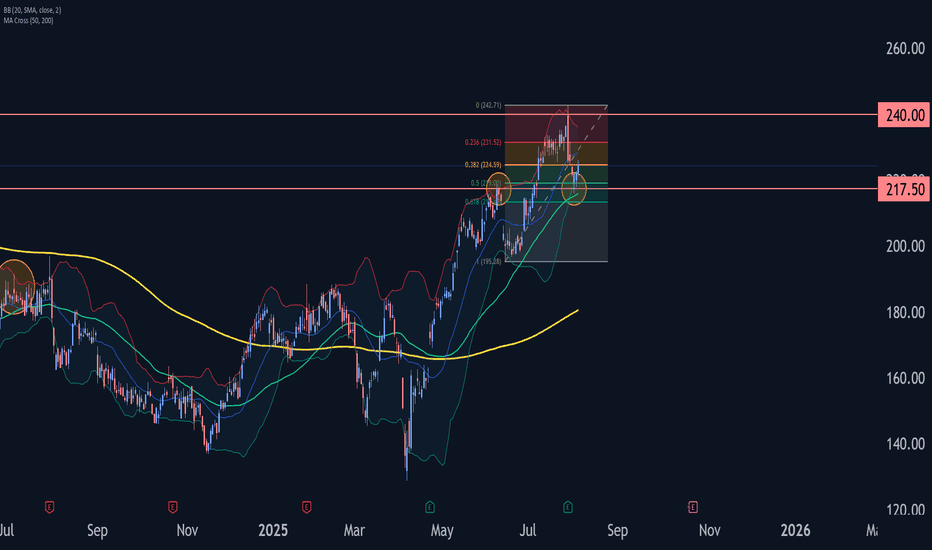

Boeing Wave Analysis – 5 August 2025- Boeing reversed from the support zone

- Likely to rise to resistance level 230.00

Boeing recently reversed up from the support zone between the pivotal support level of 217.50 (former top of wave 1 from June) and the lower daily Bollinger Band.

This support zone was further strengthened by the 5

The best trades require research, then commitment.

Get started for free$0 forever, no credit card needed

Scott "Kidd" PoteetThe unlikely astronaut

Where the world does markets

Join 100 million traders and investors taking the future into their own hands.

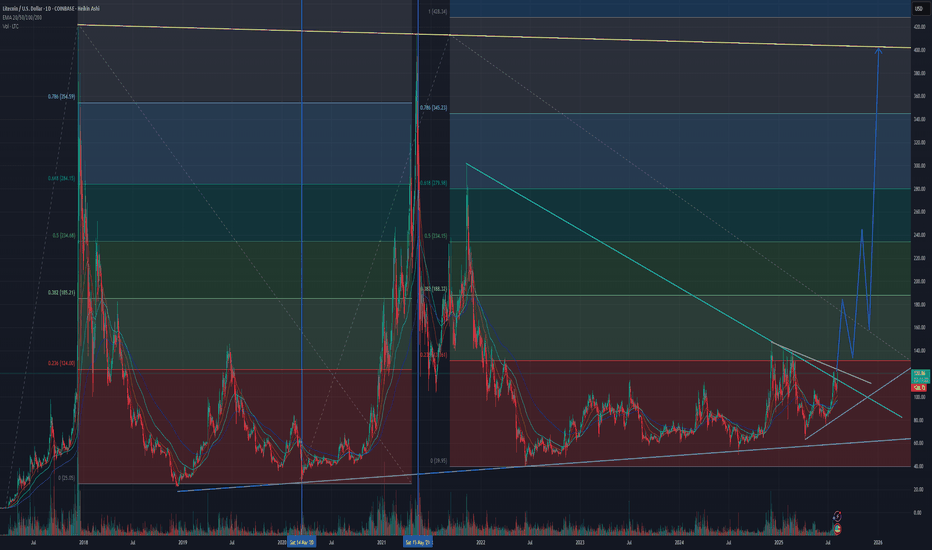

Why Litecoin is my #1 pick right nowObserving the price action between the two vertical blue lines (the '20 to '21 bull cycle), and comparing to the trend based fib extension levels on the left, we have a blueprint for the fib levels that LTCUSD responds to. At the .236 fib, a 24% pullback. At the .382 a 36% pullback. At the .5 a 38%

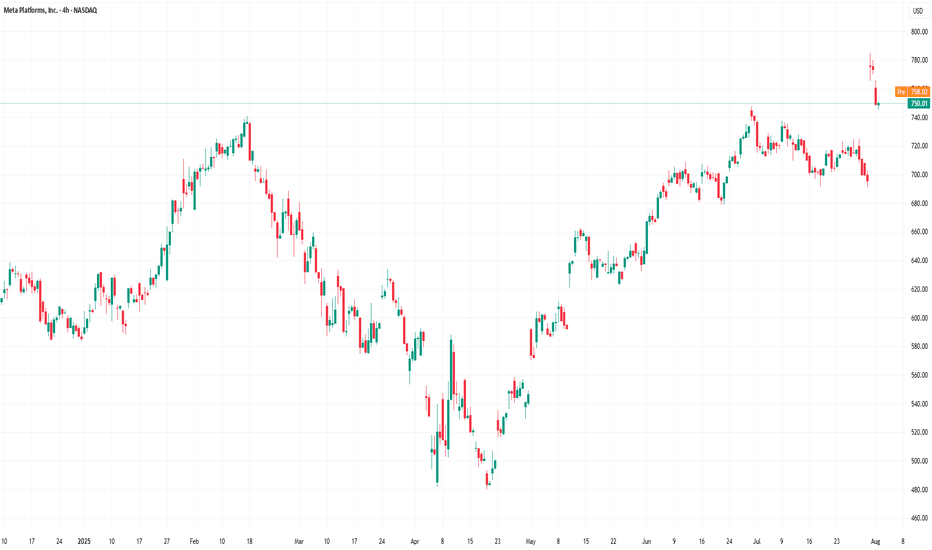

Meta Platforms (META) Shares DeclineMeta Platforms (META) Shares Decline

Shares of the US tech giant Meta Platforms (META) hit a record high last week, climbing above $780 following the release of a strong earnings report:

→ Earnings per share (EPS) came in at $7.14, significantly exceeding the forecast of $5.88.

→ The company also

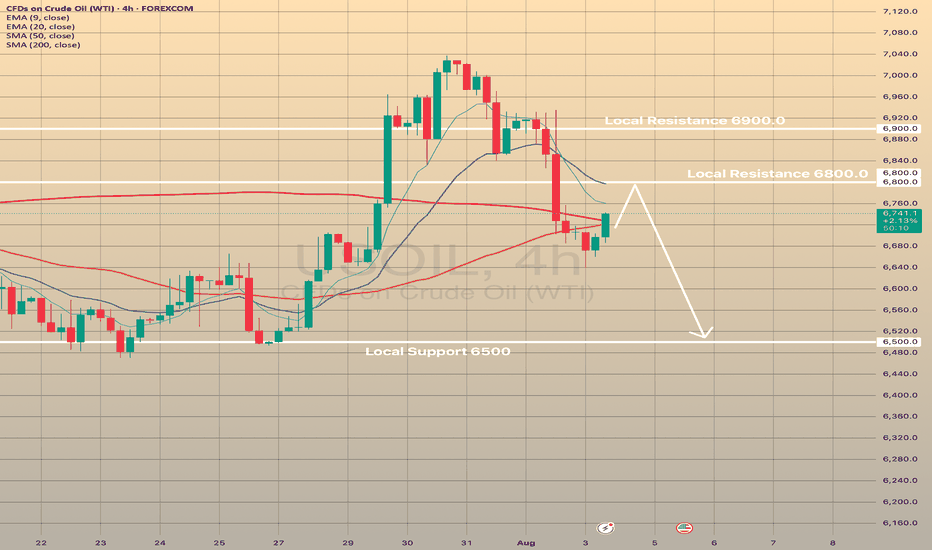

USOIL declines for the 3 days in a row. What's next?USOIL declines for the 3 days in a row. What's next?

Since the last post the USOIL has already declined on 2.5%, currently rebounding from SMA50 on 4-h chart. 2 main reasons are behind this.

On August 3, the Organization of the Petroleum Exporting Countries and their partners, collectively known

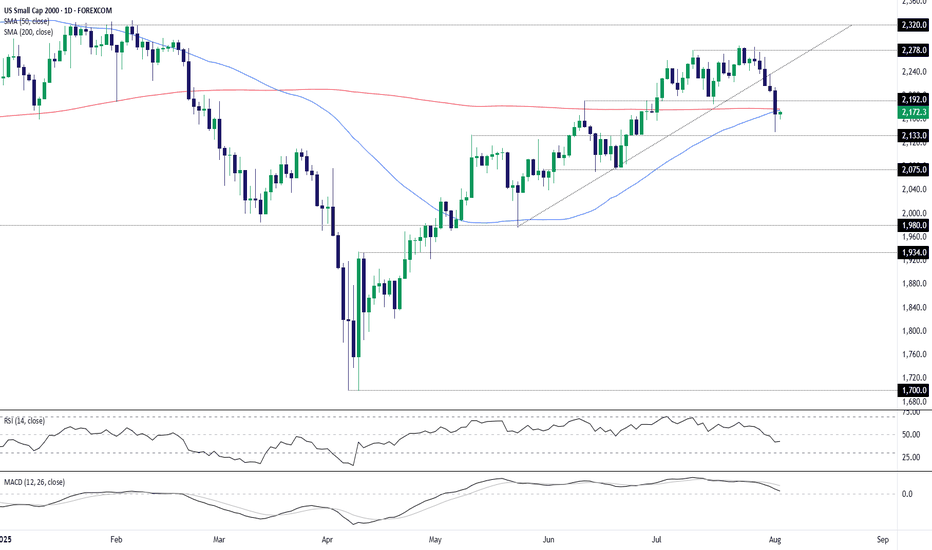

Small Caps: Rebound or rollover at 200DMA?Near-term price action in U.S. small-cap stocks may be instructive for assessing longer-term directional risks, with the contract trading near the key 200-day simple moving average.

