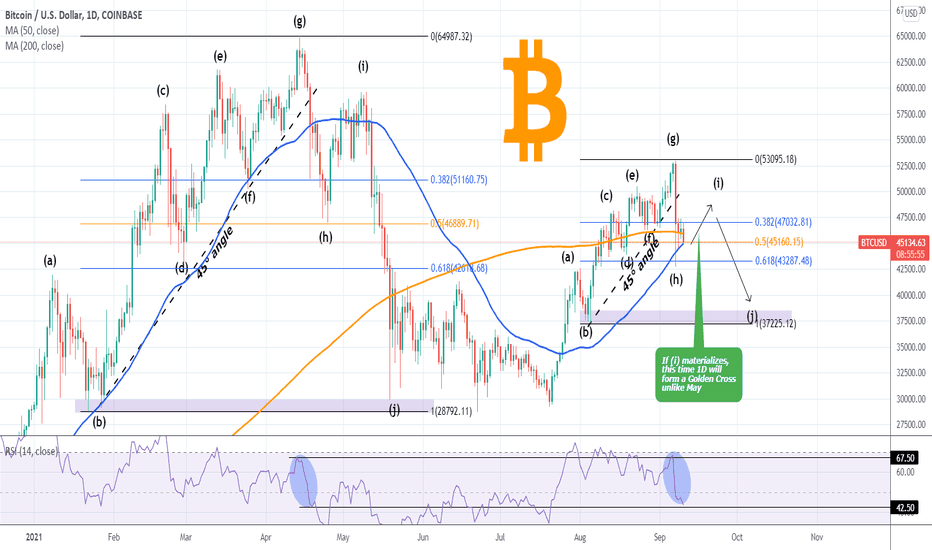

Who said history doesn't repeat itself and fractals are not something to count on in trading? My most recent Bitcoin Fractal Analysis on the similarities of the August rebound to that of March-April has played out almost perfectly:

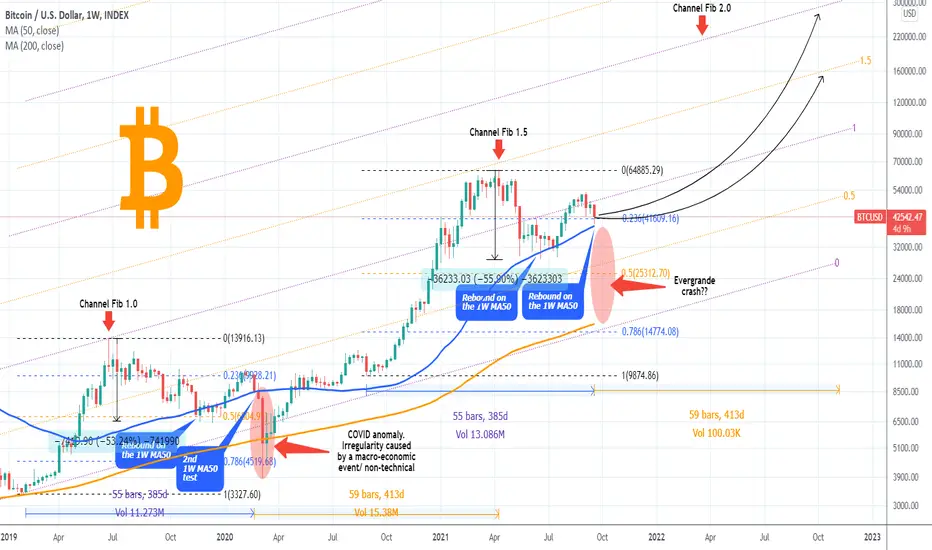

If the (j) leg has been completed, we have a new very important development emerging on the 1W time-frame this time. The price almost hit yesterday the 1W MA50 (blue trend-line as illustrated on the chart), for the first time since the 1W candle that started on July 19 (essentially the beginning of the August rally). This development brings forward another interesting fractal, as the April - September 2021 pattern can be compared with the June 2019 - February 2020 pattern.

** The June 2019 - February 2020 fractal **

As you see the 2019/20 fractal initially dropped around -55% and as it marginally broke the 1W MA50, it rebounded slightly above the 0.236 Fibonacci retracement level, only to drop back to the 1W MA50 (and the 0.5 Fib). The events that followed are well known to the economic world as the COVID pandemic caused a global melt-down asset-wide and collapsed BTCUSD even below the 1D MA200 (orange trend-line) momentarily (on 1W terms) and below the 0.786 Fib. Notice how the time distance between the start of the fractal and the 2nd 1W MA50 test (that failed) was 55 weeks i.e. 385 days. Surprisingly enough the distance from that candle until the current April All Time High (ATH) is also almost 55 weeks (59 to be exact), making the pattern symmetrical.

** The April - September 2021 fractal **

The 2021 fractal also initially dropped around -55% and also marginally broke the 1W MA50 in an attempt to find support (but not as low as the 0.5 Fib this time), which it did, that led to the August rally that as with the 2019/20 fractal, also broke above the 0.236 Fib (but not marginally). Yesterday's (near) 1W MA50 touch, is the February 2020 proportional 2nd 1W MA50 test. Notice how, in remarkable fashion, the distance between the last low that started the late 2020/early 2021 parabolic rally (August 31 2020 1W candle) until the current week, is also 55 weeks (385 days). It is striking how symmetrical those two fractals have been until now. If this symmetry continues, we could assume that the next ATH will be in around 59 weeks from now.

