Trading Idea: NASDAQ:ZM (Zoom Video Communications) - Long Setup 🎯 Idea: LONG ⏰ Timeframe: Daily 📊 Pattern: Bullish Breakout + Momentum Continuation Fundamental Context: Fundamental Score: 5/9 (Neutral). Growth: Strong Net Income Growth YoY. Balance Sheet: Excellent (Debt Score: 10/10). Zero debt. Valuation: Fairly Valued on P/E and P/B; Overvalued on...

Trading Idea: NYSE:AOS (A. O. Smith Corporation) - Long Setup 🎯 Idea: LONG ⏰ Timeframe: Daily 📊 Pattern: Bullish Structure Hold + Momentum Build Fundamental Context: Fundamental Score: 3/9 (Neutral). Stable but not strong growth. Valuation: Fairly Valued based on P/E; Overvalued on P/B and P/S. Debt Management: Excellent (Debt Score: 10/10). Very strong...

Trading Idea: NASDAQ:LRCX (Lam Research) - Long Setup 🎯 Idea: LONG ⏰ Timeframe: Daily + 4H for entry 📊 Pattern: Pullback into Support in a Bullish Trend Fundamental Catalyst: Strong Fundamental Score: 7/9 Growth: Strong YoY Revenue & Earnings Growth Balance Sheet: Excellent Debt Management (Debt Score: 10/10) Technical Setup: Trend (D1): Bullish ✅ Entry...

Ticker: NTAP (NASDAQ: NTAP) Strategy: Swing Trade / Position Trade Timeframe: Daily & 4H 📈 Trade Idea: LONG Entry: $115.91 (Breakout confirmation above recent resistance) Stop Loss: $107.91 (Below support and 20-period SMA) Take Profit: $131.38 (Measured move + R:R = 1:2) Risk/Reward Ratio: 1:2 🎯 Technical Justification: Trend: Strong bullish alignment across...

Ticker: ATAT (NYSE) Timeframe: Daily & 4H Strategy: Swing Trade / Position Trade 📈 Trade Idea: LONG Entry: $39.08 (Breakout confirmation above consolidation) Stop Loss: $34.47 (Below key support and 50-period SMA) Take Profit 1: $44.50 Take Profit 2: $48.19 (1:2 R:R Target) Risk/Reward Ratio: 1:2 🎯 Technical Rationale: Trend: Strong bullish alignment across...

🎯 Trade: Long (Buy) 📊 Timeframe: Daily (D1) / Swing Trade (5-10 days) 💰 Entry: $11.65 (Current level + RSI2 confirmation) 🛑 Stop Loss: $10.77 (Below key support & SMA 20) 🎯 Take Profit: $13.62 (Resistance zone + R:R 1:2) 📉 Risk/Reward Ratio: 1 : 2.0 🔍 Technical Analysis ✅ RSI2 Momentum Signal: RSI2 Connors Strategy triggered a "Buy signal" on Aug 18-19,...

🎯 Trade: Long (Buy) 📊 Timeframe: Daily (D1) / Swing Trade 💰 Entry: $48.11 (Breakout above recent resistance) 🛑 Stop Loss: $42.43 (Below key support & SMA 50) 🎯 Take Profit: $62.22 (Previous high & extended target) 📉 Risk/Reward Ratio: 1 : 2.5 🔍 Technical Analysis ✅ Strong Uptrend Confirmed: Price is in a clear uptrend across all major timeframes (Daily, 4H,...

🎯 Trade: Long (Buy) 📊 Timeframe: Daily (D1) / Swing Trade 💰 Entry: $55.05 (Pullback to support & value zone) 🛑 Stop Loss: $52.53 (Below recent swing low & SMA confluence) 🎯 Take Profit: $60.45 (Previous resistance & measured move target) 📉 Risk/Reward Ratio: 1 : 2.1 🔍 Technical Analysis ✅ Trend Structure: Primary Trend: Bullish. Price is holding above key rising...

🎯 Trade: Long (Buy) 📊 Timeframe: Daily (D1) / Swing Trade (Pre-Earnings) 💰 Entry: $5.80 (Breakout above consolidation) 🛑 Stop Loss: $5.14 (Below key support & SMA 50) 🎯 Take Profit: $7.46 (Major resistance zone) ⏰ Catalyst: Earnings Date: August 27, 2025 📉 Risk/Reward Ratio: 1 : 2.5 🔍 Technical & Catalyst Analysis ✅ Strong Uptrend Intact: Price is in a clear...

