cookie_moon_star

PremiumNASDAQ:NBIS looks ready for the next leg up after retesting 21 EMA and now forming a bull flag

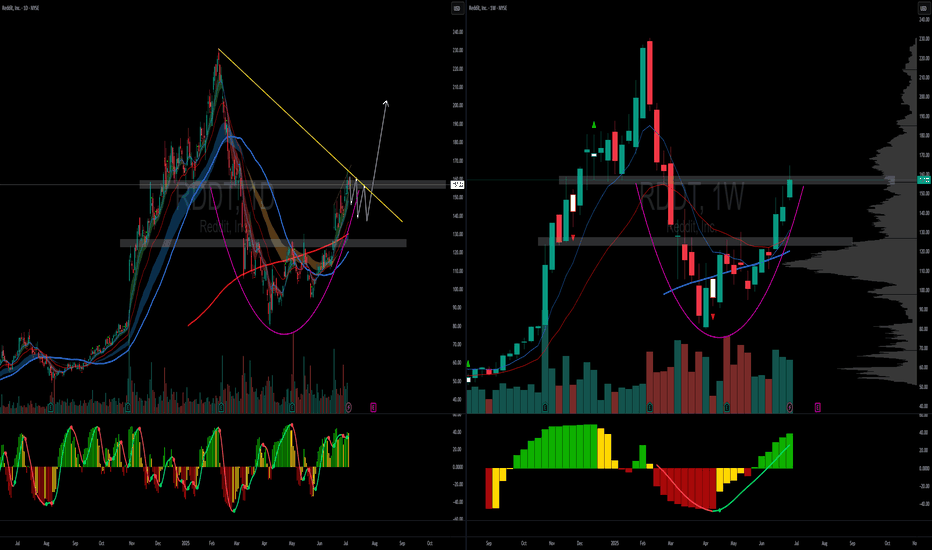

NYSE:RDDT might want to consolidate here and build a flag before launching further down trendline from ATH is acting as resistance also there is some supply from 160-180 to go through forming quite a nice rounding bottom here could go straight up too... who knows

