__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

Multi-Timeframe Analysis

Multi-tf summary:

__________________________________________________________________________________

Synthesis & Strategic Bias

__________________________________________________________________________________

Fundamentals and Macro News

__________________________________________________________________________________

On-chain Analysis

__________________________________________________________________________________

Strategic Recap & Action Plan

__________________________________________________________________________________

Conclusion

BTC remains in a primary bullish trend, supported by on-chain accumulation and extreme structural compression. Only active management (profit, leverage, stops) optimizes R/R and prepares to respond to an imminent, directional volatility event. Stay proactive and plan!

__________________________________________________________________________________

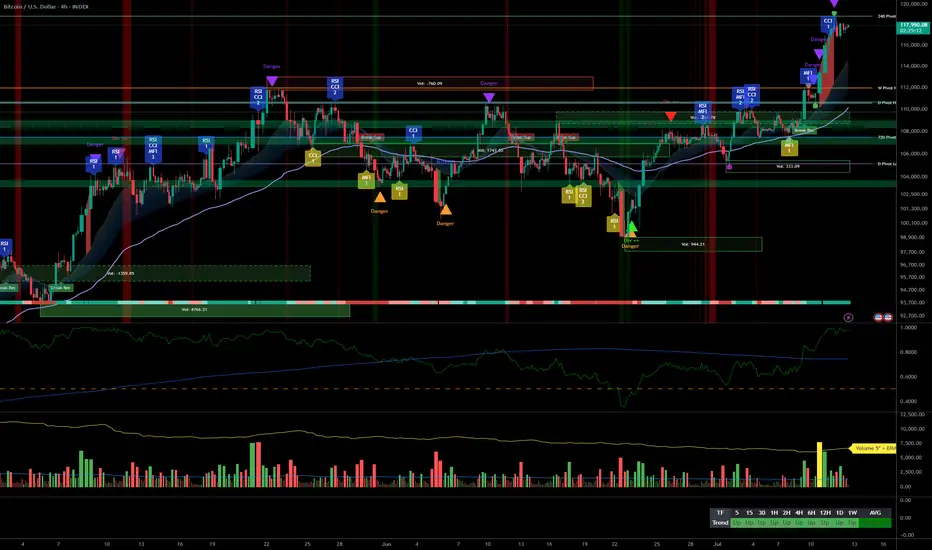

Technical Overview – Summary Points

- Strong bullish momentum across all timeframes (MTFTI “Strong Up”).

- Key supports: 110,483–111,949. Major resistances: 118,689–119,499.

- Volumes normal to slightly elevated. No anomaly or climax.

- Behaviour: early caution signals on ISPD DIV (4H–2H), sector “sell” trigger on the Risk On / Risk Off Indicator (15min).

__________________________________________________________________________________

Strategic Summary

- Overall bullish bias on all timeframes. Structural uptrend confirmed, but early behavioural/sector divergence at short term.

- Buy zones: pullback to 110,483–111,949. Stop/alert below 110,483 H4/H6 close.

- Opportunities: tight trailing above 118,689 to capture extension. Partial take profit advised in upper range (118,689–119,499) if divergences persist.

- Risks: geopolitical risk-off catalysts, start of selling extension, or loss of support.

- Plan: active management required, avoid overexposure, plan for key break levels, readiness to exploit imminent breakout.

__________________________________________________________________________________

Multi-Timeframe Analysis

- 1D: Price above all pivots, strong momentum. Key resistance in play (119,499), supports at 110,483/105,054. Volumes normal, bullish alignment.

- 12H: Confluence of resistances (119,499–115,495), structure intact, buy opportunity on retrace. No major alert.

- 6H: Strong buying extension, pure momentum. No excess signals.

- 4H: First divergence (ISPD DIV “sell”). Consolidation on resistance, consider partial profit-taking.

- 2H: Bullish momentum but ISPD DIV “sell” and moderately high volumes. Localized euphoria risk.

- 1H: No excess, post-breakout consolidation.

- 30min: Extreme consolidation, decelerating volumes, possible fatigue.

- 15min: Sector “sell” trigger (Risk On / Risk Off Indicator “Sell”). Trend remains up, but caution is advised.

Multi-tf summary:

- Bullish alignment across all horizons. Short-term behavioural caution, but trend remains unchallenged as long as above 110,483–111,949.

__________________________________________________________________________________

Synthesis & Strategic Bias

- Multi-timeframe momentum confirmed, watch supports at 110,483–111,949.

- Buy on valid retrace, take profit at highs if behaviour diverges.

- Break below 110,483 (H4/H6 close) = invalidation signal.

- Key triggers: geopolitical news, broken supports, selling spikes.

- Base scenario: likely imminent directional breakout (volatility). Watch for spikes on major headlines.

__________________________________________________________________________________

Fundamentals and Macro News

- Uncertain backdrop (Fed, US inflation, bonds & FX), no major macro trigger in 48h but latent volatility.

- Crypto: Bitcoin stable, general accumulation, no violent distribution detected.

- Geopolitics: rising tensions (Iran, Ukraine). Can prompt sharp risk-off if escalation occurs.

- No major macroeconomic event scheduled (empty calendar).

__________________________________________________________________________________

On-chain Analysis

- Accumulation phase for all holders, >19k BTC/month absorbed. Extreme volatility compression (coiling).

- Realized & implied volatility is exceptionally low, setting up violent move.

- ETF (IBIT BlackRock): record accumulation. Downside break could trigger psychological stress.

- Baseline: technical & on-chain setup disfavors bears. Any exogenous shock accelerates volatility.

__________________________________________________________________________________

Strategic Recap & Action Plan

- Bullish bias validated, risk of market fatigue on short-term signals.

- Buy on controlled pullback, tight trailing at highs, partial profit-taking in 118,689–119,499 band.

- Swing stop below 110,000 (H4); total invalidation if daily support fails.

- Expect directional move + volatility on next impulse (8–48h).

__________________________________________________________________________________

Conclusion

BTC remains in a primary bullish trend, supported by on-chain accumulation and extreme structural compression. Only active management (profit, leverage, stops) optimizes R/R and prepares to respond to an imminent, directional volatility event. Stay proactive and plan!

__________________________________________________________________________________

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.