AustrianTradingMachine

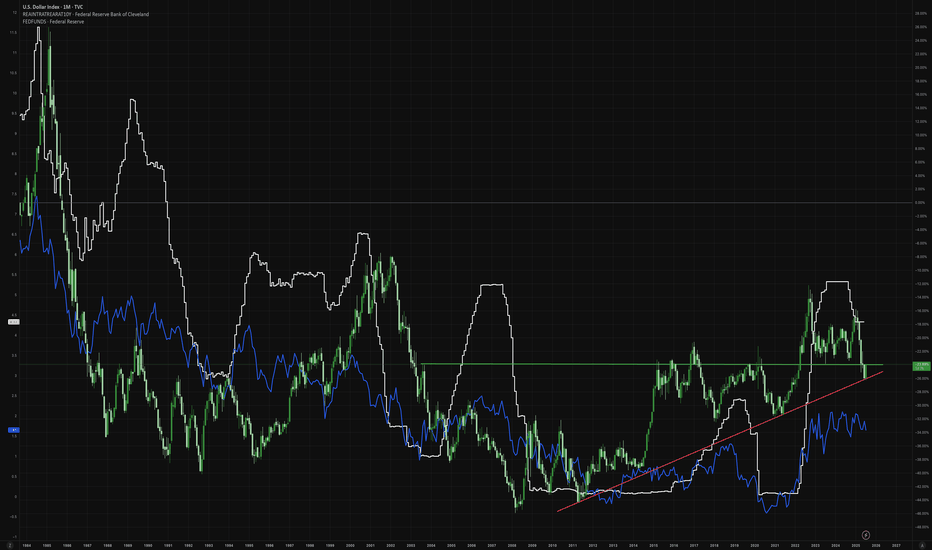

PremiumDXY sits on a major support zone. Price often delivers a reflex bounce at strong levels before continuing the prevailing trend, so a quick pop isn’t proof of a new bull run. DXY is closely linked to US real yields (10y TIPS): if real yields roll over as the Fed eases, USD strength likely fades; if real yields stay firm, a durable reversal is more plausible. This...

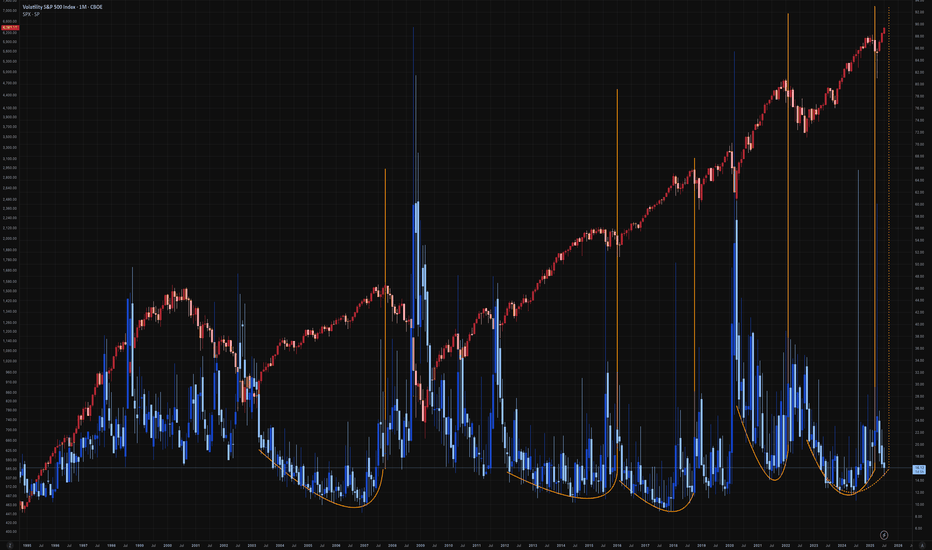

When SPX pushes fresh highs while the VIX floor makes higher lows, fragility rises. This post is for informational/educational purposes only and is not investment advice or a solicitation to buy/sell any security. Past performance is not indicative of future results. I may hold positions related to the instruments mentioned.

