MMFlowTrading

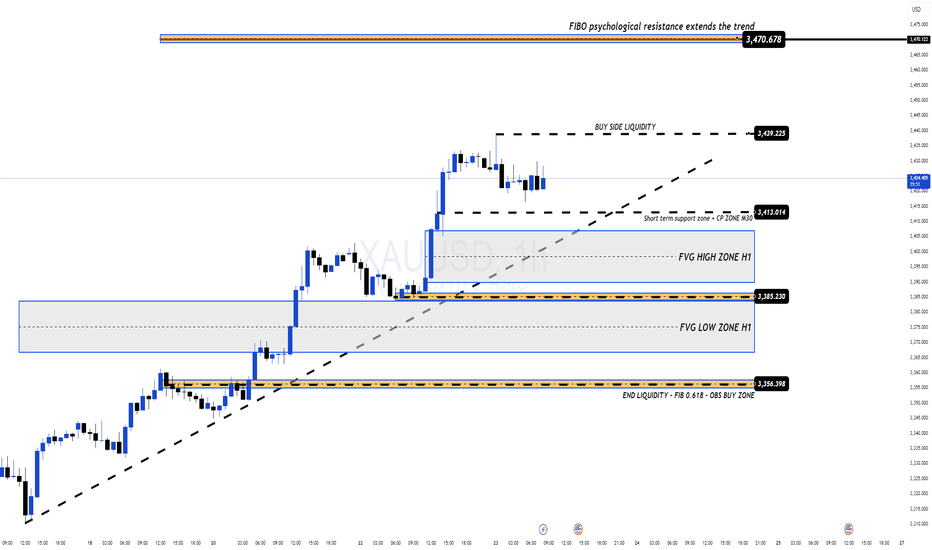

Premium【XAU/USD】GOLD TRADING PLAN – Triangle Squeeze, All Eyes on NFP Gold continues to trade within a large symmetrical triangle, tightening toward the end of its range. However, current candle structure shows clear bullish momentum, indicating the potential for a strong upside breakout. 🔍 Today’s Key Focus: Non-Farm Payrolls (NFP) Market expectations are pointing to...

