__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

__________________________________________________________________________________

Cross-analysis, synthesis & strategy

__________________________________________________________________________________

__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

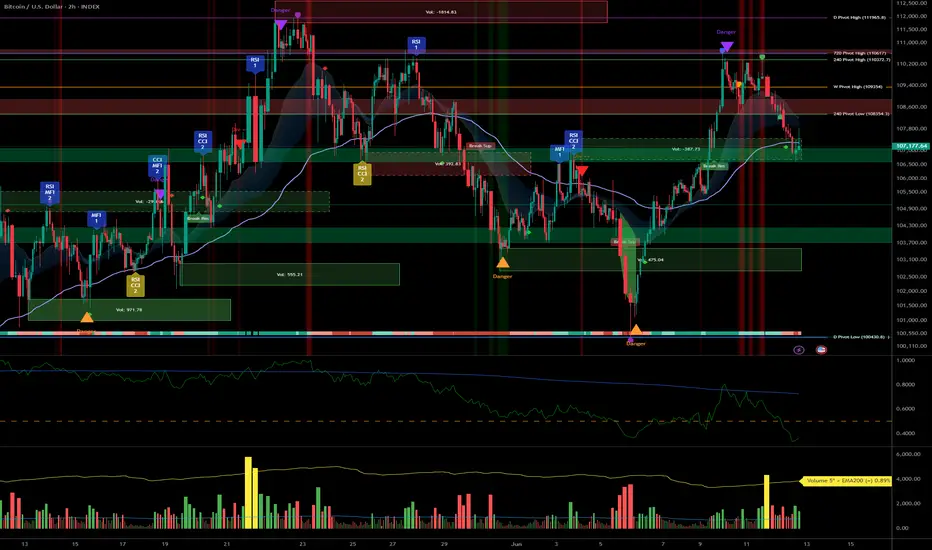

- Momentum: Bullish trend remains dominant from 1D down to 1H. Corrective consolidation on shorter timeframes (15/30min).

- Key supports/resistances: 102,000, 104,800, 106,000 (key supports) – 109,500, 110,800–111,000 (major resistances and ATH zone).

- Volume: Normal to moderately high depending on local volatility. No climax or distribution/absorption anomalies.

- Multi-TF behaviour: Risk On / Risk Off Indicator at “Strong Buy” across all >2H timeframes, ISPD DIV neutral, no detected capitulation or excess behaviour.

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

- Global bias: Strongly bullish on swing/daily horizon, healthy consolidation on short timeframes.

- Opportunities: Favour swing entries on retests of 102k–106k supports, dynamic stops below 102k.

- Risk zones: Break and close below 104,800, especially 102,000 = bullish bias invalidated.

- Macro triggers: FOMC unchanged, stable US context, focus on upcoming inflation/employment data.

- Action plan: Actively monitor pivot zones and on-chain behaviour; act on confirmed breakout signal or deep retest.

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

- 1D / 12H: Pivot support at 102k–106k, resistance 109.5k–111k. Bullish bias maintained, no excess volume, Risk On / Risk Off Indicator confirmed “Strong Buy.” Market remains mature, no concerning distribution.

- 6H / 4H: Structured supports 104.8k–106k, resistances 108.3k–110.8k. Healthy consolidation, swing buyers strong.

- 2H / 1H: Dense supports 105.6k–106.2k, barrier 109.5k–110.8k. Positive momentum, no extreme ISP/volume signals.

- 30min / 15min: MTFTI “Down” trend—micro-consolidation after extension. No stress, digestion/reload phase.

- Multi-TF summary: Strong bullish alignment above 1H. Micro TFs in low-risk consolidation—entry opportunity on clear retracement.

__________________________________________________________________________________

Cross-analysis, synthesis & strategy

__________________________________________________________________________________

- Confluences: Stable macro, on-chain & technical supports aligned, no panic or excess volume. Risk On / Risk Off Indicator “Strong Buy” dominates daily/swing horizons.

- Risks/unexpected: Potential sharp volatility if breakout >111k or sub-102k support break.

- Optimal plan: Defensive buying on support, tight stop <102k, active management post-macro data.

- On-chain: Strong recovery since $101k, matured supply, solid STH cost basis at $97.6k.

- Caution window: Wait for US data release before heavy positioning; favour scalping/swing on confirmed signal.

- Objective: Leverage multi-indicator confluence, stay flexible/reactive if structural break.

BTC market retains strong bullish markers on all ≥1H timeframes. No behavioural or volume stress. Best approach: defensive buys near supports, tight stops, watch for macro releases. Stay reactive to ATH breakout or support break—act on confluence, adjust if structure fails.

__________________________________________________________________________________

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.