📊 SOL/USDT Educational Trade Setup

HIGH RISK TRADE

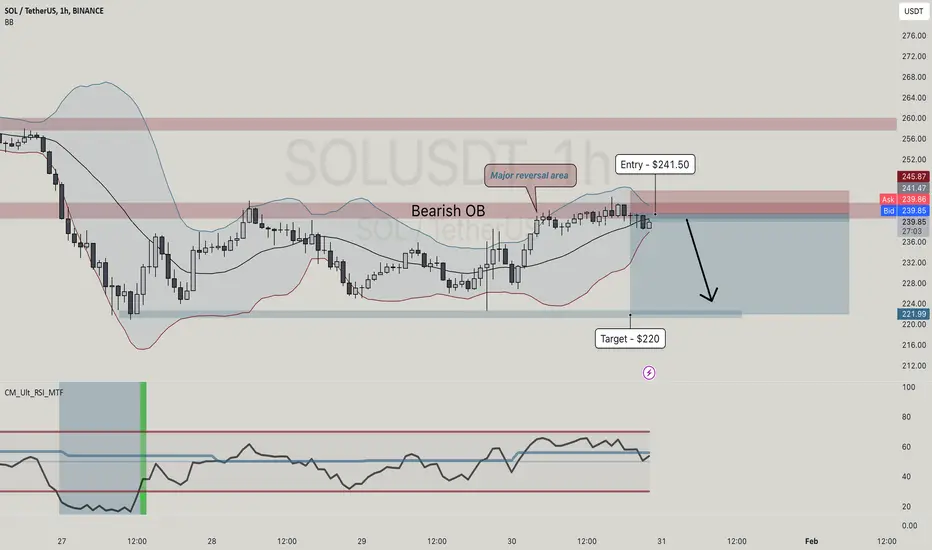

I’ve just entered this short trade for SOL/USDT based on the following setup:

Entry Point: $241.50

Stop Loss: Above $246

Target (TP1): $220

Why I Took This Trade

✅ Strong Supply Zone (Bearish OB):

The $245.00-$246.00 zone is a bearish order block where sellers have previously stepped in, rejecting further price advances. This provides a high-probability short opportunity.

✅ Bearish Momentum Indicators:

• EMA Rejection: The price has started to consolidate near resistance, with signs of potential rejection from this level.

• Ultimate RSI MTF Indicator: The RSI shows signs of bearish divergence, suggesting a possible reversal.

✅ Risk-to-Reward Opportunity:

The trade offers a favorable risk-to-reward ratio, targeting the lower bullish OB near $223.45 while keeping the stop-loss tight above $245.85.

Catalyst

• Sellers are likely to defend the bearish OB at $245.00-$246.00, resulting in a rejection and a move back toward the $223.45 bullish OB support.

• Current price action indicates waning bullish momentum, providing an ideal entry point for a short position.

📢 Disclaimer: This is not financial advice. Always do your own research before trading. Markets can be volatile, so only risk what you can afford to lose!

HIGH RISK TRADE

I’ve just entered this short trade for SOL/USDT based on the following setup:

Entry Point: $241.50

Stop Loss: Above $246

Target (TP1): $220

Why I Took This Trade

✅ Strong Supply Zone (Bearish OB):

The $245.00-$246.00 zone is a bearish order block where sellers have previously stepped in, rejecting further price advances. This provides a high-probability short opportunity.

✅ Bearish Momentum Indicators:

• EMA Rejection: The price has started to consolidate near resistance, with signs of potential rejection from this level.

• Ultimate RSI MTF Indicator: The RSI shows signs of bearish divergence, suggesting a possible reversal.

✅ Risk-to-Reward Opportunity:

The trade offers a favorable risk-to-reward ratio, targeting the lower bullish OB near $223.45 while keeping the stop-loss tight above $245.85.

Catalyst

• Sellers are likely to defend the bearish OB at $245.00-$246.00, resulting in a rejection and a move back toward the $223.45 bullish OB support.

• Current price action indicates waning bullish momentum, providing an ideal entry point for a short position.

📢 Disclaimer: This is not financial advice. Always do your own research before trading. Markets can be volatile, so only risk what you can afford to lose!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.