Tesla Rolls Out Much-Awaited Robotaxis. Buy or Sell the Stock?They’re here. After years of tweets, teasers, and timelines that aged like unrefrigerated dairy, Tesla NASDAQ:TSLA officially launched its long-awaited robotaxi service in Austin, Texas.

The self-driving revolution, we were told, would arrive like a lightning bolt. Instead, it quietly rolled up

The best trades require research, then commitment.

Get started for free$0 forever, no credit card needed

Scott "Kidd" PoteetThe unlikely astronaut

Where the world does markets

Join 100 million traders and investors taking the future into their own hands.

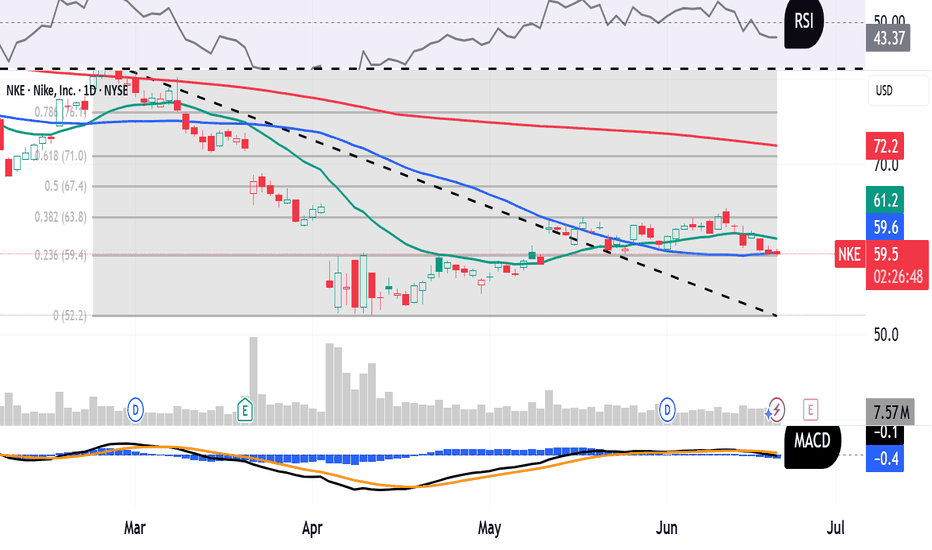

Will Nike’s Upcoming Earnings ‘Just Do It’ for Investors?This hasn’t been the greatest year for Nike NYSE:NKE , which will report earnings next Thursday at a time when the stock is down more than 20% year to date. What does technical and fundamental analysis say might happen to the stock from here?

Let’s take a look:

Nike’s Fundamental Analysis

NKE

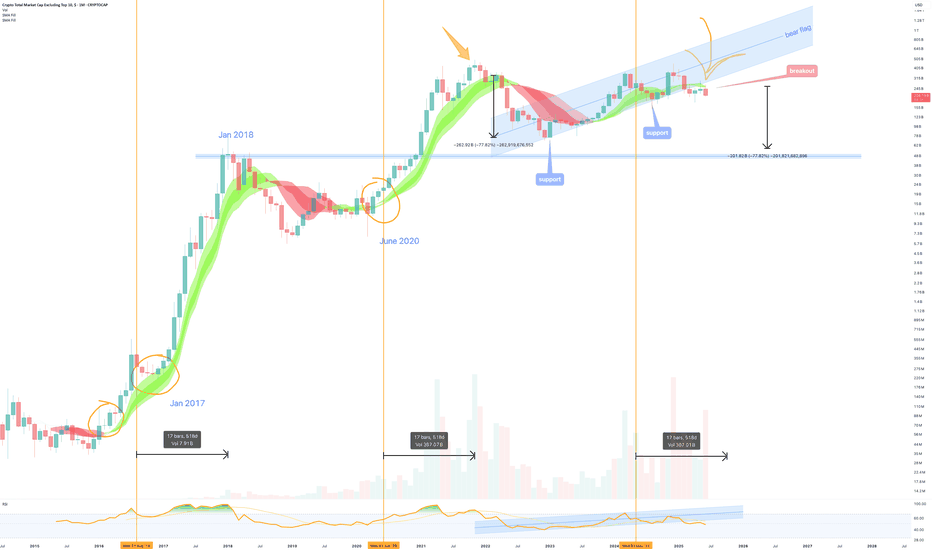

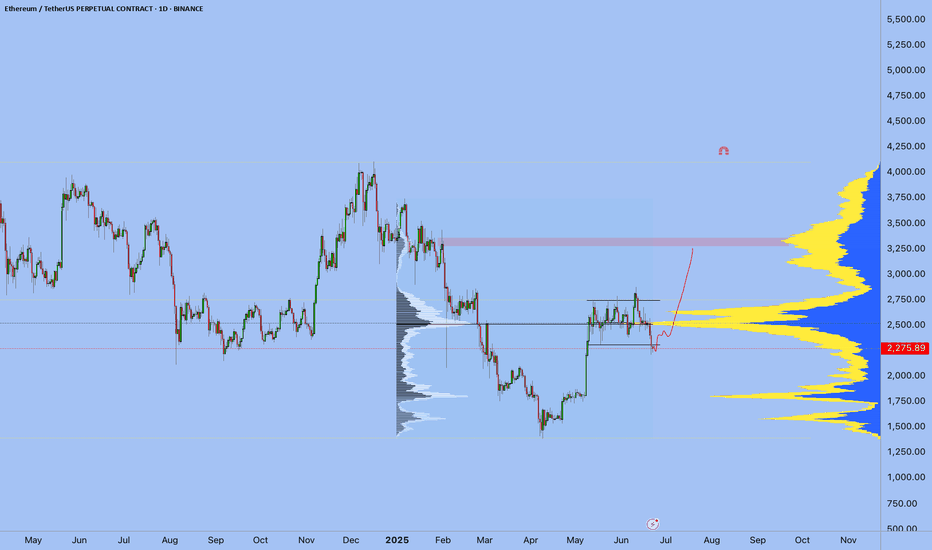

Is Alt season dead? - June 2025Let me start by saying, Youtube influencers are lying to you. The collective narrative (from those links shared with me) talk almost exclusively about the same set of narratives for triggering “alt season”:

M2 money supply. The printer will be turned on any minute.

The FED is going to cut rat

US Missiles Flyin'! Buy USD vs EUR GBP AUD NZD CAD CHF JPY!This is the FOREX futures outlook for the week of Jun 22-28th.

In this video, we will analyze the following FX markets:

USD Index, EUR, GBP, AUD, NZD, CAD, CHF, and JPY.

The USD is the world's reserve currency. When there are geo-political hot spots in the world, the USD sees inflows from investo

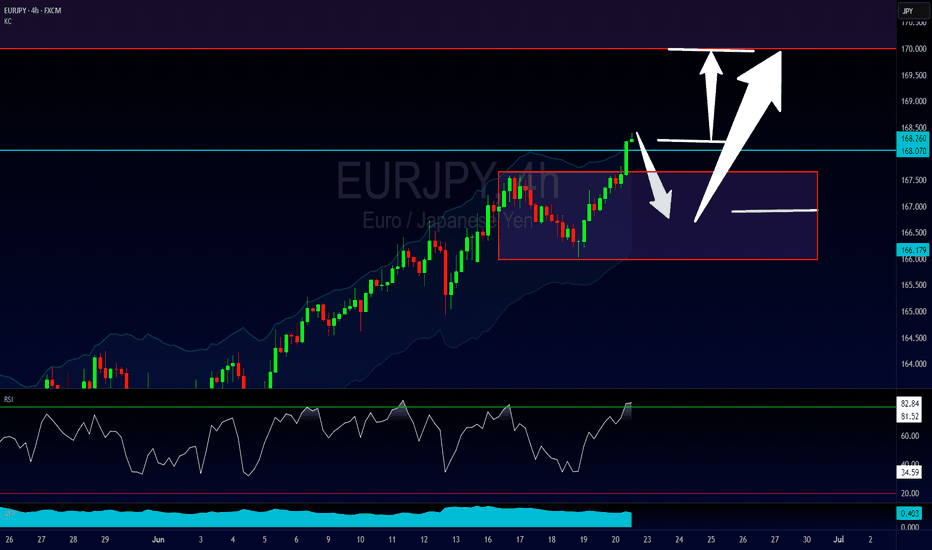

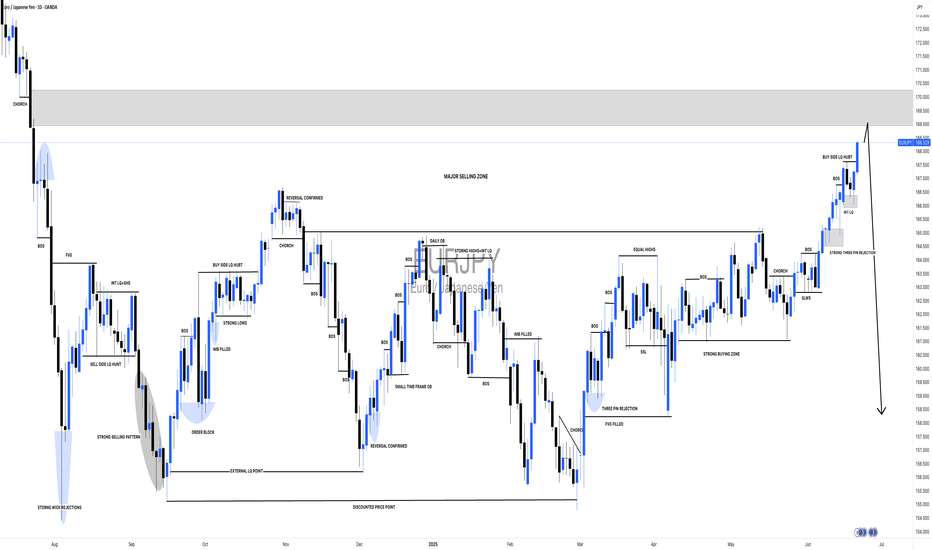

Multi-Timeframe Analysis & Trend Continuation TradingThe EURJPY has recently violated an important level of structure leading us to make the prediction of price continuing to go higher.

In this video we'll take a look at where the next stopping point may be and what I'm waiting for the market to do in order to get involved in the trade.