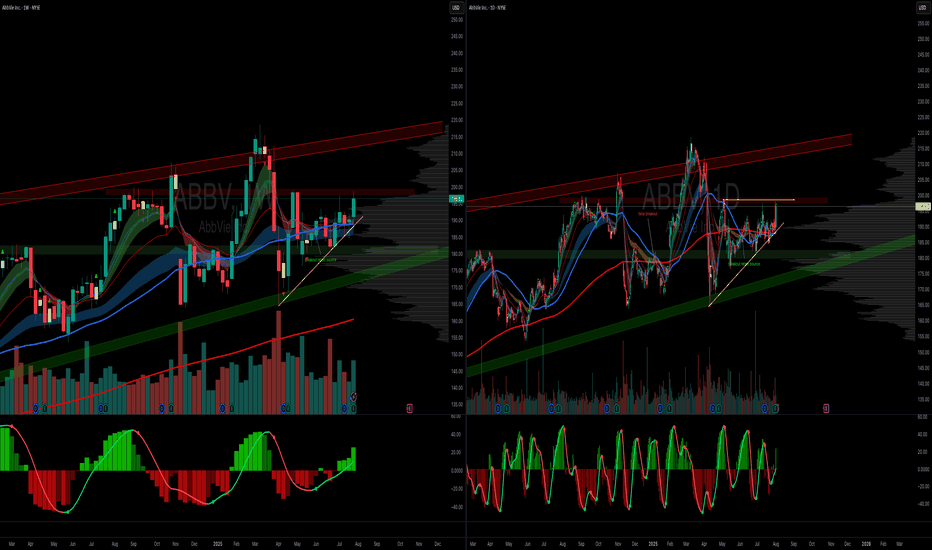

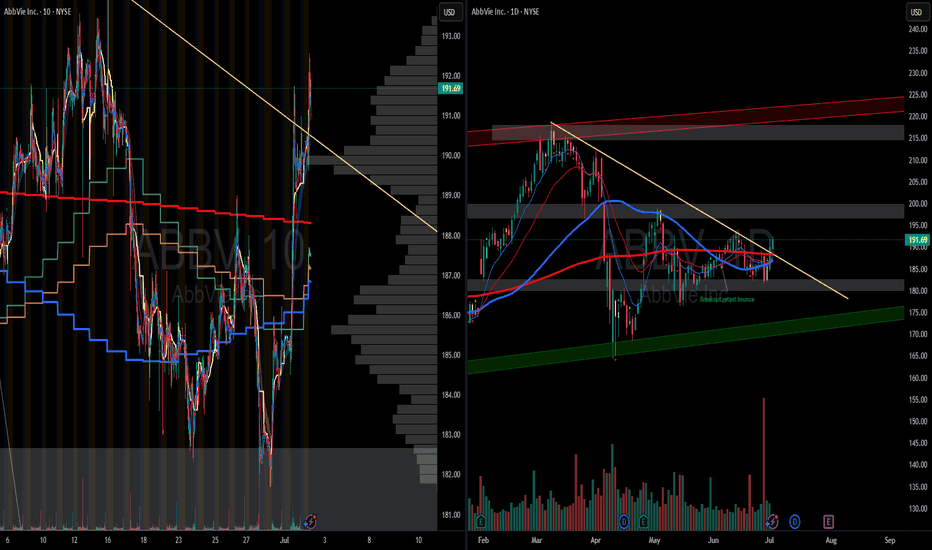

NYSE:ABBV has been very hard to trade...but with earnings behind us and good beat and guidance, I think this will run.. creating an ascending triangle here with higher highs into equal lows and a close above 197 next week could send this way past 200 IMO healthcare sector is beaten down as it is, so any rotation into the sector will also help the stock

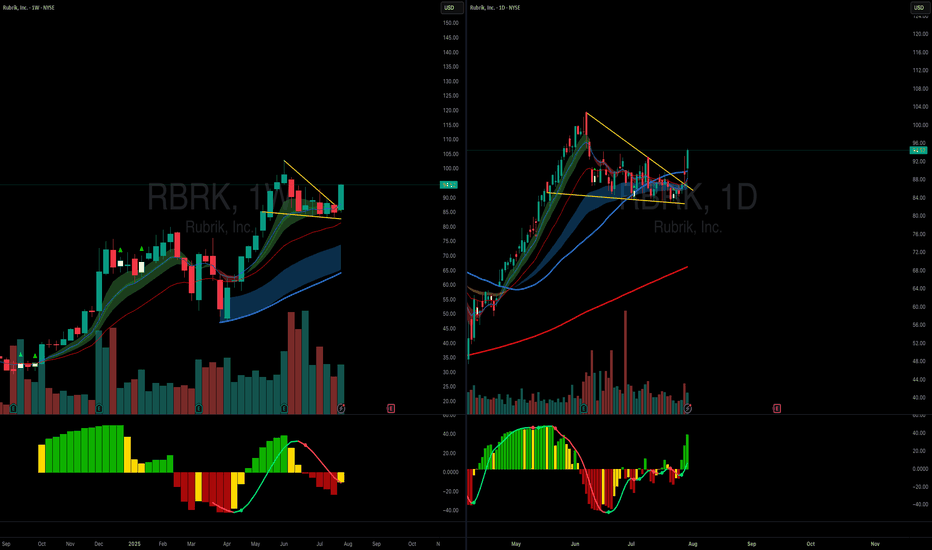

NYSE:RBRK broke out of this pennant, and I was late to enter this position, positing this as a journal entry. I half sized as the ideal entry was at 87 (91.5 for me) but looks really good here with seeking alpha showing great growth metrics targets: 100 (psych), 110

