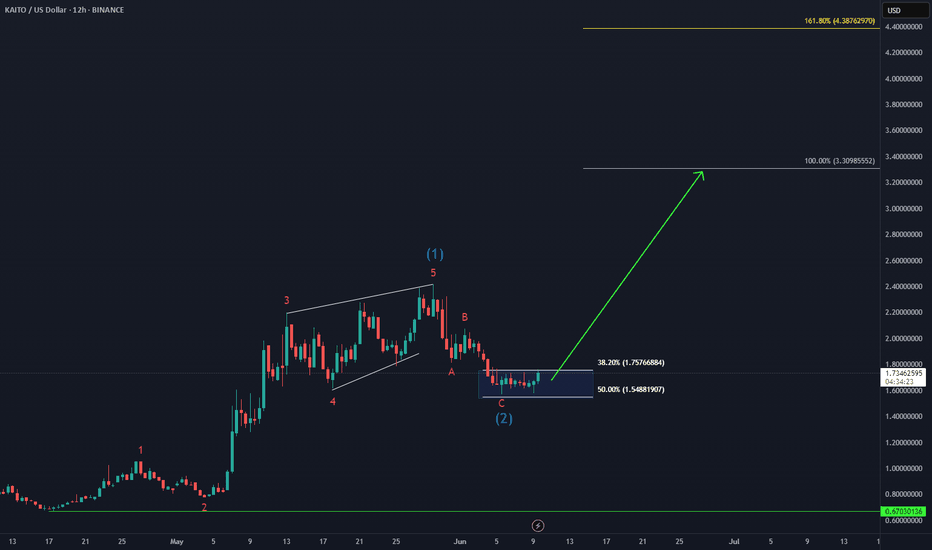

📈 BINANCE:KAITOUSDT Found strong buying interest in the #BlueBox zone and now it's gearing up for a potential 100% rally. 🚀 Targeting $3.3 - $4.3 as momentum builds. Did you catch the dip, or are you waiting for confirmation?

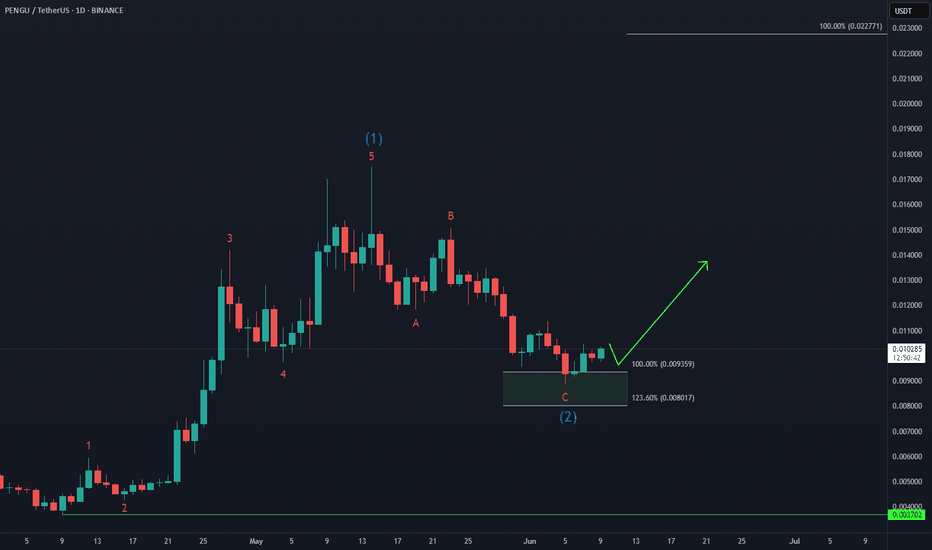

🐧 BINANCE:PENGUUSDT has completed its 5-wave advance from the April low (wave 1) and corrected with a 3-wave Zigzag structure in wave (2), reaching the buying area at equal legs $0.009 - $0.008. 🚀 Now, it's setting up for wave (3) higher, with an initial target at $0.022. 🌊 Are you positioned to catch the next wave higher?

