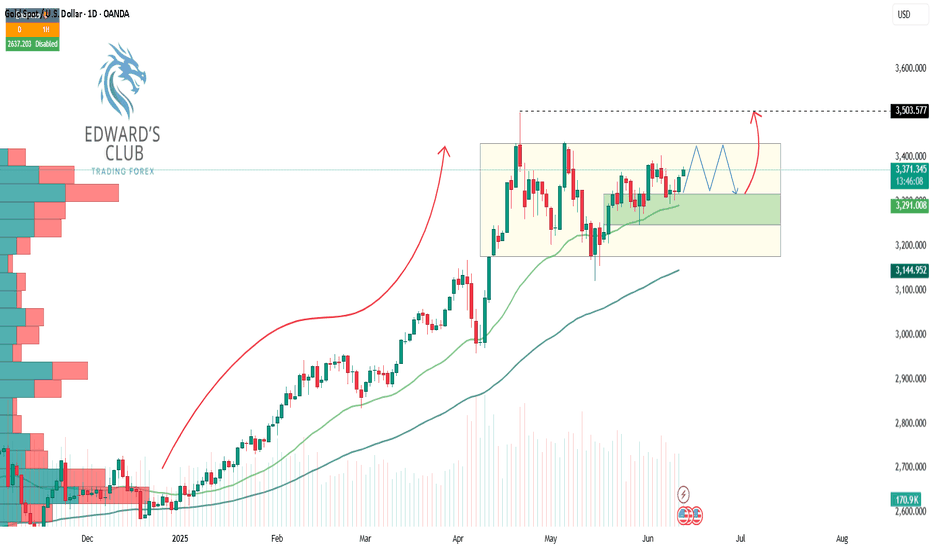

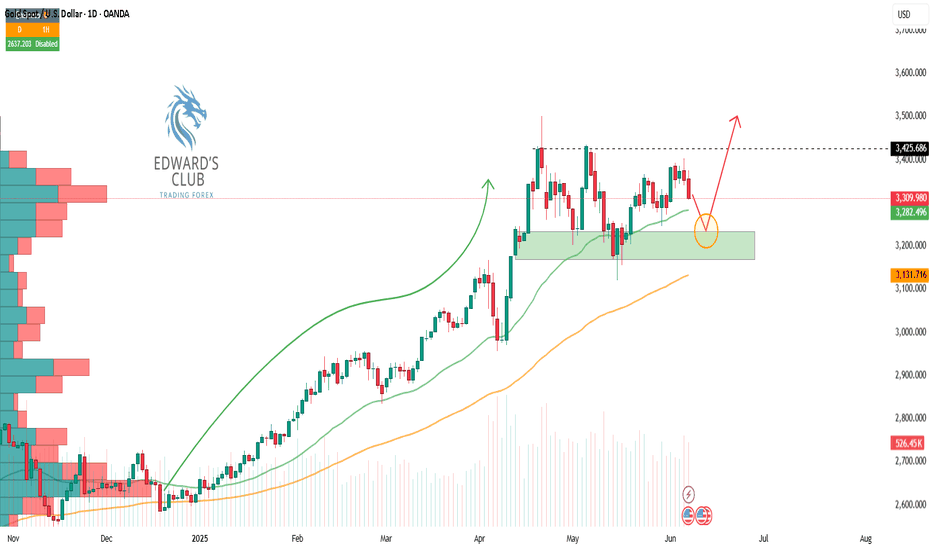

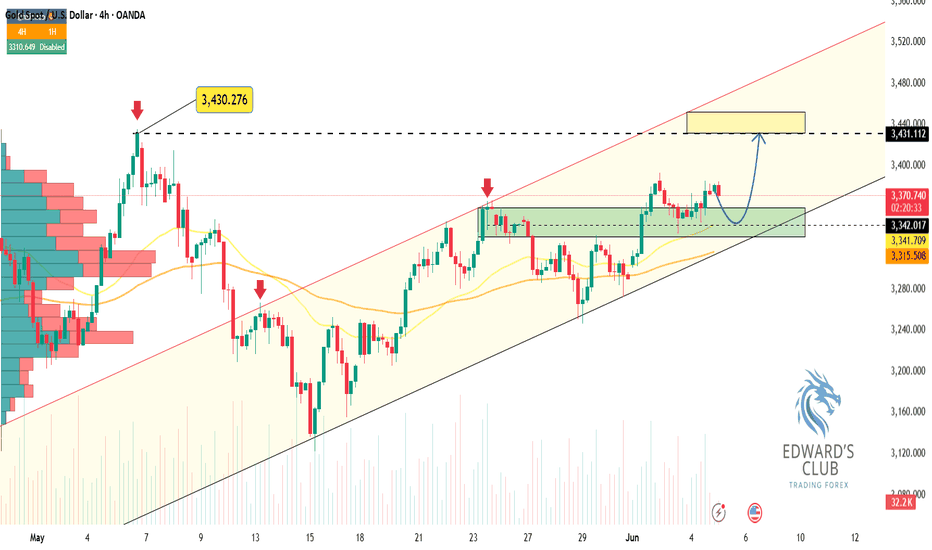

Gold attracted some dip-buying interest during Tuesday’s trading session, reversing part of the previous day’s losses as rising geopolitical tensions reignited demand for safe-haven assets. The market is increasingly pricing in the expectation that the Federal Reserve will begin a rate-cutting cycle in September — a scenario that favors non-yielding assets like...