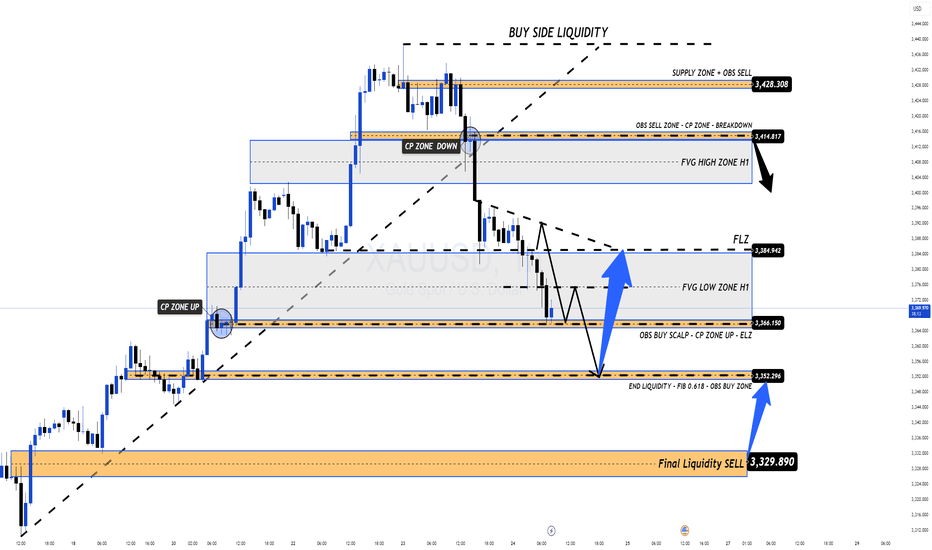

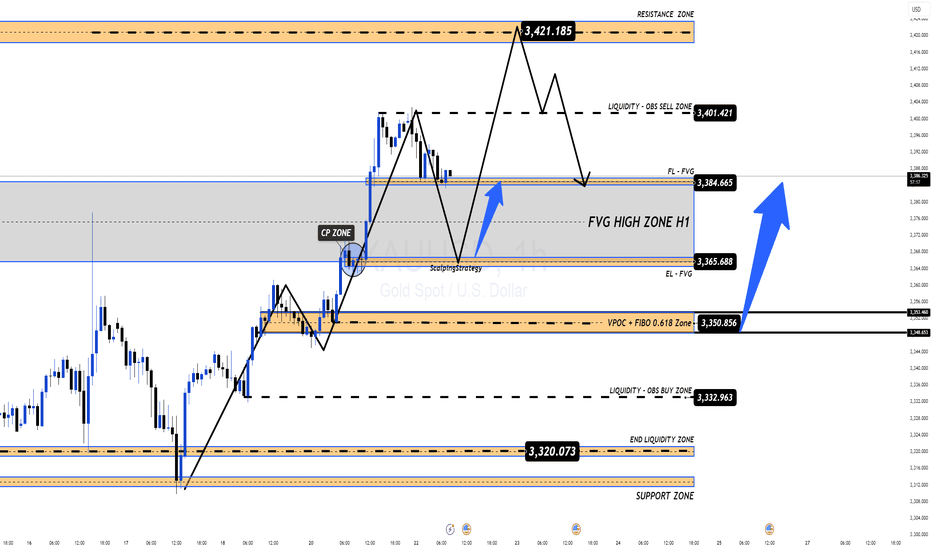

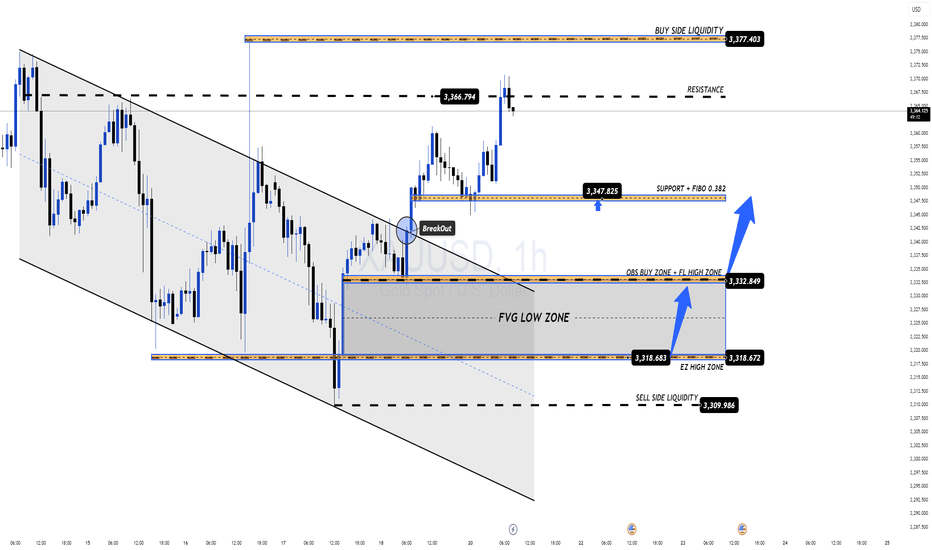

Bounce From Final Liquidity or Start of a Bullish Move? After the FOMC event, gold completed a sweep of the final liquidity zone at 3269–3271 and rebounded strongly, in line with the broader bullish trend. The price has now recovered sharply and is gradually returning to the liquidity zones left behind after yesterday’s sharp drop. 📍 At the moment, gold is...

