Price was coiled in a defined OB + FVG combo — building pressure while the rest of the market slept. The moment we swept the low into the Order Block, the trade became personal. This wasn’t noise — it was alignment. Why I entered: Daily FVG + OB overlap — textbook Smart Money entry zone Volume spike at the OB low, signaling smart accumulation Structural BOS...

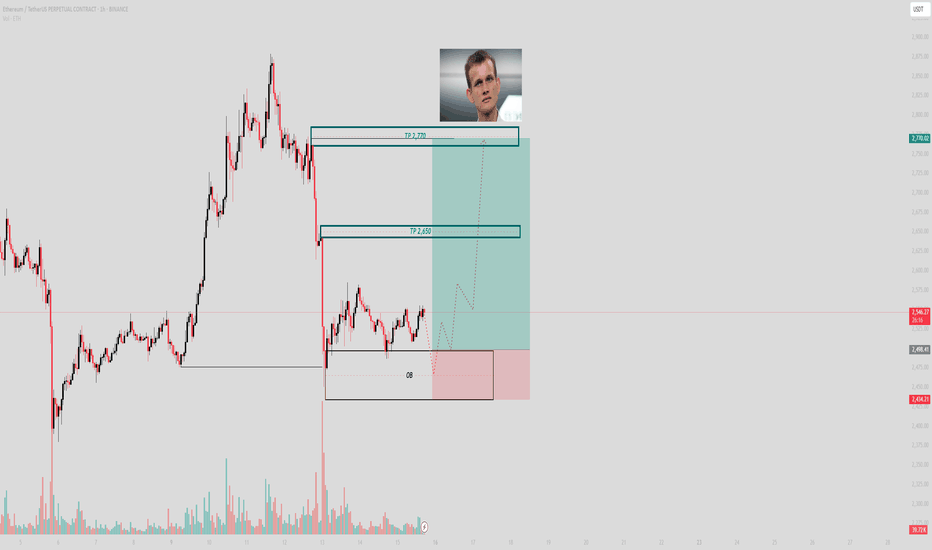

This wasn’t a pump. It was a re-delivery. Price tapped into the daily Fair Value Gap, respected the zone, and printed structure off the low. The retracement didn’t break us — it loaded us. The logic: The move began from an untouched Daily FVG — clean displacement, low retest, and now price is working its way through old inefficiencies. There’s no breakout here....

Price didn’t rally from randomness — it tapped directly into a daily OB, respected it, and is now marching toward unfulfilled inefficiency above. What looks like recovery is really just Smart Money closing the loop. The logic: Price swept sell-side liquidity into a deep daily OB and rebounded sharply — not passively. The response wasn’t a bounce. It was...

