PropNotes

PlusHey guys! Just got a new mouse, so please forgive the thumping noise, still adjusting the sensitivity because it's too low. I didn't know it would make that noise, but I'm also not going to re-record this vid. Let me know what you guys think! I'd love to hear where people disagree with me :) Cheers -

Good afternoon gang! Hope everyone is doing well & isn't getting too blown out in the carnage today in the majority of the market. If you're looking for something boring to put your money into, AT&T didn't used to be an option, but it's now gotten to a price where it's beginning to look interesting. Back when the split was announced, I remember doing some...

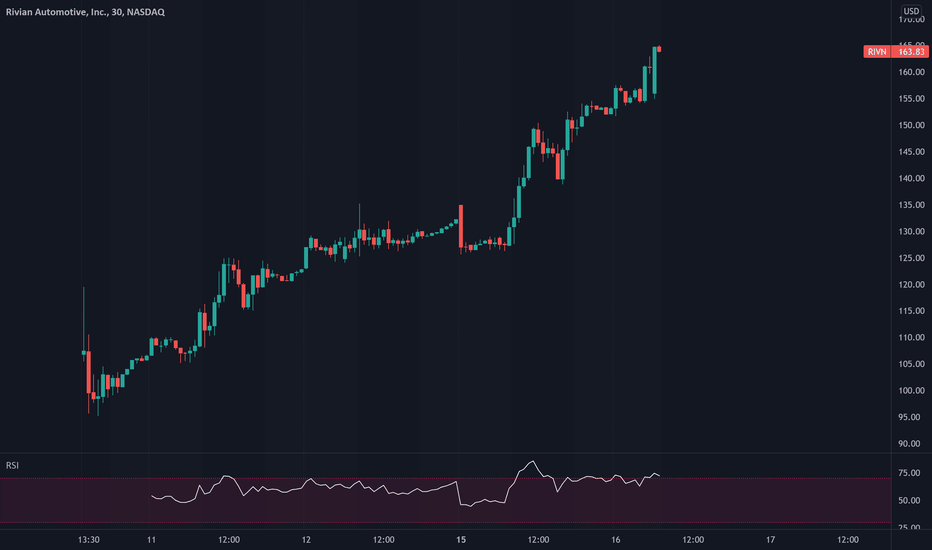

This might be cheap enough to finally take a nibble. 8x fcf, growing revs at 40% YoY. Everyone worried about margins compressing but demos are good and market opp is big if they can improve execution, which on a probability basis, they can. Going to start nibbling long to track & I'll add once it gets some momentum. The stock is definitely a trap, but I'm okay...

Hey guys! Last week I published an idea about going long PYPL depending on how it acted around earnings. Clearly, the stock got smoked (along with tons of other high multiple names, as of late: twitter.com). However, all may not be lost for longs. We are approaching an area of historical demand for the stock, which may hold true once more. In addition, the stock...