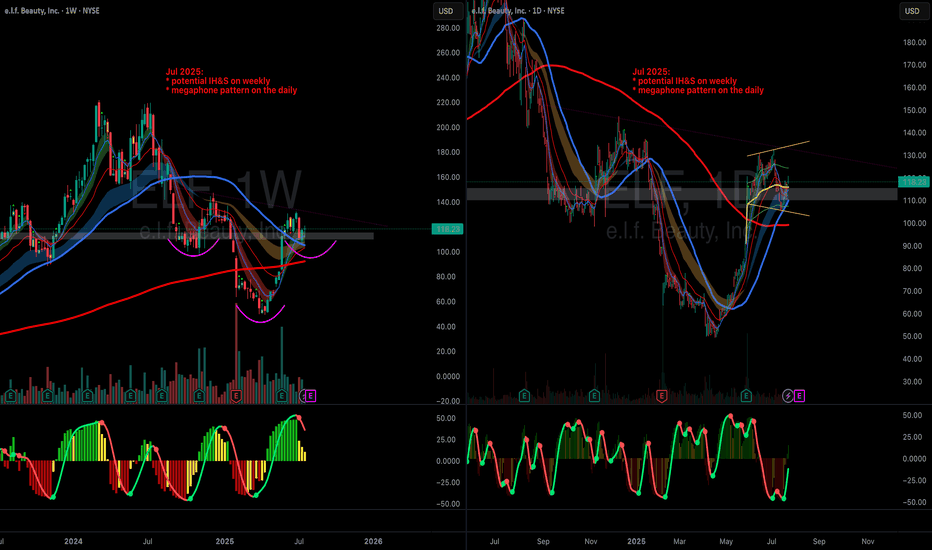

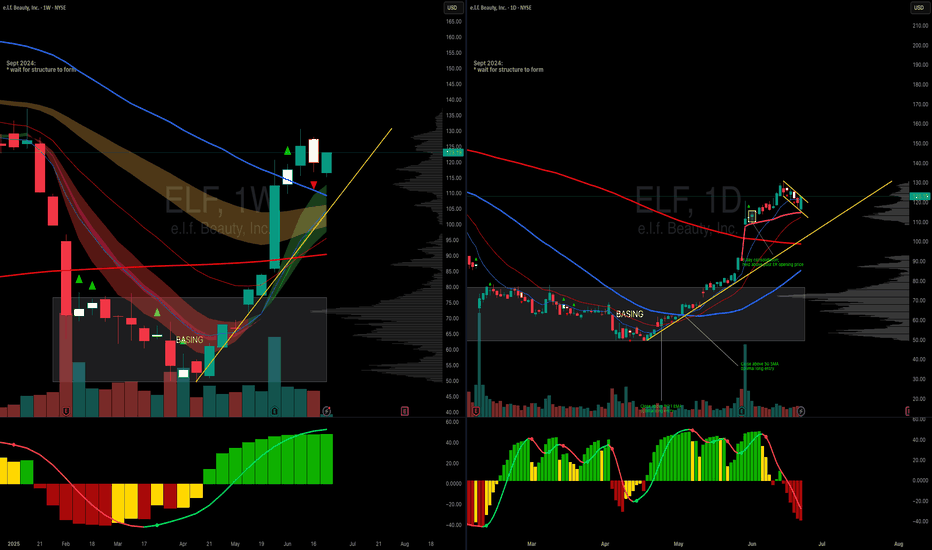

NYSE:ELF bounced off of the 50 DSMA and inside a megaphone pattern on daily. Also, looking at the weekly, there is an Inverse head and shoulder pattern in the making with the current price action forming the right shoulder... Looking for a continuation move higher here... targets 140 & 150