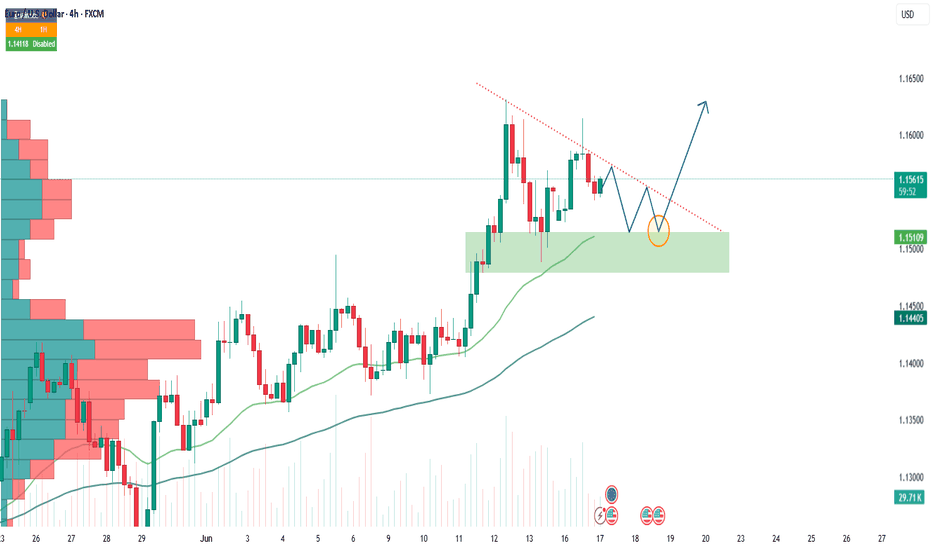

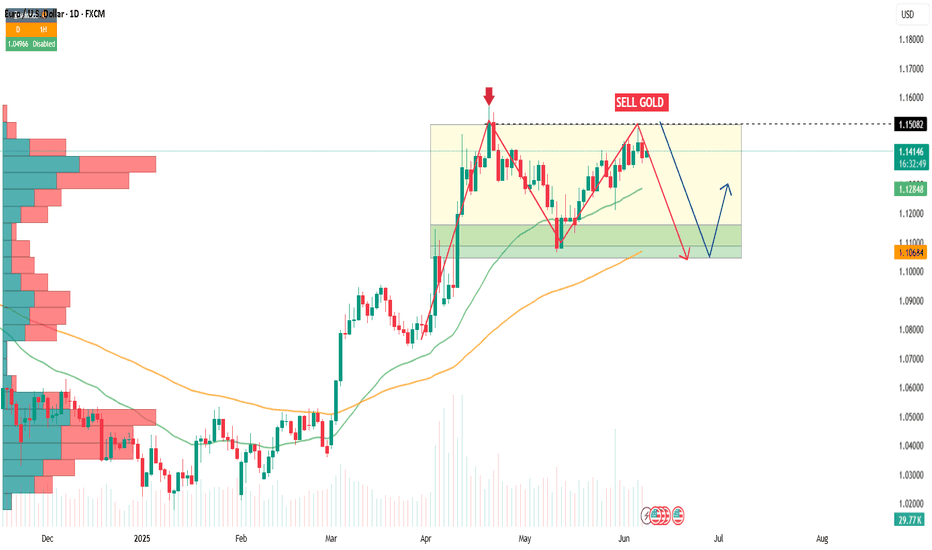

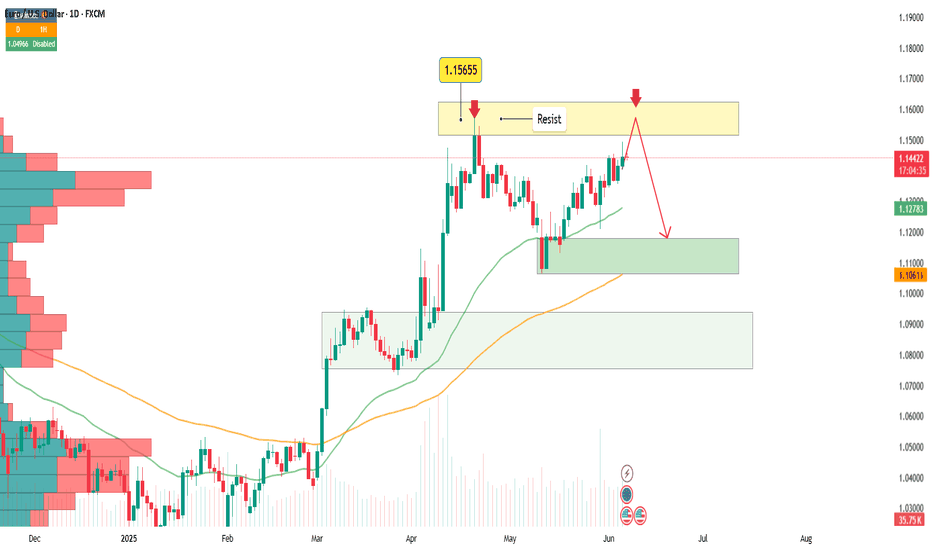

EUR/USD is currently consolidating around the 1.1510 support zone after a mild pullback from the descending trendline. Price structure remains bullish, with a wedge pattern forming — signaling that a breakout could be imminent. On the news front, expectations that the Fed may soon begin cutting rates — following a series of weak U.S. economic data — are weighing...