If you hav

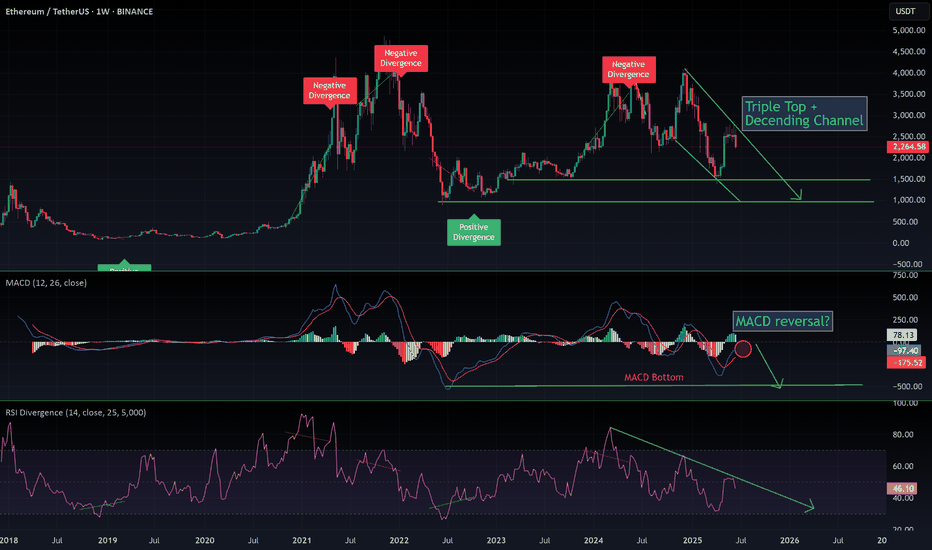

$ETH: The 1-week chart is an absolute disaster!Once again, I want to make it clear: I’m naturally a bull. But I live in Thailand, far from the noise of influencers shouting "buy, buy, buy!" I’ve learned my lesson—when they scream buy, you get rekt. That’s why I rely solely on the charts.

Charts are just mathematics—they don’t lie. So here’s my

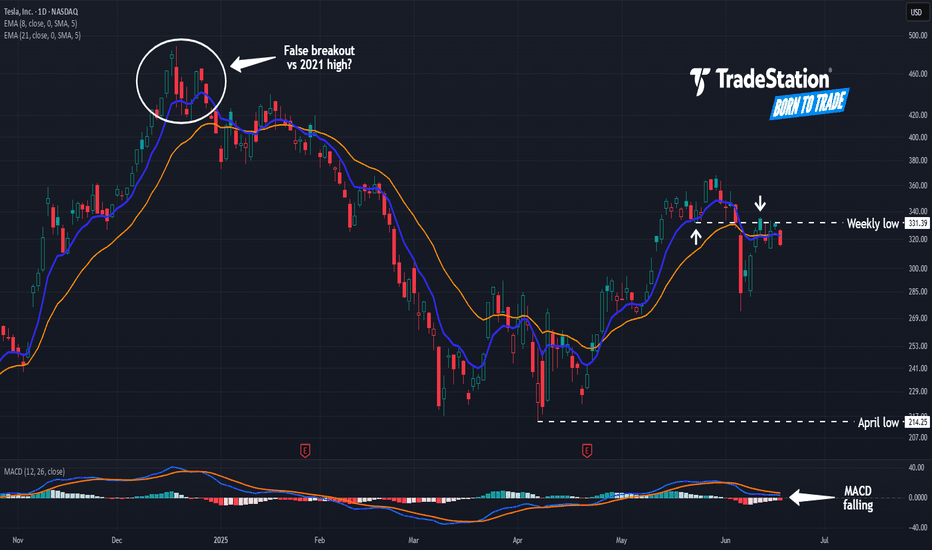

Tesla May Be StallingTesla bounced between early April and late May, but now it may be stalling.

The first pattern on today’s chart is the weekly low of $331.39 from May 22. TSLA fell below that level two weeks ago and was rejected at the same price area last week. Has old support become new resistance?

Second, the st

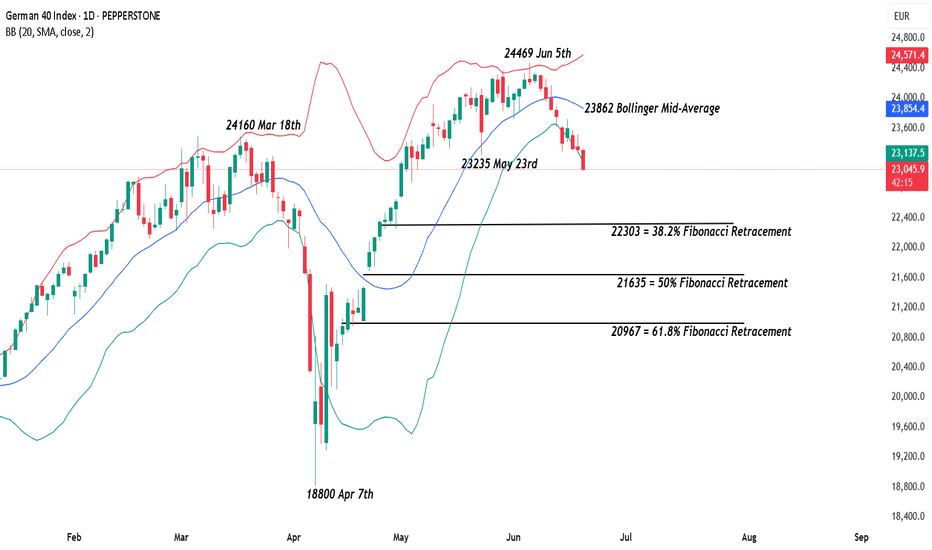

German 40 Index – Sentiment Facing a Sterm TestSince hitting its most recent all time high of 24469 on June 5th the Germany 40 index has experienced some downside pressure as traders have moved to lock in profits on a very strong start to the year. This move has the potential to turn June into the worst monthly performance of 2025 so far, althou

Coinbase Shares Rise Following Stablecoin Legislation ApprovalCoinbase (COIN) Shares Rise Following Stablecoin Legislation Approval

Shares in Coinbase Global (COIN) surged by 11% yesterday, making the company the top performer in the S&P 500 index (US SPX 500 mini on FXOpen).

The sharp rise was driven by news that the US Senate has approved the GENIUS stabl

See all editors' picks ideas

Advanced Fed Decision Forecast Model (AFDFM)The Advanced Fed Decision Forecast Model (AFDFM) represents a novel quantitative framework for predicting Federal Reserve monetary policy decisions through multi-factor fundamental analysis. This model synthesizes established monetary policy rules with real-time economic indicators to generate proba

Timeframe LoopThe Timeframe Loop publication aims to visualize intrabar price progression in a new, different way.

🔶 CONCEPTS and USAGE

I got inspiration from the Pressure/Volume loop, which is used in Mechanical Ventilation with Critical Care patients to visualize pressure/volume evolution during inhal

Deviation Trend Profile [BigBeluga]🔵 OVERVIEW

A statistical trend analysis tool that combines moving average dynamics with standard deviation zones and trend-specific price distribution.

This is an experimental indicator designed for educational and learning purposes only.

🔵 CONCEPTS

Trend Detection via SMA Slope: Detect

Rolling Z-Score Trend [QuantAlgo]🟢 Overview

The Rolling Z-Score Trend measures how far the current price deviates from its rolling mean in terms of standard deviations. It transforms price data into standardized scores to identify overbought and oversold conditions while tracking momentum shifts.

The indicator displays a Z-S

Yelober - Sector Rotation Detector# Yelober - Sector Rotation Detector: User Guide

## Overview

The Yelober - Sector Rotation Detector is a TradingView indicator designed to track sector performance and identify market rotations in real-time. It monitors key sector ETFs, calculates performance metrics, and provides actionable stock

TASC 2025.07 Laguerre Filters█ OVERVIEW

This script implements the Laguerre filter and oscillator described by John F. Ehlers in the article "A Tool For Trend Trading, Laguerre Filters" from the July 2025 edition of TASC's Traders' Tips . The new Laguerre filter utilizes the UltimateSmoother filter in place of an exponenti

Trend Impulse Channels (Zeiierman)█ Overview

Trend Impulse Channels (Zeiierman) is a precision-engineered trend-following system that visualizes discrete trend progression using volatility-scaled step logic. It replaces traditional slope-based tracking with clearly defined “trend steps,” capturing directional momentum only when

Magnificent 7 OscillatorThe Magnificent 7 Oscillator is a sophisticated momentum-based technical indicator designed to analyze the collective performance of the seven largest technology companies in the U.S. stock market (Apple, Microsoft, Alphabet, Amazon, NVIDIA, Tesla, and Meta). This indicator incorporates established

SmartPhase Analyzer📝 SmartPhase Analyzer – Composite Market Regime Classifier

SmartPhase Analyzer is an adaptive regime classification tool that scores market conditions using a customizable set of statistical indicators. It blends multiple normalized metrics into a composite score, which is dynamically evaluated

ATR RopeATR Rope is inspired by DonovanWall's "Range Filter". It implements a similar concept of filtering out smaller market movements and adjusting only for larger moves. In addition, this indicator goes one step deeper by producing actionable zones to determine market state. (Trend vs. Consolidation)

>

See all indicators and strategies

Community trends

Tesla Rolls Out Much-Awaited Robotaxis. Buy or Sell the Stock?They’re here. After years of tweets, teasers, and timelines that aged like unrefrigerated dairy, Tesla NASDAQ:TSLA officially launched its long-awaited robotaxi service in Austin, Texas.

The self-driving revolution, we were told, would arrive like a lightning bolt. Instead, it quietly rolled up

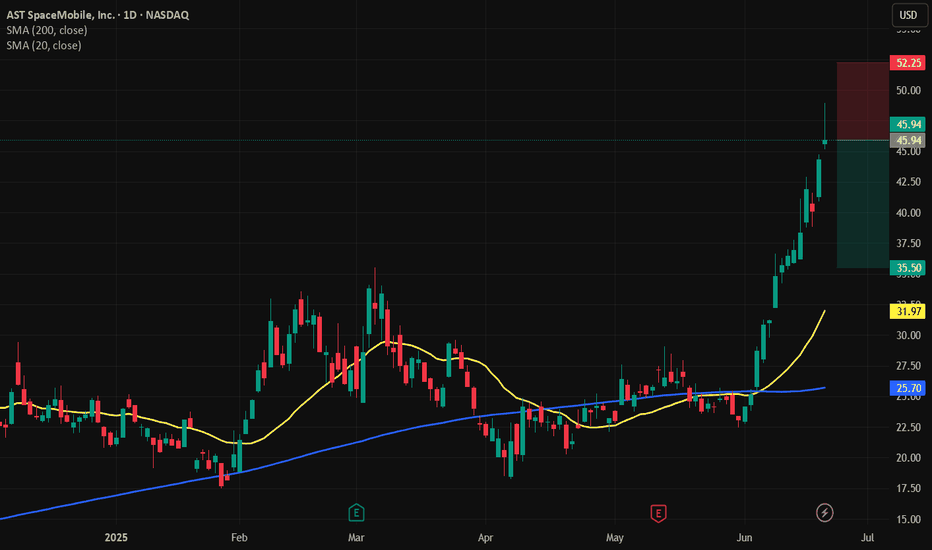

$ASTS Short PositionOvervaluation confirmed by RSI indicator.

