Market analysis from City Index

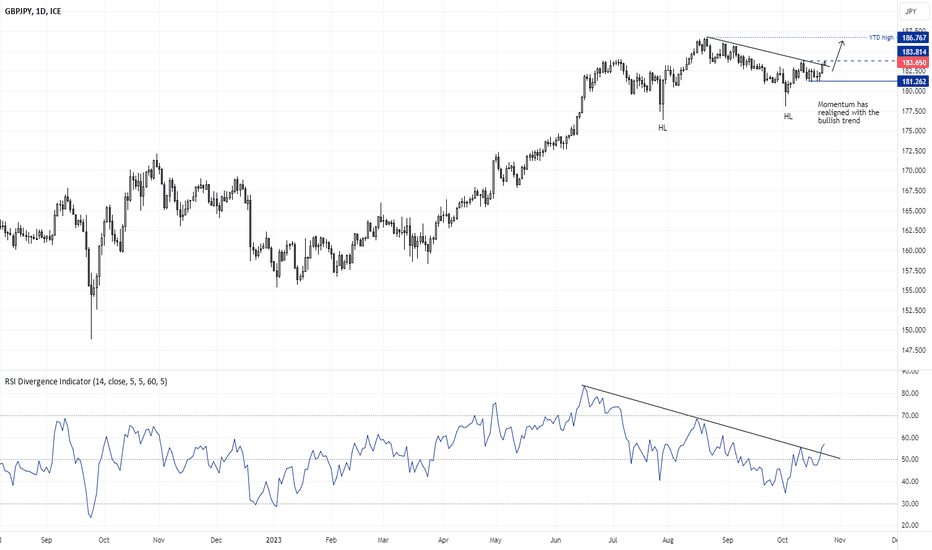

Whilst USD/JPY remains range-bound within a tight range just beneath 150, GBP/JPY appears to be making a break higher. The daily chart remains in a strong uptrend and momentum has recently realigned with that trend. Prices have teased the retracement line ahead of the UK open, so we're either looking for prices to break above the prior swing at 138.82 high or...

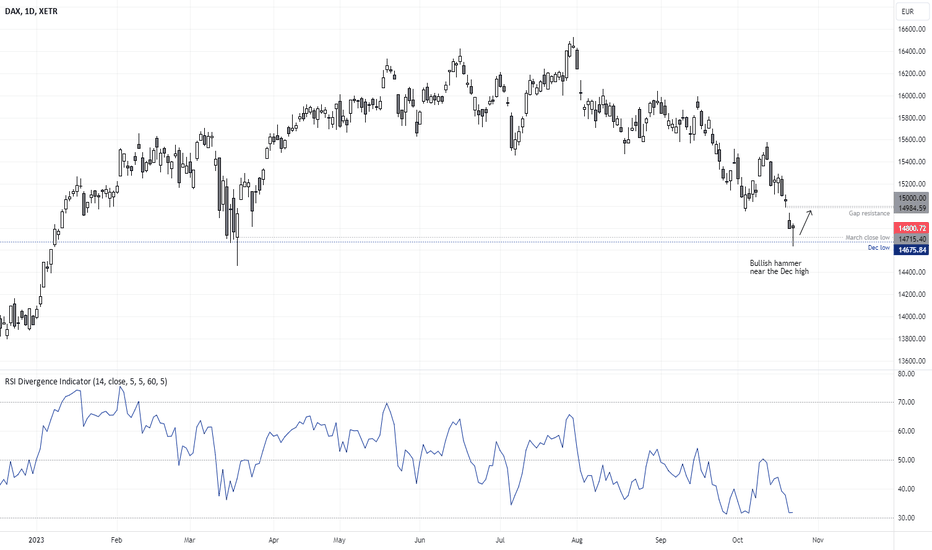

Yes, the DAX is clearly within an established downtrend on the daily chart. And its drawdown from its record high is relatively shallow at just -11.5% by historical standards - meaning we suspect further losses could be coming. Yet its failure to break beneath the December high and March low has not gone unnoticed. And given it formed a bullish hammer around...