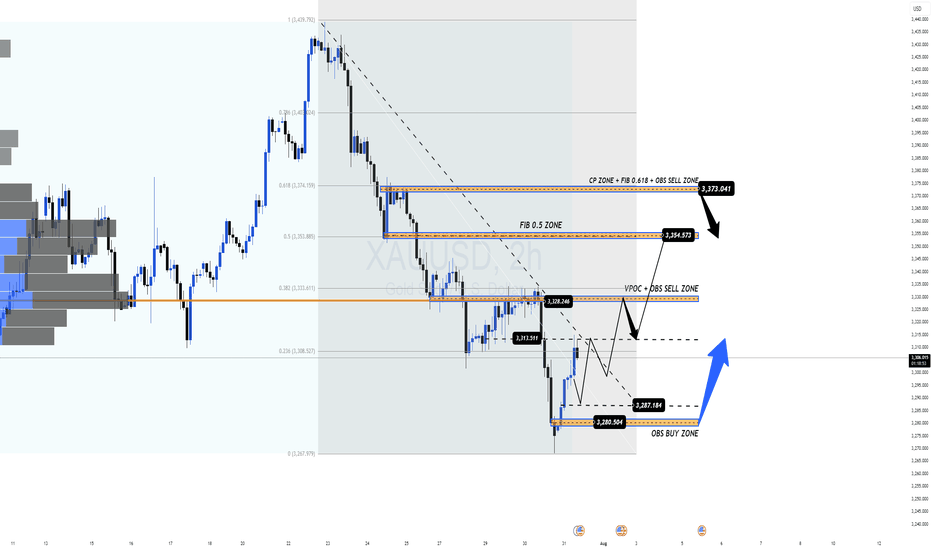

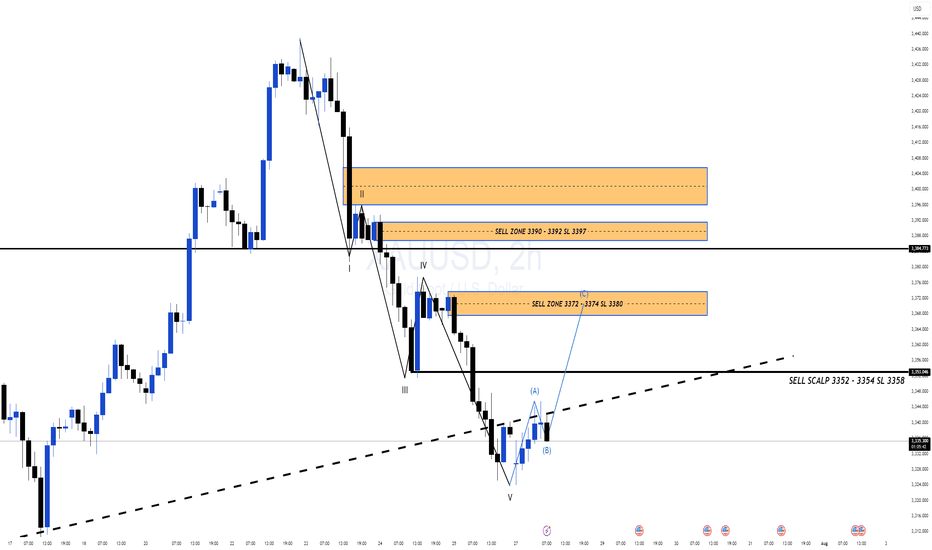

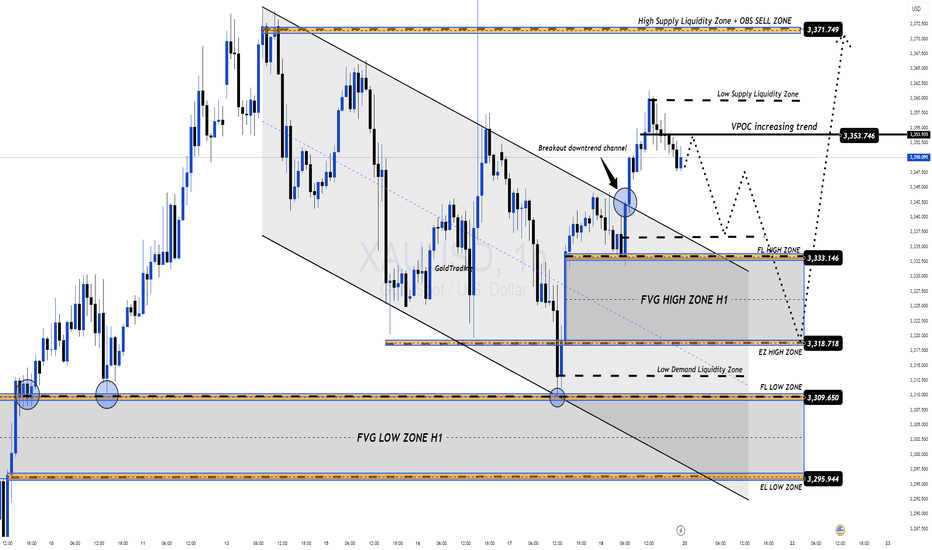

GOLD – A Bottom in Place or Just the Calm Before the Storm? Gold has recently shed nearly $50, indicating sustained bearish pressure. But here’s the real question: 👉 Is this simply a liquidity sweep before a bullish reversal? 👉 Or are we witnessing the early stages of a broader bearish continuation? Let’s break it all down – step by step – to map out smart,...

– GOLD: Bottoming Out or Just the Calm Before the Storm? Gold has dropped nearly $50 over the last 4 sessions, showing clear bearish momentum. But is this just a liquidity grab before a reversal — or are we simply pausing before another leg down? 🔍 Market Context: Recent US–EU defence and trade agreements may have weakened gold’s short-term appeal as a safe...