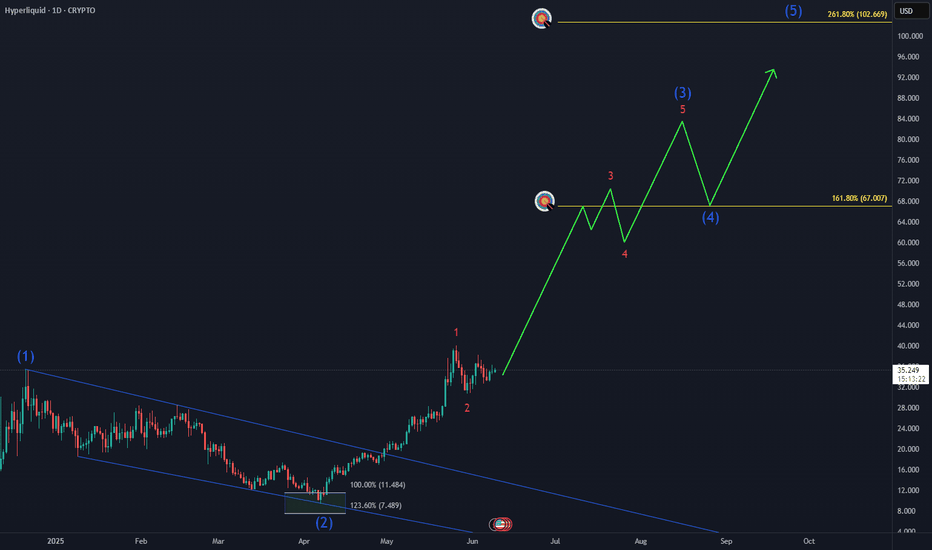

🚀 BINANCEUS:HYPEUSD has surged into a new ATH and the most bullish scenario suggests a nest structure forming. 🎯 This setup could lead to an extension beyond the 1.618 Fib level at $66, opening the door for +$100 range in the coming months. Are you positioned for this breakout? What’s your personal target for this cycle?

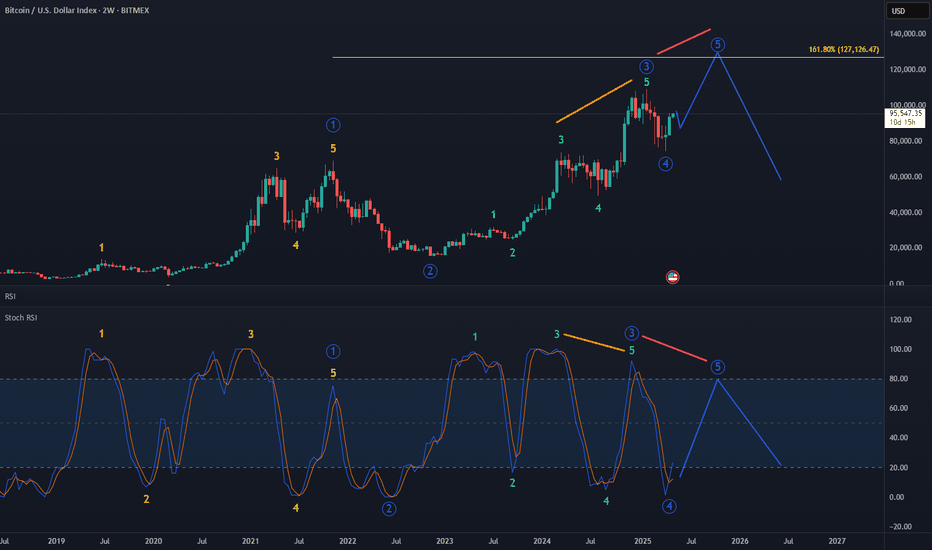

🟠 The weekly divergence between the March 2024 and January 2025 peaks has driven the recent 3-month decline. 🔴 BTC is expected to make a weekly move higher, creating another divergence in the way. 🔵 BTC held above the 2024 peak range 73K without overlap, while the Stock RSI has completed a full reset, reinforcing the bullish momentum. 🟢 Outlook: Over the next 6...