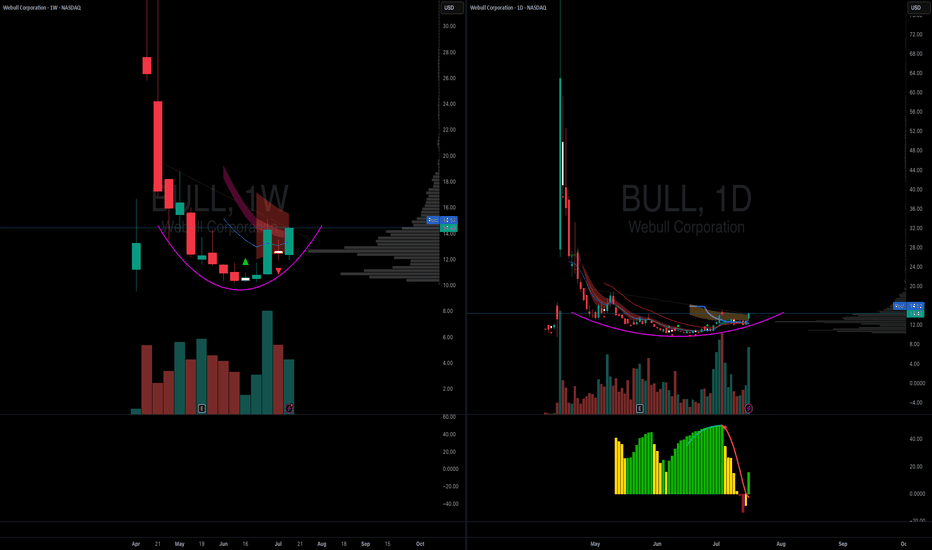

NASDAQ:BULL has a rounding base and a cranked inverted head and shoulders on the4 hour this is a recent IPO looks ready to go

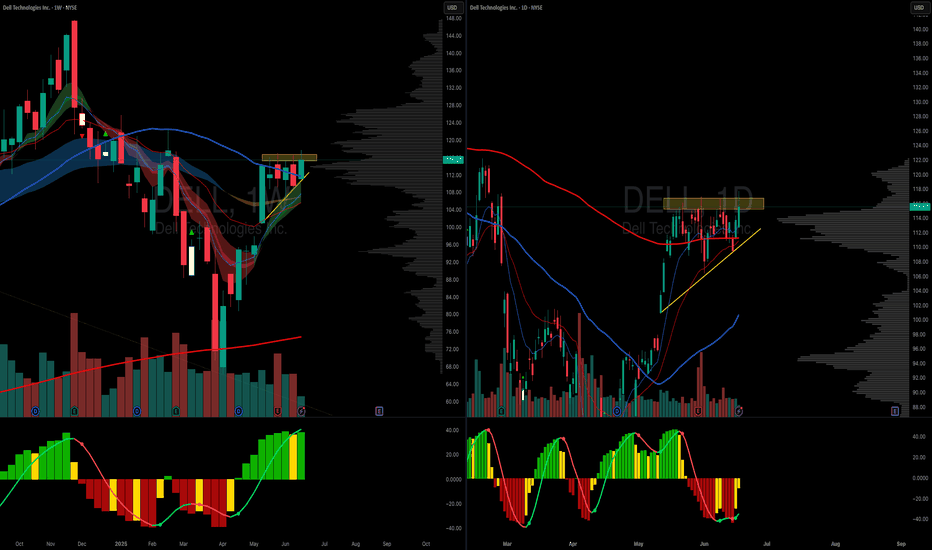

NYSE:DELL looks ready to go 4 weeks of tight price action with higher lows AI infra has been hot and dell is a key player nuff said

