SLV

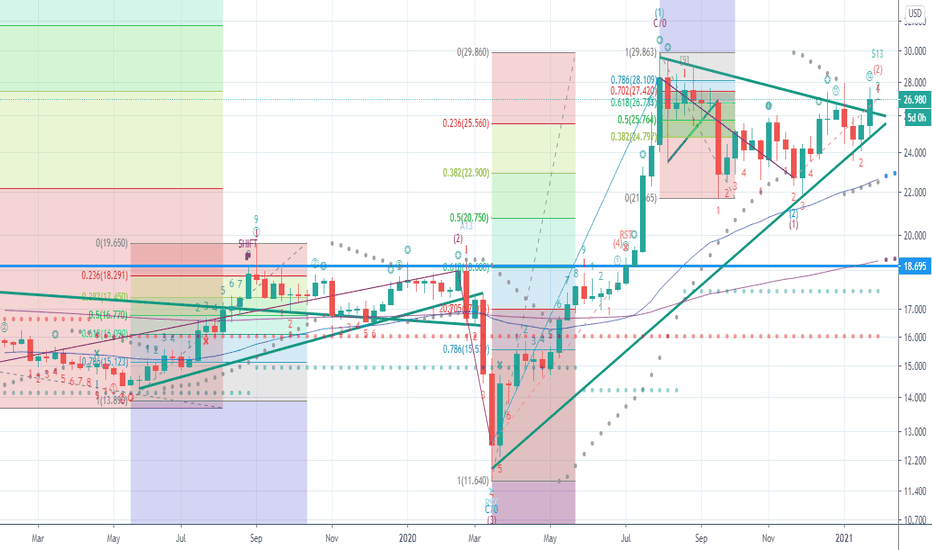

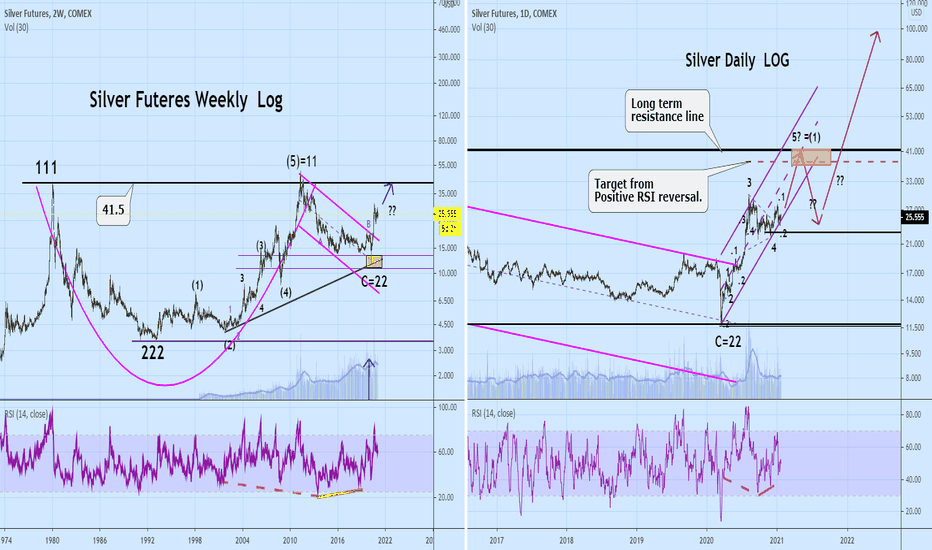

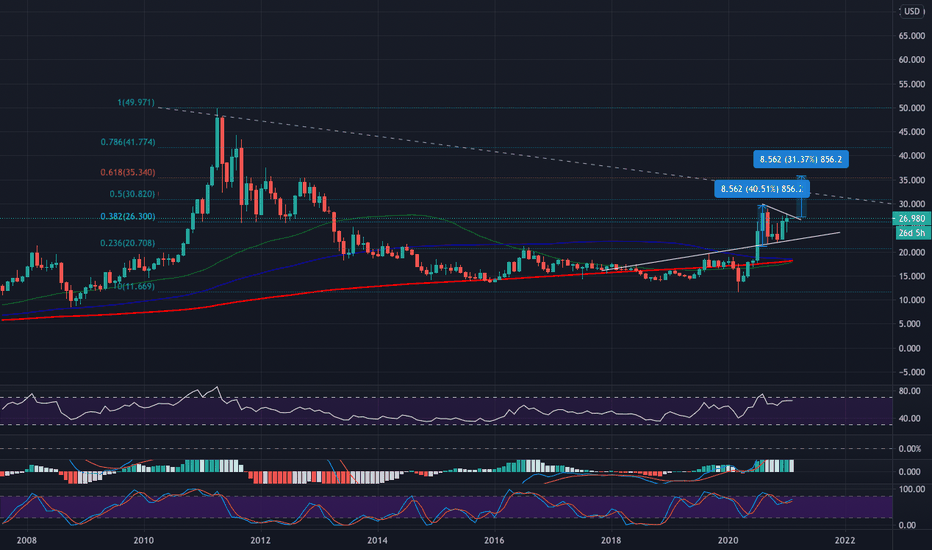

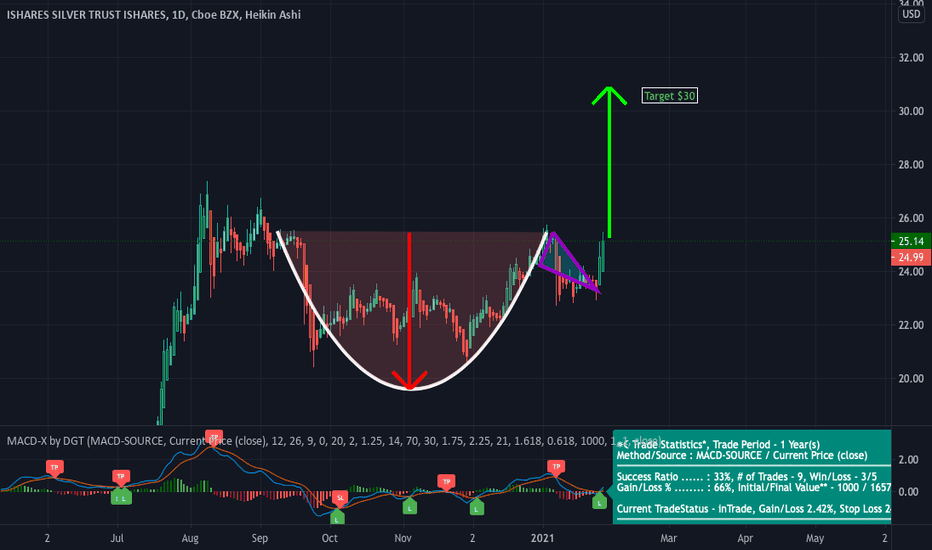

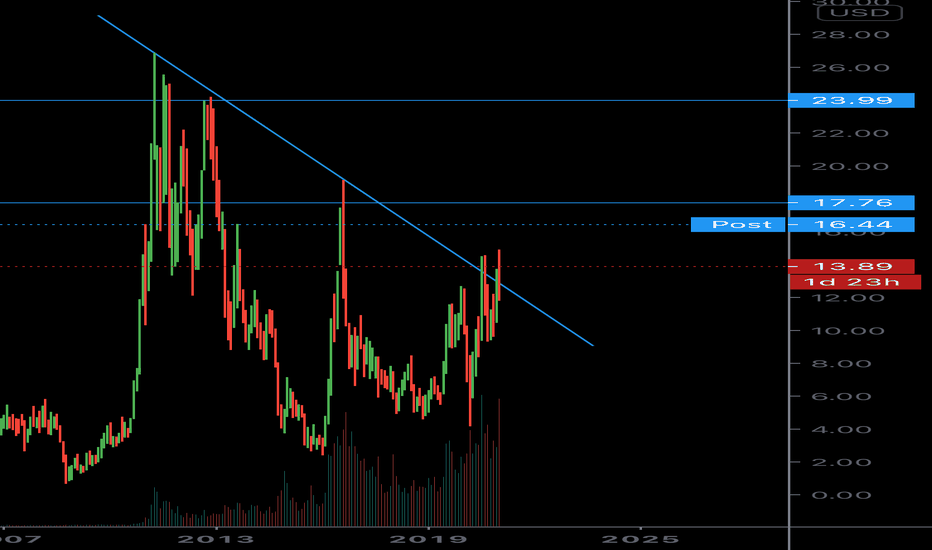

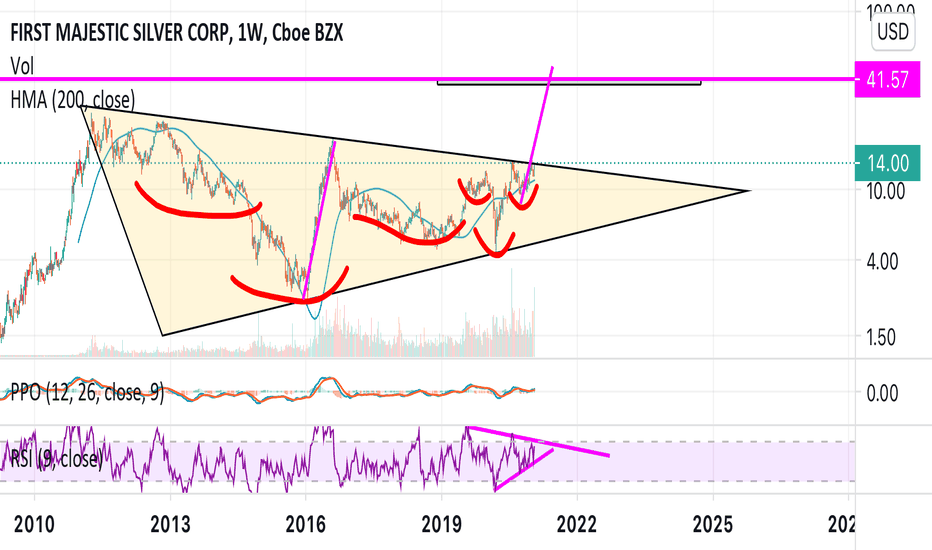

Silver: a bullish view with short term target Long term: The cup with handle pattern with the break up out of the handle is vey encouraging. If we later we get a weekly clear break up above the 41.5 level I think it would be very bullish.

Short term: we have a positive reversal in the daily RSI followed by a bullish divergence which supports higher near term peak ahead. The daily RSI target is labeled. IFFF this target is hit and IFF my count is correct I would then expect some pullback before a strong tend up to much higher levels.

As always: process your way before investing.

If you are not familiar with RIS reversals see: school.stockcharts.com

