TopgOptions

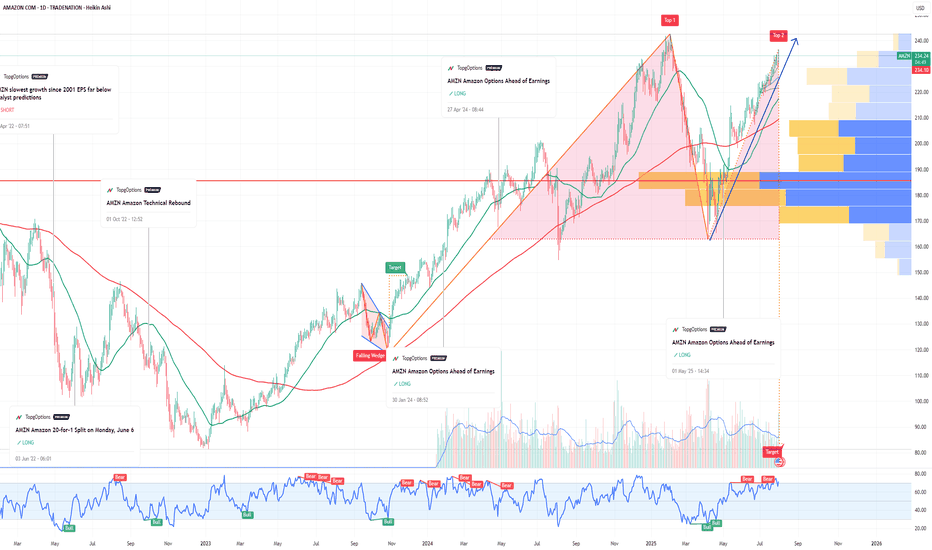

PremiumIf you ahven`t bought the recent dip on AMZN: Now analyzing the options chain and the chart patterns of AMZN Amazon prior to the earnings report this week, I would consider purchasing the 245usd strike price Calls with an expiration date of 2025-9-19, for a premium of approximately $7.02. If these options prove to be profitable prior to the earnings release, I...

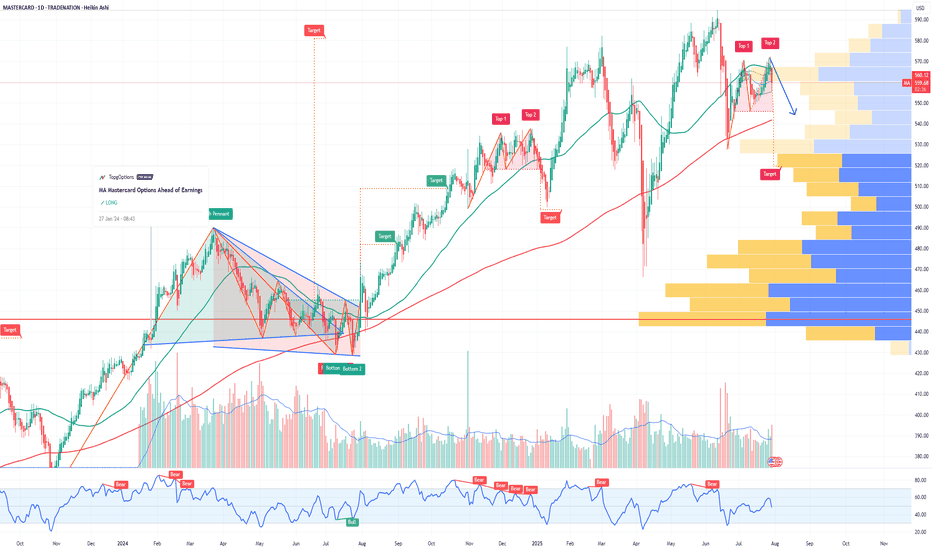

If you haven`t bought MA before the rally: Now analyzing the options chain and the chart patterns of MA Mastercard Incorporated prior to the earnings report this week, I would consider purchasing the 545usd strike price Puts with an expiration date of 2025-8-8, for a premium of approximately $4.45. If these options prove to be profitable prior to the earnings...

