Trade-Daniel

Before and after the European session, gold fell back and adjusted again; in the U.S. session, it stabilized and rebounded above 3340 as expected, and continuous low-long layouts achieved steady profits. From the hourly chart structure, the gold trend was highly consistent with the prediction, which not only continued the downward adjustment rhythm, but also...

I write every article hoping to connect with those I'm connected with. I hope to help investors in need. Regardless of initial impressions, I should give them a chance to understand me. I believe that the fact you've read all this is fate, and investing is largely about fate. If you believe in fate and believe I can do something for you, you might want to talk to...

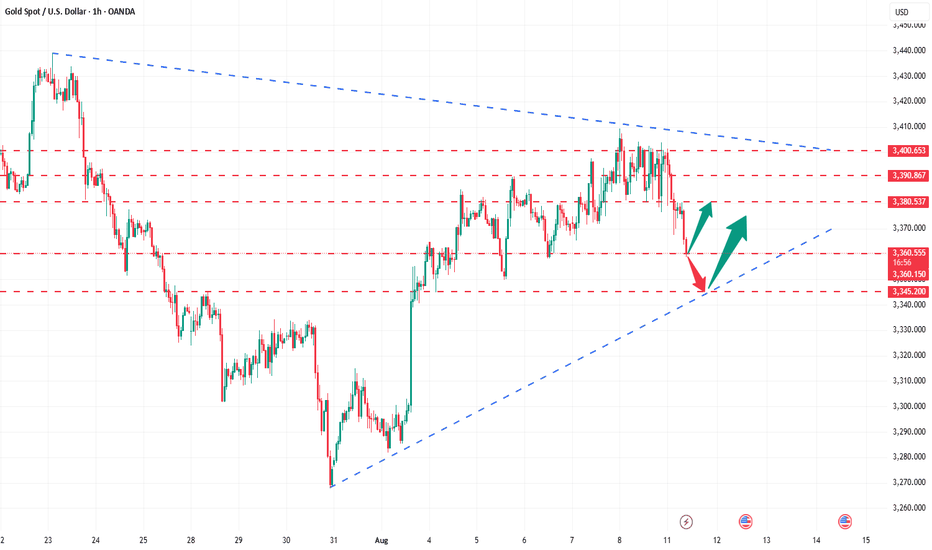

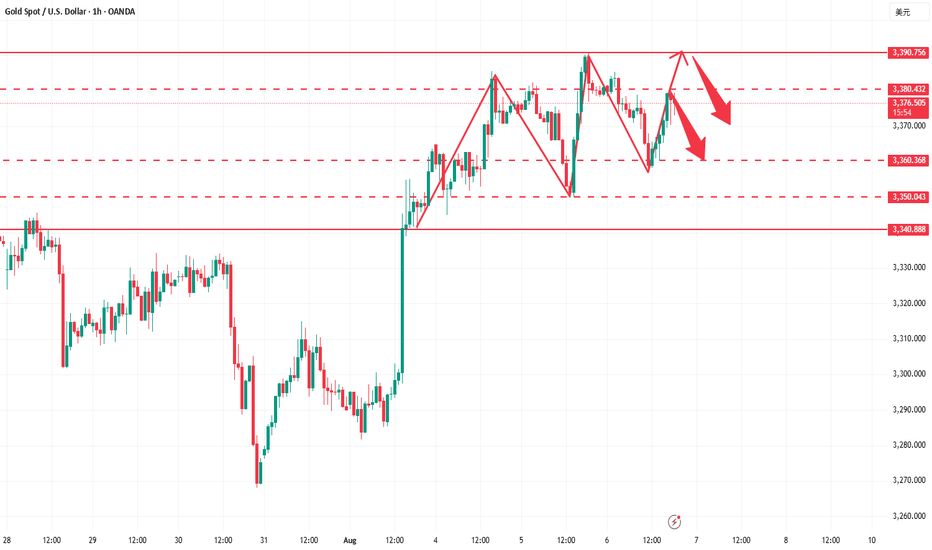

Gold's 1-hour moving average has begun to turn around from a high point. For gold bulls, this may mean that if they want to reverse their decline in the short term, they may need major news to stimulate the market. Otherwise, in the short term, gold bulls may find it difficult to make any significant progress. Gold's 1-hour moving average has fallen at this rate,...