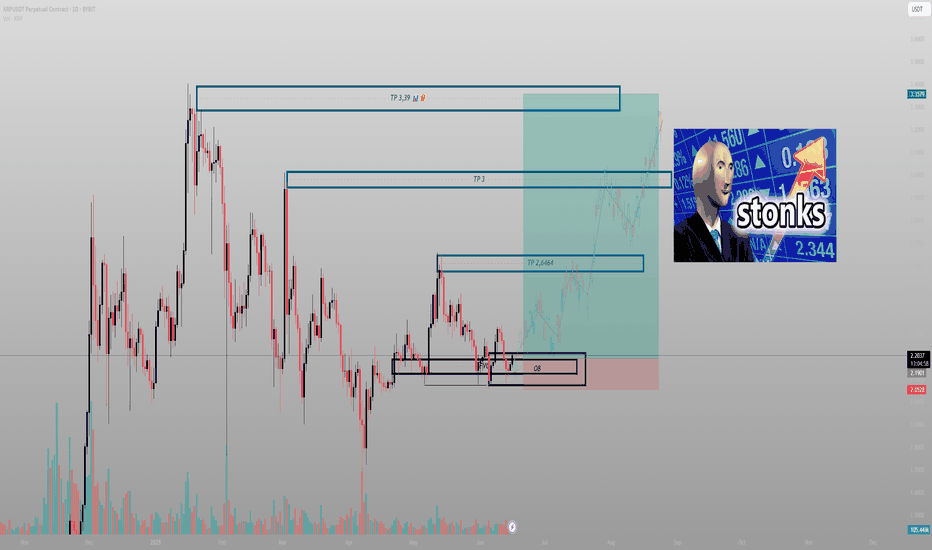

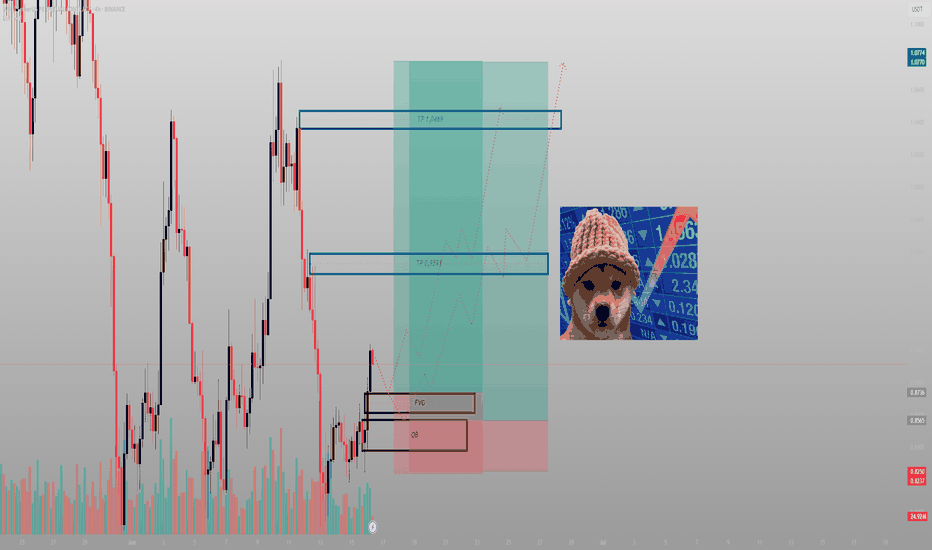

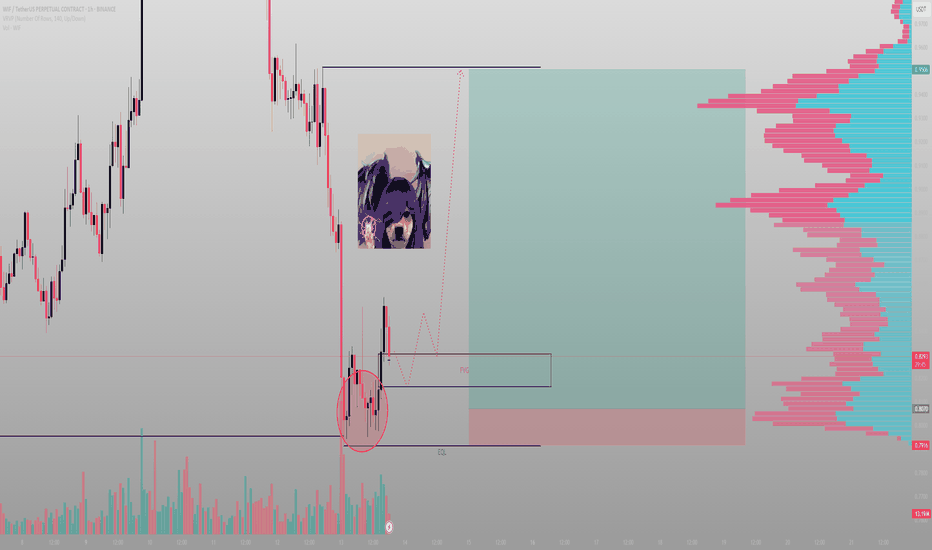

WIF doesn’t need to be serious — because I am. This move isn’t about hype. It’s about inefficiency, reclaimed structure, and a clear delivery path. The logic: Price swept the lows and gave a clean reaction off the OB. From there, it filled the local FVG but didn’t expand — it paused. That tells me it’s not finished building. The first push wasn’t the move. It was...