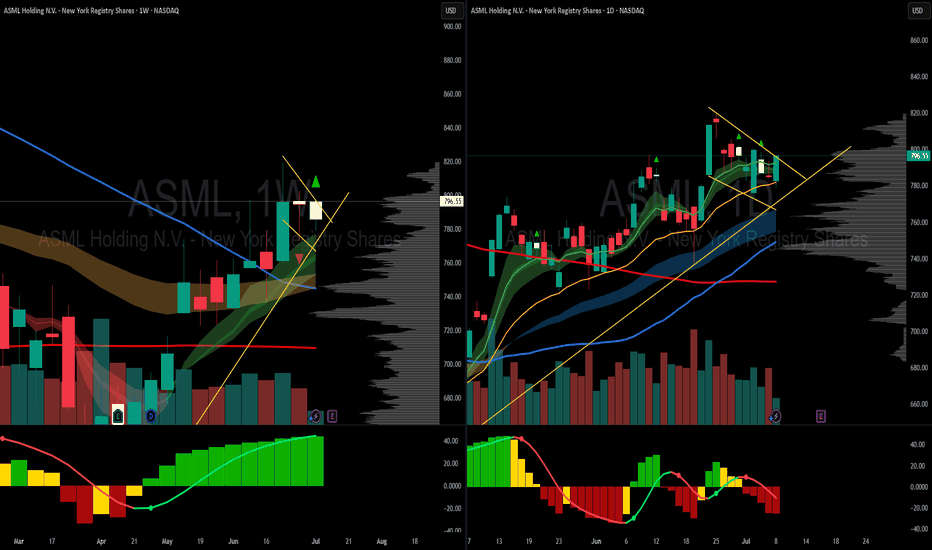

NASDAQ:ASML looks ready to go with a bull flag and a double inside week, semis are strong as a sector and it is a monopoly business... pretty good long term hold also

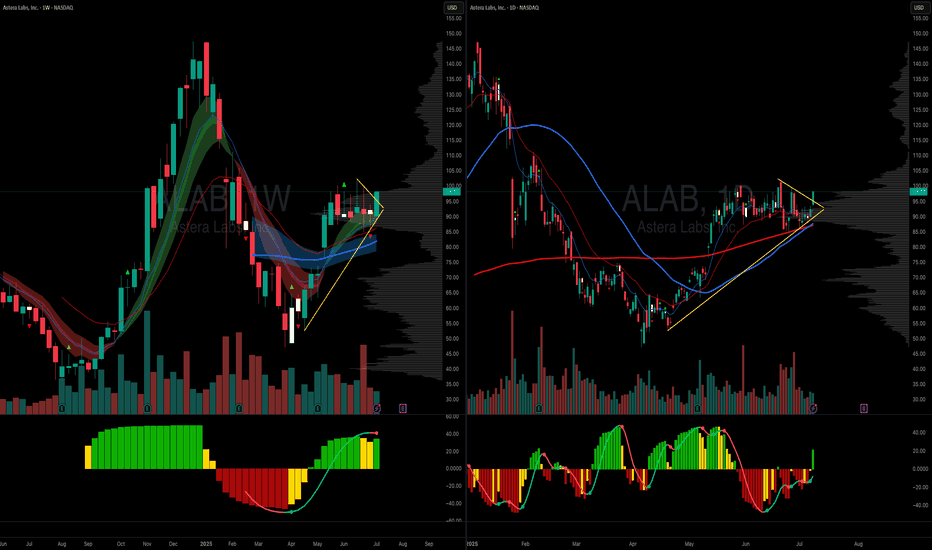

NASDAQ:ALAB is breaking out today out of this symmetric triangle, could be a big mover... Semi sector has been strong and ALAB has been lagging quite a bit, let it catch up

NASDAQ:UPST is ready to go... forming an inverted head and shoulder on the daily and testing the neckline. nuff said

