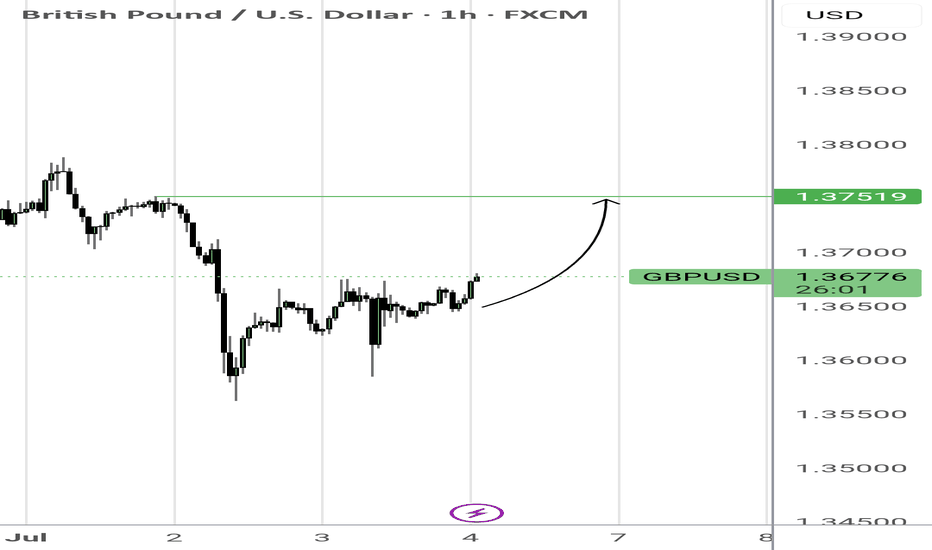

previous ideas went extremely well and were very quick! We have seen PDL and Asia sell-side taken during London then followed by a reversal. I would like to see a bullish follow through going at least mid range. Let see how that goes!

Related to a previous idea. Looks like we could have a mid-week reversal after taking sell-side as expected. Let's see what happens next. Lowest hanging fruit targets internal range buy-side at London swing high. Previous simulated trade hit target !

