PropNotes

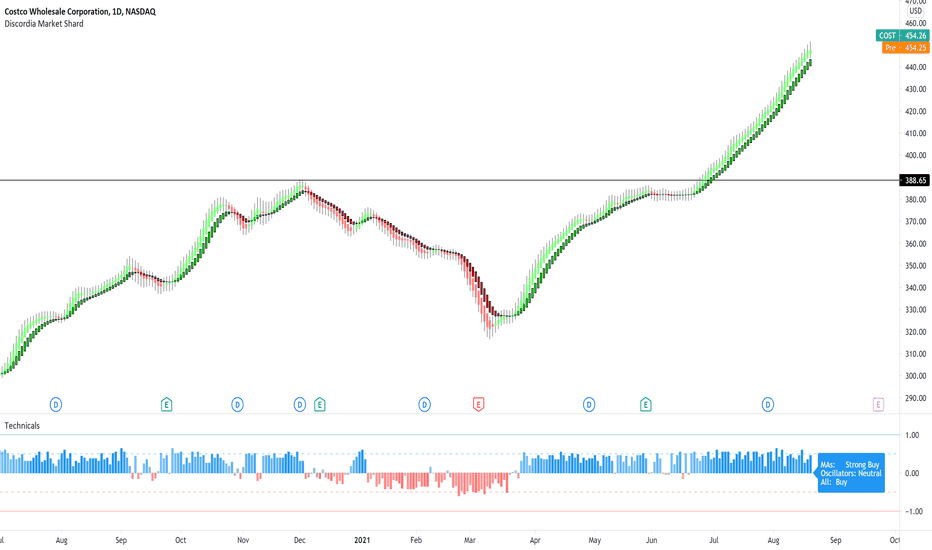

PlusCOST is an above average company with great execution on it's business plan. However, the stock, which now trades at a RICH 44x FWD earnings, is beginning to look expensive - given that's a premium to the market's long term average of 15x earnings, and even still a 30% premium to COST's average valuation over the last 5 years. Combined with the recent UMCSI...

AVGO daily chart is setting up for a huge breakout, should the right market conditions present themselves. Trading at only 14x FWD EV/EBITDA, this cheap semi conglomerate has a lot of upside should XLK continue its outperformance and the market remains how it has been. Earnings revisions have been trending upwards as well. Fiscal EPS Esti YoY Gwth 1M Trend 3M...