🔺 Technical Analysis Gold opened the Asian session this week with a slight retracement, testing the 0.382 Fibonacci Retracement level before bouncing back strongly to last week's closing price around 3339. This move further solidifies the price action from a technical perspective. Notably, gold has broken through a minor resistance on the M15 timeframe,...

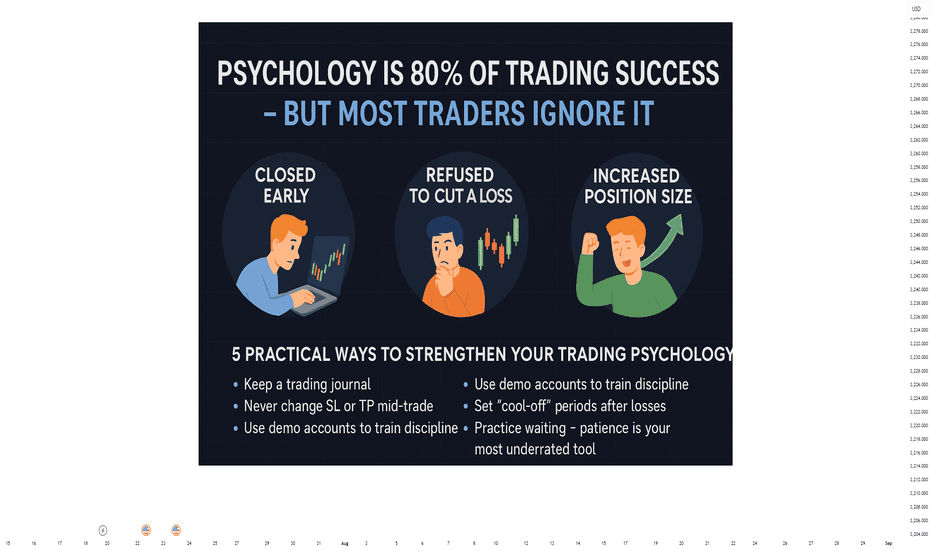

Losing over and over again? The problem isn’t your strategy – it’s your mind. Let’s be honest: Are you repeating the same old mistakes… even though you know they’re wrong? You know you shouldn’t enter a trade without confirmation – but you still do. You know you should stick to your stop-loss – but you move it. You know your mindset is unstable today – but you...

🌐 Market Overview Gold has struggled to recover after yesterday's sharp drop, driven by macro-political concerns and profit-taking at recent highs. 🔻 On July 24, former President Trump made an unexpected visit to the US Federal Reserve, sparking speculation that he's pressuring the Fed to cut interest rates soon. While the Fed has yet to make any dovish moves,...

