Israel and Iran are exchanging missile strikes, but it seems markets are trying to play their own game, assuming that this conflict will not cross the nuclear threshold. in the meantime, investors are shifting their focus to key events this week. The main highlights will be the consumer inflation reports from the UK and the eurozone. In the EU, inflation is...

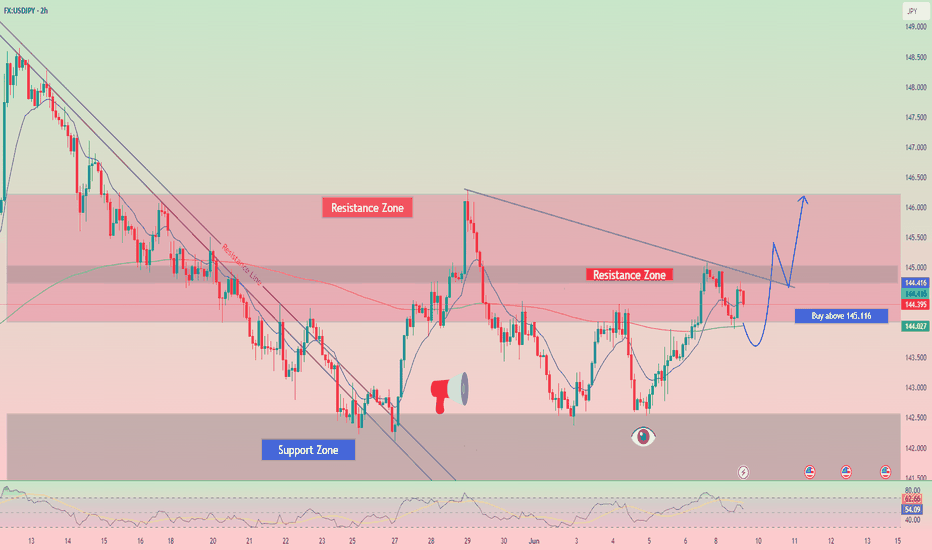

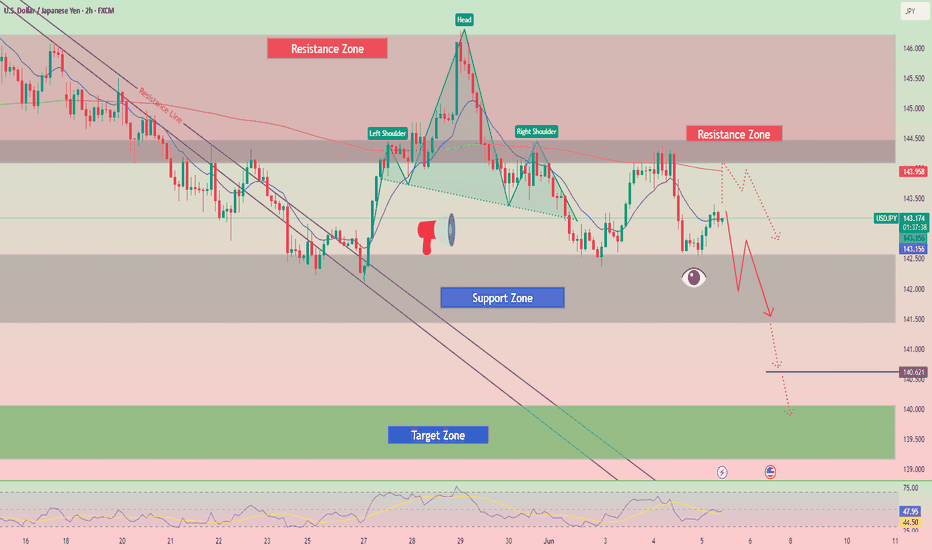

The price test at 144.27 occurred when the RSI indicator had already moved significantly above the zero line, but the strong U.S. labor market data offered a high probability of the dollar strengthening against the yen, which I decided to take advantage of. As a result, the pair rose toward the target level of 145.06. The confident growth in U.S. non-farm...

