ADA – Cardano Swing Long Idea

📊 Market Sentiment

Market sentiment remains strongly bullish as the FED is expected to deliver a 0.25% rate cut, with speculation building for a possible 0.5% cut in September. Monetary policy shifts are being driven by both inflation trends and weakening labor market data. The latest August and September job reports were soft, signaling that the economy is cooling rapidly. This environment continues to fuel expectations for a major bullish run in the weeks ahead.

📈 Technical Analysis

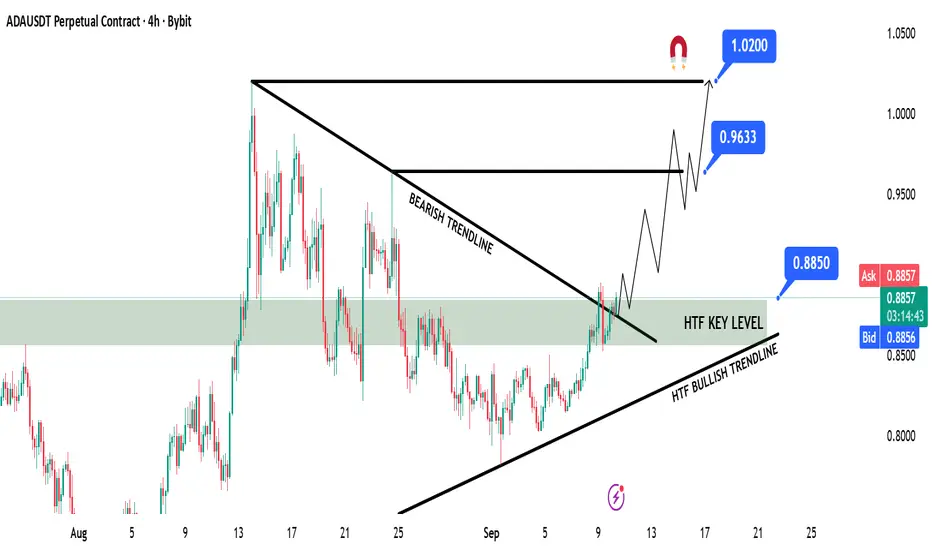

Price found support on September 1st at the bullish HTF trendline and has been moving upward since.

Price is currently at the HTF Key Resistance level, showing accumulation rather than sharp rejection, with deviations pushing upward. This indicates strength and a bias toward higher prices.

📌 Game Plan

1)Watch for a daily close above the bearish trendline.

2)Look for the HTF Key Resistance to be broken and confirmed with a daily close above.

🎯 Setup Trigger

Entry after the retest of the HTF Key Resistance level ($0.885).

📋 Trade Management

Stoploss: Daily close below HTF Key Level ($0.85 area)

Targets:

TP1: $0.96

TP2: $1.02

💬 Like, follow, and comment if you find this setup valuable!

⚠️ Disclaimer: This content is for informational and educational purposes only and does not constitute financial, investment, or trading advice. Always do your own research before making any financial decisions.

📊 Market Sentiment

Market sentiment remains strongly bullish as the FED is expected to deliver a 0.25% rate cut, with speculation building for a possible 0.5% cut in September. Monetary policy shifts are being driven by both inflation trends and weakening labor market data. The latest August and September job reports were soft, signaling that the economy is cooling rapidly. This environment continues to fuel expectations for a major bullish run in the weeks ahead.

📈 Technical Analysis

Price found support on September 1st at the bullish HTF trendline and has been moving upward since.

Price is currently at the HTF Key Resistance level, showing accumulation rather than sharp rejection, with deviations pushing upward. This indicates strength and a bias toward higher prices.

📌 Game Plan

1)Watch for a daily close above the bearish trendline.

2)Look for the HTF Key Resistance to be broken and confirmed with a daily close above.

🎯 Setup Trigger

Entry after the retest of the HTF Key Resistance level ($0.885).

📋 Trade Management

Stoploss: Daily close below HTF Key Level ($0.85 area)

Targets:

TP1: $0.96

TP2: $1.02

💬 Like, follow, and comment if you find this setup valuable!

⚠️ Disclaimer: This content is for informational and educational purposes only and does not constitute financial, investment, or trading advice. Always do your own research before making any financial decisions.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.