Antwerp_winning_trader-Maitham

PremiumTrading Plan is scalping Trading Plan scalping :- 1-take the trade in the direction of the of the HTF 2-waiting for the opportunity 3-when the market retraced or pullbacked and making ifvg and fvg , wait for mss for confirmation on the LTF ,then enter the trade 4-not every retracement is profitable so confirmation by mss on the LTF is mandatory Thank You

Trading Plan scalping :- 1-take the trade in the direction of the of the HTF 2-waiting for the opportunity 3-when the market retraced or pullbacked and making ifvg and fvg , wait for mss for confirmation on the LTF ,then enter the trade 4-not every retracement is profitable so confirmation by mss on the LTF is mandatory Thank You

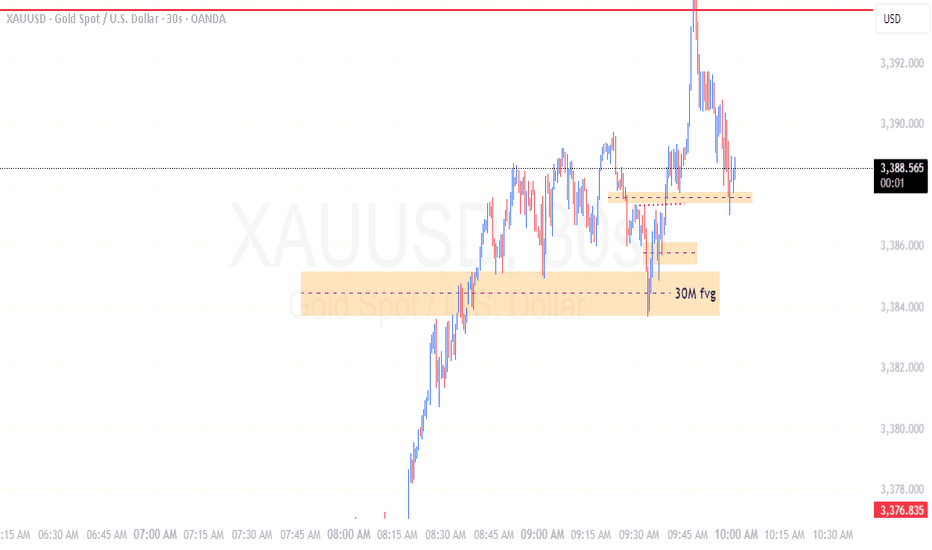

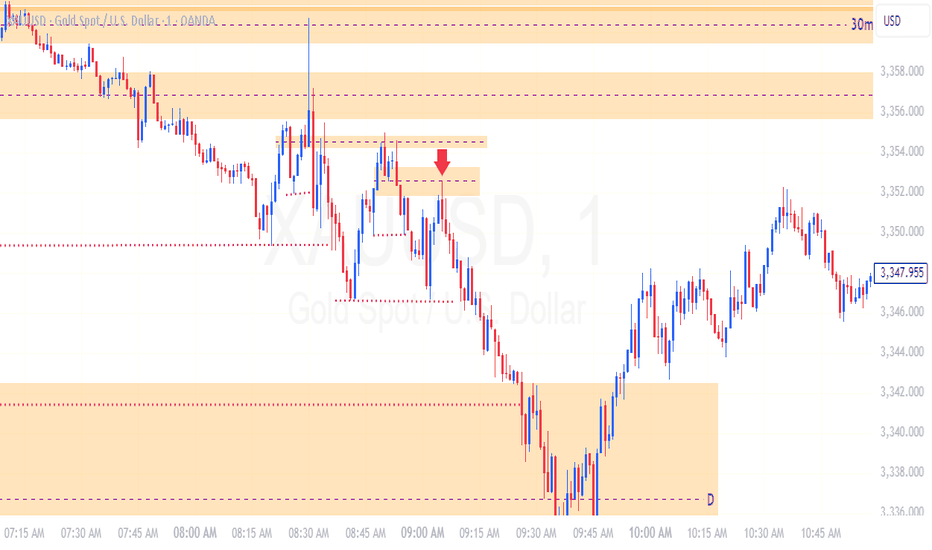

Trading Plan :- 1-PDA:-from IRL (30m FVG )to the ERL(HOW) 2-Rejection +ifvg+fvg 3-mss Thank you