Despite breaking uptrend support and extending the bearish move late last week, buying dips remains the preferred str

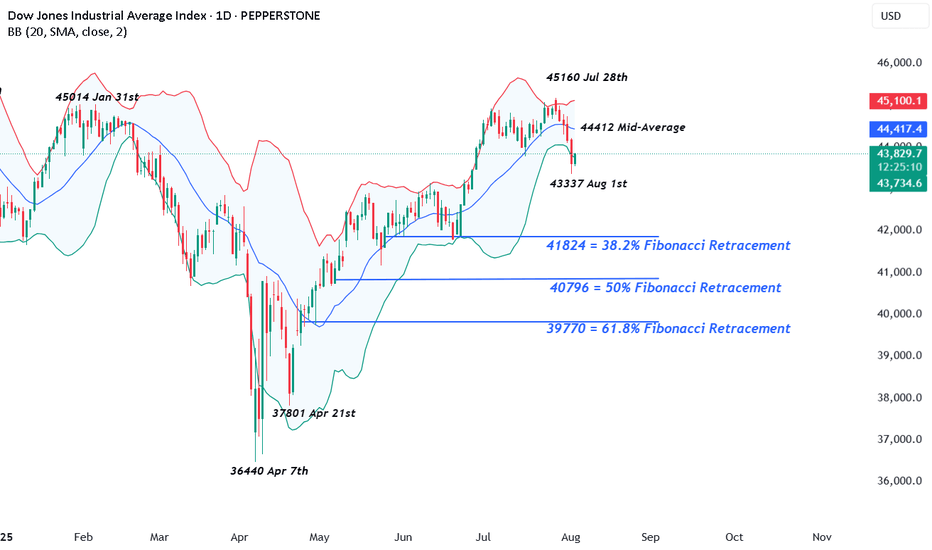

US 30 Index – Potential Rebound or Deeper Retracement Ahead?Just as the US 30 became the last of the three major US indices to register a new all time high last Monday at 45160, on a final wave of positivity generated by the announcement of a trade deal between the US and EU, it was snatched away again as traders used the up move to take profit on longs.

Figma Stock Goes Parabolic in Market Debut — Should You Buy?Figma stock NYSE:FIG more than tripled on IPO day. But that’s not thanks to the Figma guys — they had agreed to sell the company to Adobe NASDAQ:ADBE just two years ago.

Figma stock NYSE:FIG made a spectacular entrance into public markets last week — and then some. Shares of the design softw

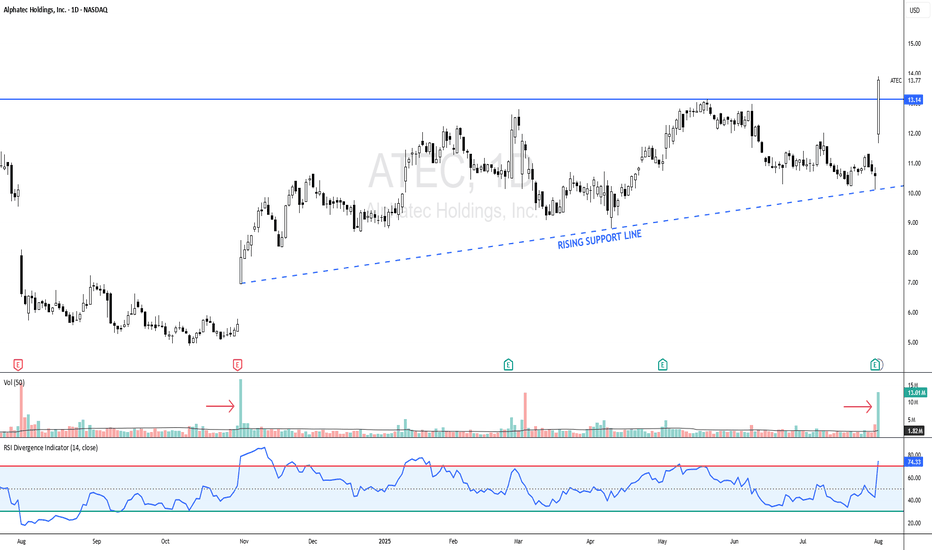

ATEC - NEW 52-WEEK HIGHATEC - CURRENT PRICE : 13.77

ATEC made a new 52-week high last Friday with burst in trading activity. Look at the volume pointed by red arrows. On 31 Oct 2024 there was a significant gap up with high volume, from there the stock continue rises - indicating strong buying interest. Now same scenario

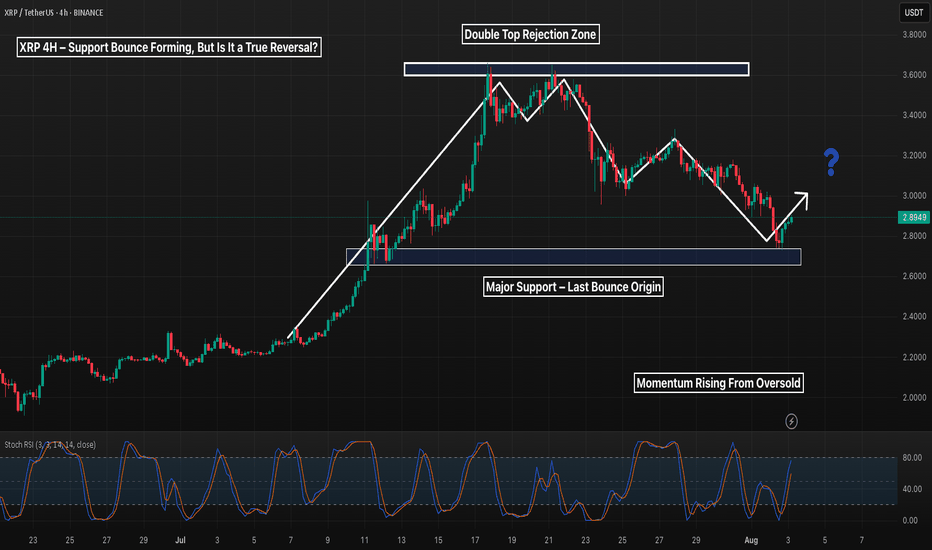

XRP 4H – Double Bottom… or Just Another Lower High?

XRP bounced cleanly from major support — the same zone that sparked its last leg up.

This could mark the early stages of a double bottom or just another bear market rally before continuation.

🔹 Previous top = strong supply rejection

🔹 Current support = high-volume bounce zone

🔹 Stoch RSI turning

See all editors' picks ideas

Trading Report Generator from CSVMany people use the Trading Panel. Unfortunately, it doesn't have a Performance Report. However, TradingView has strategies, and they have a Performance Report :-D

What if we combine the first and second? It's easy!

This script is a special strategy that parses transactions in csv format from Paper

Smart Money Breakout Channels [AlgoAlpha]🟠 OVERVIEW

This script draws breakout detection zones called “Smart Money Breakout Channels” based on volatility-normalized price movement and visualizes them as dynamic boxes with volume overlays. It identifies temporary accumulation or distribution ranges using a custom normalized volatility me

Trend Range Detector (Zeiierman)█ Overview

Trend Range Detector (Zeiierman) is a market structure tool that identifies and tracks periods of price compression by forming adaptive range boxes based on volatility and price movement. When prices remain stable within a defined band, the script dynamically draws a range box; when p

BE-Indicator Aggregator toolkit█ Overview:

BE-Indicator Aggregator toolkit is a toolkit which is built for those we rely on taking multi-confirmation from different indicators available with the traders. This Toolkit aid's traders in understanding their custom logic for their trade setups and provides the summarized results o

Synthetic VX3! & VX4! continuous /VX futuresTradingView is missing continuous 3rd and 4th month VIX (/VX) futures, so I decided to try to make a synthetic one that emulates what continuous maturity futures would look like. This is useful for backtesting/historical purposes as it enables traders to see how their further out VX contracts would'

Intrabar Efficiency Ratio█ OVERVIEW

This indicator displays a directional variant of Perry Kaufman's Efficiency Ratio, designed to gauge the "efficiency" of intrabar price movement by comparing the sum of movements of the lower timeframe bars composing a chart bar with the respective bar's movement on an average ba

Strategy█ OVERVIEW

This library is a Pine Script™ programmer’s tool containing a variety of strategy-related functions to assist in calculations like profit and loss, stop losses and limits. It also includes several useful functions one can use to convert between units in ticks, price, currency or a per

Signs of the Times [LucF]█ OVERVIEW

This oscillator calculates the directional strength of bars using a primitive weighing mechanism based on a small number of what I consider to be fundamental properties of a bar. It does not consider the amplitude of price movements, so can be used as a complement to momentum-based osc

Estimated Time At Price [Kioseff Trading]Hello!

This script uses the same formula as the recently released "Volume Delta" script to ascertain lower timeframe values.

Instead, this script looks to estimate the approximate time spent at price blocks; all time estimates are in minute.second format.

The image above shows functionality.

Volume Profile, Pivot Anchored by DGTVolume Profile (also known as Price by Volume ) is an charting study that displays trading activity over a specified time period at specific price levels. It is plotted as a horizontal histogram on the finacial isntrumnet's chart that highlights the trader's interest at specific price levels. Specif

See all indicators and strategies

Community trends

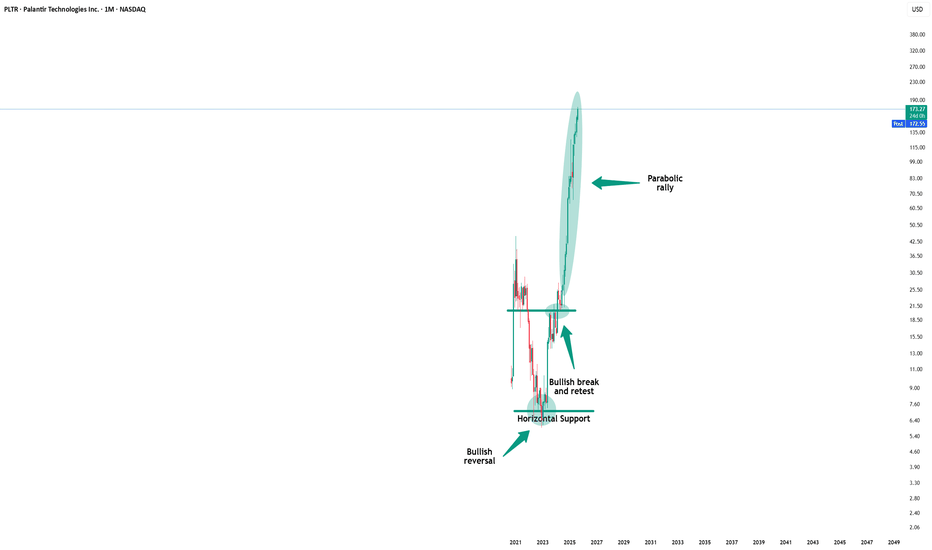

Palantir - The unstoppable company!💣Palantir ( NASDAQ:PLTR ) is just too strong:

🔎Analysis summary:

Since mid 2022, Palantir managed to rally more than 2.500%, creating new all time highs every single month. Eventually this rally will slow down, but before this happens, Palantir could rally another +100%. This is a classic exa

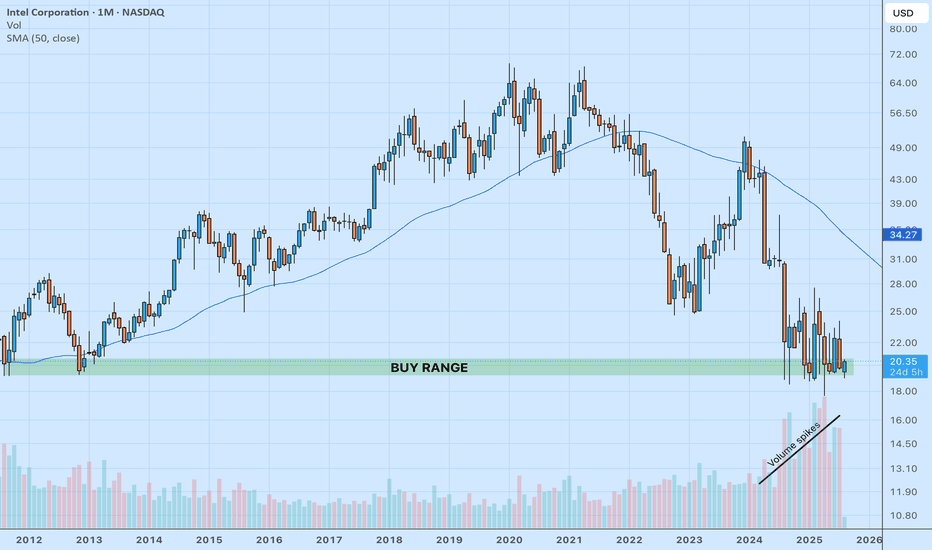

$INTC - Best in the sector against Trump tariffsIntel is a semiconductor technology giant, renowned for its x86 processors that dominate the CPU segment, top revenue in Q2 2025 came from PC chips (Client Computing Group, ~$7.9B) and server/AI chips (Data Center & AI, ~$3.9B) . Other revenue includes foundry services ($4.4B) and legacy businesses

Boeing Wave Analysis – 5 August 2025- Boeing reversed from the support zone

- Likely to rise to resistance level 230.00

Boeing recently reversed up from the support zone between the pivotal support level of 217.50 (former top of wave 1 from June) and the lower daily Bollinger Band.

This support zone was further strengthened by the 5

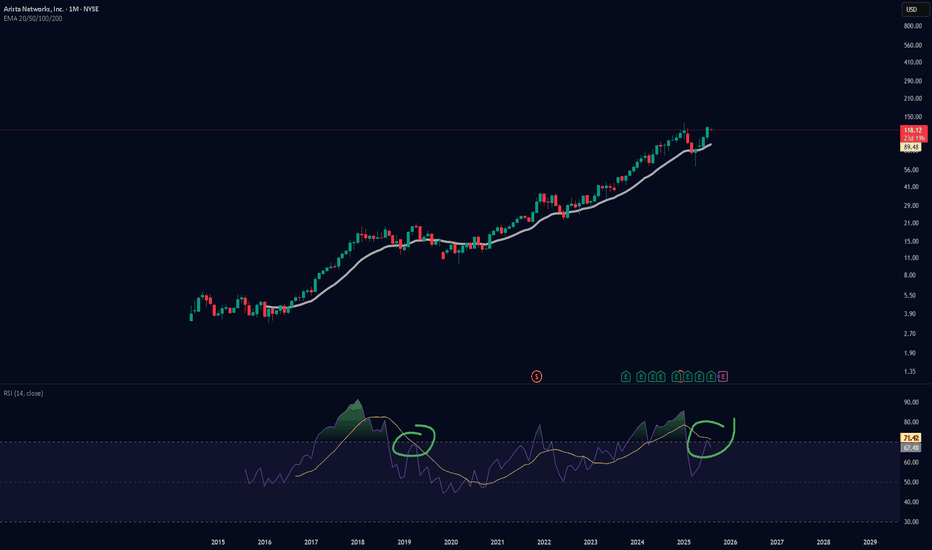

ANET top tomorrowSame pattern as April 2019. Chart tops out, drops really hard, market decides to not pay shorts and rebounds incredibly strongly. Chart forms new high which eliminates the shorts and gets the market thinking bull bull bull and then it proceeds to sell off. I think the top for ANET will happen tomorr

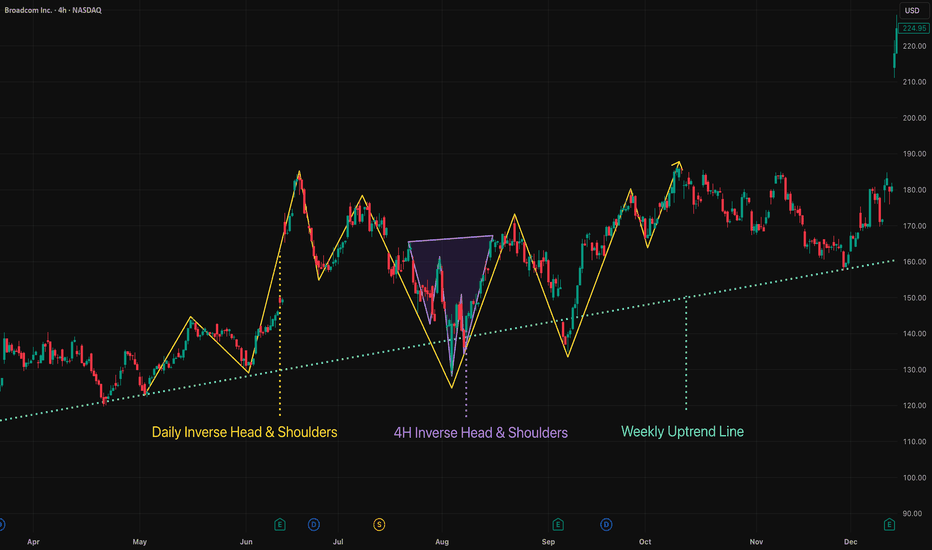

How to Identify a Head and Shoulders Pattern on TradingViewTo effectively trade the head and shoulders pattern, there are a few factors to consider. If you don’t have an Alpaca account but have a TradingView account, you can sign up for an Alpaca account.

Multiple Time Frame Analysis

Analyze the chart on different time frames—such as 4-hour, daily, and wee

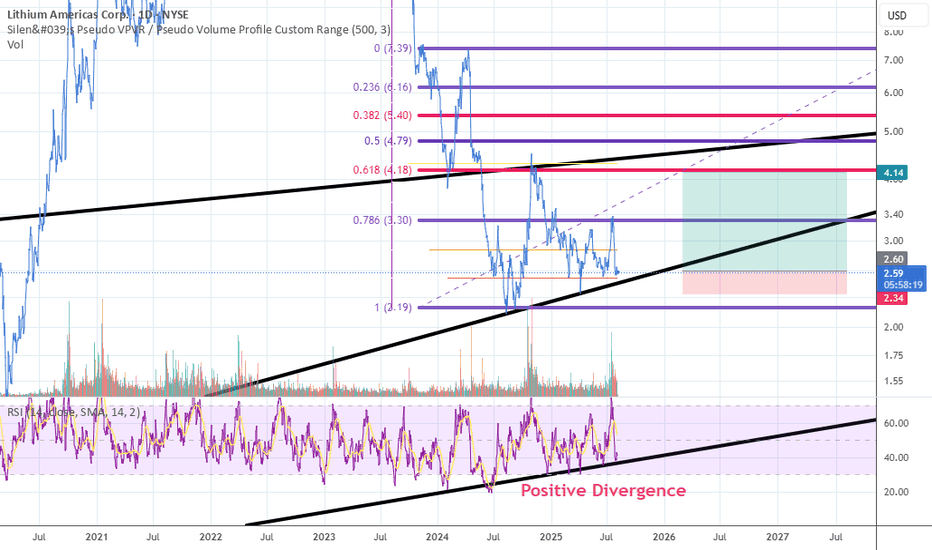

The trend line suggests that an upward move is likely soonIt looks like taking some profits around the 0.786 level (around 3.3) and 0.618 (around 4.18) could be a good move. As for the stop-loss, the previous low near 2.34 makes sense, which is about a 10% downside.

The trend line connecting the lows has been in place since way back in 2012, forming a lon

SMCI Earnings Setup: Big Miss Incoming? Put Flow Exploding

### 🧨 SMCI Earnings Setup: Big Miss Incoming? Put Flow Exploding 🚨

📆 **Earnings Date:** Aug 5, 2025 (After Market Close)

💣 **Sentiment:** **Moderate Bearish** — 72% conviction

💬 **Why?**: Weak margins, cash burn, heavy put activity, and bearish technicals.