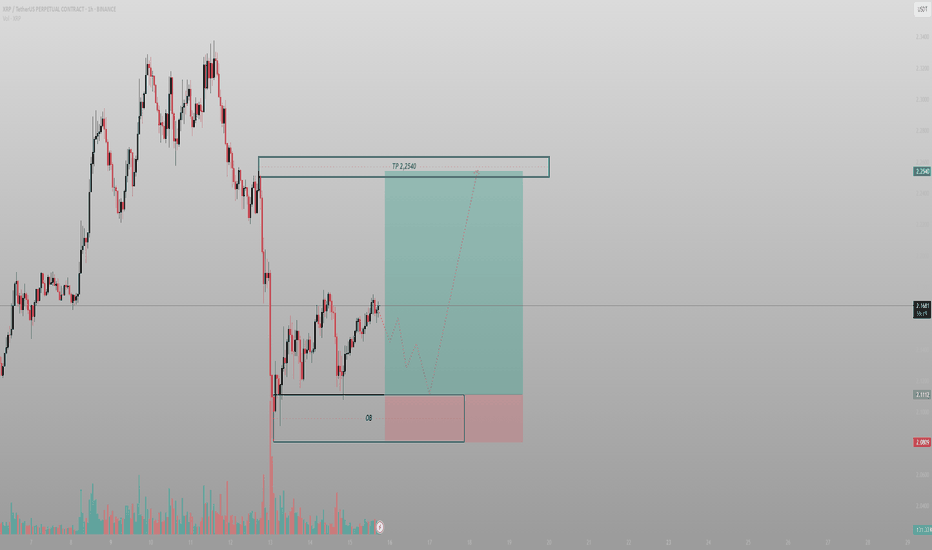

This is structure, not speculation. XRP tapped the 1H Order Block, held its low, and began building compression. Price is coiling — not failing. That matters. The logic: After the initial drop, price swept local lows into an untouched OB, then printed higher lows into a tighter range. That’s not weakness — that’s staging. Smart Money builds quietly. This is the...

