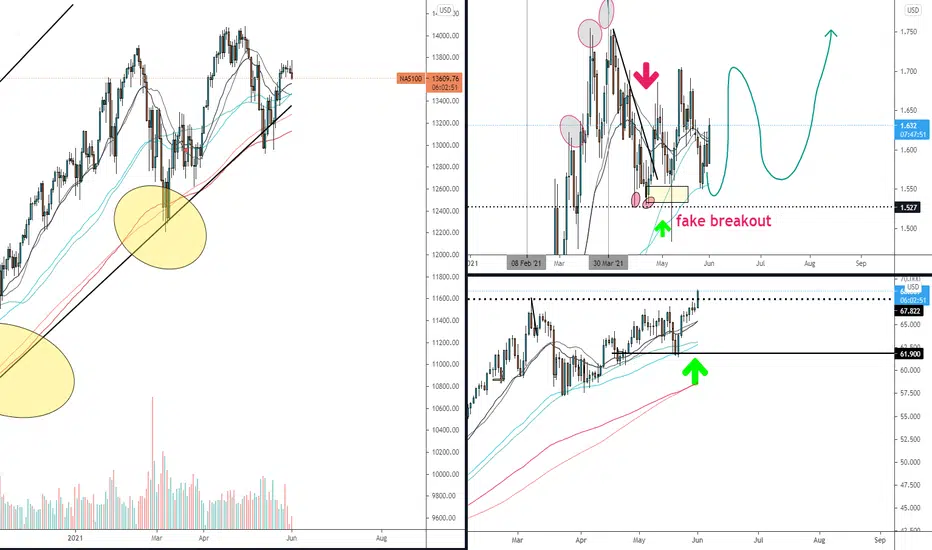

Today's a bit bumpy for Nasdaq. The tech-heavy index has reached a key zone(flip zone) . In my opinion, correlation come into play again!

Crude oil has risen steadily for the past few days. It might add inputs to future costs as oil plays a very important role in the modern society. I know the concept of ESG but until No. of new energy cars outnumbers traditional ones.

We know the economic outlook and inflation can impact the US 10Y yield. Normally, better economy and high inflation would push up the yield. What's more, the rising yield could weigh on the stock market and we all what happened in Feb.

Job data(NFP) will be released this Friday. This might be the old play that good news is bad for stocks or vice versa.

So how high could crude oil go? I would say 70 is a key level.

Crude oil has risen steadily for the past few days. It might add inputs to future costs as oil plays a very important role in the modern society. I know the concept of ESG but until No. of new energy cars outnumbers traditional ones.

We know the economic outlook and inflation can impact the US 10Y yield. Normally, better economy and high inflation would push up the yield. What's more, the rising yield could weigh on the stock market and we all what happened in Feb.

Job data(NFP) will be released this Friday. This might be the old play that good news is bad for stocks or vice versa.

So how high could crude oil go? I would say 70 is a key level.

plan your trade and trade your plan

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

plan your trade and trade your plan

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.