PropNotes

PlusI bought a starter position in this today on the rumors that IPOF will be merging with Rivian, the second most high profile EV company behind Tesla & part owned by Amazon. I understand that this may be completely bogus, but the risk in this is ultimately capped at about 80c as it will be redeemable in cash if nothing happens. Seems like a massively asymmetric risk...

Hey guys! So I've been getting a ton of messages asking me about my opinion on Tesla, and whether this is a long, a short, or what have you, and I thought I would make this post to illustrate the framework I'm working from when trading it. From a fundamental perspective, Tesla has an unbelievable valuation. It's valued at 230 times 2021 Earnings, and at OVER...

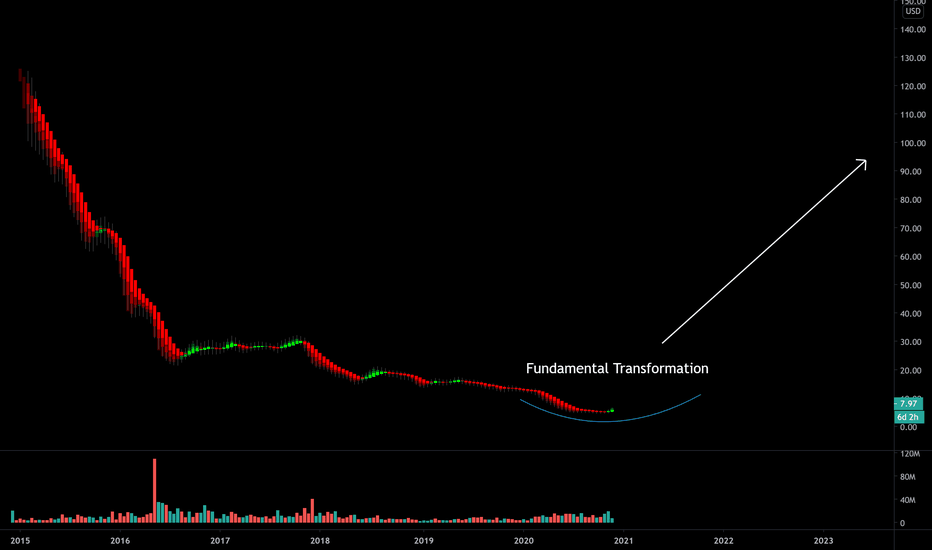

Hey guys - today I have a super under-followed name making all of the right moves from my perspective that is poised to make huge gains over the next couple years. The company? LendingClub. Some of you may remember this as a busted IPO from a few years ago, and while the company had been struggling to find its identity, the upcoming acquisition of Radius Bank...

Those of you who have been following me for a while now know that one of, if not my absolute favorite piece of trading literature is "How To Trade Like A Stock Market Wizard" by Mark Minervini. The book is an incredible tool for finding super-performing stocks, dissecting them, and understanding how the most common stock models used by institutions are...

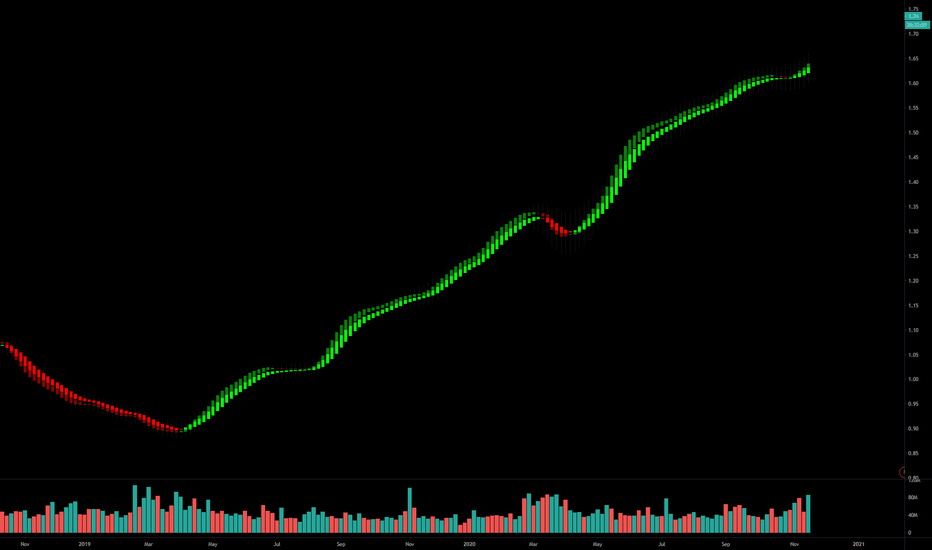

Hey! So this trade is a super simple trade having to do with Amazon's recent announcement that they will be entering the online pharmacy space. TLDR: go long CVS and short WBA on a pullback in this pair. While I like this trade long term from a valuation / EPS / brand strength perspective, the catalyst for a new leg up in this ratio was just announced: the...