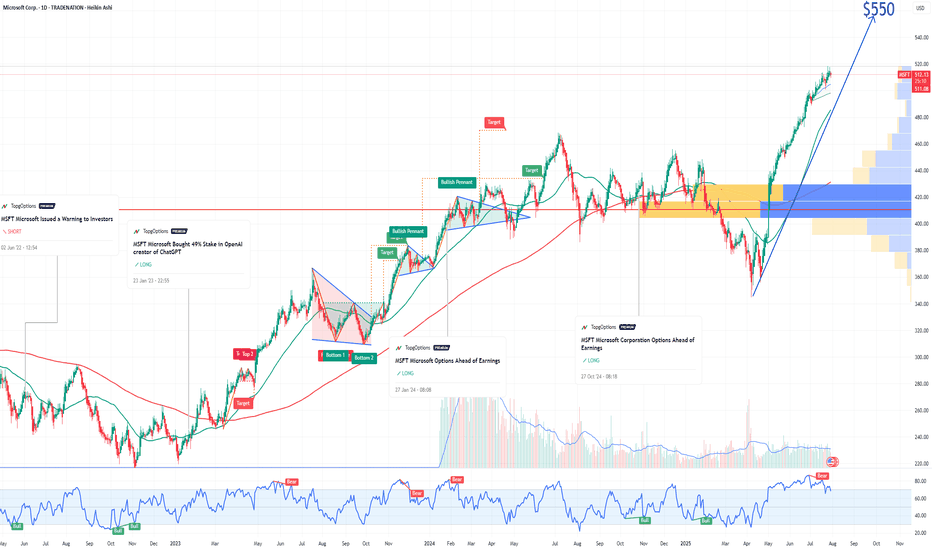

If you haven`t bought MSFT when they announced the 49% stake in OpenAI: Now analyzing the options chain and the chart patterns of MSFT Microsoft Corporation prior to the earnings report this week, I would consider purchasing the 550usd strike price Calls with an expiration date of 2025-12-19, for a premium of approximately $14.75. If these options prove to be...

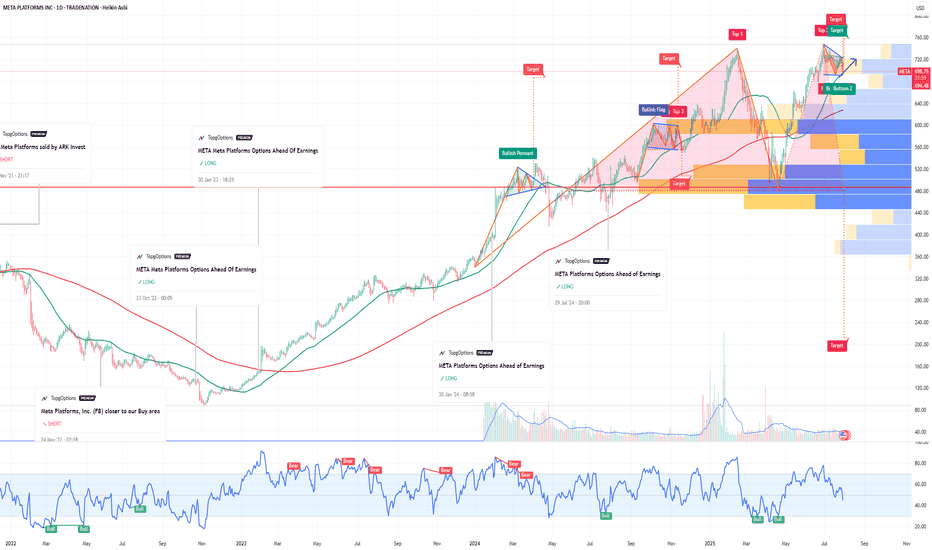

If you haven`t bought META before the rally: Now analyzing the options chain and the chart patterns of META Platforms prior to the earnings report this week, I would consider purchasing the 710usd strike price in the money Calls with an expiration date of 2026-6-18, for a premium of approximately $89.30. If these options prove to be profitable prior to the...

