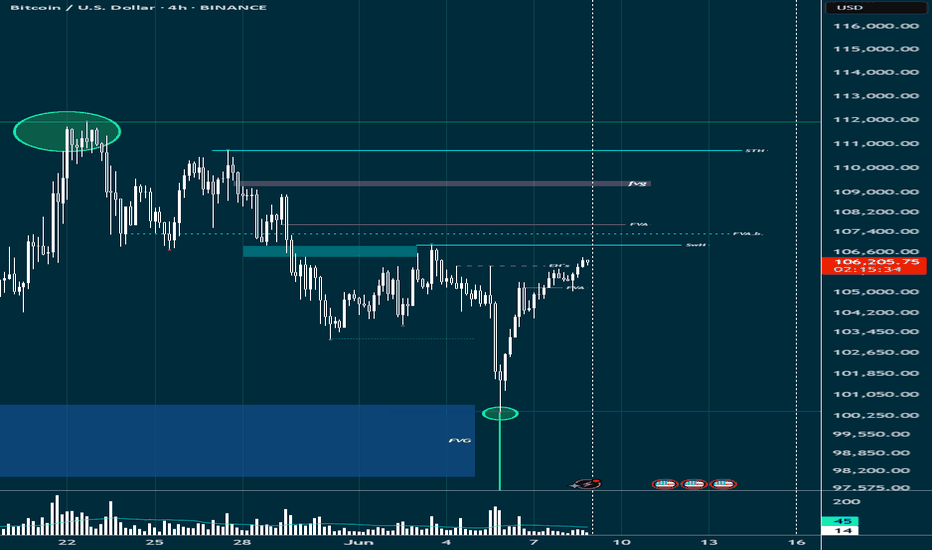

Following on from my HTF analysis on BTC, same shit applies you little reprobates! - BTC tapped into a weekly FVG on Thursday, taking out 4 hour and daily liquidity levels in the process. Since tapping the Weekly FVG, price has printed a strong bullish reversion, back into the 4H and Daily areas of potential resistance. Right now, is crunch time (so to speak) -...

HTF analysis on Bitcoin: Anyone with eyes can read the Monthly structure and bias as being bullish, April swept the prev ATH at 108K, tapping the 111K levels, before selling off sharply (to be expected, price must come down, to go up, after all!). - Monthly context shows we need to do just that, and this week, we did! I had the target as the Weekly Bullish FVG...

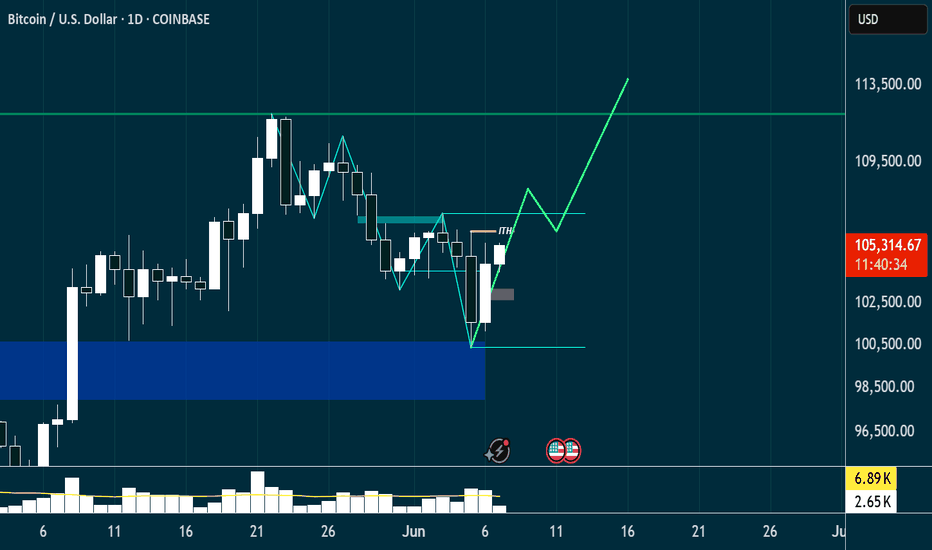

BTC on the Daily for the thesis: general idea is a continuation of the overall bearish trend, but in context of the monthly & weekly TF, where we have an FVA residing at the FWB:73K level, meaning that could be our low before a potential reversal to a new ATH, in line with Monthly market structure. If we dont come lower from here, expect higher prices, but, my...

