Solana’s been stealing the spotlight again and not just for the memes this time!

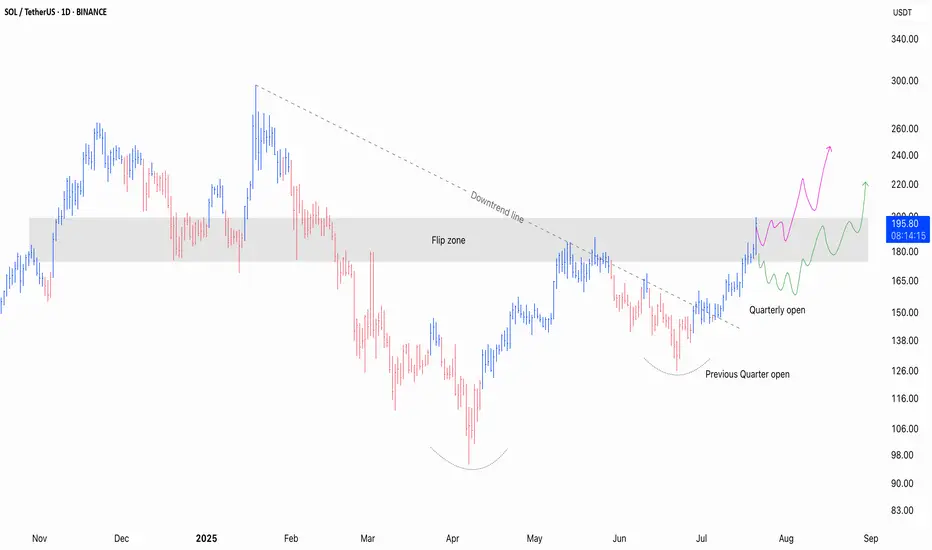

After months of getting smacked down at key levels, it’s finally reclaiming the lost ground with conviction. Price is grinding its way through zones that had been solid resistance for ages, flipping sentiment along the way.

The combination of structure, volume, and market psychology paints a clear story here. Let's break it down piece by piece in simple terms.

———x———x———x———

Table of Contents

⦿ Volume Profile

⦿ Key Technical Levels & Insights

⦿ Market Structure

———x———x———x———

⦿ Volume Profile

The Volume Profile offers crucial insight into where meaningful participation has taken place throughout this range and how these levels continue to influence the current structure.

Point of Control (POC) – ~145 USDT

This is the level where the highest volume changed hands during the entire consolidation. In simple terms, this is where buyers and sellers were most active in establishing positions.

The POC is like a price magnet where the market finds equilibrium when direction becomes uncertain. If bulls lose momentum, the price may gravitate back towards it.

Value Area Low – ~123.50 USDT

Below this threshold, prior market interest thinned out significantly. A breakdown here would likely accelerate downside as it signals acceptance below value, typically inviting stronger bearish flows and forcing trapped longs to capitulate.

Value Area High – ~213 USDT

This area marks a logical short-term upside target if the current rally can sustain its footing. VAH is where the prior range began to thin out and sellers historically pushed back. If buyers want to reclaim control, this is a key level to watch.

Currently, the price has cleanly reclaimed the POC and is now pressing into what I’d define as the Flip Zone (an area where former resistance is getting retested as potential support). Acceptance above the VAH will lead a rally towards the ATH.

⦿ Key Technical Levels & Insights

Several key factors are aligning here to create a compelling case and it’s about the broader narrative these levels are constructing together.

Quarterly Open – ~150 USDT

The recent breakout and push above the QO shows a clear intent buyers' intent. It’s a important reference point for ongoing structure.

Yearly Open – ~188 USDT

Reclaiming the Yearly Open is rarely a trivial event. Currently, the price is flirting with the YO. If the price manages to reclaim it with a strong push, it'll shift the broader sentiment back in favour of the bulls.

Flip Zone – 175–190 USDT

This zone has historically been a battleground, serving as both support and resistance since March 2024. A clean breakout above this zone won't just clear resistance, it'll open the door for further upside as sidelined participants as well as trapped shorts will be forced to react.