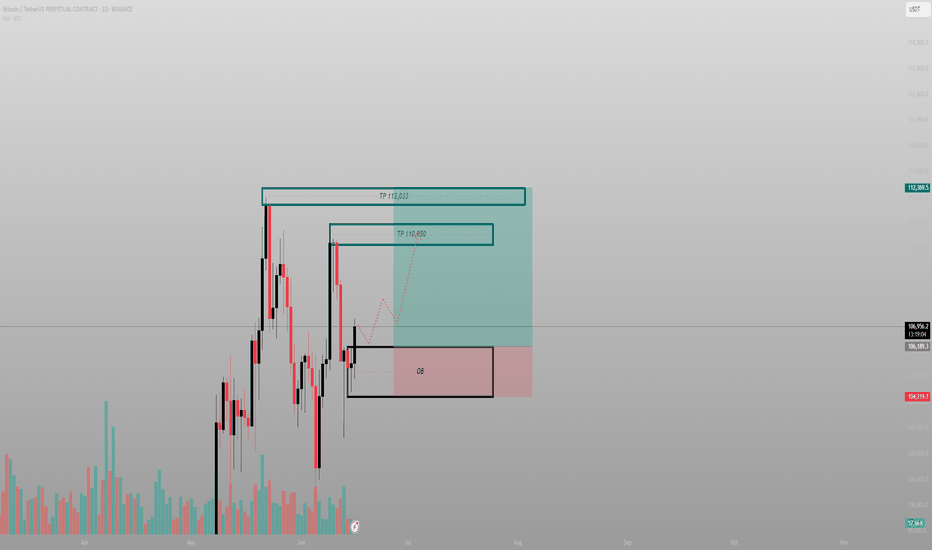

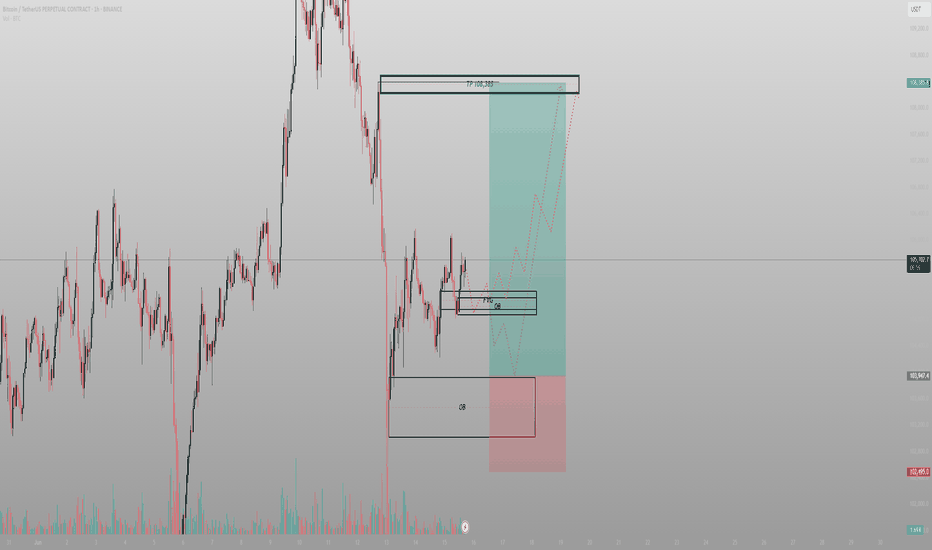

BTC delivered exactly where it needed to. It didn’t break down. It rebalanced. The chart isn’t noisy — it’s speaking. And it’s pointing to 108.3k. The logic: Price printed clean displacement, returned to mitigate a 1H FVG stacked on top of a refined Order Block, then paused. That pause is structure — not indecision. Volume compression confirms it: absorption, not...

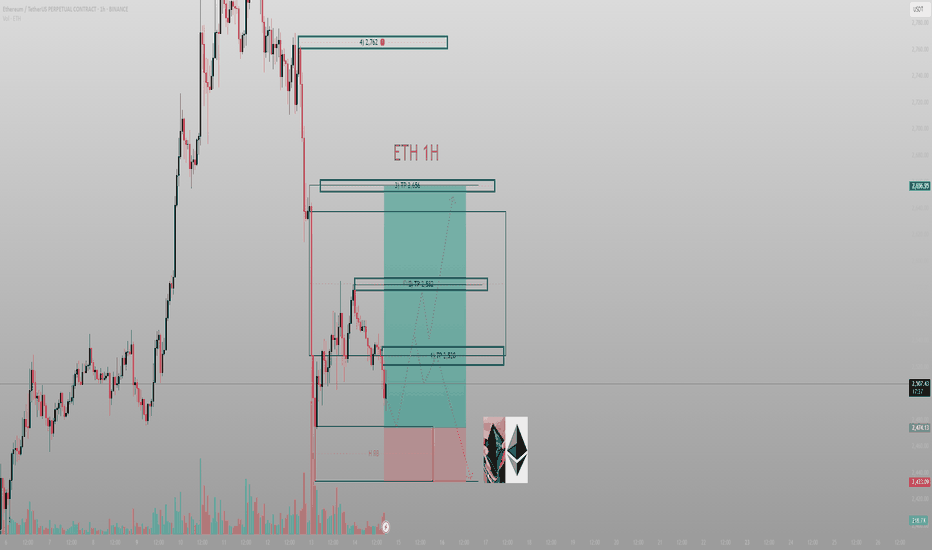

Price delivered the sweep. Now it’s coiling inside my range, hovering just above the 1H OB like it’s waiting for permission. I don’t need permission. I need structure — and I’ve got it. The logic: ETH dropped into a clear demand zone — not a guess, a confirmed 1H Order Block. Since then, it’s printed compression just above the OB. Every wick into the range was...