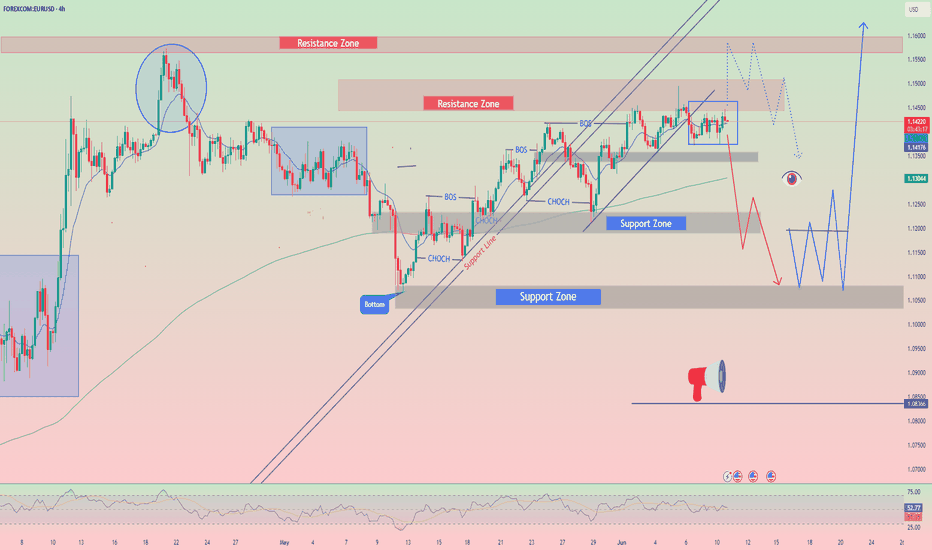

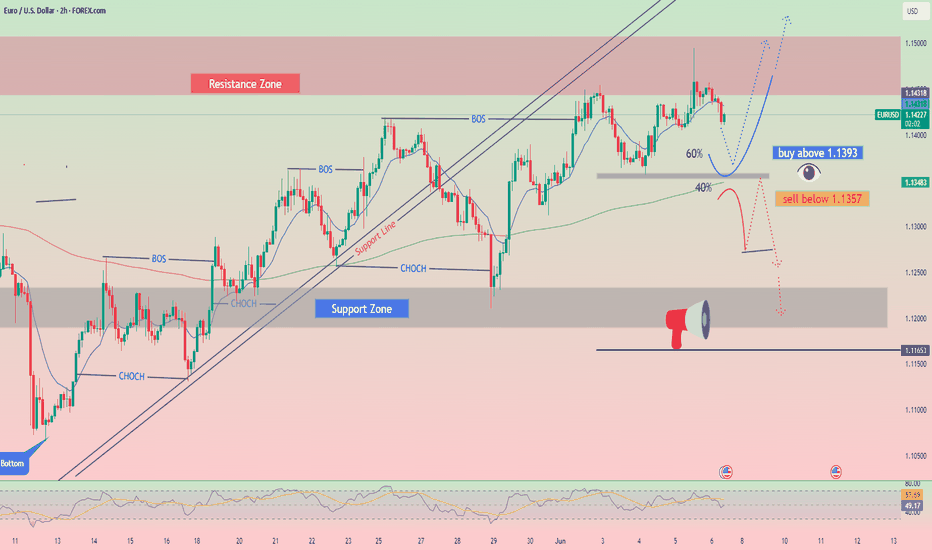

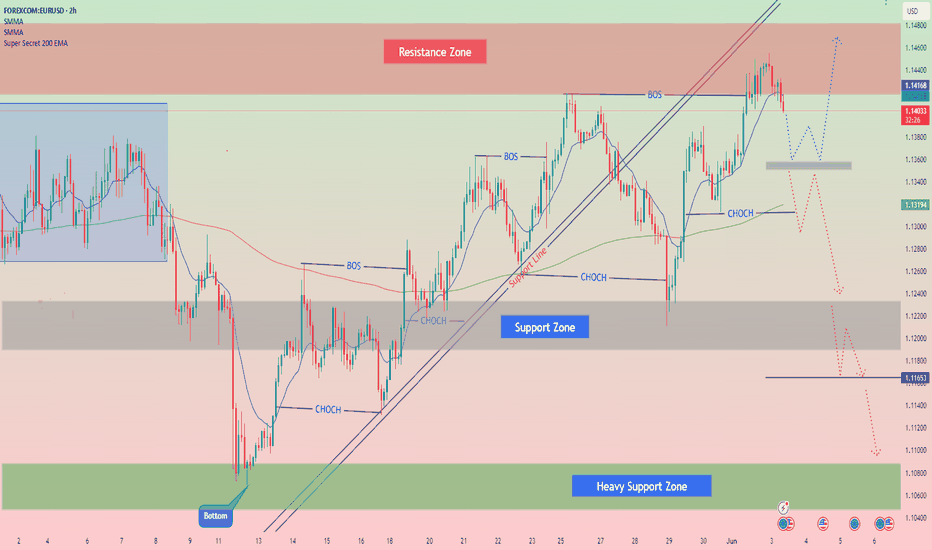

Today, the EUR/USD pair is under pressure, having failed to consolidate above the 1.1447 level and showing intraday declines toward the psychological level of 1.1415 and below, amid U.S. dollar strength. The main drive of the dollar's rise was Friday's strong U.S. Non-Farm Payrolls (NFP) report, which reduced expectations for an imminent rate cut by the...