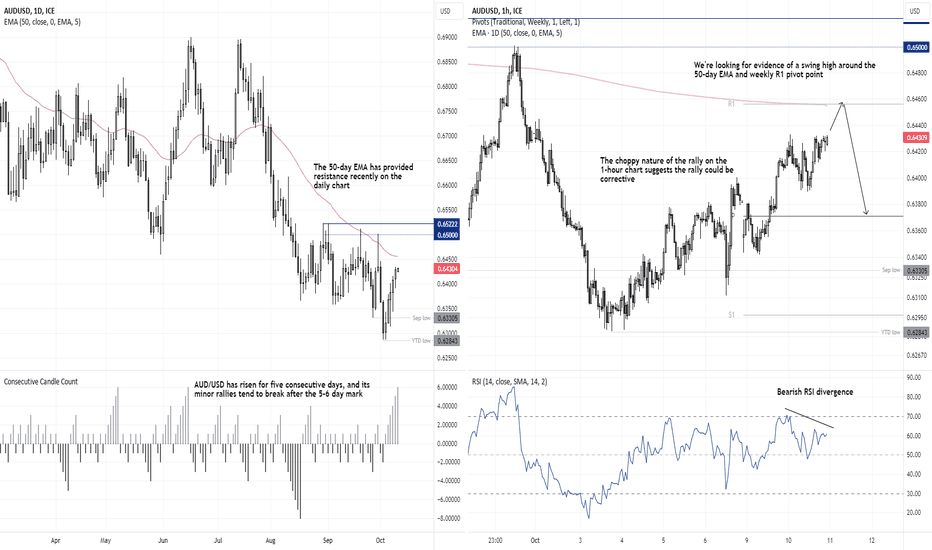

The Aussie has risen for a fifth day, but it is worth noting that minor rallies tend to peter out around the 5-6 day mark. Price action on the 1-hour chart also suggests the rally could be corrective, against its drop from 65c-63c. Given a bearish RSI divergence is forming on the 1-hour RSI (14) and the 50-day EMA resides around the weekly R1 pivot, we're...

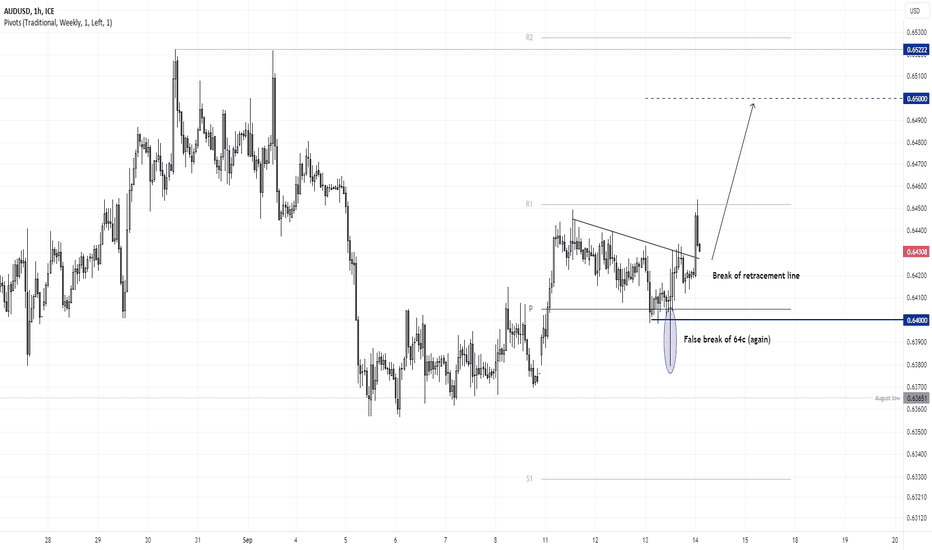

The Aussie fell in line with our bearish bias last week, thanks to stronger-than-expected CPI data from the US and the Middle East conflict. Yet despite the risk-off sentiment, the Aussie held above 63c last week and formed a bullish engulfing day on Monday. A bullish engulfing candle also formed on the 4-hour candle, prices are back above the September low and...

