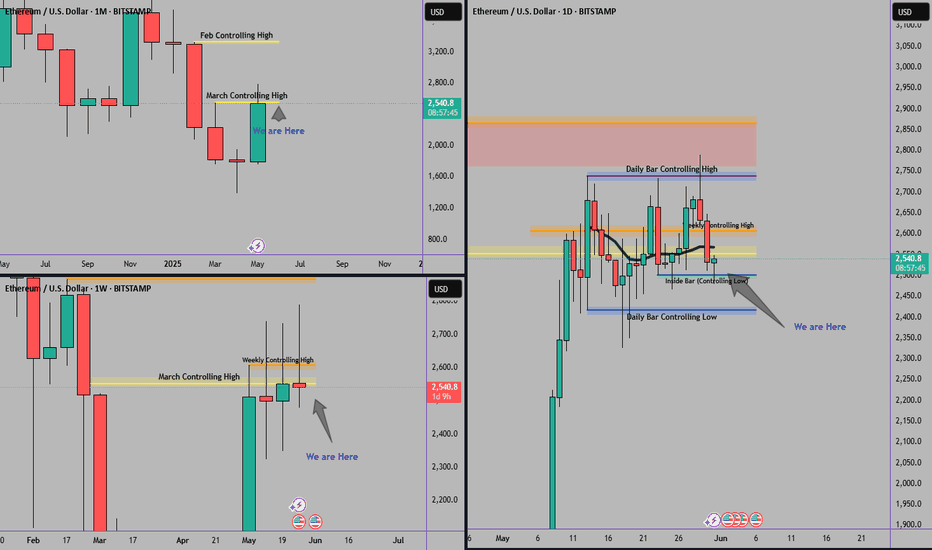

BITSTAMP:ETHUSD has been consolidating within a daily inside bar for the past few sessions, signaling a potential move. 📈If bullish momentum resumes, we could see a strong breakout to the upside, with initial resistance expected around the $3,300 level. Currently, price is hovering near $2,500. 📉On the downside, if ETH fails to hold $2,400 and we see a weekly...

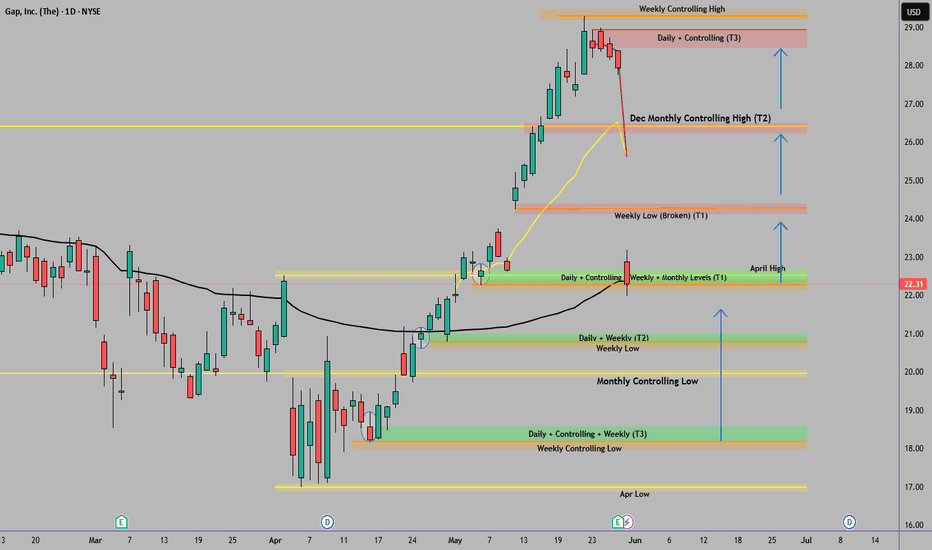

NYSE:GAP currently broke its uptrend due to earnings. However, I'm still bullish on ticker since it has multiple entry points and solid upside targets. Stop losses can be micro-managed right under buy zones. 📌 Entry Points: 1️⃣ ~$22 2️⃣ ~$21 3️⃣ ~$18 🎯 Profit Targets: ✅ ~$24 ✅ ~$26 ✅ ~$29

NYSE:SG is approaching a key monthly control level following a sharp decline. I’ve started a front-side entry and plan to scale in further if price moves lower toward the back-side level. Entries & Targets: **First Entry: $13 Target 1 (T1): Daily supply zone around $15 Target 2 (T2): ~$16.50 Target 3 (T3): ~$18.50 Target 4 (T4): ~$21 **Second Entry: $11 (if...

