DigitalSurfTrading

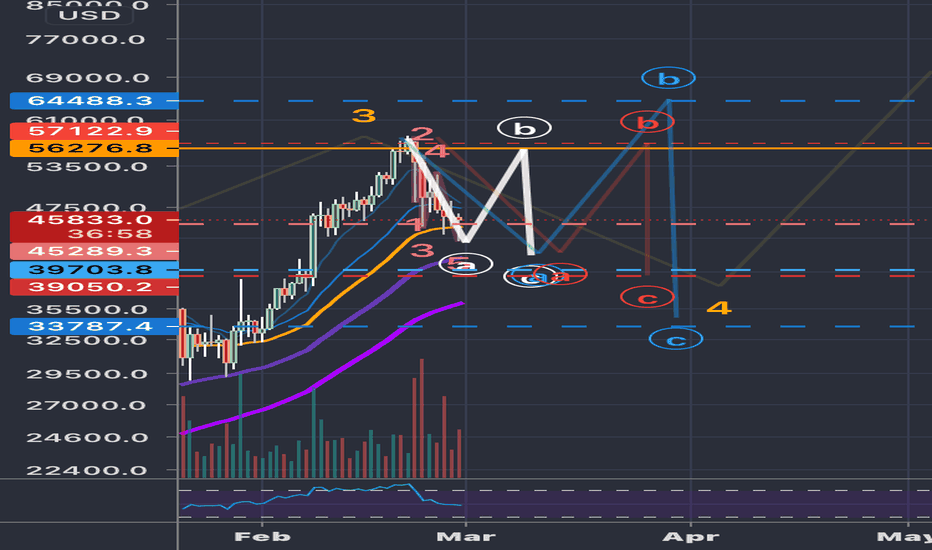

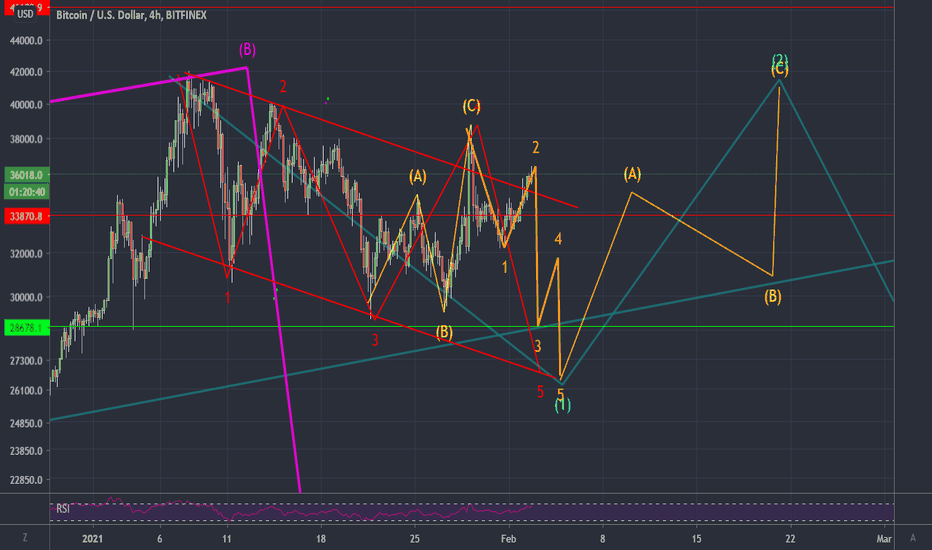

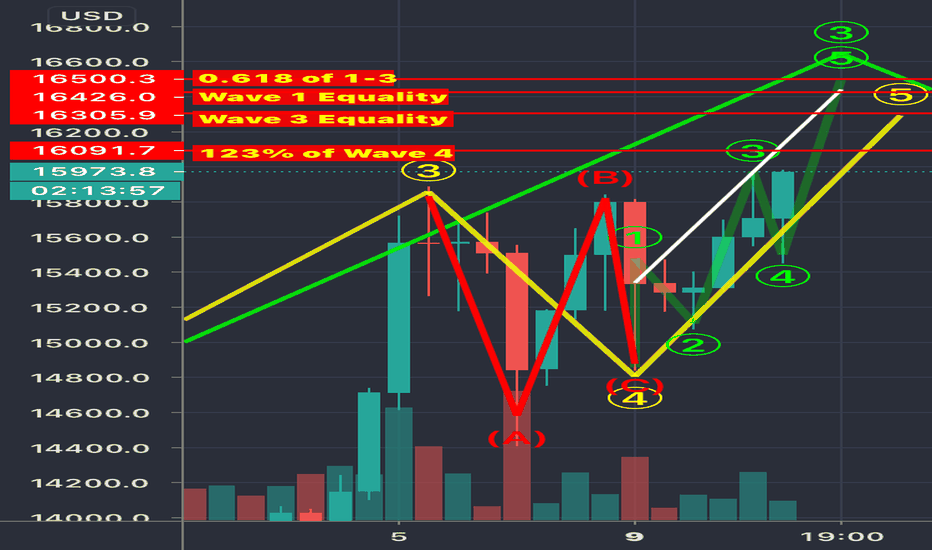

PremiumCurrently in the 2nd Swing (B Wave) of the initial A wave. What sort of flat will we get for Wave 4 of 5/3? I’ve outlined a few potential target ranges; see above.