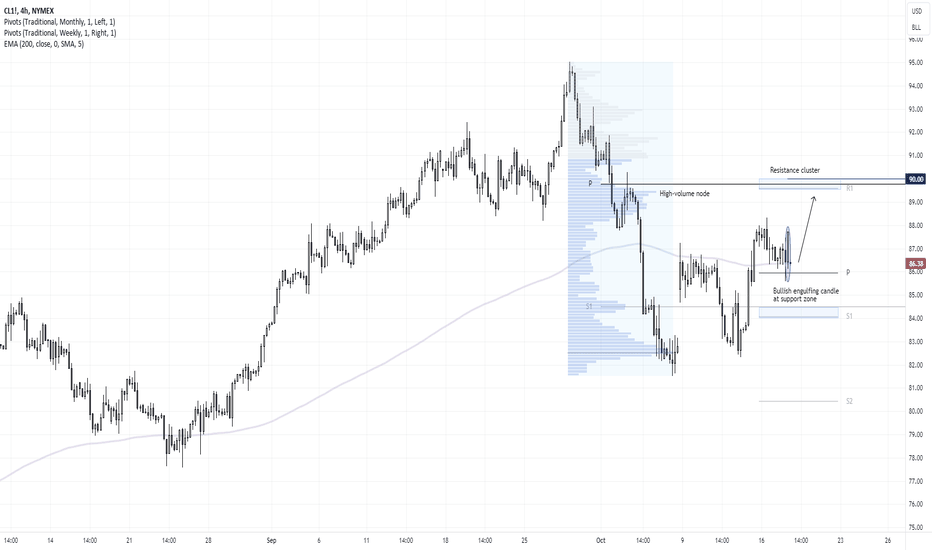

We saw the pullback into the support area we were waiting for, around the 200-dar EMA on the 4hour chart and weekly pivot point. A bullish engulfing candle also formed at the end of the session, and whilst prices have gapped lower at the open, we're now looking to enter long and target the resistance zone around $90.

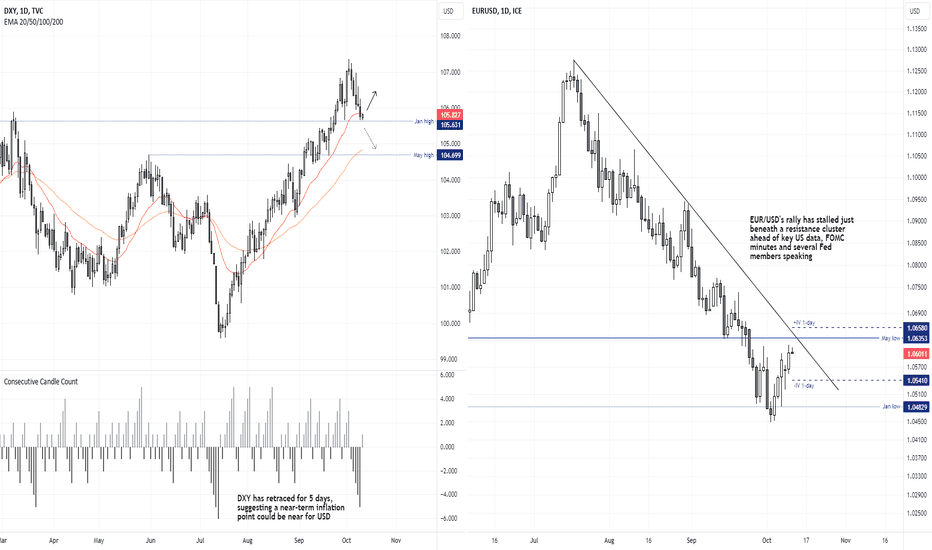

We have a busy claendar today for forex traders, with US producer prices data, FOMC minutes and several Fed members set to speak. Clearly this lineup has the potential for some larger moves on the US dollar, and that helps explain why the 1-day implied volatilty level for EUR/USD is nearly 200% of its 20-day average. What’s grabed our attention is that DXY has...