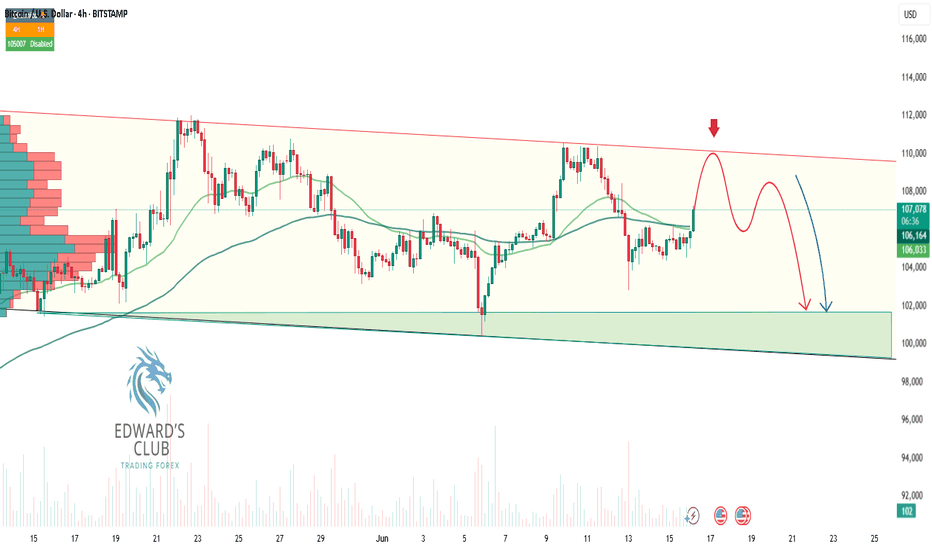

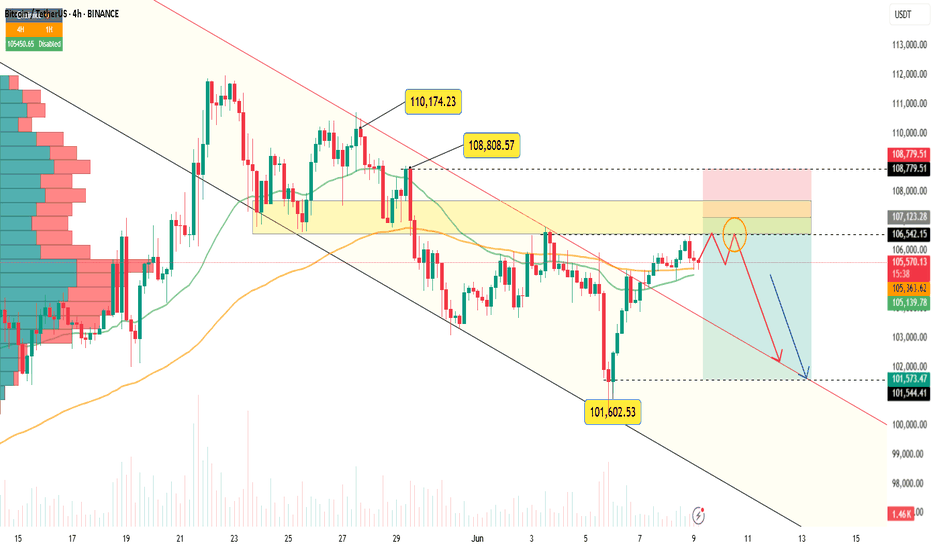

Bitcoin is trading near $106,600 and still moving cleanly within a well-defined descending channel on the daily chart. Every time price touches the upper boundary, sellers step in aggressively — and this time looks no different. BTC is once again approaching that key resistance zone. From where I stand, if we don’t see a breakout in the next few sessions, this...

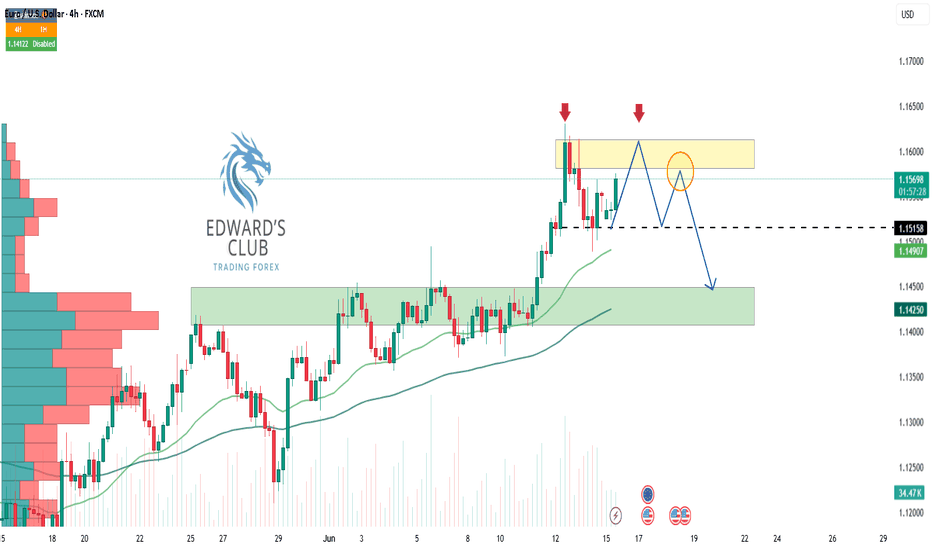

EUR/USD kicked off the week under pressure, hovering near 1.1540 during the Asian session. The drop comes as the U.S. dollar regains strength, driven by safe-haven demand amid rising geopolitical tensions in the Middle East. In times like these, the greenback shines — and riskier currencies like the euro naturally take a hit. If the situation escalates further,...