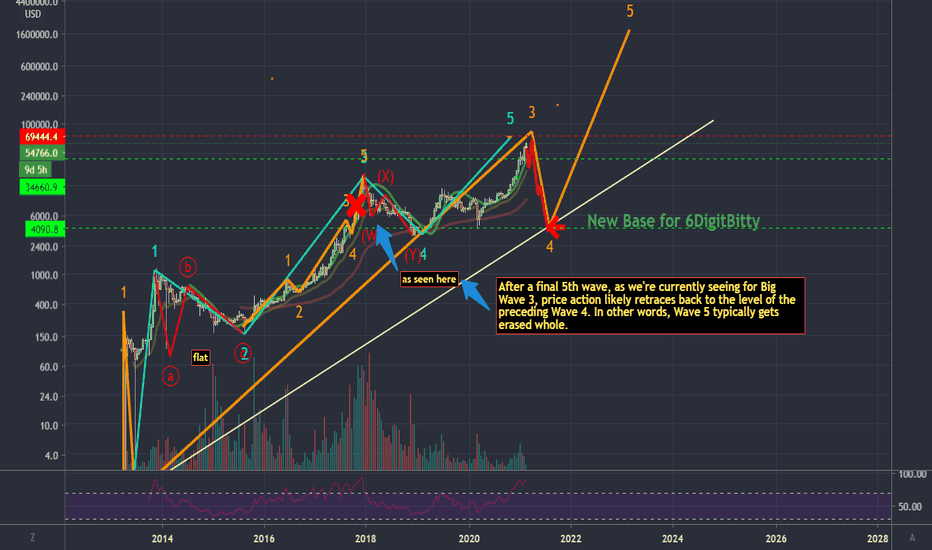

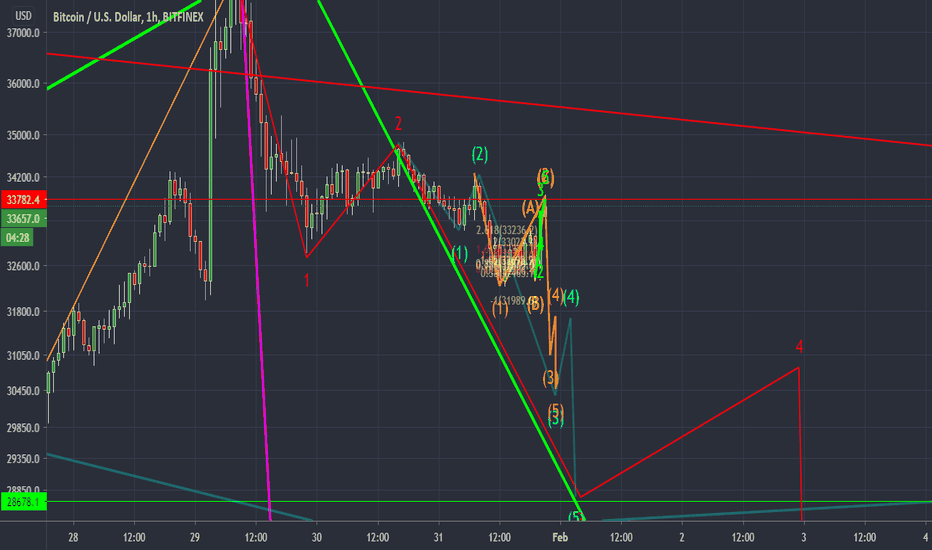

Bitcoin may be in the process of completing the biggest, most extended Wave 3 in the history of all assets, literally jumping from $3K to $50K+ in one, single, pump! Quite unimaginable actually but it sort of makes sense if you think about it (of course its easy to say this in hindsight, lol). The 4/3 was a massively tricky one to catch, which I surely failed to...