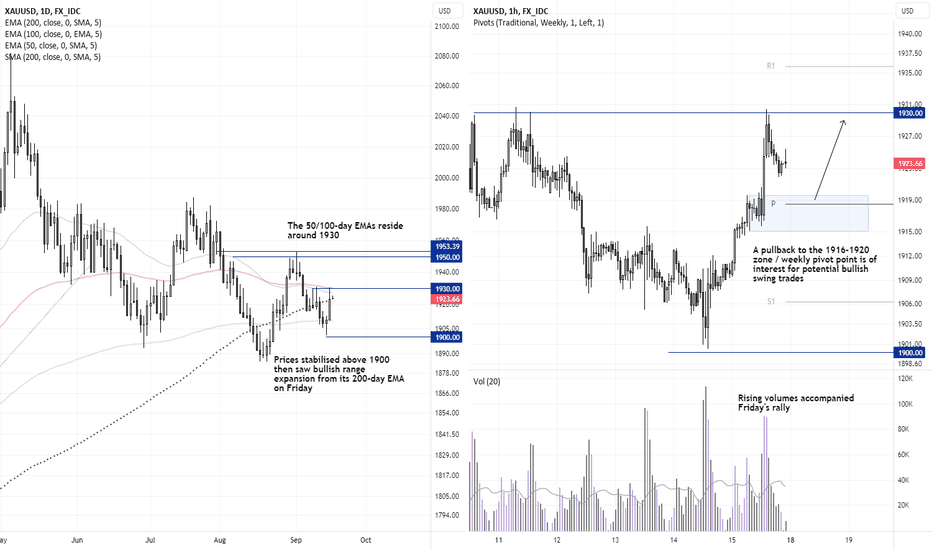

Gold has fallen around -7% since bearish pinbar high around 1950, and has done so in a relatively straight line. Yet bearish momentum has receded, and prices are holding above the monthly S1 pivot point. The decline has also failed to test 1800 (a likely solid area of support), which adds to the case we may be due a bounce. We’re not looking for any home runs,...

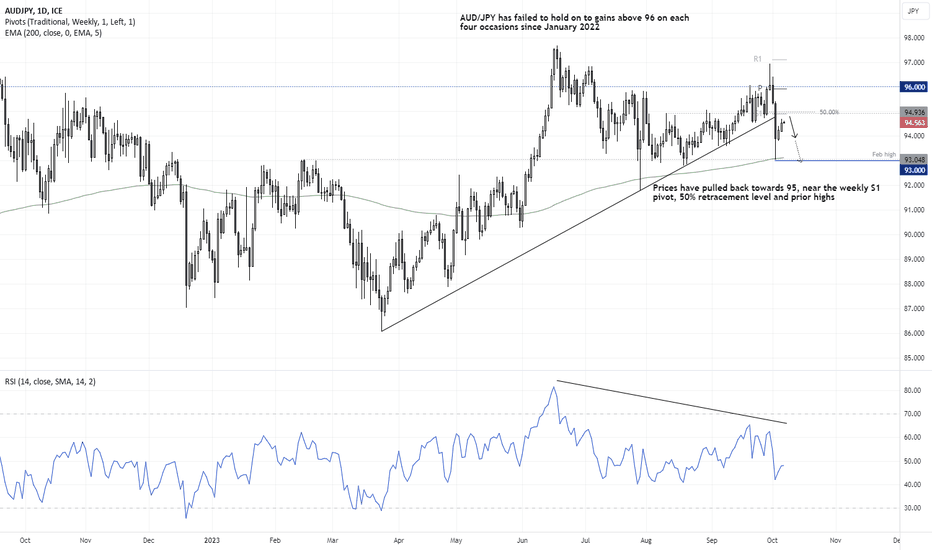

Once again we saw AUD/JPY rally above 96 before reversing lower, which is a pattern we have seen occur four times since January 2022. A shooting start reversal formed on Friday and the cross fell around -4% Tuesday’s low, breaking a bullish trendline before finding support at the 200-day EMA, February high and 96 handle. We’ve seen two modest up days since,...