I started my trading career in early 2016, right as VRX was collapsing (S-O to people who remember Valeant Pharmaceuticals), and at the time, I knew basically nothing about the markets. My first ever trade was a junior gold miner called "Vista Gold Corp", (Still around as VGZ), and I remember being bitten with the trading bug the instant the stock shot up and I...

Good evening guys! I just wanted to give a little update on a trade I posted several months ago called "This Trade Refuses To Stop Making Money". In my post, I said the following: This trade is fairly simple; it's looking to capitalize on the fact that Apple and Microsoft, America's two largest companies by market cap, are enjoying the spoils of immense...

One of my favorite names in the entirety of the U.S. stock market is BKNG, a massive travel conglomerate that earns revenues from referral commissions on car rentals, restaurant reservations, accommodations, flights, and travel packages. It's an incredibly high margin business growing at a quick clip with few competitors, but often ignored due to its high absolute...

Will we finally break out of the megaphone pattern we have been experiencing to the upside, or will we reverse back to the downside following some lite buying? Something to keep an eye on! It's decision time for SPY and other major indices right now.

My father has never been much of a self directed investor. For most of his life he's had a money guy, but now that he has a lot of free time on his hands he's slowly been coming around to the idea of managing an account personally. I wrote him this short primer to help him navigate the world of investing, but I realized that it might be valuable to some other new...

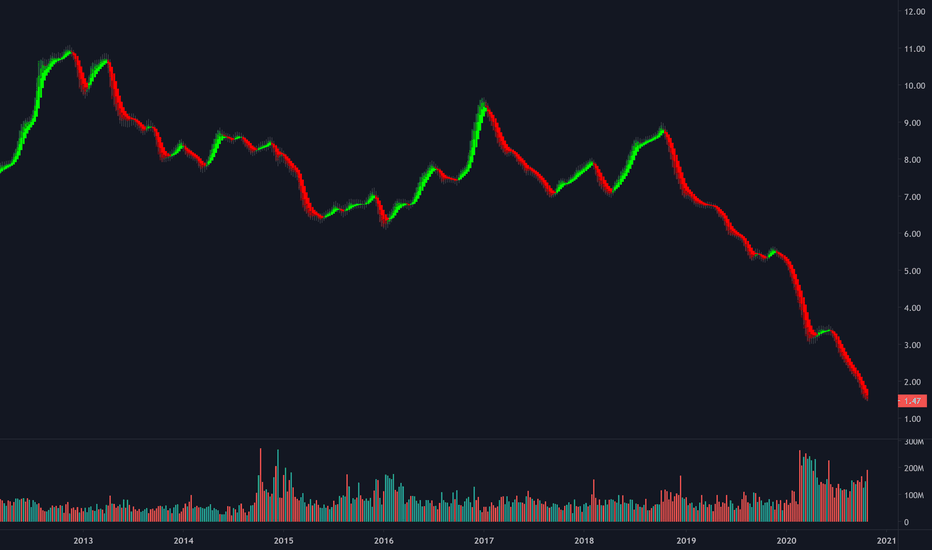

While the recent pain in fossil fuel companies and overall bullish run in clean energy names seems to have given the impression that oil is finally in its inevitable secular downtrend, I prefer to look at the situation and see a massive cyclical medium term buying opportunity. While its obvious that over time oil and gas companies will *eventually* see their...