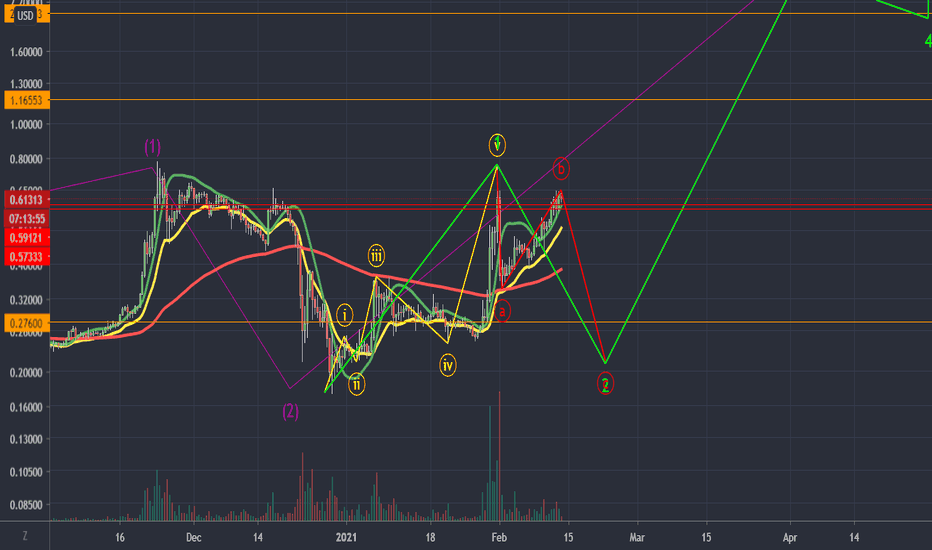

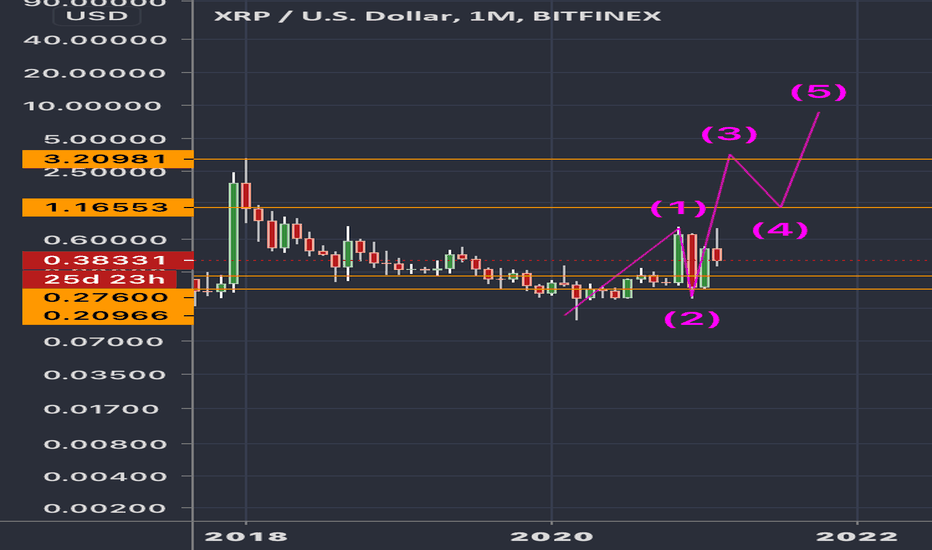

My last short term Ripple idea was a bit off key but the larger analysis remains in tact for the most part. The current Leading Diagonal formation is promised to have an extremely deep retracement. To find out the exact target of the super sized zig-zag, we can simply apply the