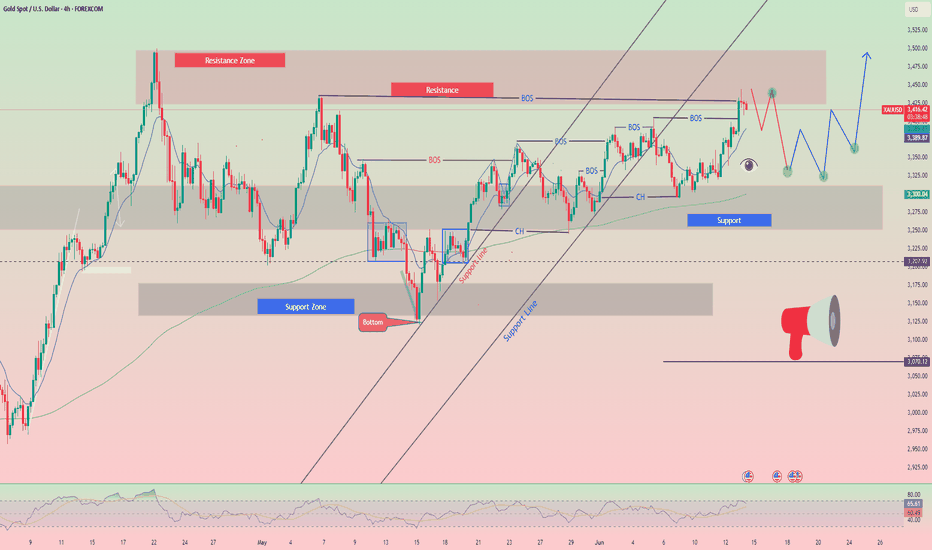

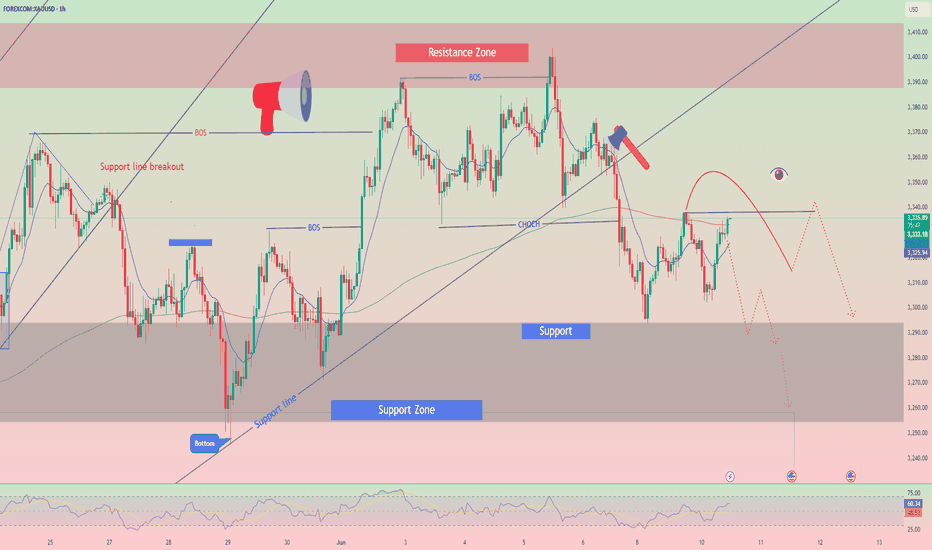

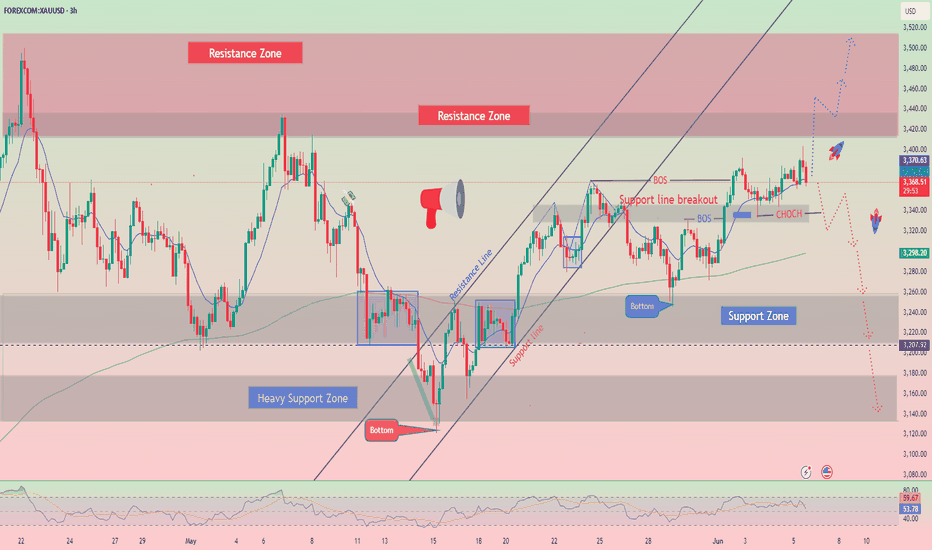

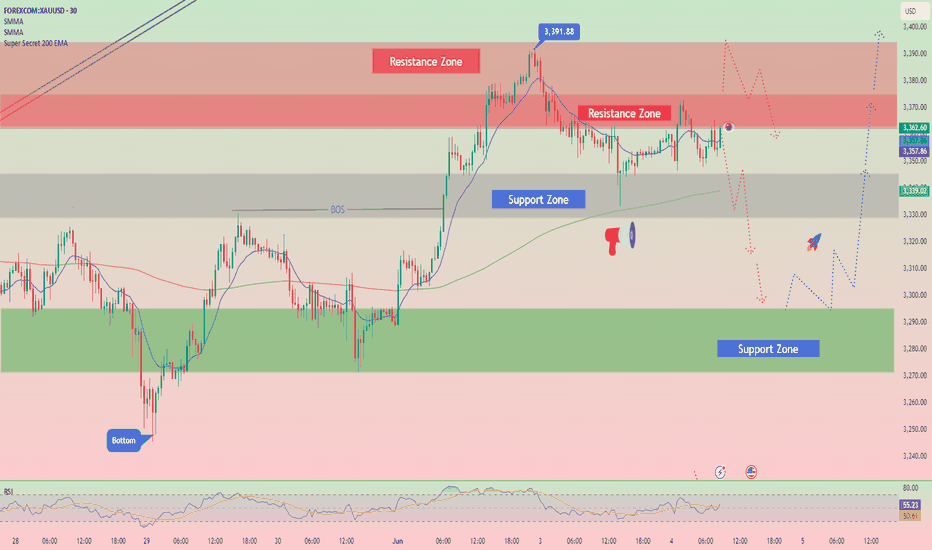

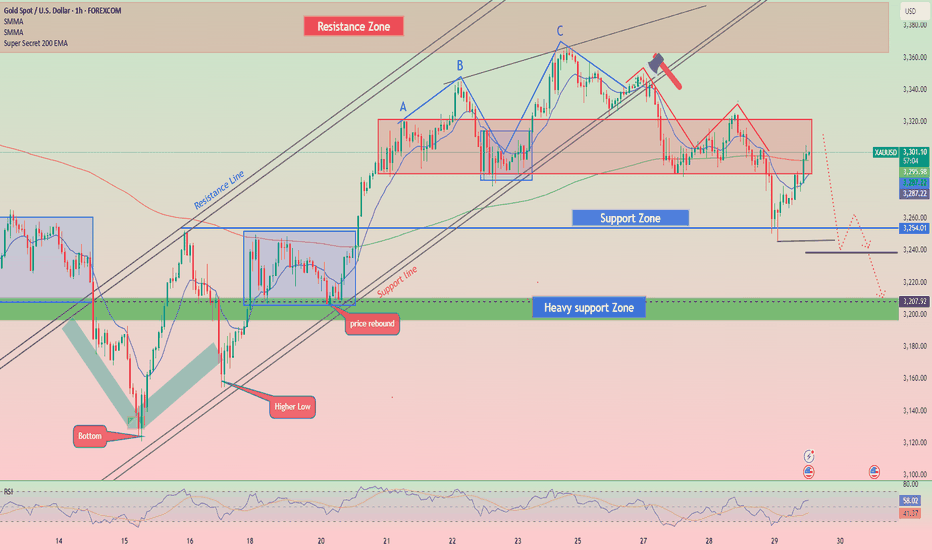

The XAU/USD trend remains bullish as long as the price consolidates above 3,384. Therefore, it would be prudent to buy