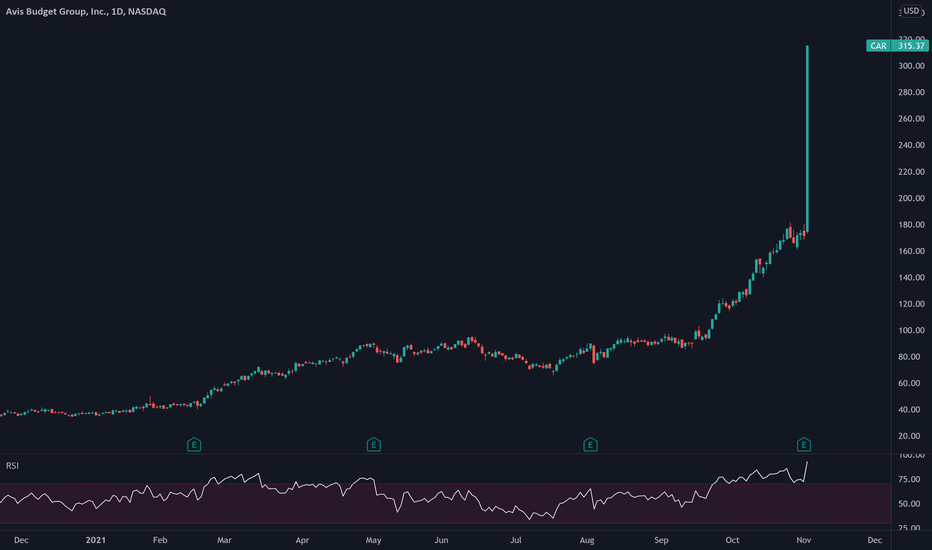

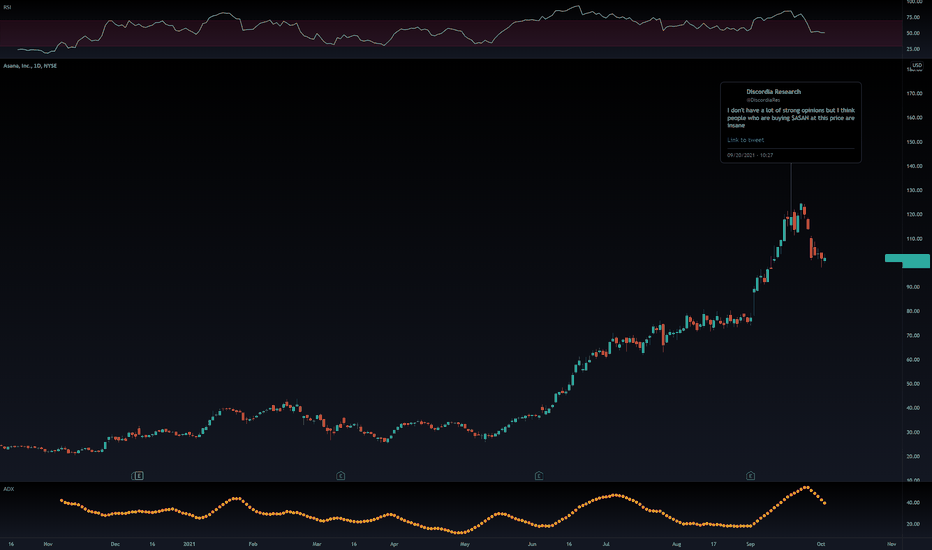

I don't always make top predictions, but when I do, I drink Dos Equis. I kid. However, I have a pretty solid track record making predictions on stuff that I think looks too blow-off-y, with only two notable failures in $JKS and $AMC - too early on both. The rest of my calls you can see here: Two takeaways looking at the fundamentals, the chart, and the...

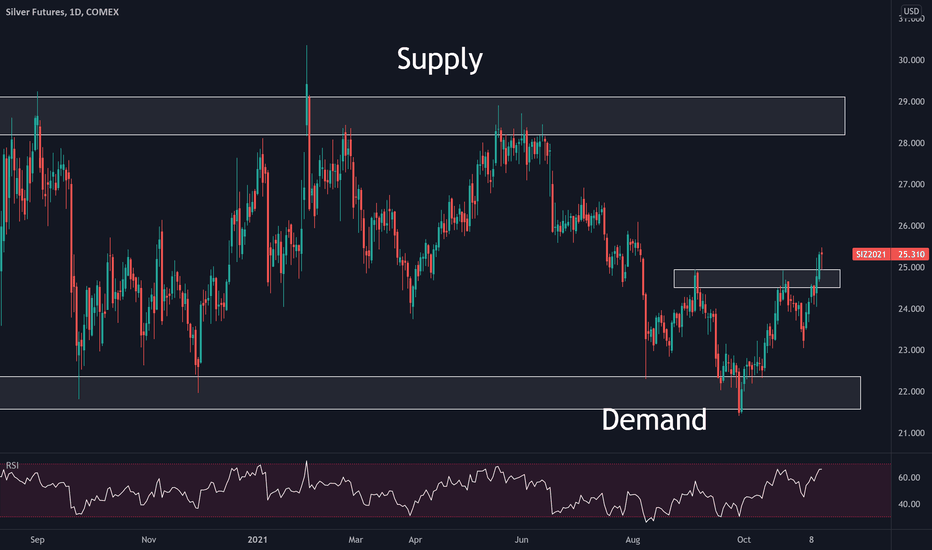

This is going to be a dead-simple, quick idea. I've been looking at Precious metals for a while now, and silver in particular. It appears that there is a significant amount of demand for silver near 22, and a large supply of silver between 28-29. Right now we are trading in the middle of this range, but with inflation picking up and the recent break higher above...

