🔥🦹♂️ "SPX500 BANK HEIST – LAYERED BULL RAID IN PROGRESS!" 💰📈

(Thief Trader’s Multi-Limit Order Bullish Ambush – No Weak Hands Allowed)

📍 ASSET: US500 / SPX500 (S&P 500 INDEX)

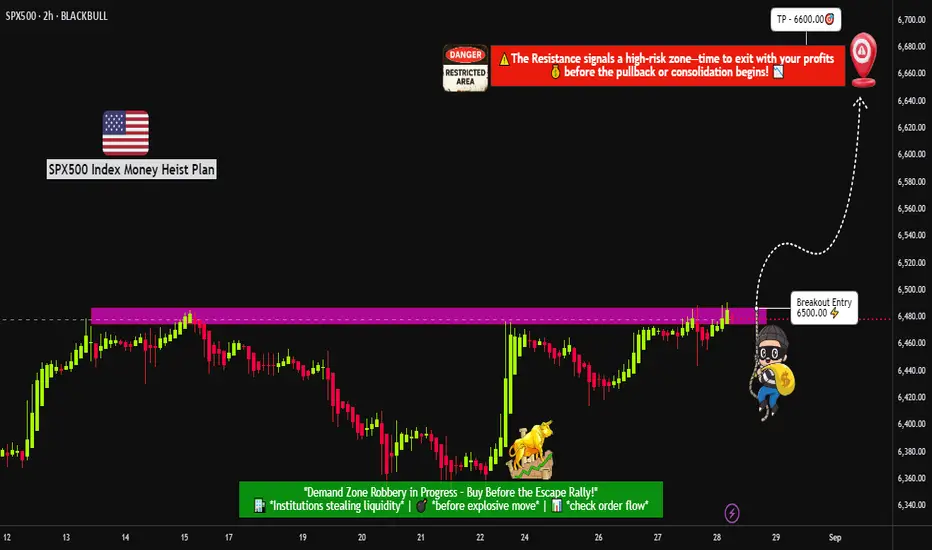

🎯 HEIST PLAN: BULLISH BREAKOUT 6500.00

💣 ENTRY: ANY PRICE LEVEL (Thieves use Layered Limit Orders – adapt like a pro!)

🔫 SAMPLE LAYERS: (Scale in like a boss!)

BUY LIMIT LAYER 1: 6475.00

BUY LIMIT LAYER 2: 6460.00

BUY LIMIT LAYER 3: 6440.00

(Add more layers if needed – flexibility is key!)

🛑 STOP LOSS: 6400.00 (Thief’s Emergency Exit – adjust based on your risk!)

🎯 TARGET: 6600.00 (First profit zone – trail or take gains!)

🦹♂️ THIEF TRADER’S MASTER PLAN:

"We don’t ask for permission – we take profits."

🔹 ENTRY TACTICS:

Use multiple limit orders (LAYERED STRATEGY) – like planting timed explosives at key levels.

No panic entries – thieves strike with precision, not emotion.

DCA if needed – but keep bullets for the real move.

🔹 STOP LOSS RULES:

6400 = Danger Zone – if price breaks, abort mission & regroup.

SL too tight? You’ll get stopped out by market noise. SL too wide? You’ll bleed. Find balance.

🔹 TAKE PROFIT STRATEGY:

First TP @ 6600 – secure partial profits.

Let runners ride with trailing stop – or full exit if momentum fades.

🚨 THIEF’S GOLDEN RULES:

✅ Only LONG – no revenge shorts, no greed traps.

✅ Trade in SILENCE – avoid high-impact news (CPI, NFP, Fed).

✅ Risk management = Survival – don’t blow your account on one play.

✅ BOOST & SHARE – if this plan helps, spread the word!

📢 FINAL WARNING:

"This is not financial advice – it’s a thief’s blueprint.

Plan your escape before entry. Market heists require discipline."

💬 COMMENT "ROBBING SPX" if you’re in!

🔥 LIKE & BOOST if you ride with the Thief Trader crew!

🦹♂️ THIEF TRADER OUT.

💸 STEAL SMART. GET RICH. REPEAT.