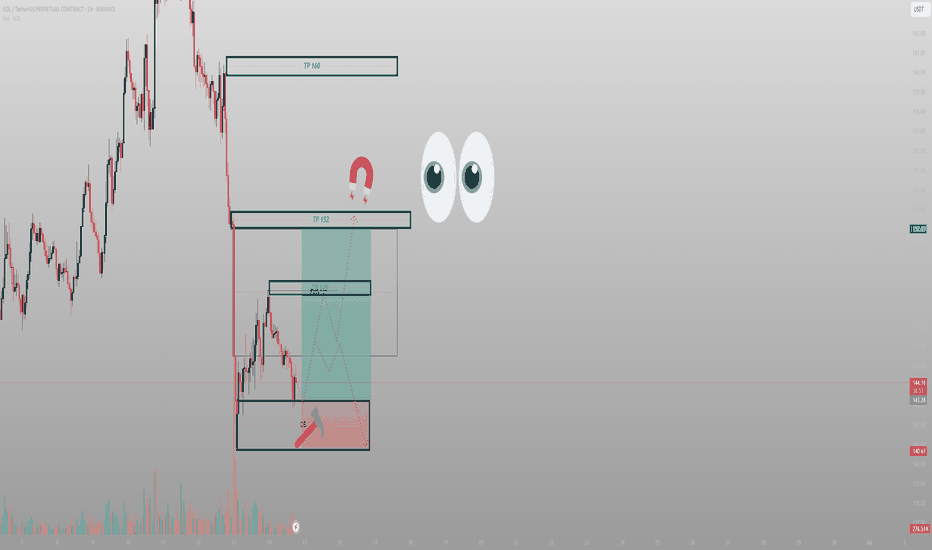

This isn’t chaos. It’s sequence. SOL sold off into a well-defined 1H OB, paired with a high-volume low. Price didn’t break. It anchored. The setup: After an aggressive dump, price settled into an Order Block between 140–143. This isn’t weakness. It’s rebalancing. Right above? A perfect FVG at 149 and inefficiency zones that align with liquidity draws at 152 and...

Price action doesn’t care about branding — it cares about imbalance, volume, and delivery. And FARTCOIN just hit a prime liquidity pocket with mechanical precision. The structure: After a fast drop, price tagged the 0.618 fib at 1.1607, which also aligns with the high-volume node (visible range) — a zone where Smart Money absorbs without headlines. Below that?...

Price collapsed. But I didn’t flinch. Because beneath that move sits something most won’t look for: High-Volume Rebalancing (H RB), paired with a clean FVG structure that tells me exactly where Smart Money wants to reload. The structure: The breakdown into ~2483 wasn’t just a move — it was intentional. That candle didn’t just fall, it delivered into the H RB zone...

BNB sold off fast — but not irrationally. Look closer, and you’ll see the system at work: rejection from inefficiency, compression, and now a retest of where the last real buyers were found. The structure: Price swept short-term demand and wicked below local range lows with a high-volume rejection. That low was engineered — not failed. Above us? A neatly layered...