gold as long as the price consolidates above3,444, where the 7/8 Murray level is located. Gold's volatility will continue over the next few days, so we believe it could move between 3,386 and 3,356. Consequently, if gold consolidates and breaks...

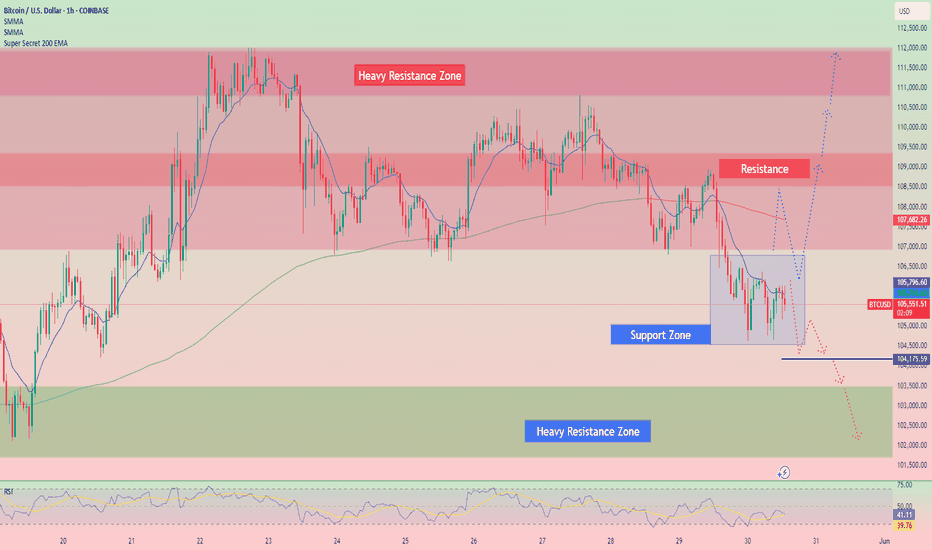

U.S. Treasury Secretary Scott Bessent stated yesterday that USD-backed stable coins could reach a market capitalization of $2 trillion or more. His remarks indicate growing governmental interest in cryptocurrencies, particularly stable coins, as a potentially vital component of the future financial system. Bessent emphasized that with proper regulation, stable...