(Thief Trader’s Multi-Limit Order Bullish Ambush – No Weak Hands Allowed)

📍 ASSET: US500 / SPX500 (S&P 500 INDEX)

🎯 HEIST PLAN: BULLISH BREAKOUT 6500.00

💣 ENTRY: ANY PRICE LEVEL (Thieves use Layered Limit Orders – adapt like a pro!)

🔫 SAMPLE LAYERS: (Scale in like a boss!)

BUY LIMIT LAYER 1: 6475.00

BUY LIMIT LAYER 2: 6460.00

BUY LIMIT LAYER 3: 6440.00

(Add more layers if needed – flexibility is key!)

🛑 STOP LOSS: 6400.00 (Thief’s Emergency Exit – adjust based on your risk!)

🎯 TARGET: 6600.00 (First profit zone – trail or take gains!)

🦹♂️ THIEF TRADER’S MASTER PLAN:

"We don’t ask for permission – we take profits."

🔹 ENTRY TACTICS:

Use multiple limit orders (LAYERED STRATEGY) – like planting timed explosives at key levels.

No panic entries – thieves strike with precision, not emotion.

DCA if needed – but keep bullets for the real move.

🔹 STOP LOSS RULES:

6400 = Danger Zone – if price breaks, abort mission & regroup.

SL too tight? You’ll get stopped out by market noise. SL too wide? You’ll bleed. Find balance.

🔹 TAKE PROFIT STRATEGY:

First TP @ 6600 – secure partial profits.

Let runners ride with trailing stop – or full exit if momentum fades.

🚨 THIEF’S GOLDEN RULES:

✅ Only LONG – no revenge shorts, no greed traps.

✅ Trade in SILENCE – avoid high-impact news (CPI, NFP, Fed).

✅ Risk management = Survival – don’t blow your account on one play.

✅ BOOST & SHARE – if this plan helps, spread the word!

📢 FINAL WARNING:

"This is not financial advice – it’s a thief’s blueprint.

Plan your escape before entry. Market heists require discipline."

💬 COMMENT "ROBBING SPX" if you’re in!

🔥 LIKE & BOOST if you ride with the Thief Trader crew!

🦹♂️ THIEF TRADER OUT.

💸 STEAL SMART. GET RICH. REPEAT.

Note

📊 US500 Snapshot (02 SEP 2025)Current Level: 6,460.26

Daily Change: -0.64% 🔻

52-Week Range: 4,835.04 - 6,508.23

Monthly Gain: +1.32%

Yearly Gain: +16.00%

😰😊 Fear & Greed Index

Current Reading: 64 (Greed)

Sentiment Outlook: Investors are driven by optimism, but not excessively bullish.

Key Drivers:

Positive momentum in large-cap stocks

Moderate volatility expectations

Balanced options activity

🏛️ Macro & Fundamental Highlights

Fed Rate Cut Probability: 89% chance of 25 bps cut in September meeting 📉

Key Events This Month:

Jobs Report (Sep 5)

CPI Inflation Data (Sep 11)

Fed Meeting (Sep 16-17)

Trade Policy Uncertainty: Court ruling against Trump’s tariffs introduced short-term volatility.

Seasonal Trend: September historically weak for equities (avg. -0.8% for S&P 500).

📈 Investor Sentiment Breakdown

Retail Traders:

Sentiment: Cautiously Optimistic (55% Long) 🤔

Focus: Tech earnings, Fed policy, and AI-themed stocks.

Institutional Traders:

Sentiment: Neutral to Slightly Bearish (45% Long) 🏦

Focus: Valuation concerns, geopolitical risks, and bond yield shifts.

🐂🐻 Overall Market Outlook

Bullish Score: 60% (Moderate Bull) ✅

Bearish Risks:

Seasonal weakness (September effect)

Tech stock corrections ("Magnificent Seven" down ~18% from highs)

Trade policy uncertainty

Bullish Catalysts:

Strong YTD gains (+16%)

Expected Fed rate cuts

AI innovation driving long-term growth

💡 Key Takeaways

Greed sentiment prevails, but macro risks linger.

September historically volatile; focus on Fed and jobs data.

Tech stocks cooling off, but broader market resilient.

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.