Downtrend Line – Broken

The trend line that was established earlier this year has been breached now, adding another positive factor for the bulls.

200 EMA / 200 SMA – ~163 USDT

Both KMAs are converging here, adding weight to this level as a reference for long-term trend direction. Price reclaiming and holding above these MAs often signals a meaningful shift in market sentiment.

The confluence of reclaiming major opens, breaking downtrend resistance, and positioning above critical moving averages strengthens the bullish case.

⦿ Market Structure

The current structure shows a market transitioning from bearish exhaustion, through a phase of accumulation, and now stepping confidently into breakout territory.

Double Bottom Formation (April lows ~95 USDT to recent highs):

This is a textbook accumulation. It’s not a fast V-shape reversal but a slow build. These kinds of structures often lay the groundwork for sustained trends.

Higher Lows in Place: 95 → 126 → 150 → 190 USDT

Each successive low is higher than the last, showing consistent buyer strength and deliberate positioning by participants with a longer-term view.

Breakout Above Prior Range Highs (187–190 USDT):

This area acted as clear resistance in previous attempts, capping price for months. Once this range is reclaimed with force, expect higher prices for multiple weeks/months.

TLDR

✅ Current Bias: Bullish while above 175–190 USDT.

✅ Structure: Breakout of multi-month downtrend, reclaiming key levels.

✅ Volume: Strong above POC, targeting Value Area High next.

✅ Invalidation: Failure below 150 USDT flips bias back to bearish.

I’m only focused on bullish continuation or healthy pullback scenarios for now, as I plan to keep holding my existing spot positions.

If you found this breakdown helpful, drop a like and let me know your thoughts in the comments. Always keen to hear how others are seeing the market. 👇

⚠️ Disclaimer

As always, this post is purely for educational purposes. I am not a financial advisor, and nothing here should be taken as financial advice. Always consult your financial advisor before making any investment or trading decisions. Or at the very least, consult your cat. 🐱

After months of getting smacked down at key levels, it’s finally reclaiming the lost ground with conviction. Price is grinding its way through zones that had been solid resistance for ages, flipping sentiment along the way.

The combination of structure, volume, and market psychology paints a clear story here. Let's break it down piece by piece in simple terms.

———x———x———x———

Table of Contents

⦿ Volume Profile

⦿ Key Technical Levels & Insights

⦿ Market Structure

———x———x———x———

⦿ Volume Profile

The Volume Profile offers crucial insight into where meaningful participation has taken place throughout this range and how these levels continue to influence the current structure.

Point of Control (POC) – ~145 USDT

This is the level where the highest volume changed hands during the entire consolidation. In simple terms, this is where buyers and sellers were most active in establishing positions.

The POC is like a price magnet where the market finds equilibrium when direction becomes uncertain. If bulls lose momentum, the price may gravitate back towards it.

Value Area Low – ~123.50 USDT

Below this threshold, prior market interest thinned out significantly. A breakdown here would likely accelerate downside as it signals acceptance below value, typically inviting stronger bearish flows and forcing trapped longs to capitulate.

Value Area High – ~213 USDT

This area marks a logical short-term upside target if the current rally can sustain its footing. VAH is where the prior range began to thin out and sellers historically pushed back. If buyers want to reclaim control, this is a key level to watch.

Currently, the price has cleanly reclaimed the POC and is now pressing into what I’d define as the Flip Zone (an area where former resistance is getting retested as potential support). Acceptance above the VAH will lead a rally towards the ATH.

⦿ Key Technical Levels & Insights

Several key factors are aligning here to create a compelling case and it’s about the broader narrative these levels are constructing together.

Quarterly Open – ~150 USDT

The recent breakout and push above the QO shows a clear intent buyers' intent. It’s a important reference point for ongoing structure.

Yearly Open – ~188 USDT

Reclaiming the Yearly Open is rarely a trivial event. Currently, the price is flirting with the YO. If the price manages to reclaim it with a strong push, it'll shift the broader sentiment back in favour of the bulls.

Flip Zone – 175–190 USDT

This zone has historically been a battleground, serving as both support and resistance since March 2024. A clean breakout above this zone won't just clear resistance, it'll open the door for further upside as sidelined participants as well as trapped shorts will be forced to react.

