CEOTraders

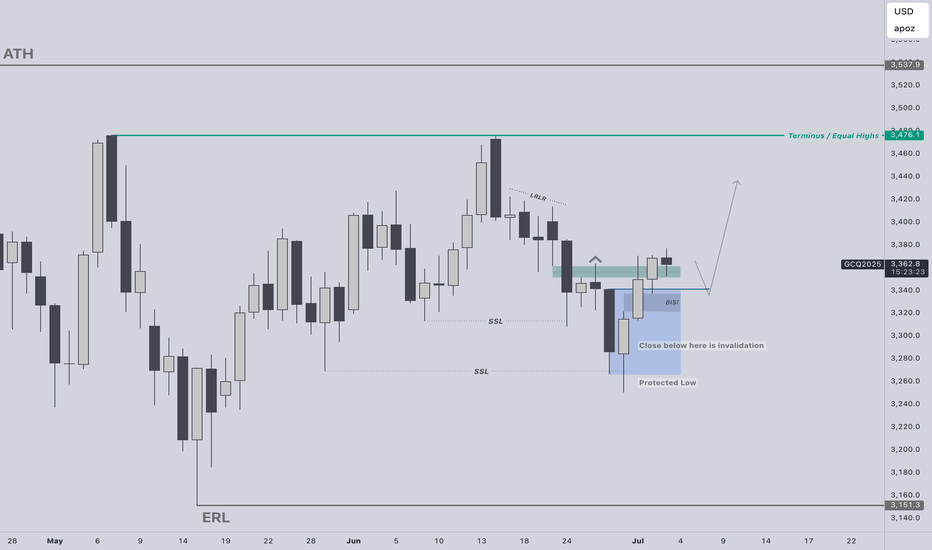

PremiumSolid daily structure for Gold heading into the holiday weekend. Bullish going into next week if price closes bullish on the week. Daily discount SSL swept and closed back inside the range on Monday. Daily OB confirmed on Tuesday. FVG created and inversion fvg confirmed on Wednesday. Anticipating Thursday to possibly pull back and offer a prime continuation to...

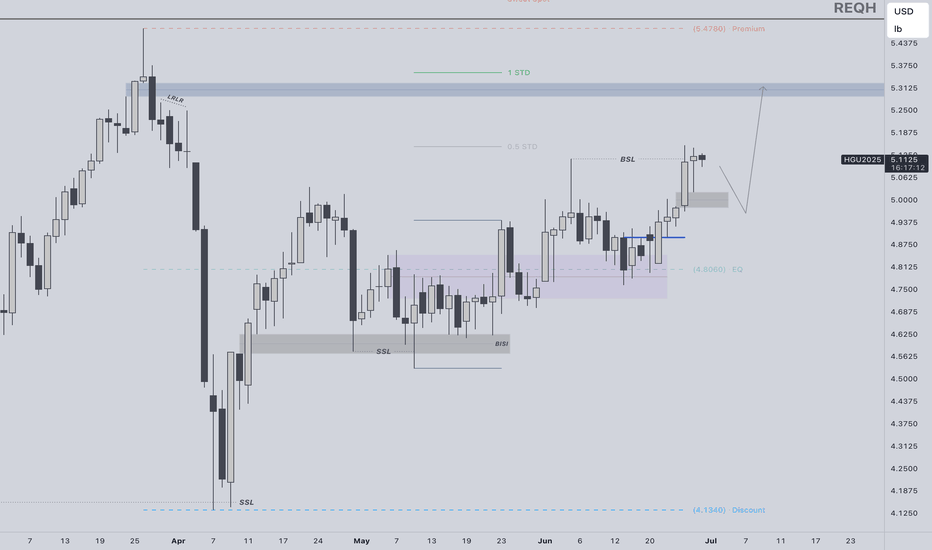

Bullish Bias for copper. Looking for daily BPR target, then possibly relative equal highs. Ideally would like to pair a bullish weekly profile with longs. If the week opens lower first and delivers to a key level, thats favoring longs. So looking for Monday, Tuesday or Wednesday to create the low of the week. I see a daily MMBM in play. Price expanded off the...