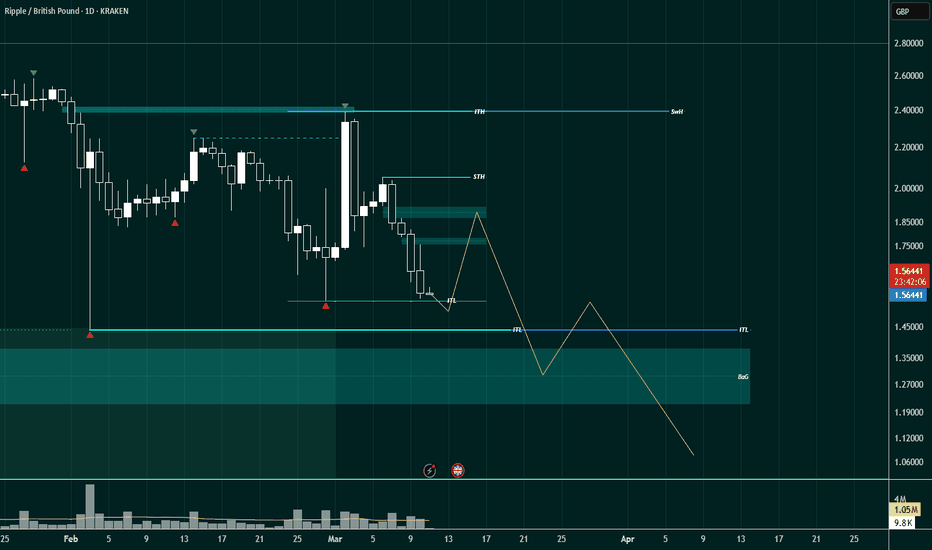

Short Term Bearish outlook here team on the daily, but I'll be entering on lower TF's, overall markets are bearish whether anyone likes it or not. Expecting XRP (and more so BTC) to induce buyers in to complete overall HTF bearish bias YTD - retracement into the D FVG's above (Bags') but not until we sweep the current D/W Swing Lows. Will add more commentary in...

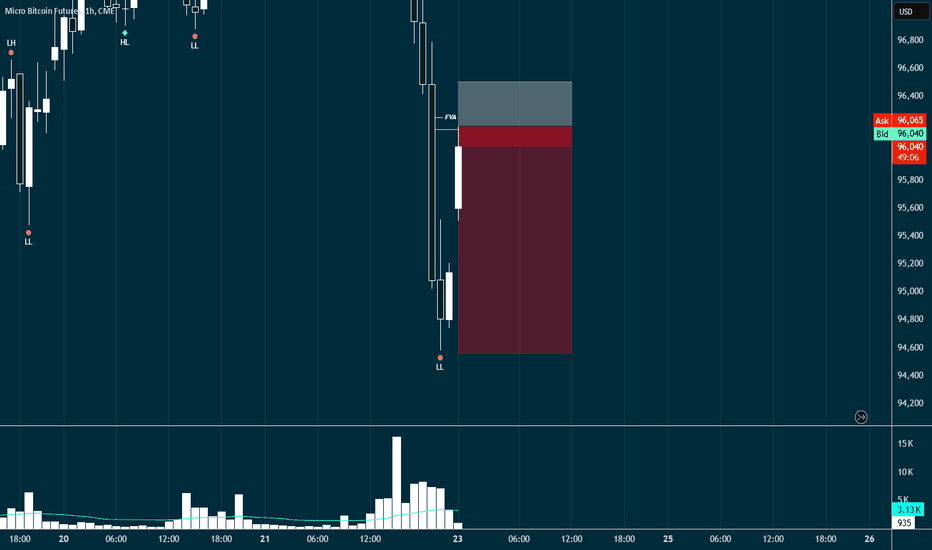

Just opened a short position on BTC, that was entered as the futures markets opened with a sudden influx of liquidity, moving into a 4H Bearish FVG, that should hold and price then turn to continue weekends bearish bias, and by extension, the overall bearish bias in play currently. Target is the hourly TF's SwL, which would be a good reversal area for price to...