---

### 🔍 Quick Breakdown:

📉 **Fundame

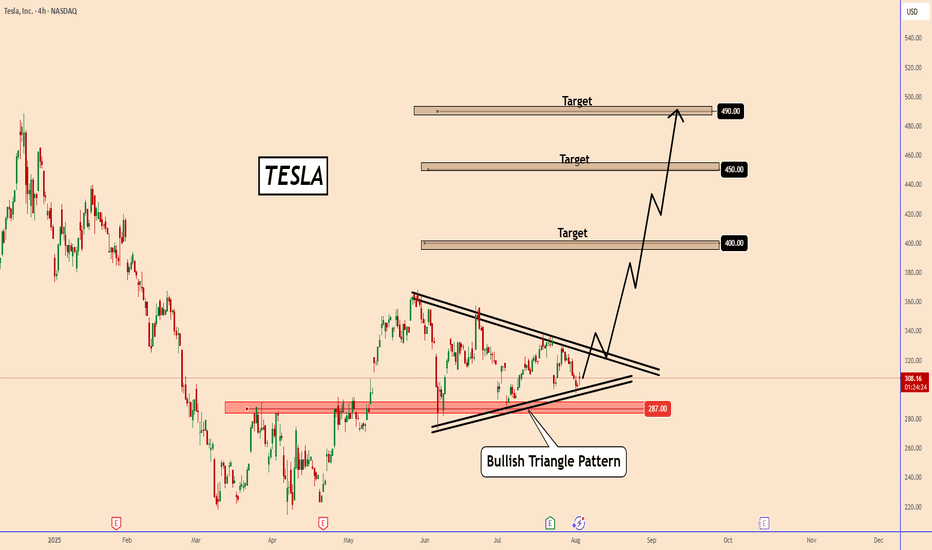

Tesla Builds Momentum - Can It Reach $490?Tesla Builds Momentum - Can It Reach $490?

From a technical perspective, Tesla is showing signs of volume accumulation and appears to be forming a contracted triangle pattern.

The price seems to have found solid support around 287, suggesting this corrective phase might be nearing its end.

If

See all stocks ideas

Today

OTFBlue Owl Technology Finance Corp.

Actual

—

Estimate

0.33

USD

Today

WIXWix.com Ltd.

Actual

2.28

USD

Estimate

1.75

USD

Today

CCEPCoca-Cola Europacific Partners plc

Actual

2.38

USD

Estimate

2.41

USD

Today

ACMRACM Research, Inc.

Actual

0.54

USD

Estimate

0.49

USD

Today

EVTLVertical Aerospace Ltd.

Actual

−2.42

USD

Estimate

−0.43

USD

Today

OCOwens Corning Inc

Actual

4.21

USD

Estimate

3.82

USD

Today

LPXLouisiana-Pacific Corporation

Actual

0.99

USD

Estimate

1.03

USD

Today

EVEXEve Holding, Inc.

Actual

−0.21

USD

Estimate

−0.16

USD

See more events

Community trends

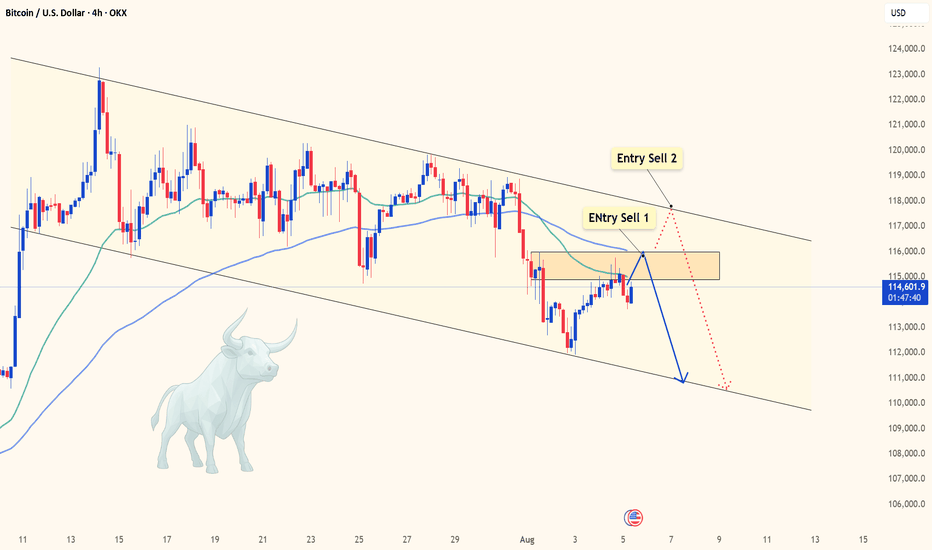

TradeCityPro | Bitcoin Daily Analysis #145👋 Welcome to TradeCity Pro!

Let’s get into Bitcoin analysis. Yesterday, Bitcoin was rejected from the zone I had mentioned, and today it will probably begin its new downward move.

⏳ 4-Hour Timeframe

In yesterday’s analysis, I told you that a pullback to SMA25 and the 0.5 Fibonacci zone was possible

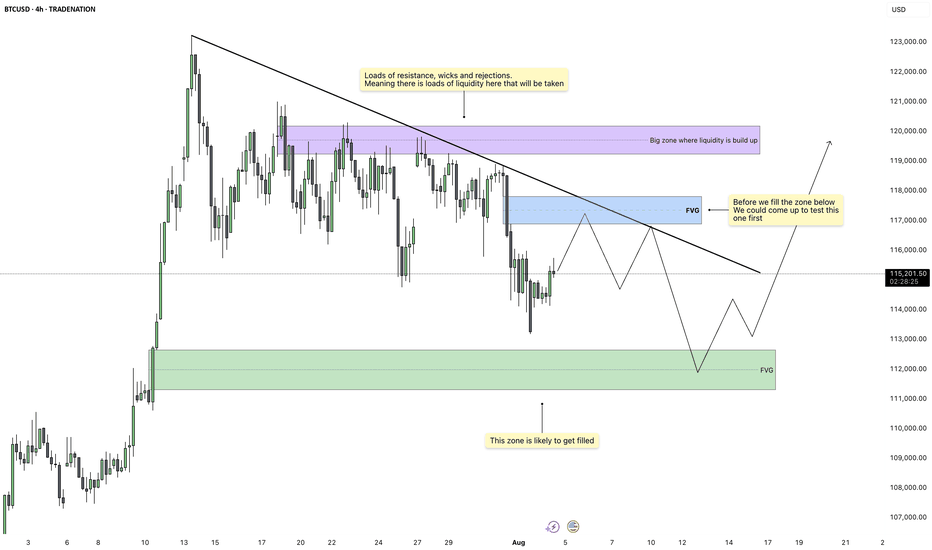

Bitcoin - Imbalance Fill Before Liquidity ExpansionBitcoin is trading inside a compressing structure beneath a clean descending trendline. Price action has been choppy but controlled, creating multiple zones of inefficiency that remain unfilled. We’re currently positioned between two major Fair Value Gaps, one above and one below, which gives us a c

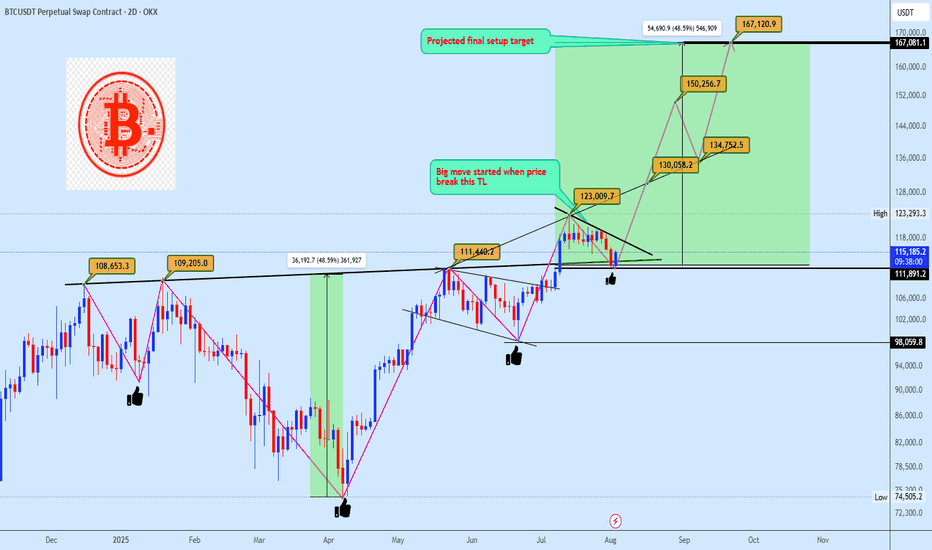

Bitcoin Preparing for Explosive Breakout Toward $167KBitcoin is currently respecting a clean trendline resistance following a bullish pennant formation. Price is holding firmly above the neckline breakout from the inverse head and shoulders (ISHS), confirming demand strength around the $111K–$113K region. The structure implies another 48% rally projec

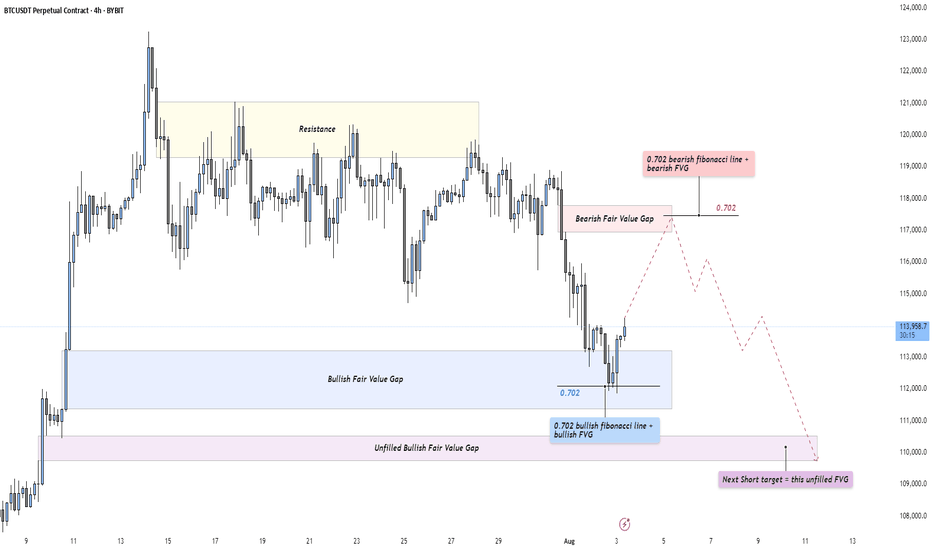

BTC - Short Setup at 0.702 Fibonacci & Fair Value GapMarket Context

Bitcoin recently rejected from a major resistance area and has since been retracing downward, finding temporary support inside a bullish Fair Value Gap. The market is currently in a corrective phase, with buyers attempting to defend lower levels while sellers look for optimal positio

