Antwerp_winning_trader-Maitham

PremiumTrading Plan:- In reality ,I missed the opportunity 2 times ,may be due to emotion and not vigilant to the chart But the most important thing that i should make it is the Disciplined with Awareness that play an important role in the market NOTE:- put in your mind that there is something wrong in the market

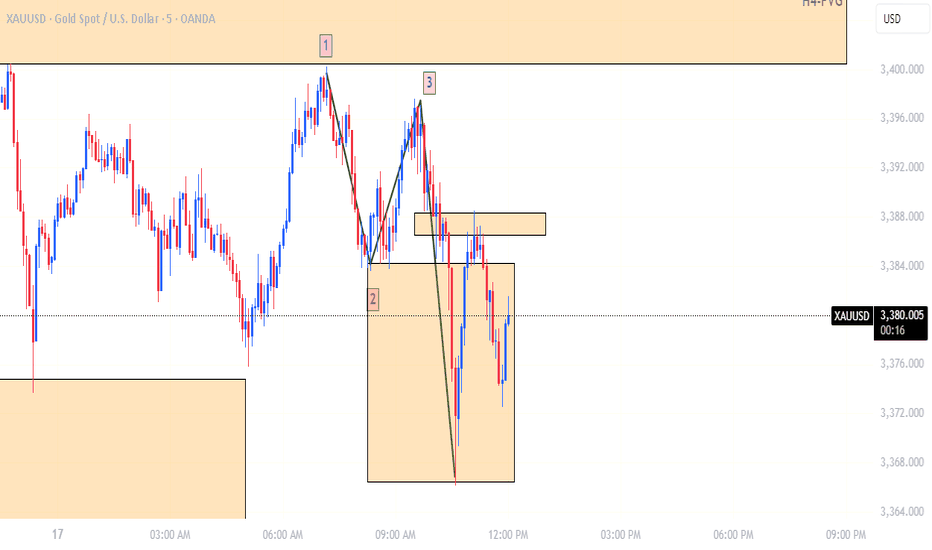

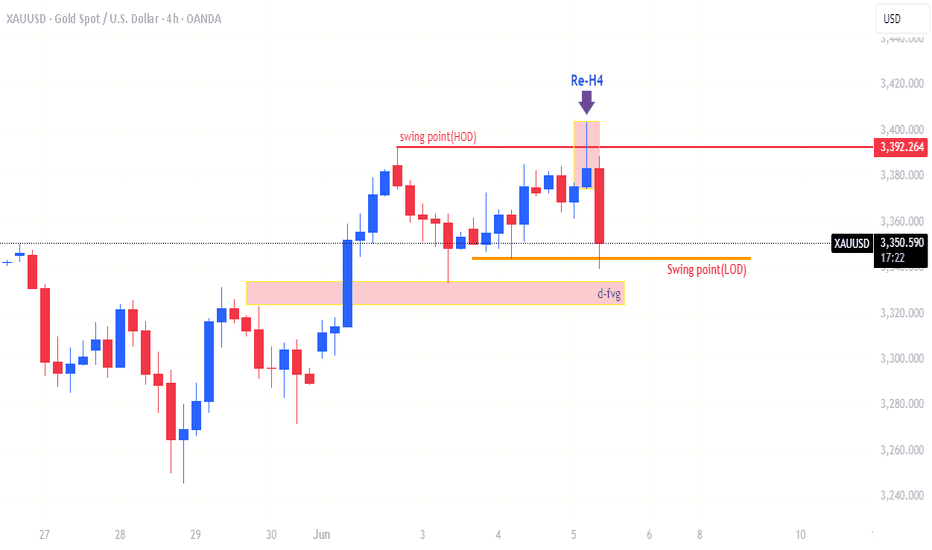

Trading Plan 1-Bias:- bearish 2-The price move from H4-FVG to the LOD(from IRL to ERL) BUT THE FAILED TO CONTINUE AND MOVING UP AGAIN looking for LQ from swing high 3-two candle rejection H4 on the H4-FVG (bearish bias) 4-order flow and MSS 5- CISD The point is the LIQUIDITY above the swing point ,which may be needed to targeting down