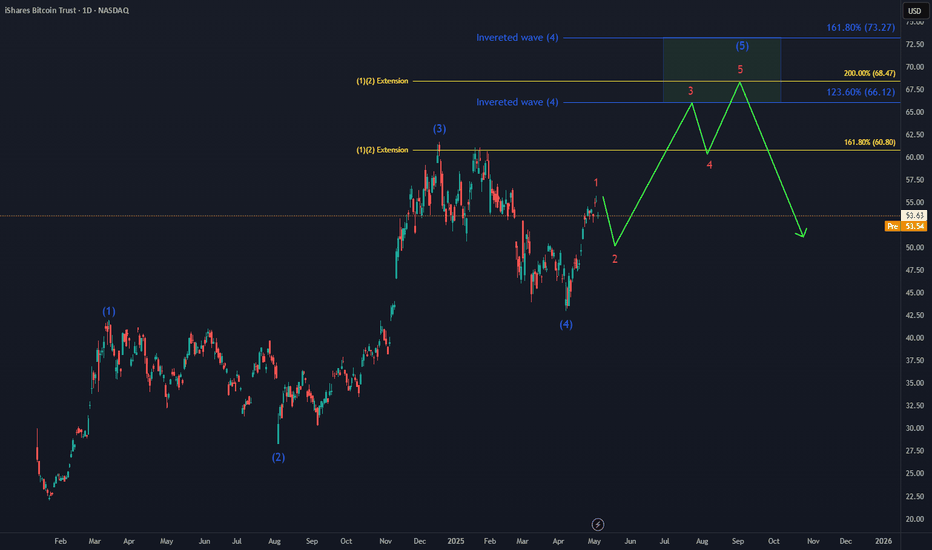

The Bitcoin INDEX:BTCUSD ETF NASDAQ:IBIT is shaping a 5-wave move toward a new ATH, set to complete its cycle within a regular impulse. Key technical area for the next move higher: 🔵 Inverted wave (4) target : $66 - $73 🟡 Wave (1)(2) extension : $68

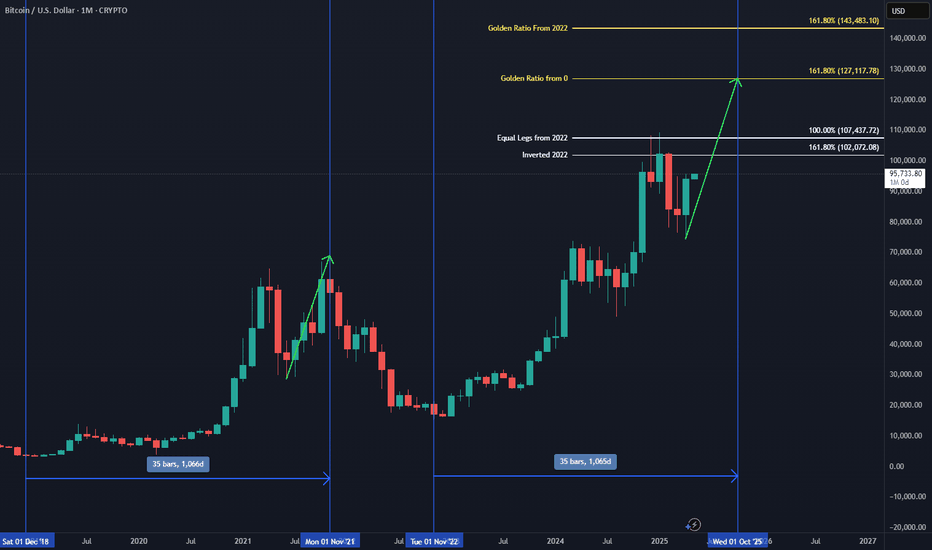

Bitcoin BTC 4-year cycle is set to conclude within the golden ratios, using both the 2010 and 2022 lows as reference points. Based on historical patterns, the projected target range is 127K - 143K, aligning with previous cycle behavior.