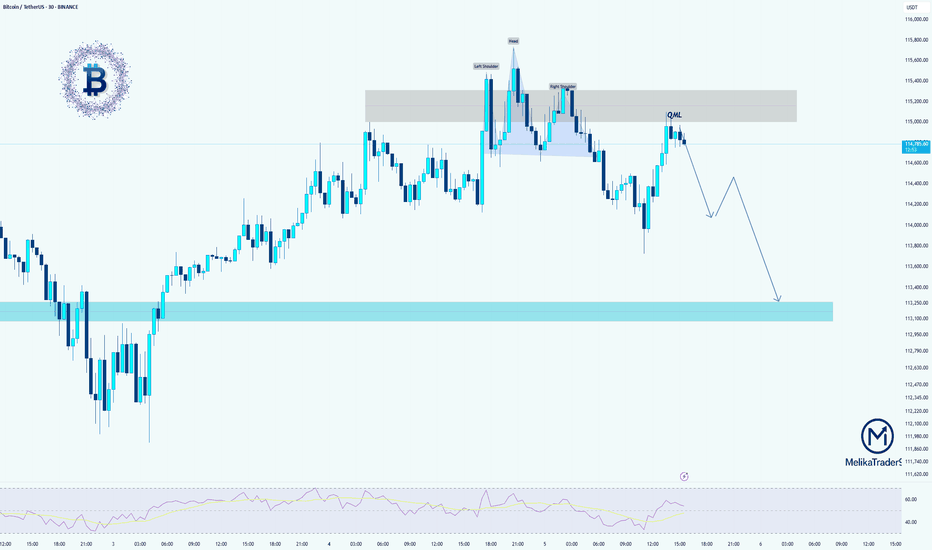

BTCUSDT: Head & Shoulders + QML SetupHello guys!

We have a clean Head & Shoulders pattern forming near a supply zone, with a nice QML (Quasimodo Level) rejection confirming the bearish bias. Price is struggling to break above 115K and has already reacted to the QML zone.

If this structure holds, we could see BTC start a new bearish l

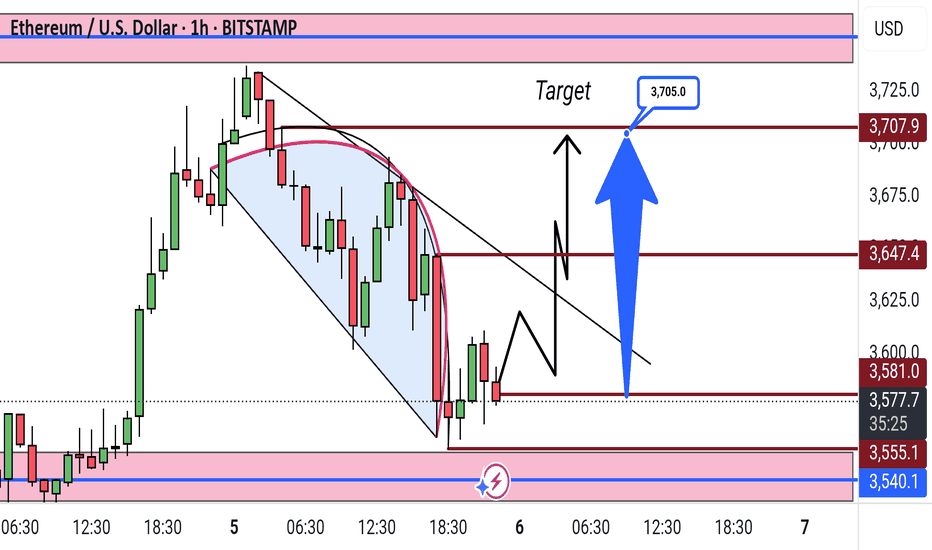

Ethereum Breakout Targeting $3,705ETH/USD 1H Analysis:

Price broke out of the falling wedge pattern and is showing signs of bullish reversal. Key resistance levels are at $3,581 and $3,647, with a target set at $3,705. Support holds near $3,555. Potential for upward continuation if momentum sustains.

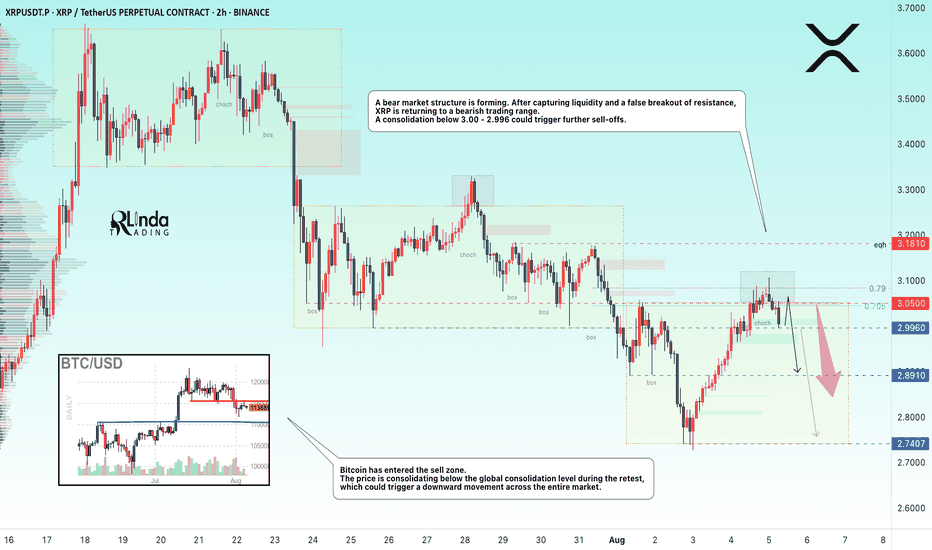

XRPUSDT → Hunting for liquidity ahead of a possible declineBINANCE:XRPUSDT.P is forming a downward market structure after a false breakout of global resistance. Bitcoin is in a correction phase and, after a slight rebound, may continue its movement...

Bitcoin has entered the sell zone. The price is consolidating below the global consolidation boundary

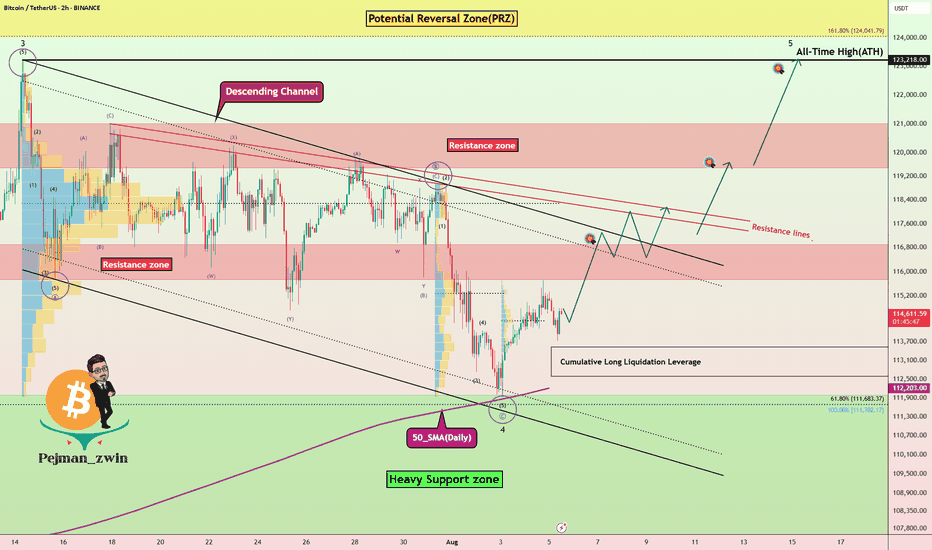

Bitcoin Bounces Back — Is $120K the Next Stop?!Bitcoin ( BINANCE:BTCUSDT ) reacted well to the 50_SMA(Daily) and the Heavy Support zone($112,000-$105,800 and started to rise again.

The question is, can Bitcoin reach $120,000 again and even create a new All-Time High(ATH)!?

In terms of Elliott Wave theory , it seems that Bitcoin has

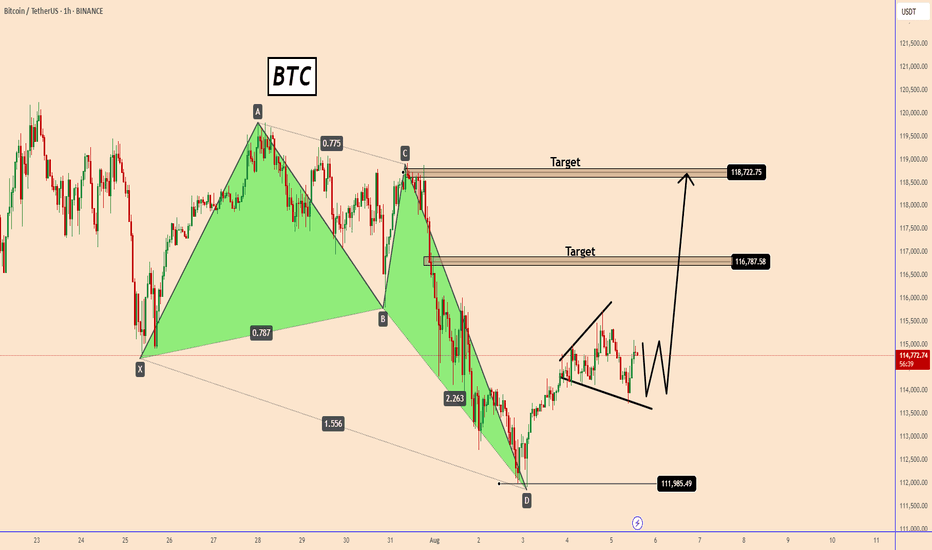

BTC – Bullish Breakout in SightBTC – Bullish Breakout in Sight

Bitcoin recently completed a bullish harmonic pattern near 112K, and the reaction was strong—showing that buyers stepped in around that level.

In just two days, BTC climbed by about 3.5%, reaching 115.7K—and it did so with relatively low trading volume, which highl

BTC recovery within the downtrend – watch for sell signalsHello friends,

Today, BTCUSD is showing a slight bearish bias, currently hovering around $115,000.