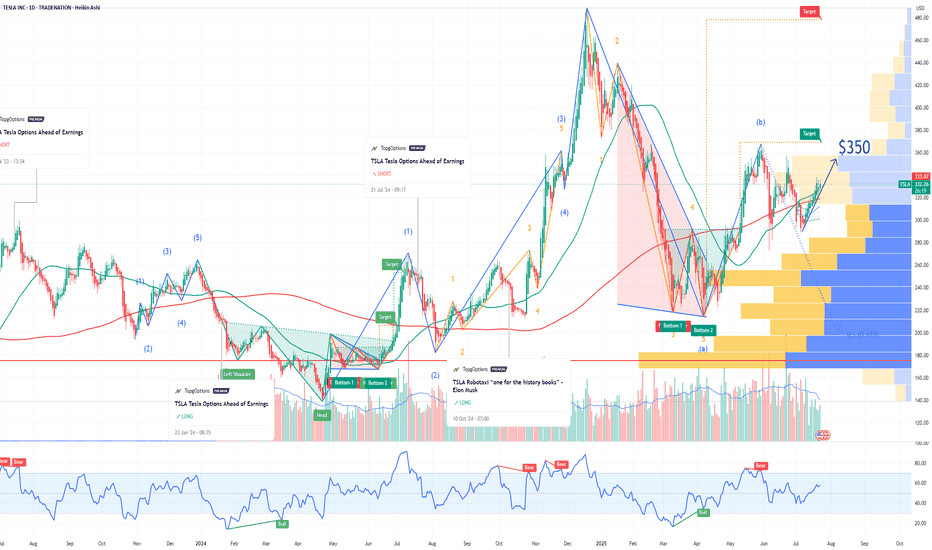

If you haven`t bought TSLA before the recent rally: Now analyzing the options chain and the chart patterns of TSLA Tesla prior to the earnings report this week, I would consider purchasing the 350usd strike price Calls with an expiration date of 2025-8-15, for a premium of approximately $14.90. If these options prove to be profitable prior to the earnings...

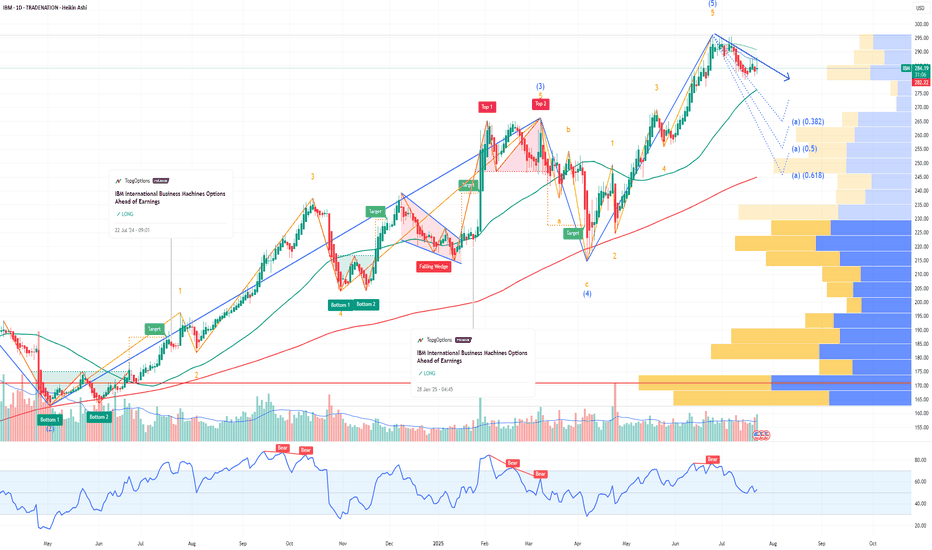

If you haven`t bought IBM before the rally: Now analyzing the options chain and the chart patterns of IBM International Business Machines prior to the earnings report this week, I would consider purchasing the 290usd strike price Puts with an expiration date of 2025-9-19, for a premium of approximately $17.30. If these options prove to be profitable prior to the...