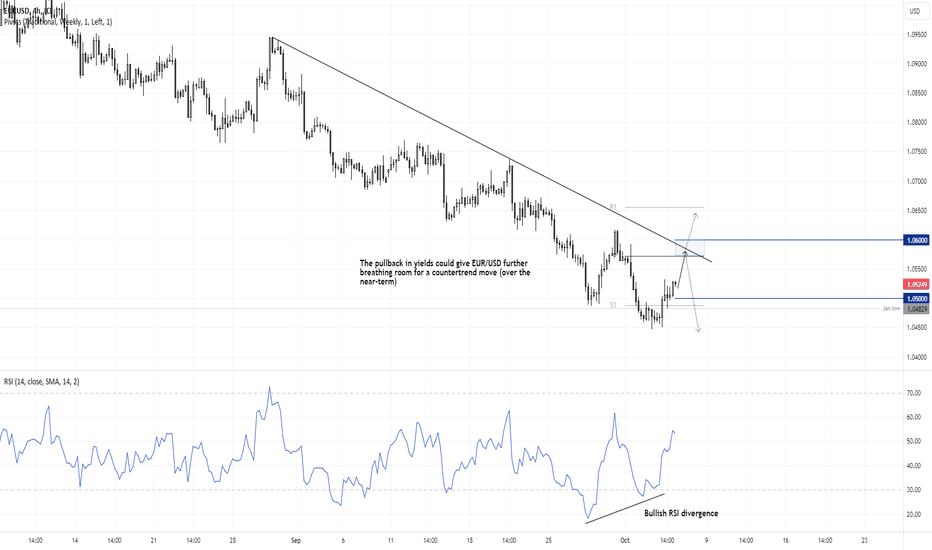

EUR/USD has managed to retrace further from its YTD low during Thursday’s Asian session, and it looks set to extend its countertrend move (assuming yields retrace lower). A bullish RSI divergence formed ahead of the recent lows, and momentum has turned higher, and it looks like EUR/USD now wants to reach for the 1.05570 – 1.0600 level, near the weekly pivot point,...