Fibonacci tool to the A wave down (big drop on the red wave) --- oops, the fib tool...

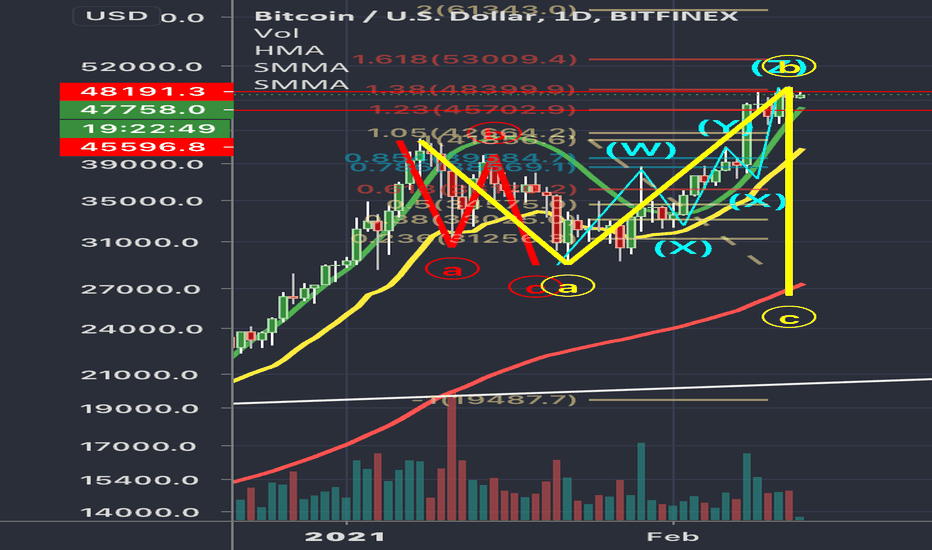

The pump up to $48K still seems to be in range for the Extended Flat correction to be valid. Invalidation level is at $60K but technicals make a route to that level look impossible. Which do you think will come first, $60K or $21K?