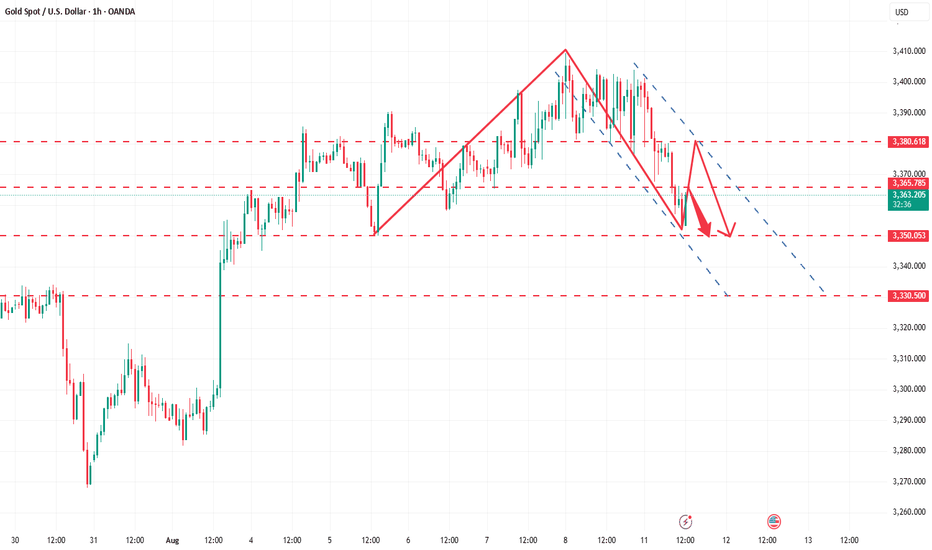

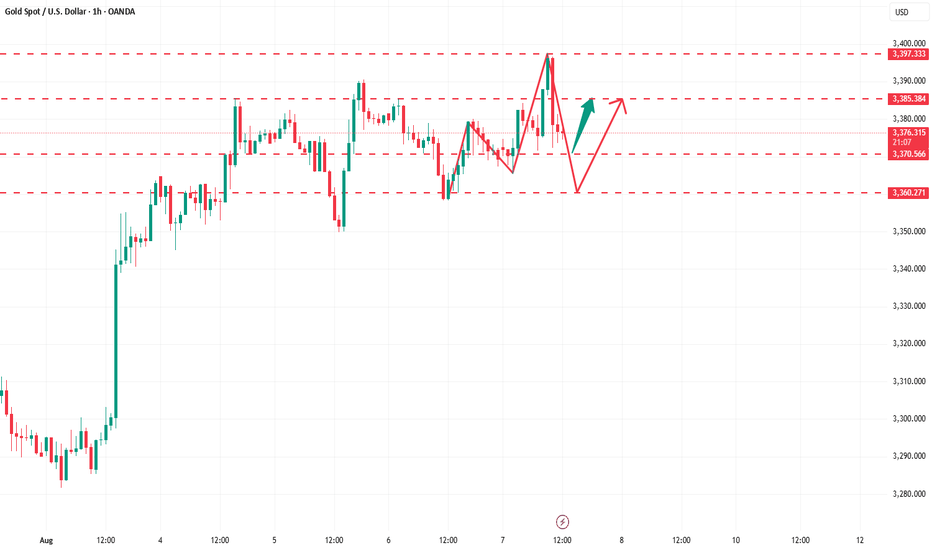

After short-term sideways consolidation, gold continued its downward trend in the European session. It is expected to break the previous wide sweeping pattern today. In the 4H cycle, the price effectively fell below the middle Bollinger band under the pressure of continuous negative lines, showing the momentum of continued decline; after the short-term support of...

