Bitcoin was born as a revolutionary, decentralized currency, promising financial freedom and independence from traditional banking systems. Yet, as we analyze its real-world distribution, it becomes clear that Bitcoin’s decentralization is more myth than reality.

🔍 The Illusion of Decentralization

Bitcoin operates on a decentralized blockchain, meaning no single entity controls the network. However, when we examine who actually owns Bitcoin, we see a highly concentrated wealth structure that mirrors traditional financial inequality.

📊 Bitcoin’s Wealth Concentration

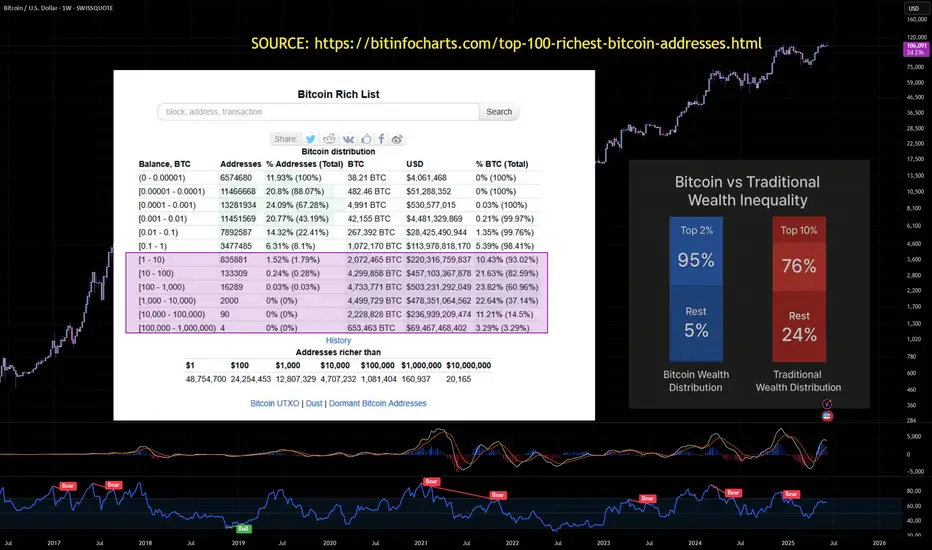

The top 0.01% of Bitcoin wallets control over 37% of total supply.

The top 1% of Bitcoin holders control over 40% of Bitcoin.

The top 2% of Bitcoin wallets control over 95% of total supply.

The bottom 98% of wallets hold less than 5% of Bitcoin.

The bottom 50% of wallets hold less than 0.03% of Bitcoin.

10,000 Bitcoin investors own 5 million BTC, worth $230 billion.

Institutional investors and early adopters dominate Bitcoin ownership.

This means that a tiny fraction of wallets dominate the entire market, while millions of small holders own completely insignificant amounts.

💰 Bitcoin vs Traditional Wealth Inequality

Bitcoin was supposed to be more equitable than traditional finance, but its wealth distribution is even more extreme than global financial inequality.

Bitcoin’s wealth gap is far worse than traditional financial inequality, proving that decentralization does not mean fair distribution.

📉 How Did Bitcoin Become So Centralized?

1. Early Adopters Accumulated Massive Holdings

Bitcoin’s first miners and tech-savvy investors acquired BTC when it was nearly worthless.

Many of these wallets still hold huge amounts, making redistribution difficult.

2. Institutional Investors Took Over

Hedge funds, exchanges, and corporations now control a massive portion of BTC.

Bitcoin ETFs and custodial wallets concentrate ownership even further.

3. Lost & Dormant Bitcoin Shrinks Circulating Supply

An estimated 29% of Bitcoin is lost or inactive, meaning fewer coins are available.

This makes the remaining BTC even more concentrated among active holders.

🚨 The Harsh Reality: Bitcoin Is Not Financial Freedom

Bitcoin was supposed to empower individuals, but in practice, it has become a playground for the wealthy.

Decentralization in theory ≠ decentralization in reality.

Institutional investors and exchanges hold a massive portion of BTC.

Bitcoin’s fixed supply (21 million BTC) makes redistribution nearly impossible.

Bitcoin is not the democratized financial system it was promised to be—it’s just another asset class where the rich get richer.