Best to ya. Have a good week ahead.

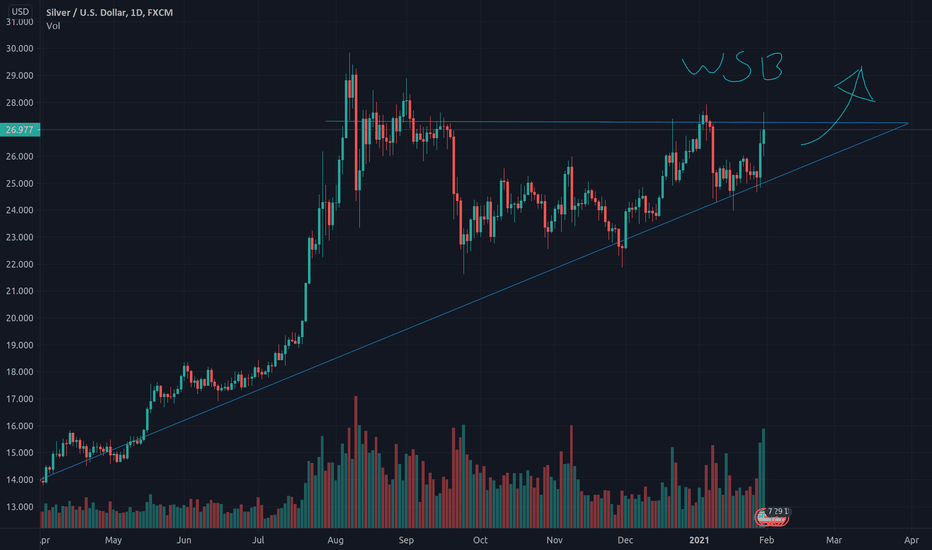

Silver to THE MOONIf we breakout of this - lights out. $35 is coming and then higher.

Ton of macro reasons to buy it - I truly think silver is under valued. Did you ever ask yourself why in the world is Gold and Silver doing so poorly in an environment when it should thrive? Rates are low, ton of money supply...?

WSB is pumping $SLV already. Will they succeed? - I don't know. Silver is a much much bigger market than GME. However...

There are ton of macro guys scratching their heads trying to figure out why are metals not moving. Rumor has it that JPM is keeping silver price low via paper market. WSB wants to squeeze the F out of them.

Bullion dealers are out of physical stuff. How do I know? Go on APMEX website and read in red "Due to unprecedented demand on physical silver products, we are unable to accept any additional orders on a large number of products, until global markets open Sunday evening." Why? They need to see what futs do.

If this plays out and we break out of this pattern then the buying pressure will come from:

1. Technical traders will be all over it.

2. WSB gang will double down which would send it into a self feeding loop.

3. Macro guys will jump (most of them are already in)

4. Peter Schiff will have an orgasm and he will pump it like a maniac

5. EV demand will put more pressure on it.

6. More crypto adoption = more silver demand.

7. Silver is used extensively in the production of solar panels.Biden and his gang is all over renewables.

8. Medicine loves silver. Silver kills germs.

9. We require more and more technology. SIlver is used in printed circuit boards, cell phones, computer chips, keyboard membranes and so on...

