aviranos

PlusSummary Rocket Companies (RKT) has formed a multi-year Cup & Handle pattern, now testing the key breakout zone at $19.8–20.2. Last week’s earnings beat (+41% EPS surprise, +6.6% revenue surprise) adds bullish sentiment. A confirmed breakout with volume could trigger a strong continuation move toward higher Fibonacci targets. Technical Confluence Cup & Handle :...

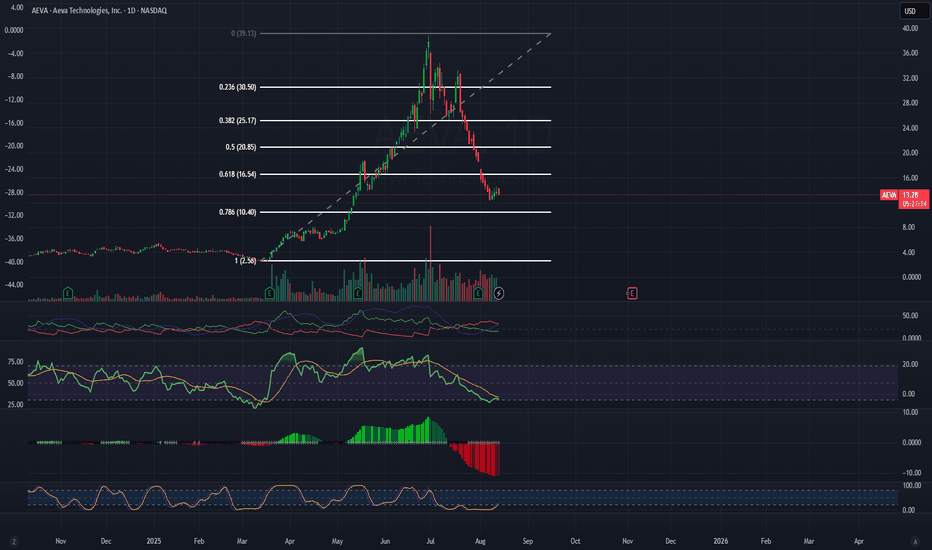

AEVA has experienced a major pullback from its highs, retracing deeply into the Fibonacci levels. On the weekly timeframe, a Cup & Handle structure is forming right at a key reversal zone. Recent price action and indicators suggest that the stock may be ready to change direction and start a new bullish leg. Technical Highlights: Pattern: Weekly Cup & Handle...

BULL is showing a textbook Cup & Handle formation on the daily chart, signaling a potential bullish breakout if key resistance is cleared. The price is consolidating just under the $18.06 level after a healthy pullback – a classic setup for a continuation move. Technical Highlights: Pattern: Cup & Handle with the handle forming on low volume, suggesting sellers...

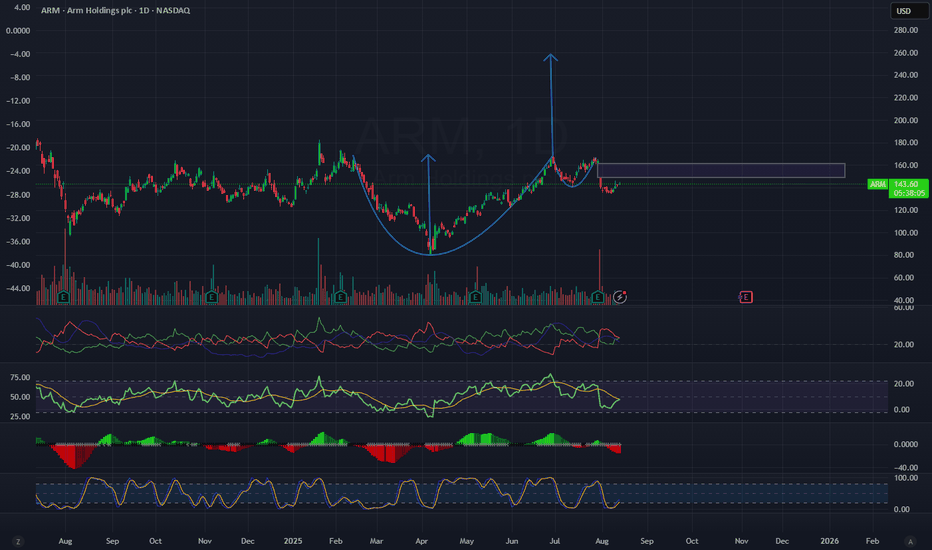

On ARM’s daily chart, we can see a clear Cup & Handle pattern – twice in a row – with strong upward moves following each completion. The latest pattern completed around the $165 area, after which the stock pulled back into a healthy correction and is now consolidating in the $140–$150 range. Technical Analysis: Pattern: Cup & Handle with a small pullback,...

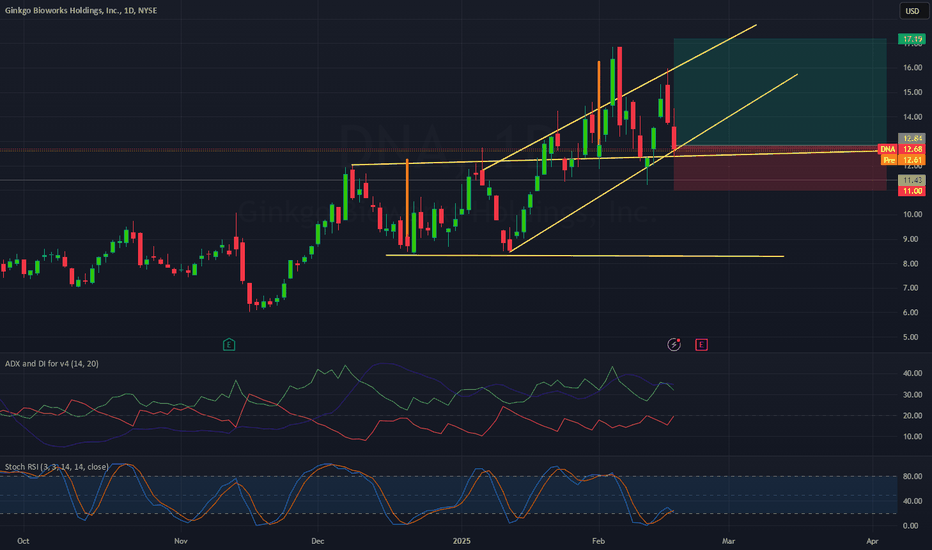

📊 Technical Overview: DNA stock is currently trading inside a well-defined ascending channel, bouncing between support and resistance levels. After a sharp pullback, the price is now testing a critical support zone around $12.50-$12.70 – a key decision point for traders. 🔍 Key Technicals: ✔ Strong Uptrend: Despite the recent drop (-7.92%), the stock remains...