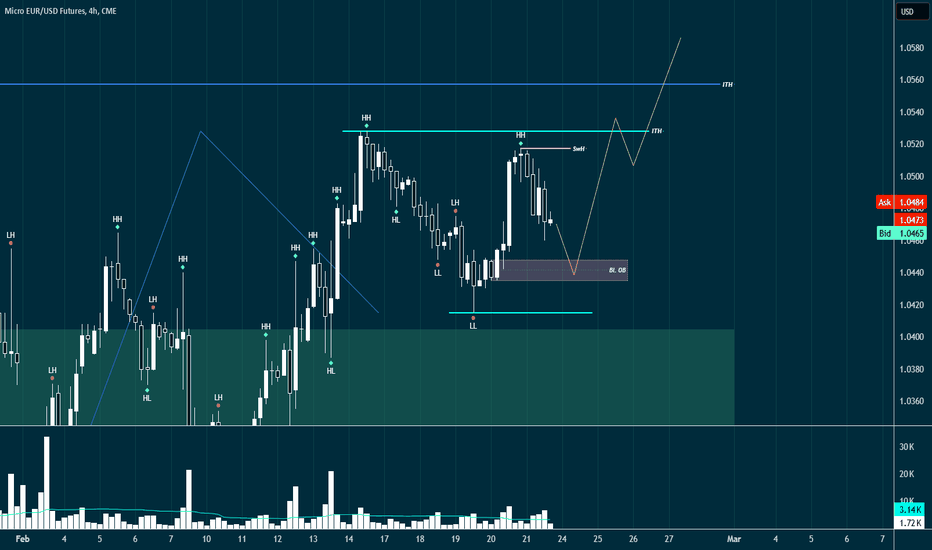

M = Green W = Deep Blue D = Neon Blue 4H = Pink. Vice Versa of my DXY analysis, EUR/USD should see bullish price action in repsonse to the DXY dropping. The EURUSD pair HTF's are somewhat mixed, with the M looking like its in the motion of forming a reversal coming off of the M bullish FVG created during the last bullish expansive leg. There are key levels on...

Similar thesis to my NASDAQ analysis, with the DXY in a current bear trend, with key levels unmitigated below, and very close to current price action. Overall, expecting a decline in the price of the DXY over the next weeks sessions, mainly to hunt liquidity below to then continue the monthly Bullish bias and trend. Align it with the current US economic...

Bearish downtrend on the NASDAQ, targeting the Daily STL as nearest draw on liqudity. Expecting a retracement into the 4H BaG (Pink area) to then continue the current down-trend to sweep the liquidity at the daily STL. As we can see, the recent bullish expansion to the upside actually took Monthly liquidity which then saw a sharp reversal which has taken out most...