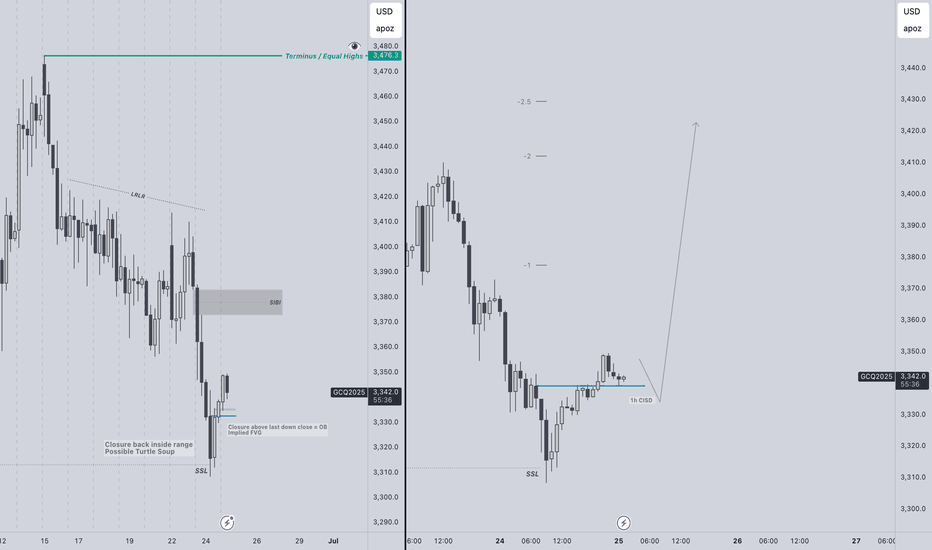

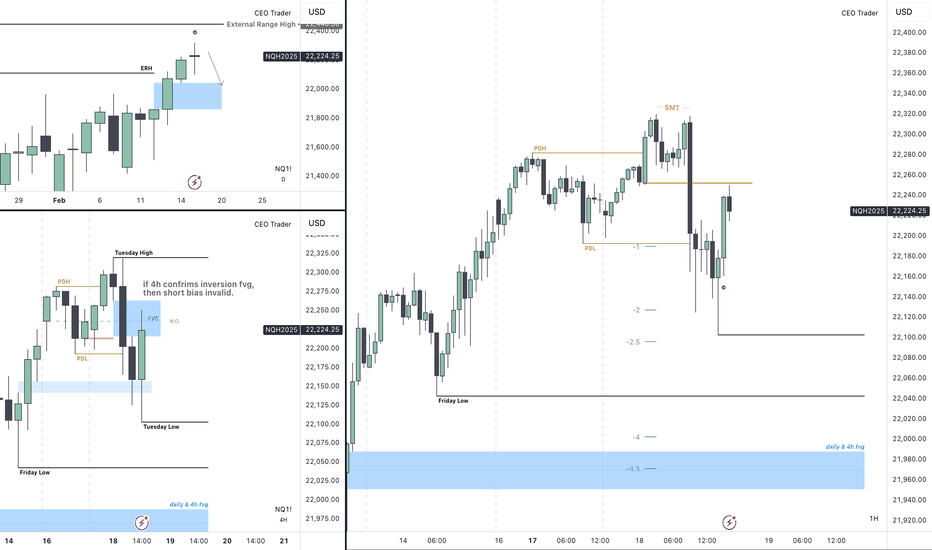

Bullish weekly bias for Gold. Classic Expansion Weekly profile in play. Price opened lower first, Im treating this as the possible manipulation for the week. Tuesday swept key ssl and closed back inside the range. Drop to a 4h and OB is confirmed. 1h CISD aligned with 4h. Execution off 4h OB with stop at OB Low / Tuesday low. If BSL is the draw, I would like to...