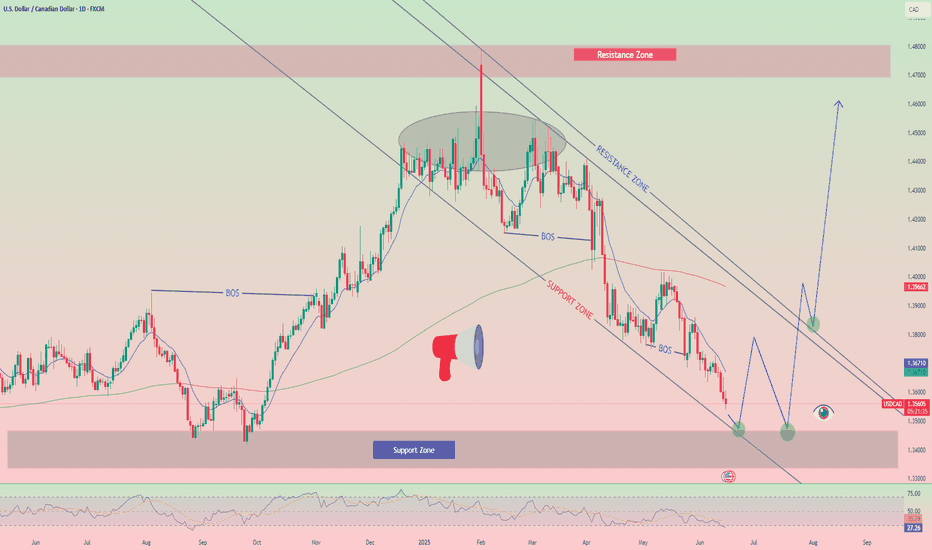

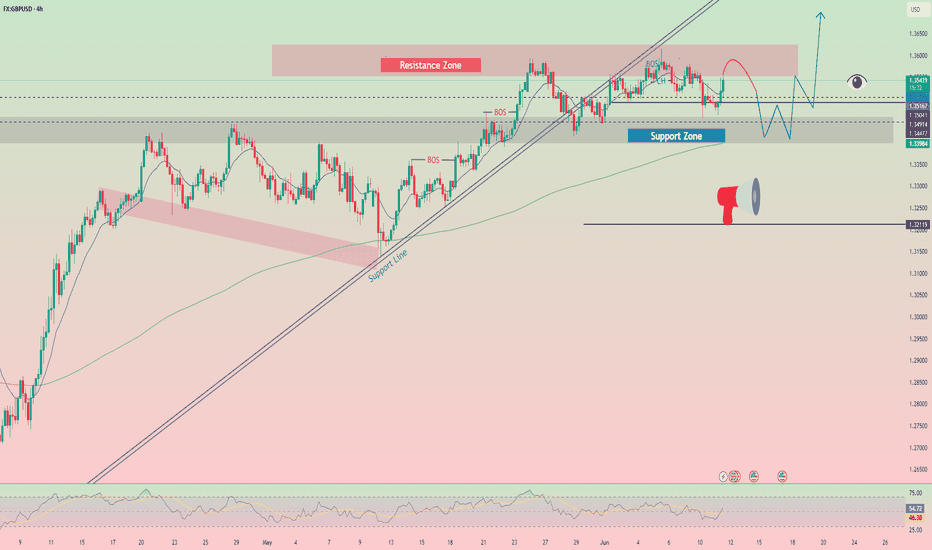

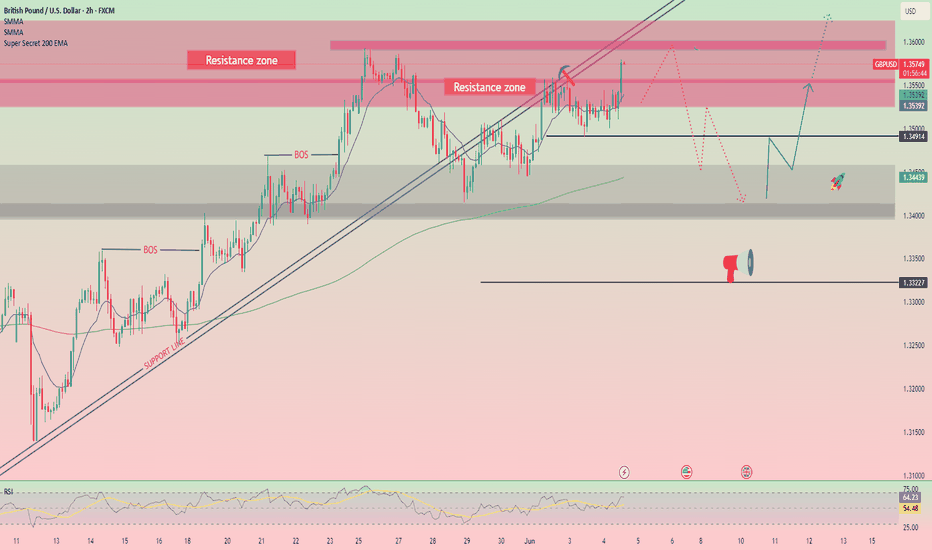

The test of the 1.3614level occurred when the RSI indicator had already risen significantly above the zero line, which limited the pair's upside potential. For this reason, I did not buy the GBP/USD. There has been progress in the trade negotiations between China and the United States: yesterday, both sides stated that consensus had been reached on the main...

Early in the American session, gold traded around 3,334, within the bearish trend channel formed on 1H charts since May 23. The yellow metal is likely to continue its bearish cycle in the coming hours if the price consolidates below the 21SMA or below 3,337. If its bearish cycle continues, we should expect gold to fall below 3,337. Then. it could reach the 6/8...

The price test at 1.3535 in the second half of the day occurred just as the RSI indicator was beginning to move downward from the zero line. This confirmed the correct entry point for selling the pound, resulting in a decline of more than 30 pips. U.S economic indicators published on Friday sparked a wave of optimism across financial markets. Non-farm employment...

Early in the European session, the euro is trading around 1.1422, undergoing a technical correction after reaching the psychological level of 1.15. The US Non-Farm Payrolls dat will be released in the American session, and strong volatility will hit the market. If the market reacts favorably to the US dollar, it could continue to pressure the EUR/USD pair. On...