🎯 Trade: Long (Buy) 📊 Timeframe: Daily (D1) 💰 Entry: $21.96 (dynamic support zone) 🛑 Stop Loss: $20.30 (below SMA 50 & recent swing low) 🎯 Take Profit 1: $23.50 (previous resistance) 🎯 Take Profit 2: $25.30 (all-time high + Fibonacci extension) 🔍 Technical Analysis ✅ Uptrend Confirmed: Price above SMA 20 (20.31) and SMA 50 (20.55), confirming bullish...

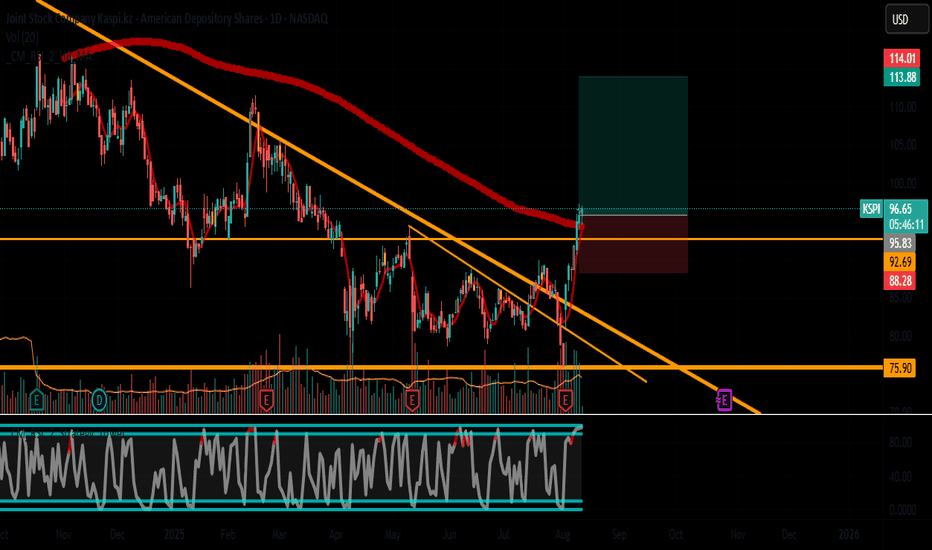

📈 Trade Setup Symbol: KSPI (Kansas City Southern Pacific) Timeframe: Daily Strategy: Breakout + Fundamental Momentum Entry: $96.82 (above consolidation high) Stop Loss: $88.28 (8.8% risk, below SMA 50 & swing low) Take Profit: $114.01 (+17.8% reward) Risk/Reward: 1:2 🔥 Why KSPI? 1. Technical Strength: Breakout from 3-week consolidation ($90-$96 range) Volume...