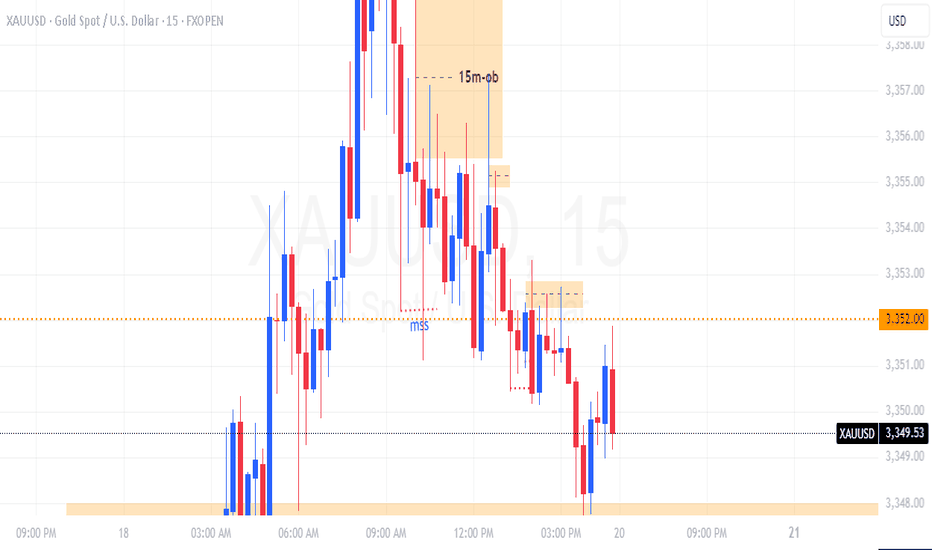

Trading Plan of Friday 18-JULY-2025 and Monday 21-JULY-2025

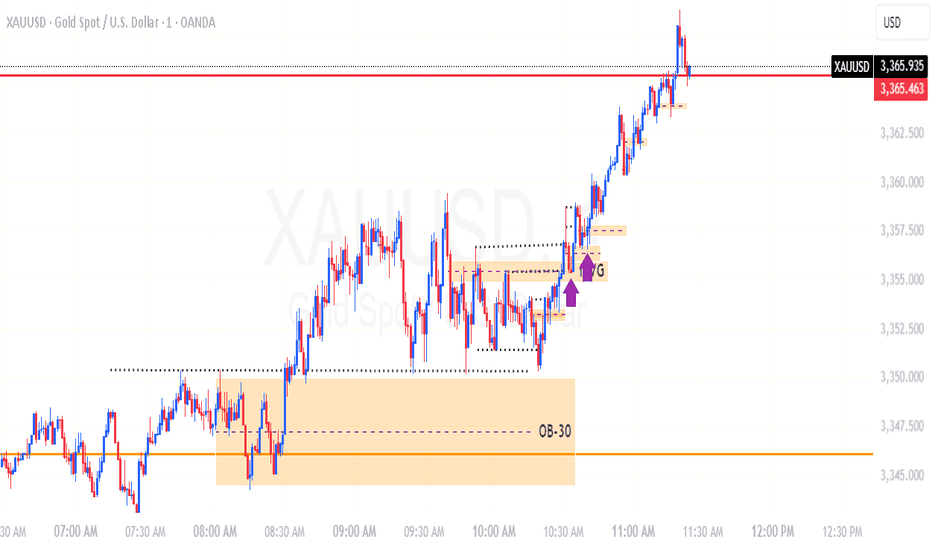

Trading Plan :- 1-The combination of Ifvg+fvg+mss in the direction of bias is the most profitable setup 2-double buttom is LQ area that attract the price to sweep it 3-SSL and BSL Thank you