On the macro front, global financial markets are still digesting expectations that the Fed could cut interest rates in September, with current odds close to 90%, according to the CME FedWatch Tool. T

See all crypto ideas

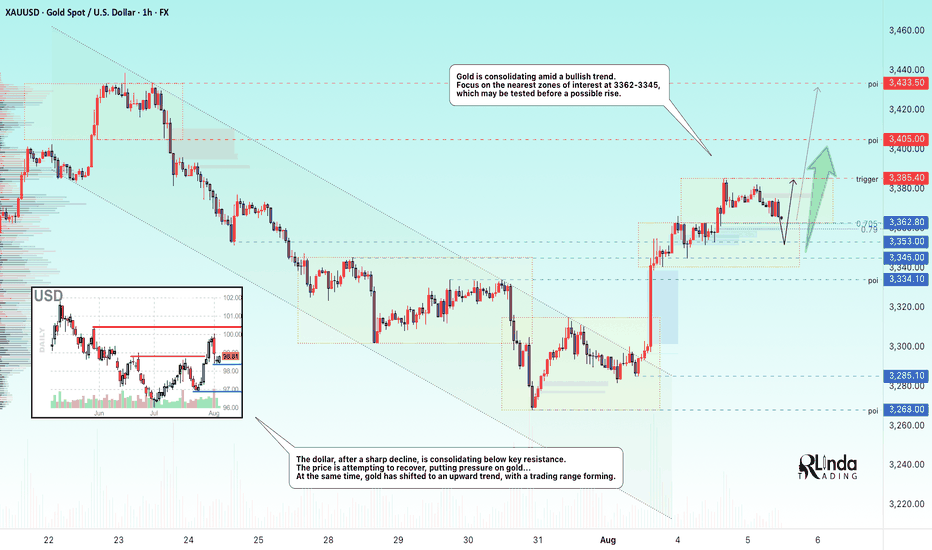

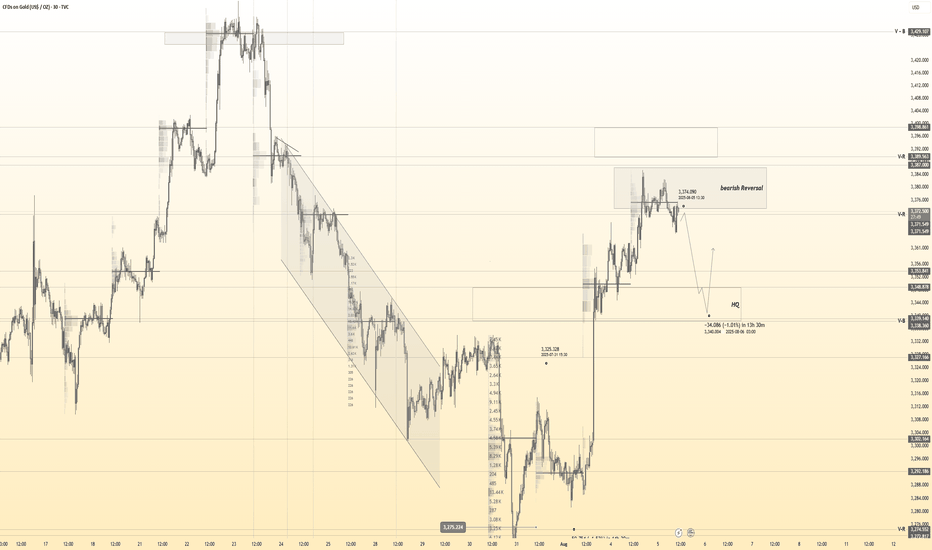

GOLD → Consolidation and correction before growthFX:XAUUSD continues to consolidate after a strong rally. The market is returning to a bullish trend, but a correction is possible before growth continues...

Gold is rising amid expectations of Fed policy easing. The market is finding support amid:

a 90.5% probability of a Fed rate cut in Septe

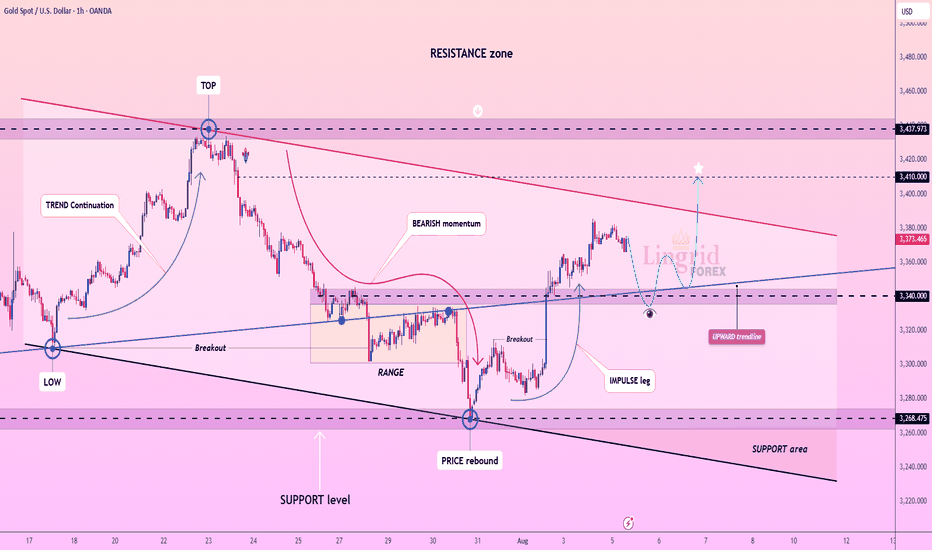

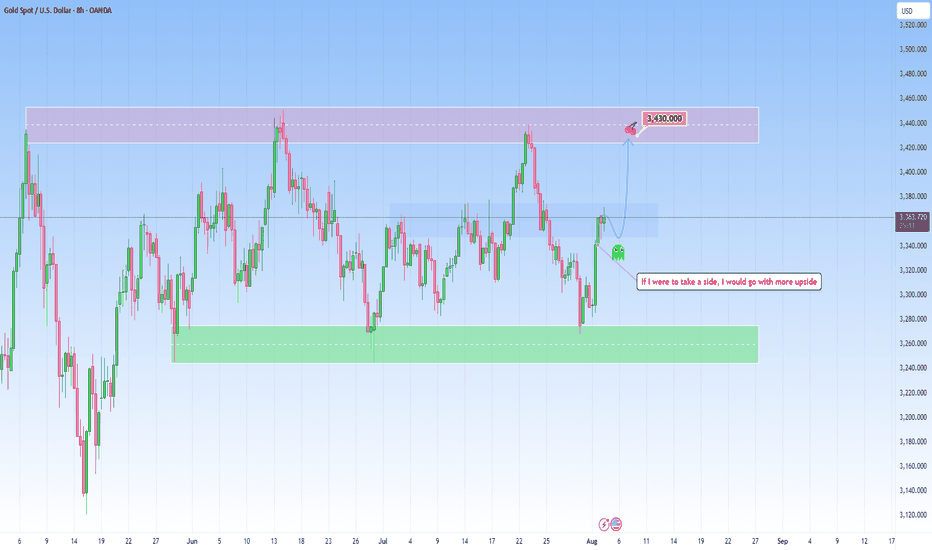

Lingrid | GOLD Potential Bullish Extension Following Pullback OANDA:XAUUSD is rebounding strongly from the support zone after a deep correction from the previous top near 3,437. The price has broken back above the range and formed a new impulse leg, now hovering just above the upward trendline. As long as the structure holds above 3,330, further continuation

GOLD undecided: Looking for a positive outlookThe current market context on GOLD seems undecided and heavily influenced by news release and macroeconomic catalysts. The recent reversal from the support was pretty decisive, catching short-sellers off guard and forcing them to cover positions.

However, the structure has yet to produce a clean b

XAU/USD | Bounce in Play – Watching $3350 Support for Next Move!By analyzing the gold chart on the 4-hour timeframe, we can see that after hitting the first target at $3361, gold continued its rally and reached our second supply level at $3385. Upon reaching this key level, the price faced strong selling pressure, dropping over 350 pips down to $3349. Gold is no

Breakout Levels in Focus for XAUUSDWhy did I say to cancel the last position? because gold is in the critical area!

Price is testing a key resistance area around 3374.

If it breaks above the first resistance level, we may see a bullish continuation toward the second breakout line.

If both levels are broken and retested successfu

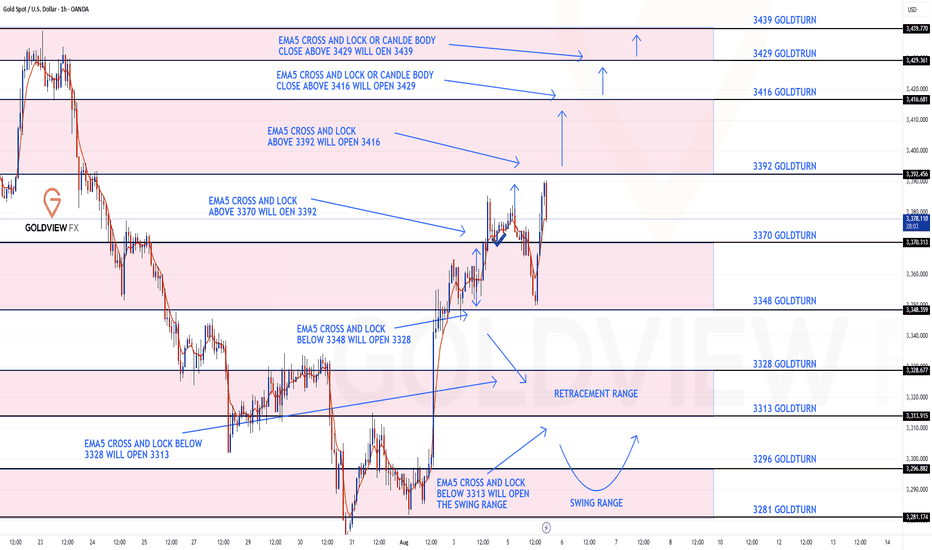

GOLD ROUTE MAP UPDATEHey Everyone,

Another PIPTASTIC day on the charts!!!

After completing our Bullish target 3370 yesterday, we stated that we are now waiting for ema5 lock to confirm gap to 3392.

We got the ema5 lock above 3370 opening 3392. A nice drop into the lower zone just above our bearish gap allowed us to

Gold Bounces from PRZ — Is a Short-Term Rally Underway?Gold ( OANDA:XAUUSD ) started to rise from the Support zone($3,307-$3,275) as I expected in the previous idea .

