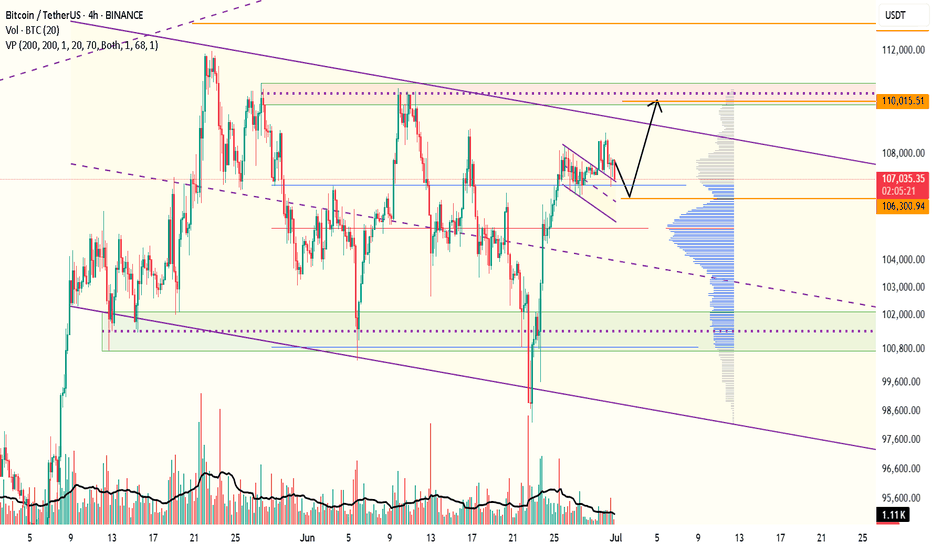

📈 Bitcoin Short-Term Outlook – Coming Week Currently, Bitcoin is expected to gather liquidity around the $106,000 zone, potentially initiating a move toward the $110,000 resistance level. This area will be crucial in determining the next directional move. 🔍 The market's reaction around $110,000 will be closely monitored, and the analysis will be updated once...

Bitcoin may once again attempt to break into the $113,000 zone. If this level acts as resistance, a correction down to $100,000 is likely.

Bitcoin Analysis: If Bitcoin stabilizes around the $100,000 zone, it could continue its upward momentum and potentially reach new all-time highs. However, if the $98,000–$100,000 resistance range holds strong, we may see a price correction that could bring Bitcoin down to the $68,000 support level. It’s also crucial to closely monitor macroeconomic factors such...

Bitcoin, according to the previous analysis, pumped after reaching the $78,000 zone and filling the CME gap following a tweet from President Trump. However, due to a lack of demand in the spot and ETF markets, along with news of U.S. economic tariffs, it quickly retraced. The market still lacks sufficient demand, and if the U.S. government meeting on Friday, March...

I still consider the 85K scenario likely because this price increase has been very weak and low-volume in the spot market. However, unlike some others, I see this correction as a buying opportunity. In my opinion, the market sentiment will be pushed so negative that few will dare to buy. As for altcoins, dominance is unlikely to decline. Based on the news and...

After the correction and the liquidity removal around the 90,000 zone, along with U.S. inflation data that increased optimism for a potential rate cut, Bitcoin has once again moved toward the top of the channel. However, in my opinion, this move cannot be sustained for various reasons, including the lack of demand in the spot market. Therefore, the 85,000...

Bitcoin is in an ascending channel on the daily time frame. Given the proximity of Christmas, it could have a correction market. In the first scenario, a correction to the $80,000 range for me.In the bullish scenario, by breaking through the $108,000 to $110,000 level, we could continue to rise to $120,000,

Bitcoin Mid-Term Analysis If the interest rate cut is done and the US economy does not stagnate, and of course President Trump wins the US election, I will share other possible scenarios for Bitcoin in the coming days.

Before the halving target of $75,000, we will move towards the liquidity area of $34,000, and the final target for the 2024-2025 cycle will be $300,000

LONG BTC D1 In my opinion, Bitcoin will rise to 45000 in a one-day time frame