Massive Doji, signaling pressure and resistance from sellers.

Entry Point: $45.94 (Last daily candle close price)

Stop/Loss: $52.25

Target Profit Price: $35.50

Disclaimer: Charting is strictly for personal analysis, and should not be used for financial ad

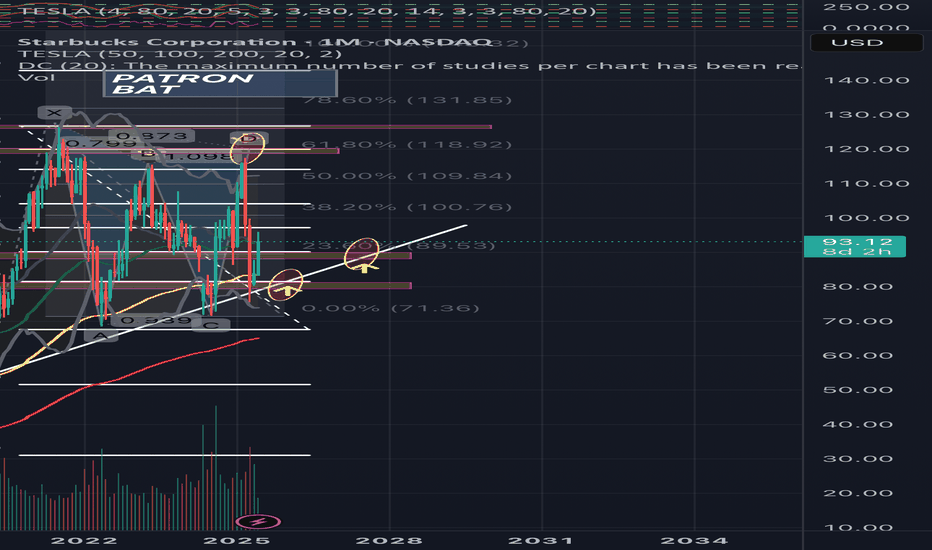

PDF-RDF-LDT-BBA perceived fibonacci pattern was fulfilled when SB stock was at 117USD, seeing a drop that could have given us liquidation in a matter of a month, reaching a trend line waiting for a price change fulfilling a fibonacci retracement when the price reached 76USD, giving us liquidation to buy for two m

$TSLA The Magnificent PennyWelcome to a comprehensive analysis of the little Penny Stock that could..

NASDAQ:TSLA is at it again, ripping shorts and trapping longs. Business as usual.

NASDAQ:TSLA operates primarily from one chart being the Hourly. All signals giveth and all Signal taketh away from this chart.

At pres

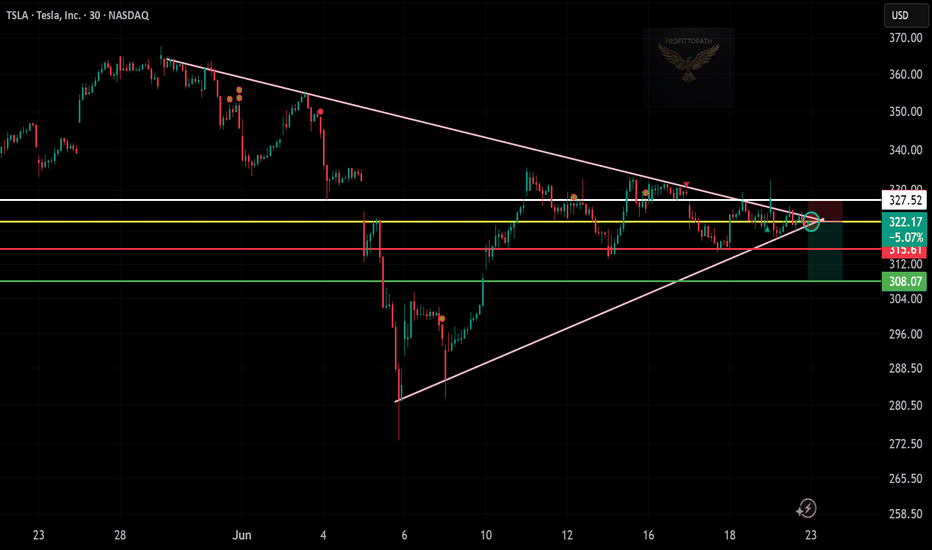

$TSLA Short Trade – Breakdown in the Making “When pressure buil⚡🔻 💣📉

Tesla ( NASDAQ:TSLA ) is coiling tighter than ever inside this symmetrical triangle — but this isn’t strength… it’s stress.

With lower highs stacking and bulls running out of breath, the breakdown could hit like a spark in a lithium mine. ⚠️🔋

Is this just technicals? Or is the market doubti

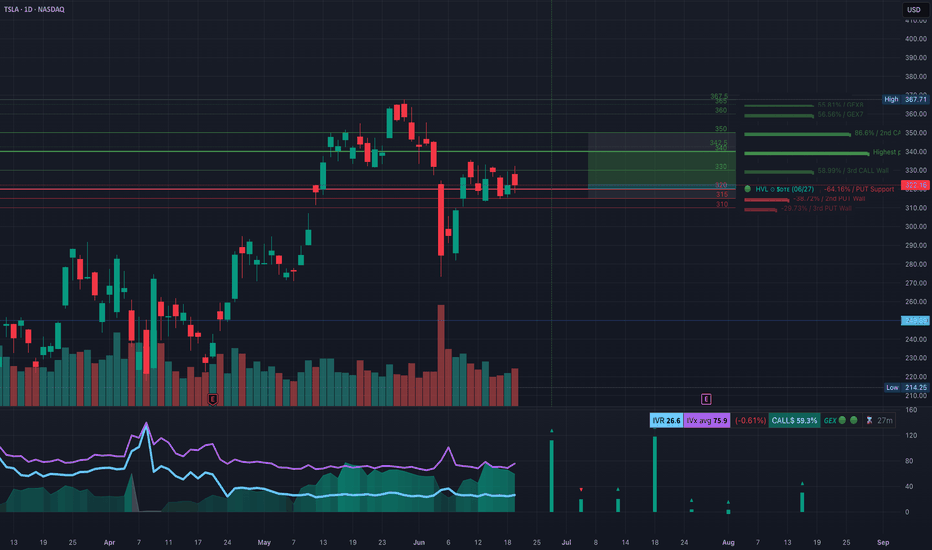

Weekly Technical Analysis for TSLA (June 24–28)TSLA is entering a critical squeeze zone between major gamma walls and key price structure levels. Let’s break this down with both the Daily GEX Map and the 1-Hour Price Action to strategize your trades this week.

📊 GEX Map (Daily Timeframe Insights)

From the first chart:

* Current Price: $322.16

*

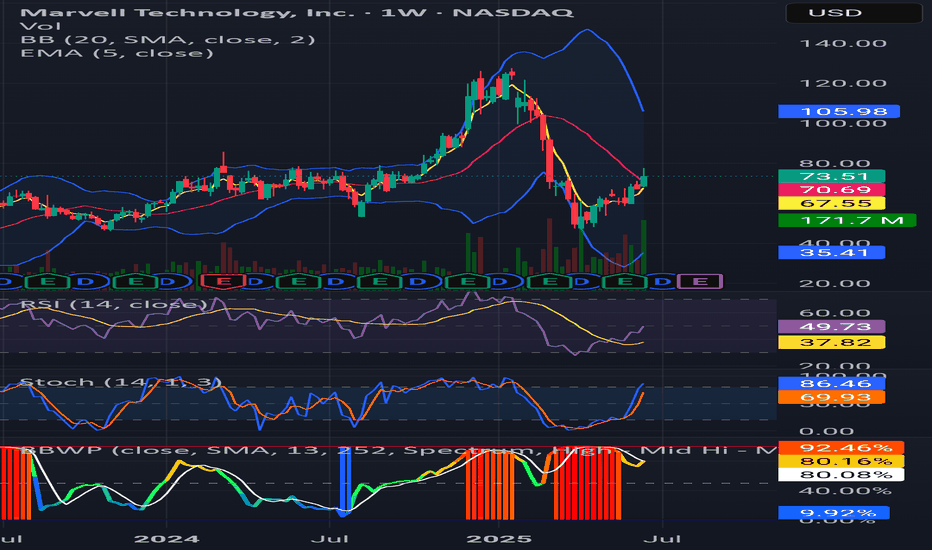

MRVL BullishIncreased volatility on weekly tf as indicated by BBWP. Significant volume increase on the weekly as well. Momentum indicators pointed up. Resistance 1 @ $78-80. Resistance 2 @ $85-$95 range. Psychological Resistance @$100. I have calls dated Aug.15th. $100 strike. Decent enough lotto ticket i think

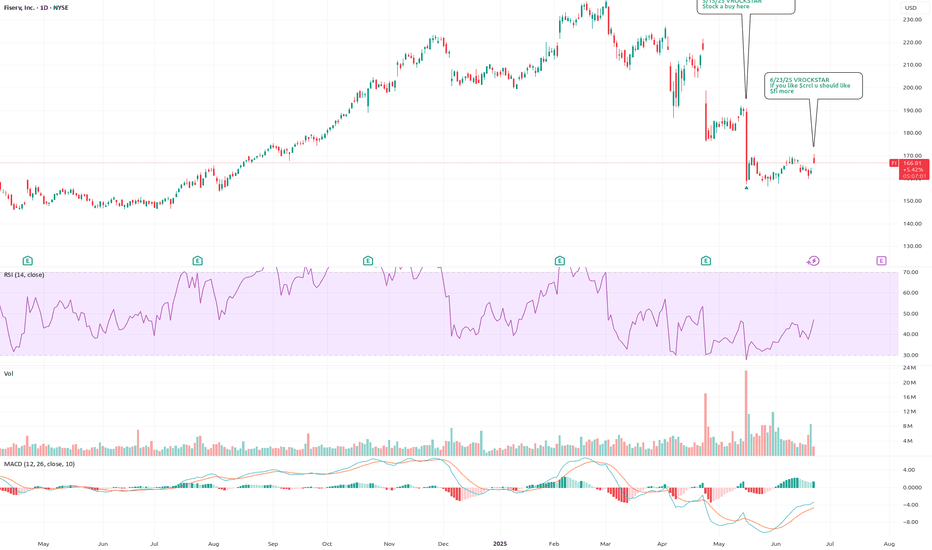

6/23/25 - $fi - If you like $crcl u should like $fi more6/23/25 :: VROCKSTAR :: NYSE:FI

If you like NYSE:CRCL u should like NYSE:FI more

- all banks will have their own stable coins

- but for a player like FI what makes their launch so unique is that it can/ will likely be used for much more txn volume than any given bank based on their payments r

See all stocks ideas

Today

EBFEnnis, Inc.