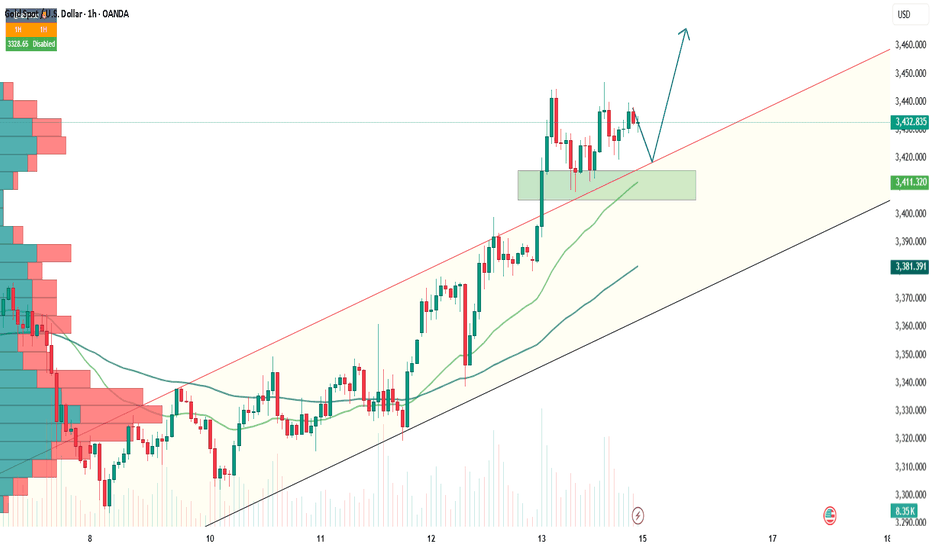

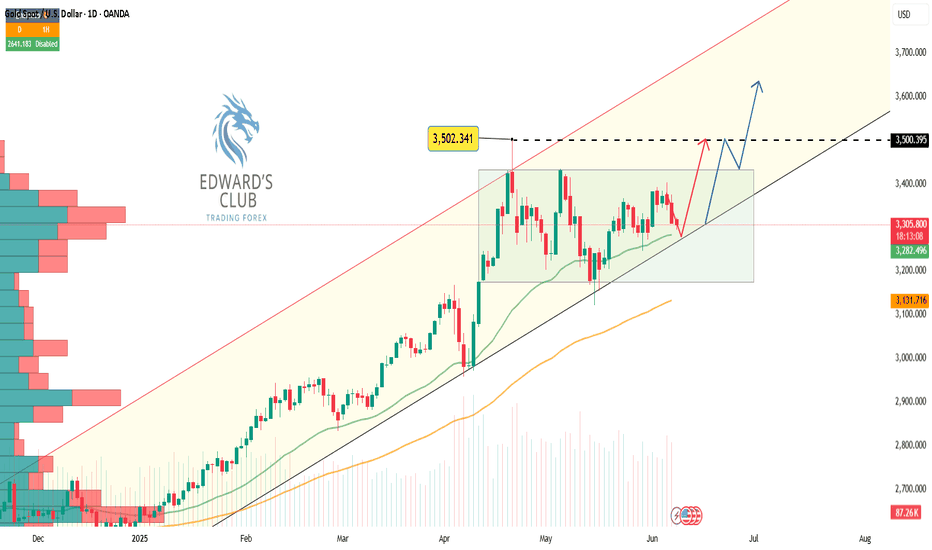

Gold is currently trading around $3,438 and continues to show positive momentum. After a week focused on inflation data, the gold market is now shifting its attention to interest rate decisions and policy guidance from major central banks. The week begins with the Empire State Manufacturing Index, a key indicator of economic activity in the New York region....