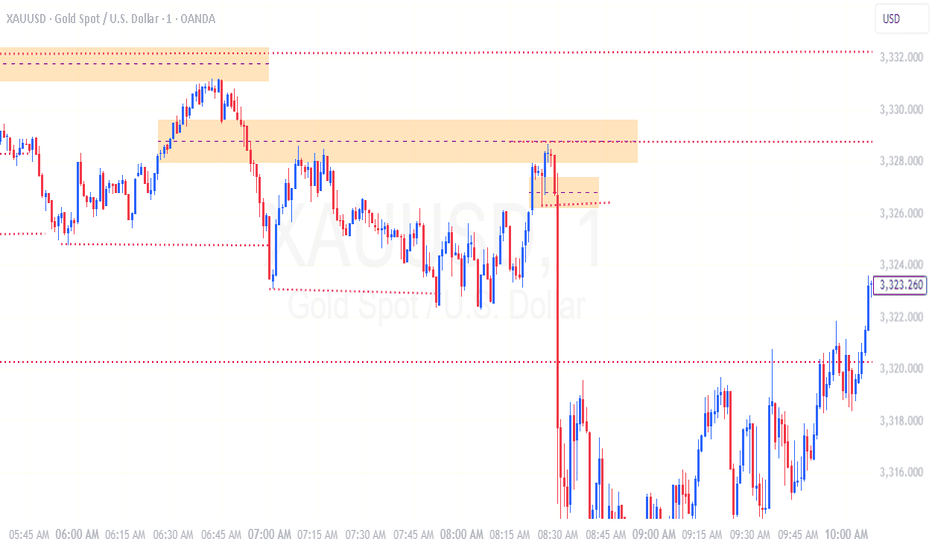

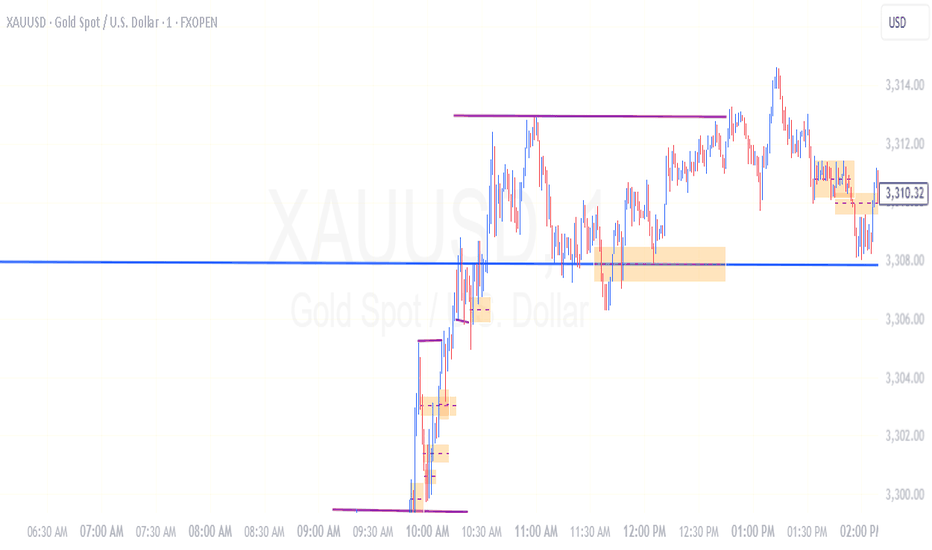

Trading Plan :- 1-PDA targen from IRL to the ERL 2-iFVG and FVG together with MSS and CISD 3-release PPI at 08:30 am NYT 4-double bottom and LOD is the target like a magnet for the price these are the confirmation tools for the direction of the price for the target Thank You