Actual

0.38

USD

Estimate

0.37

USD

Today

CMCCommercial Metals Company

Actual

0.74

USD

Estimate

0.85

USD

Today

FDSFactSet Research Systems Inc.

Actual

4.27

USD

Estimate

4.30

USD

Today

JRSHJerash Holdings (US), Inc.

Actual

−0.01

USD

Estimate

0.01

USD

Today

GRCEGrace Therapeutics, Inc.

Actual

0.11

USD

Estimate

−0.28

USD

Today

MEIMethode Electronics, Inc.

Actual

—

Estimate

−0.01

USD

Today

IGCIGC Pharma, Inc.

Actual

—

Estimate

−0.02

USD

Today

QMCOQuantum Corporation

Actual

—

Estimate

−1.17

USD

See more events

Community trends

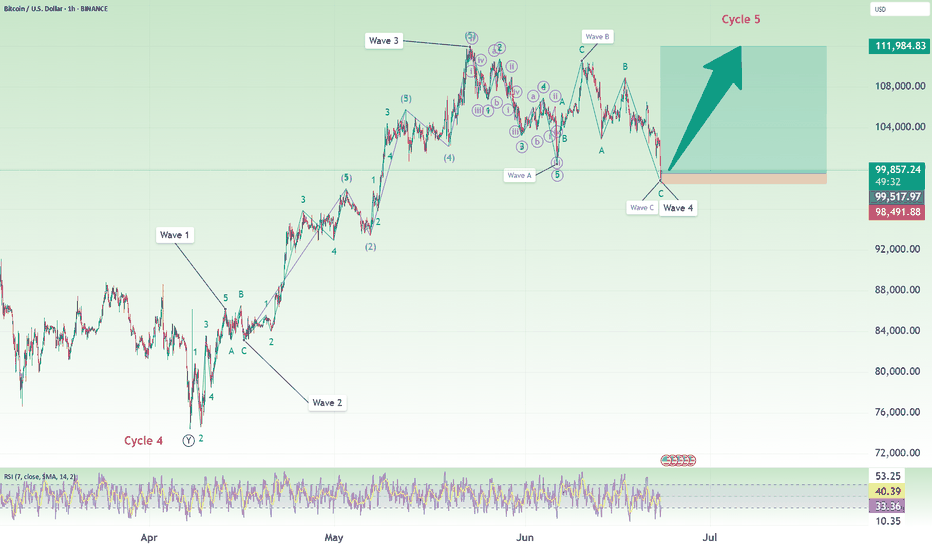

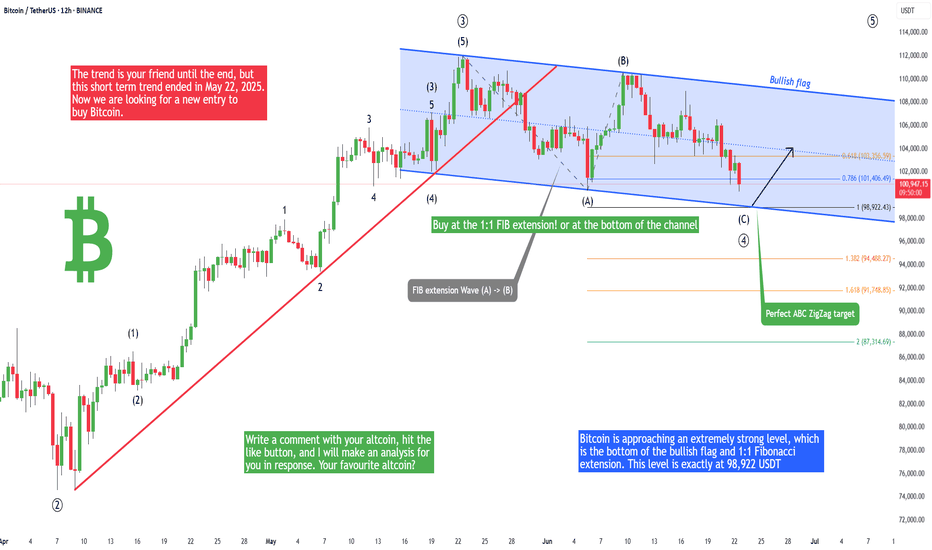

Bitcoin - Drop to 98,922 then a big pump! (Buy here)Bitcoin is falling again mostly because of Trump's aggressive attack on Iran. But technical analysis in general is very strong, and we can find strong levels where smart money has their buy orders. You, as a fish, always want to trade with big whales. Bitcoin is approaching an extremely strong level

Is Alt season dead? - June 2025Let me start by saying, Youtube influencers are lying to you. The collective narrative (from those links shared with me) talk almost exclusively about the same set of narratives for triggering “alt season”:

M2 money supply. The printer will be turned on any minute.

The FED is going to cut rat

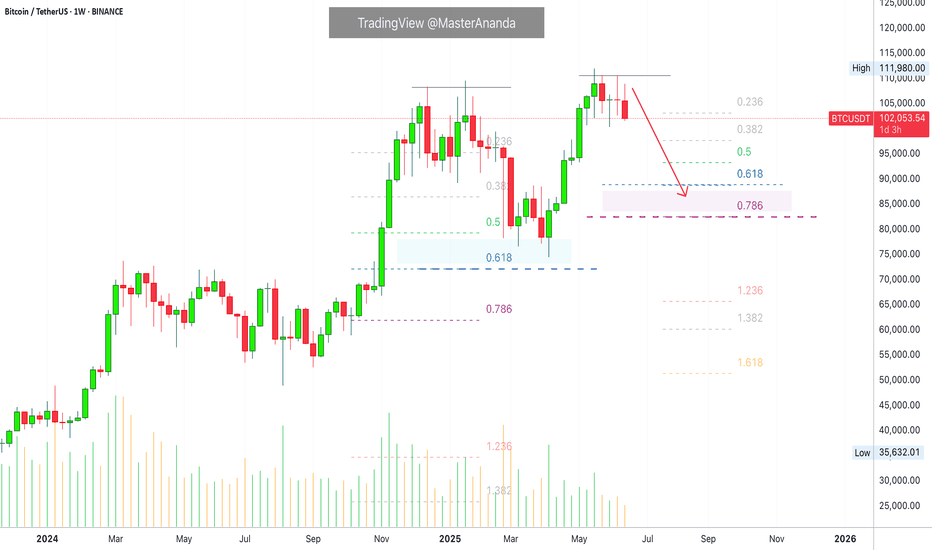

Bitcoin Weekly Ultra-BearishThe 100K support is still valid but the weekly timeframe chart isn't looking good.

Good afternoon my fellow Cryptocurrency trader, how are you feeling today?

Bitcoin peaked the week 19-May. Then we have bearish action only.

The week after 19-May was red, then two neutral weeks and a continuation t

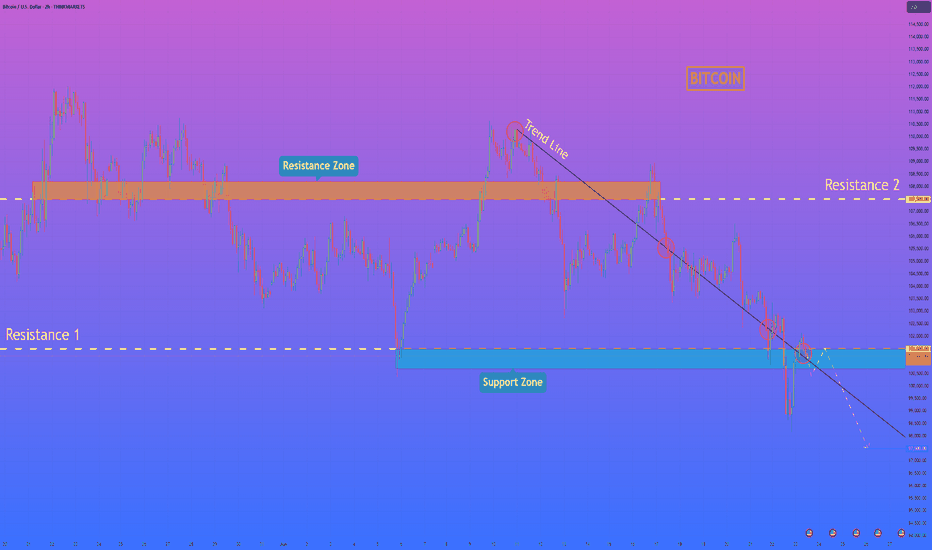

BTCUSDTHello Traders! 👋

What are your thoughts on BITCOIN?

Bitcoin has once again failed to break above its previous high and entered a corrective phase. The price is now moving within a channel and is approaching the lower boundary of that channel.

