Reasons to buy:

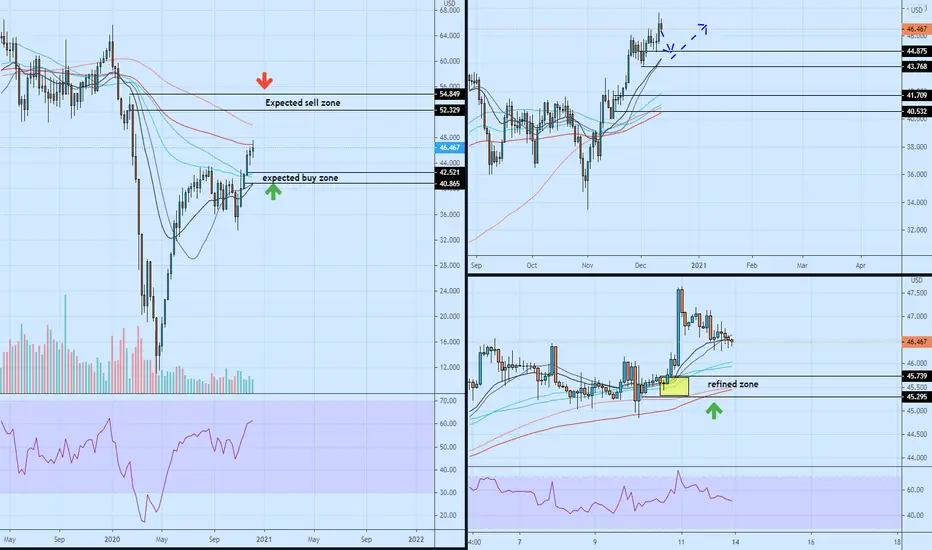

1. Oil is clearly in the uptrend on my weekly & daily chart indicated by my duo MA system

2. Previous flip zone of 42.3ish has been firmly taken out. That's my odds enhancer.

3. 2H bullish setup is actually refined based on the daily demand zone.

Fundamentals:

1. With vaccine being distributed in UK and States, it's much more clear that economy will rebound against the backdrop of rising cases.

2. loose monetary policy leads to weaker dollar

3. According to market outlook released by some big institutions, the price range of crude oil is 45 - 55. I don't know their models so it's for your reference.

Other Options:

If you prefer to hold longer, I'd recommend USO which is an crude oil ETF. Future trading involves leverage which is a bit risky...You gotta have capabilities of managing your positions well. Or you will be stopped out even you bet on the right side.

1. Oil is clearly in the uptrend on my weekly & daily chart indicated by my duo MA system

2. Previous flip zone of 42.3ish has been firmly taken out. That's my odds enhancer.

3. 2H bullish setup is actually refined based on the daily demand zone.

Fundamentals:

1. With vaccine being distributed in UK and States, it's much more clear that economy will rebound against the backdrop of rising cases.

2. loose monetary policy leads to weaker dollar

3. According to market outlook released by some big institutions, the price range of crude oil is 45 - 55. I don't know their models so it's for your reference.

Other Options:

If you prefer to hold longer, I'd recommend USO which is an crude oil ETF. Future trading involves leverage which is a bit risky...You gotta have capabilities of managing your positions well. Or you will be stopped out even you bet on the right side.

Trade active

I got stopped out for another bullish setup on 1h chart. I've clearly put the reason and how to handle the situation. This one works well. Now RR is at least 1:3Note

Target one which is near the previous high got filled. Now, move the stop to 46.46 if you're in the trade.Note

The show must go on...As the higher high created, you can move the stop to 46.86 if you're in the trade.Note

As the new high created, move the stops to 47.10 if you're in the trade.plan your trade and trade your plan

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

plan your trade and trade your plan

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.