Related commodities

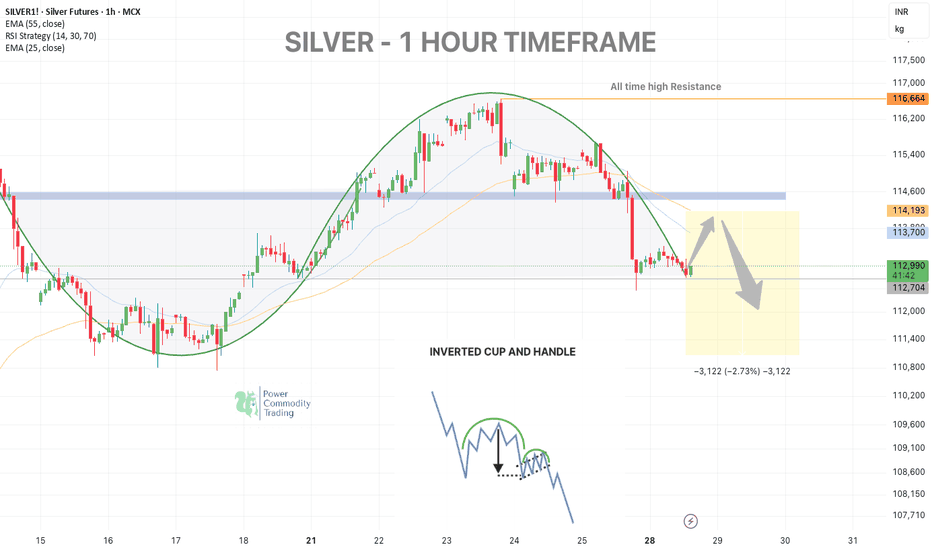

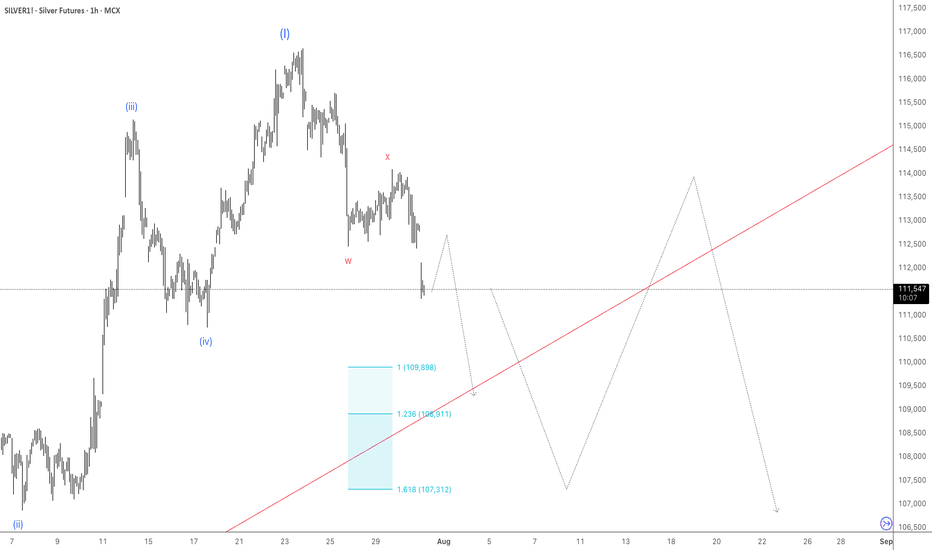

SILVER WEEKLY UPDATE - Dead Cat Bounce Setup📉 SILVER – 1H TIMEFRAME - Inverted cup and handle pattern

Silver tested support around 112,800–113,000 after a rounded top formation, rejecting the key EMA zones (25 & 55) and the previous demand-turned-supply zone.

🟠 Scenario Unfolding:

Expecting a short-term bounce towards 113,750–114,200 (EMA c

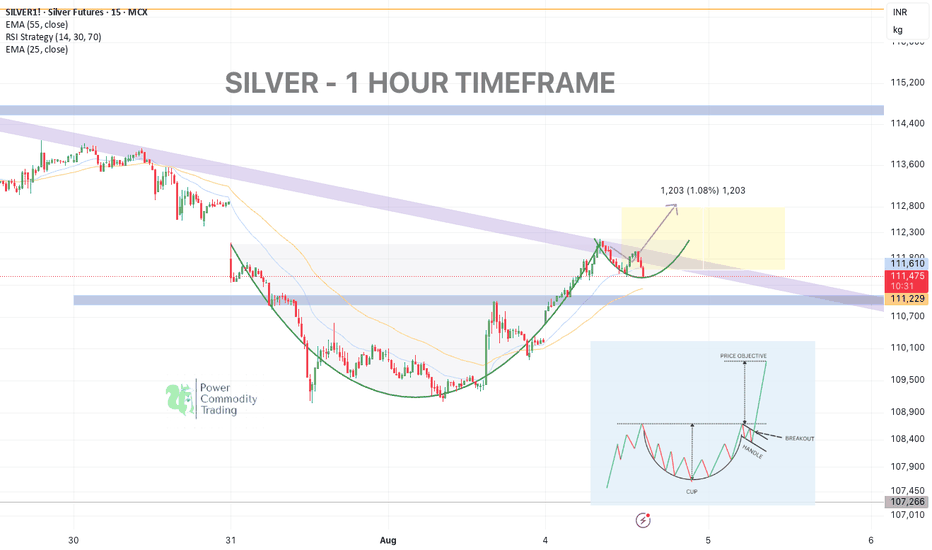

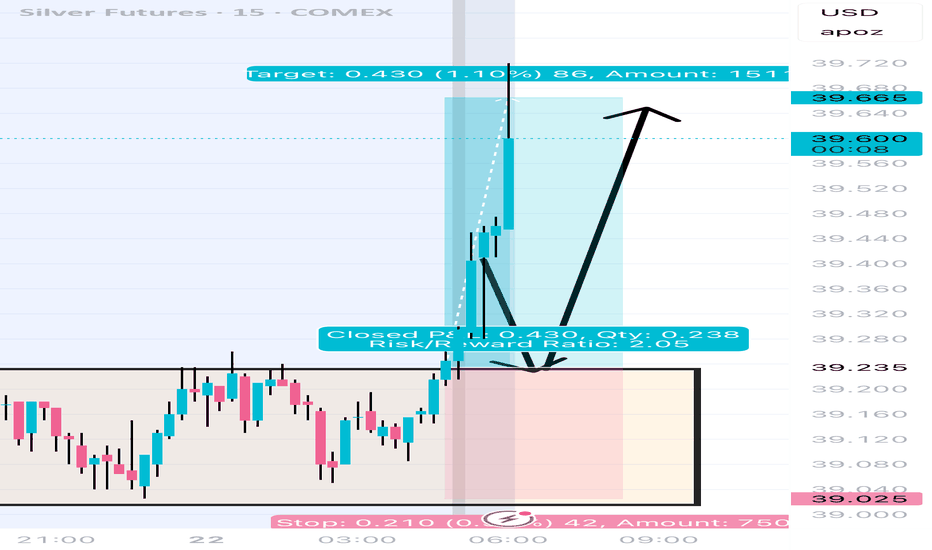

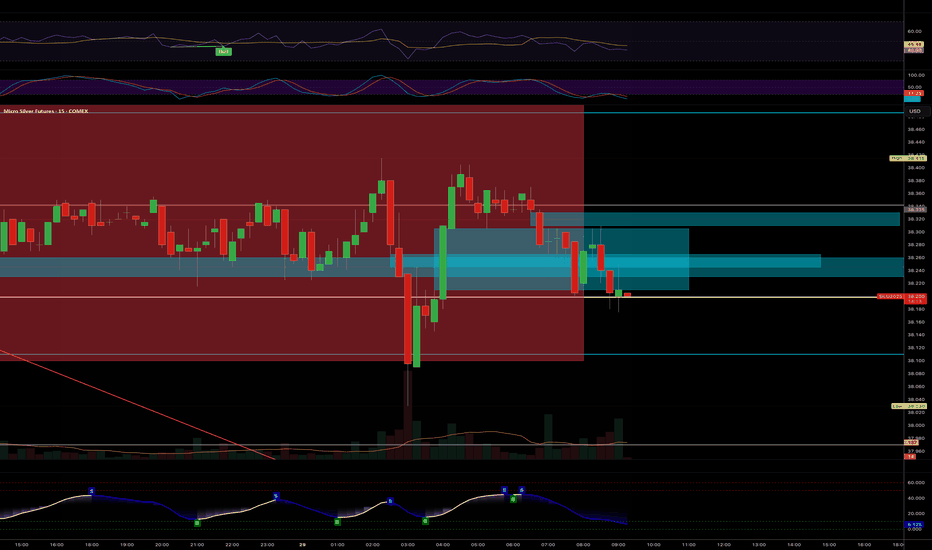

SILVER – Breakout Attempt Underway SILVER | 1H TIMEFRAME

Price is breaking out of the falling wedge + forming a cup-type rounded bottom from support.

