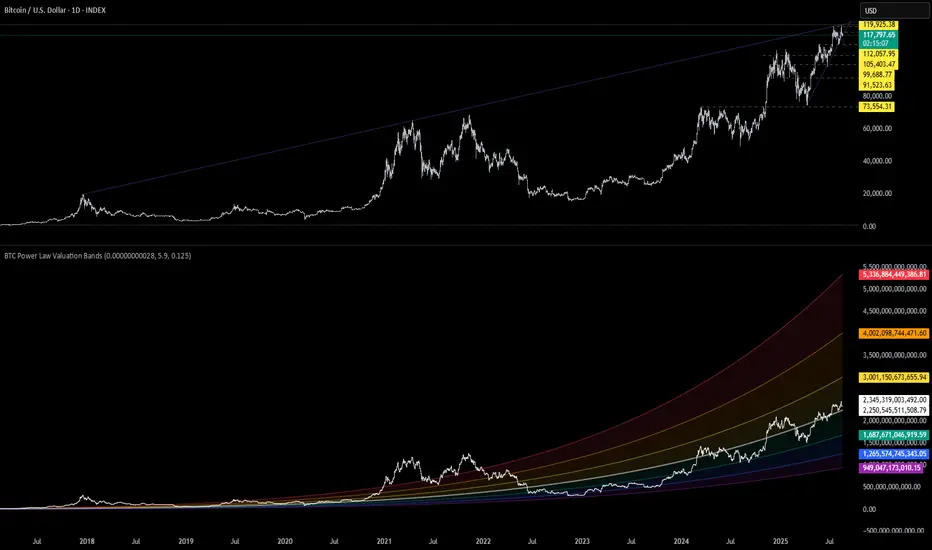

This chart applies a Power Law Rainbow Model to Bitcoin using a long-term logarithmic regression fitted to BTC's historical price action. Power laws are mathematical relationships often found in nature, science, and network systems — and Bitcoin is no exception.

Rather than relying on arbitrary trendlines, this model fits a curve based on the equation:

Price = a × t^b

Where:

t is the number of days since inception

a and b are constants optimized to Bitcoin's growth

Bands represent log-scaled standard deviation zones from the curve

🌈 Interpreting the Chart

The center white curve reflects Bitcoin's "fair value" according to its adoption-based trajectory.

Colored bands represent ±1σ, ±2σ, ±3σ from the model, creating a "valuation rainbow."

Historically, Bitcoin's cycle bottoms have touched the lower bands (blue/purple), while euphoria tops align with the upper bands (orange/red).

✅ Current Outlook

BTC is trading just under the fair value curve, suggesting it's fairly valued or slightly undervalued from a long-term perspective.

This position has historically preceded major upside moves, especially in post-halving environments.

From a Smart Money Concepts angle, we're in a potential accumulation or markup phase, with institutional and informed capital likely already positioning.

🧠 Why Power Laws Work for BTC

Bitcoin adoption follows network effects — more users = more value — which naturally follows a power law.

Unlike linear trends, power law curves scale with time, making them ideal for modeling exponential assets.

They offer a more objective long-term valuation framework, avoiding emotional cycle chasing.

⚠️ Disclaimer

This is not financial advice. The model reflects historical behavior and is a tool to support long-term perspective — not short-term prediction. Always do your own research and risk management.

Rather than relying on arbitrary trendlines, this model fits a curve based on the equation:

Price = a × t^b

Where:

t is the number of days since inception

a and b are constants optimized to Bitcoin's growth

Bands represent log-scaled standard deviation zones from the curve

🌈 Interpreting the Chart

The center white curve reflects Bitcoin's "fair value" according to its adoption-based trajectory.

Colored bands represent ±1σ, ±2σ, ±3σ from the model, creating a "valuation rainbow."

Historically, Bitcoin's cycle bottoms have touched the lower bands (blue/purple), while euphoria tops align with the upper bands (orange/red).

✅ Current Outlook

BTC is trading just under the fair value curve, suggesting it's fairly valued or slightly undervalued from a long-term perspective.

This position has historically preceded major upside moves, especially in post-halving environments.

From a Smart Money Concepts angle, we're in a potential accumulation or markup phase, with institutional and informed capital likely already positioning.

🧠 Why Power Laws Work for BTC

Bitcoin adoption follows network effects — more users = more value — which naturally follows a power law.

Unlike linear trends, power law curves scale with time, making them ideal for modeling exponential assets.

They offer a more objective long-term valuation framework, avoiding emotional cycle chasing.

⚠️ Disclaimer

This is not financial advice. The model reflects historical behavior and is a tool to support long-term perspective — not short-term prediction. Always do your own research and risk management.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.