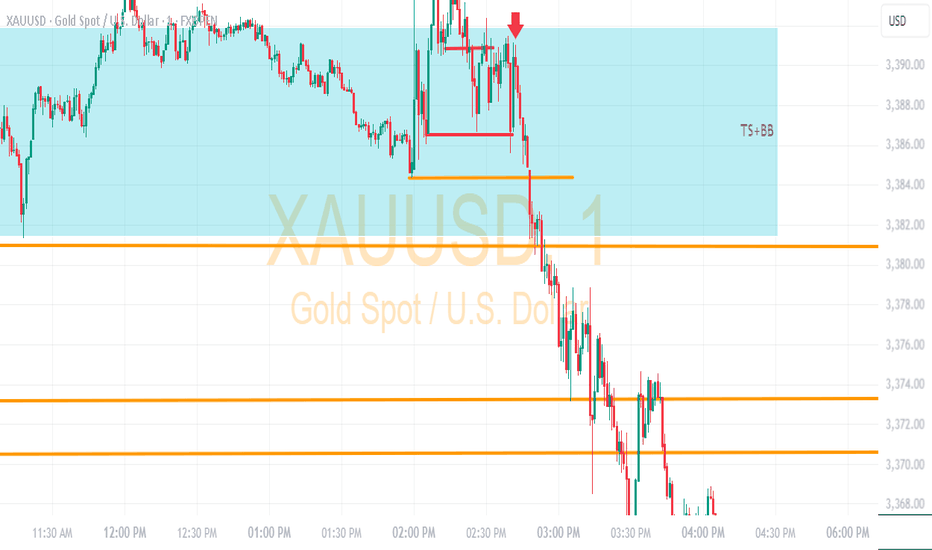

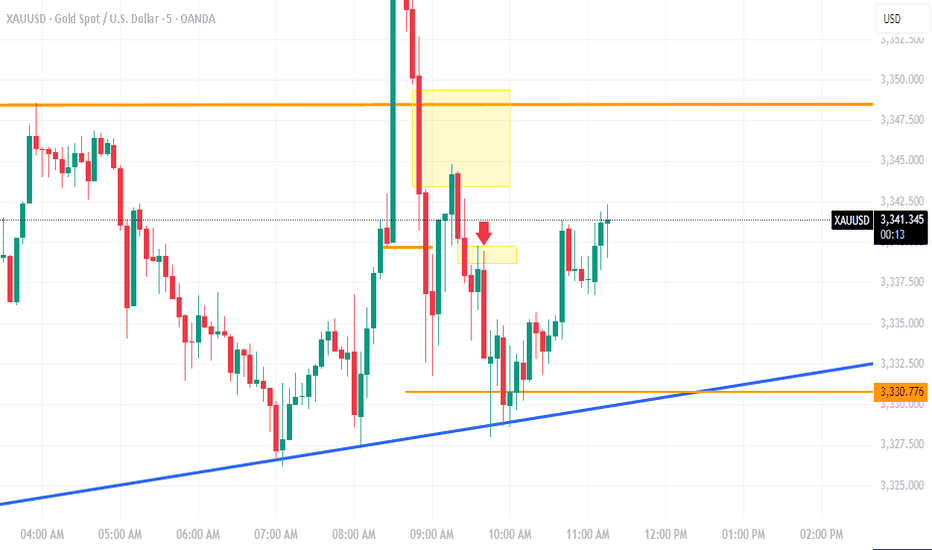

Trading Plan of the Day 24-June-2025 1-High and Low of the Week and D 2-the price did not respect the bullish trend ,bullish FVG 3-continue lower looking for LIQUIDITY below the low of day and week 4-CISD on different timeframe 5-MSS 6-AMD 7-(1-2-3) pattern 8-TS-BB Thank You

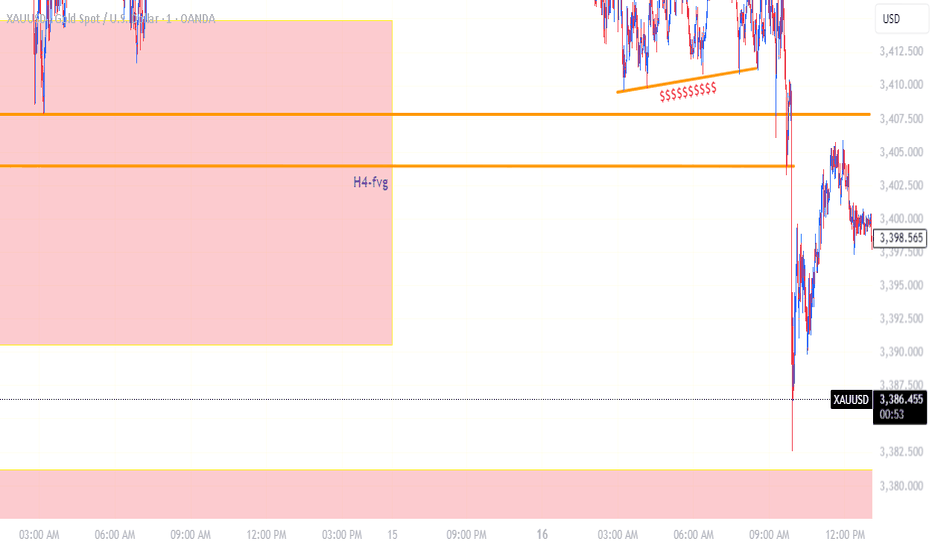

Trading Plan:- 1-PDA :-FVG-H2 to the ERL(HOD) 2-Rejection Block on D,H4,H2,H1 3-CISD 4-IRL to ERL 5-MSS 6-(1-2-3) pattern 7-TS+BB on H1 and on lower timeframe 8-AMD 9-Reclaimed OB