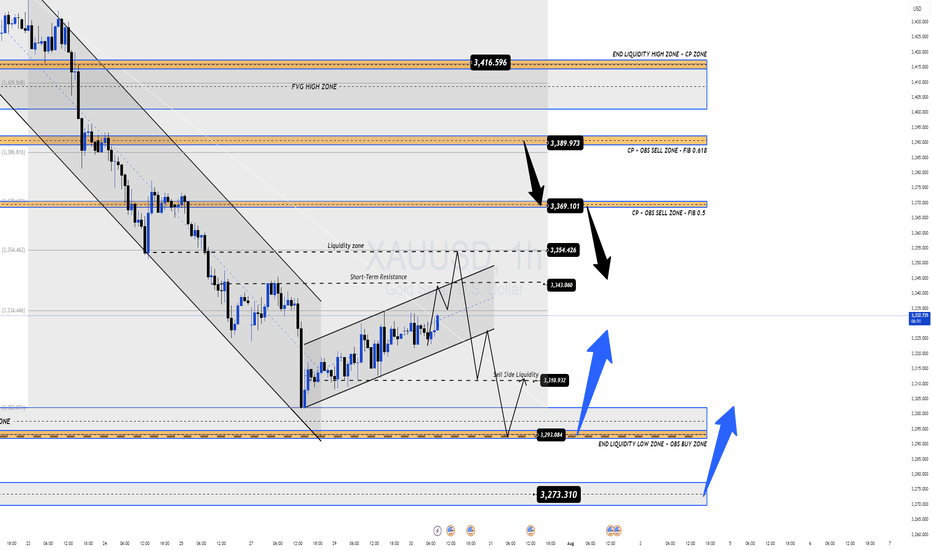

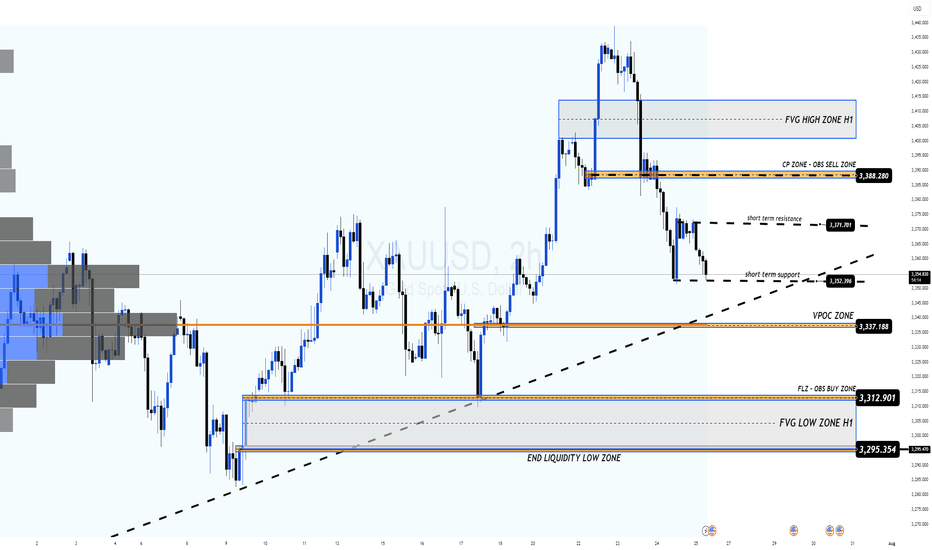

XAUUSD 24/07 – Correction in Play, Long-Term BUY Opportunity Ahead 🧭 Market Outlook Gold has dropped sharply from the 343x region, exactly as outlined in yesterday’s plan. Price has broken below the ascending trendline on the H1 chart and is now tapping into lower liquidity zones (FVG + OBS), signaling continuation of the short-term bearish move. Key context to...