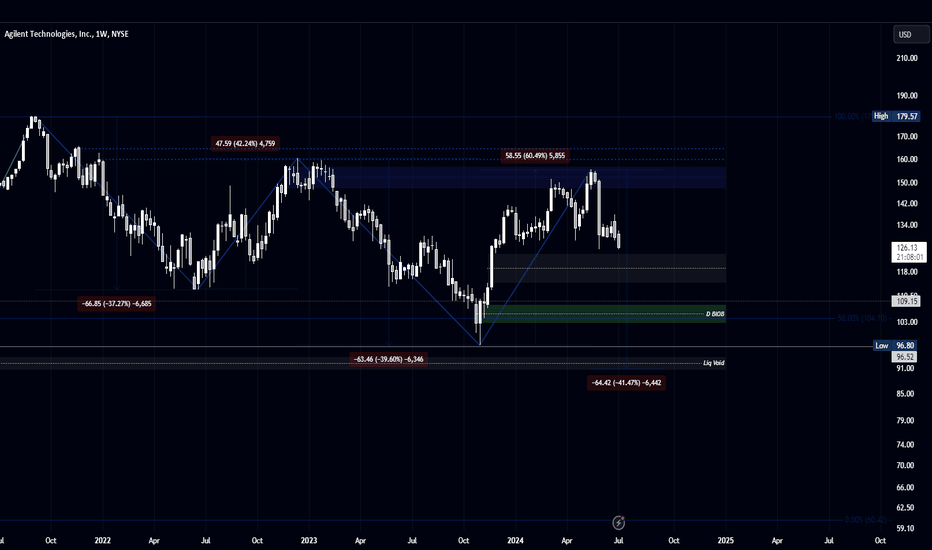

Concentrix share price hasn't performed well, at all! - Since its IPO in 2020, which saw a large uptrend that lasted until the start of 2022, where price has since fallen in a picturesque, somewhat cliche bearish down-trend, with perfect form. Price has respected Premium Arrays and obliterated Discount Arrays, consistently running lows and reversing back into the...

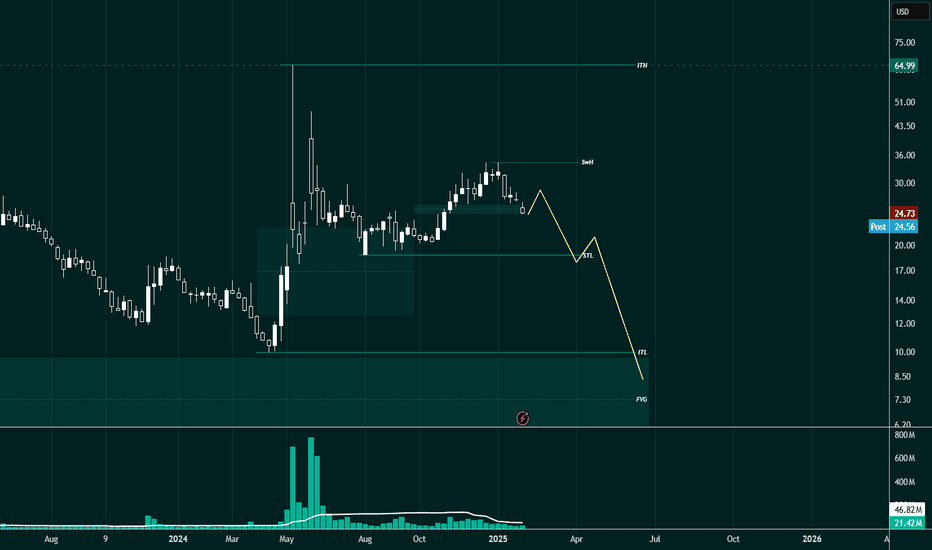

GME had its day in the sun, im nothing but certain that that entire escapade was institutional orderflow and capitulation on the back of retail hype. smart move! Current structure looks bearish on the HTF's, M showing possible failed swing pattern in play, with an unmitigated BISI residing below current ITL formed after the sharp reversal in May '24. (that, may i...

Hear me now, people pon de rydm know not what they see, but what ye hear, ja feel? L-yfe be dealing bool-shit, but us faithful de deejay rydm know not what de simu-layshan deelivah, but only what JAHHHHH delivah! - testify my bredrin. restecpah.

Just a little playful backtest trade for the weekend, theres been a nice little pump on crypto this past day or two, im just being bearish on the short-term interim to see if the STL's get ran. lets see!