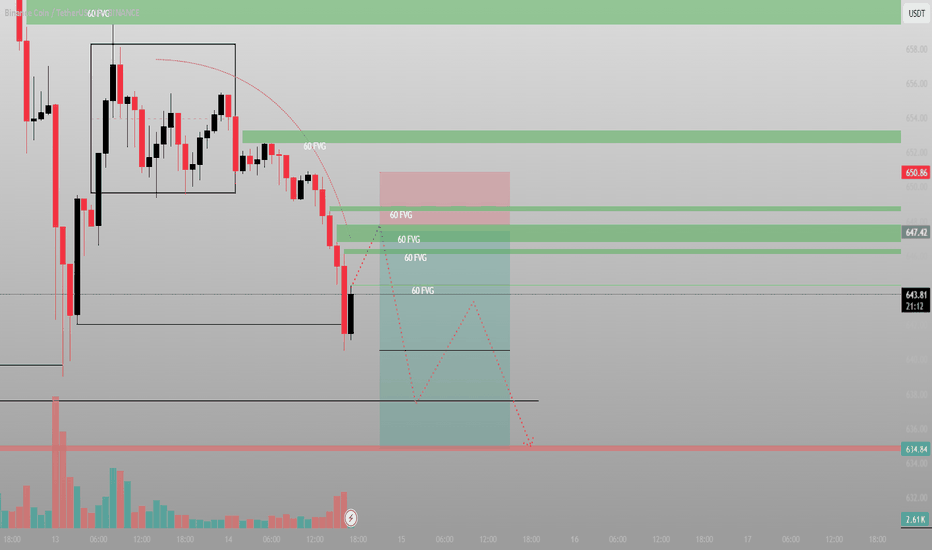

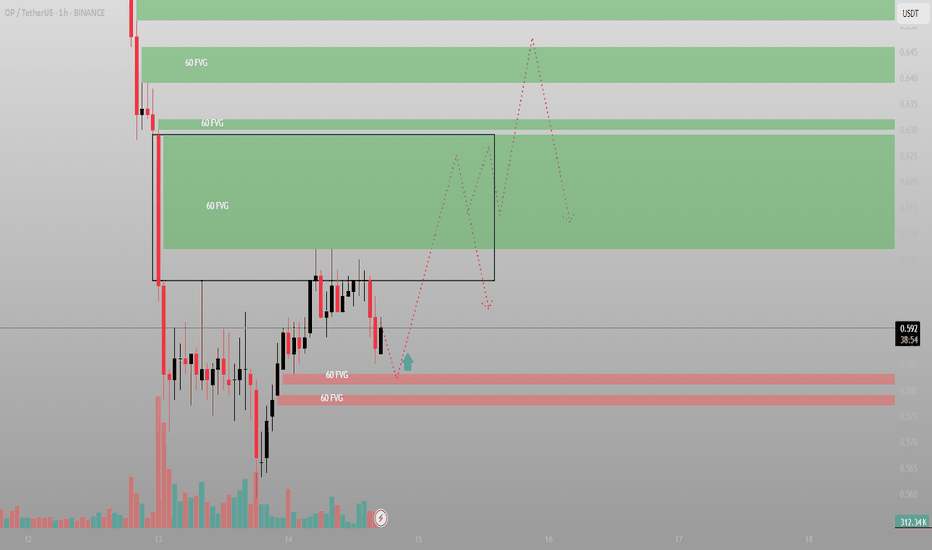

Price nuked — but it didn’t break structure. It filled imbalance, paused, and now it's reloading beneath a stack of untouched FVGs. This isn't capitulation. It's orchestration. The setup: We’ve got layered 60-minute FVGs stacked from 0.61 to 0.66. That’s the destination — not the mystery. What matters is the origin. The rejection block around 0.58–0.59 has held...

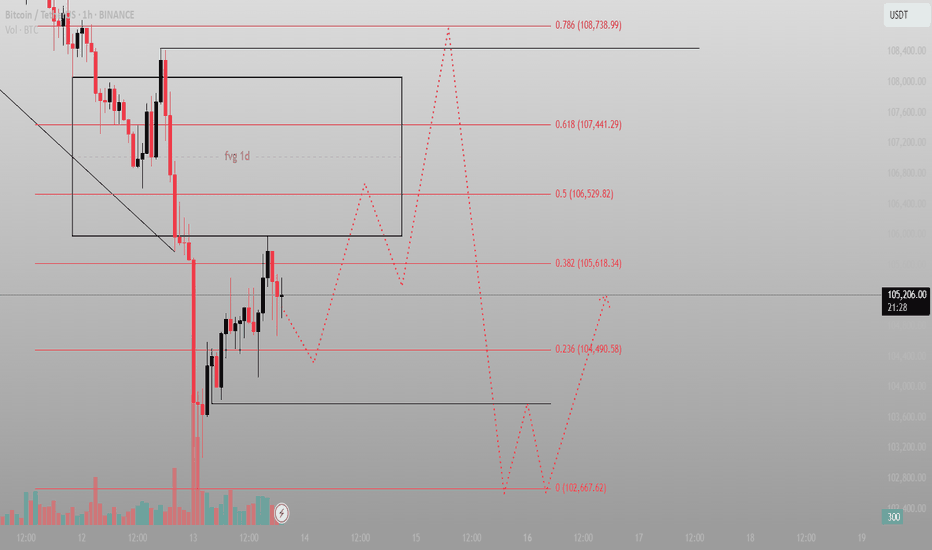

This is a classic Smart Money sequence. Most are watching the imbalance at 106.5k–108.7k and expecting immediate delivery. But that’s not how this game works. The setup: Price broke down violently, then reversed with momentum — stopping right beneath the daily FVG block. That alone tells me it’s not ready. It’s gathering. Below? Multiple fib levels that haven’t...