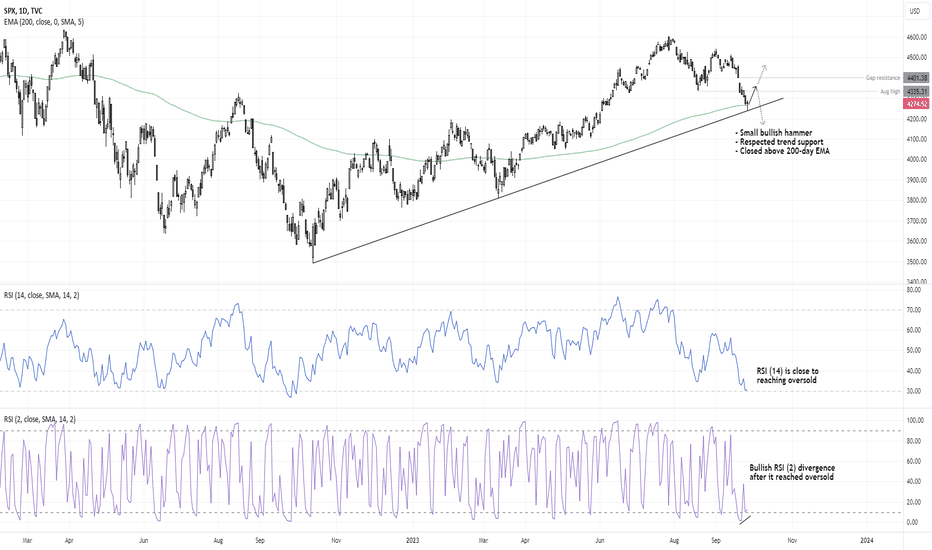

We all know that global indices have been under pressure whilst the US dollar and bond yields scream higher. But with the S&P 500 respecting key levels of support and forming a bullish hammer on Wednesday, perhaps it is time for at least a sympathy bounce? Furthermore, the hammer low perfectly respected trend support and closed above the 200-day EMA, with a...

Gold prices enjoyed their best day in nearly three weeks on Friday, with clear bullish range expansion helping it to rally from the 200-day EMA after finding stability above 1900 on Thursday. However, Friday's high met resistance at the 50/100-day EMAs and prices pulled back to the 200-day average. Given we have an FOMC meeting looming this week, we might find...

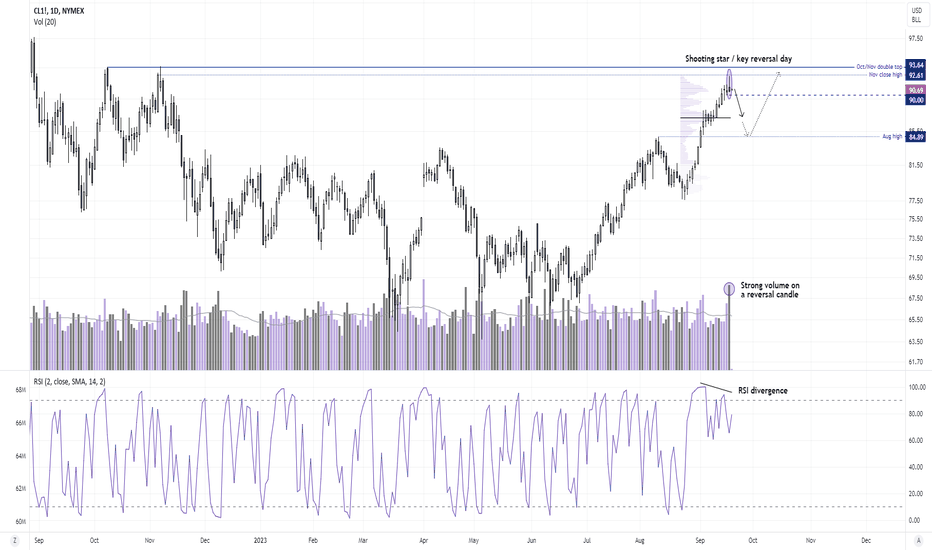

Whilst we retain our view that oil prices could be headed for $100 further out, the trend seems to have hit a speed bump over the near-term. WTI broke above $90 with ease yet faltered around $95 with a shooting car candle with high volume (which makes it a potential key reversal day). A bearish divergence has also formed with the RSI (2) after it reached...

Yes, EUR/USD has fallen to a key support level around the May low. And that will likely deter some bears around current levels from entering short (depending on their timeframe). But given the potential for for the Fed to deliver a more hawkish message than money markets are pricing in whilst the ECB suggest they are done tightening, we're not discounting the...