Gold is currently moving near the Support zone($3,350-$3,326) , Potential Reversal Zone(PRZ) , and $3,334 (Important price) .

From the Elliott wave theory , it seems that Gold

Gold 30Min Engaged ( Bearish & Bullish Entry Detected )Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸Bearish From now Price - 3373

🩸Bullish Reversal : 3341

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they mo

Gold Poised to Rise on Looming Russia Sanctions!!Hey Traders, above is a breakdown of the current technical and fundamental setup for Gold, with a focus on key support zones and the macro landscape that could drive further upside.

From a technical standpoint, the first major support area to watch is around 3,334, which previously acted as a stron

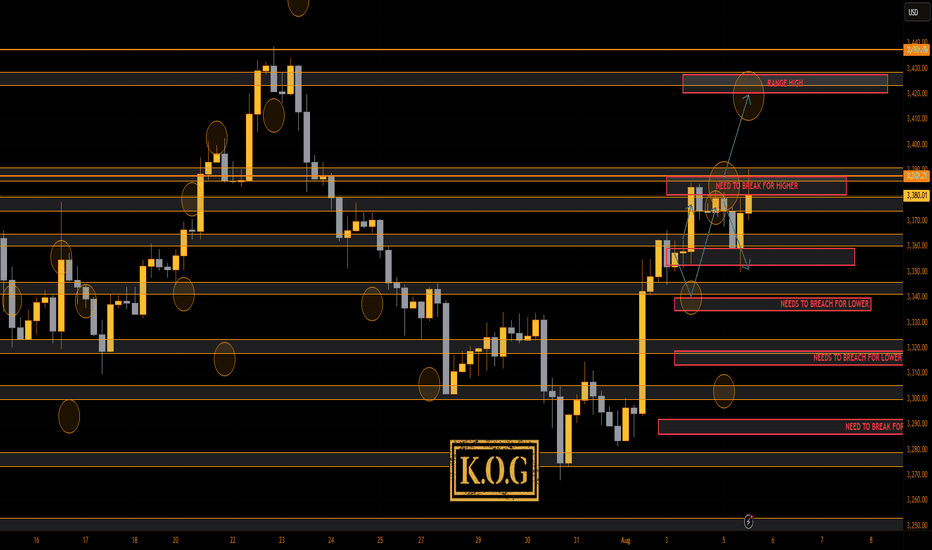

THE KOG REPORT - UpdateEnd of day update from us here at KOG:

What a mission with gold, swings one way, swing the other, taking liquidity within the range and yet sticking with the illustration posted. We managed to get the move upside, pin point short into the level we wanted and then a bounce from the 3350 level again

See all futures ideas

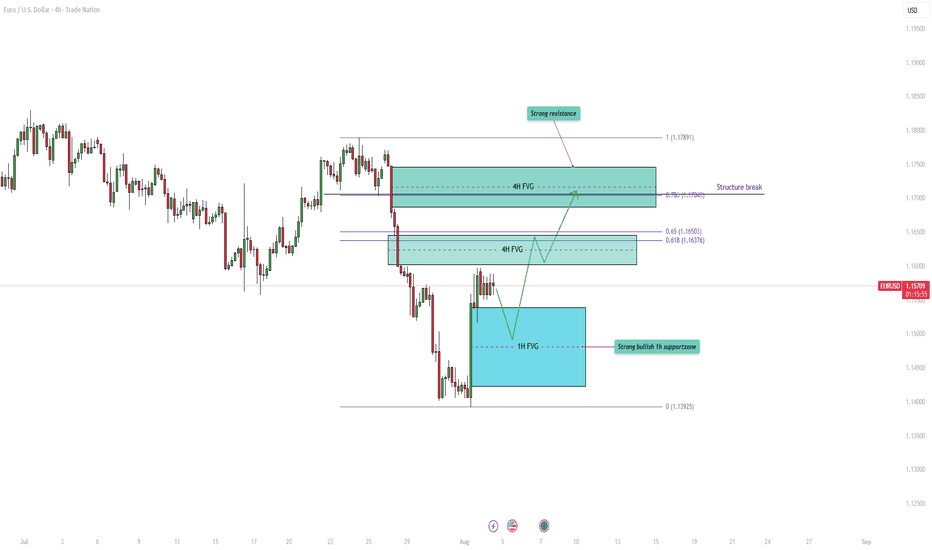

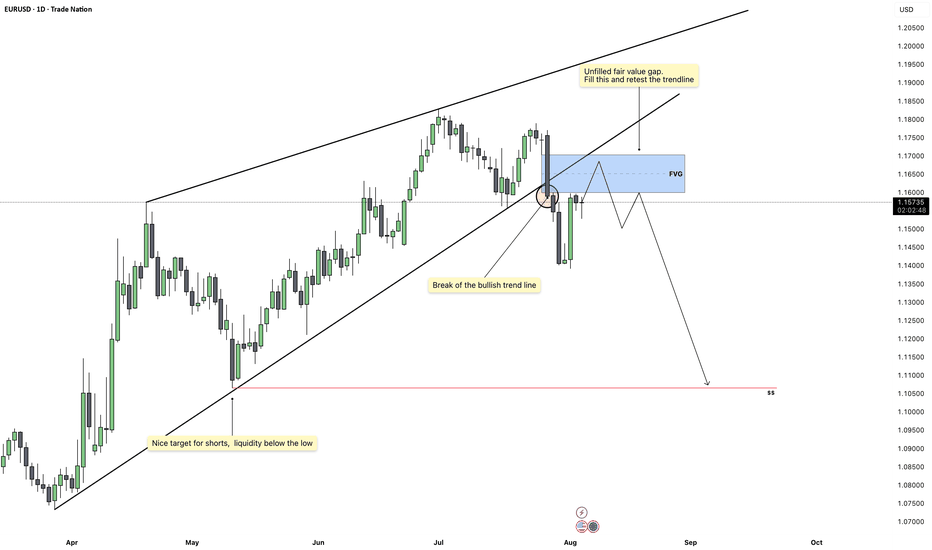

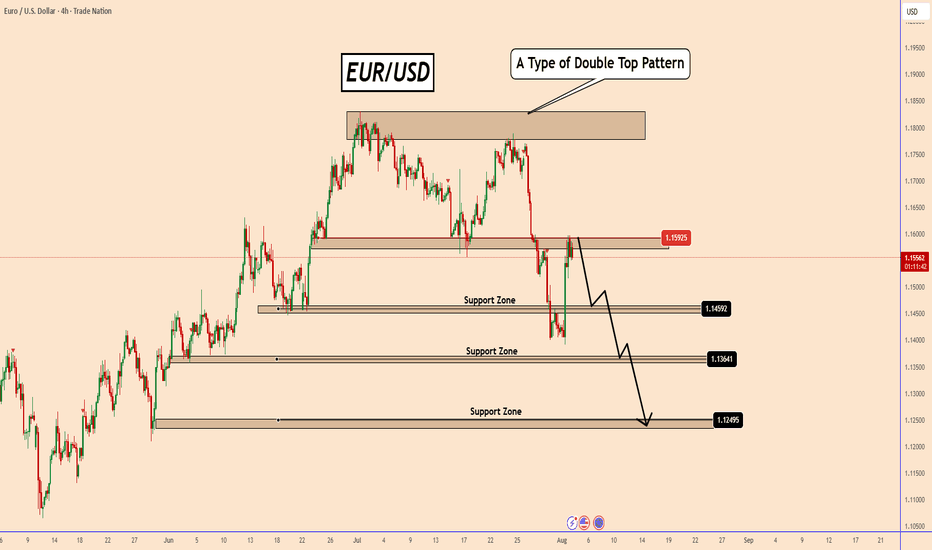

EURUSD - Major resistance ahead with the fair value gaps!The EUR/USD pair remains firmly within a prevailing downtrend, characterized by a consistent pattern of lower highs and lower lows. This bearish momentum has resulted in the formation of several significant Fair Value Gaps (FVGs) on the 4-hour chart, which now act as potential resistance zones on an

EURUSD - EURUSD – The Calm Before the SweepAfter months of climbing steadily within a rising wedge structure, EURUSD has finally broken beneath the bullish trend line that previously acted as dynamic support. This shift is significant, as it marks the first decisive violation of the bullish momentum that has carried price from the April lows

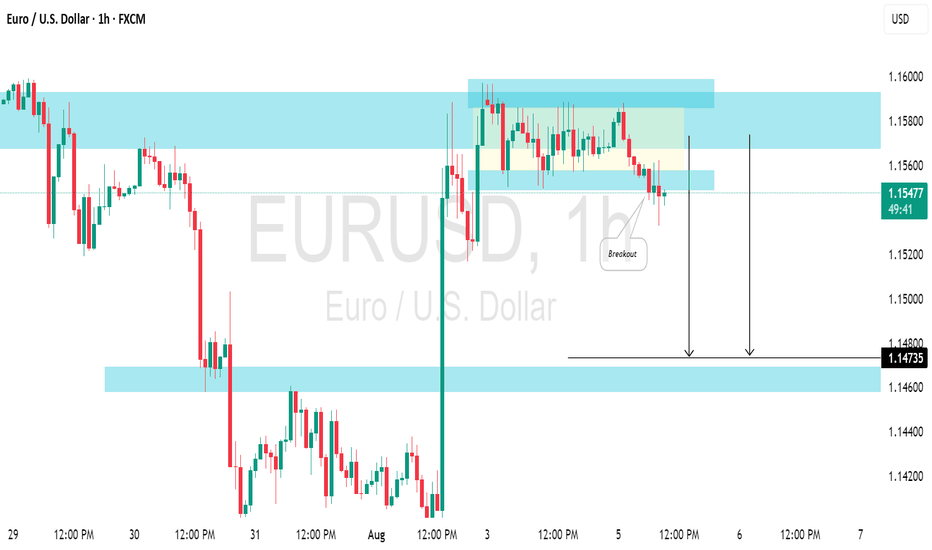

EURUSD: Time For PullbackThe 📉EURUSD pair reacted significantly to the highlighted intraday resistance zone following the market's opening on Monday.

After testing this blue structure, the market began to consolidate, creating a horizontal trading range on the hourly chart.