📊 Technical Overview:

• Cup formation breakout spotted ✅

• Price attempting to sustain above falling wedge resistance

• 55 EMA & 25 EMA crossed bullish

• Volume buildup visible

•

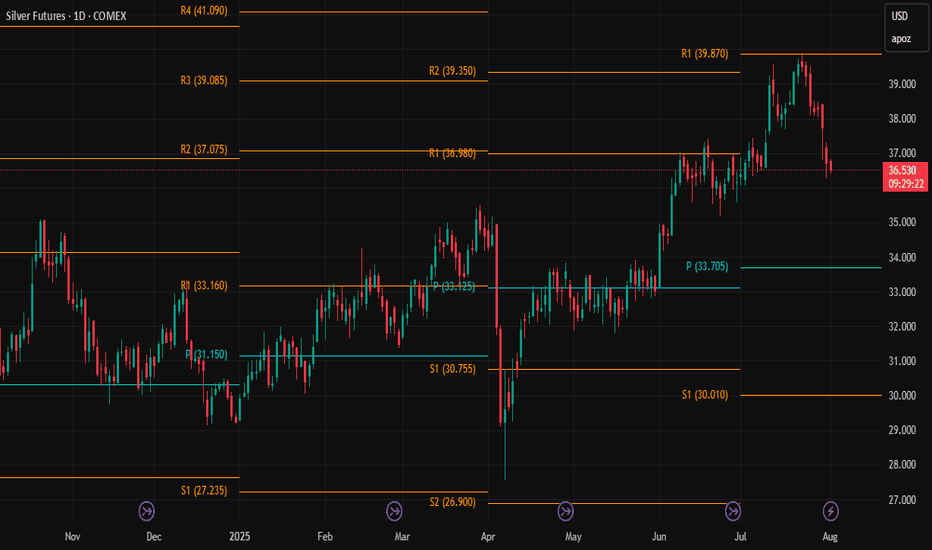

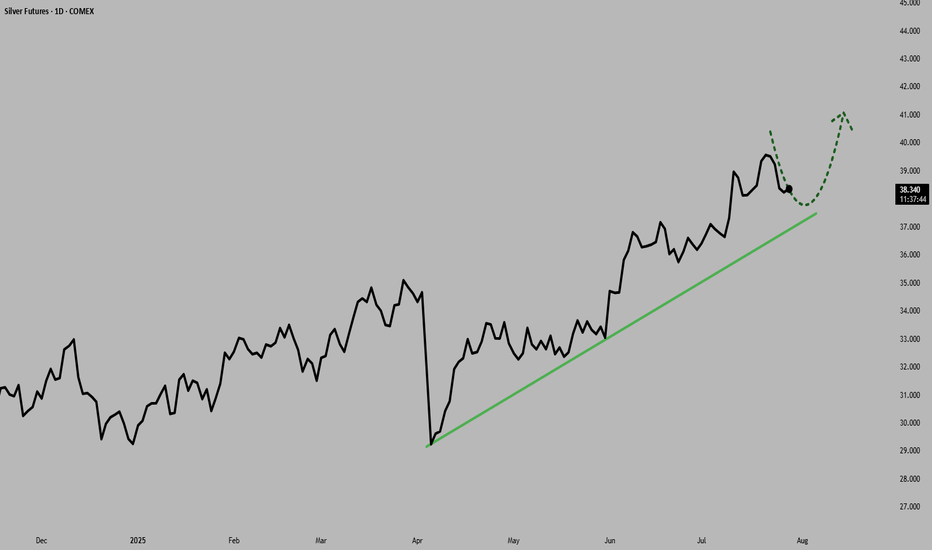

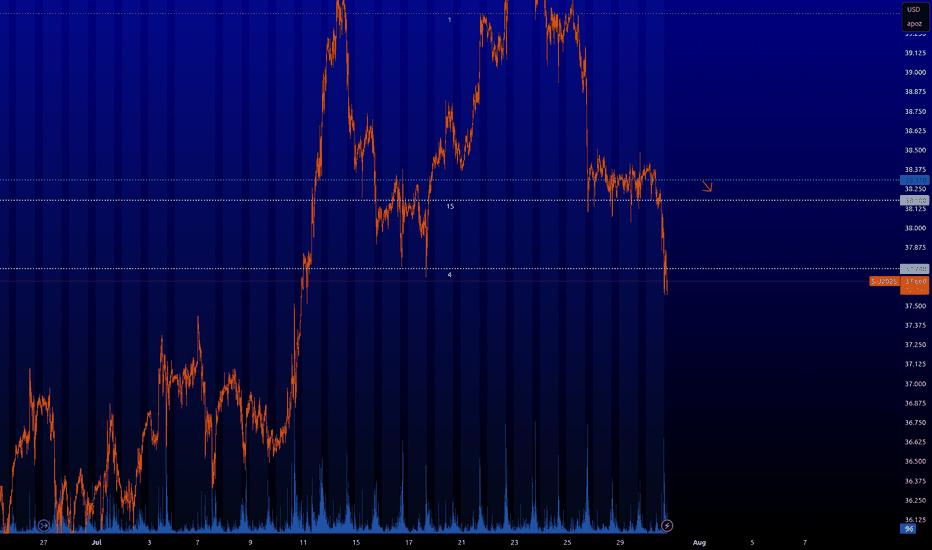

Silver Near $40: Deficits and Demand Fuel the RallySilver prices surged to multi-year highs in July 2025, driven by an extraordinary convergence of bullish factors, pushing prices above $39 per ounce, levels last seen in 2011.