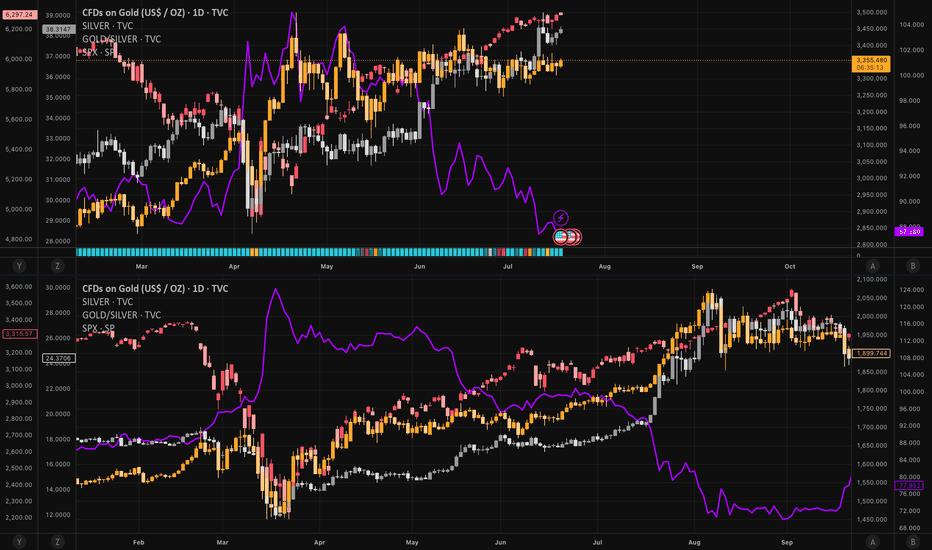

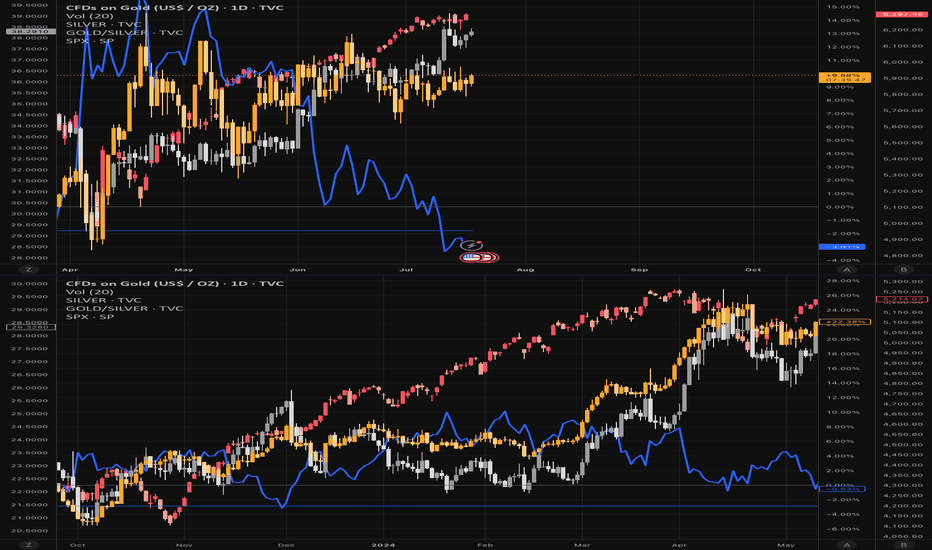

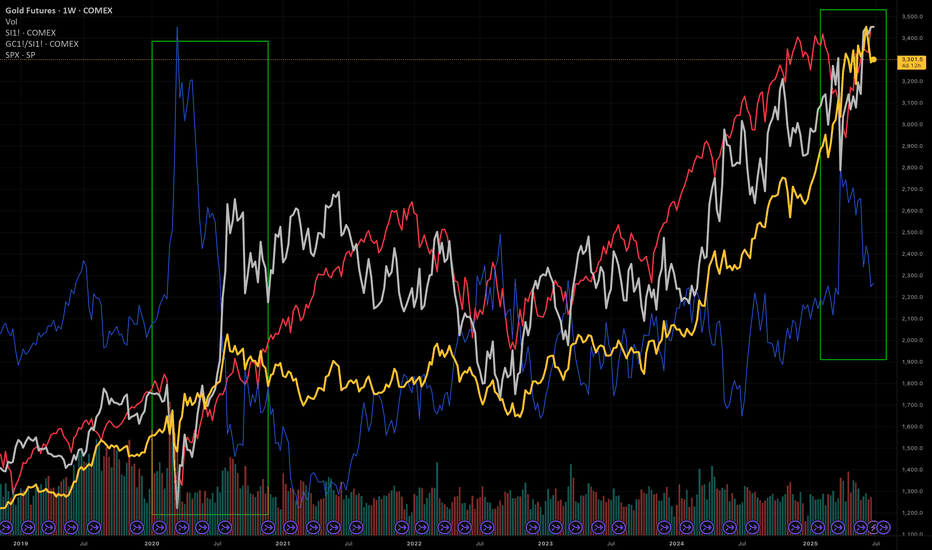

1️⃣ Why the 2020 déjà-vu is EVEN louder 2025 (now) 2020 (pre-rally) TradingView ideas still bearish 💬 > 70 % 60 % bearish Managed-money net-longs ≈ 115 k -35 % from Apr. –25 % from peak + $741 m PM-ETF inflow Record IN-flows G/S ratio 87 (< 90) Fell to 95 S&P...

1️⃣ Why the 2020 déjà-vu is EVEN louder 2025 (now) 2020 (pre-rally) TradingView ideas still bearish 💬 > 70 % 60 % bearish Managed-money net-longs ≈ 115 k (-35 % from Apr) –25 % from peak + $741...

Retail sentiment is ultra-bearish, positioning is cooling, Silver is outperforming and the S&P 500 is screaming risk-on … exactly the cocktail we saw in June 2020, right before Gold & Silver exploded higher. 1️⃣ WHY THIS FEELS LIKE 2020 AGAIN 2025 (now) 2020 (pre-rally) Read-through > 70 % of TradingView ideas are bearish 💬 > 60 % were bearish Crowd may be...