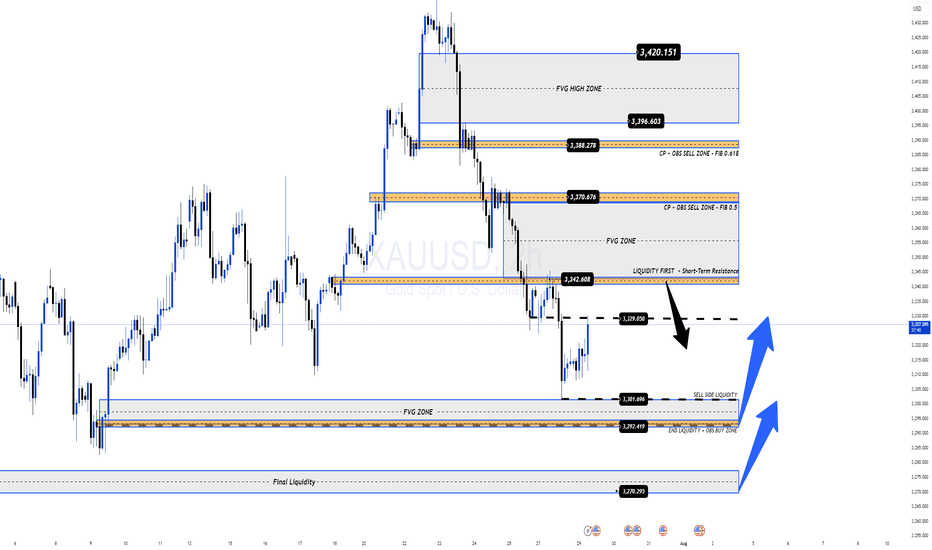

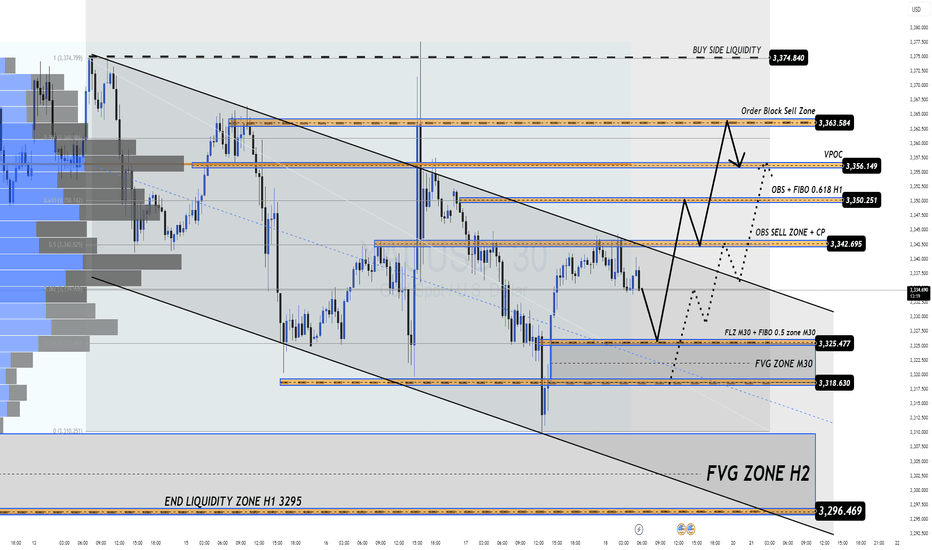

XAUUSD – Bullish Momentum Fading? Key Correction Levels Ahead (23 July) 📰 Market Overview Gold surged strongly overnight, driven by: A speech from Fed Chair Jerome Powell, with no hints of resignation or major policy shift. Rising geopolitical tensions between the US, China, and the EU — with the 1st of August marked as a key deadline. A notable drop in US...

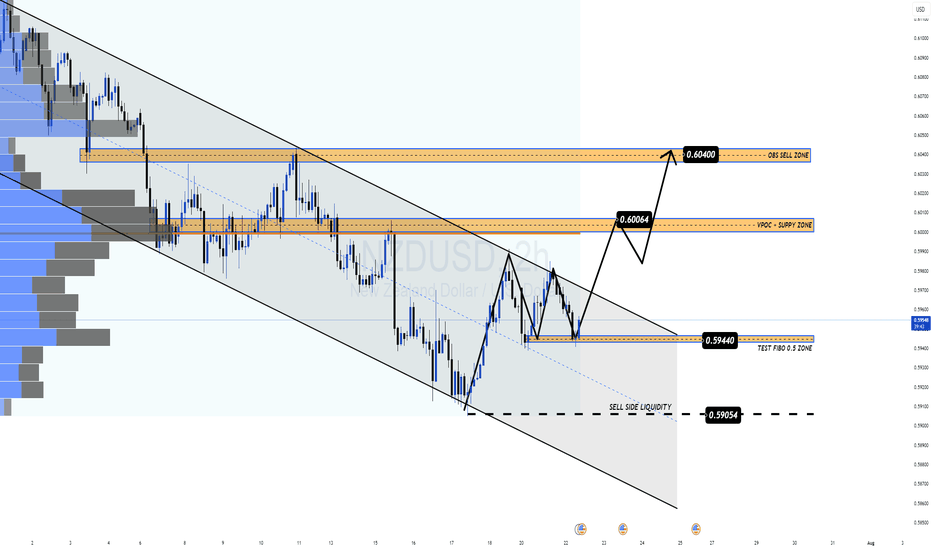

NZD/USD is down nearly 0.4% in Tuesday’s European session, trading near the key support area of 0.5940 — a confluence of the 0.5 Fibonacci retracement and the midline of a descending channel. The pair is pressured by rising expectations that the RBNZ may cut rates in August, while the USD remains volatile amid uncertainty surrounding trade talks between the US and...

XAUUSD – Intraday Market Outlook (22/07) Gold posted a strong rally in the previous session, completing its short-term impulsive wave structure. However, as price approached the psychological resistance at $3400, it began to lose momentum, and a clear reversal candle appeared — a signal that today’s session may favour a pullback or correction. 🔍 Technical...