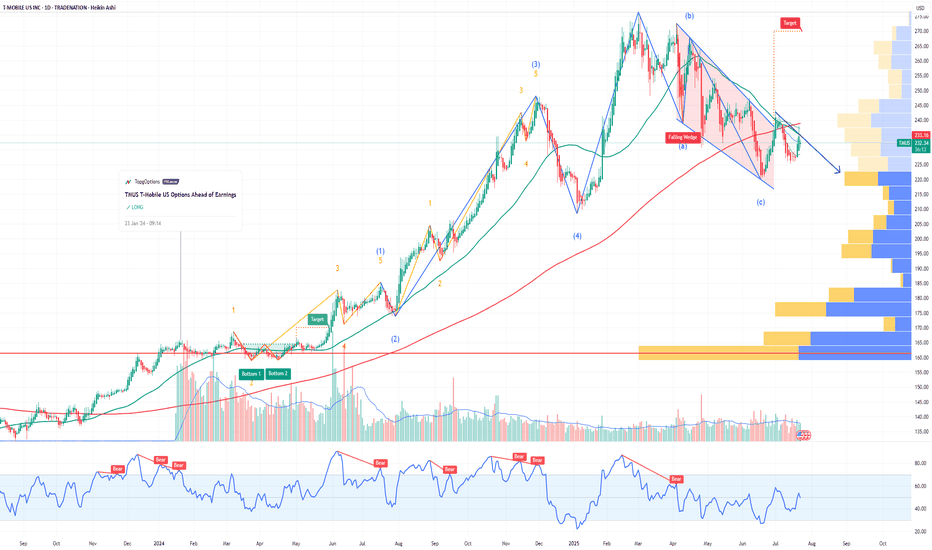

If you haven`t bought TMUS before the rally: Now analyzing the options chain and the chart patterns of TMUS T-Mobile US prior to the earnings report this week, I would consider purchasing the 227.5usd strike price Puts with an expiration date of 2025-7-25, for a premium of approximately $3.50. If these options prove to be profitable prior to the earnings...

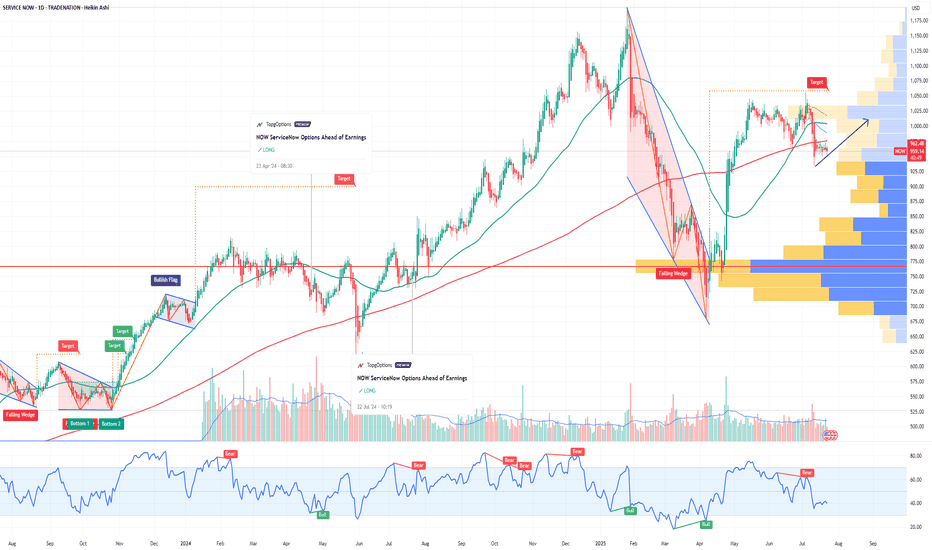

If you haven`t bought NOW before the recent rally: Analyzing the options chain and the chart patterns of NOW ServiceNow prior to the earnings report this week, I would consider purchasing the 960usd strike price Calls with an expiration date of 2025-12-19, for a premium of approximately $97.60. If these options prove to be profitable prior to the earnings...