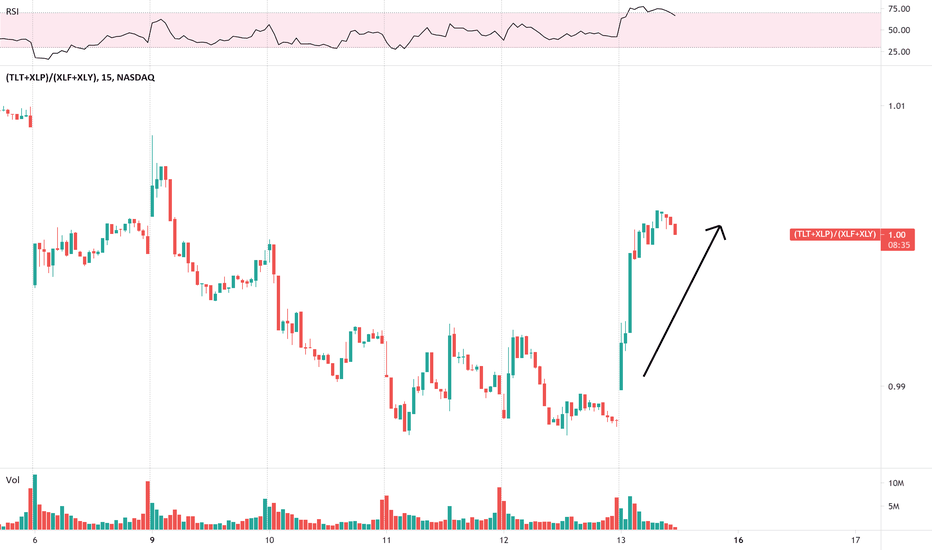

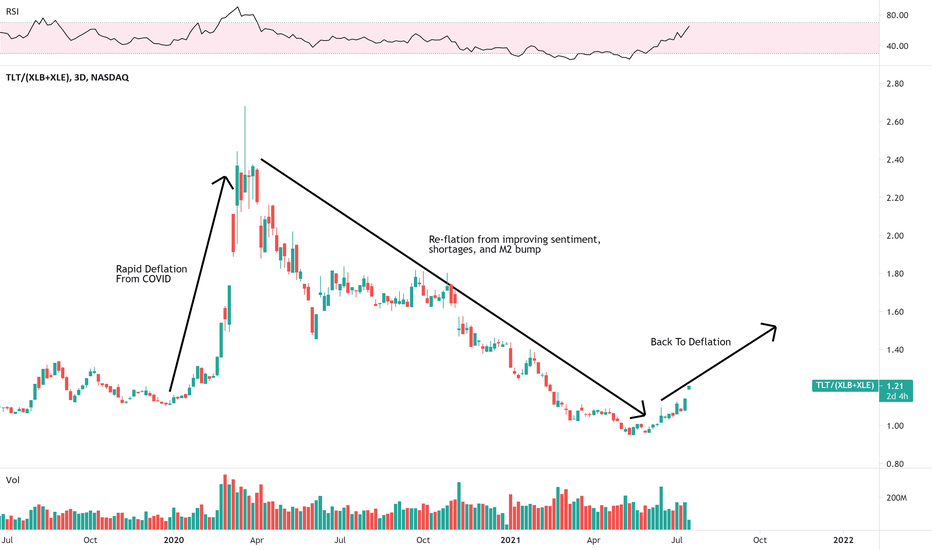

This morning, the UMCSI printed a 70.2, which is the worst number since March of last year and, prior to that, the end of 2011. If you were wondering why TLT is up 1.4% today, and XLP is crushing, while XLY and XLF are getting hurt, it's because a slowdown in consumer sentiment is REALLY bad for inflation expectations and retail spending. This further plays into...

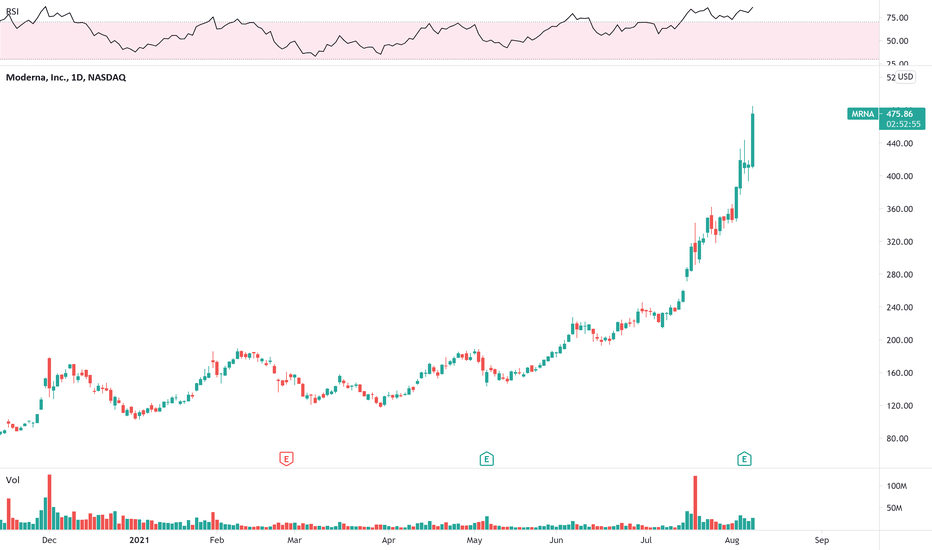

It might finally be time to short this bad boy. Stock has been on the run of all runs, and today possibly caps an unbelievable buying crescendo as it truly feels as though sentiment may have peaked. Piecing into this seems like the move because it's going to be hard to tell when it's peaked precisely. The only way to short this would be with a defined risk put...

