PropNotes

PlusTotal liquidation in this name today. I like the 5G story long term and didn't think the narrative changed with the earnings report. Stock pulling into an area of support. I'm short $10 puts. Cheers!

CarLotz is one of the most promising young names that I like right now, and this is a play on the warrants of that company, which are listed. Firstly, the underlying: CarLotz is an online used car consignment company. Think CVNA, except CarLotz doesn't own the inventory, rather just markets used cars people / companies want them to sell. This stands opposed to...

Last Monday morning, I woke up to an interesting text from my roommate. It was a screenshot he got from a friend of an email the friend got from his prime broker, talking about how they would be restricting leverage on SPAC plays going forward. After some conversation, It seemed as though this was a street wide phenomenon, and not just a single desk doing this. As...

Pretty normal technical post - just to mention that buyers keep showing up into dips whenever we get to the channel bottom / 50 day. Do with this what you will! Cheers

Hey Guys! Sorry it's been a little while since I've posted, but I'm back today with an interesting idea that I think many of you may be interested in. Over the last couple of days, a small Chinese bitcoin mining company called Bit Digital has exploded in value as the market has begun to realize the potential of the company's bitcoin mining operations. In the last...

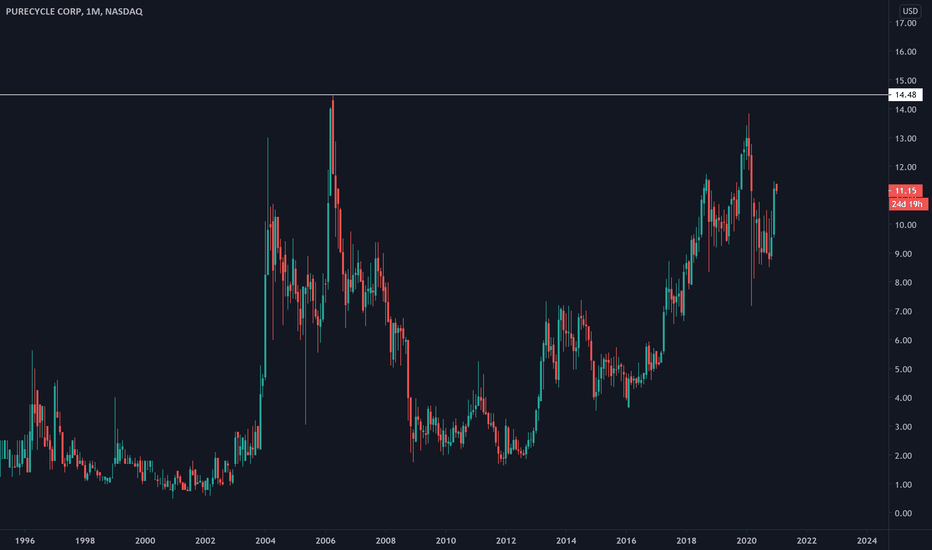

Exactly what the title says. If you want to see what it looks like when somebody wants to liquidate a huge position where price doesnt matter, look no further than this chart on the heels of the short report. I think this dips another day or two and is then a buy. I like buying liquidations because they are price insensitive. if this opens down tomrrow i will look...

Just an overly verbose analysis of the bubble narrative I have been seeing everywhere for the last week or two.