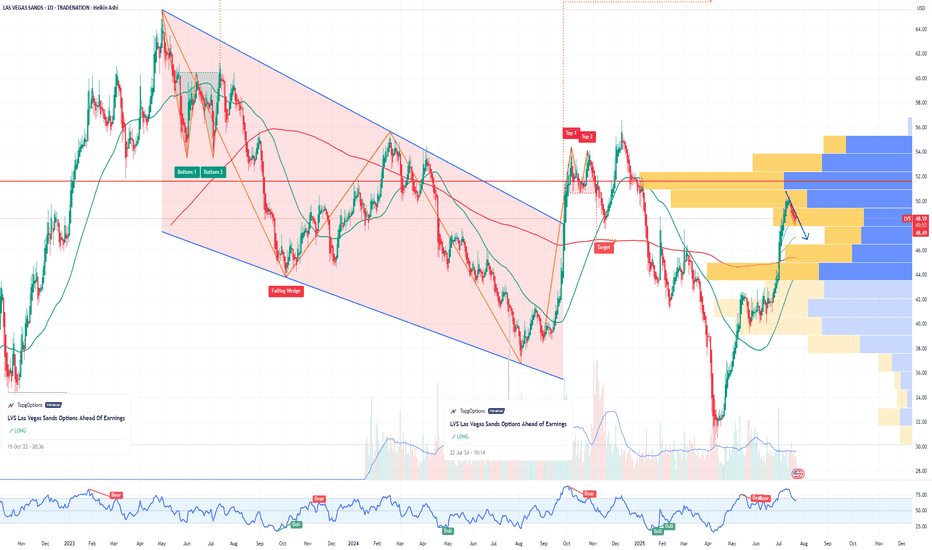

If you haven`t bought LVS before the rally: Now analyzing the options chain and the chart patterns of LVS Las Vegas Sands prior to the earnings report this week, I would consider purchasing the 48.5usd strike price Puts with an expiration date of 2025-7-25, for a premium of approximately $1.22. If these options prove to be profitable prior to the earnings...

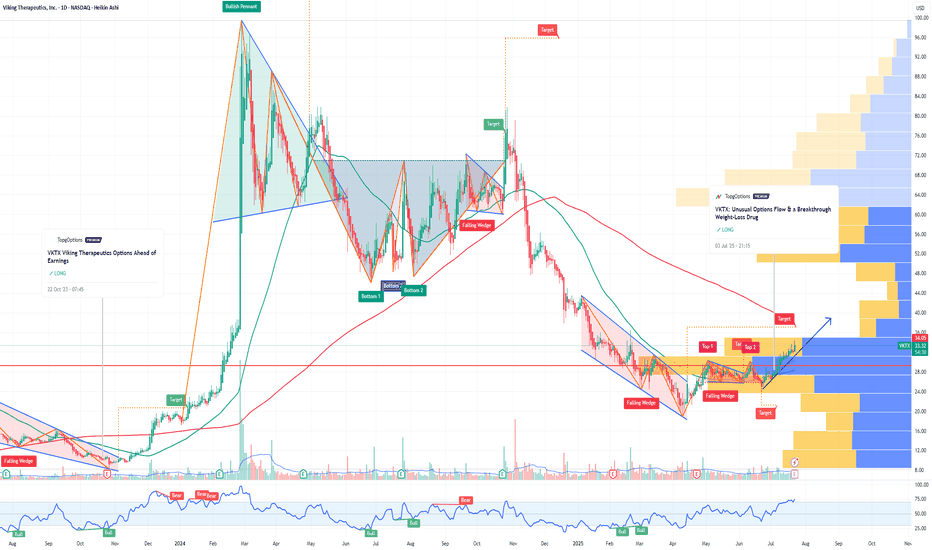

If you haven`t bought VKTX before the breakout: Now analyzing the options chain and the chart patterns of VKTX Viking Therapeutics prior to the earnings report this week, I would consider purchasing the 40usd strike price Calls with an expiration date of 2026-1-16, for a premium of approximately $7.65. If these options prove to be profitable prior to the...

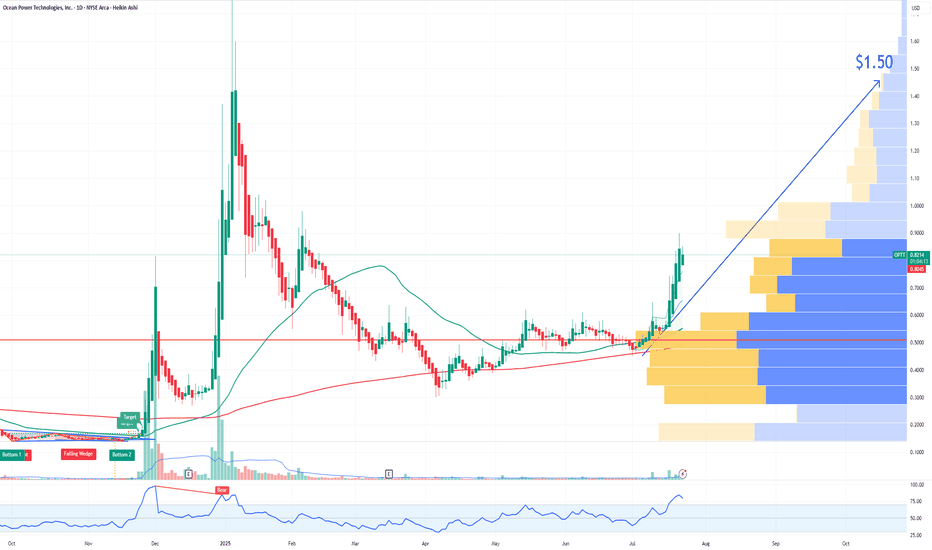

Analyzing the options chain and the chart patterns of OPTT Ocean Power Technologies prior to the earnings report this week, I would consider purchasing the 1.50usd strike price Calls with an expiration date of 2025-11-21, for a premium of approximately $0.25. If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