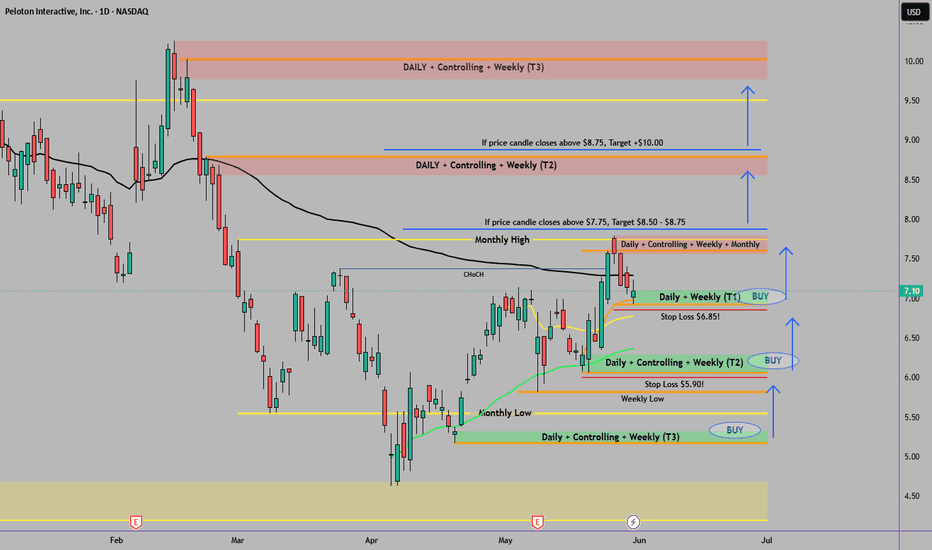

NASDAQ:PTON in lower time frames is reversing. If momentum to upside continues, this would be a good trade for short-term. * First Entry: $7, targeting the daily supply around ~$7.75 * Second Entry: ~$6, if price continues lower, with the same $7.75 targe if the first entry doesn't reach it.

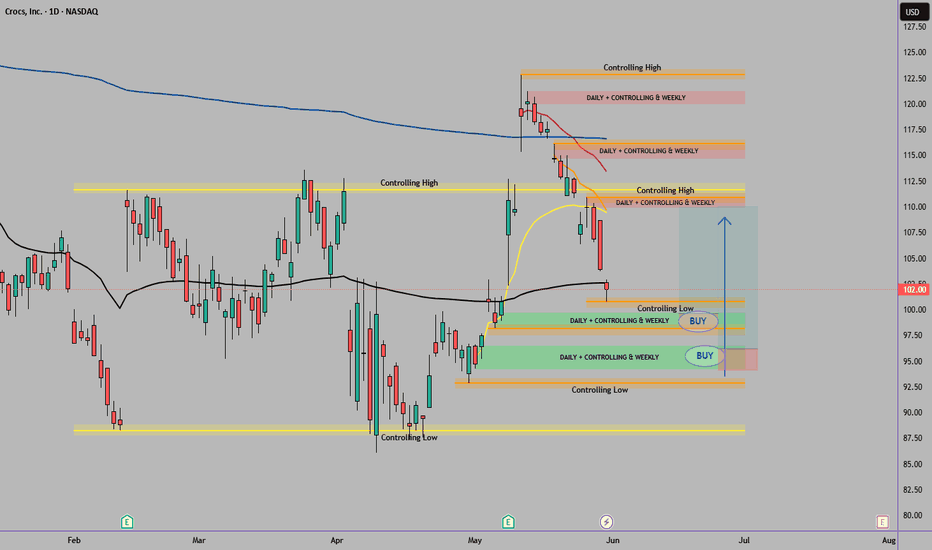

NASDAQ:CROX is approaching daily control levels that align with key weekly lows. The current price also coincides with the YTD AVWAP, and the recent decline appears to be fundamentally driven. * First Entry: $99 - $100, targeting the daily supply around $110. * Second Entry: $94 - $95, if price continues lower, with the same $110 targe if the first entry...

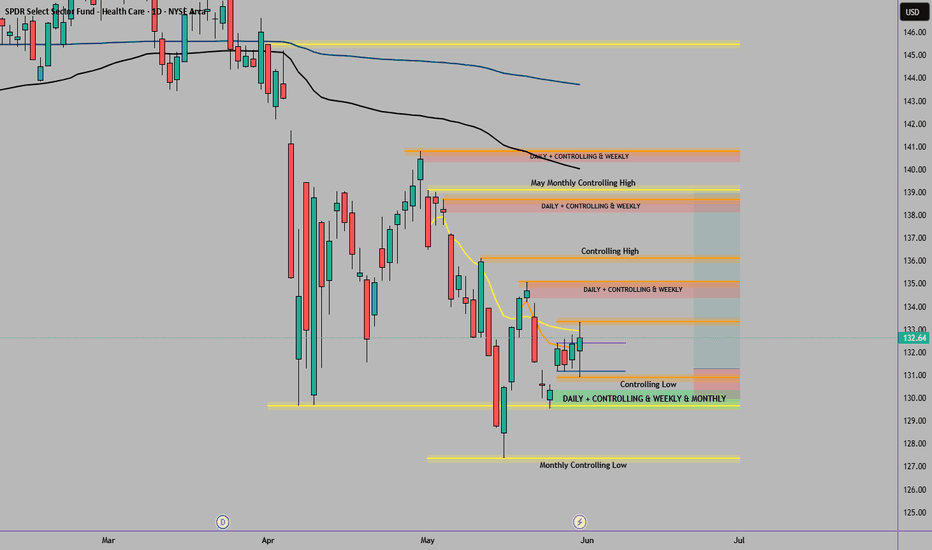

I picked up calls for September based on price action and key control levels. The stock has been in a downtrend and recently tested significant support levels on both a monthly and weekly basis. Considering the slow price movement and that the recent decline was driven by fundamental factors, I'm targeting a rebound back to the monthly high from May.