Instrument: ETHUSD Timeframe: Daily Date: August 4, 2025 Analysis: ETH fell 7.9% to $3,500 from $3,800, testing support after failing to break its high. The hawkish FOMC and rising BTC.D (62%) pressured altcoins. I entered the dip on $3,500, as shared on X and my previous report Chart Setup: Support: $3,500 Resistance: $3,600, $3,800

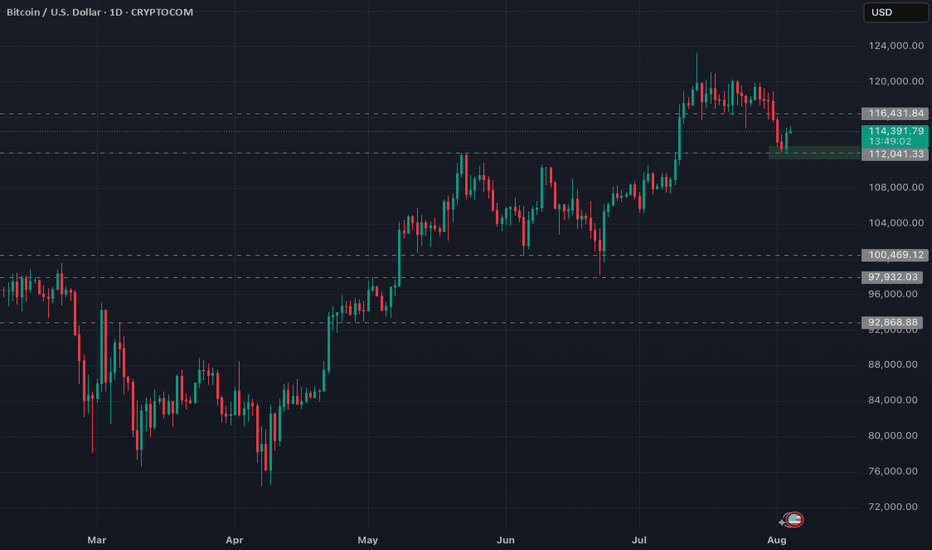

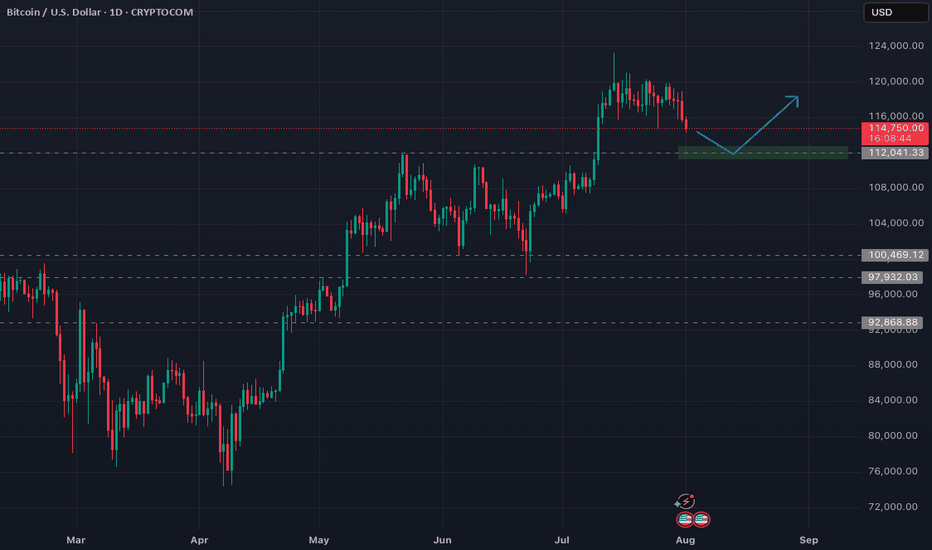

Instrument: BTCUSD Timeframe: Daily Date: August 4, 2025 Analysis: BTC dropped to $112,000, down 5.1% from $118,000, holding above the $112,000 support. The hawkish FOMC triggered this pullback, but $112K is a key level. I scaled in on the dip as seen in my previous BTC idea and X Chart Setup: Support: $112,000, $100,000 Resistance: $115,000, $120,000

Hi all, As you may have noticed, Wednesday's FOMC meeting delivered a less-than-optimistic outlook. The absence of rate cuts, combined with uncertainty about potential cuts in September, triggered a downward move in the markets. Bitcoin is currently trading 7% below its high from July 14th. I anticipate a relatively shallow downtrend and plan to add to my...

ETH is showing a strong uptrend on the 1D chart, recently hitting $3,639.37 after a -1.59% dip. A key support zone around $3,500 is in sight, which I’m eyeing as a potential buy opportunity. The chart suggests a solid base here, with historical price action holding firm. Watch for a bounce or consolidation around $3,500-$3,600 before the next leg up. Target:...