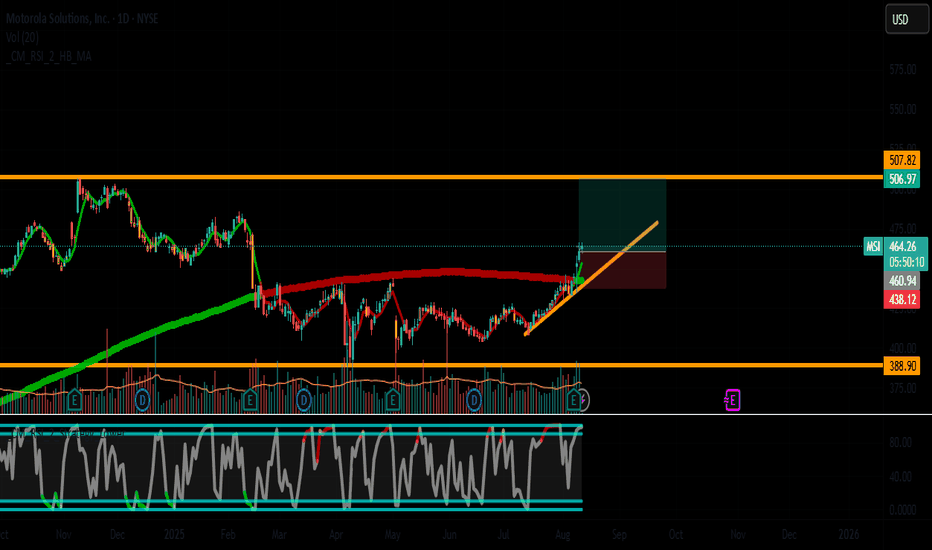

TradingView Idea: MSI (Motorola Solutions) – Technical Breakout with Fundamental Context 📈 Trade Setup Symbol: MSI (NYSE) Timeframe: Daily Entry: $465 (breakout above consolidation) Stop Loss: $439 (below 50-day SMA) Take Profit: $507.8 (measured move target) Risk/Reward: 1:1.6 (5.6% risk | 9.2% reward) 🔍 Technical Analysis Price Action: Consolidating between...

GSL (Global Ship Lease, Inc.) - Undervalued Container Shipping Play with Strong Technicals Symbol: GSL (NYSE) | Sector: Marine Shipping | Market Cap: $1.1B 🚢 Trade Setup (Daily Chart) Entry: $30.76 Near cluster support (50-day EMA + horizontal $30.50 level) Confirm with bullish candle/volume surge Stop Loss: $27.80 (-9.6%) Below 200-day SMA and July swing...

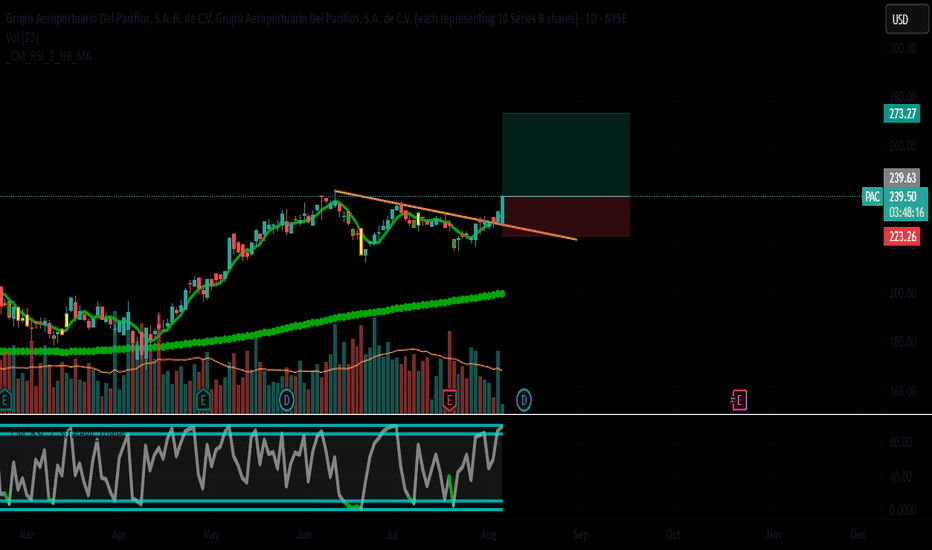

Symbol: PAC (NYSE) Timeframe: Daily Strategy: Breakout with Measured Move Target Risk: 6.7% | Reward: 14.2% | RRR: 1:2.1 📈 Trade Setup Entry: $239.4 Trigger: Break above descending trendline resistance (from May 2025 highs) Confirmation: Close above $240 with above-average volume Stop Loss: $223.26 Just below the 200-day SMA and recent swing low (strong...