Downtrend Line – Broken

The trend line that was established earlier this year has been breached now, adding another positive factor for the bulls.

200 EMA / 200 SMA – ~163 USDT

Both KMAs are converging here, adding weight to this level as a reference for long-term trend direction. Price reclaiming and holding above these MAs often signals a meaningful shift in market sentiment.

The confluence of reclaiming major opens, breaking downtrend resistance, and positioning above critical moving averages strengthens the bullish case.

⦿ Market Structure

The current structure shows a market transitioning from bearish exhaustion, through a phase of accumulation, and now stepping confidently into breakout territory.

Double Bottom Formation (April lows ~95 USDT to recent highs):

This is a textbook accumulation. It’s not a fast V-shape reversal but a slow build. These kinds of structures often lay the groundwork for sustained trends.

Higher Lows in Place: 95 → 126 → 150 → 190 USDT

Each successive low is higher than the last, showing consistent buyer strength and deliberate positioning by participants with a longer-term view.

Breakout Above Prior Range Highs (187–190 USDT):

This area acted as clear resistance in previous attempts, capping price for months. Once this range is reclaimed with force, expect higher prices for multiple weeks/months.

TLDR

✅ Current Bias: Bullish while above 175–190 USDT.

✅ Structure: Breakout of multi-month downtrend, reclaiming key levels.

✅ Volume: Strong above POC, targeting Value Area High next.

✅ Invalidation: Failure below 150 USDT flips bias back to bearish.

I’m only focused on bullish continuation or healthy pullback scenarios for now, as I plan to keep holding my existing spot positions.

If you found this breakdown helpful, drop a like and let me know your thoughts in the comments. Always keen to hear how others are seeing the market. 👇

⚠️ Disclaimer

As always, this post is purely for educational purposes. I am not a financial advisor, and nothing here should be taken as financial advice. Always consult your financial advisor before making any investment or trading decisions. Or at the very least, consult your cat. 🐱

Note

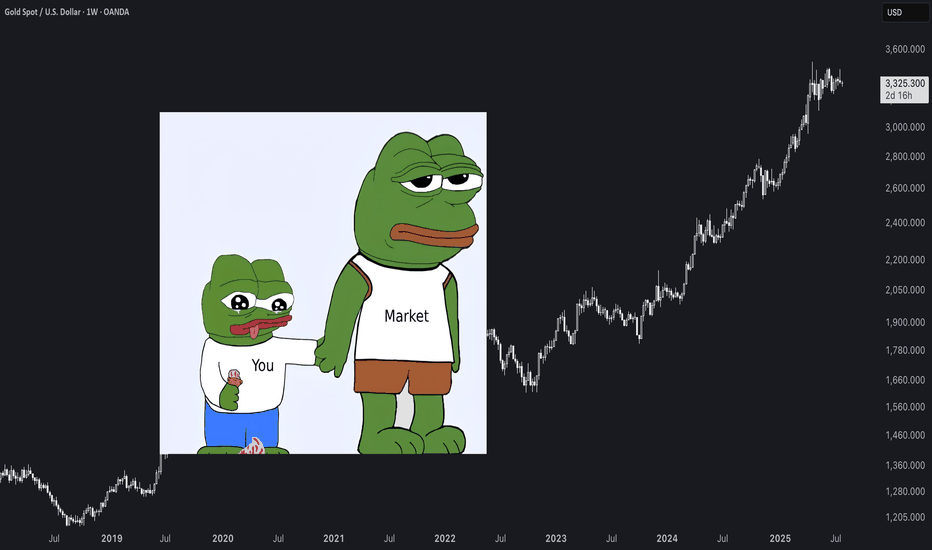

Volatility will always test you. That's its nature. Patience will always protect you. That's your choice.If you’re in one of those stretches right now - high volatility, failing setups, doubt creeping in; remind yourself this is part of the process. It’s normal, and it’s not the time to force progress.

Read this 👇

Global Community & Moderation Manager,

TradingView

TradingView

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Global Community & Moderation Manager,

TradingView

TradingView

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.