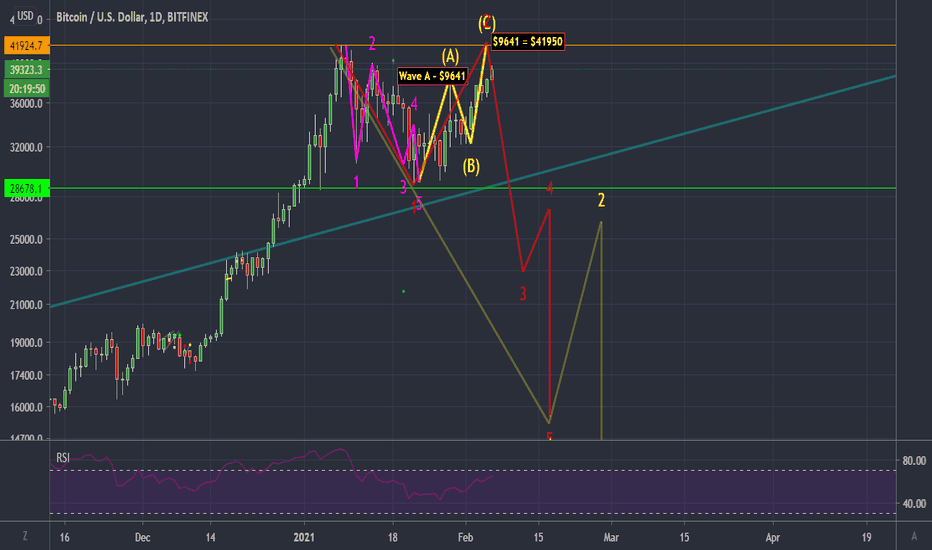

Small charts under 1D have been extremely choppy which has made for a ton of liquidations on both sides of the market. I myself included. Thank heavens for risk management and stop losses. Zooming out to the 1D chart, we can see a much clear picture and pattern at play. The previous Leading Diagonal formation which I was expecting to play out, unfortunately...

I usually pay no mind to XRP but since BTC was so terribly slow today, I found myself with a little free time, so here we are. This is a long term outlook based solely on Elliott Wave theory. After Ripple’s March 2020 swing low near $0.10, the market delivered a Leading Diagonal formation which produced a super deep Wave 2 correction. Leading Diagonals (not...

Misaligned fib tool on my last call for top at $36.1 $36.3 was truly the top. Like Al Pacino said, "life's a game of inches". That's also what 'she' said. Prepare for the drop and bounce from around the $27K area.

BItcoin Bears will regain momentum from here and force the market down toward $30K ; very likely we will break down below it but only for a limited time. According to Elliott Fibonacci , we're currently in Wave 3 of the 3rd Wave of the final 5th wave down, for Wave Cycle 1 . Link up with me here: tradingview.sweetlogin.com

THE BITCOIN BEARS HAVE RESPONDED IN AWESOME FASHION AND LOOK TO TAKE PRICE DOWN TO $27k. HUNGRY BULLS AWAIT THE DIP AND WILL PURCHASE BIG TO SEND THE MARKET BACK UP TO $41K FOR A HUGE RETEST OF THE HIGH. EXPECT FAILURE AND MORE BLOOD.

Bulls need a bounce here and now if the rise to $41.8K should play out.

