TheAlphaView

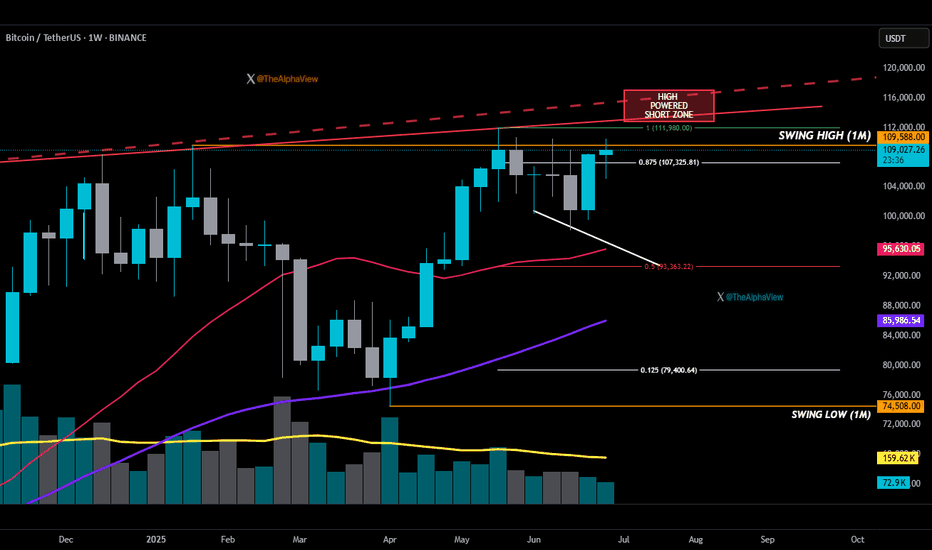

PremiumAs you can see, the Volume Moving Average (YELLOW LINE) has been steadily declining ever since that sharp move up back in April. That’s not bullish behavior—it’s a warning. This week ENDING ON THE 13TH, Bitcoin must close above the monthly swing high (Top ORANGE LINE) if the bulls want any shot at locking in a green monthly candle. Now, here’s the part most miss:...

🟡The Ancient Metric: Reflecting on Gold’s Financial Role Hard Money Lens: All asset ratios are expressed vs gold (XAUUSD) to: • Strip out fiat currency distortion • Reveal true purchasing power • Treat gold as a timeless unit of account ________________________________________ 📈 1. S&P 500 / Gold (SPX/XAUUSD) Ratio: • Now: 1.88 • Jan 2025: 2.16 • Jul 2024:...

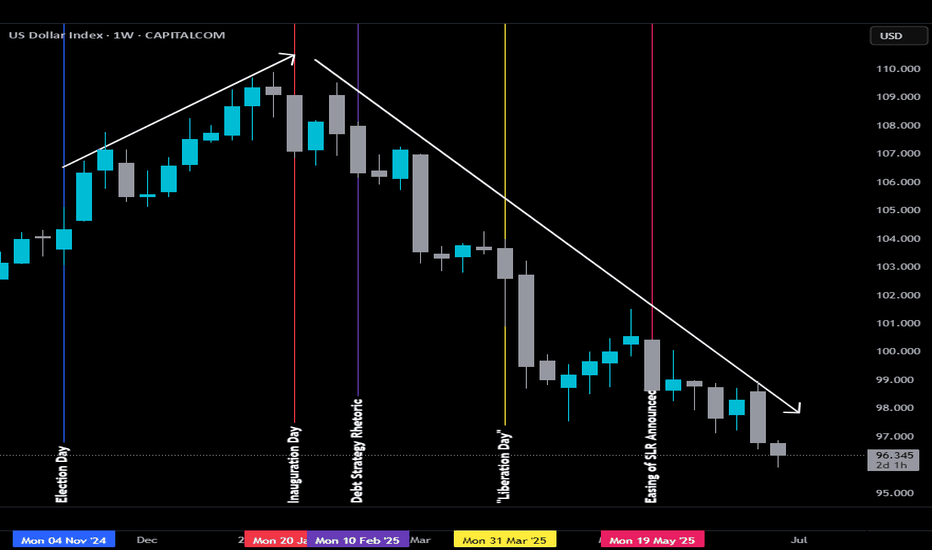

The Bessent Effect Explained: Weaken the Dollar There’s no coincidence that the U.S. dollar has had its worst first half of the year since the dawn of free-floating currencies in the 1970s. And if anyone knows how currencies tick — or unravel — it’s Scott Bessent, the man who once stood behind George Soros during the legendary short of the British pound in 1992....

The 10-year Treasury yield is the heartbeat of commercial lending — it’s what sets the tone for everything from real estate financing to economic sentiment. And interestingly, it’s now hovering right around the same level it was on Election Day 2024 (Blue Line), which feels like a lifetime ago in policy terms. So what’s happened since then? Quite a bit. Yields...

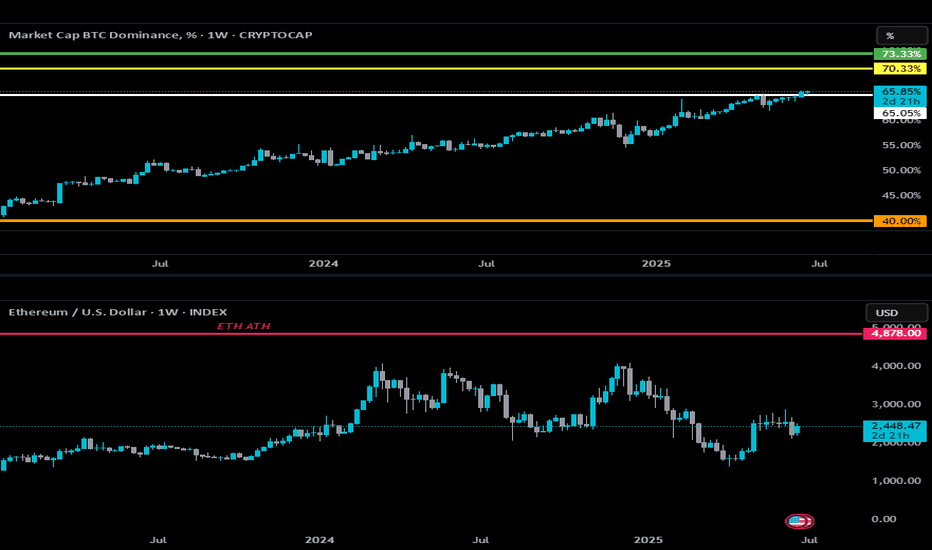

BTC.D is back at 65% (White Line) — same level we saw 5 years ago (5 years is a natural market cycle). In Dec 2020, it spiked to 73% (Green Line) before dipping hard... and that drop kicked off the last real Altseason. BTC.D dipped to 40% by May 2021 (Orange Line) ETH pumped +470% 🚀 in that window. A few months later in Nov '21, ETH hit its ATH of $4,878 (Pink...