At present, the suppression of 3410 is still quite strong. After testing the resistance, a short-term long-short reversal was formed, and it retreated and broke the 3380 low support. It is expected to test the 3360 and 3345 moving average supports below today. After falling below the 3380 bullish starting point, the short-term trend will temporarily be mainly...

Gold Market Forecast for Next Week: Gold News Analysis: The US dollar strengthened on Friday, but it is poised for a weekly decline as weak economic data led traders to price in the possibility of more interest rate cuts this year. Investors also assessed US President Trump's Federal Reserve nominations. Gold prices experienced a roller-coaster week from August...

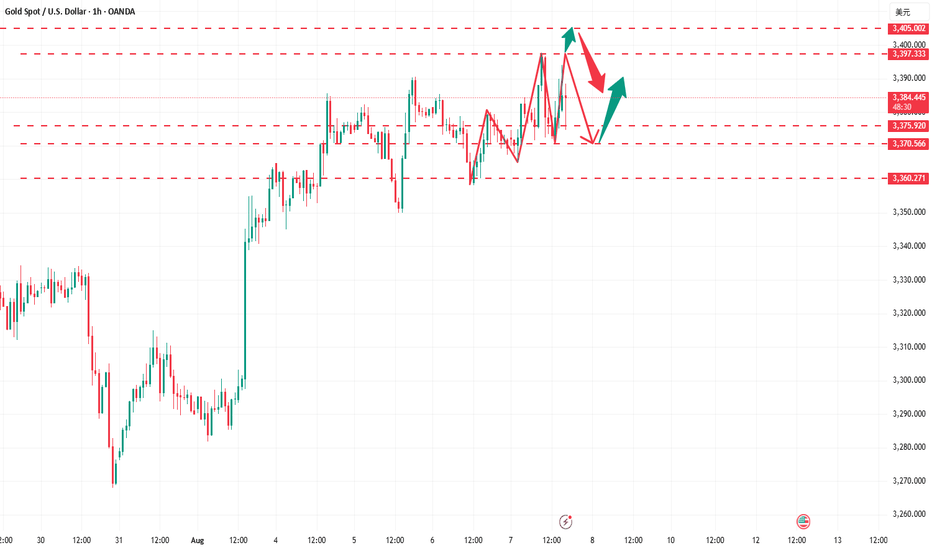

On Friday, gold did not break through the highs or the bottoms, and maintained the range of 3400 to 3380, which was in line with our expectations. In the analysis layout on Friday, I made it clear that I would short at the pressure of 3400 during the day, and go long at the support near 3380 before and after the US market, with an overall gain of 580pips. The...

After testing the 3380 support level several times in a row today, gold maintained an oscillating upward trend. Today's layout of 3380 repeatedly went long, and 3400 shorts were all successfully closed with profits, with a total profit of 580pips. Currently, gold is oscillating at a high level in the 3404-3380 range. The possibility of a direction choice cannot be...

Up to now, the 1 long and 1 short position has earned a total profit of 400pips. First, I clearly positioned myself in the 3400 area for a short position. As expected, gold fell back under pressure, hitting a low near 3391. However, the decline lacked continuity, and after rebounding, it hit a stop-loss at 3395, exiting the position with a small profit-taking...

Expectations for Federal Reserve policy remain dovish, providing bullish support for gold prices. Weak US non-farm payroll data for July, coupled with a second consecutive week of rising jobless claims, suggests a weakening labor market. According to data released by the US Department of Labor, initial jobless claims rose to 226,000 in the week ending August 2nd,...