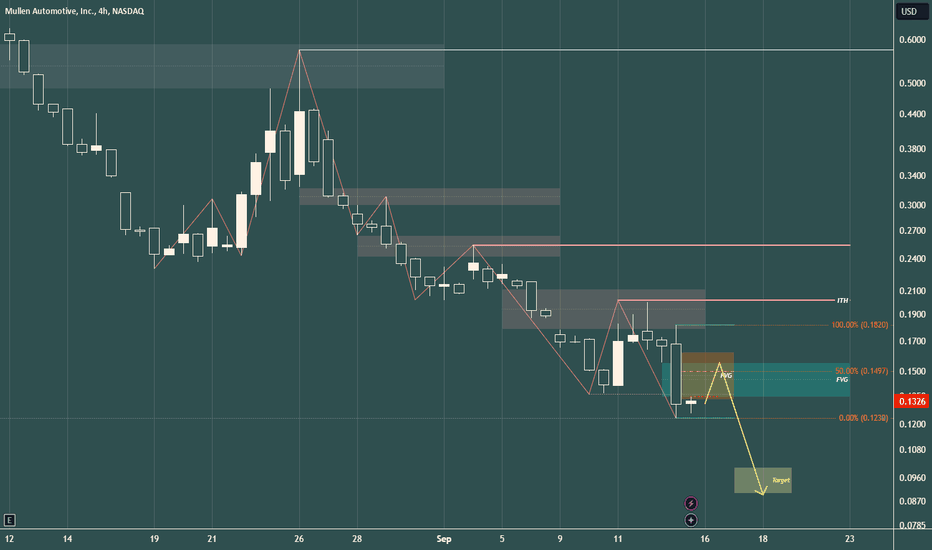

Anyone with eyes can take a look at the HTF's and see its nothing but bearish! Im actually still shocked its even at these current levels, given the amount of RS's they have done! I am curious if anyone holding MULN can shed some light as to why they are still holding?!

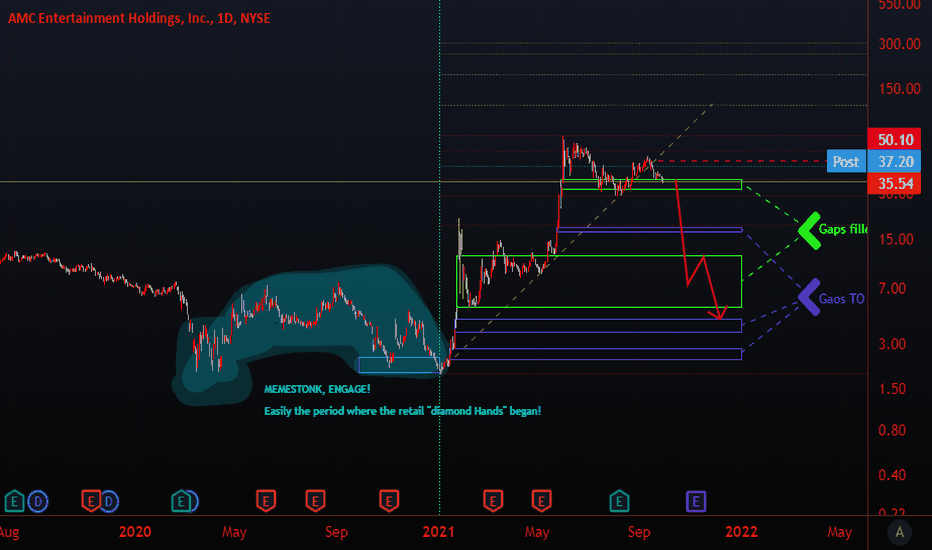

Higher Time Frame (HTF) analysis on the weekly TF. Clear Bearish bias with last leg up not running the previous key swing high, price sharply reversed and has left behind a liquidity void above (could yield higher prices to collect orders in that area), but overall, we appear to have a repeat of bullish turned bearish market sentiment. Since the ATH, we can see...

DJI outlook: Monthly and Weekly, i feel with the current economic climate and the world being on fire, especially the supposed banking crisis just around the corner, its hard not to feel the recent bullish action since Oct 2023 was a melt up to allow large money institutions to exit at the best possible prices. Prev ATH was ran through completely, and i...

Monthly (and lower timeframes) simple Tech Analysis for NASDAQ:CNXC (Concentrix + Webhelp) chart to track potential ESPP participant's view of share price.

I'll start by stating, I’m a fan of NIO, and I’m not looking to shit on it at all, this is all purely TA, I haven't factored in any fundamentals (please comment with any you're aware of - sharing is caring! :) ), this is purely an outlook for long term holders, but also with a scope for my fellow day traders who might want to note the more longer time frame levels...

Enjoy. For the record, i said back in Dec2020/Jan2021, that this wouldn't end well for the simpletons thinking social media terms like "diamond hands" and "hold the line" ever would have worked out, and thanks to Evergrande (3333.HK) and Inflation, its NOW time for those little slogans to REALLY get tested. Lets see how "diamond" your hands are soon, when you're...