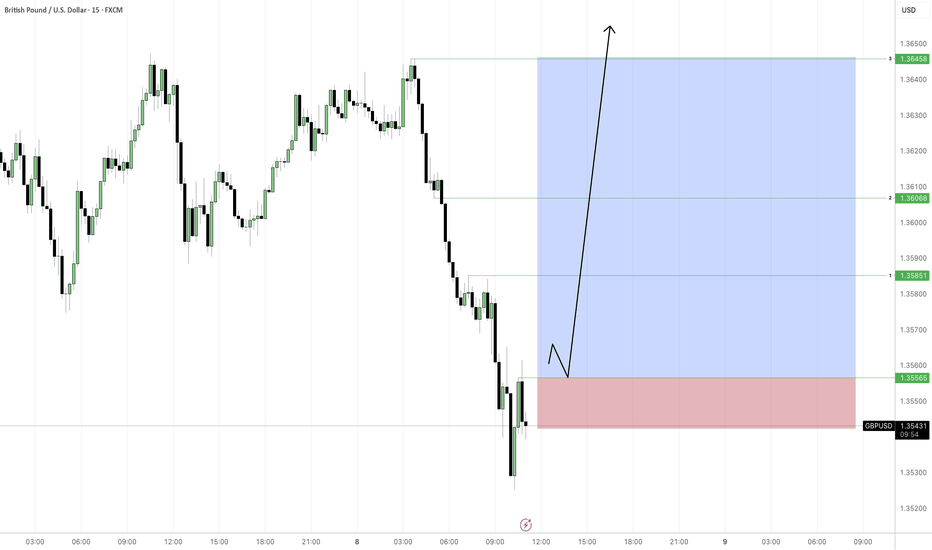

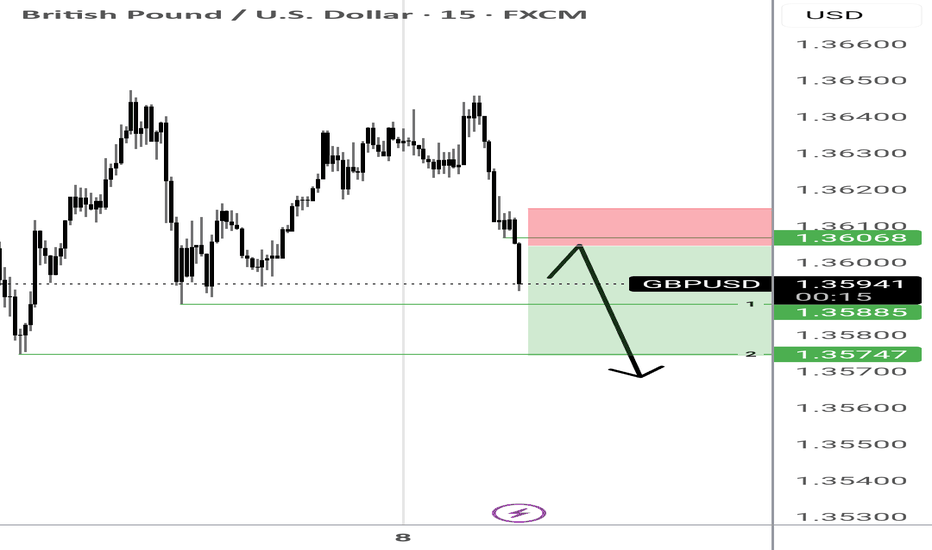

I have been a little lately calling but let's try to improve this a little. The call me Samurai for a reason :) So i am not going to fight the momentum this week so far however i do favour a bullish pound at least for this week and likely into the next couple of weeks. I I think we are engineering mid week sell side to then take and then resume weekly trend. I...