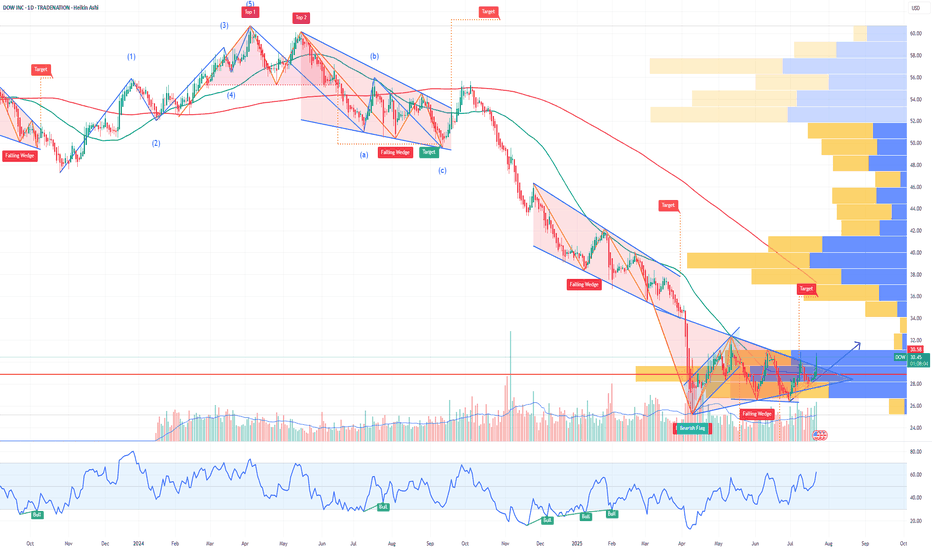

Analyzing the options chain and the chart patterns of DOW prior to the earnings report this week, I would consider purchasing the 30usd strike price Calls with an expiration date of 2025-9-19, for a premium of approximately $2.36. If these options prove to be profitable prior to the earnings release, I would sell at least half of them. Disclosure: I am part of...

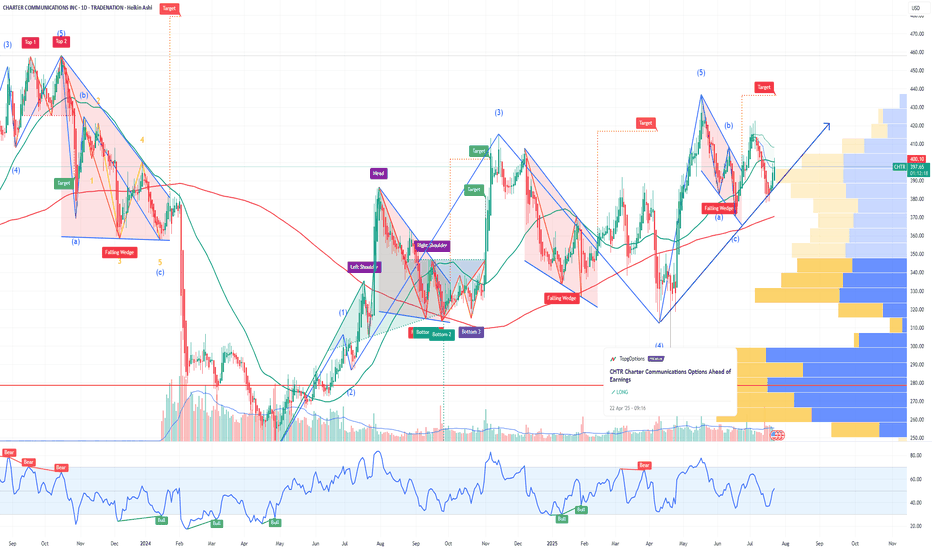

If you haven`t bought CHTR before the previous earnings: Now analyzing the options chain and the chart patterns of CHTR Charter Communications prior to the earnings report this week, I would consider purchasing the 387.5usd strike price Calls with an expiration date of 2025-7-25, for a premium of approximately $22.55. If these options prove to be profitable...