10. I can find another 100 reasons why it is a metal that will be more valued than gold. Probably can make the same case for ETH!!!

It is not a crowded trade yet. I got stopped out from my last position but I am becoming increasingly more bullish on it than on any other asset class.

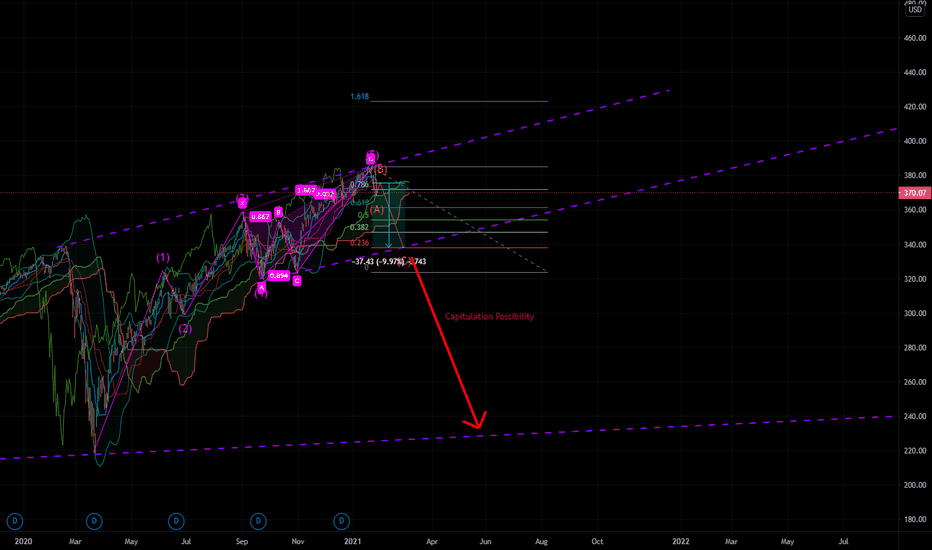

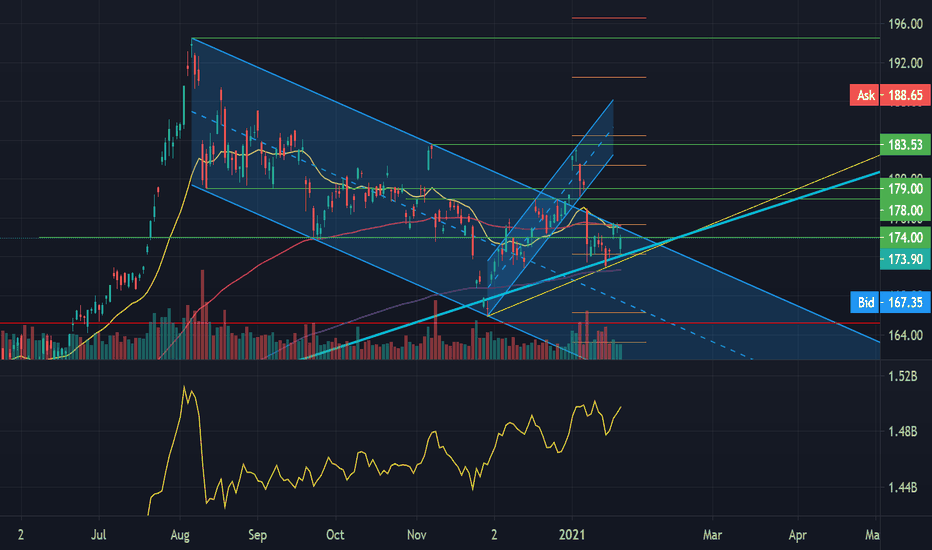

$SPY $SPX Market correction imminent. SPY to 338The GME saga has gone for too long. Jan. 29th saw Robinhood and co. go to desperate measures to prevent irreparable damage to the market.

- The puny market pump for Big Tech ER is almost over. Nothing can hold it up anymore.

- 70 billion has been lost by short institutions, and they are long positions to cover their short position

- The short interest remains over 130%, if the data is to be believed. It is possible that that it is in actuality much higher. Shareholders now own over 100% of the company's shares. The extend of fake shares existing for naked shorting is unknown.

- Silver is the next target on the chopping block for short squeezers. Major banks, direct arms of the Federal Reserve, are at risk of liquidation on their short positions.