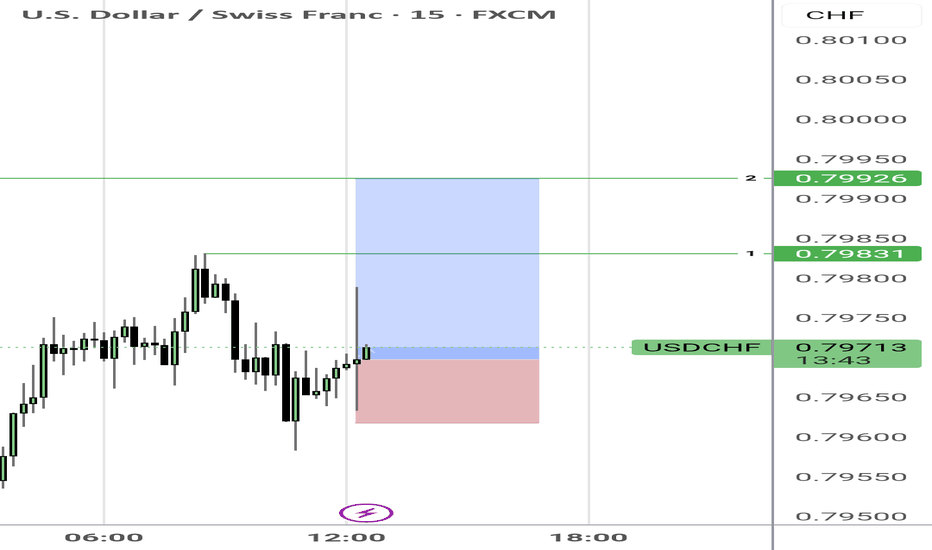

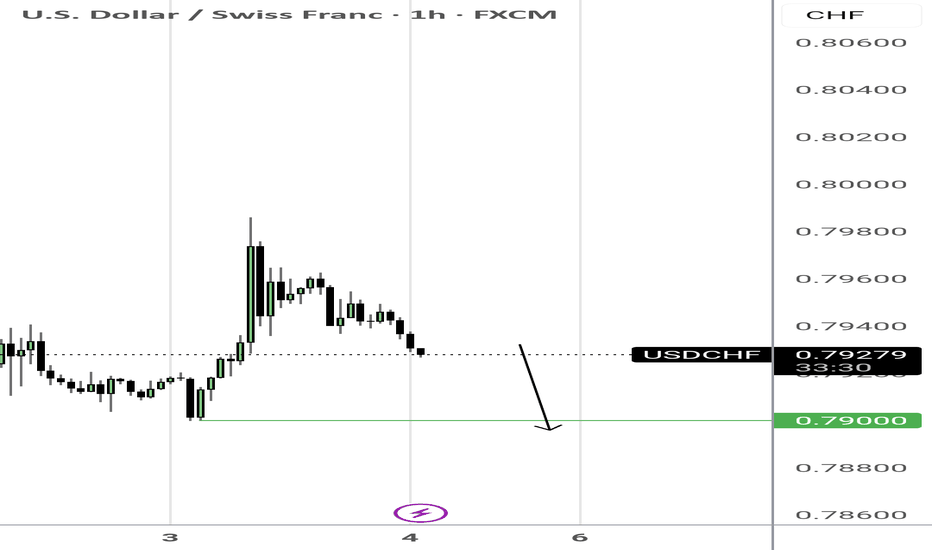

I like that we took London sell-side liquidity and then shifted back into the range. I am bearish dollar until we take at least one weekly low. Right now i want to see some pullback as depicted and then a run on some buy-side liquidity as depicted and maybe PDH. This will be another simulated trade setup.

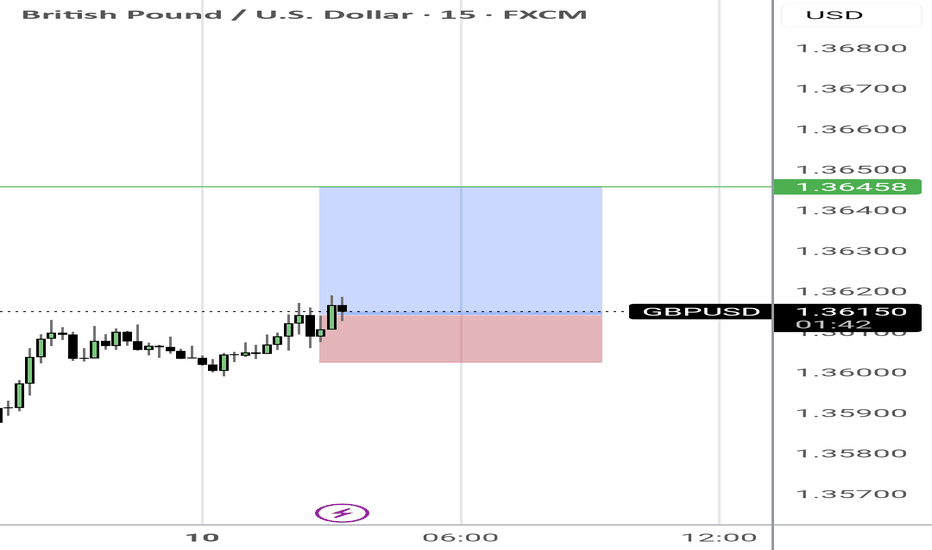

I am looking at what looks like a draw on sell-side liquidity under equal lows during London then a shift thereafter. I want to see NY pull back into the range between London swing low to current swing high and find support before expanding to at least PDH. That would be another simulated long setup.

