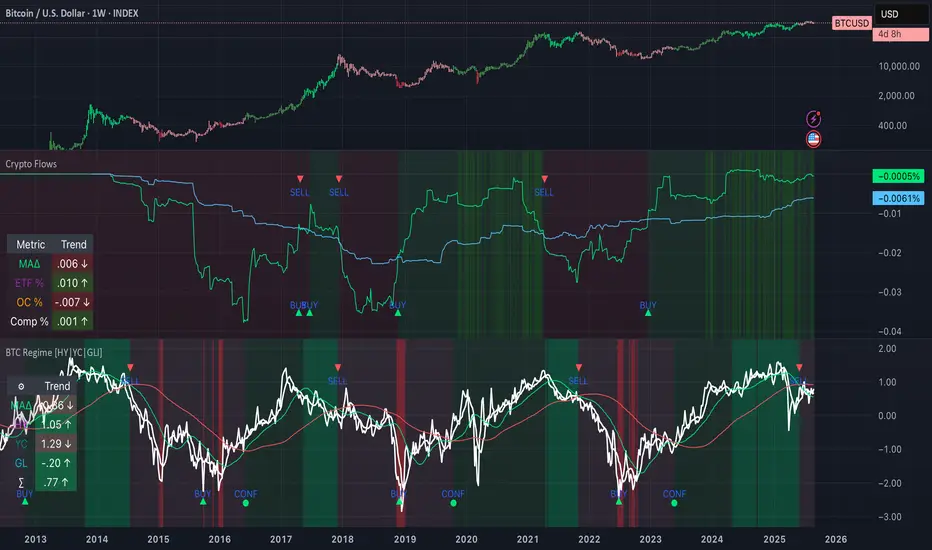

I’ve been digging into the current  BTCUSD Bitcoin cycle using my indicator, and it’s throwing up an interesting contradiction. If I focus only on the liquidity side – M2, the yield curve and high‑yield spreads – we look to be at the very start of a bear market for BTC and other high‑risk crypto assets. Those macro gauges are turning down, which would normally spell trouble.

BTCUSD Bitcoin cycle using my indicator, and it’s throwing up an interesting contradiction. If I focus only on the liquidity side – M2, the yield curve and high‑yield spreads – we look to be at the very start of a bear market for BTC and other high‑risk crypto assets. Those macro gauges are turning down, which would normally spell trouble.

![BTC Regime Phase [HY|YC|GLI]](https://tradingview.sweetlogin.com/proxy-s3/s/sYvx3fwR_mid.png)

Yet, when I look at actual capital flows, the picture is completely different. Spot ETF inflows remain very strong and show real institutional appetite. In fact, they’ve been robust enough to offset even the whale selling on‑chain. Because of that, my Crypto Flow indicator is still flashing “risk‑on” even though liquidity is tightening.

![Crypto Flows [ETF|On-chain]](https://tradingview.sweetlogin.com/proxy-s3/l/lC89wbUp_mid.png)

How do I square those two? My personal view is that we’re entering a stagflationary phase thanks to the Trump administration and a declining independence of the central bank and its increasing influence by the government. That means my model probably won’t look like the same as in past cycles in terms of timing and cycle length. I expect more back‑and‑forth: some days “more liquidity” will feel bullish, other days it will be seen as a policy mistake and turn bearish again. NVDA Nvidia’s earnings will set part of the tone, but I also think inflation and asset inflation will be much higher than most expect. We’re in the fiscal stimulus endgame where assets may gain in nominal terms, but after adjusting for inflation there might not be much left for a simple buy‑and‑hold investor. In my mind, it’s shifting into a trader’s regime. And because many Americans have their retirement savings in the

NVDA Nvidia’s earnings will set part of the tone, but I also think inflation and asset inflation will be much higher than most expect. We’re in the fiscal stimulus endgame where assets may gain in nominal terms, but after adjusting for inflation there might not be much left for a simple buy‑and‑hold investor. In my mind, it’s shifting into a trader’s regime. And because many Americans have their retirement savings in the  SPX S&P 500, I suspect Trump will support higher inflation while doing everything he can to prop up the stock market so ordinary citizens don’t feel poorer in real terms.

SPX S&P 500, I suspect Trump will support higher inflation while doing everything he can to prop up the stock market so ordinary citizens don’t feel poorer in real terms.

In my liquidity model, the Z‑score is in a declining zone but has recently started to show some strength again. The big question is whether ETF inflows celebrate this turnaround or dismiss it as a false signal. One thing feels clear to me: everyone is being pushed into owning assets like stocks and ETFs. The only debate is whether institutions will continue to load up on crypto ETFs or rotate into traditional value stocks. I’m curious to hear what others think about where we go from here.

![BTC Regime Phase [HY|YC|GLI]](https://tradingview.sweetlogin.com/proxy-s3/s/sYvx3fwR_mid.png)

Yet, when I look at actual capital flows, the picture is completely different. Spot ETF inflows remain very strong and show real institutional appetite. In fact, they’ve been robust enough to offset even the whale selling on‑chain. Because of that, my Crypto Flow indicator is still flashing “risk‑on” even though liquidity is tightening.

![Crypto Flows [ETF|On-chain]](https://tradingview.sweetlogin.com/proxy-s3/l/lC89wbUp_mid.png)

How do I square those two? My personal view is that we’re entering a stagflationary phase thanks to the Trump administration and a declining independence of the central bank and its increasing influence by the government. That means my model probably won’t look like the same as in past cycles in terms of timing and cycle length. I expect more back‑and‑forth: some days “more liquidity” will feel bullish, other days it will be seen as a policy mistake and turn bearish again.

In my liquidity model, the Z‑score is in a declining zone but has recently started to show some strength again. The big question is whether ETF inflows celebrate this turnaround or dismiss it as a false signal. One thing feels clear to me: everyone is being pushed into owning assets like stocks and ETFs. The only debate is whether institutions will continue to load up on crypto ETFs or rotate into traditional value stocks. I’m curious to hear what others think about where we go from here.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.