The correction is expected to continue toward the sup

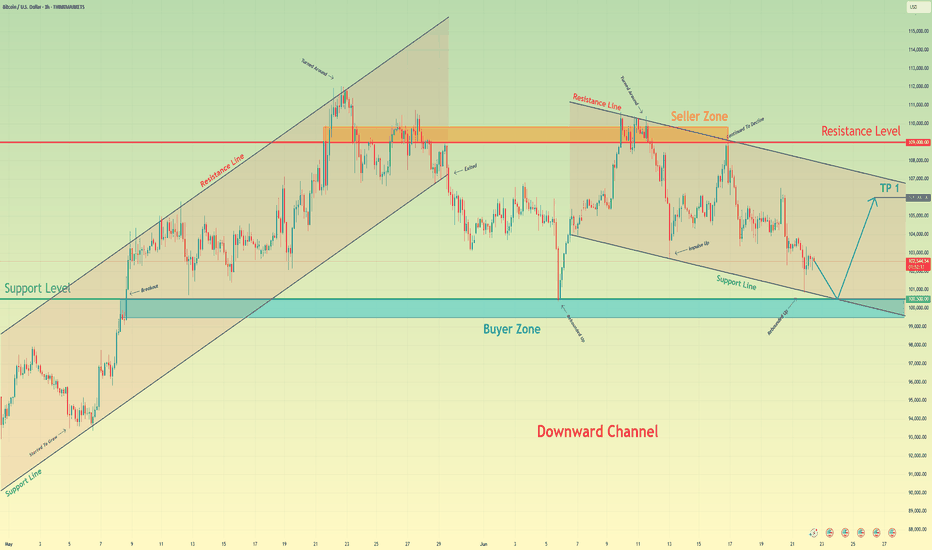

Bitcoin can correct to support line of channel and start to growHello traders, I want share with you my opinion about Bitcoin. The price was moving inside a strong upward channel, where it managed to break through the support level and then the resistance level, eventually reaching the seller zone. After that, BTC started to turn around and declined, once again

Bitcoin Break: Watch 100K Revesal Or Test Of 95K.Bitcoin broke 100K support without any type of retrace attempt (YET). This move which is attributed to global events should not be entirely surprising. Most importantly do not OVERREACT, especially with all the nonsense hype this will generate. Here is a more effective way to process the current sit

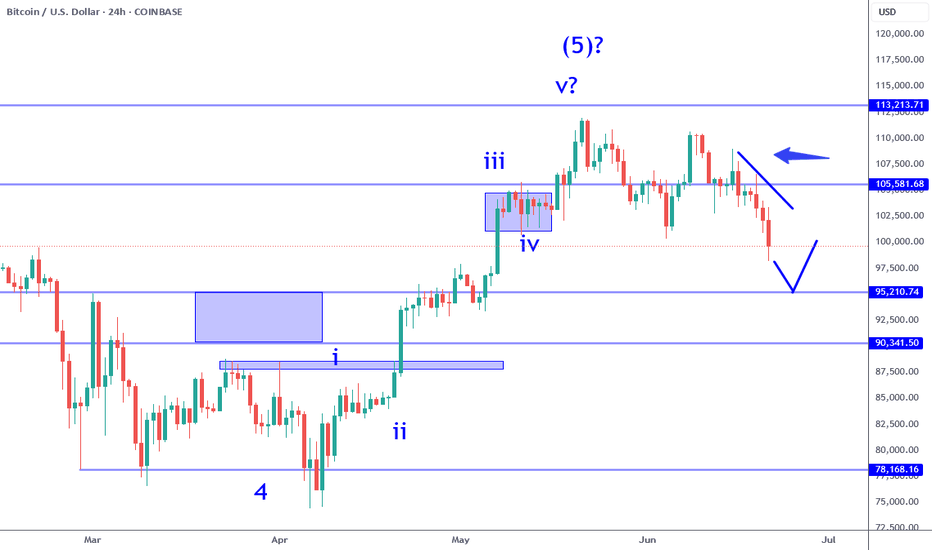

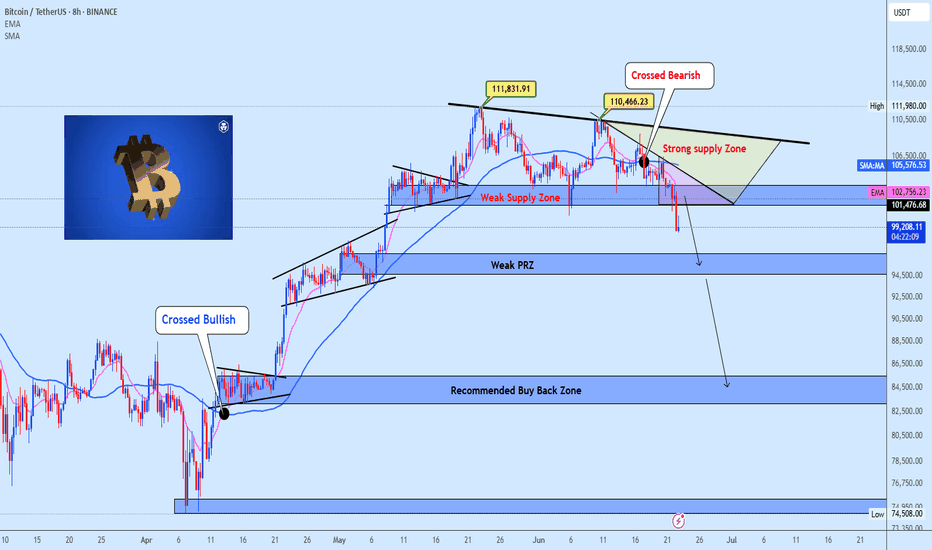

BTC Breakdown Escalates Bearish MomentumBitcoin has officially broken below the critical 104K support level, invalidating the recent short-term bullish structure. The price action reflects a clear shift in market sentiment, confirmed by the bearish EMA/SMA crossover and a firm rejection from the strong supply zone between 110K–111.8K.

Th

HelenP. I Bitcoin may break trend line and continue to move downHi folks today I'm prepared for you Bitcoin analytics. After testing the resistance area between 107500 and 108200 points, the price started to form a clear descending pattern, respecting the downward trend line with multiple touches. The price consistently failed to break above it, confirming beari

See all crypto ideas

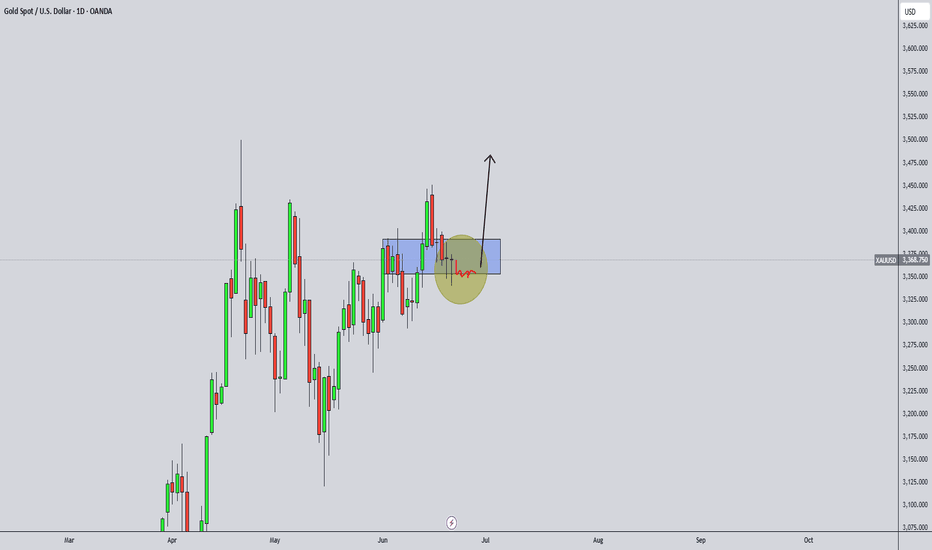

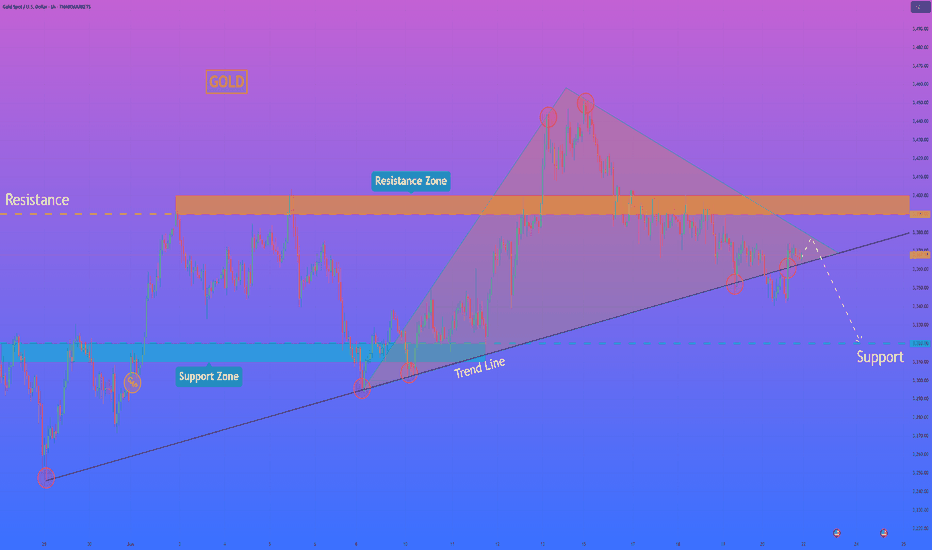

Lingrid | GOLD Weekly Outlook: Corrective Phase Tests SupportOANDA:XAUUSD experienced a notable pullback this week, retreating from the $3,450 resistance zone as profit-taking emerged following the recent geopolitical rally. The market appears to be entering a healthy corrective phase after the strong upward momentum driven by Middle Eastern tensions and saf

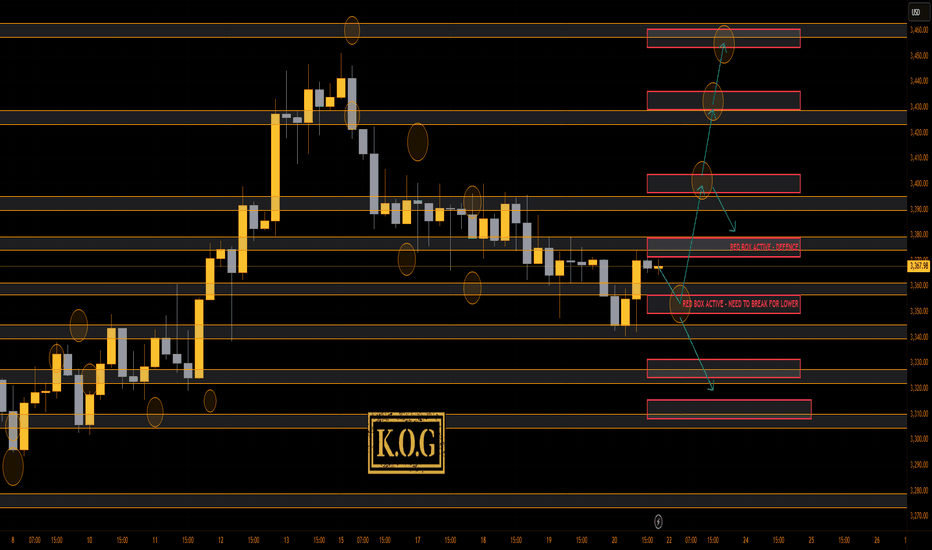

THE KOG REPORTTHE KOG REPORT:

In last week’s KOG Report we said we would be ideally be looking for the market to open, give us a high into that red box region 3455-60 and then give the reaction we wanted for the short trade. We didn’t quite hit that level falling just shy, but the move did present itself and as

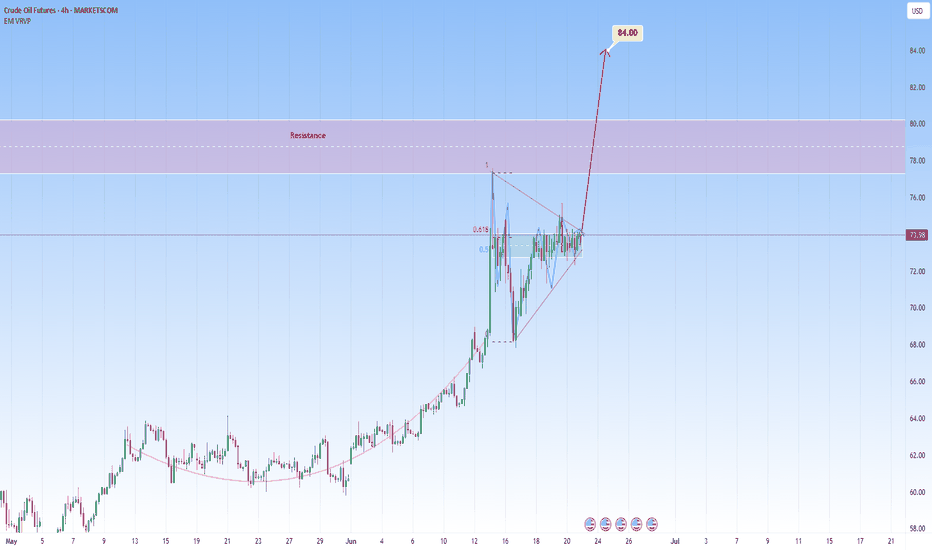

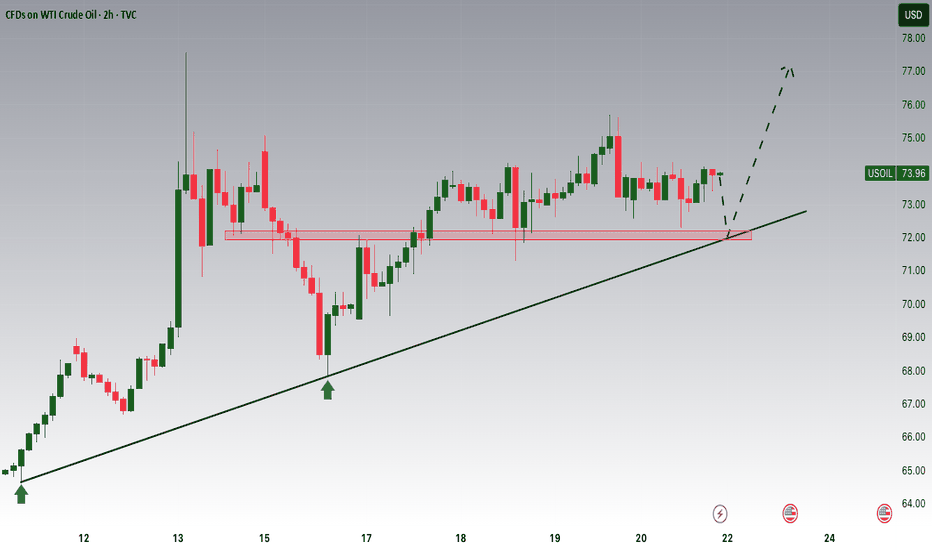

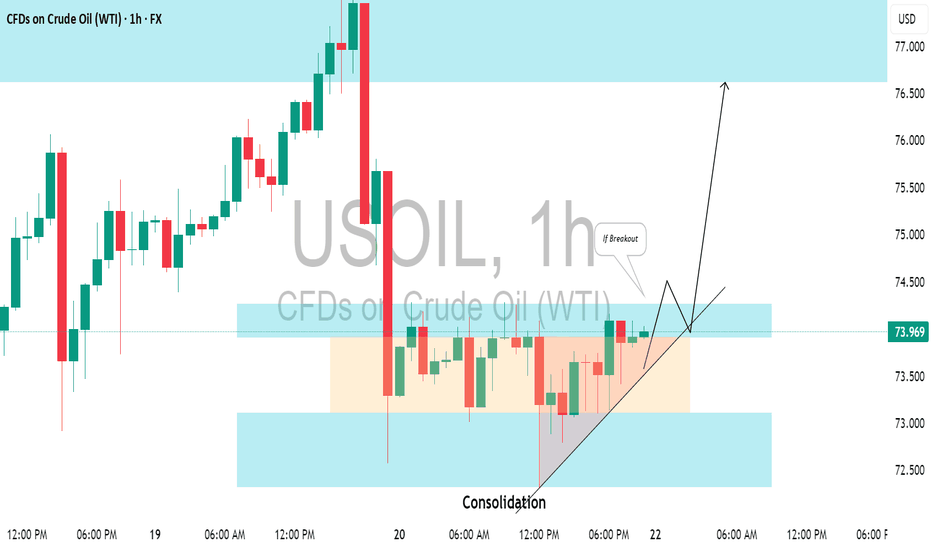

|Symmetrical Triangle| Squeeze in Crude OilCrude oil is currently forming a symmetrical triangle pattern, a classic squeeze formation with price compressed into a tight range. Symmetrical triangles typically act as continuation patterns, favoring the prevailing trend, and in this case, on the daily chart, the trend is well established: a bul

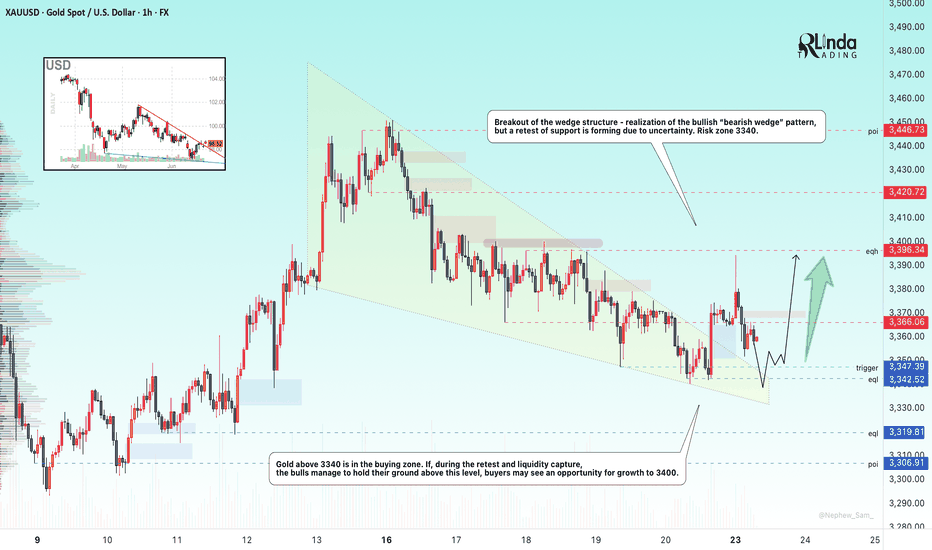

GOLD → Risk zone 3340. Sell-off after rallyFX:XAUUSD , after breaking out of its accumulation phase, rallied towards the 3400 zone of interest, but failed to reach liquidity and reversed, selling off its gains due to economic uncertainty.

In my opinion, the market is unexpectedly subdued and has reacted very weakly to geopolitical prob

XAUUSD Analysis Today: Technical and Order Flow !In this video I will be sharing my XAUUSD analysis today, by providing my complete technical and order flow analysis, so you can watch it to possibly improve your forex trading skillset. The video is structured in 3 parts, first I will be performing my complete technical analysis, then I will be mov

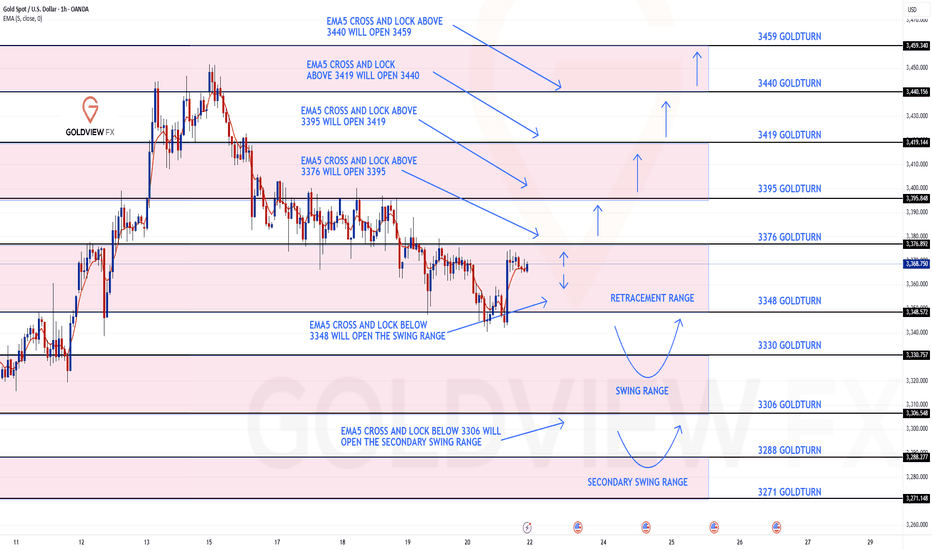

GOLD 1H CHART ROUTE MAP UPDATE & TRADING PLAN FOR THE WEEKHey Everyone,

Please see our updated 1h chart levels and targets for the coming week.