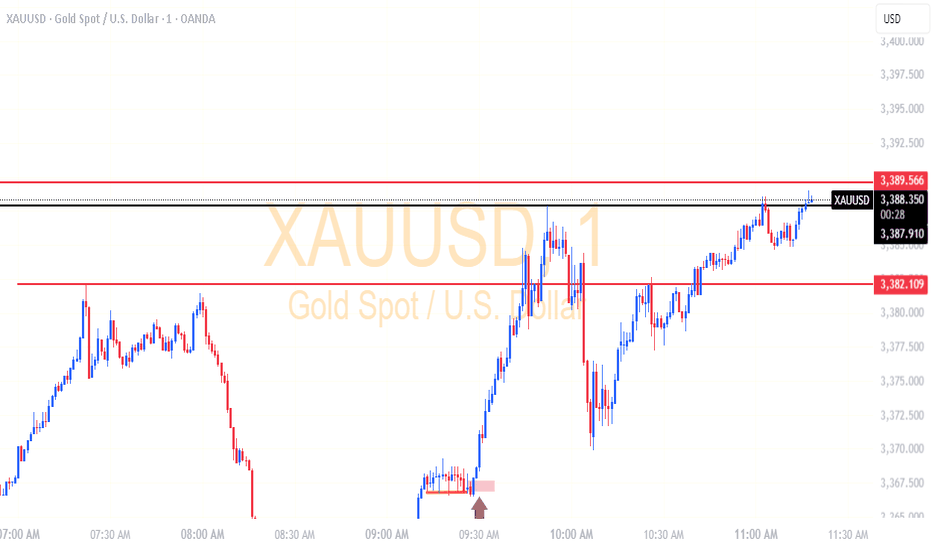

Trading Plan 1-the PREVAILING trend is bearish 2-the price was moving sideway 3-CISD 4-TS and and BB

The Trading Plan:- 1-the main trend on D-TF is bullish 2-PDA:-D-fvg and the target is the swing high 3-Rejection Block on D-TF 4-Rejection candles on the H4 from the D-FVG 5-The price is already moving sideway for 2 days so there is accumulation 6-the trading is on lower timeframe with MS between the high and low of the trading range Thank you

Trading Plan of the day :- 1-bearish trend 2-(1-2-3)pattern 3-PDA :-30 m FVG 4-FVA:-which should give a chance for buyer to take its opportunity and then selling pressure increase in the bearish direction at the PDA 5-At Lower timeframe :-CISD with FVG 6-ARGUMENT:- There was an FVA with FVG and OB bullish :-That make the rejection candles against the trend These...

Trading Plan:- 1-PDA:-swing point of the week 2-Rejection block from the swing point 3-CISD 4-FVG :-2 fvg.s on H4,H2 and H1 5-AMD on the NY session :-The price take on the LQ from above and move down 6-Then the price move down to the target (D-FVG) My argument is followed by another video Thank You

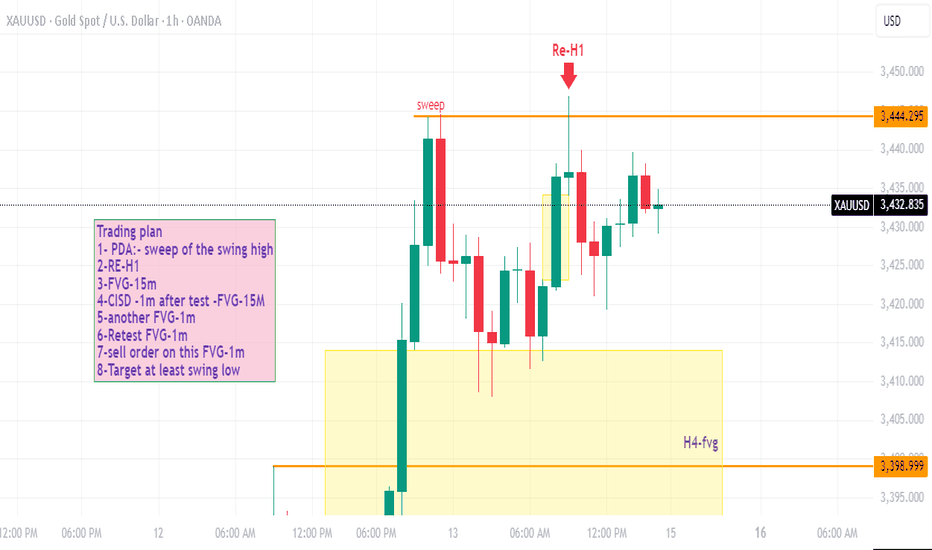

Trading plan 1- PDA:- sweep of the swing high 2-RE-H1 3-FVG-15m 4-CISD -1m after test -FVG-15M 5-another FVG-1m 6-Retest FVG-1m 7-sell order on this FVG-1m 8-Target at least swing low