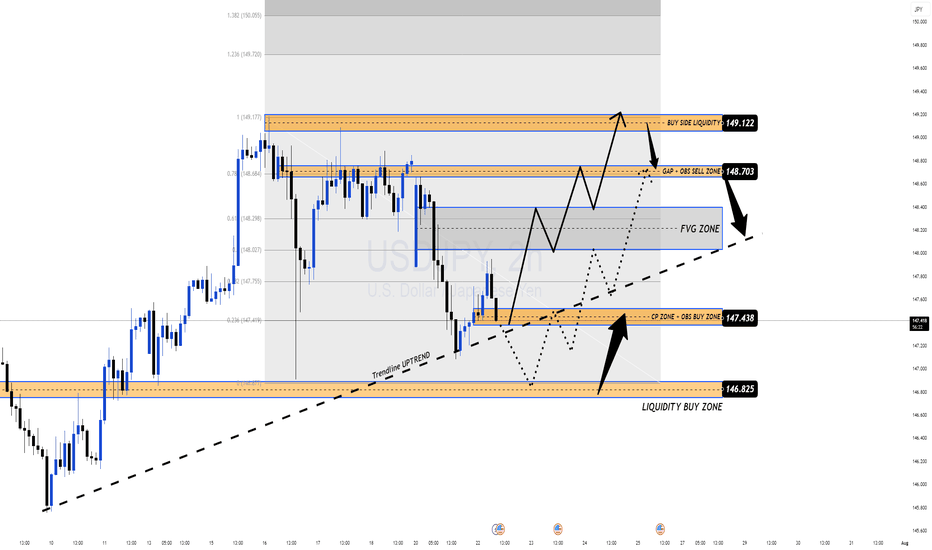

After pulling back from the recent high near 149.17, USDJPY has shown signs of strength again, rebounding off the confluence support at the ascending trendline. The bullish narrative is supported by a hawkish FOMC tone and news that a U.S. federal court temporarily blocked Trump-era tariffs. The pair now awaits upcoming U.S. economic data for further directional...

🔔 GOLD PLAN 21/07 – QUIET START TO THE WEEK, WATCH OUT FOR KEY RESISTANCE! 🌍 Market Overview Gold has bounced back strongly following a brief pullback late last week. The move comes as geopolitical tensions and global conflicts continue to escalate. While this week may not feature high-impact economic data, macroeconomic risks and global uncertainty remain the...

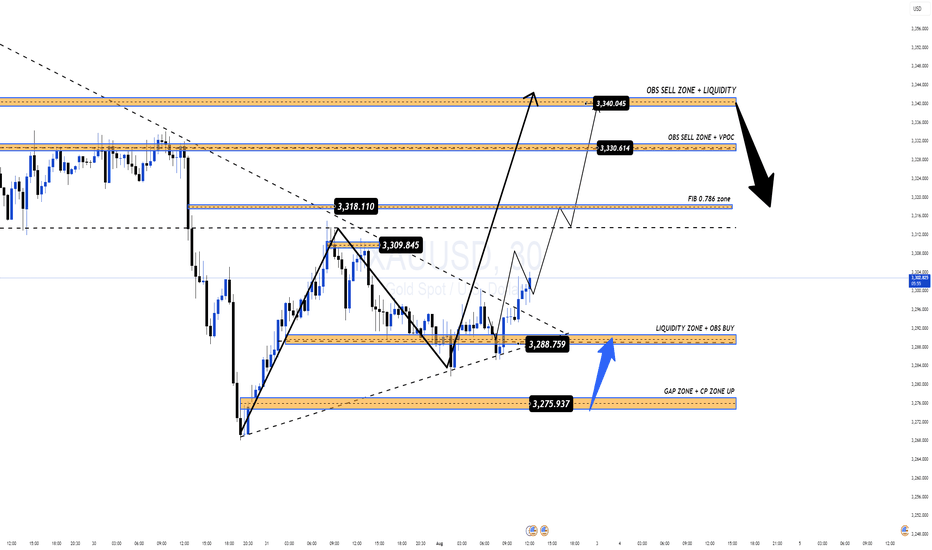

GOLD OUTLOOK – READY FOR THE NEW TRADING WEEK (JULY 21–25) 🟡 Market Recap: Gold made a strong bullish reversal at the end of last week, following a liquidity sweep at the FVG ZONE 3310. Price surged quickly toward the OBS SELL ZONE around 335x–336x. However, by Friday’s close, price reacted to multiple confluences (OBS + FIBO zones) and closed below the VPOC...

Psychology Is 80% of Trading Success – But Most Traders Still Ignore It Have you ever followed a perfect setup… and still lost money? You entered at the right level. The trend was clear. Confirmation was solid. But you closed the trade too early. Or held onto a losing trade far too long. Or took a revenge trade just to “get it back.” This isn’t a strategy...