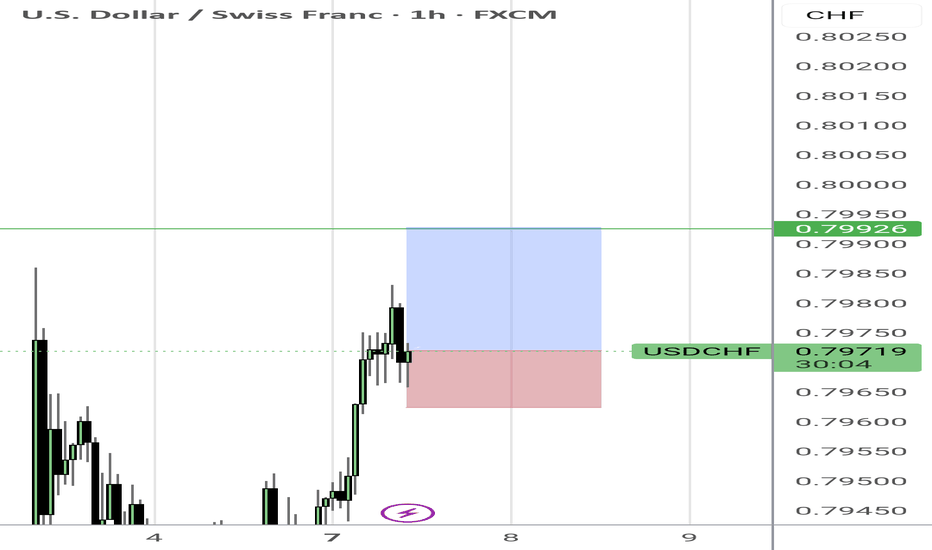

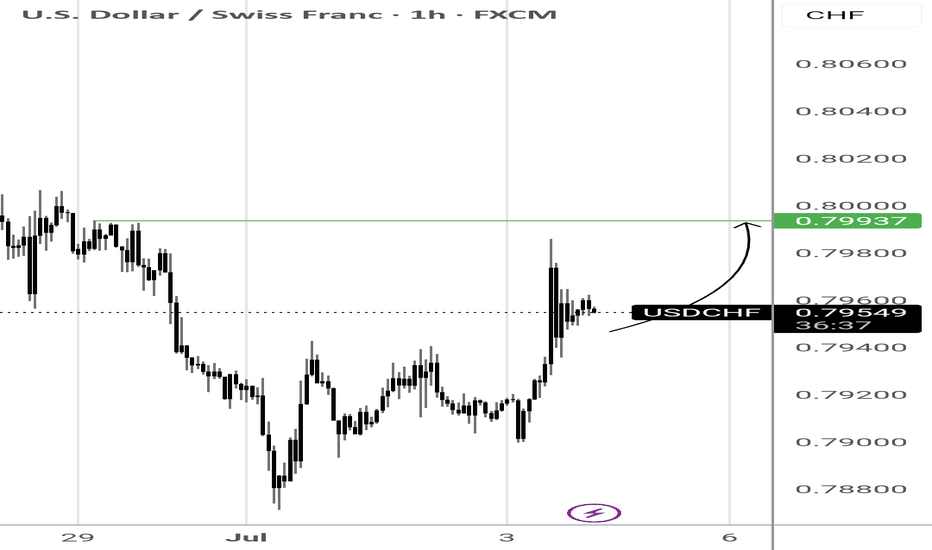

I like current consolidations near equal high depicted with green line. I want to see a draw towards the equal highs. This would be simulation trade #7 out of 100

Waiting confirmation with close above 1.35565, entry will at retest of that level for trade #7. So far 6 out of 100 trades. 5 losses 1 win.