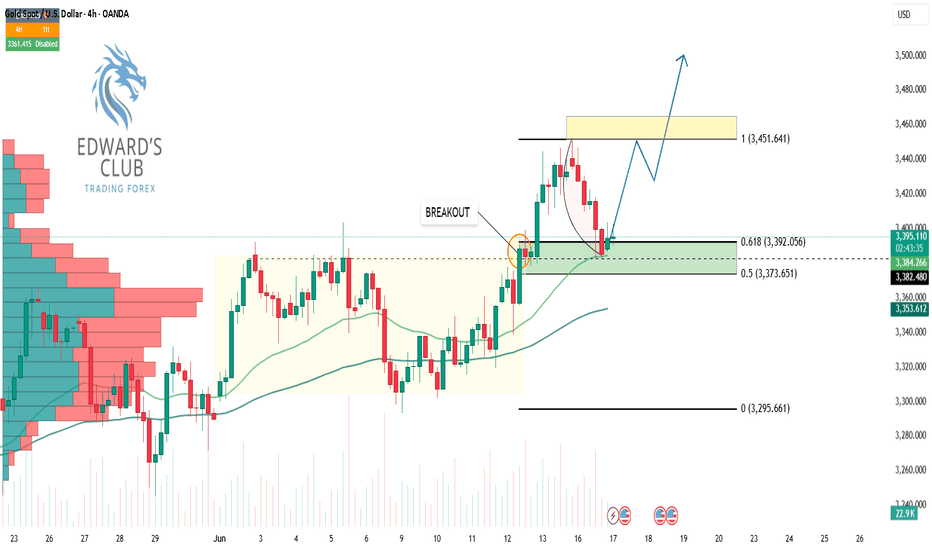

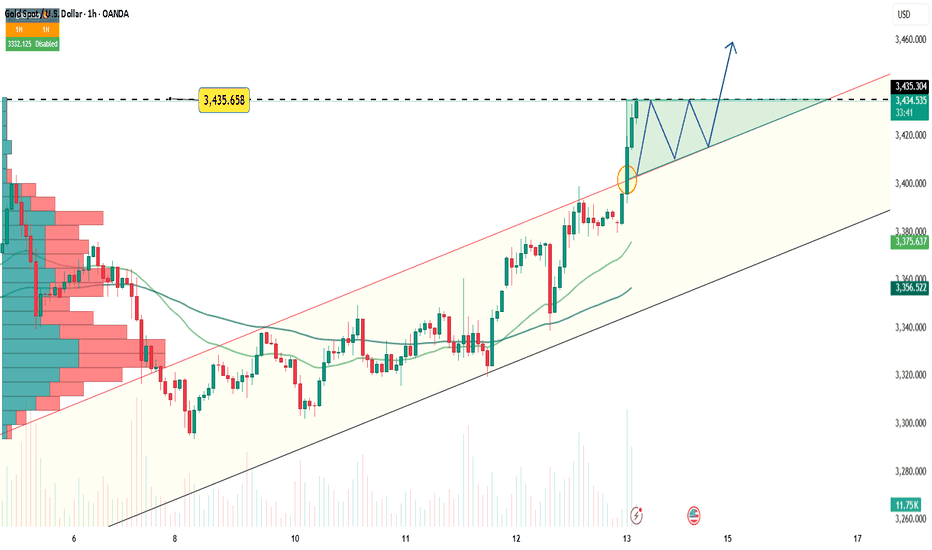

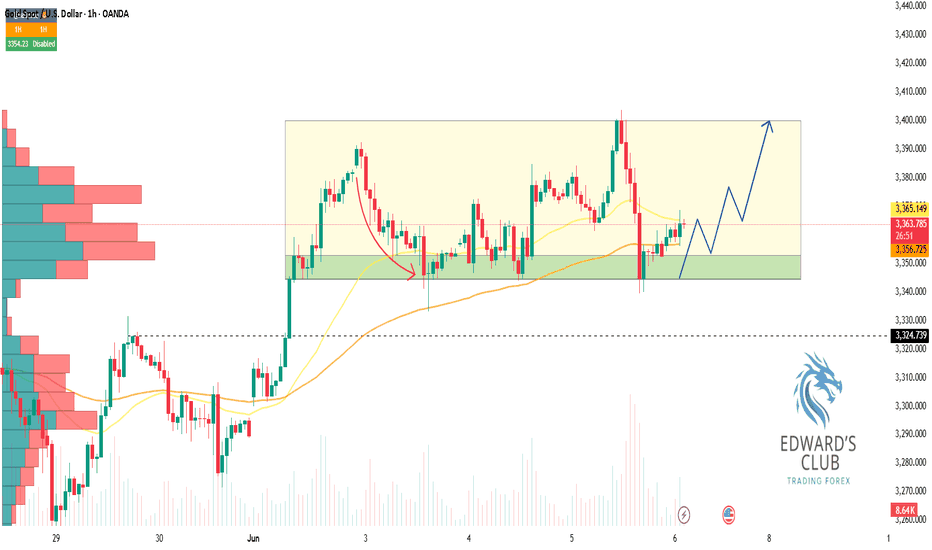

Hey traders! What’s your view on XAUUSD? Yesterday, gold surged over 400 pips and the rally hasn't slowed down. Price is now hovering around $3,428, right below a key resistance above the all-time high. Why the spike? US CPI came in lower than expected, boosting hopes for a Fed rate cut. The dollar weakened, tensions in the Middle East grew, and central banks...

The recent escalation in the Middle East — particularly Israel’s surprise strike on Iran — has stirred up significant volatility in global financial markets. Oil prices surged, stock markets around the world turned red, just as many had predicted. However, in a surprising twist, capital did not rush into the usual safe havens like the US dollar or Treasury bonds....