Not sure who just blew up on this but I'm assuming we will find out in the coming days! Obviously if you have any of this dump it immediately, don't be greedy.

Alright. Settle down. This is getting ridiculous. It might *actually* *finally* be time to begin looking at the put ladder a couple months out. I understand trend, and I understand momentum. I don't understand what fund is looking at this stock right now thinking "Yup. 50% CAGR growth for the next decade makes sense, and there's still room for upside!" The second...

We are close to a breakout in the IWM mid/small cap index, which could produce a low risk, high probability trading setup by taking the index long Vs. 223-ish. Nice simple trade here out of consolidation.

Hey everyone! Just wanted to do some quick analysis & labeling of the supply and demand situation right now in the market for PayPal stock. Marked out on the chart you can see zones of supply and demand, and we are approaching a zone of demand coming into this earnings release. Should PayPal post solid EBITDA and raise its outlook at all, then any bounce might...

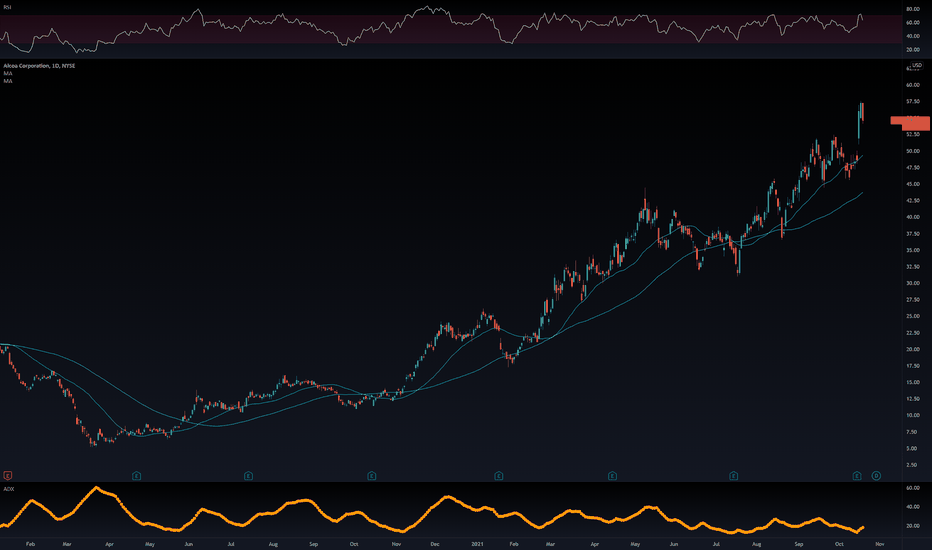

Afternoon! Just combing through charts, and I saw this one in Alcoa. Kinda insane. Now, I know Metals are in vogue right now from both a narrative & flows perspective (positive and improving): *** Financials 4 Energy 4 Consumer Cyclical 4 Consumer Defensive 2 Industrials 1 ---- Materials 1---- Utilities 0 Technology 0 Real...