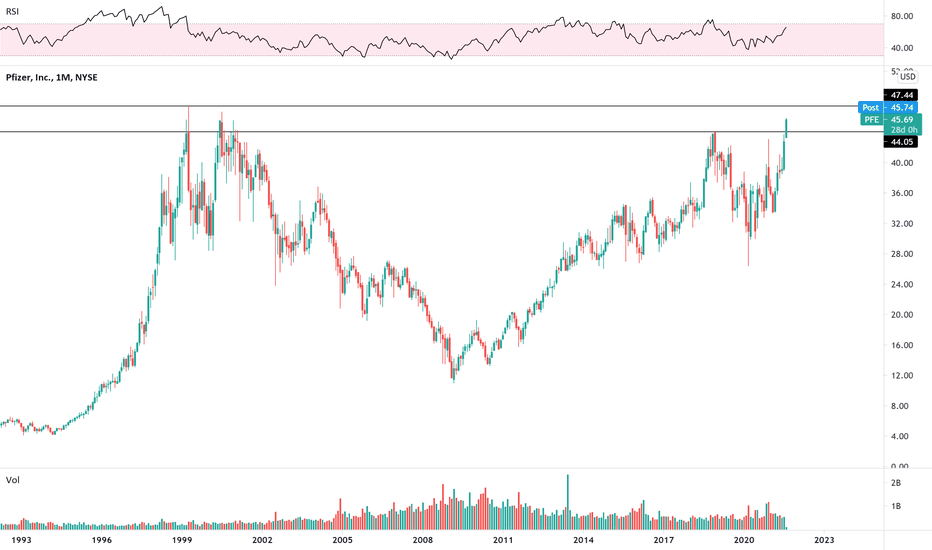

Just been looking at this chart more and more lately. Seems like PFE wants higher into the 50's-60's. It's certainly been trading sideways long enough. Also, doesn't seem like MRNA should be trading at 60% of PFE's market cap. Potential for an interesting long short trade here. Cheers!

This idea is really just a follow up to another idea we posted a little while back about this same scenario playing out. Looks like we might be there, again! We are bidding lower. Cheers all!

Something happened this morning that I think is worth talking about - the official death of the categorical re-flation trade. Thanks Delta Variant and UMCSI! Over the last eight months, there's been a lot of prognosticating about the state of inflation within the economy, coupled with fears that the Fed had gotten it wrong. Runaway Inflation was considered a key...

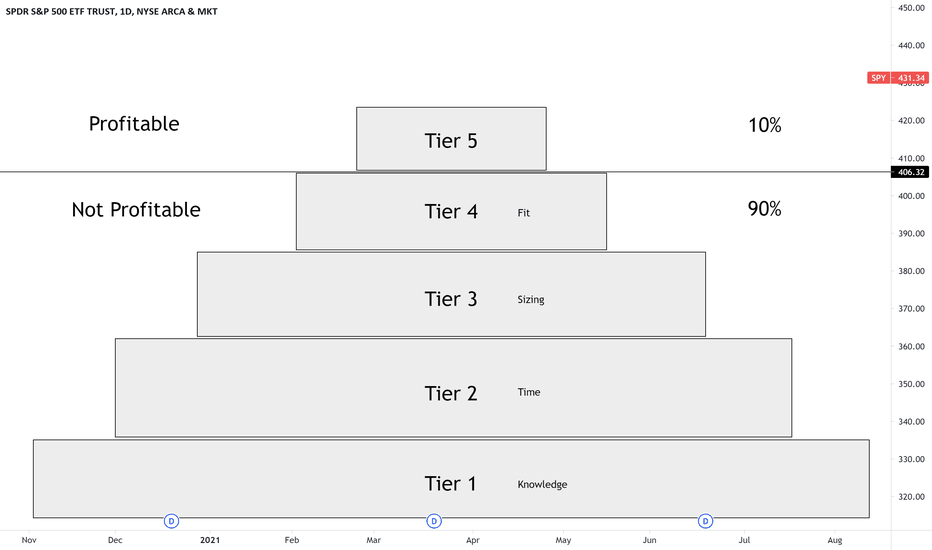

My thoughts on why traders fail, and each of the stumbling blocks that people find themselves against. Cheers!

-- With Senate Majority Leader Chuck Schumer proposing legislation on Wednesday to federally legalize Cannabis, it's important to analyze what ETF options investors have to invest in the budding sector. -- There are many different ETFs, each with different liquidity profiles, investment strategies, and geographical focuses. -- MSOS and YOLO are the best...

Morning all! An oft-overlooked stock, RAD is trading at a solid value to it's underlying performance on a number of metrics. As it happens, investors weren't happy with the previous earnings report, and the stock has slid some 30%+ in the last few weeks. This presents a great opportunity for long term investors -- selling the 11 strike, October monthly puts....

Good morning guys! So I was chatting with a good friend last night (who is an excellent prop trader), right as he was in the middle of analyzing the recent split trade phenomenon that's been going around. If you haven't been paying attention, over the last several months, AAPL, TSLA, and NVDA have conducted stock splits, which have each boosted share prices +40%,...

Hey guys! Happy Independence Day! I hope everyone has enjoyed the holiday weekend and gets some rest on the day off tomorrow. Today's trade is an old pick that's come back into an area I wouldn't mind starting to scoop some via long shares and short otm puts. Reminder: DM is a company that makes 3d printers that print metal, an industry that's supposed to expand...

