The conflict between Israel and Iran has escalated since the initial strike on Friday. After sustaining a wide-scale strike on nuclear facilities, ballistic missile factories and military commanders, Iran retaliated by launching drones and missile attacks on Israel. Reuters reports that Iran has rejected calls for a ceasefire, while Israel has vowed to make...

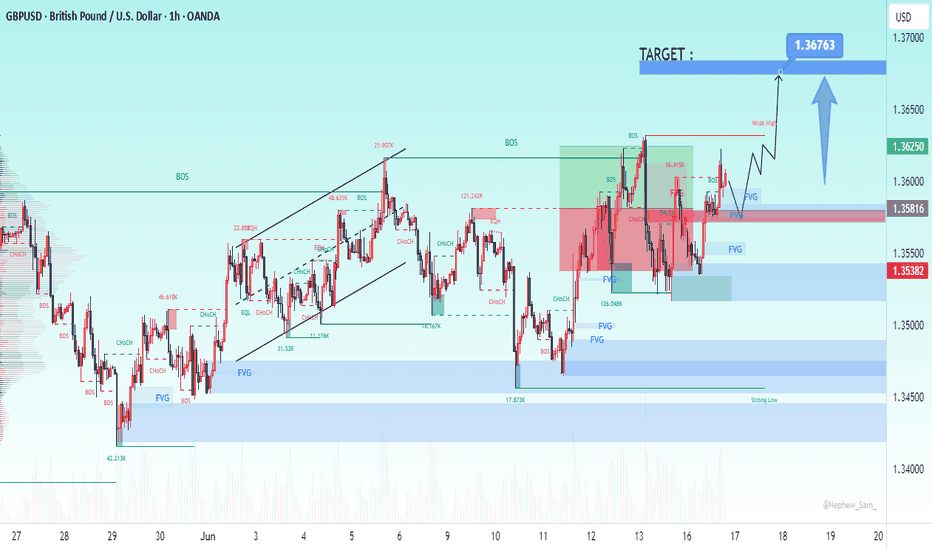

GBP/USD now faces some renewed selling orders and slips back to the 1.3600 zone on Monday. Cable's decent gains come on the heels of rising pessimism about the US Dollar and encouraging geopolitical news.

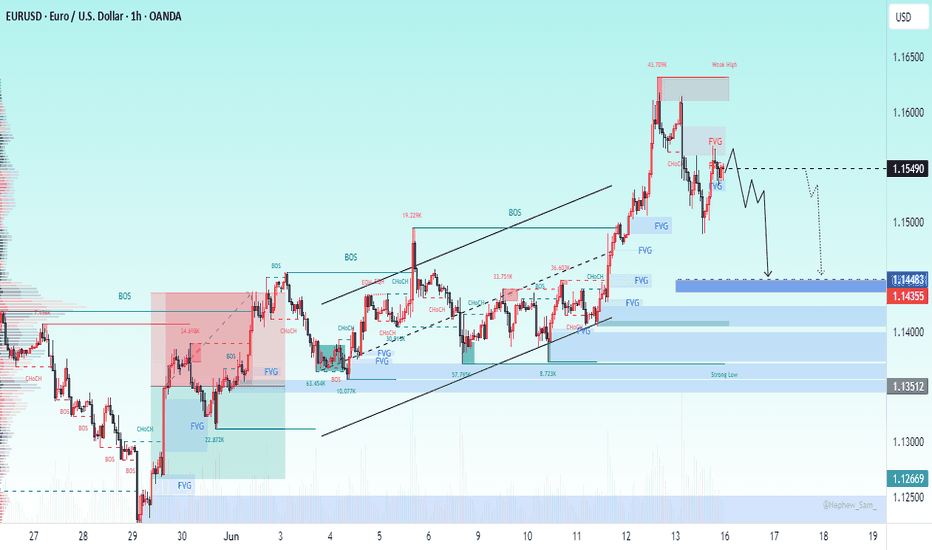

EUR/USD continues to recover ground lost and now extends the rebound to the 1.1550 zone on Friday. Meanwhile, the US Dollar maintain its bullish bias intact in response to a significant flight to safety amid increasing geopolitical concerns, while positive consumer sentiment data also contribute to the daily uptick.