Early in the European session, gold traded around 3,368, showing signs of exhaustion after reaching the weekly high of 3,403. We could expect a technical correction to occur in the coming hours toward the 21SMA or the 7/8 Murray EMA at 3,355. If the bearish momentum is maintained, gold could continue its decline. To do so, we should wait for confirmation below...

The price test at 144.06 coincided with the moment when the MACD indicator had just started moving downward from the zero line, confirming a correct entry point for selling the dollar. As result, the pair plunged toward the target level of 143.39. Yesterday was marked by significant fluctuations in the currency market, triggered by the release of disappointing...

EUR/USD is trading around 1.1410, below the Murray 6/8 level and within the uptrend channel formed on May 9. The instrument has an area where buyers have found it easier to take profits around 1.1476. This level could be a barrier for the euro, and from there we could expect a technical correction. If the bullish force prevails, the euro could reach the top of...

In my morning forecast. I focused on the 1.3536 level and planned to make trading decisions based on it. Let's take a look at the 5-minute chart and see what happened. A rise and formation of a false breakout around 1.3536. On Tuesday, the GBP/USD currency pair also showed a downward movement, although the decline and the day's volatility were relatively weak....

Gold is trading around 3,355, reaching the 100% technical rebound according to the Fibonacci extension indicator. Gold could continue to rise in the coming days and could reach 161.8% around 3,437. 8/8 Murray has acted as a strong selling zone in the past, so we believe this level could serve as a good selling point only if the gold price consolidates below...