Gold prices extended gains today, driven primarily by lower-than-expected U.S. inflation data, which has increased speculation that the Federal Reserve may soon cut interest rates. The weaker inflation reading sent the U.S. dollar and Treasury yields lower, giving gold a strong push to the upside. Currently, markets are pricing in a 68% chance of a Fed rate cut...

The EUR/USD pair is currently hovering around 1.141, reflecting a clear lack of buying interest. As Friday's U.S. session unfolded, the pair lost momentum and slipped below the 1.1400 mark—an important psychological level that had previously offered support. This decline came on the back of stronger-than-expected U.S. nonfarm payrolls data for May, which...

Bitcoin is now pressing against the key resistance zone around $106,920—a level that has consistently rejected price advances in recent weeks. After a decent recovery, momentum seems to be stalling, and often, that quiet before the storm tells us more than a breakout ever could. Zooming in, we may be witnessing a classic fake-out formation—a subtle move above...

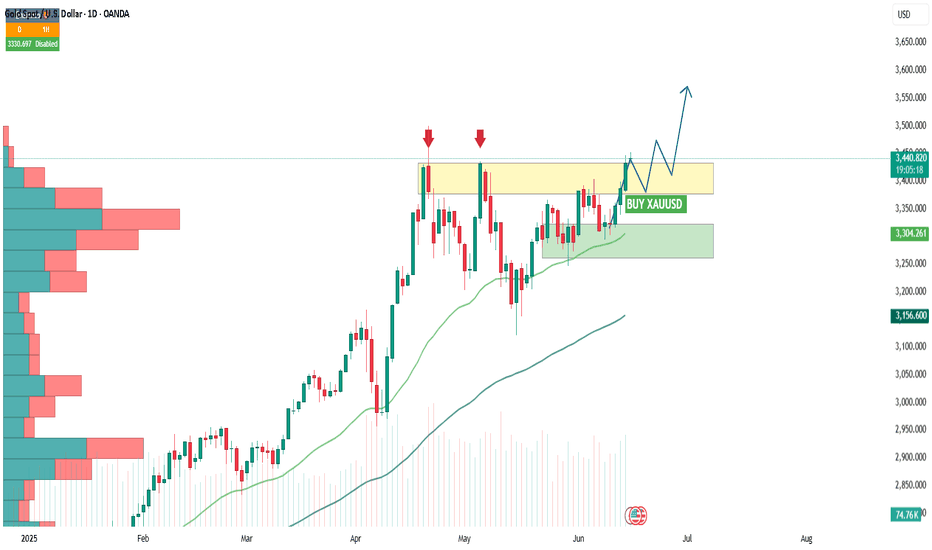

Hey traders, let’s take a closer look at what’s happening with gold this week. After multiple failed attempts to break above the 3,385 USD resistance, XAUUSD has continued to retreat, searching for fresh momentum. As the new week begins, price action is hovering around the psychological 3,330 USD level, with no clear signs of a bottom yet. At the moment, gold...

Gold has returned to a weaker stance, trading around $3,309 during the U.S. session. The U.S. dollar gained some positive momentum as markets leaned toward the possibility that the Federal Reserve will keep its policy unchanged in July following the May report, causing XAU/USD to drop lower into the weekend. Additionally, U.S. economic data released on the same...

Hello traders! What’s your take on EURUSD? EURUSD is currently trading just below a key resistance zone, signaling a potential pullback. A double top pattern may be forming, suggesting the pair could correct before regaining bullish momentum. We expect a short-term retracement toward the identified support levels before any continuation of the broader...

Hey traders! Let’s take a quick look at what’s happening with gold as the week wraps up. Yesterday, OANDA:XAUUSD saw a sharp drop during the U.S. session, sliding more than 600 pips. But by this morning, the metal bounced back with a short-term recovery, finding strong support around the $3,342 level. The move came after U.S. jobless claims data came in...

Gold surged to around $3,373/oz today, rising over $22 compared to the same time yesterday, after weaker-than-expected U.S. jobs data sparked fresh demand for safe-haven assets. According to ADP, the U.S. private sector added just 37,000 jobs in May—far below the 115,000 forecast and April’s 60,000. The sharp slowdown in hiring suggests growing cracks in the U.S....