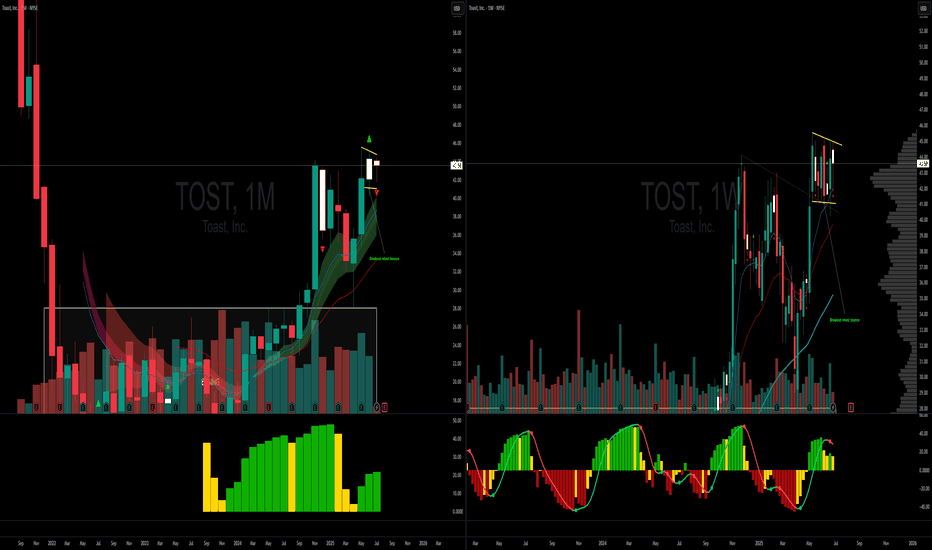

NYSE:TOST this has given so many chances to enter while still maintaining this flag, currently a double inside month and creating a tight flag here can still enter here for a good risk reward, since the price has not gone anywhere, the IV on the options will be relatively lower and any increase in IV would mean your options gain value, has earnings coming up...

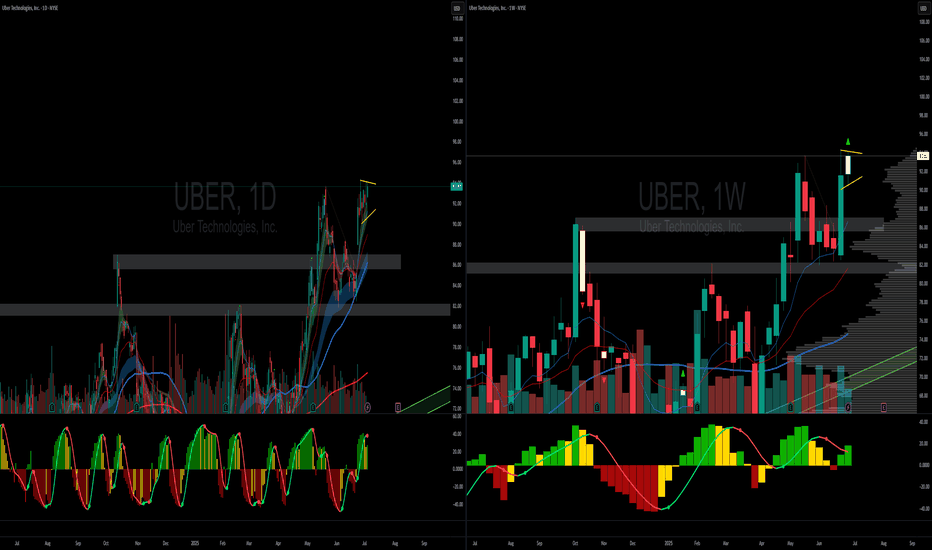

NYSE:UBER beautiful inside week here close to ATs and could see 100 in a few weeks