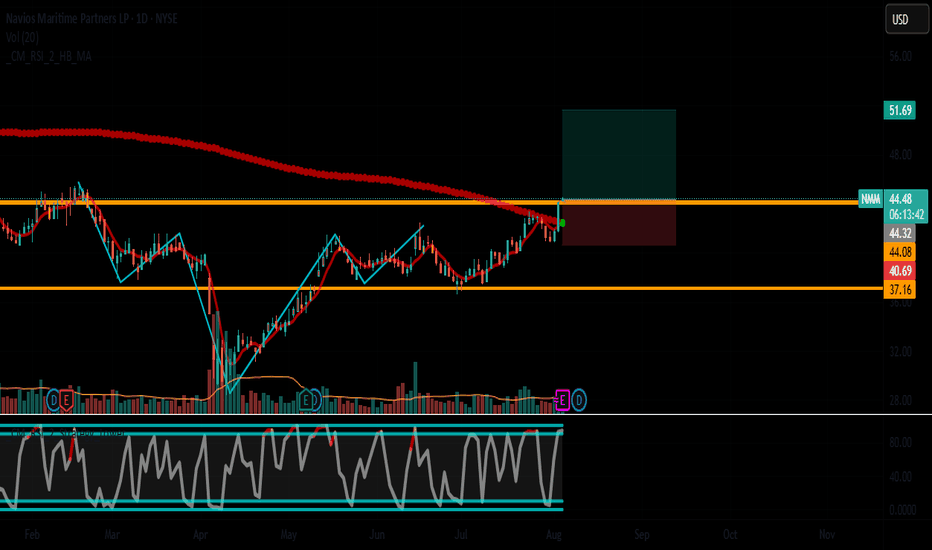

🚀 Trade Idea: NMM (Navios Maritime Partners LP) - Bullish Shipping Play with Strong Upside 📈 Trading Setup Entry: $44.35 (Breakout above consolidation) Stop Loss: $40.70 (8.2% risk) Take Profit: $51.70 (+16.5% upside) Risk/Reward Ratio: 1:2 🔍 Why NMM Now? ✅ Fundamental Catalysts Shipping Rates Recovery: Baltic Dry Index up 22% MTD Dividend Yield: 3.8% (Paid...

🚀 Trade Idea: SFD (Smithfield Foods, Inc.) - Reversal Play with Measured Upside 📈 Trading Setup Entry: $25.00 (Break of descending trendline) Stop Loss: $23.74 (Below recent swing low) Take Profit: $27.55 (+10.2% upside) Risk/Reward Ratio: 1:2.1 🔍 Why SFD Now? ✅ Fundamental Drivers Protein Demand Recovery: Post-pandemic foodservice rebound Margin...

🚀 Trade Idea: LRCX (Lam Research) - RSI2 Connors Strategy Setup Entry: $98.59 Stop Loss (SL): $89.34 (~9.4% risk) Take Profit (TP): $117.29 (~19% upside) Risk-Reward Ratio: 1:2 📈 Trade Rationale RSI2 Connors Buy Signal Triggered LRCX hit an RSI2 ≤ 10 (oversold) on July 31, generating a high-probability buy signal per Connors' mean-reversion...

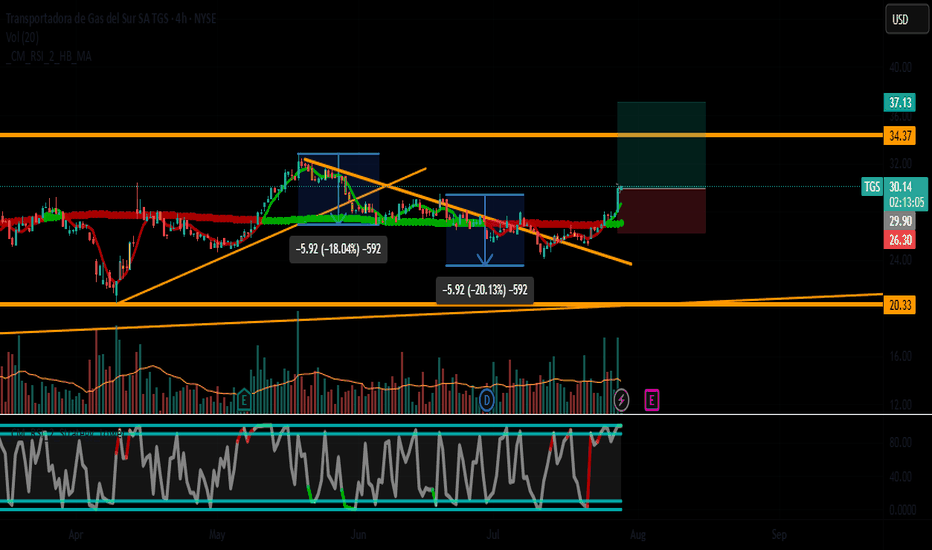

🚀 Trade Idea: TGS (TGS Ltd.) – Breakout Play with Strong Upside Potential 📈 Entry: $29.90 (Breakout above resistance) 🛑 Stop Loss: $26.30 (Below key support & SMA-50) 🎯 Take Profit: $37.13 (~24% upside, near next resistance zone) 📊 Risk-Reward Ratio: 1:3 (Favorable setup) 🔍 Analysis Breakdown 📊 Technical Setup Trend: Daily trend is consolidating, but 4H/1H show...