** Are we ahead of a major crash? **

Does that mean though that a March 2020 flash crash to the 1D MA200 will be also repeated? It goes without saying that this was non-technical/ systemic anomaly, an outside catalyst, which on pandemic terms only happens once in 100 years and is unlikely to happen again. If the 2021 fractal is to repeat this, a catalyst of equal magnitude is required (there is a growing sentiment that Evergrande is such a catalyst but the very fact that more and more market participants believe that, makes it less likely to be true).

** The Fibonacci Channel **

As you've noticed I've applied the Fibonacci Channel, which has been quite useful in predicting market tops during this new crypto Bull Cycle since the Dec 2018 bottom. Bitcoin in particular has made the Higher Highs of these two fractals on the Fib 1.0 and the Fib 1.5 extension. on a 59 week horizon then, a modest (based on that model) estimate for the next Higher High would be the 1.5 Fib extension again, which could be around $150000. If however this targets the 2.0 Fib on an arithmetic fashion, then it can be considerably higher.

** Conclusion **

This analysis brings to question various dynamics. The most important of all is do you think that the 1W MA50 will again hold and provide the necessary support for a new rally or will the market collapse on an Evergrande default? Are the two fractals that symmetrical so as to expect the next ATH in 59 weeks from now? And if yes, could that be on the 1.5 Channel Fib extension or the 2.0?

Feel free to share your work and let me know in the comments section!

Please like, subscribe and share your ideas and charts with the community!

--------------------------------------------------------------------------------------------------------

!! Donations via TradingView coins also help me a great deal at posting more free trading content and signals here !!

🎉 👍 Shout-out to TradingShot's 💰 top TradingView Coin donor 💰 this week ==> Vergnes

--------------------------------------------------------------------------------------------------------

If the (j) leg has been completed, we have a new very important development emerging on the 1W time-frame this time. The price almost hit yesterday the 1W MA50 (blue trend-line as illustrated on the chart), for the first time since the 1W candle that started on July 19 (essentially the beginning of the August rally). This development brings forward another interesting fractal, as the April - September 2021 pattern can be compared with the June 2019 - February 2020 pattern.

** The June 2019 - February 2020 fractal **

As you see the 2019/20 fractal initially dropped around -55% and as it marginally broke the 1W MA50, it rebounded slightly above the 0.236 Fibonacci retracement level, only to drop back to the 1W MA50 (and the 0.5 Fib). The events that followed are well known to the economic world as the COVID pandemic caused a global melt-down asset-wide and collapsed BTCUSD even below the 1D MA200 (orange trend-line) momentarily (on 1W terms) and below the 0.786 Fib. Notice how the time distance between the start of the fractal and the 2nd 1W MA50 test (that failed) was 55 weeks i.e. 385 days. Surprisingly enough the distance from that candle until the current April All Time High (ATH) is also almost 55 weeks (59 to be exact), making the pattern symmetrical.

** The April - September 2021 fractal **

The 2021 fractal also initially dropped around -55% and also marginally broke the 1W MA50 in an attempt to find support (but not as low as the 0.5 Fib this time), which it did, that led to the August rally that as with the 2019/20 fractal, also broke above the 0.236 Fib (but not marginally). Yesterday's (near) 1W MA50 touch, is the February 2020 proportional 2nd 1W MA50 test. Notice how, in remarkable fashion, the distance between the last low that started the late 2020/early 2021 parabolic rally (August 31 2020 1W candle) until the current week, is also 55 weeks (385 days). It is striking how symmetrical those two fractals have been until now. If this symmetry continues, we could assume that the next ATH will be in around 59 weeks from now.

** Are we ahead of a major crash? **

Does that mean though that a March 2020 flash crash to the 1D MA200 will be also repeated? It goes without saying that this was non-technical/ systemic anomaly, an outside catalyst, which on pandemic terms only happens once in 100 years and is unlikely to happen again. If the 2021 fractal is to repeat this, a catalyst of equal magnitude is required (there is a growing sentiment that Evergrande is such a catalyst but the very fact that more and more market participants believe that, makes it less likely to be true).

** The Fibonacci Channel **

As you've noticed I've applied the Fibonacci Channel, which has been quite useful in predicting market tops during this new crypto Bull Cycle since the Dec 2018 bottom. Bitcoin in particular has made the Higher Highs of these two fractals on the Fib 1.0 and the Fib 1.5 extension. on a 59 week horizon then, a modest (based on that model) estimate for the next Higher High would be the 1.5 Fib extension again, which could be around $150000. If however this targets the 2.0 Fib on an arithmetic fashion, then it can be considerably higher.

** Conclusion **

This analysis brings to question various dynamics. The most important of all is do you think that the 1W MA50 will again hold and provide the necessary support for a new rally or will the market collapse on an Evergrande default? Are the two fractals that symmetrical so as to expect the next ATH in 59 weeks from now? And if yes, could that be on the 1.5 Channel Fib extension or the 2.0?

Feel free to share your work and let me know in the comments section!

Please like, subscribe and share your ideas and charts with the community!

--------------------------------------------------------------------------------------------------------

!! Donations via TradingView coins also help me a great deal at posting more free trading content and signals here !!

🎉 👍 Shout-out to TradingShot's 💰 top TradingView Coin donor 💰 this week ==> Vergnes

--------------------------------------------------------------------------------------------------------

👑Best Signals (Forex/Crypto+70% accuracy) & Account Management (+20% profit/month on 10k accounts)

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

👑Best Signals (Forex/Crypto+70% accuracy) & Account Management (+20% profit/month on 10k accounts)

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.