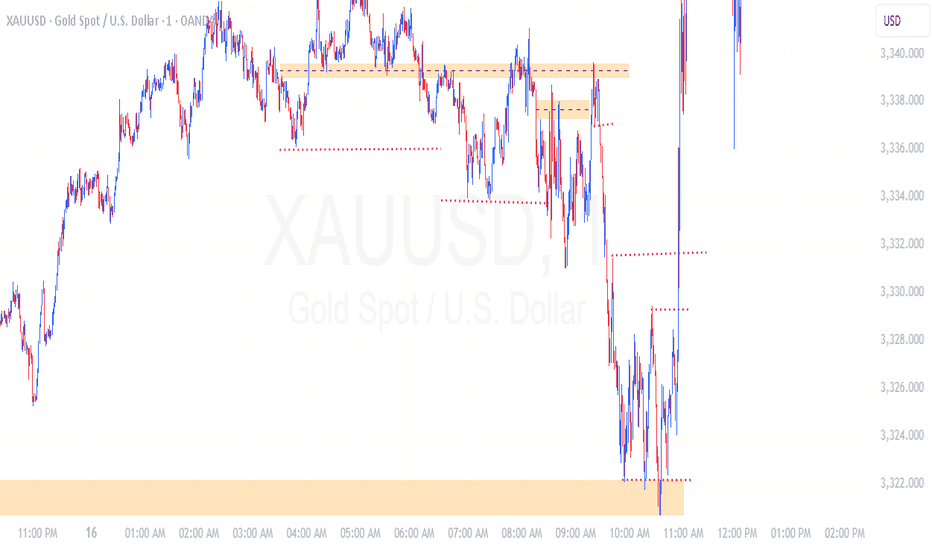

Trading Plan :- 1-the price from one PDA to another PDA PDA is either swing point ,weekly high and low ,daily high and low and FVG DOUBLE BOTTOM /TOP and TRIPLE BOTTOM /TOP are a very beautiful areas to be target by the price specially when there is FVG beyond it these are areas of accumulation of Liquidity 2-release of CPI at 08:30 3-iFVG and FVG together...

Trading Plan:- 1-BIAS 2-NARRATIVE 3-CONTEXT 4-ENTRY 5-RISK MANAGEMENT My tools:- OB,nested OB , FVG , iFVG ,MSS and CISD

Trading plan 1-bias 2-narrative 3-context 4-entry 5-risk management iFVG and FVG is the cornerstone of my trade today iFVG is a failed FVG BB is failed OB

Trading Plan :- 1-weekly profile which is midweek reversal 2-Target:- high of the week 3-CISD 4-MSS 5-sweep of the low 6- orderflow leg:- bullish 7-AMD 8-iFVG +BB+OB and FVG thank you

Something that i missed it :- 1-CISD 2-ifvg 3-Ob 4-fvg thank you

Trading Plan 1- SSL and BSL 2-sweeping of the triple buttom and i confused it as CISD and made sell order and later SL was hit 3-there was iFVG which is very beneficial in trading that make compensation and profit 4-there was always a chance to enter the market perfectly even when your SL hit 5-there was disrespection to the H2 and H4 fvg 6-iFVG and FVG on lower...

Trading Plan:- 1-SSL and BSL 2-MSS and cisd 3-HOD and LOD 4-iFVG and fvg

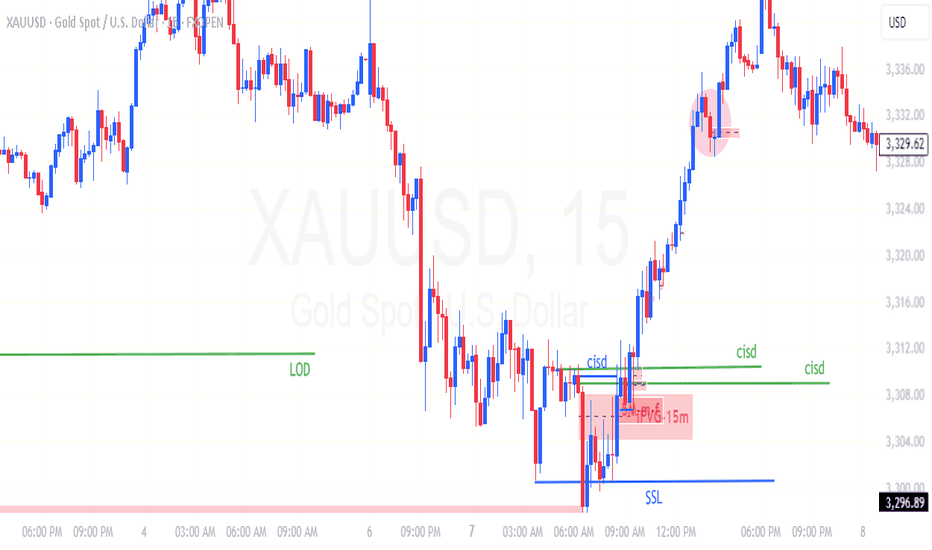

Trading Plan:- 1-SSL 2-CISD 3-OB 4-iFVG+FVG 5-NY session

Trading Plan :- 1-BSL and SSL 2-MSS and CISD 3-iFVG and FVG 4-probabilistic mindset Thank You