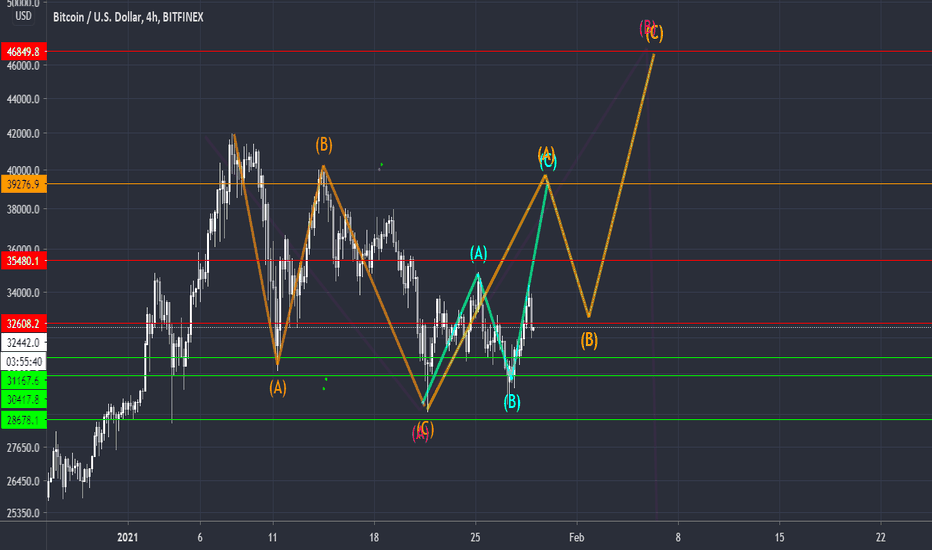

The difference between a 3 wave count and a 5 wave count makes all the difference in the world. Bears have eaten good over the past couple of weeks but the Bitcoin bulls will remain in control for the next few weeks as price continues to mount up towards $46.8K. The big crypto reset that a lot of people have been calling for has been postponed.' Super sized 3-3-5...

Bulls have clearly overtaken the Bears and reclaimed the wave's momentum. All pumps will include retracements however :) We should get nice sizeable swings in this zone.

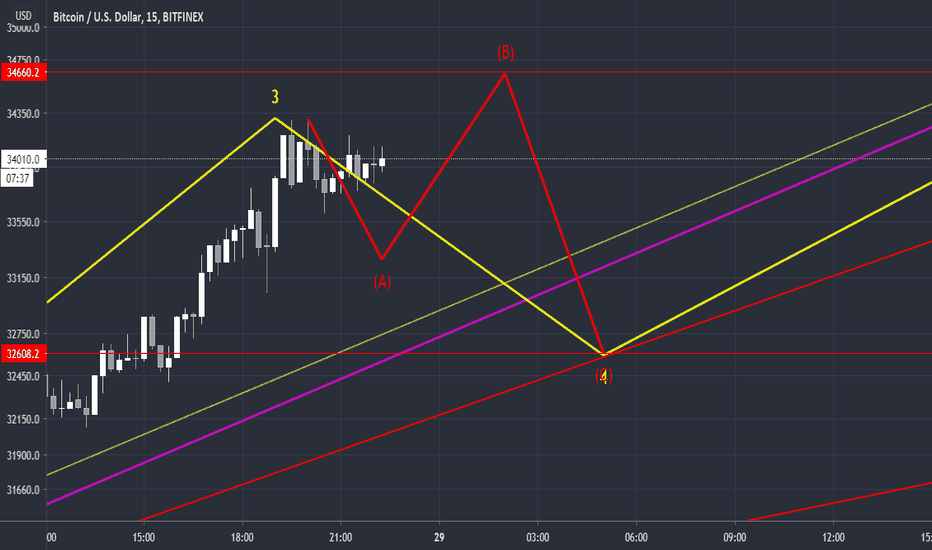

Due for a C (impulsive) Wave up near 39K, Wave 1 is now confirmed as a Leading Diagonal. Expect 30K to break temporarily in the next 6-8 hours but the bounce afterwards should be undeniable. Bulls should regain momentum near 29.7-29.4; anything lower belongs to the Bears.

BIG BEARS LOOK TO BREAK DOWN THE FORMATION AT $19.5 LEVELS. WAVES. GUMPTION.

LEVELS. GUMPTION. WAVES. SILVER SETS ITS EYES ON A BREAKOUT BY SETTING UP A LEADING DIAGONAL FORMATION. WATCH FOR WAVE 5 TO BOUNCE HARD AND THEN CORRECT DEEPLY TOWARDS WAVE 1 TO SET UP FOR WAVE 3.

LEVELS. WAVES. GUMPTION. COMMON ELLIOTT WAVE LEVELS HAVE BEEN PLOTTED. ELLIOT WAVES + TREND LINES SHOULD EQUAL SUCCESS HERE. THIS WILL CONCLUDE WAVE 3; BIG DIP IN WAVE 4 COMING. DONT GET CAUGHT UP! LIKE, FOLLOW AND ALL THAT GOOD SHIT.

Levels. Waves. Gumption.

Levels. Waves. Gumption.