ColdSai

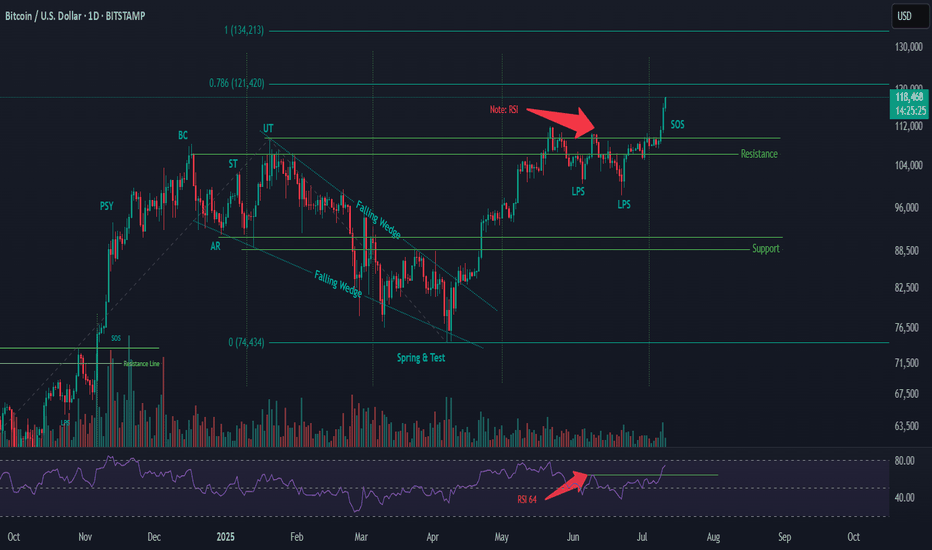

This is an updated outlook on BTC’s current price structure based on Wyckoff methodology. 🔹 Structure Overview: BTC has broken out above its previous resistance and reached a new ATH. Based on current price action and volume behavior, I believe we are at the Sign of Strength (SOS) phase in a Wyckoff Re-Accumulation Phase 2. Key Wyckoff Labels in this...

I won’t say much — the chart speaks for itself. Based on my ongoing study of Wyckoff methodology, it appears that Bitcoin is currently in the Test phase within a re-accumulation structure. This suggests the Mark-Up phase is not yet complete, and we may still have room for price expansion before the next major distribution. This is not a prediction, but a...

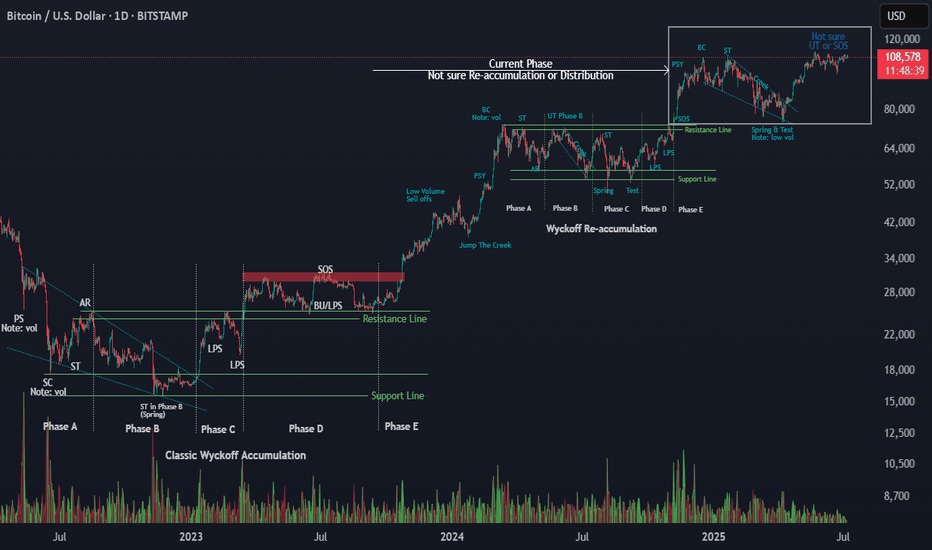

Over the past few months, I’ve been closely studying Bitcoin’s macro structure from June 2022 to June 2025, and I believe we’re witnessing a textbook example of Wyckoff theory unfolding in real time — not just once, but in multiple phases. 🔍 Phase 1: Classic Wyckoff Accumulation (June 2022 – Oct 2023) Starting June 2022, BTC began forming a major bottoming...

Disclaimer: I am not an expert in technical analysis. However, in order to track whether my views are correct or not over time, I’d like to share my current analysis here. After reviewing the market structure, I believe that Bitcoin (BTC) will not surpass 100K in this bull run. Instead, we are likely to see a shift in momentum towards a reversal. Here's how I see...

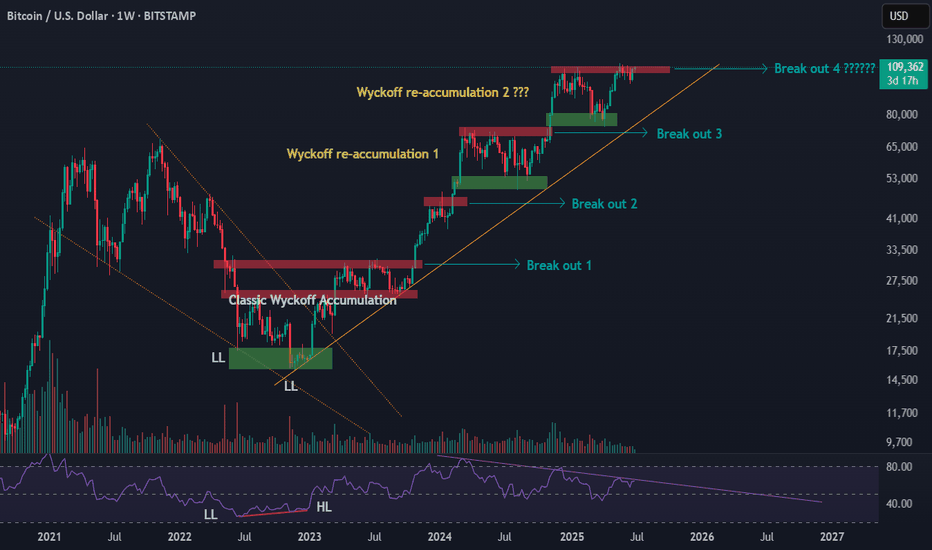

After studying the Wyckoff scheme, I want to test my analysis whether it is effective or not.

After long consolidation, it seems like the bear market is over and ready to start bull run. According to this Wyckoff Accumulation Schematic, Phase E will start soon.