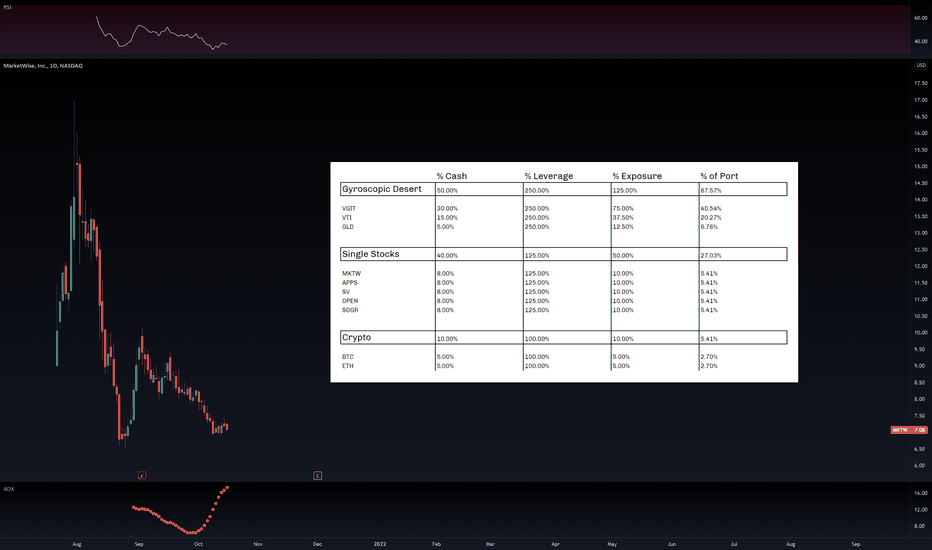

here's the PA portfolio. quarterly rebal'd. This doesn't cover all of my assets, just what the plan is for the long term portfolio, not the active accounts. The single stock picks are the closest I can come to exposure in my favorite themes. $MKTW for the rise of the individual in their own investment process. $APPS for BIC mobile ads. $SV for vertical farming,...

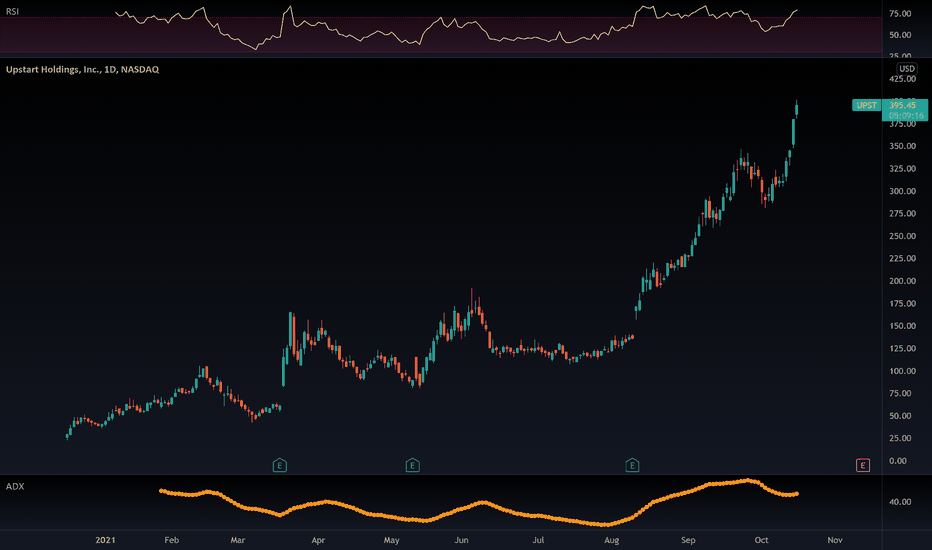

Upstart originated $2.8B in loans this most recent quarter. The current valuation assumes annual originations of well over $120B annually. If you own Upstart, you are assuming traditional banks willingly cede loan originations to this company, and that Upstart originates ~18% of ALL PERSONAL AND AUTO loans annually. Both of the above are outrageous assumptions....

Just wanted to throw this idea out there -> Back in December of 2017, BTC saw a huge run in prices as part of a retail frenzy, but also in response to the introduction of BTC futures into the financial ecosystem. They almost mark the *exact* top in prices. I think it's possible that with the potential approval of Bitcoin ETF's (decision on Monday) we see a...

A few weeks ago, we posted a trade setup idea about Netflix, where we were looking to buy the breakout of this recent consolidation zone. We sold our position this morning on the early surge, because at this price, with these technicals - and with where rates are at, this no longer seems like a compelling opp. ADX falling, RSI divergence, macro and sector...

Morning all! Just wanted to post quickly about the recent sector rotations going on, and the overall market selloff. Typically we post our sector updates on Tuesday, but the market continues to selloff so some might get some use out of this directly. Clearly, the focal point of the market is rates, which have been climbing on stubbornly high inflation. Supply...

Exactly what it sounds like! Each Tuesday we publish our sector reads. These reads combine relative and absolute performance projections in order to come up with strength profiles. You could use these as the basis of a long/short sector strategy, or as a starting point for a top-down hunt to find the best positioned single names. The scale goes from -4 to +4. Good...

Good morning everyone! Every Thursday morning we highlight our favorite trade setup of the week. This week, we will be taking a look at a High Yield setup in $VALE. It's been an interesting week of trading, and the kind of price action & news flow that gets you thinking about the bigger picture. Yesterday, we saw this chart, and it got us thinking about the...