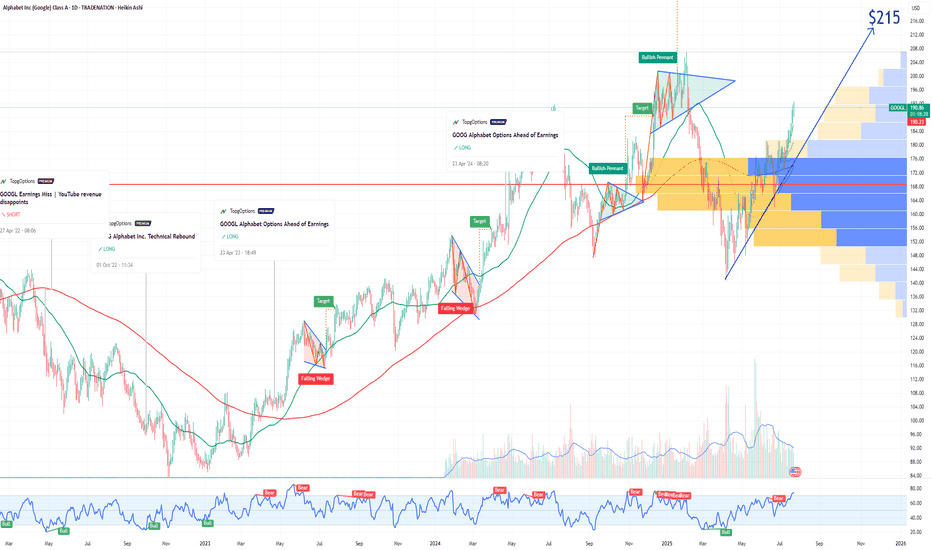

If you haven`t bought GOOGL before the rally: Now analyzing the options chain and the chart patterns of GOOGL Alphabet prior to the earnings report this week, I would consider purchasing the 215usd strike price Calls with an expiration date of 2026-1-16, for a premium of approximately $8.20. If these options prove to be profitable prior to the earnings release,...

If you haven`t exited UAL before the recent selloff: Now analyzing the options chain and the chart patterns of UAL United Airlines Holdings prior to the earnings report this week, I would consider purchasing the 92.5usd strike price Calls with an expiration date of 2025-9-19, for a premium of approximately $5.12. If these options prove to be profitable prior to...

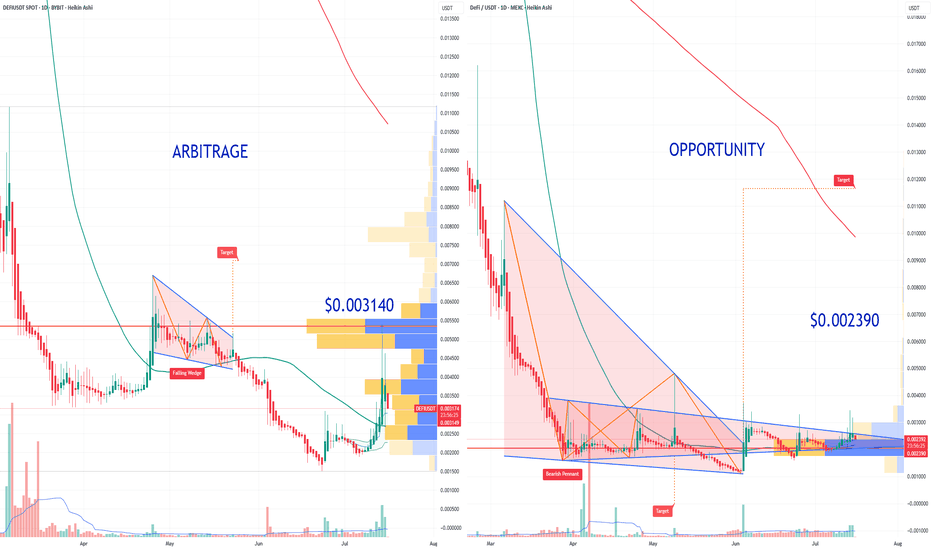

I believe I’ve identified an arbitrage opportunity involving the DEFI cryptocurrency: it trades at $0.003200 on Bybit, compared to only $0.002390 on MEXC. I recall encountering a similar situation with Shiba Inu, when the price gap between Binance and Coinbase was as high as 8X. Feel free to play the chart below to see the outcome: I also remember the...