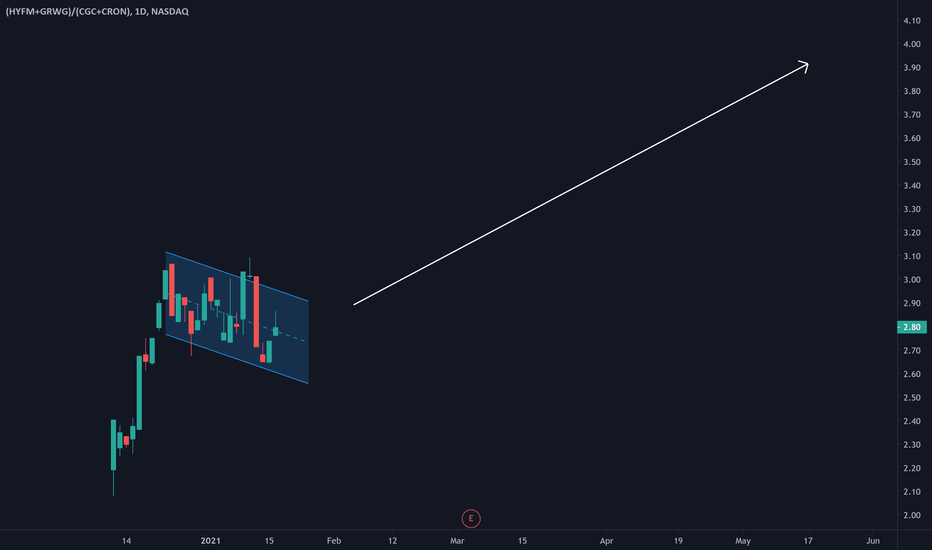

This is a pretty simple stat arb bet - Long DIA, Short IWM. As you can see, only a few times in the last 3 decades has the RUT been this highly valued vs. the DOW, and only two other times has this pair been so technically oversold. Both of the other times presented tremendous buying opportunities, and I plan on taking full advantage of that here. Balanced dollar bet.

Many of you may have heard this old business maxim before, but if you haven't, it essentially means that the people who made the most money during the gold rushes in centuries' past were the people who sold picks, shovels, and mining equipment to the miners. Sure, every now and again a miner would strike it rich, finding a profitable ore vein or massive nugget of...

A few days ago, I mentioned that FB might be a buy now that the stock is coming into multiple areas of support. The stock has now fully pulled back into those levels, and in addition has opened in oversold territory for the first time since last March. With the Nathanson upgrade this morning, I think the stock is set up for a great looking buy. I'll be buying and...

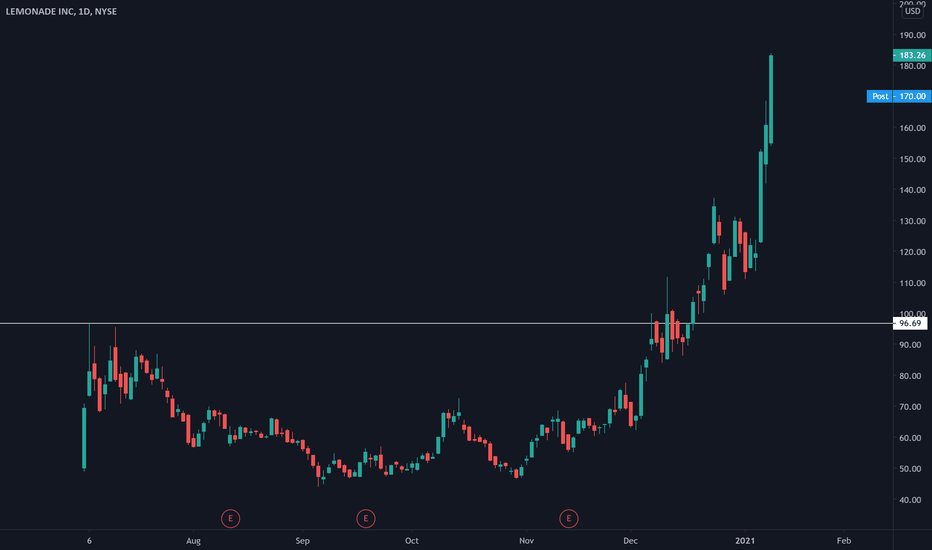

This is a pretty simple post telling you to sell / short this stock. It's gone too far in too short an amount of time, and you can expect to buy it back lower in the next two weeks. I like the company but will be bidding lower for it. Cheers!

Given the run that the market has had over the last 8 weeks or so, it's been interesting to see how some of the largest / highest flying tech names have acted individually. One of the ones that has caught my attention - for the wrong reasons - has been FB, and its shocking level of underperformance to the market as a whole. To me, the level to watch here is 244,...

So, if there's one lesson that I've learned in my time as a trader, it's that you should never discount growth - no matter where it's coming from, and no matter how it's happening. This is especially true nowadays in the era of ZIRP, where people will pay through the nose for increasing top line revenues. And, if it looks like those growing revenues are recurring,...

Let me be clear: I'm not bullish on NKLA. In fact, I don't think it's a good company at all. Companies with drawings of electric vehicles and fully staffed IR departments don't often add up to solid fundamentals and real revenue. That said, this isn't a fundamental play - it's based on some of the market mechanics I think are happening under the hood. First: NKLA...

If you're anything like me, then recently you've had a great deal of trepidation about buying U.S. equities with the indices at all time highs - and for good reason. Concerns about overvaluation, fiscal spending, and overcooked sentiment have cast shade on an otherwise resoundingly bullish technical reading for the markets, and purchasing stock has become an...

This is easily my favorite company to come out of the SPAC craze that's currently gripping markets, and right now it's currently available for a solid looking dip buy. Desktop Metal is an interesting company, essentially leading the second generation of 3d printing, which they call "additive manufacturing". The key difference between DM and the companies of yore...