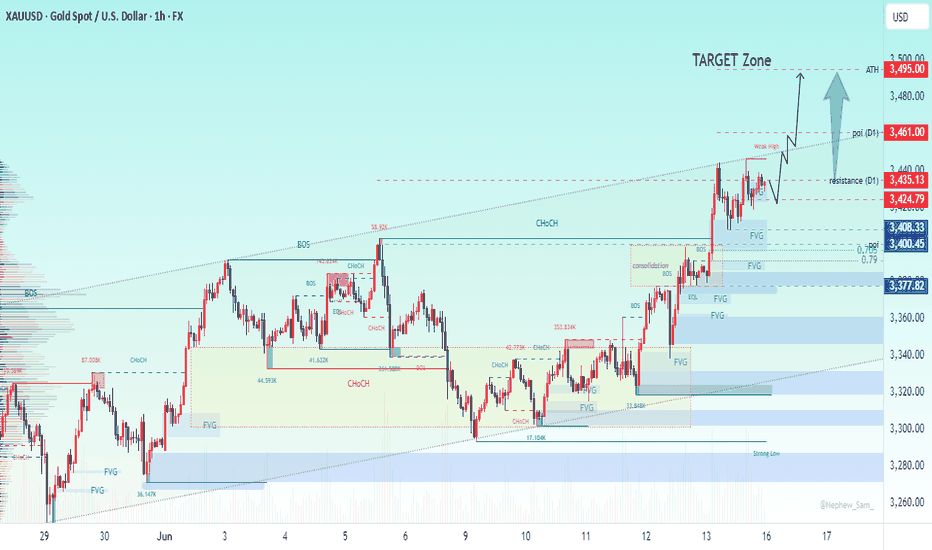

Gold prices maintain its upward trajectory on Friday, reaching its peak level since late April above the $3,400 mark per troy ounce. Furthermore, the precious metal draws increased safe-haven interest amid escalating tensions in the Middle East, triggered by Israel's military action against Iran.

Gold price recovers a major part of intraday losses and climbs back closer to the $2,800 mark during the first half of the European session on Monday. It remains within striking distance of the all-time peak touched on Friday and continues to draw support from concerns about the potential economic fallout from US President Donald Trump's trade tariffs.

Gold remains on a positive trajectory, hitting an all-time high of around $2,815 per troy ounce on Friday, driven by persistent safe-haven demand amid rising uncertainty over President Trump's tariff plans.

Gold prices now face some selling pressure and retreat to the area of daily lows around the $2,750 mark per ounce troy as market participants remain cautious prior to the Fed's interest rate decision.

Trump’s tariff chatter, coupled with a rebound in European stocks and a more upbeat tone in US futures, helped Gold prices stage a solid recovery and partially offset Monday’s steep pullback, climbing above the $2,750 region on Tuesday.

EUR/USD remains in corrective mode, accelerating its recent breakdown below the 1.0500 support level, though it manages to hold onto daily gains amid a mild recovery in the US Dollar.

Gold gathers bullish momentum and climbs to a fresh multi-month high above $2,780. The Fed will announce monetary policy decisions following the first meeting of 2025 next week. The near-term technical outlook suggests that Gold is about to turn overbought

Gold price (XAU/USD) enters a bullish consolidation phase during the first half of the European session and oscillates in a range above the $2,770 area, near a multi-month top touched earlier this Friday. The US Dollar (USD) attracts sellers for the second straight day and drops to over a one-month low amid a fresh leg down in the US Treasury bond yields,...

Bitcoin’s (BTC) price continues to decline, trading below $102,000 at the time of writing on Thursday after falling 2.3% the previous day. Later in the day, BTC could expect volatility after the US weekly Initial Jobless Claims data release. In an interview with Bloomberg Live on Wednesday, BlackRock CEO Larry Fink said BTC could raise to $700,000.

Gold (XAU/USD) fails to extend its weekly rally on Thursday, coming under some renewed selling pressure following three consecutive days of gains. Indeed, the precious metal surged past $2,760 per troy ounce for the first time since early November on Wednesday, driven by persistent uncertainty surrounding announcements from former President Trump, particularly...

Gold price sticks to positive bias for the third successive day on Wednesday and trades near its highest level since November 1 above $2,750. The uncertainty around US President Donald Trump's trade policies turns out to be a key factor that continues to drive haven flows towards the precious metal.

Gold price (XAU/USD) retreats slightly after touching its highest level since November 6 during the early European session on Tuesday and currently trades just below the $2,725 area, still up over 0.50% for the day.

Gold stays in positive territory above $2,700 on Monday as the improving risk mood makes it difficult for the US Dollar to find demand. Markets await US President Donald Trump's speech at the inauguration ceremony.

Gold’s price faces some selling pressure while staying above the $2,700 level on Friday, with some profit-taking occurring after its three-day rally this week. Fed governor Christopher Waller spooked traders by commenting on Thursday that a March interest rate cut should not be ruled out.

Gold price seesaws between tepid gains/minor losses through the early European session and consolidates its recent gains to over a one-month peak touched this Thursday. Growing acceptance that the Fed will pause its rate-cutting cycle late this month assists the USD to move away from a one-week low touched on Wednesday.