🧠 Summary: Bitcoin ( CRYPTO:BTCUSD ) has moved up to the upper part of the resistance zone I highlighted in my previous analysis. That analysis still holds—I’m still expecting BTC to start pulling back from here. 🔍 Key Levels: - Resistance zone: $94 000 - $98 000 - Support zone: $86 000 - $83 000 - Major Support zone: $72 000 - $68 000 📅 Upcoming...

🧠 Summary: Bitcoin ( BITSTAMP:BTCUSD ) is currently testing a major resistance zone around $95 000 -- this is a strong supply zone from February. We have a lot of macroeconomic data and FOMC meeting coming soon so be prepared for some volatility. 🔍 Key Levels: - Resistance zone: $94 000 - $98 000 - Support zone: $86 000 - $83 000 - Major Support zone: $72 000...

Hi Everyone, In today's market update, I’m analyzing a potential short setup that I plan to take in the coming weeks. While we are currently experiencing an upward rally, the broader macroeconomic environment remains uncertain. This leads me to believe that the current move is merely a relief rally, with further downside likely ahead. I will begin building my...

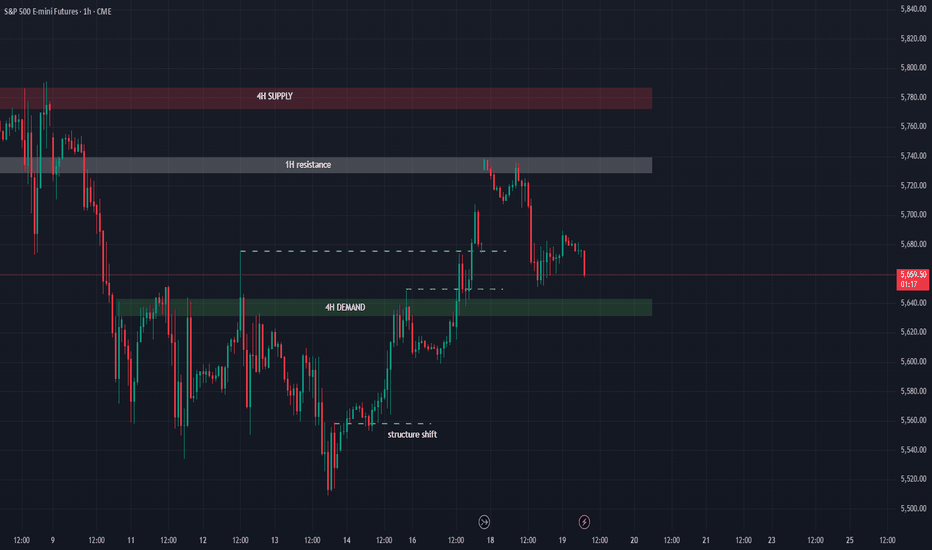

Yesterday was choppy with minimal price movement, so I didn't take any trades. Today is FOMC day, so I'll stay out of the market and watch the meeting's outcome to see if rate cuts might be coming soon. Make sure to follow for more trading updates!