- Prepare for volatile times.

Current Silver Squeeze (Jan.28 Idea):

XAG Ascending triangle WSB BreakoutPurchasing in the physical market will force the ascending triangle established throughout the last year to break out hard to the upside for XAG. Bonus info is to watch physical PM dealers prices on the weekend for an indicator of futures prices. Currently they are climbing fairly aggressively.

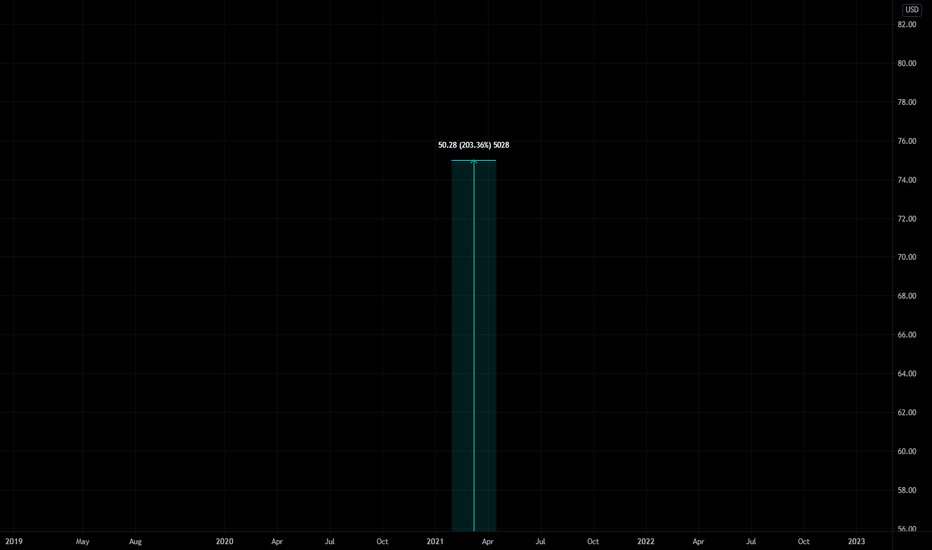

$SLV $PSLV $GME 2: Infinity Squeeze- Gamma squeeze of silver and silver futures is possible.

- Key is that the supply of underlying is only a fraction of the future contracts being traded.

- If enough contracts are physically settled, there will not be enough underlying, and this will squeeze the price.

- In essence, the silver market will be cornered.

- Up against JPM & co. Tough competition.

I like the stock

PT: 75

SL: None

“We choose to go to the moon, not because it is easy, but because it is hard." -JFK