Silver’s rally, supported by robust industrial demand and safe-haven inflows, aligns with traditional patterns as the U.S.

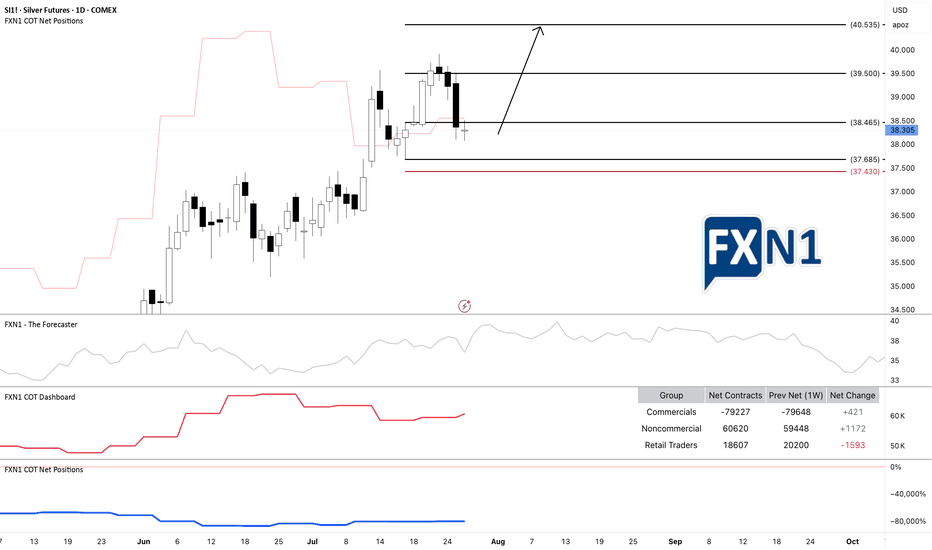

SI1!: Silver Demand Zone: Possible Bullish ContinuationI am currently observing a potential long-term continuation on SI1! Silver (XAG/USD), as the Commitment of Traders (COT) data indicates an increase in positions from both commercial and non-commercial traders. The price is approaching a demand zone on the daily chart, suggesting a possible bullish m

See all ideas

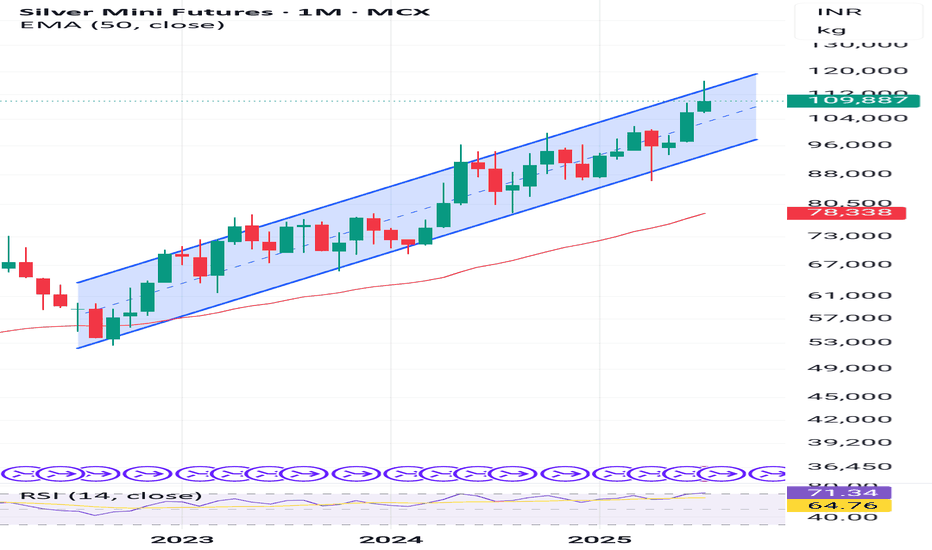

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.