MSTR

MSTR  CRCL

CRCL  COIN

COIN  GOLD

GOLD  SILVER

SILVER  BTCUSD

BTCUSD  TSLA

TSLA  DXY

DXY  HOOD

HOOD  MARA

MARA

🔍 The Illusion of Decentralization

Bitcoin operates on a decentralized blockchain, meaning no single entity controls the network. However, when we examine who actually owns Bitcoin, we see a highly concentrated wealth structure that mirrors traditional financial inequality.

📊 Bitcoin’s Wealth Concentration

The top 0.01% of Bitcoin wallets control over 37% of total supply.

The top 1% of Bitcoin holders control over 40% of Bitcoin.

The top 2% of Bitcoin wallets control over 95% of total supply.

The bottom 98% of wallets hold less than 5% of Bitcoin.

The bottom 50% of wallets hold less than 0.03% of Bitcoin.

10,000 Bitcoin investors own 5 million BTC, worth $230 billion.

Institutional investors and early adopters dominate Bitcoin ownership.

This means that a tiny fraction of wallets dominate the entire market, while millions of small holders own completely insignificant amounts.

💰 Bitcoin vs Traditional Wealth Inequality

Bitcoin was supposed to be more equitable than traditional finance, but its wealth distribution is even more extreme than global financial inequality.

Bitcoin’s wealth gap is far worse than traditional financial inequality, proving that decentralization does not mean fair distribution.

📉 How Did Bitcoin Become So Centralized?

1. Early Adopters Accumulated Massive Holdings

Bitcoin’s first miners and tech-savvy investors acquired BTC when it was nearly worthless.

Many of these wallets still hold huge amounts, making redistribution difficult.

2. Institutional Investors Took Over

Hedge funds, exchanges, and corporations now control a massive portion of BTC.

Bitcoin ETFs and custodial wallets concentrate ownership even further.

3. Lost & Dormant Bitcoin Shrinks Circulating Supply

An estimated 29% of Bitcoin is lost or inactive, meaning fewer coins are available.

This makes the remaining BTC even more concentrated among active holders.

🚨 The Harsh Reality: Bitcoin Is Not Financial Freedom

Bitcoin was supposed to empower individuals, but in practice, it has become a playground for the wealthy.

Decentralization in theory ≠ decentralization in reality.

Institutional investors and exchanges hold a massive portion of BTC.

Bitcoin’s fixed supply (21 million BTC) makes redistribution nearly impossible.

Bitcoin is not the democratized financial system it was promised to be—it’s just another asset class where the rich get richer.

TLDR? Watch the Video

MSTR: youtu.be/h7aZwtoZ3AI?si=c2rh7mdNp_c1qpHh

Tesla BYD: youtu.be/AD45kA1TXwQ?si=jwoSqkLTRPdkFANZ

Platinum: youtu.be/IAiq3x1x72s?si=KbD0LDPDpX4KeLR2

Gold youtube.com/watch?v=sT2v2vyhy7Q&t=10s

MSTR: youtu.be/h7aZwtoZ3AI?si=c2rh7mdNp_c1qpHh

Tesla BYD: youtu.be/AD45kA1TXwQ?si=jwoSqkLTRPdkFANZ

Platinum: youtu.be/IAiq3x1x72s?si=KbD0LDPDpX4KeLR2

Gold youtube.com/watch?v=sT2v2vyhy7Q&t=10s

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

TLDR? Watch the Video

MSTR: youtu.be/h7aZwtoZ3AI?si=c2rh7mdNp_c1qpHh

Tesla BYD: youtu.be/AD45kA1TXwQ?si=jwoSqkLTRPdkFANZ

Platinum: youtu.be/IAiq3x1x72s?si=KbD0LDPDpX4KeLR2

Gold youtube.com/watch?v=sT2v2vyhy7Q&t=10s

MSTR: youtu.be/h7aZwtoZ3AI?si=c2rh7mdNp_c1qpHh

Tesla BYD: youtu.be/AD45kA1TXwQ?si=jwoSqkLTRPdkFANZ

Platinum: youtu.be/IAiq3x1x72s?si=KbD0LDPDpX4KeLR2

Gold youtube.com/watch?v=sT2v2vyhy7Q&t=10s

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.