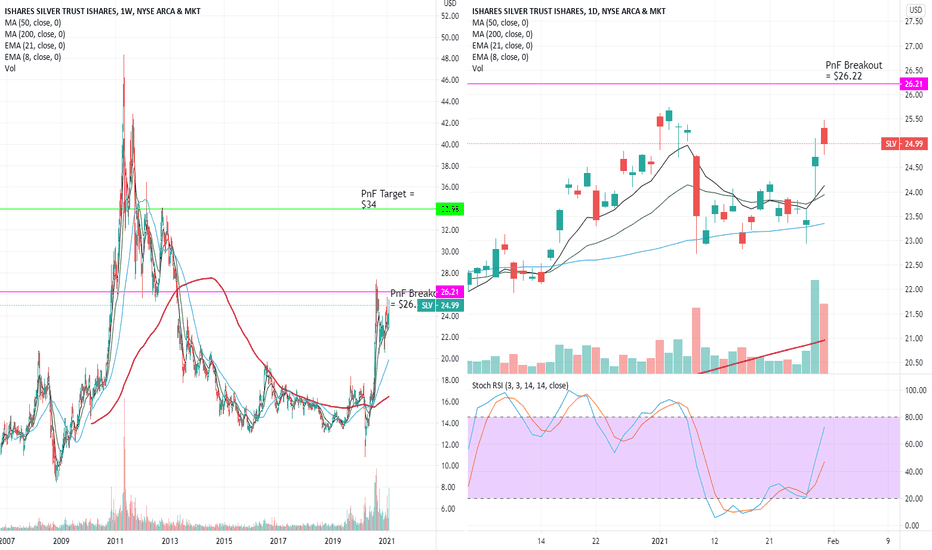

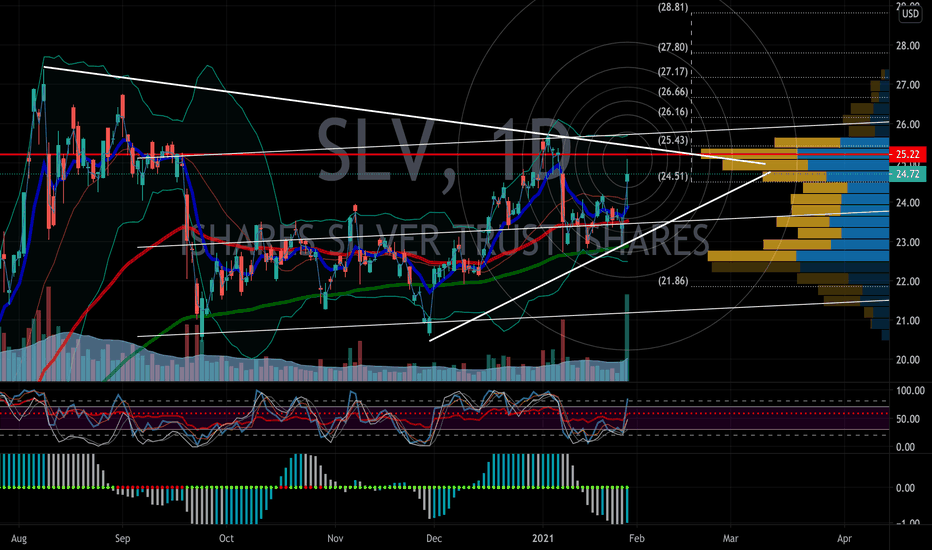

$SLV SQUEEZE POTENTIALCharts indicate we could be in for another spike, the likes of which we have not seen since the market crash of 2008. All EMAs are converging on the current price point and with a tremendous amount of squeezing to be had in the weeks to come, more and more people will be hedging with silver as the big hedge funds start to take losses. Squeeze indicators show a lot of positive momentum, mirroring the same volume prior to the 2008 spike.

Options in the money currently are adjacent to relative resistance levels are an ideal play in my opinion.

Silver is the latest market boomYou probably know what happened to GameStop.

The new instrument that has aroused the interest of regular investors is silver.