A bearish breakout below its support level sig

USD/JPY 30Min Engaged ( Bullish Reversal Entry Detected )Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸Bullish Reversal : 147.120

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved size.

Volume is rising be

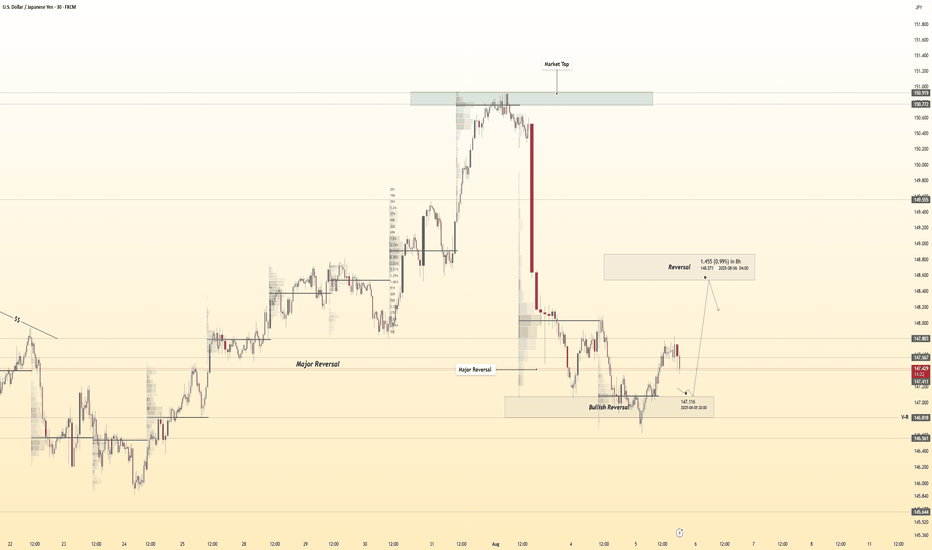

USDJPY Breakout and Potential RetraceHey Traders, in today's trading session we are monitoring USDJPY for a selling opportunity around 148.300 zone, USDJPY was trading in an uptrend and successfully managed to break it out. Currently is in a correction phase in which it is approaching the retrace area at 148.300 support and resistance

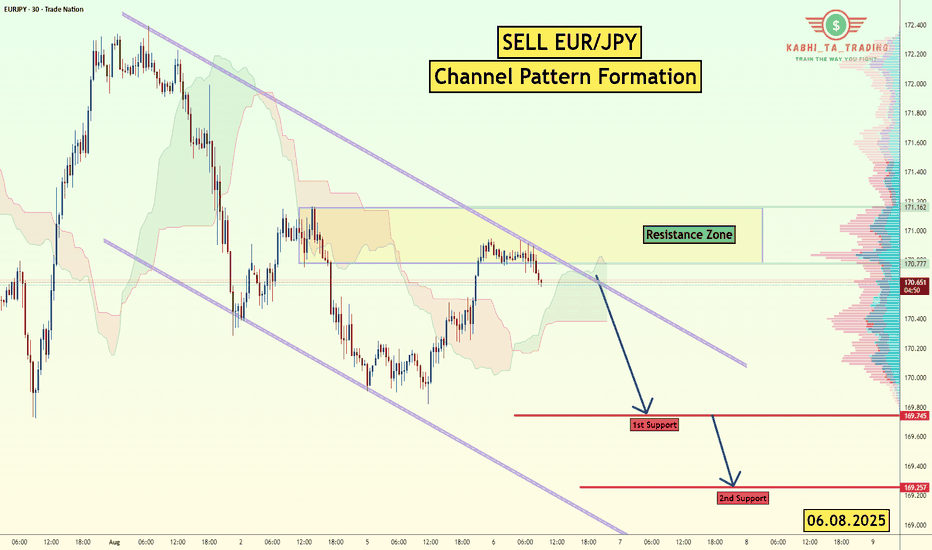

EUR/JPY Channel Formation (6.08.2025) The EUR/JPY Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Channel Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Patt

EURUSD rises again amid growing Fed rate cut expectationsEURUSD rises again amid growing Fed rate cut expectations

On Friday, U.S. job data (NFP) showed an increase of just 73,000 for July—far below forecasts. This weak result suggests deeper problems in the labor market.

Many financial institutions now expect the Federal Reserve to cut interest rates

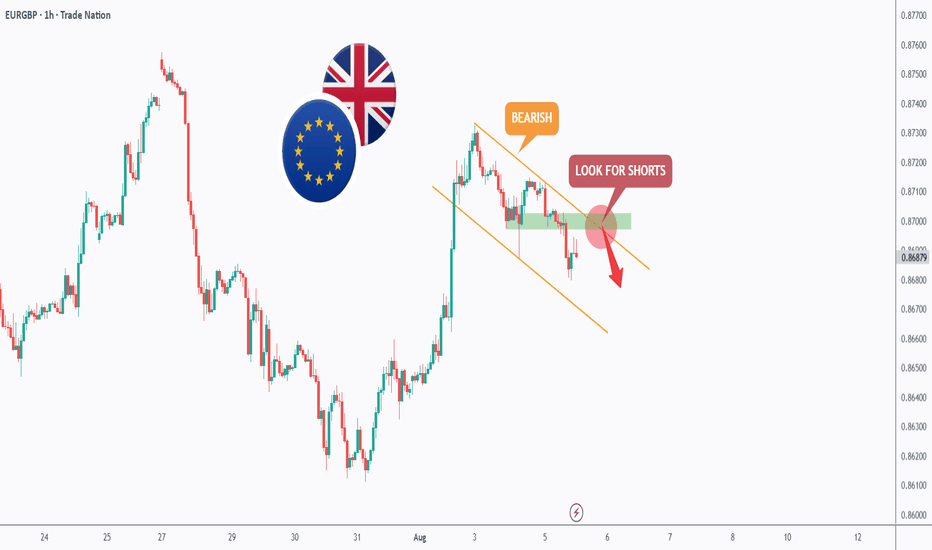

EURGBP – Bearish Continuation in Play?Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈EURGBP has been overall bearish trading within the falling channel marked in orange.

Moreover, the green zone is a strong structure.

📚 As per my trading style:

As #EURGBP approaches the red circle zone, I w

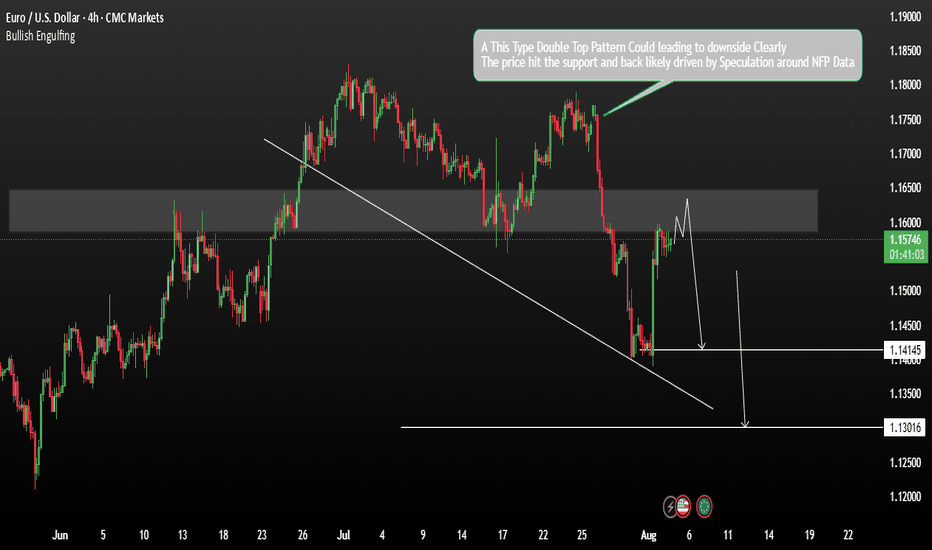

EURUSD Technical and Fundamental AnalysisEURUSD may begin another downtrend movement from the current zone, as suggested in our earlier chart analysis. The price is expected to retest the support line after a short-term bounce, likely influenced by speculation around the NFP report.

Fundamental Outlook:

Adding to the market’s uncertainty

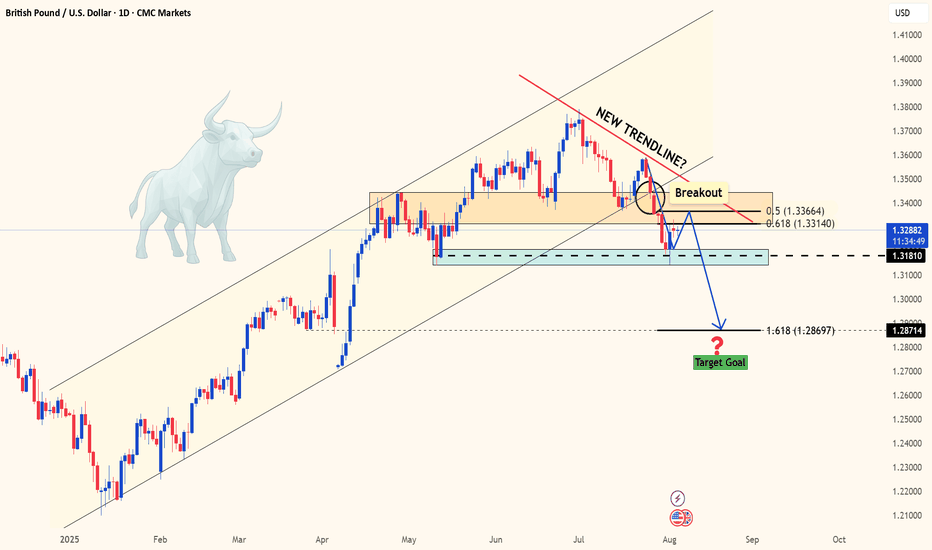

GBP/USD: Sell setup shaping upHey everyone, what’s your take on GBP/USD right now?

After breaking below the trendline, GBP/USD tried to retest the area but failed to hold. Price is now hovering around 1.329, and the selling pressure is still clearly present.

This current setup is aiming toward the Fibonacci 1.618 extension zon

See all forex ideas

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - |

Trade directly on the supercharts through our supported, fully-verified and user-reviewed brokers.