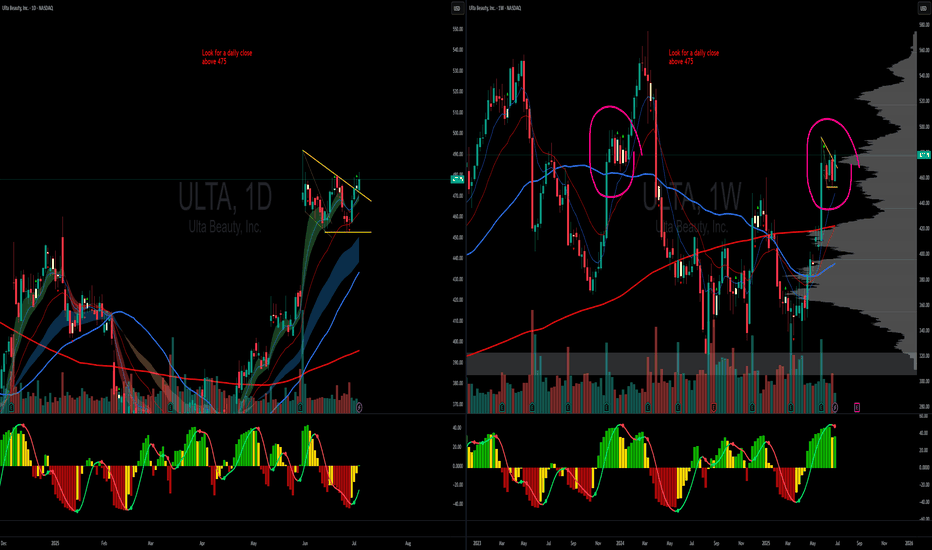

NASDAQ:ULTA has been frustrating to wait for but might be ready to go forming a consolidation similar to what it did in end of 2023, and could go way above 500 if it follows through less taxes on tips means those ladies will have more money to spend on makeup and ULTA will profit from it stops would be a weekly close below the 9 EMA or 2 daily closes below the 21 EMA

NYSE:ABBV has tested my patience has been in a downtrend for a while now and has finally broken out, is now above all MAs on the daily and above 50 SMA on the weekly 193 is a high volume node to cross and after that there is not much volume targetting 200 ER coming up and expecting a very good quarter and guidance

NYSE:ELF in a tight flag as it makes a bullish engulfing candle on the daily and bounces off of the Earnings AVWAP flag break sends it to 140 imo

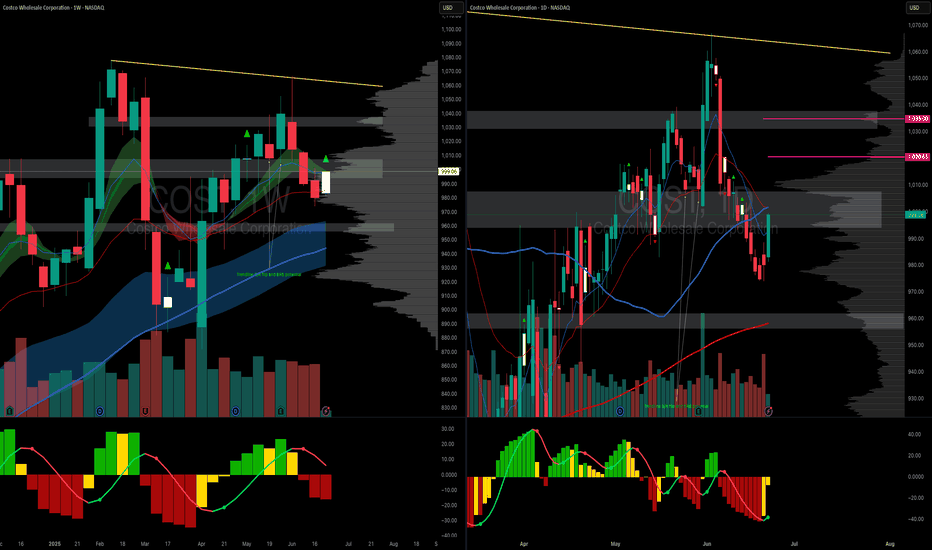

NASDAQ:COST finally seems to be turning around if it closes above the 21 EMA and 50 SMA on the daily, it can go back to ATHs will initiate a position at 1000 and stop at 990/980 depending on size current targets are 1020 & 1035