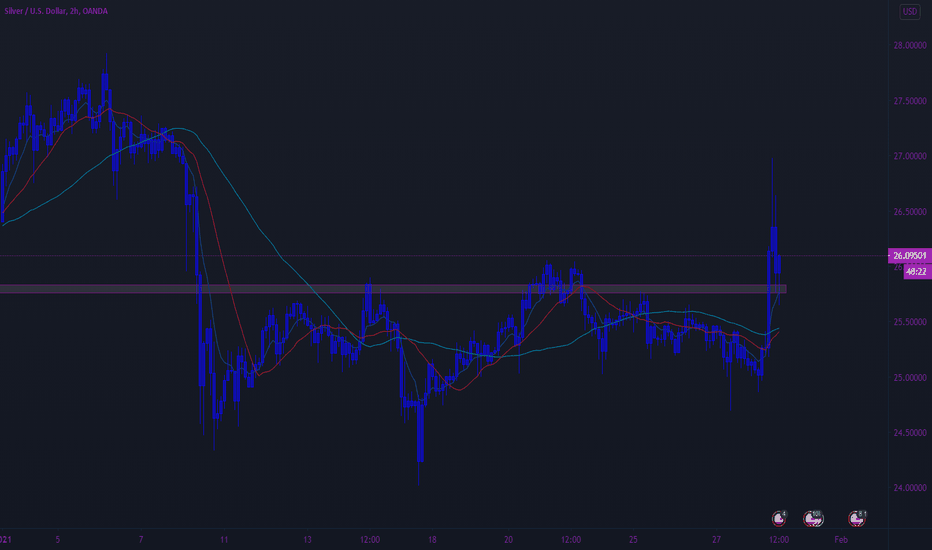

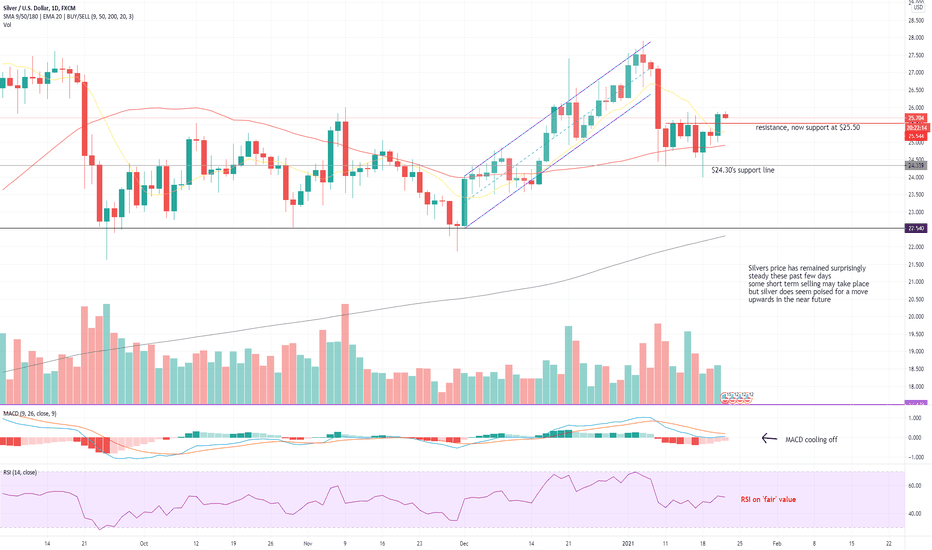

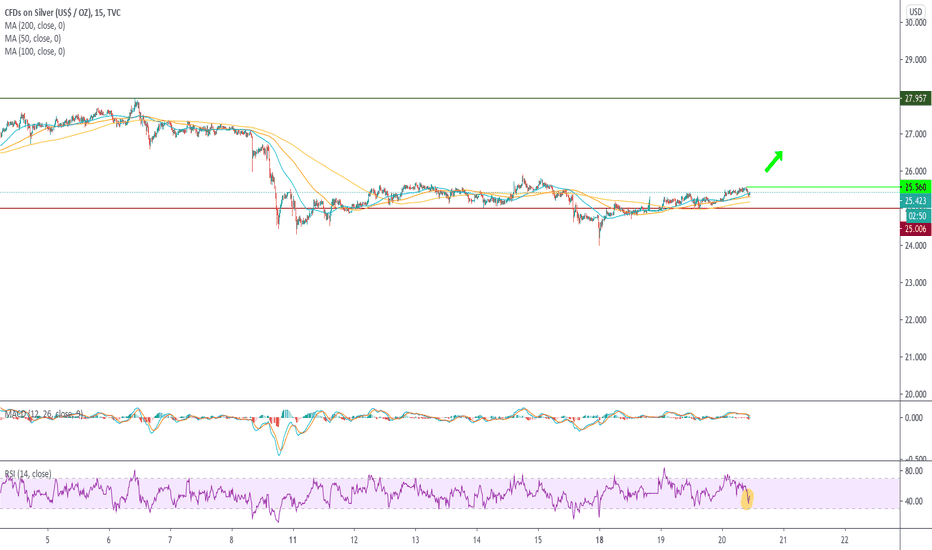

Yesterday we saw a rise of almost $ 2, but immediately after that the price fell off.

Today we have the opportunity to see a new rise.

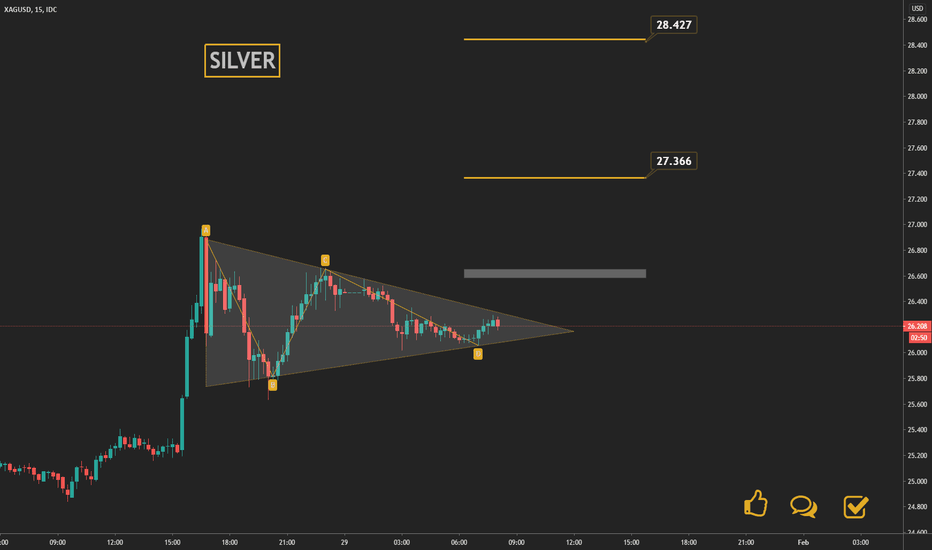

Confirmation will be exit from the triangle and a break of the previous peak.

Expectations for higher values can be very high, but the initial targets for silver will be 27.36 and 28.42!