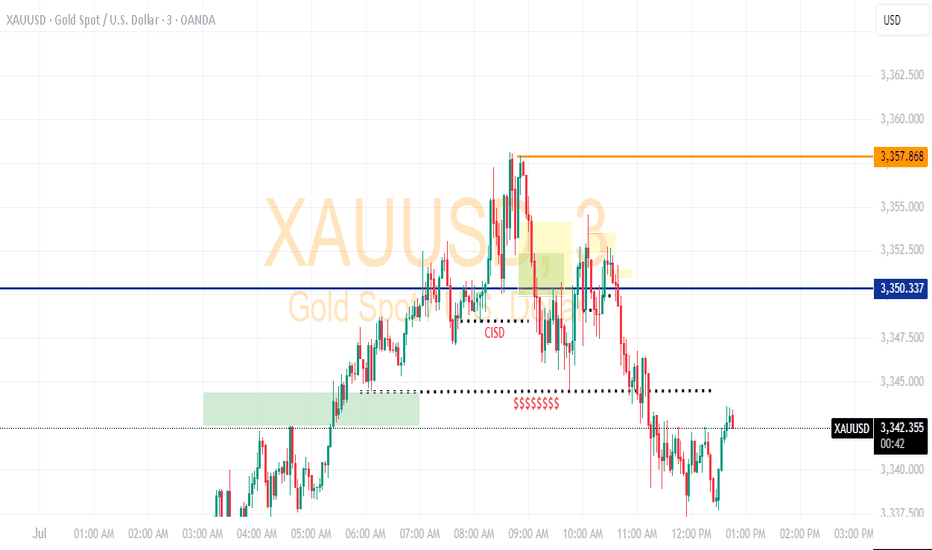

Trading Plan :- 1-PDA:-swing point high 2-FVG:- 15 minutes TF 3-CISD :-15 minutes TF 4-The price returned to the FVG and order block above then make rejection block on 3 mins with CISD ON 3 mins 5- then entry short bearish with the first target (double buttom) THANK YOU

Trading Plan:- 1-PDA:-swing point of the week low 2-TS+BB 3-OB 4-AMD 5-(1-2-3)pattern 6-CISD+MSS 7-Rejection Block Thank you

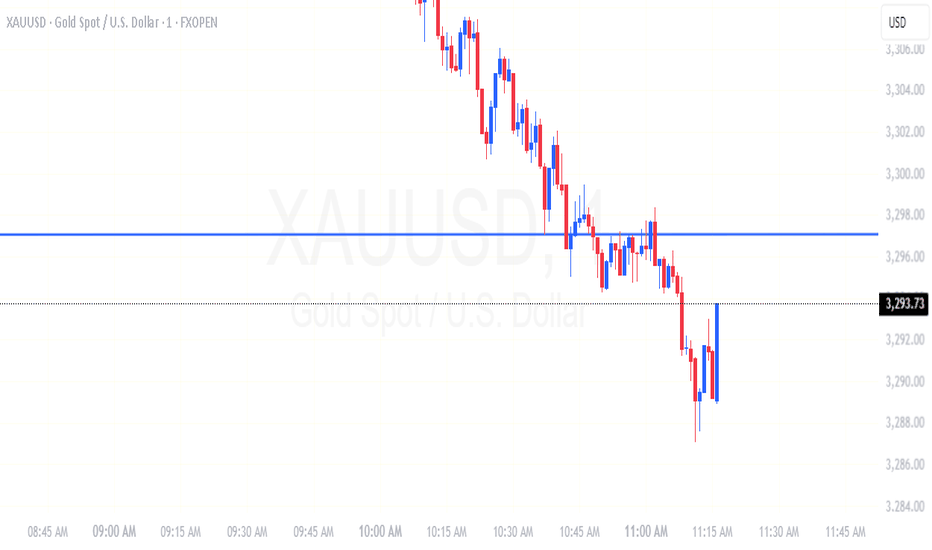

Trading Plan:- 1-bias:-bearish 2-CISD 3-the price move from H2-FVG to the LOW(low of the week) 4-At the H2-FVG ,the price change its direction and make (CISD) with FVG-15M 5-Then the price move short for long term Thank you