__________________________________________________________________________________

Technical Overview – Summary Points

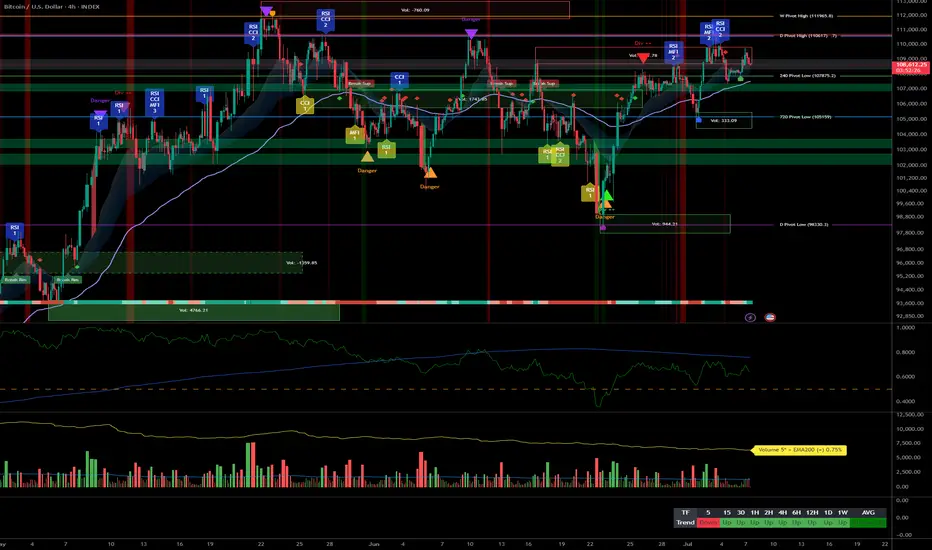

➤ Momentum: Predominantly bullish on all higher timeframes, momentum slowdown observed on short-term (15min).

➤ Supports/Resistances:

➤ Volume: Within normal ranges on daily/12H/6H, elevated but not extreme on 15min – potential short-term distribution signal.

➤ Behavioral: No buy/sell climax (ISPD DIV neutral), no panic, Risk On / Risk Off Indicator with strong buy signal up to 1H.

__________________________________________________________________________________

Strategic Summary

➤ Global bias: Mature bullish. Confirmed momentum across timeframes, but caution with short-term timing (frequent traps under resistance).

➤ Opportunities:

➤ Risk zones:

➤ Macro catalyst: Few high-impact events expected before FOMC end of July; overall global environment is risk-off but no immediate escalation.

➤ Action plan: “Trend Following” until invalidation, active stop management below key pivots, entries on pullback or clear breakout, flexibility for upside/faulty support.

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

Strategic bias summary

__________________________________________________________________________________

Technical Overview – Summary Points

➤ Momentum: Predominantly bullish on all higher timeframes, momentum slowdown observed on short-term (15min).

➤ Supports/Resistances:

- Major resistance: 110,630 – 111,949 (repeated tests on Weekly/Daily pivot high)

- Key supports: 107,761 – 106,000 (H4/H12 pivot), weaker pivot zones below 105,054 and 98,133

➤ Volume: Within normal ranges on daily/12H/6H, elevated but not extreme on 15min – potential short-term distribution signal.

➤ Behavioral: No buy/sell climax (ISPD DIV neutral), no panic, Risk On / Risk Off Indicator with strong buy signal up to 1H.

__________________________________________________________________________________

Strategic Summary

➤ Global bias: Mature bullish. Confirmed momentum across timeframes, but caution with short-term timing (frequent traps under resistance).

➤ Opportunities:

- Tactical buying on pullback into 107,761–106,000 support zone with confirmed reversal signals (wicks, absorption, incoming volume)

- Momentum buying on confirmed break above 110.6–112k, with active stop management below latest pivot

➤ Risk zones:

- Invalidation below 105,054, then strong reversal under 98,133

- Avoid trading low timeframes if abnormal volume ("liquidity grabs")

➤ Macro catalyst: Few high-impact events expected before FOMC end of July; overall global environment is risk-off but no immediate escalation.

➤ Action plan: “Trend Following” until invalidation, active stop management below key pivots, entries on pullback or clear breakout, flexibility for upside/faulty support.

__________________________________________________________________________________

Multi-Timeframe Analysis

- [D, 12H, 6H, 4H, 2H, 1H]: Strong bullish alignment (“Strong Up”/“Up”), technical support on major pivots 107,761–106,000.

- 30min: Micro-range compression, recent volume up but no excess – weak immediate opportunity (await breakout or retest of support/pivot zone).

- 15min: Very high volumes on micro-range, increasing micro-volatility – likely distribution/trap, observation only, no action unless 107.7k support breaks hard.

- Risk On / Risk Off Indicator: Strong buy signal daily–1H, neutral on 15min; institutional confidence preserved as long as major range remains intact.

- Synthetic summary: BTC market structurally healthy, tactical upside still valid – increased monitoring required for short-term volume flush or first distribution move on key support break.

__________________________________________________________________________________

Strategic bias summary

- Mature bullish, low euphoria, institution-driven environment

- Prioritize entries on validated support zones, or breakout with agile stop management

- Short-term volatility to be handled with care (frequent traps on 5–15min)

__________________________________________________________________________________

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.