If you have questions about how to trade this or another situation, contact us!

To support us, like and comment!

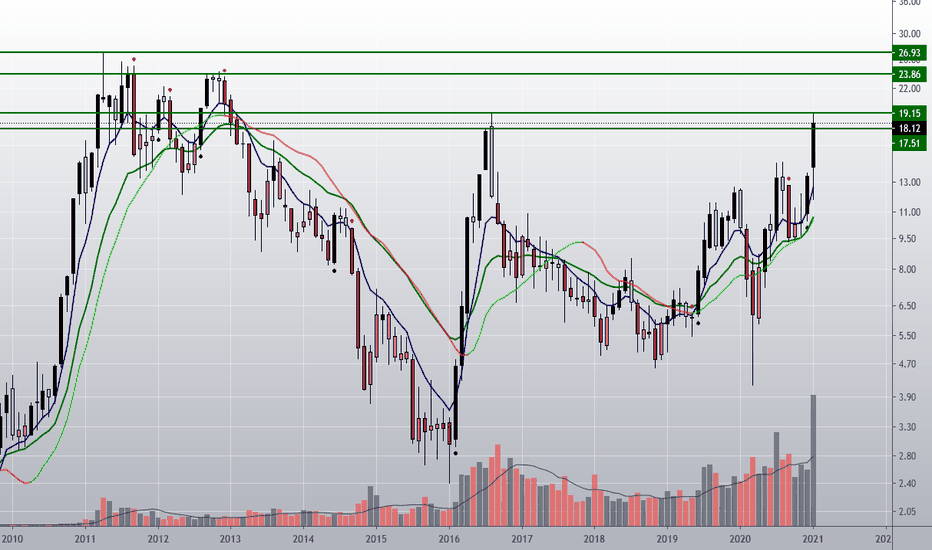

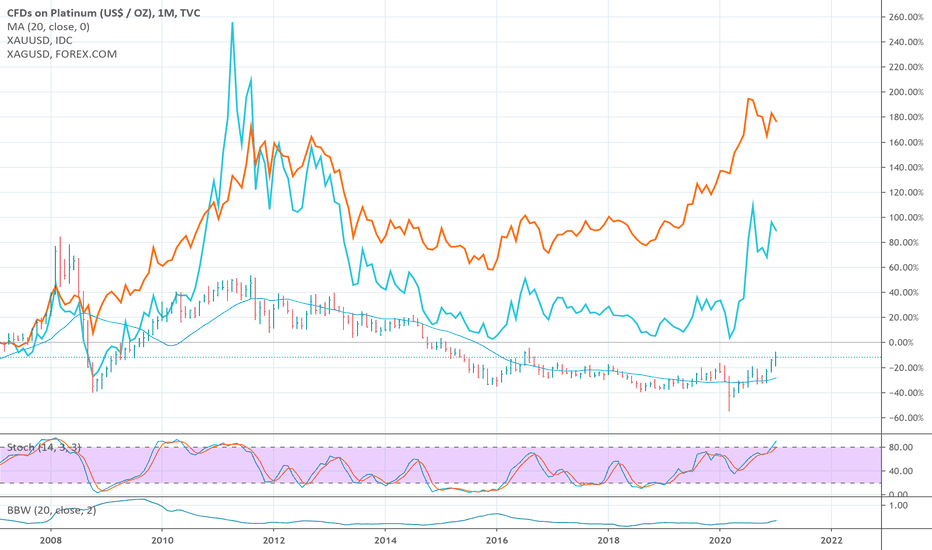

Platinum over Gold and Silver?Precious metals sold off some but in light of Ms. Yellen moving in to Treasury, a continuation of her currency expansion is likely. To disregard physical precious metals as perhaps the only safe store of wealth seems to be folly. While the gold/silver ratio has fallen from nearly 120:1 down to the mid 70s, Silver is no longer the best value. The Platinum Silver ratio had ranged from 126 down to 33. At it's current 43 level, it does seem like the place place to put new cash.

Hi Ho Silver!

Silver has traded sideways for too long, and you know what they say! "The bigger the base, the higher the space". The gold to silver ratio has been on a gradual but steady downtrend indicating silver's outperformance. Based on my trend lines, it is checking back down from the upper end of the spectrum. This should give silver a boost and I think it is a sign of a comeback.

Janet Yellen spoke about the necessity for a very large stimulus bill, which will only weaken the dollar further and strengthen hard assets like gold and silver. Silver has more alpha and more upside potential. So if you are looking for an inflation hedge and would like more of a runway with more alpha, go long silver. I suggest playing it through SLV.