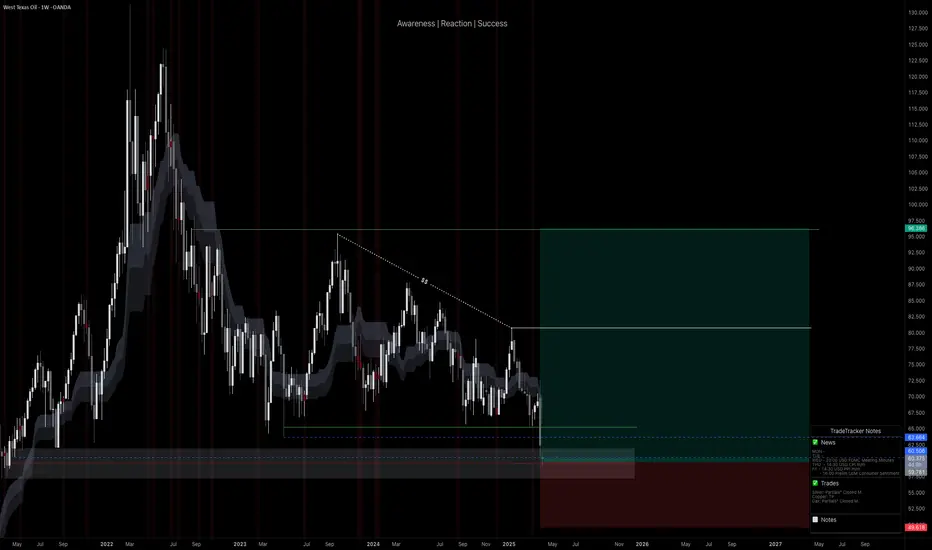

WTI Oil has finally dipped into my long-watched buy zone, driven by macro fear and an aggressive tariff agenda. The current drop aligned perfectly with my long-term execution plan. I’ve placed this trade based on key historical demand levels with my stop-loss and take-profit clearly defined. I’m prepared for deeper drawdown, but this area remains high-conviction for me. Execution > Prediction.

Technicals:

• Key Level: Price tapped into a major demand zone dating back to 2021 lows, which had been protected ever since.

• Liquidity Sweep: This drop mitigated every low formed post-2021 — clearing out late longs and stop hunts.

• Trendline Break Anticipation: I expect a potential trendline breakout from the long-term descending structure.

• SL/TP Defined: This trade has structure. It’s not a hope-based setup, it’s pre-planned and managed.

• Consolidation + Accumulation: This is where strong hands prepare, and I’m joining in.

Fundamentals:

• Tight supply, rising global demand, and structural underinvestment in oil exploration.

• Chinese reopening + Russian ban tighten market availability.

• Central banks expected to support demand via easing cycles.

• Oil Bearish Catalyst (Short-Term):

• US tariff wave: Trump announced a total 54% tariff on China and baseline tariffs on all trading partners.

• Escalating fears of global economic slowdown pushed prices to $58.80, a 4-year low.

The bearish panic gave bulls like us a gift. This is how real trades are born - not in euphoria, but in blood.

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.

Technicals:

• Key Level: Price tapped into a major demand zone dating back to 2021 lows, which had been protected ever since.

• Liquidity Sweep: This drop mitigated every low formed post-2021 — clearing out late longs and stop hunts.

• Trendline Break Anticipation: I expect a potential trendline breakout from the long-term descending structure.

• SL/TP Defined: This trade has structure. It’s not a hope-based setup, it’s pre-planned and managed.

• Consolidation + Accumulation: This is where strong hands prepare, and I’m joining in.

Fundamentals:

• Tight supply, rising global demand, and structural underinvestment in oil exploration.

• Chinese reopening + Russian ban tighten market availability.

• Central banks expected to support demand via easing cycles.

• Oil Bearish Catalyst (Short-Term):

• US tariff wave: Trump announced a total 54% tariff on China and baseline tariffs on all trading partners.

• Escalating fears of global economic slowdown pushed prices to $58.80, a 4-year low.

The bearish panic gave bulls like us a gift. This is how real trades are born - not in euphoria, but in blood.

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.

Note

Finally taking off, currently +16% in profit. Opened a second position at $56 to cover swap fees and improve positioning. From here, I’ll manage both entries based on price behavior, ready to close one or both as market conditions unfold.Trade closed manually

Trade closed at $77 due to war-related headlines and extended price action, in my experience, such surges often retrace. First position closed at +28.62%, second at +36.64%, held for 75 days. From here, if price revisits the $60–62 zone, I’ll look to re-enter with $80–82 as a target. I could’ve held longer, but locking in a 65% combined gain puts me in a stronger position, either to compound with one clean re-entry or to reduce risk. That’s the game: put yourself in the best possible position to act, and always pay yourself when the market gives you the chance.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.