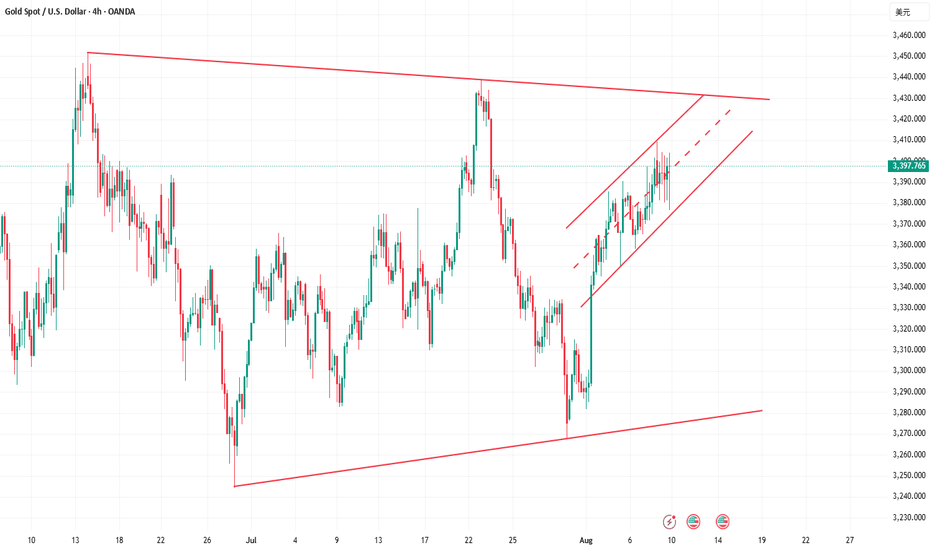

The 4-hour gold chart shows a slow, volatile upward trend. While gradually climbing higher, it has failed to effectively break through key resistance areas. This suggests the market is not in a one-sided bullish trend, but rather in a state of sustained oscillation. Current price momentum is weakening, so it's not advisable to continue chasing higher prices....

The daily structure of gold still maintains a bullish dominant pattern. The upper target is the upper Bollinger band of 3400. If it breaks through this position, the upside space will be further opened up. The 4-hour Bollinger band is gradually closing, and the price is fluctuating in the range of 3400-3360. In the short term, it is still treated with range...

The market expects the probability of the Federal Reserve cutting interest rates in September to be over 70%, with some institutions even predicting as high as 93.6%. Fed officials have recently released dovish remarks. If the rate cut is implemented, it will reduce the opportunity cost of holding gold, which is good for gold prices. The US has imposed tariffs on...

In the previous strategy, we recommended maintaining a high-selling and buying-low strategy for gold. We accurately predicted the high point near 3397 and arranged short positions near 3395. It then fell steadily to around 3371. Judging from the current gold trend, gold rose and then fell in the European session, touching around 3397, which is exactly the pressure...

Gold continues to fluctuate in an upward structure, with lows gradually rising, showing that the bulls are still in a dominant position. The current key support has moved up to the 3360 line. Before this position is effectively broken, the overall idea is to maintain a low-long strategy. It should be noted that the current market has been consolidating at a high...

Gold currently lacks sustained bullish momentum. The monthly chart has formed four consecutive upper shadows, indicating significant market pressure at high levels. Bulls are hesitant to take risks and lack the appetite for aggressive action, leading to a typical volatile pattern of rapid rises and equally rapid declines in gold prices. Yesterday's price action...

Yesterday, the gold bulls refreshed the high point, and the daily line closed in the form of a medium-sized Yang line with a long lower shadow. The idea of continuing to be bullish in the short term remains unchanged, and what needs to be paid attention to is the strength of the retracement, which is similar to yesterday. The current support below is maintained at...

Gold bottomed out and rebounded yesterday, breaking the high slightly to touch 3390 before falling back. The daily line closed with a small bullish cross overnight, and the upward momentum has slowed down. Today it tends to fluctuate at a high level. In the 4H cycle, the Bollinger band is closing, and the overall bulls continue to run upward. The big positive line...