We are seeing price play between two weighted levels with a gap above at 3376 and a gap below at 3348. We will need to see ema5 cross and lock on either weighted level to determine the next range.

We will see le

HelenP. I Gold may continue to decline to support levelHi folks today I'm prepared for you Gold analytics. After dropping from the support zone, the price of Gold found temporary support near the trend line and started to rise again. The upward movement was sharp and even created a gap while breaking through the previous support level, which then acted

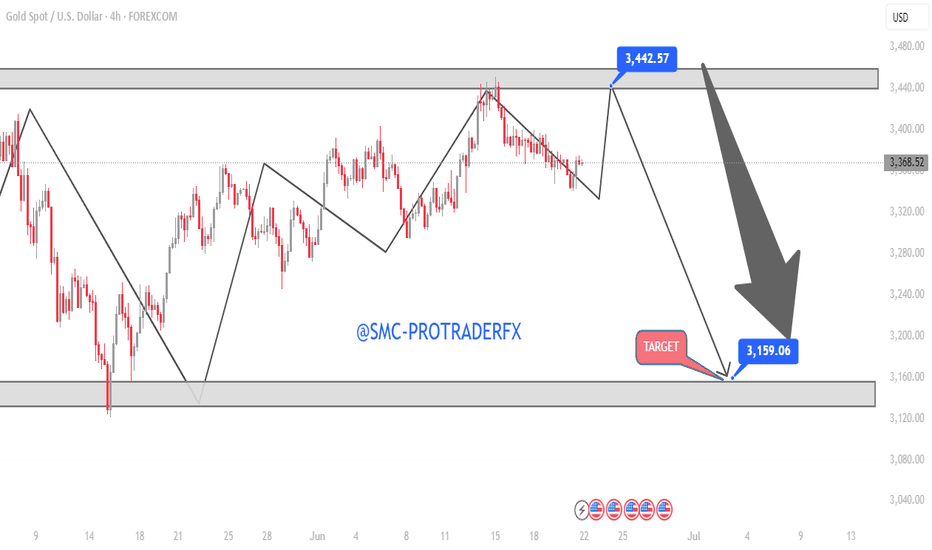

XAUUSD H4 Chart Pattern – Liquidity Grab Before Major Sell-Off📉 XAUUSD Bearish Setup | Smart Money Concept Analysis

Gold is currently trading within a clear range between strong supply and demand zones on the 4H chart. After multiple rejections near the resistance zone, price is likely to tap into the liquidity zone near 3,442.57, followed by a potential stro

CRUDE OIL (WTI): Technical Analysis & Important pattern to WatchHere’s my latest analysis on ⚠️USOIL price action.

The price has recently finished a correction, followed by a brief consolidation in a horizontal range and an ascending triangle pattern

A bullish breakout above the intraday resistance levels would suggest a likely end to the accumulation phase.

See all futures ideas

EURJPY: A Big Move In Making, Please Share Your Views! Date: 22/06/2025

Hello everyone,

I hope you’re all having a good weekend. As we previously discussed, we expected a sharp decline in Europe/JPY, but unfortunately, it didn’t work out in our favour due to the extremely bullish US dollar. This led to the crossing and invalidation of our two selling

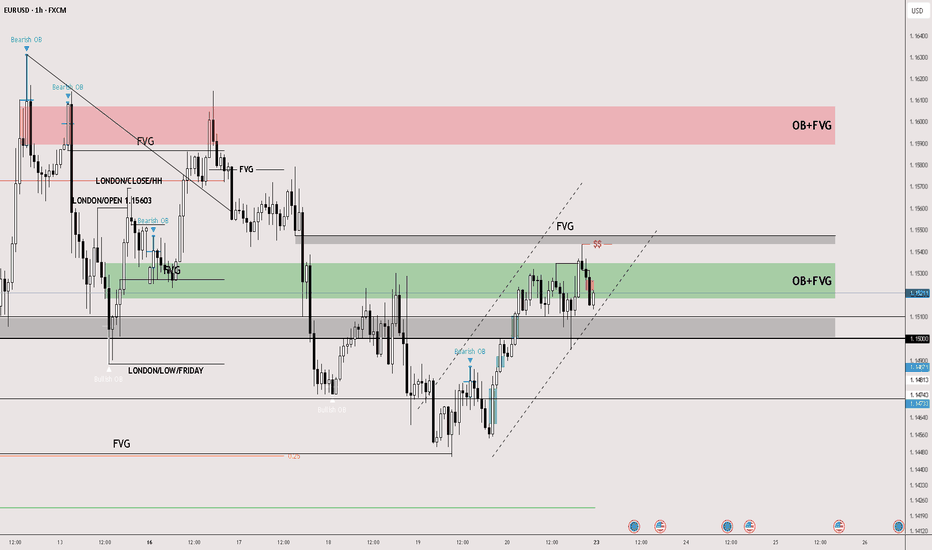

EUR/USDScenario 1: Bullish Reversal (If current FVG support holds)

Bias: Short-term bullish, looking for a continuation of the bounce.

Rationale: The price responded positively to an earlier low and is completing an FVG at this juncture. If this FVG is supported and the price breaks out above the latest b

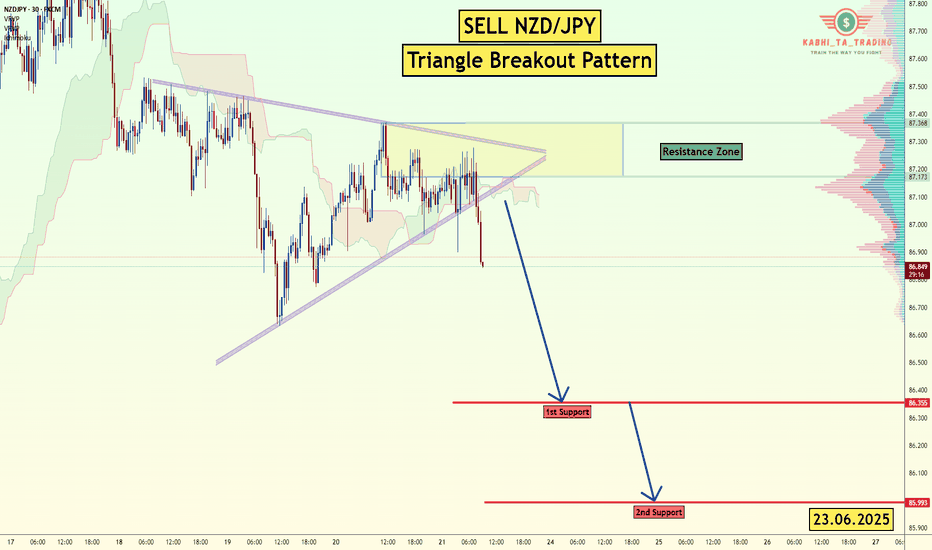

NZD/JPY - Triangle Breakout (23.06.2025)The NZD/JPY Pair on the H1 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Triangle Breakout Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline O

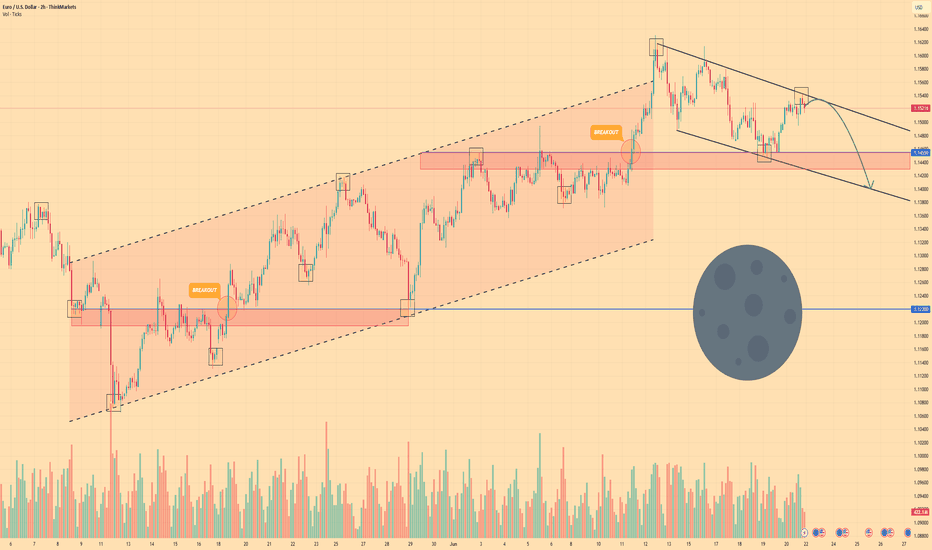

EURO - Price can continue to decline inside wedge patternHi guys, this is my overview for EURUSD, feel free to check it and write your feedback in comments👊

Some days ago, price tried to grow, but failed and dropped below $1.1220 support level, after which started to grow in channel.

In rising channel, price broke $1.1220 level one more time and then ro

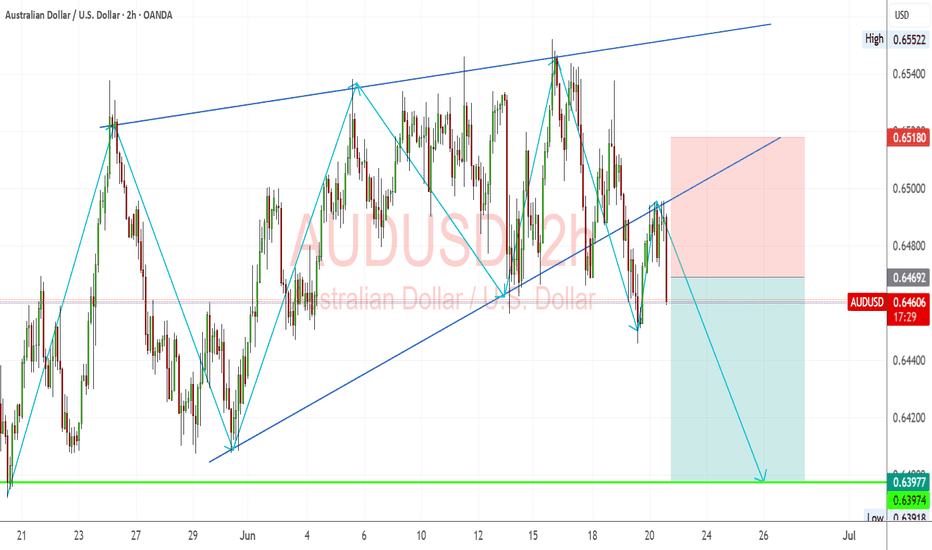

AUDUSD Analysis – Falling from the Rising WedgeAUDUSD pair broke below an ascending wedge, a bearish reversal pattern.