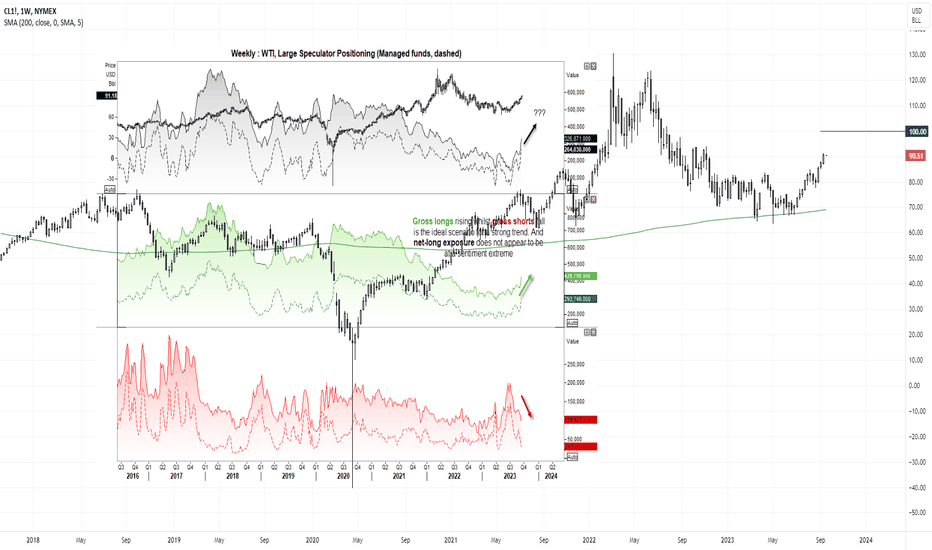

The more we look at market positioning on WTI, the more we suspect that oil may be dominating headlines as we head into 2024. In recent weeks we can see that large speculators and asset managers have been increasing long exposure and reducing shorts, which is the ideal scenario for a bullish trend. Yet net-long exposure for both sets of traders remains low by...

Despite strong data from the US and weak data from China over the past few weeks, AUD/USD bears have failed to keep the Aussie below 64c. Even a strong inflation report from the US on Wednesday resulted in the Aussie springing back above that key level. Since then, we have seen the pair break a retracement line on the 1-hour chart as part of a bullish breakout...

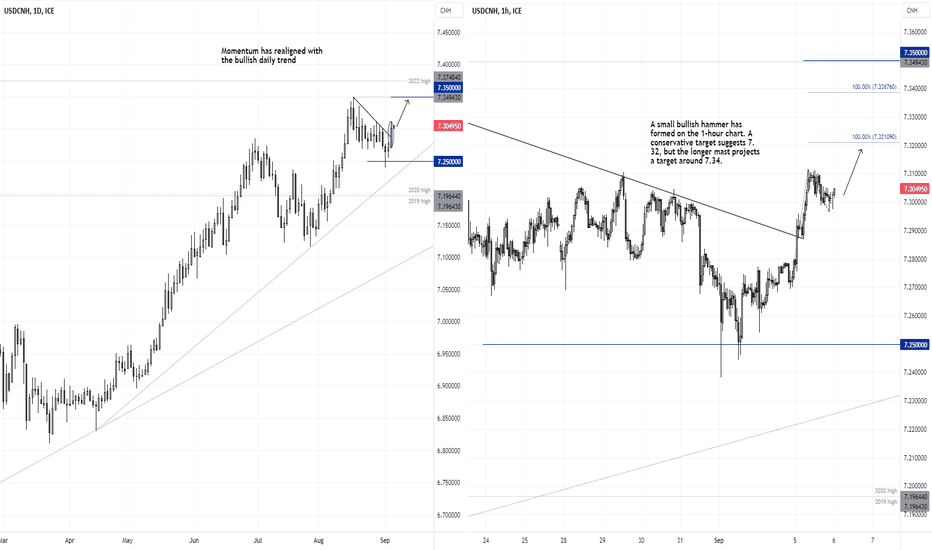

USD/CNH remains in a soliud uptrend on the daily chart and, after consolidating around the June highs and forming a bullish hammer at 7.25, the swing low appears to be in. A bullish range expansion day broke the bearish resistance line, and bulls could seek to enter upon any pullbacks towards yesterday’s low for a tigher long entry. The bias remians bullish above...