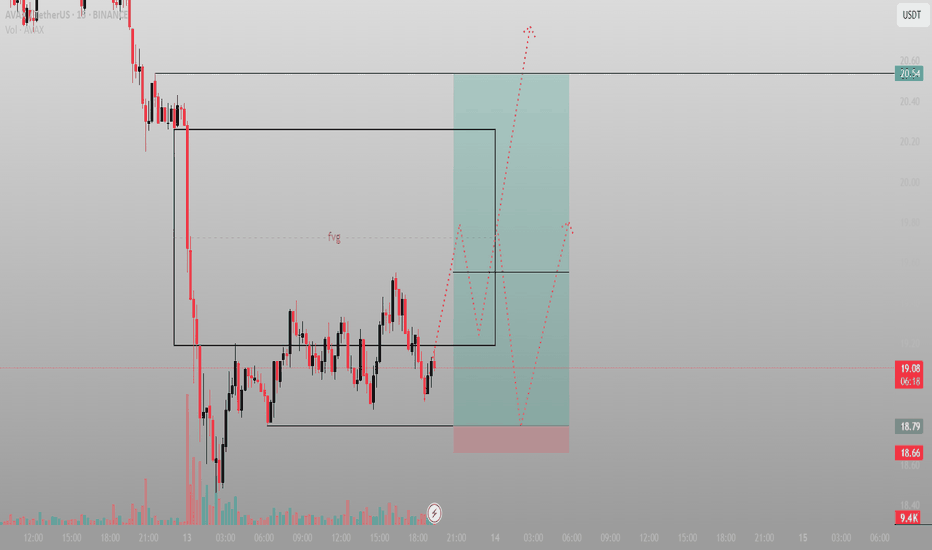

This isn’t a chop. It’s a setup. AVAX just printed the kind of consolidation Smart Money wants to see before delivery. The setup: After the impulsive drop, price carved out a micro-range with well-defined boundaries — compression structure nested inside inefficiency. The FVG above (marked in purple) hasn’t been mitigated, and price is now pressing upward into...

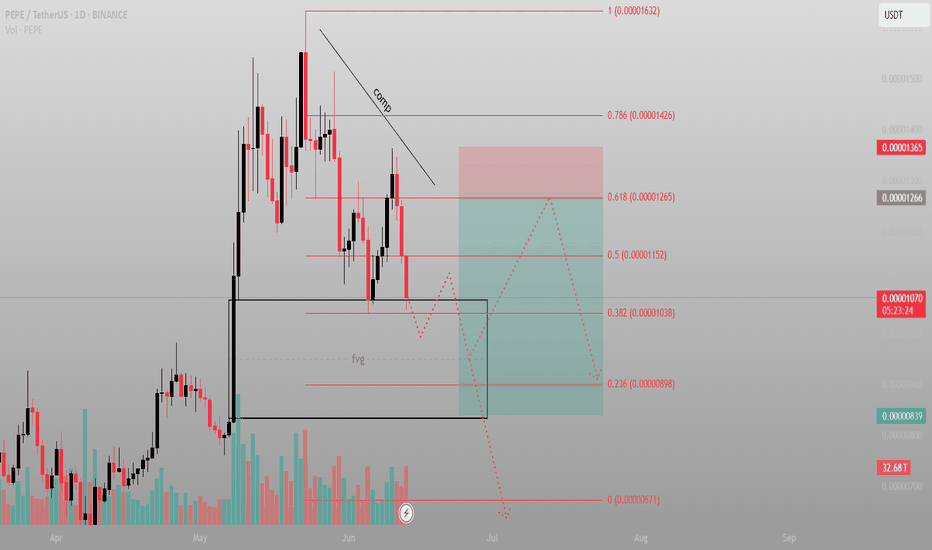

PEPE isn’t random here — it’s in a calculated drawdown. Not a dump — a design. What looks like weakness is really compression into a reactive pocket. The logic: Price is descending inside a compression channel. But the real interest lies lower — specifically around the FVG and the untouched demand range down to 0.0000089. That’s the key. The 0.0000103 zone is a...