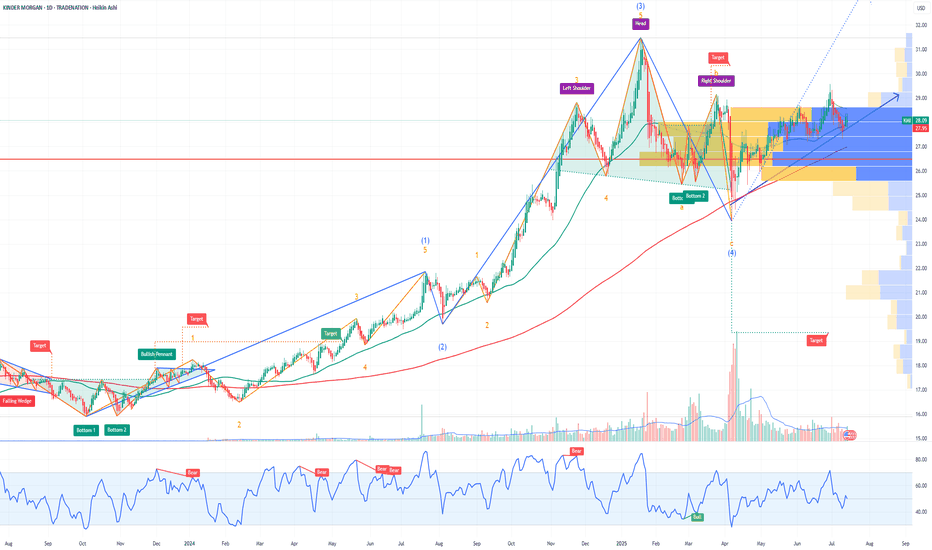

Analyzing the options chain and the chart patterns of KMI Kinder Morgan prior to the earnings report this week, I would consider purchasing the 28.5usd strike price Calls with an expiration date of 2025-7-18, for a premium of approximately $0.25. If these options prove to be profitable prior to the earnings release, I would sell at least half of them. Disclosure:...

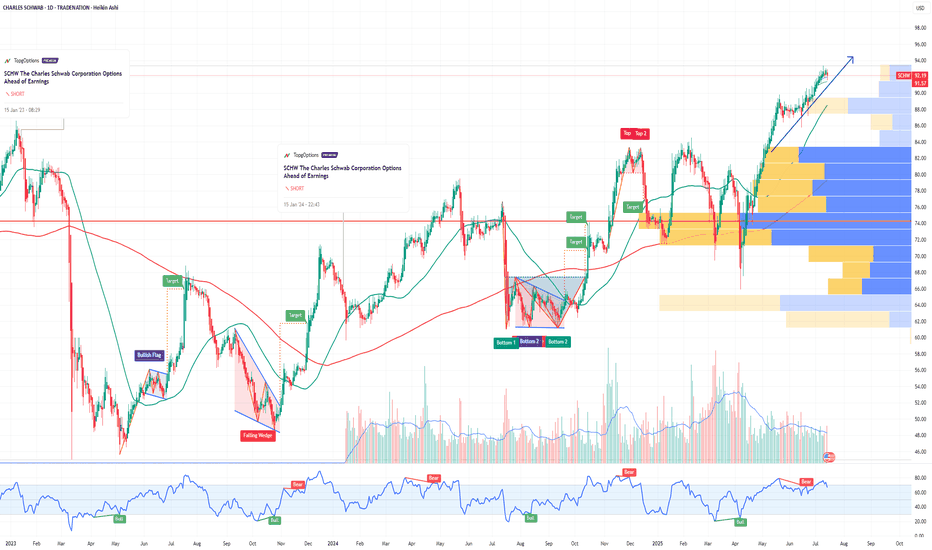

If you haven`t sold SCHW before the sell-off: Now analyzing the options chain and the chart patterns of SCHW The Charles Schwab Corporation prior to the earnings report this week, I would consider purchasing the 92.5usd strike price Calls with an expiration date of 2026-1-16, for a premium of approximately $7.15. If these options prove to be profitable prior to...