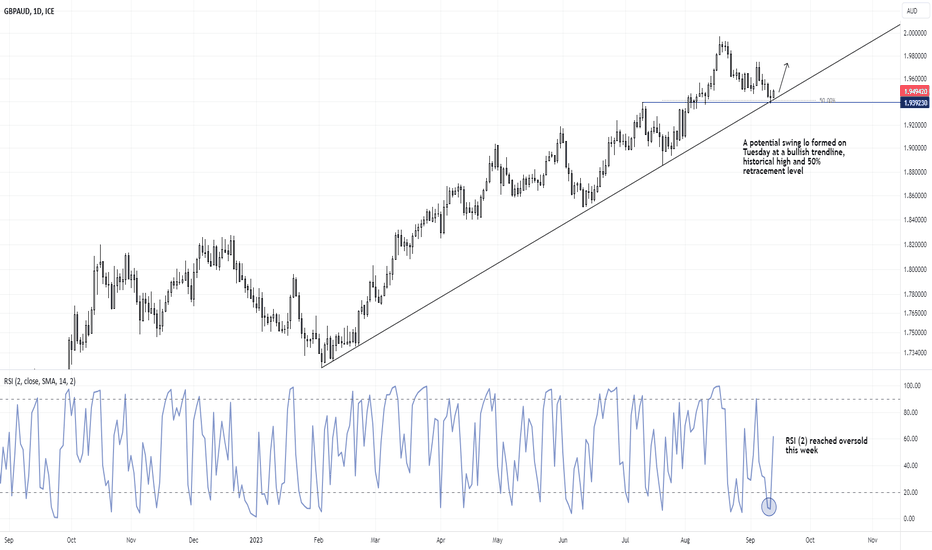

GBP/AUD has retraced from its YTD highs in three waves, and hinted at a swing low with a Doji yesterday. Moreover, the doji formed at a long-term trendline, historical high and 50% retracement level whilst RSI (2) was in the oversold level. The bias remains bullish whilst prices remain this week's low, with an interim target near 1.9700. Given its established...

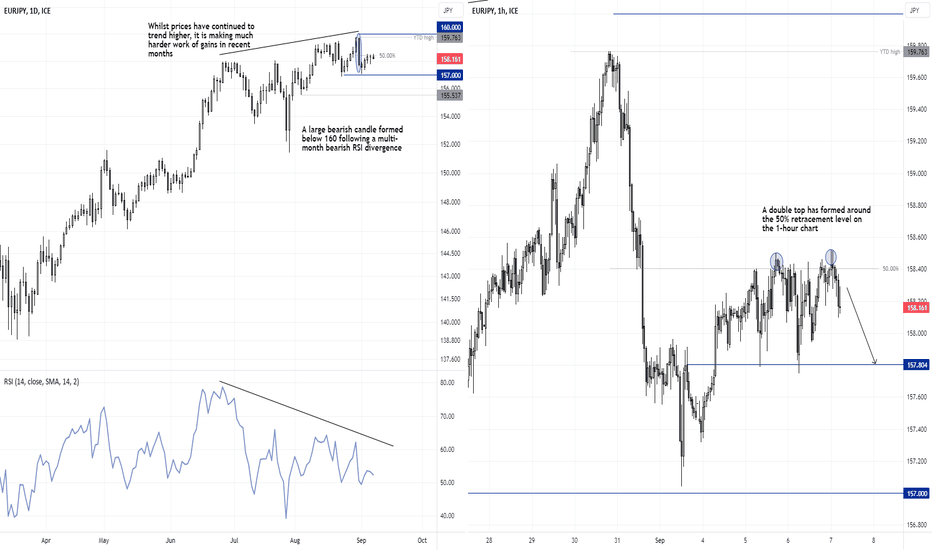

Last week we outlined a bearish bias on the daily EUR/JPY chart, due to its elongated bearish candle below 160 following an established RSI divergence on the daily chart. The 1-hour chart shows a strong move lower from the August highs, followed by choppy price action and a lame attempt to recoup half of the losses sustained from the initial drop - which suggests...