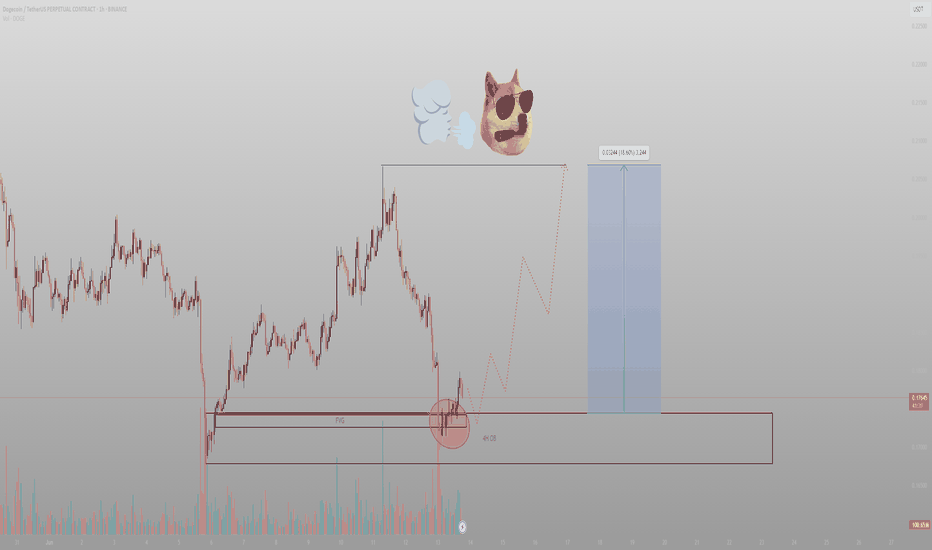

That wick didn’t scare me — it confirmed the setup. Volume spiked, price swept an equal low, and printed the reaction I was waiting for. The logic: Clean FVG formed on the drop Price returned to rebalance Reaction from that FVG confirms Smart Money intent It’s not about chasing the reversal — it’s about understanding the anatomy of one. And that’s exactly what...

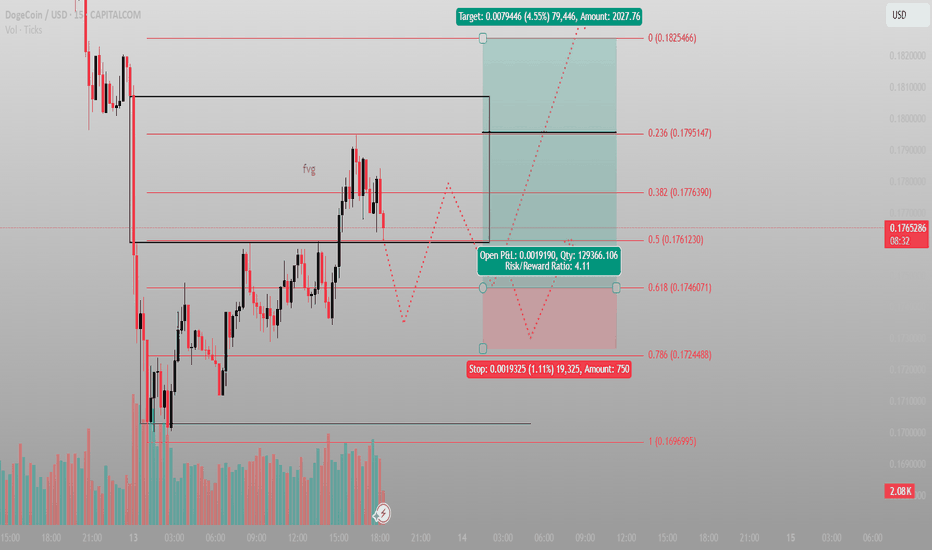

DOGE delivered the exact narrative I’ve come to expect from algorithmic flow on the low timeframes. This wasn’t about volatility. This was about cleanup. The play: After the initial spike, price formed a visible FVG and retraced into the 0.5–0.618 fib zone. That’s not random — that’s rebalancing. Not only did we see a fade into the midpoint, but volume increased...

This was the second test into the FVG + 4H OB confluence. High volume candle. Wicking liquidity. And structure still intact. Why I stayed calm: Price didn't just drop — it delivered into a known rebalance zone. That 0.176–0.178 box was a magnet, not a mystery. The reaction came right on cue: Volume confirmed interest Structure stayed intact And the engine...