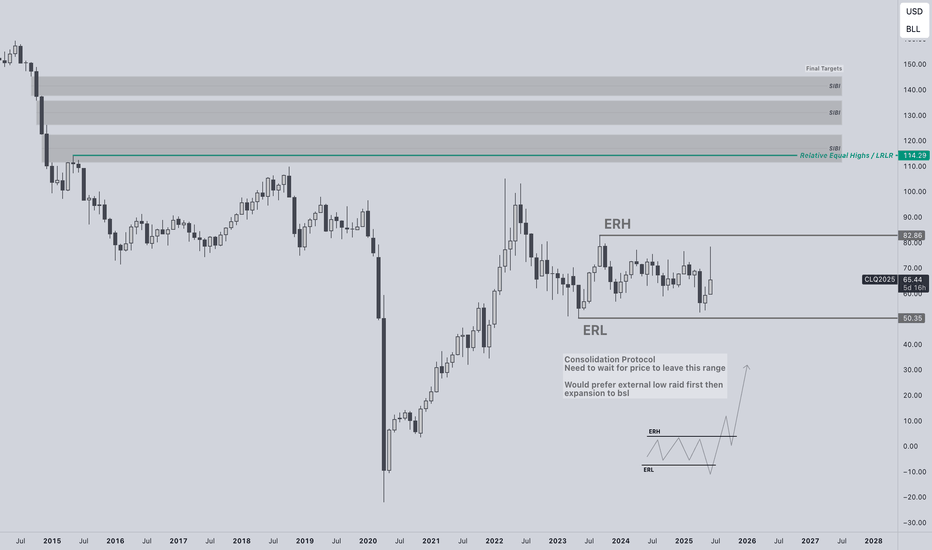

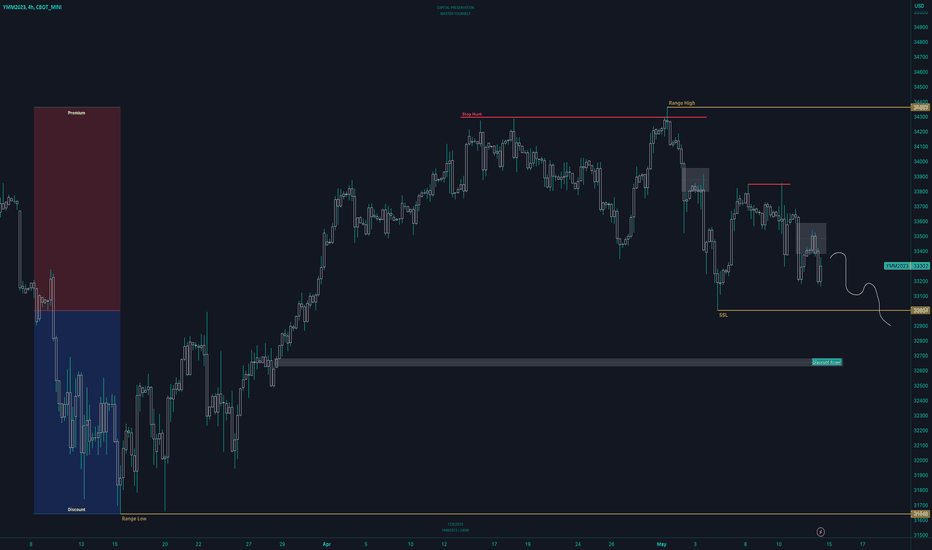

Currently sitting on my hands but closely watching oil, especially after Iran & Israel Consolidation Protocol active. Need to see external range taken. I will not trade inside this range. Favoring longs. Think accumulation, manipulation, distribution. Right now its in the accumulation phase. Manipulation phase is next. Preferably sweeping external low first then...

Wednesday failed to expand through Tuesday range. Weekly range currently in a consolidation. Consolidation protocol active. I am neutral on price until a sweep on the external range. Once a sweep occurs, I will hunt the 15m cisd and target the opposing liquidity. This will confirm the weekly profile & the intraday profile. Need the alignment for a high...

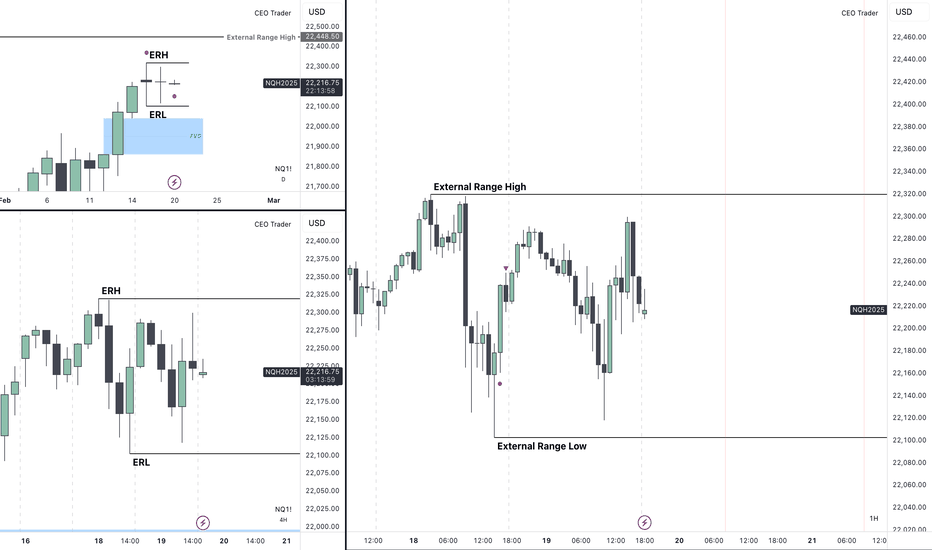

Last week NQ ran out its external range high. Tuesday ran out Monday (check 4h) high and low and closed bearish. On the 4h and 1h, we have a cisd to the downside. Paired with ES smt at the highs (check 1h). Measure the manipulation leg on the 1h for STD extensions and targets align with daily fvg. This is giving me evidence of a possible short term retracement...