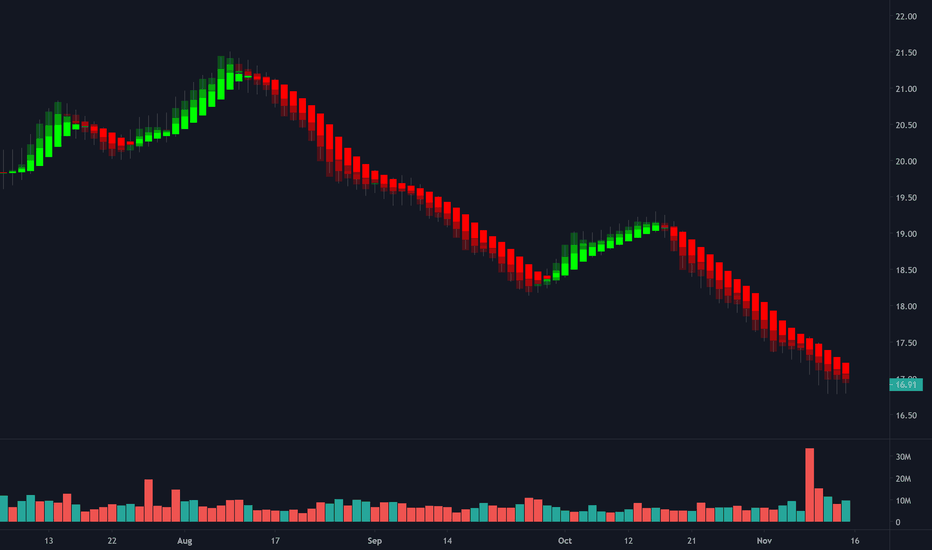

Recent Ipo RKT is a huge and established player in the mortgage business, and I like the company from a fundamental perspective. Right now the Technical situation isn't favoring the long side, but once we start to see a turnaround in share prices I'll be looking to take this long, guns-a-blazing. I could easily see this company trading in the 30's again by year...

This idea has to do with TSLA's recent earnings report, which was highly sobering to the market. Heightened expectations were not met with what amounts to a fairly bang-average earnings report, and following a quick gap up, the stock has been met with 3 solid days of selling, one of which coincided with a massively negative market day (today). This selling is...

For this, I would simply like to quote something I read recently put out by Elazar Advisors, LLC. They recently put out a report talking about how AAPL is one of TER (Teradyne)'s biggest customers. They had the following analysis, which I think is great: "Teradyne produces automatic test equipment. These are machines used to perform automatic tests on equipment...

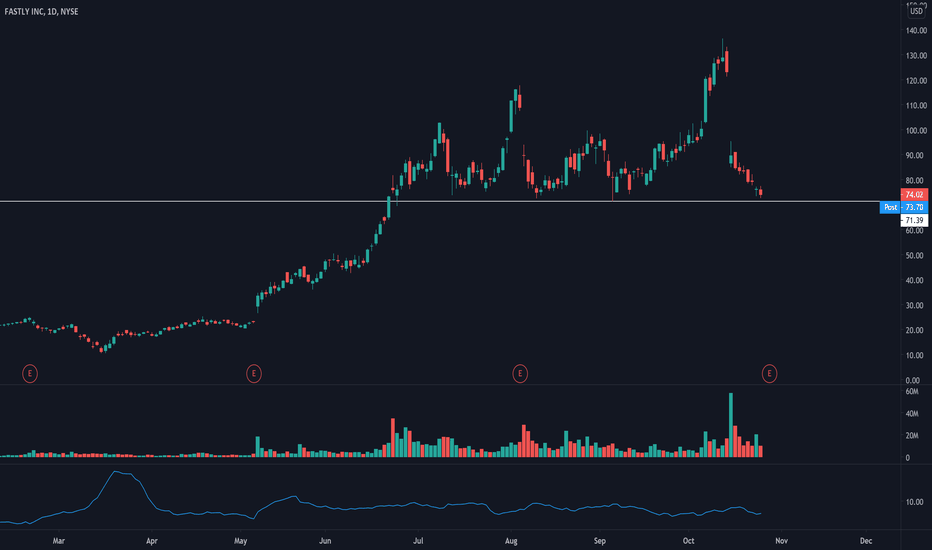

This is a fairly straightforward trade idea and I'd like to take this FSLY long off of it's support zone. It reminds me a LOT of the LULU call I had a few weeks ago that printed money, so here's hoping this does the same. Obviously a close below this level would be terrible for the stock, so I'm basically going to be long with a target of 100 until that happens. Cheers!

Time to buy some EURUSD! Times have indeed changed since my last post about EURUSD several months ago, and it appears that we are now on the verge of another leg of euro strength as the DXY weakens and cases begin spike in the U.S, prompting discussion about another round of stimulus / easing that would surely continue to devalue the dollar. Long long term, I'd...

It would appear that the brief respite that the dollar saw from its relentless selling this year is has now reached an end, and the bears are now back in control. Until we see the trend change back to being bullish USD, I highly encourage taking long dollar trades only with the best of setups. I'd wager that we see 90 in the dollar index before we see 96.5 again. Cheers!

Like the title says, I hate to join the crowd on this idea but it's becoming clear that we are finally upon what seems to be another potential bull run in BTCUSD, with a time horizon of about 6 months. While the space has matured significantly from 2017, meaning that liquidity exists at higher prices in greater size, and countless market mechanisms now exist that...