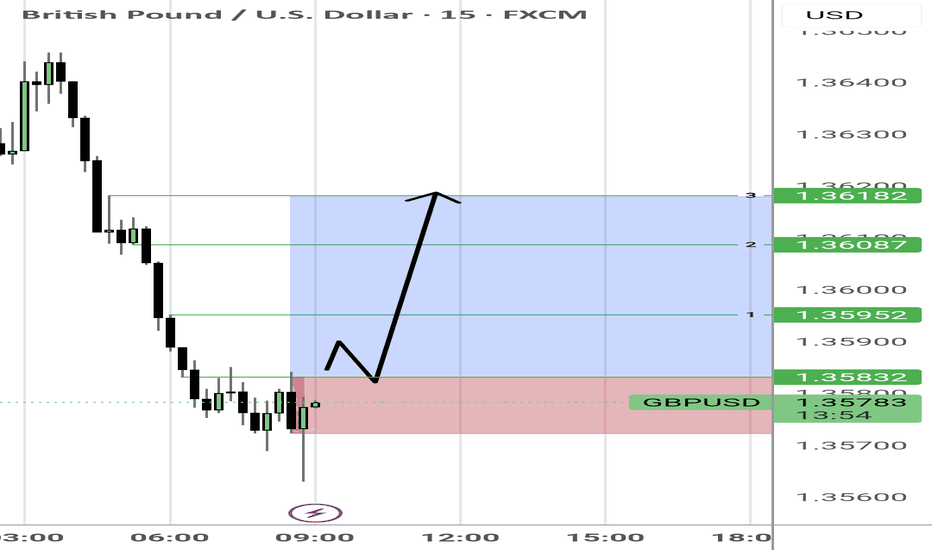

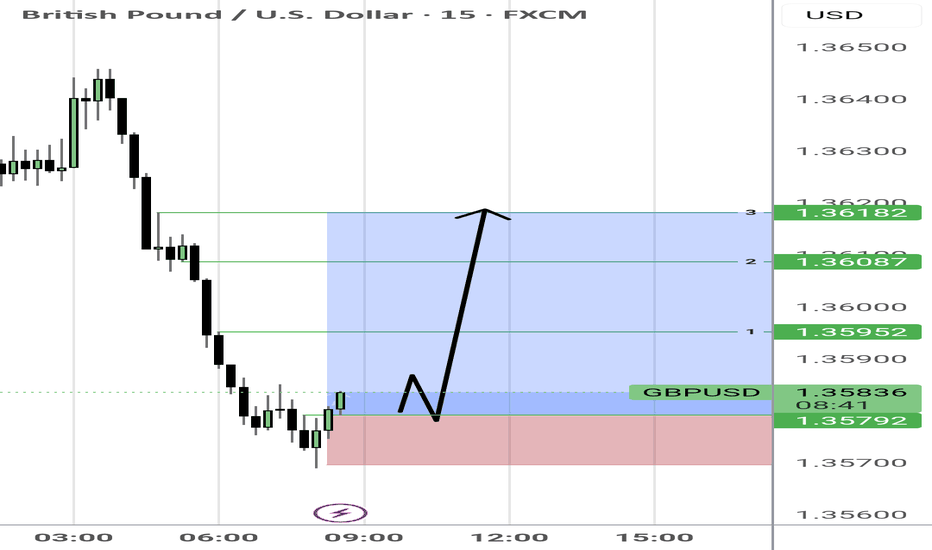

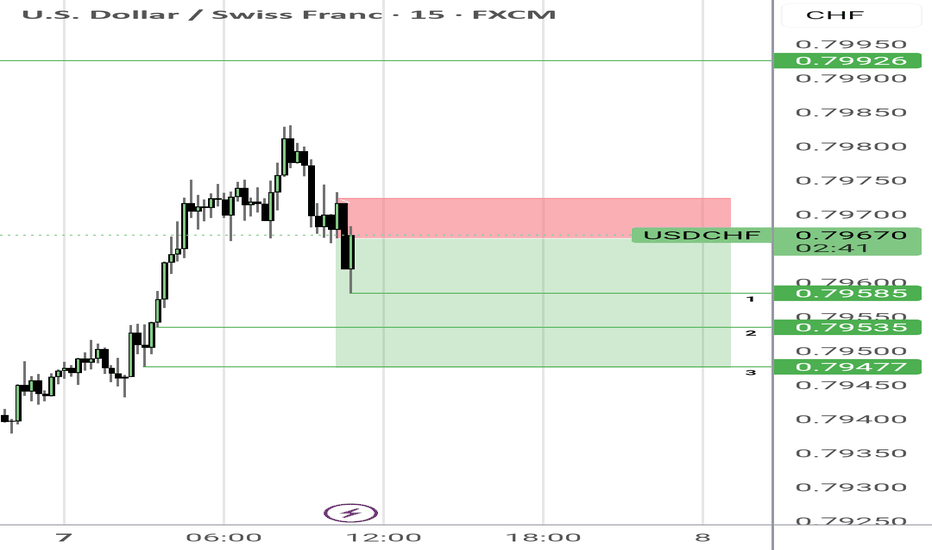

Same idea as previous post, I want to see a close above 1.35832 and a return into that level would be my entry. 3 targets as depicted.

We've taken some sellside liquidity. I am expecting price revert back into the range. Simulated trade #6 already triggered at 1.35792 any return into this level would be a good entry or near this level allowing 3 pips.

I will consider a short only if pull back happens prior to target 1 being a traded to. I like the downward monetum this morning. 4 losses 1 win for the simulated scalps. If this one is triggered it is the 6th scalp out of 100

Update from previous analysis l for the sckap. Going long with 2 targets

Short scalp as continuation from previous trade idea. Simulation #3 with 3 targets... Success assessment when only one successful target reached.

I like the clear rejection of last time's bias at 50% of range. We are hovering near equal highs. I like to simulate a buy from here. This is the second simulation. Follow for more. I plan to simulate 100 simulations of trades for entertainment purposes if I get the support.

Update of previous call after we broke structure. I see this one attacking buyside liquidity at equal highs formed on Tuesday. Possible market maker buy model playing out here.

An update of previous idea. I see this one in reversal mode. Likely marker maker sell model playing out now.

Piggybacking on the strong dollar idea as per previous posts. Today's data was positive for the greenback. I want to see price draw higher into equal highs depicted with green line as an attractive premium liquidity pool.

I like this premium zone. I am looking at 1.36544 to 1.36498 as good price to sell from. Target is still same, refer to previous post.

I like the daily bearish momentum to the down side. Not trying to pick the top or anything but I think will will see a follow through. I like one of the nearest internal range liquidity pool depicted with green line. Let's see how it goes!