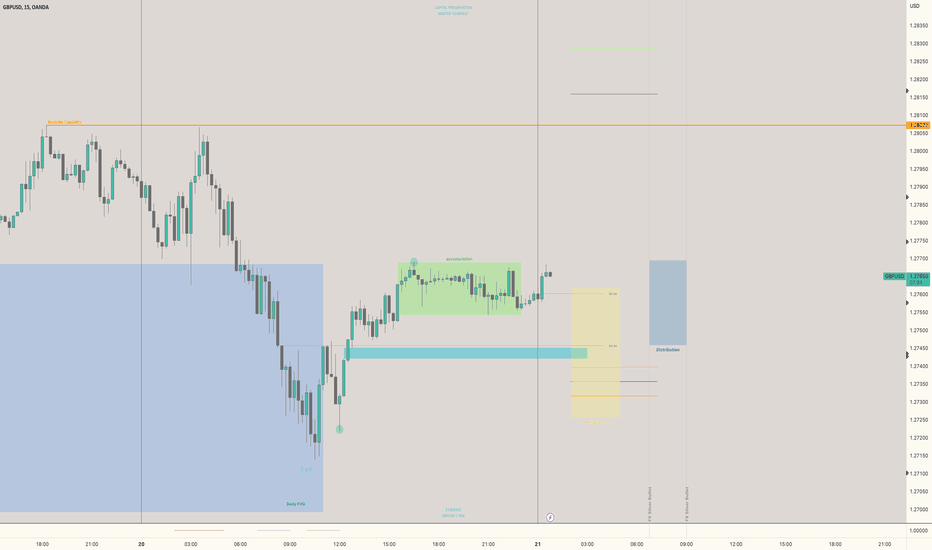

Possible Tuesday low of week profile. GBP CPI I believe will be the manipulation move into a discount fvg in the form of a bisi. Would like to see distribution to the upside heading into New York kill zone.

I see DXY trading to a premium array. YM gives me market maker sell model vibes. Looking for a discount array to be the draw on liquidity.

I'm pushing towards a bullish week due to my specific pattern I see on my chart. There is a lot of high impact news this week in the New York session so volatility will be injected. This week might be very choppy and possibly a search and destroy on highs and lows with all the news. Everything will depend on Price Action for me. If the chart speaks to me, I'll...

Higher Timeframe bias I am bearish. Looking for banks to create the high of the week tue/wed back into the bearish ob. Taking shorts if price action gives me my setup. Good luck this week

Im looking for longs on Tuesday. Higher Timeframe Analysis coupled with DXY analysis. I want to see what london session will offer. If I see london form a reversal model, creating the low of the day, plus confirmation on the lower timeframe, I'm sniping the buy button targeting buyside liquidity. There is a possibility London can have a false breakout and fill...

Looking for a continuation from yesterday. Wednesday could possibly create the low of the week. If Tuesday is the true low of the week & EU is bullish for the remaining week, it will blow through Tuesday's high. If price offers the reversal sell model, then I'll hunt to take out Tuesday's low. If price does anything other than what I'm looking for specifically,...

My pick on btc. Higher timeframe bias, I'm personally bearish... but its bitcoin so 250k here we come. I'd like to see a 20%-30% retracement from the all time high but with a market structure break on the 4hr/1hr, thats about 10% retracement and could reach for all time highs. Good luck

Here's my model for EURUSD. Patiently waiting. I'm anticipating London manipulation to create the low of the day. The daily equal highs are candy to my eyes and i will target those highs for my TP. GLGT

Been learning more on Macro analysis from my mentor. This is my long term bias on GBPUSD. Personally, I'm a day trader and don't really swing trade or position trade at all but will keep this analysis in my pocket for the long term. The equal highs formed last week interest me and are a possible area where stops will be raided. We shall see, good luck this week

Good luck & Good trading this weeks bruvs. I've been studying ICT teachings and I believe I have spotted a mitigation block on the 4hr, but simply looks like a market maker buy model on the daily. Either way, it personally gives me stronger possibilities for buys. I simply use structure and price action to determine my bias along with Insitiutional levels as my...

Happy Trading Bruvs. Here's my analysis and bias for GBPUSD. Simple and clean and based off structure and price action. I'll be hunting for buys since the higher timeframes are bullish. We have a clean break of structure (BOS) of a swing high. We're already seeing a strong rally up for sunday. I'd really like to see monday or tuesday create the low of the week....

I’ve been studying market maker models from ICT. I believe this is a potential setup. I will be looking for the “zenith” or the retracement of the break of structure (BOS) into the OTE fib entry. My thought on this is institutions need to take out sell side liquidity. I marked up logical areas where stops are likely to be trailed at/ where orders sit at....