Clean rejection from 0.6518, with lower highs and new lower lows confirming bearish momentum.

Price is now sitting below former trendline support, retested and respected as resistance.

Bearish target points toward 0.6400–0.63

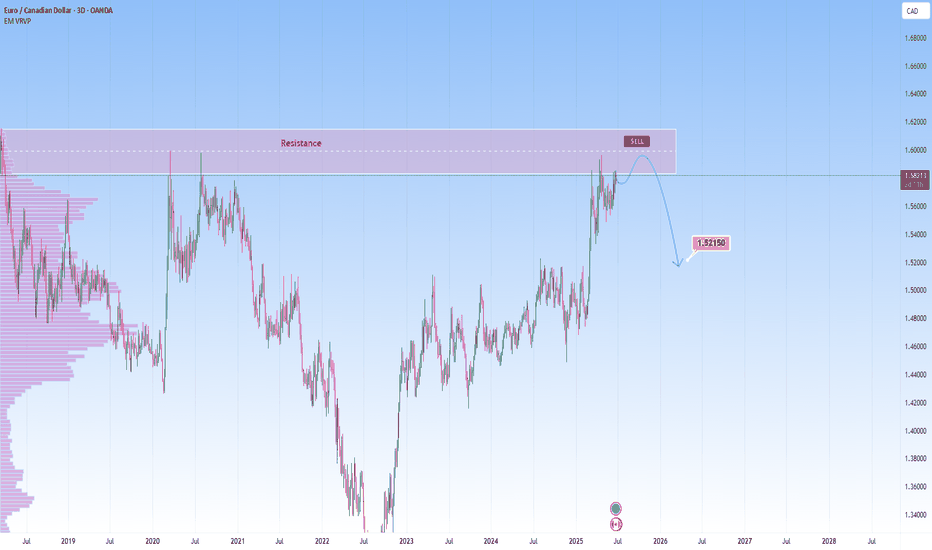

EURCAD at key resistance: Will price rebound to 1.5215?The price is currently at a strong resistance level, where it has struggled to break through and reversed sharply to the downside before. This makes the area particularly important to monitor, especially for traders considering potential short setups.

If we begin to see signs of rejection at this

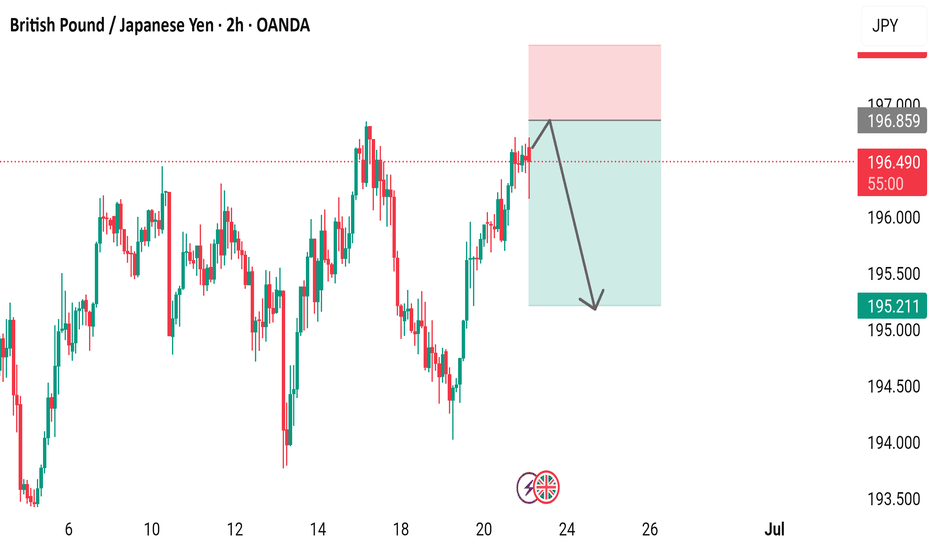

GBP/JPY 2-Hour Chart - OANDA2-hour price movement of the British Pound (GBP) against the Japanese Yen (JPY) from OANDA, showing a current value of 196.248 with a slight decrease of 0.256 (-0.13%). The chart includes candlestick patterns, a highlighted resistance zone (pink), and a support zone (cyan), with key levels marked at

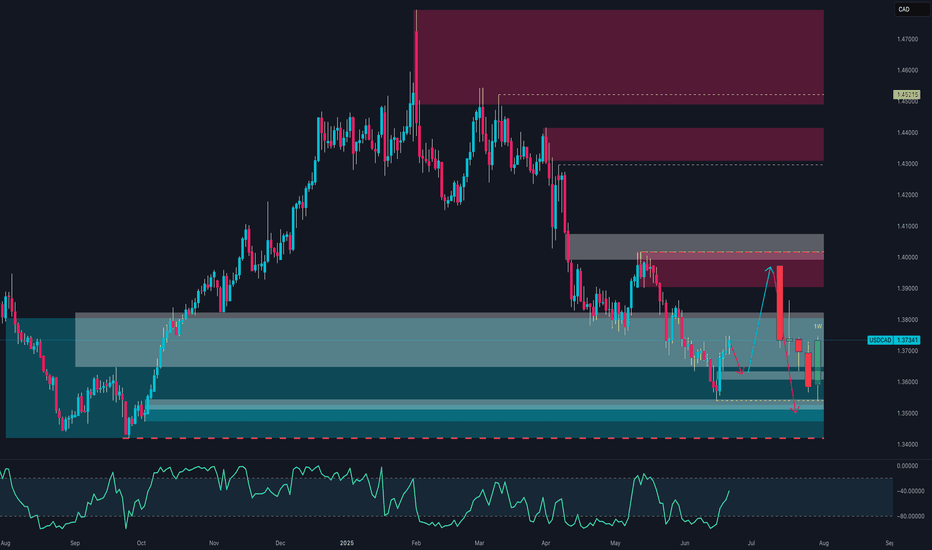

USD/CAD Trap in Progress? Smart Money Flips BearishUSD/CAD is currently in a rebalancing phase after the strong downside correction seen over recent weeks. Following a rejection in the 1.3900–1.4000 supply zone, price retraced down to a major demand area between 1.3500 and 1.3650, where it has shown a notable bullish reaction. The pair is now tradin

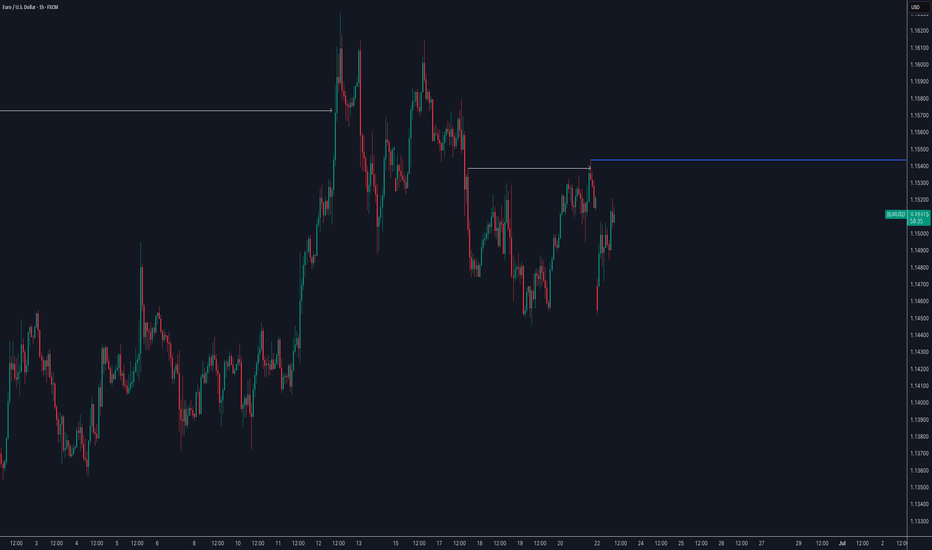

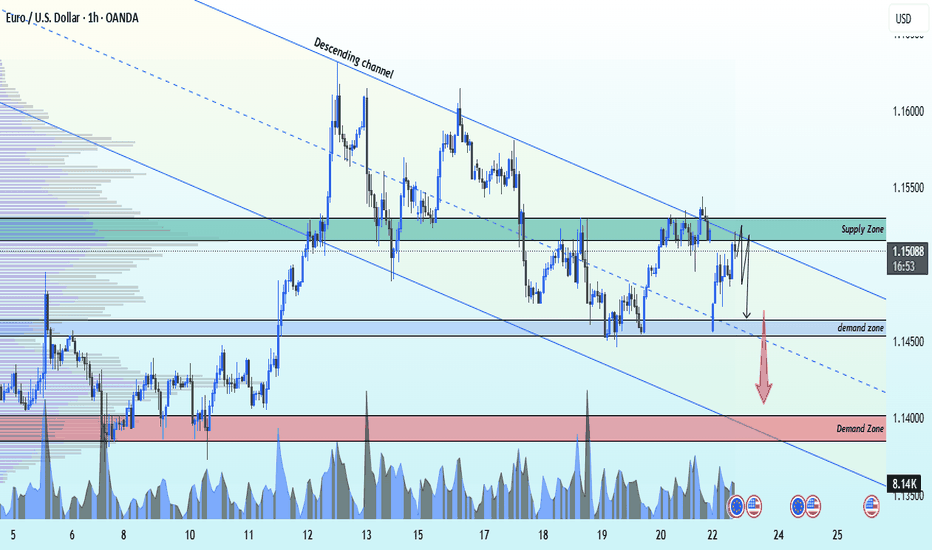

EURUSD Sell Channel Strong Selling From Key Resistance 1.15200EURUSD Technical Update

Pair is respecting the descending channel and showing strong selling pressure from key resistance at 1.15200.

1H Time Frame Outlook

🔻 Target 1: 1.14700

🔻 Target 2: 1.14000

Momentum favors the bears as long as price remains below resistance.

💬 Drop your thoughts below,

📈

See all forex ideas

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - |

Trade directly on the supercharts through our supported, fully-verified and user-reviewed brokers.