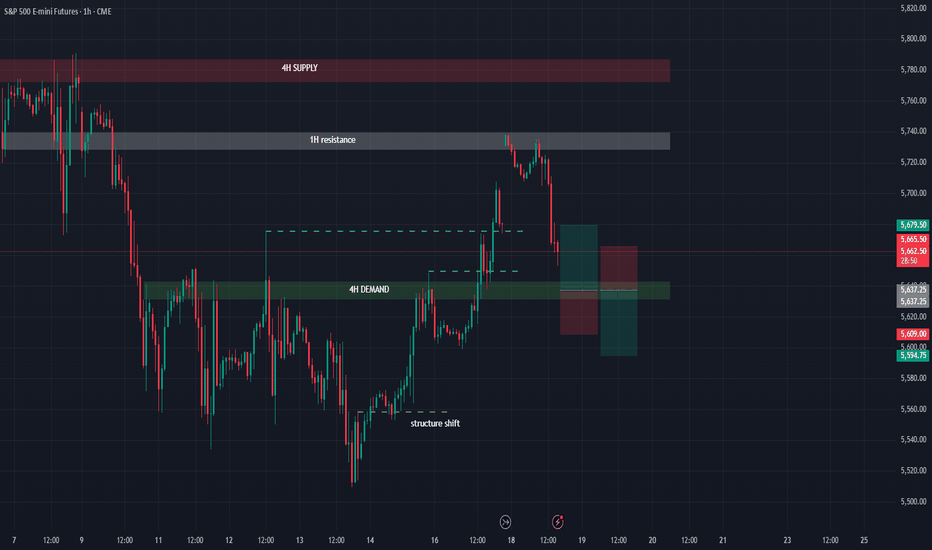

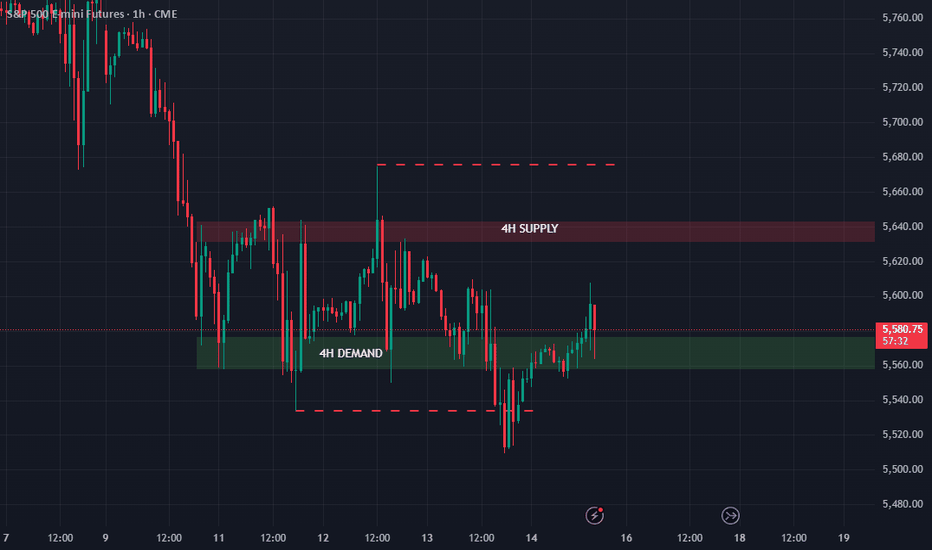

In today's market update, I maintain a neutral stance. While we saw a breakout yesterday, price has since been rejected at the 1-hour resistance. The key area I'm watching is the 4-hour demand zone. Since the overall trend on higher timeframes remains bearish, I plan to wait until price reaches this level—I'm cautious about entering long positions. If price...

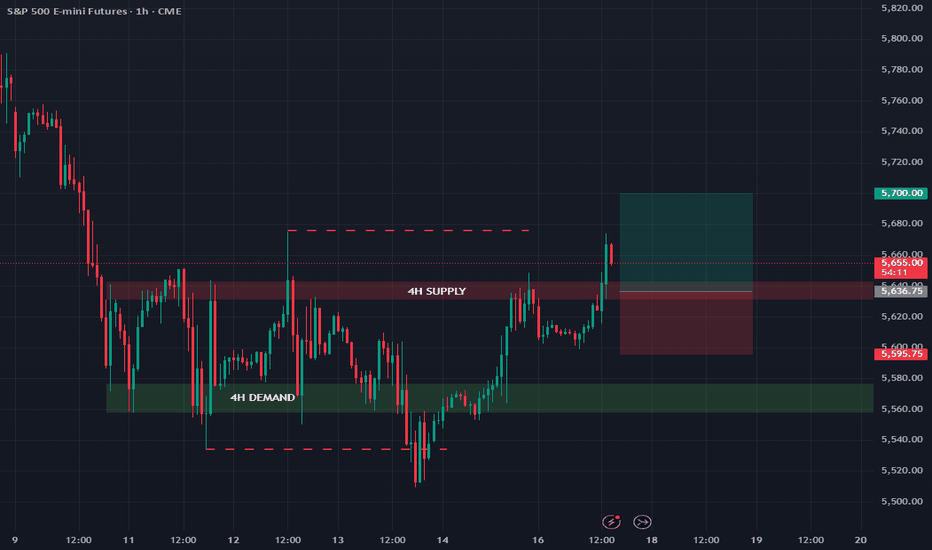

Last week, I mapped out some trading zones that are still valid and unchanged. The 4H supply zone has broken out, so I will be looking for a long position after a retest of this broken supply zone, which should now act as support. My last trade was a short from this zone, resulting in a small profit since market closing prevented reaching the full take-profit...

The key trading zones from yesterday's analysis remain unchanged. Yesterday's plan was to short at the demand zone retest after the breakdown, but the trade was cancelled since price never reached my entry point. Today, I'll be watching for either a short opportunity at the 4H supply zone or a long position after a breakout and retest of the supply zone. Follow...

Hello, In today's trade analysis, I will review potential setups for this trading day. Since the overall trend is bearish, I favor short positions over long positions. I have identified two important zones on the 4H timeframe that align well with the 1H timeframe. 4H supply zone: 5,643 - 5,630 4H demand zone: 5,577 - 5,558 We've seen both false breakouts and...