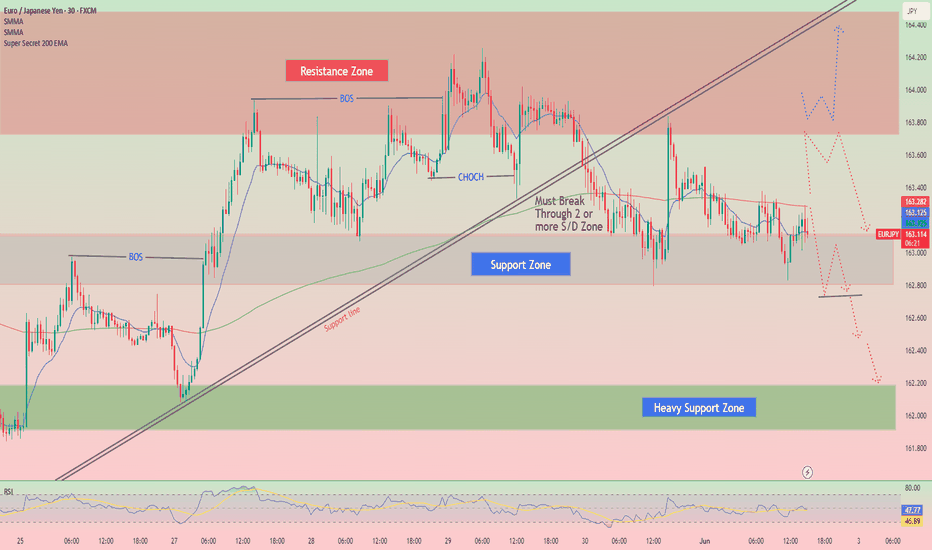

Early in the American session, the EUR/JPY pair is trading around 163.200, below the downtrend channel formed on may 13 and showing signs of exhaustion. The euro could resume its bearish cycle in the coming hours. However, there is strong resistance around 163.836 and around 164.259. Both levels could act as a barrier to the euro. and after a technical rebound,...

Early in the American session, gold is trading around 3,347 after a sharp drop due to US data and showing signs of weakening bearish momentum. Gold has good support around the 6/8 Murray level, this level is key. Gold is eventually breaking the 6/8 Murray level. If it continues its bearish cycle, it could find another support around 3,259 (200 EMA). In this area,...

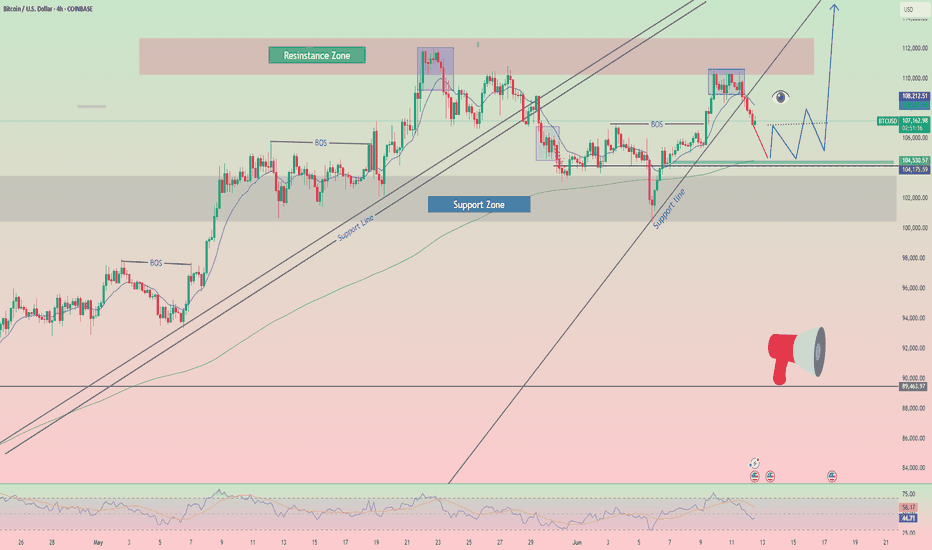

Scenario #1: My plan to buy Bitcoin today at the entry point $105,370, aiming for a rise to $107,600. Around $107,600, my plan to exit the buys and immediately sell on a pullback. Before buying on a breakout, ENSURE THE 50-day moving average is below the current price and the Awesome Oscillator is in the positive zone. Scenario #2: Bitcoin can also be bought from...

Early in the American session, gold is trading around 3,302 within the bearish trend channel formed on H1 charts since May 23. The yellow metal is likely to continue its bearish cycle in the coming hours if the price consolidates below the 21SMA or below 3,310. If its bearish cycle continues, we should expect gold to fall below 3,310. Then, it could reach the 6/8...