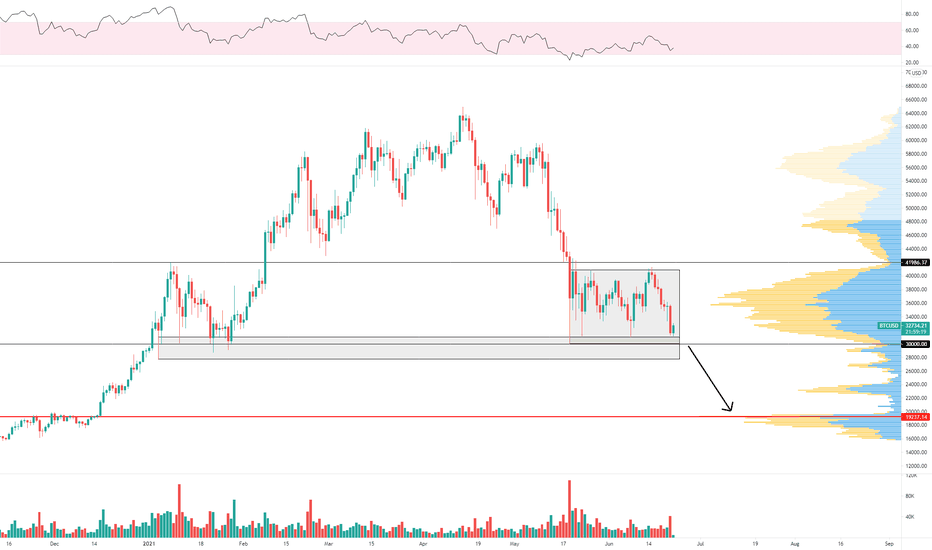

Good evening! Just wanted to throw up a quick post, because it seems BTCUSD and crypto in general is in a very interesting spot. Right now, we are in the midst of a massive volume node, between 41k and 31k. As of this very minute, we are bouncing off of a huge area of support, which has held numerous times since the initial breakout above 20k last December. The...

Looks like risk off in front of the Fed today. I'm a buyer into this degree of downside extension for a short term bounce play. No real catalyst for the selloff aside from the lower trading revs guide, but I don't think that's a huge deal and was already mostly priced in due to the general slowing market conditions.

Over the course of the last couple days, BTCUSD has been rejected from the previous highs after failing to gain any buying volume on the attempted breakout. This furthers the idea that we are on the "backside" of the move, and there will likely be more downside. Of course, BTC could always surprise to the upside, but we have bids out near 20k. Cheers!

We've gotten some questions of late about how to trade the AMC squeeze, and while we don't have any position, we have a simple, defined risk trade here that we would consider taking if triggered. If it closes green today, and gaps up tomorrow, we would strongly look at buying some ATM Aug Puts. No matter what happens here, it's clear that fair value for this...

I was talking to a buddy of mine last weekend who works in lumber, and we were just chatting about the markets over some drinks. At one point in the conversation, we were talking about shipping, and he was mentioning that "you can't beg, borrow, or steal" (verbatim) freight traffic right now, because of the shipping situation at the port of LA. In other words,...

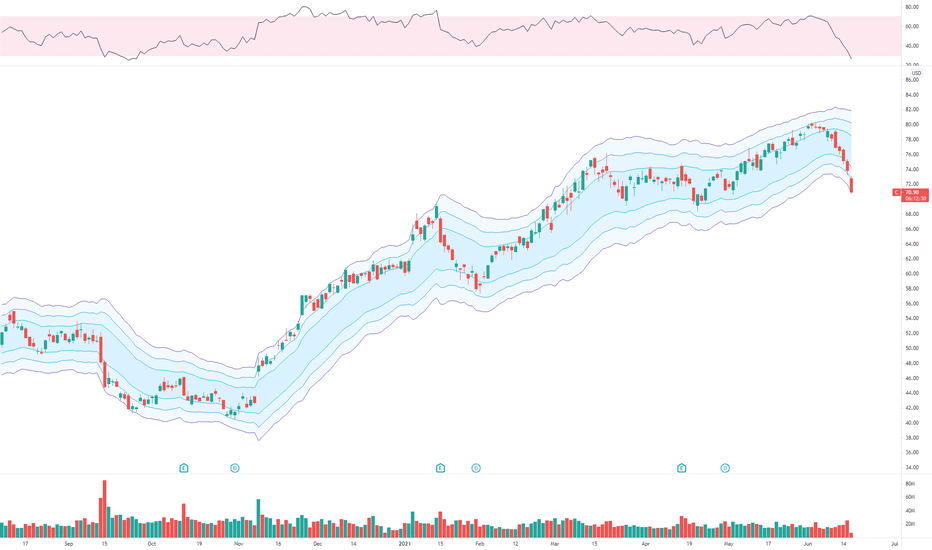

I'm of the opinion that the oil market has gone too far, too fast (along with a bunch of other commodities), and I'm looking at this as a potential spot to get some short. Even prior to covid, in what you might call a "normal" supply and demand environment, oil stayed between 75 and 27, with the majority of the price action occurring between 65 and 43. Oil is at a...