Gold Outlook – Market Tensions Mount, Liquidity Zones in Play Price action heats up as we enter the final trading day of the week. Are you ready to ride the wave or get caught in the liquidity sweep? 🔍 Market Sentiment & Global Highlights Gold rebounded strongly after dropping on better-than-expected US data. However, several macro risks are keeping gold buyers...

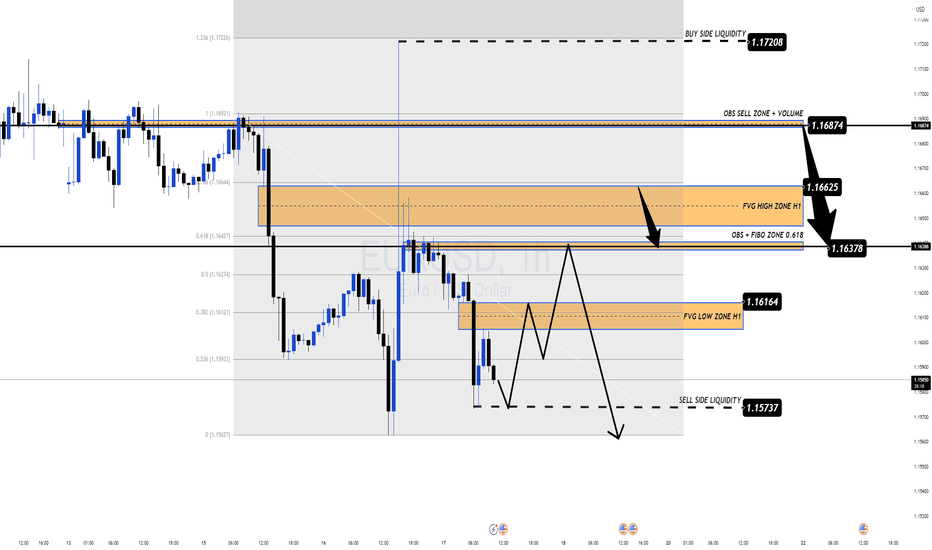

EUR/USD Forecast – Bears in Control Ahead of US Jobless Data 🌐 Macro View: Dollar Regains Strength Amid Uncertainty EUR/USD remains under selling pressure as the greenback finds renewed strength following midweek weakness. The market is bracing for fresh U.S. jobless claims data, expected to show a slight rise to 235K. A print below 220K could reignite USD demand,...

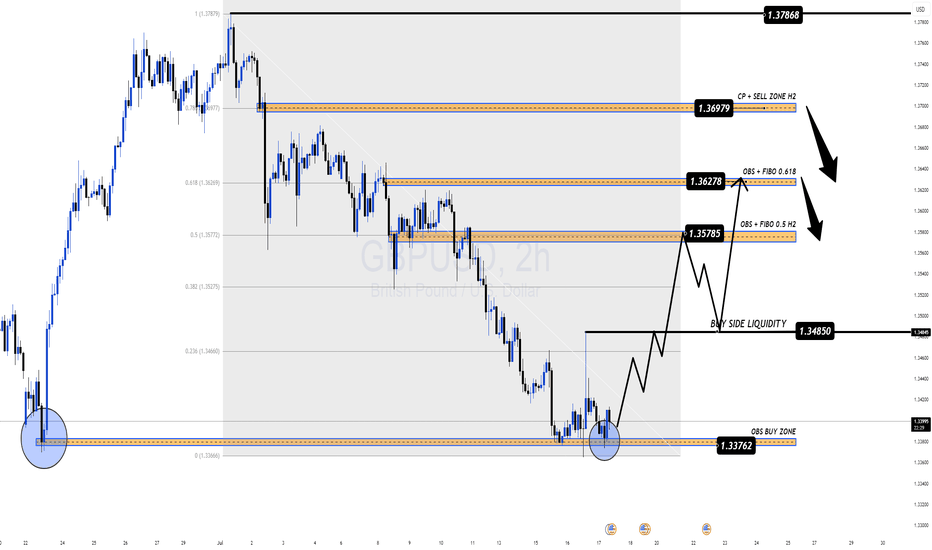

GBP/USD Outlook – Sterling Rebounds But Faces Heavy Resistance Ahead 🌐 Macro Insight – UK Labour Data Mixed, Trump Headlines Stir Market The British Pound (GBP) regained some lost ground against the U.S. Dollar after the UK labour market data revealed mixed signals: Wage growth cooled as expected, suggesting a potential easing in inflationary pressures. UK ILO...