On this day 11-MAY-2025 ,CPI core,m and y was released and all of them were negative for the dollar My performance depend on patience . So after release of the NEWS ,be patient and patient and patinet until the price gives you the direction and give you the opportunity to enter the market 1-PDA :- which is the OB 2-Re- (H4-H2-H1-30m) and ST (SHARP TURN)in lower...

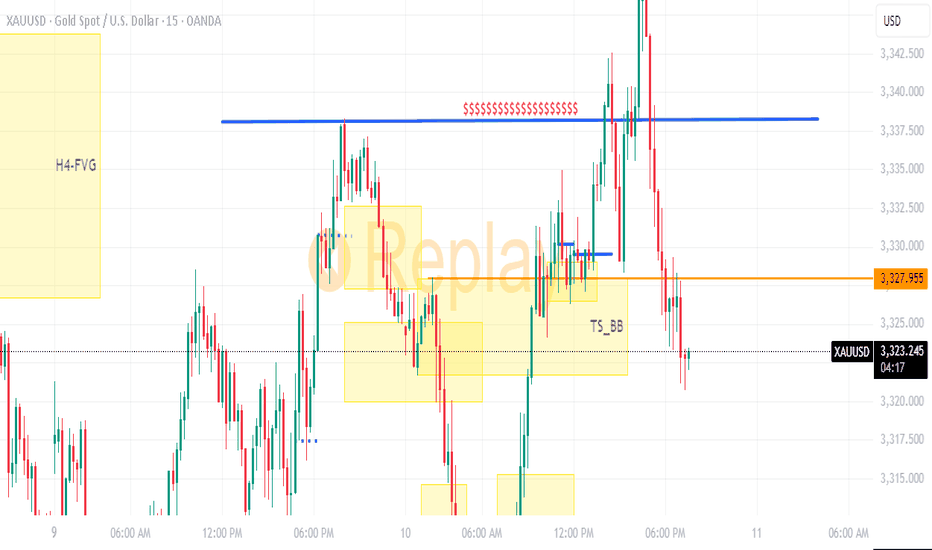

The trading plan of the day :- 1-the price disrespected the bearish FVG,s 2- formation of Bullish FVGs 3-TS_BB 4-cisd 5-Rejection 6- Reclaimed OB 7-Targeting the swing high The price was struggling in this area at first but at the end continue to its target swing high

Trading Game of the day:- 1-PDA (H4-FVG) 2-CISD 3-(1-2-3) pattern 4-Rejection candle 5-Market structure 6-Order flow holding 7-FVA+FVG+swing point

The update include:- 1-H4-FVG 2-Sharp Turn (iFVG +oFVG) 3-TS+BB 4-TARGET :-divided into 3 partitions

Trading game of the day 1- PDA 2-Market structure is bearish 3-Rejection block (multiple) 4-pennant formation which is a continuation pattern 5-CISD 6-AMD(accummulation ,manipulation and distribution 7-FVG 8- TS+BB 9-Target is the swing low

Trading game of the day is the same trading plan of the day 1-PDA:- SWING POINT (HOD) 2-Rejection Block from the swing point on H4-TF 3-Market Structure 4-CISD 5-FVG which represent (Unusual Context) 6-Rejection from the fvg 7-TS+BB

Trading plan of the day :- 1-PDA:- the swing high of the day 2-Re-H4 from the swing high of the day 3-FVG-H1 bearish which is (unusual context) 4-CISD 5-MS bearish

Trading Plan of the today on lower timeframe 1-PDA:-FVG-15M 2-(1-2-3 pattern):-3V2 3-CISD+MSS 4-BOS 5-TS+BB SEll order

Trading of the Day with A+ setup This trade is contained (unusual context)because the price did not respect the bullish FVG and trend and make Bearish FVG and reacting to it. Our variables of our plan is available in this trend :- 1-PDA:-H1-FVG 2-rejection block on 30 m TF 3-CISD (2 times) 4-(1-2-3 pattern) 5-TS+BB 6-OB Then the price retraced and sell order...