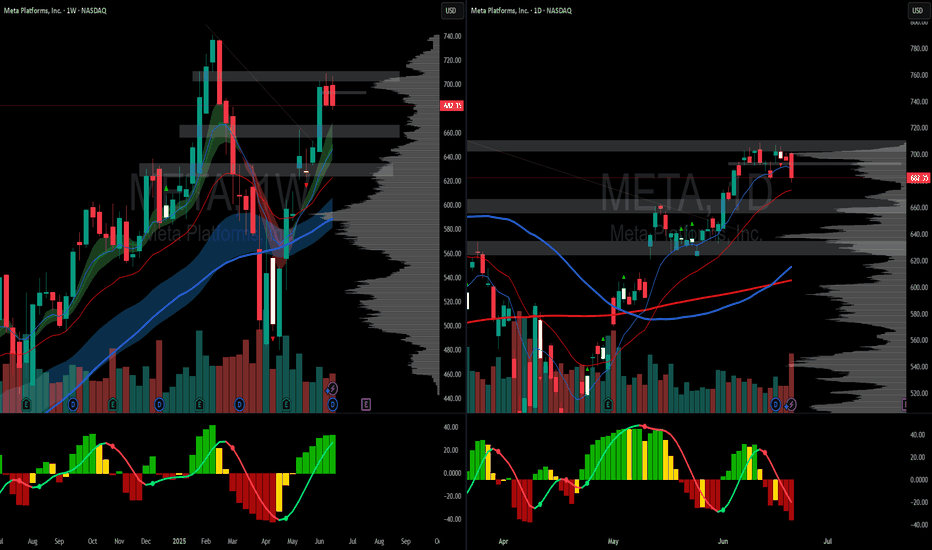

Traded from that flag consolidation and was able to make some money on it. now NASDAQ:META looks like a double top on the daily but very bullish chart and can be added back between 660-665 that's it

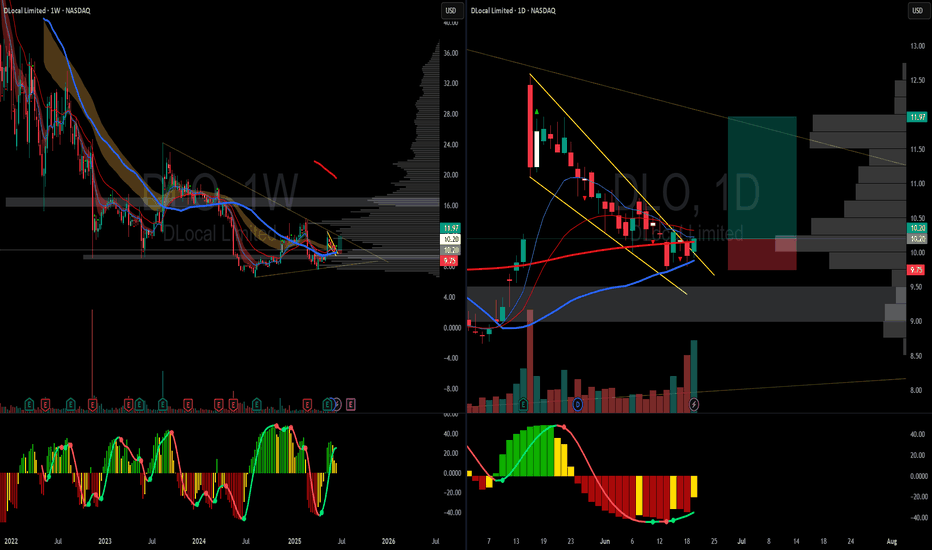

NASDAQ:DLO looks like it is ready to head back higher. Broke out of the falling wedge and has a very defined risk (exit when it closes below 9.75) Has had good upgrades from analysts recently as well